Fill Out Your Sc C 278 Form

The SC C-278 form serves a critical function for businesses in South Carolina looking to close their tax accounts. This form is specifically tailored for the closure of various tax accounts, including sales, withholding, admissions, property, use tax, motor fuel, and electric power. It caters to business owners who are permanently closing their operations, selling their business, or simply no longer employing individuals. Filling out the form requires precise information, such as the tax file number, the type of tax to be closed, and relevant dates. It is essential that all sections are completed thoroughly to ensure the account closure process is smooth and efficient. Failure to provide the necessary details may lead to delays or the return of the form. Business owners should take note that this form cannot be used for closing ABL or tobacco tax accounts, nor for corporate income tax accounts, which require additional steps. For those in doubt, resources are available, including guidance from the South Carolina Department of Revenue and the capability to submit the form online for faster processing.

Sc C 278 Example

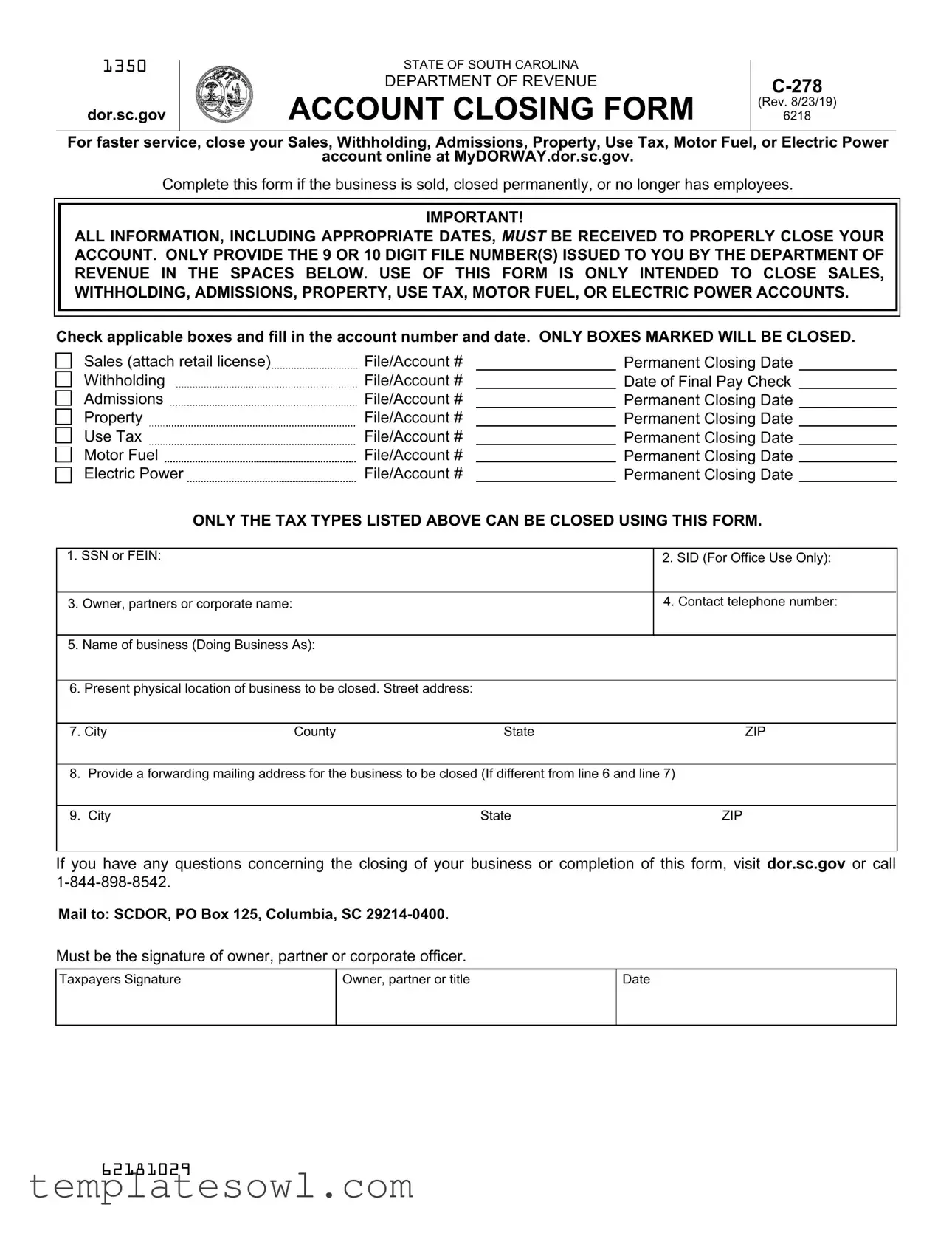

1350

dor.sc.gov

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

ACCOUNT CLOSING FORM

(Rev. 8/23/19)

6218

For faster service, close your Sales, Withholding, Admissions, Property, Use Tax, Motor Fuel, or Electric Power

account online at MyDORWAY.dor.sc.gov.

Complete this form if the business is sold, closed permanently, or no longer has employees.

IMPORTANT!

ALL INFORMATION, INCLUDING APPROPRIATE DATES, MUST BE RECEIVED TO PROPERLY CLOSE YOUR ACCOUNT. ONLY PROVIDE THE 9 OR 10 DIGIT FILE NUMBER(S) ISSUED TO YOU BY THE DEPARTMENT OF REVENUE IN THE SPACES BELOW. USE OF THIS FORM IS ONLY INTENDED TO CLOSE SALES, WITHHOLDING, ADMISSIONS, PROPERTY, USE TAX, MOTOR FUEL, OR ELECTRIC POWER ACCOUNTS.

Check applicable boxes and fill in the account number and date. ONLY BOXES MARKED WILL BE CLOSED.

Sales (attach retail license) |

File/Account # |

|

Permanent Closing Date |

Withholding |

File/Account # |

|

Date of Final Pay Check |

Admissions |

File/Account # |

|

Permanent Closing Date |

Property |

File/Account # |

|

Permanent Closing Date |

Use Tax |

File/Account # |

|

Permanent Closing Date |

Motor Fuel |

File/Account # |

|

Permanent Closing Date |

Electric Power |

File/Account # |

|

Permanent Closing Date |

ONLY THE TAX TYPES LISTED ABOVE CAN BE CLOSED USING THIS FORM.

1. SSN or FEIN: |

|

|

2. SID (For Office Use Only): |

||

|

|

|

|

|

|

3. |

Owner, partners or corporate name: |

|

|

4. Contact telephone number: |

|

|

|

|

|

||

5. |

Name of business (Doing Business As): |

|

|

||

|

|

|

|

||

6. |

Present physical location of business to be closed. Street address: |

|

|

||

|

|

|

|

|

|

7. |

City |

County |

State |

ZIP |

|

|

|

|

|||

8. |

Provide a forwarding mailing address for the business to be closed (If different from line 6 and line 7) |

||||

|

|

|

|

|

|

9. |

City |

|

State |

ZIP |

|

|

|

|

|

|

|

If you have any questions concerning the closing of your business or completion of this form, visit dor.sc.gov or call

Mail to: SCDOR, PO Box 125, Columbia, SC

Must be the signature of owner, partner or corporate officer.

Taxpayers Signature

Owner, partner or title

Date

62181029

Instructions

Failure to file all appropriate returns through the closing date may result in the issuance of notices/assessments by the

SCDOR.

Make sure that all applicable sections of the

If closing a sales tax account, attach the retail license to this form.

If closing more than one tax account, use the spaces provided below or attach a sheet listing the type of tax account, current account number, closing date or final check date, and business address.

This form must be signed by an owner, partner, or corporate officer.

You cannot use this form to close your ABL or Tobacco Tax account. Complete form

You cannot use this form to close your Corporate Income Tax account. To correctly close your Corporate Income Tax account the following must be done:

For Secretary of State purposes:

(1)A domestic corporation must file the Articles of Dissolution with the Secretary of State.

(2)A corporation other than a domestic corporation must file an Application to Surrender Authority to do Business with the Secretary of State.

Contact the Secretary of State for forms and/or questions by calling

For South Carolina Department of Revenue purposes:

(3)The corporation must file a final tax return within 75 days after filing the Articles of Dissolution or Application to Surrender Authority to do Business. Your final return must include an

(4)The appropriate box in the upper right corner of the return should be marked in the space indicating the reason for the final return.

|

|

|

|

Permanent |

|

Present Physical Location |

Type Tax |

|

File/Account # |

|

Closing Date |

|

of Business to be Closed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i) permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the SCDOR is limited to the information necessary for the SCDOR to fulfill its statutory duties. In most instances, once this information is collected by the SCDOR, it is protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third parties for commercial solicitation purposes.

62182027

Form Characteristics

| Fact | Description |

|---|---|

| Governing Tax Types | This form is specifically designed to close accounts for Sales, Withholding, Admissions, Property, Use Tax, Motor Fuel, and Electric Power in South Carolina. |

| Filing Requirements | All necessary information, including relevant dates, must be provided. Incomplete forms will be returned for completion. |

| Signature Requirement | The form must be signed by an owner, partner, or corporate officer to be valid. |

| Instructions for Corporations | Corporations need to complete additional steps, including filing Articles of Dissolution or Application to Surrender Authority with the Secretary of State, in conjunction with this form. |

Guidelines on Utilizing Sc C 278

Filling out the SC C-278 form is a crucial step if your business is sold, closed permanently, or no longer has employees. It ensures that your tax accounts are properly closed to avoid further obligations or notices from the South Carolina Department of Revenue. Follow these steps carefully to complete the form accurately.

- Gather your Social Security Number (SSN) or Federal Employer Identification Number (FEIN).

- Locate the SID number if applicable; this is for office use only.

- Input the name of the owner, partners, or corporate name in the designated field.

- Provide a contact telephone number for any inquiries related to the form.

- Fill in the business name as it appears (Doing Business As).

- Indicate the present physical location of the business to be closed, including street address, city, county, state, and ZIP code.

- If necessary, provide a forwarding mailing address, different from the business location.

- Check all applicable boxes for the tax types you wish to close and fill in the corresponding account numbers and closing dates. Ensure that the retail license is attached if closing a sales tax account.

- Sign the form, indicating the title of the signatory (owner, partner, or corporate officer) and the date of signing.

- Double-check all the information provided for accuracy and completeness.

- Mail the completed form to: SCDOR, PO Box 125, Columbia, SC 29214-0400.

After submitting the form, keep a copy for your records. Ensure that any outstanding returns are filed through the closing date to prevent notices from the Department of Revenue.

What You Should Know About This Form

What is the purpose of the SC C 278 form?

The SC C 278 form is used to officially close various tax accounts with the South Carolina Department of Revenue. If your business is sold, closed permanently, or no longer has employees, this is the form you need. It allows you to close accounts related to sales tax, withholding tax, admissions tax, property tax, use tax, motor fuel tax, or electric power tax.

How do I complete the SC C 278 form correctly?

To complete the form, provide accurate information in all required fields, including your business’s file number, contact details, and closing date. Ensure you check the appropriate boxes for the accounts you wish to close. If closing a sales tax account, attach your retail license. Any incomplete information may delay the processing and result in your application being returned.

What should I do if I have multiple tax accounts to close?

If you need to close more than one tax account, you can use the spaces provided on the form or attach an additional sheet. This sheet should list the type of tax account, current account number, and closing date or final check date for each account. Make sure to provide complete details to avoid any issues.

What happens if I don’t file all appropriate returns before closing?

Failure to file all required returns through the closing date can lead to notices or assessments from the South Carolina Department of Revenue. It is crucial to ensure that your filings are current and complete before submitting the SC C 278 form to avoid unexpected penalties or complications.

Can I use the SC C 278 form to close other types of tax accounts?

No, the SC C 278 form is specifically designed to close sales tax, withholding tax, admissions tax, property tax, use tax, motor fuel tax, and electric power tax accounts. If you need to close your Alcohol Beverage License (ABL) or Tobacco Tax account, you must complete form L-1278 instead. Additionally, to close a Corporate Income Tax account, specific steps with the Secretary of State must be followed.

Common mistakes

Completing the SC C 278 form can be straightforward, but common mistakes can lead to delays or complications. One frequent error involves incomplete information. When fields such as account numbers or dates of closure are missing, the form may be returned for corrections. Ensure that every required field is filled out completely to avoid this issue.

Another mistake is failing to use the correct account number. Only the 9 or 10 digit file numbers assigned by the Department of Revenue should be entered. Entering incorrect or irrelevant numbers can hinder the processing of the account closure.

People often overlook the need to mark the appropriate boxes for the tax types they wish to close. Only the boxes that are checked will result in the closure of specific accounts. Failing to mark these boxes means that the business may remain liable for taxes associated with those unchecked accounts.

Some individuals do not attach necessary documentation, such as the retail license for closing a sales tax account. If this information is left out, the processing may be stalled. Be sure to include any required attachments to ensure a smooth closure process.

Signature issues are another common pitfall. The form must be signed by the owner, partner, or corporate officer. If the correct person does not sign the document, it will not be considered valid. Make sure the signature matches the name of the person listed as the owner or authorized signatory.

Lastly, people sometimes confuse the SC C 278 form with other forms intended for different tax accounts. For instance, this form should not be used for closing ABL or Tobacco Tax accounts. Using the incorrect form will only complicate the process. Always verify the requirements for closing specific accounts to select the right form.

Documents used along the form

When closing a business account, several additional forms and documents might be necessary alongside the SC C-278 form. Each serves a specific purpose to ensure compliance with state regulations. Below are some of the most common forms used in conjunction with SC C-278.

- L-1278: Business License Closure Form - This form is used to formally close various business licenses and permits. If a business is ceasing operations, it must submit this form to cancel licenses like the ABL or Tobacco Tax. It prevents penalties for operating without the required permits.

- I-349: Corporate Closing Schedule - Corporations must file this form when they are closing. It includes details about the corporation's final tax return and asset distribution to stockholders, ensuring compliance with state tax laws during the closure process.

- Articles of Dissolution - For domestic corporations, submitting this form to the Secretary of State is crucial. It officially ends the corporation’s status in the state. Failing to file can result in ongoing tax obligations and liabilities.

- Application to Surrender Authority - Non-domestic corporations must file this application to notify the Secretary of State that they are ceasing business operations in South Carolina. It helps ensure that the state is aware of the corporation’s status and prevents further liabilities.

These documents play an important role in ensuring that all legal obligations are met when closing a business. Completing them properly helps avoid issues with the state and confirms that the business is officially closed.

Similar forms

The SC C-278 form, used for closing various tax accounts in South Carolina, shares similarities with several other important documents. Here’s a brief overview of these forms:

- Form L-1278: This form is specifically used for closing Alcoholic Beverage License (ABL) or Tobacco Tax accounts. It requires the submission of the license or permit along with the completed form.

- Form SC1120-T: Corporations use this form to request an extension of time to file the Corporate Income Tax return, especially relevant after a company has filed Articles of Dissolution.

- Articles of Dissolution: Domestic corporations need to file this document with the Secretary of State to officially dissolve the business, marking its closure.

- Application to Surrender Authority to do Business: This form is for non-domestic corporations that wish to discontinue their business operations in South Carolina.

- I-349 Corporate Closing Schedule: This schedule is required alongside the final corporate tax return, documenting asset distribution among stockholders upon business closure.

- Final Tax Return: Corporations must file this return within 75 days after dissolution, ensuring all tax obligations are met before the business officially closes.

- Retail License Attachment: When closing a sales tax account via the C-278, businesses must attach their retail license to validate the closure.

- Withholding Tax Final Report: This report is necessary for employers to finalize any outstanding withholding tax obligations when they cease business operations.

- Use Tax Return: Similar to the withholding report, this return ensures that any unpaid use tax obligations are settled before closing an account.

Each of these documents plays a crucial role in properly closing a business's tax accounts, reflecting the specific regulations and requirements that need to be followed in South Carolina.

Dos and Don'ts

When filling out the SC C-278 form, it is essential to follow certain guidelines to ensure accuracy and prevent delays.

- Do provide all required information, including appropriate dates and account numbers.

- Do ensure correct reporting of the business closing type and date by checking applicable boxes.

- Do attach necessary documents, such as your retail license, if closing a sales tax account.

- Do sign the form with the signature of the owner, partner, or corporate officer before submission.

- Do confirm that all returns are filed through the closing date to avoid any penalties.

- Don’t omit any required information, as incomplete submissions will be returned for correction.

- Don’t use this form for closing accounts not specified, like ABL or Tobacco Tax accounts.

- Don’t submit the form without checking for accuracy, as errors can cause processing delays.

- Don’t forget to provide a forwarding mailing address if it differs from the business location.

- Don’t submit multiple account closures on different forms without following the provided instructions for listing them.

Misconceptions

When it comes to the SC C 278 form, there are many misconceptions that people may have. Understanding the facts can help ensure that businesses close their accounts properly. Here is a list of eight common misunderstandings:

- You can close any type of tax account using this form. The SC C 278 form is specifically designed to close sales, withholding, admissions, property, use tax, motor fuel, or electric power accounts only. Other types of accounts, like Corporate Income Tax or Tobacco Tax accounts, require different forms.

- It's okay to submit the form without all required information. Incomplete forms will be returned, which can delay the closure of your accounts. All information must be provided accurately, including appropriate dates.

- You only need to fill out one section if closing multiple accounts. Each tax type must have its section completed in full. If you're closing more than one account, you need to list them properly on the form or attach an additional sheet detailing each account.

- Online submissions are not available. In fact, there is an option for faster service by closing your account online at MyDORWAY.dor.sc.gov, which many find convenient.

- Signing the form is optional if you provide all information. The signature of the owner, partner, or corporate officer is mandatory to validate the form. Without it, the closure cannot be processed.

- There are no penalties for late filings. Failing to file all appropriate returns through your account's closing date can lead to notices or assessments by the South Carolina Department of Revenue (SCDOR).

- Personal information is at risk after submission. The Family Privacy Protection Act protects the information collected by SCDOR from public disclosure and prevents third-party use for commercial solicitation purposes.

- You don’t need to submit any additional documents. If you are closing a sales tax account, for example, you must attach your retail license to the SC C 278 form. Not attaching required documents can complicate the closure process.

Clarifying these misconceptions can ease the process of closing a business account and ensure compliance with state regulations.

Key takeaways

Filling out and using the SC C-278 form requires attention to detail and an understanding of the process involved in closing various tax accounts. Here are key takeaways to keep in mind:

- Purpose of the Form: The SC C-278 is specifically designed to close sales, withholding, admissions, property, use tax, motor fuel, or electric power accounts. Ensure you are using this form for the correct tax types.

- Accurate Information: All sections must be completed accurately, including appropriate dates. Incomplete forms will be returned, which can delay the closing process.

- Required Documentation: If closing a sales tax account, it's mandatory to attach the retail license to the form. Failing to do so may result in processing issues.

- No ABL or Tobacco Tax: This form cannot be used for Alcoholic Beverage License (ABL) or Tobacco Tax accounts. For those, a different form, L-1278, must be completed.

- Corporate Closures: Corporations have additional steps for closing their accounts, including filing Articles of Dissolution with the Secretary of State and submitting a final tax return.

- Contact Information: If you encounter any questions while completing the form, you can visit the South Carolina Department of Revenue website or call their support line for assistance.

By keeping these points in mind, you can help ensure a smooth process when closing your tax accounts with the SC C-278 form.

Browse Other Templates

How to Fill Out a Customs Form for International Shipping - The U.S. street address or destination must be listed on the form.

Pennsylvania Rent Rebate - The form can also be submitted electronically for a smoother filing experience.

Ez Pass Massachusetts Login - Monthly account statements can be sent via physical mail or accessed online based on the applicant’s choice.