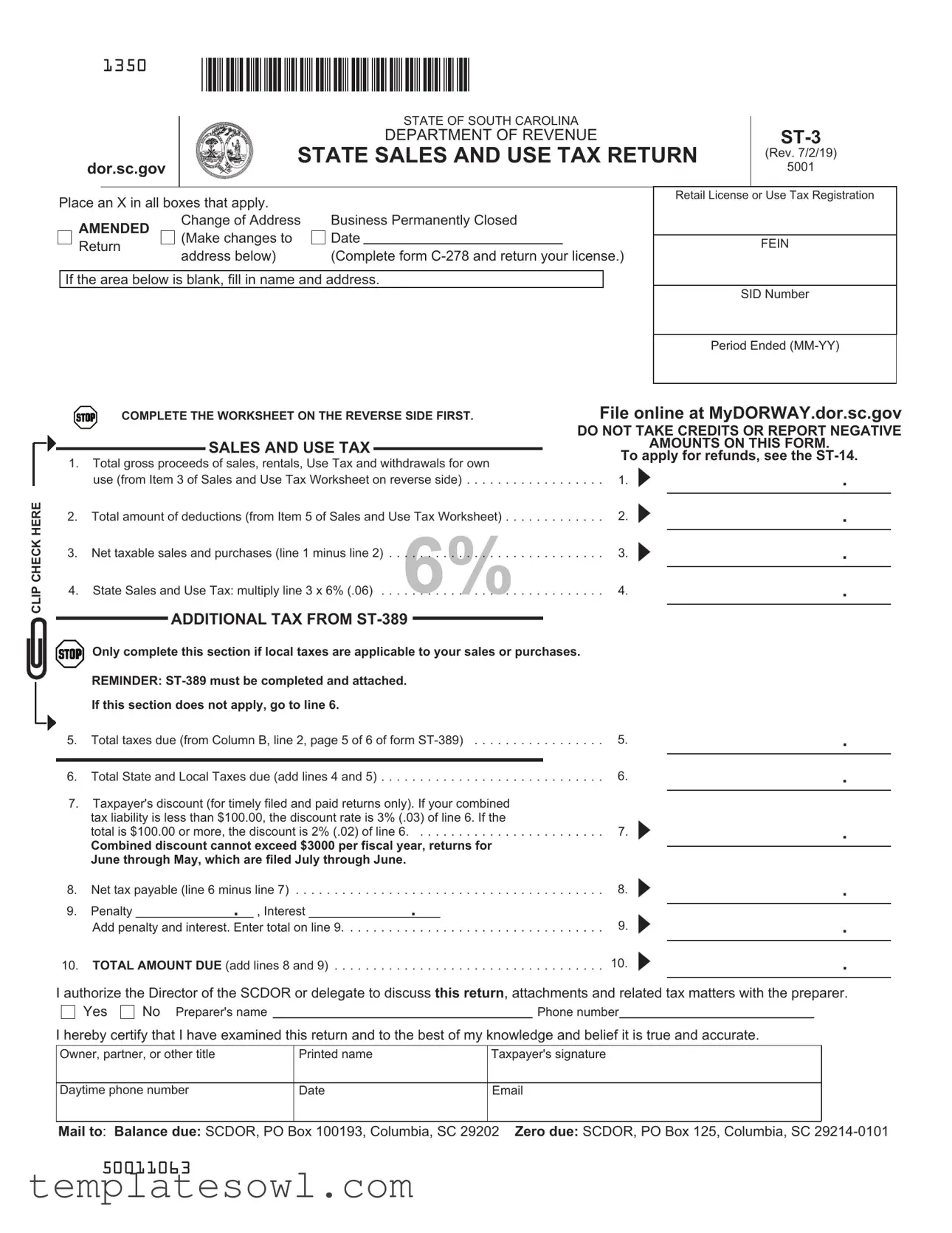

Fill Out Your Sc St 3 Sales Form

The Sc St 3 Sales form is a crucial document for businesses operating in South Carolina, facilitating the reporting of state sales and use tax. It includes multiple sections that require businesses to detail their gross sales, deductions, and ultimately calculate the total tax due. The form prompts users to indicate relevant status changes, such as if their business is permanently closed or if they are submitting an amended return. Businesses must begin by completing a worksheet on the reverse side before progressing to report gross proceeds from sales, rentals, or other applicable transactions. The form requires amounts for deductions and calculates net taxable sales, which are subject to the state's sales tax rate of 6%. Additional sections may apply if local taxes are relevant to the business's sales, necessitating the completion of an accompanying ST-389 form. Taxpayers can also claim a discount for timely filing, and the form provides specifics on penalties and interest for late submissions. By submitting the Sc St 3 Sales form, businesses ensure compliance with state tax regulations while safeguarding their legal and financial responsibilities.

Sc St 3 Sales Example

1350

CLIP CHECK HERE

|

|

|

|

|

|

|

|

|

STATE OF SOUTH CAROLINA |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

DEPARTMENT OF REVENUE |

|

|

|

|

|

|

|||||||||

|

|

dor.sc.gov |

|

|

STATE SALES AND USE TAX RETURN |

|

(Rev. 7/2/19) |

|||||||||||||||||

|

|

|

|

|

5001 |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Place an X in all boxes that apply. |

|

|

|

|

|

|

|

|

|

|

|

|

Retail License or Use Tax Registration |

|

||||||||||

Business Permanently Closed |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

AMENDED |

|

Change of Address |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

(Make changes to |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Return |

|

|

|

|

|

|

|

|

|

FEIN |

|

|||||||||||

|

|

|

address below) |

(Complete form |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

If the area below is blank, fill in name and address. |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SID Number |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period Ended |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

COMPLETE THE WORKSHEET ON THE REVERSE SIDE FIRST. |

File online at MyDORWAY.dor.sc.gov |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DO NOT TAKE CREDITS OR REPORT NEGATIVE |

||||||||||

|

|

|

|

|

|

SALES AND USE TAX |

|

|

|

|

|

|

|

|

AMOUNTS ON THIS FORM. |

|||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

1. |

Total gross proceeds of sales, rentals, Use Tax and withdrawals for own |

|

To apply for refunds, see the |

|||||||||||||||||||||

|

|

|

|

|

. |

|

|

|

||||||||||||||||

|

|

use (from Item 3 of Sales and Use Tax Worksheet on reverse side) |

1. |

|

|

|

|

|

|

|||||||||||||||

|

2. Total amount of deductions (from Item 5 of Sales and Use Tax Worksheet) |

2. |

|

|

|

. |

|

|

|

|||||||||||||||

3. |

Net taxable sales and purchases (line 1 minus line 2) |

3. |

|

|

|

. |

|

|

|

|||||||||||||||

|

|

State Sales and Use Tax: multiply line 3 x 6% (.06) . . . 6% |

|

|

|

|

|

|

|

|

|

|||||||||||||

4. |

4. |

|

|

|

. |

|

|

|

||||||||||||||||

|

|

|

|

ADDITIONAL TAX FROM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Only complete this section if local taxes are applicable to your sales or purchases. |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

REMINDER: |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

If this section does not apply, go to line 6. |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

5. Total taxes due (from Column B, line 2, page 5 of 6 of form |

5. |

|

|

|

. |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

|

|

|

. |

|

|

|

|

|

6. Total State and Local Taxes due (add lines 4 and 5) |

|

|

|

|

|

|

|||||||||||||||||

7. |

Taxpayer's discount (for timely filed and paid returns only). If your combined |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

tax liability is less than $100.00, the discount rate is 3% (.03) of line 6. If the |

|

|

|

|

|

. |

|

|

|

|||||||||||||

|

|

total is $100.00 or more, the discount is 2% (.02) of line 6 |

7. |

|

|

|

|

|

|

|||||||||||||||

|

|

Combined discount cannot exceed $3000 per fiscal year, returns for |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

June through May, which are filed July through June. |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

8. Net tax payable (line 6 minus line 7) |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

. . . . . . . |

. |

8. |

|

|

|

. |

|

|

|

|||||||||

9. |

Penalty _________________. , Interest ___________________. |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

9. |

|

|

|

. |

|

|

|

||||||||||||||||

|

|

Add penalty and interest. Enter total on line 9 |

|

|

|

|

|

|

||||||||||||||||

10. |

TOTAL AMOUNT DUE (add lines 8 and 9) |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

. . . . . . . |

. |

10. |

|

|

|

. |

|

|

|

|||||||||

I authorize the Director of the SCDOR or delegate to discuss this return, attachments and related tax matters with the preparer.

Yes |

No Preparer's name |

|

Phone number |

I hereby certify that I have examined this return and to the best of my knowledge and belief it is true and accurate.

Owner, partner, or other title |

Printed name |

Taxpayer's signature |

|

|

|

|

|

Daytime phone number |

Date |

||

|

|

|

|

Mail to: Balance due: SCDOR, PO Box 100193, Columbia, SC 29202 Zero due: SCDOR, PO Box 125, Columbia, SC |

|||

50011063

|

|

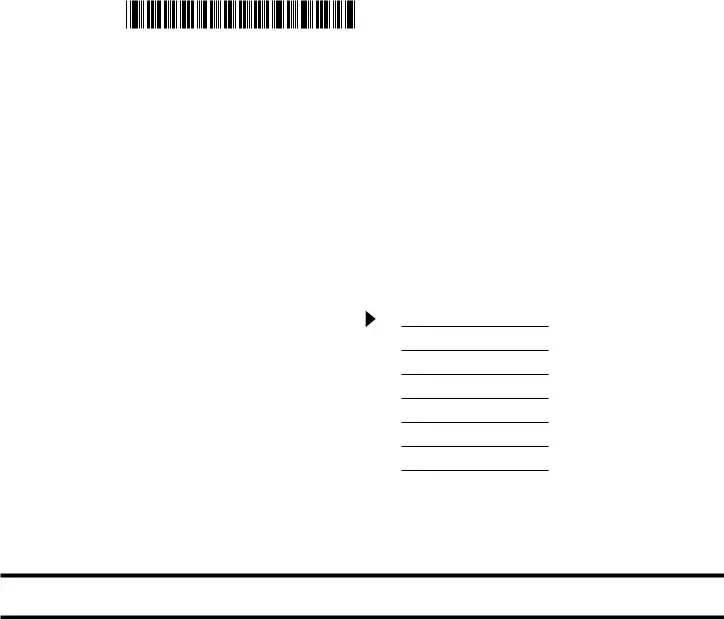

SALES AND USE TAX WORKSHEET |

|

|

|

|

|

|

|

6% |

|

|

|

|

|

|

Retail License or Use Tax Registration Number |

|

|

Period Ended |

|||

Item 1. |

Gross proceeds of sales/rentals and withdrawals of inventory for own use |

1. |

|

|

|||

Item 2. |

|

2. |

|

|

|||

Item 3. |

Total - Gross proceeds of sales/rentals, Use Tax and withdrawals of |

3. |

|

|

|||

|

|

inventory for own use (Add Items 1 and 2. Enter here and on line 1 on front of |

|

|

|||

If local tax is applicable, enter the total on Item 1 of

Note: Sales of unprepared foods are exempt from the state Sales and Use Tax rate. However, local taxes still apply to sales of unprepared foods unless the local tax law specifically exempts such sales. Sales that are subject to a local tax must be entered on the

Item 4. Sales and Use Tax allowable deductions (Itemize by type of deduction and amount of deduction)

Column A |

Column B |

Type of deduction |

Amount of deduction |

a. *Sales Exempt During "Sales Tax Holiday" in August |

$ |

b. **Sales over $100.00 delivered onto Catawba Reservation |

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

Item 5. Total amount of deductions (Enter total of Column B here and on Line 2 on front of

Item 6. Net taxable sales and purchases (Item 3 minus Item 5. Enter total here and Line 3 on front of

5. |

< |

> |

6. |

|

|

IMPORTANT: Your return is DELINQUENT if it is postmarked after the 20th day following the close of the period. Sign and date the return. Questions? Call toll free

*Sales Exempt During "Sales Tax Holiday"

If your business sells clothing, clothing accessories, footwear, school supplies, computers, printers and printer supplies, computer software, bath wash cloths, blankets, bed spreads, bed linens, sheet sets, comforter sets, bath towels, shower curtains, bath rugs and mats, pillows and pillow cases, South Carolina's "Sales Tax Holiday" may impact your business. This

During this time period, the 6% state Sales and Use Tax and any applicable local sales and use tax will not be imposed on sales of qualifying items.

Sales of qualified items during the exemption period should be taken as a deduction on your tax return. The deduction should be labeled "sales tax holiday." Learn more at dor.sc.gov/taxfreeweekend.

**Catawba Tribal Sales: See the

The Catawba Tribal Sales Tax is imposed on the delivery of tangible personal property onto the reservation by retail locations in South Carolina when the sale is greater than $100. If the sale (delivery on the reservation) is $100 or less, then the Catawba Tribal Sales Tax does not apply and only the 6% state Sales Tax applies (not local taxes). The Catawba Tribal Sales Tax is also imposed on the delivery of tangible personal property on the reservation by retail locations located on the reservation, regardless of the amount of the sale. The Catawba Tribal Sales Tax is not imposed on deliveries onto the reservation by retail locations located outside of South Carolina and registered with the SCDOR to collect the state tax; however, these deliveries are subject to the 6% state Use Tax (not local taxes).

Sales subject to the Catawba Tribal Sales Tax must be included with all other sales in gross proceeds on Item 1 of worksheet on the

50012061

Form Characteristics

| Fact Name | Detail |

|---|---|

| Governing Law | The ST-3 form is governed by South Carolina Sales and Use Tax laws. |

| Filing Frequency | This form must be filed regularly, often monthly, depending on the taxpayer's obligation. |

| Form Purpose | The ST-3 is used to report sales and use taxes owed to the state. |

| Net Taxable Sales | Line 3 represents the net taxable sales and purchases after deductions. |

| Sales Tax Rate | The standard state sales tax rate is 6% for most sales. |

| Local Tax Consideration | If applicable, additional local taxes must be calculated and reported using form ST-389. |

| Filing Method | Taxpayers can file the ST-3 online at MyDORWAY.dor.sc.gov. |

| Discount for Early Payment | A discount is available for timely filings; it varies based on the total tax owed. |

Guidelines on Utilizing Sc St 3 Sales

Completing the Sc St 3 Sales form is an important task for taxpayers in South Carolina. Ensuring accuracy in this process helps avoid potential penalties or issues with the South Carolina Department of Revenue. Following a step-by-step approach can streamline the completion of this form, ensuring that all necessary information is captured correctly.

- Prepare the necessary information: Before starting the form, gather documents that contain your total gross sales, deductions, and any relevant tax details.

- Mark applicable boxes: In the box labeled "Place an X in all boxes that apply," check any that are relevant to your situation, such as “Retail License” or “Business Permanently Closed.”

- Enter personal information: If the name and address section is blank, provide your business name and address. Ensure your SID number and the period ended (in MM-YY format) are filled in accurately.

- Complete the worksheet: Refer to the worksheet on the reverse side. Calculate your total gross proceeds of sales, rentals, Use Tax, and withdrawals for your own use. Enter this figure in line 1 of the main form.

- Record deductions: From the worksheet, tally the total amount of deductions and record it in line 2 of the main form. This can include items like sales exempt during sales tax holidays.

- Calculate net taxable sales: Subtract line 2 from line 1 to find your net taxable sales and enter this amount on line 3.

- Determine state sales tax: Multiply the amount on line 3 by the state rate of 6% and write this figure on line 4.

- If applicable, attach local tax information: If local taxes apply, refer to the ST-389, complete it, and enter the total in line 5.

- Calculate total taxes due: Add the amounts from line 4 and line 5 to determine your total state and local taxes due on line 6.

- Taxpayer’s discount: If your return is timely filed and the total tax liability meets the threshold, calculate and record your discount on line 7.

- Compute net tax payable: Subtract line 7 from line 6 for your net tax payable and record on line 8.

- Penalties and interest: If applicable, add your penalty and interest charges and write this total on line 9.

- Total amount due: Add the figures on lines 8 and 9 to find the total amount due, recording this on line 10.

- Sign and date the return: Ensure that the authorized person signs, provides a printed name, and includes a daytime phone number, date, and email if required.

- Mail the completed form: Send your completed form to the address specified based on whether you have a balance due or zero due.

What You Should Know About This Form

1. What is the purpose of the SC ST-3 Sales Form?

The SC ST-3 Sales Form is primarily used for reporting state sales and use tax obligations. Businesses in South Carolina utilize this form to declare their gross revenues, deductions, and to calculate the total taxes they owe. The form helps ensure that businesses remain compliant with state tax regulations while facilitating the collection of taxes that support public services.

2. How do I complete the deductions section of the SC ST-3 Sales Form?

Completing the deductions section is vital for accurately reporting your taxable sales. You will need to list the various types of deductions and their respective amounts. Common deductions include sales exempt during the “Sales Tax Holiday” in August and certain transactions associated with tribal sales. By calculating these deductions accurately and entering their total on Line 2, you can effectively reduce your taxable sales reported on the form.

3. What happens if I miss the filing deadline for the SC ST-3 Sales Form?

Filing your SC ST-3 Sales Form after the 20th day following the end of the reporting period is considered delinquent. This will result in penalties and interest being assessed on any amount owed. It is essential to file your form on time to avoid these additional costs. If you find yourself unable to meet the deadline, consider contacting the South Carolina Department of Revenue for guidance on potential extensions or relief options.

4. Can I apply for refunds using the SC ST-3 Sales Form?

No, the SC ST-3 Sales Form is specifically designed for filing sales tax returns and does not accommodate refund requests. If you need to apply for a refund, you should use Form ST-14, which is intended for that purpose. When filling out the ST-14, be sure to follow the required procedures and provide any necessary documentation to support your claim.

Common mistakes

Filling out the SC ST-3 Sales form can be straightforward, but mistakes often occur. Here are eight common errors people make when completing this important document.

One frequent mistake is forgetting to check the appropriate boxes at the top of the form. It's essential to mark all boxes that apply, such as whether your business is permanently closed or if you are filing an amended return. Omitting this step can lead to confusion and delays in processing.

Another common error is failing to complete the required worksheet on the reverse side of the form before entering figures. This worksheet is crucial, as it guides you through calculating gross sales and deductions. Skipping it may result in inaccurate numbers on the main form.

Incorrectly reporting the total gross proceeds of sales is also a notable mistake. This total should include all sales, rentals, and any withdrawals for personal use. If this number is miscalculated, it will affect everything else you report on the form.

Moreover, some individuals do not clearly itemize deductions. It is important to provide specific types and amounts of deductions as instructed. Failure to detail these may lead to denials of certain deductions, resulting in increased tax liability.

Missing deadlines is another issue that can create problems. The return is due on the 20th day following the close of the period. A late submission can lead to penalties and interest charges, adding unnecessary stress.

Additionally, many people overlook signing the return. Without a signature, the form is not valid. Ensure that the owner or partner’s signature is present, along with the printed name, title, and date.

It’s also essential to check the accuracy of all figures before submission. Simple arithmetic errors in calculating taxes due, discounts, or penalties can lead to significant consequences. Double-check your math to avoid these pitfalls.

Lastly, not keeping a copy of the completed form for your records is a mistake often made. Retaining a copy is essential for tracking your financials and for further reference if the Department of Revenue has any questions in the future.

Documents used along the form

The SC ST-3 Sales form is a vital document for businesses conducting sales in South Carolina. Often, this form is accompanied by other important documents that aid in the sales tax reporting process. Below is a list of forms and documents commonly used alongside the SC ST-3 Sales form, each accompanied by a brief description.

- ST-14: This form is used to apply for refunds of sales and use tax that has been overpaid or erroneously collected. It provides the necessary details for the Department of Revenue to process the refund request.

- ST-389: Local Sales Tax Worksheet, which must be completed when local sales taxes apply. It details additional local taxes owed and must be submitted with the SC ST-3 form if applicable.

- C-278: This form allows businesses to request a change to their retail license or use tax registration. It is also used to surrender a license if the business is permanently closed.

- Sales and Use Tax Exemption Certificate: This document certifies a buyer's exemption from sales tax for specific purchases. Vendors often require this certificate for exempt sales.

- Monthly Tax Returns: Depending on the volume of sales, some businesses are required to file monthly returns, detailing gross sales and taxes collected, in addition to the standard forms.

- Use Tax Worksheet: This worksheet helps businesses to calculate use taxes owed on out-of-state purchases. It provides a structured way to ensure taxes are accurately reported.

- Notice of Delinquency: If a tax return is filed late, this notice is issued. It outlines any penalties or interest charges that may be applied due to the delay.

These forms and documents ensure compliance with sales tax regulations and help streamline the process of tax reporting and payment. Understanding their functions will aid businesses in managing their tax responsibilities effectively.

Similar forms

The SC ST-3 Sales form is essential for reporting sales and use taxes in South Carolina. There are several other documents that share similarities with this form. Here are five of them:

- Form ST-14: This form is used for applying for sales tax refunds. Like the ST-3, it deals with sales tax calculations but focuses on obtaining refunds rather than reporting tax owed.

- Form ST-389: The ST-389 Local Sales Tax Worksheet is utilized when local taxes apply to sales. It complements the ST-3 by requiring additional calculations for local tax obligations, ensuring comprehensive reporting of all applicable taxes.

- Form C-278: This form is for making changes such as updating an address or reporting a business closure. The ST-3 also accommodates similar changes, which highlights their interconnectedness in managing business tax responsibilities.

- Form ST-4: This is a form for claiming sales tax exemptions. Much like the ST-3, it incorporates specific sales categories but is focused on certifying transactions that qualify for exemption, making it a critical supplement for those seeking relief from sales tax.

- Form ST-3A: Used for reporting sales and use tax for non-retail entities, the ST-3A serves a similar function to the ST-3 but applies to a different set of taxpayers, indicating the broader context of sales tax reporting in the state.

Dos and Don'ts

When filling out the Sc St 3 Sales form, adherence to specific guidelines is crucial to ensure accuracy and compliance. Below are important do's and don'ts to consider.

- Do complete the worksheet on the reverse side before filling out the main form.

- Do ensure all boxes that apply are checked properly.

- Do apply for refunds through the ST-14 form if necessary.

- Do verify that all calculations are correct to avoid penalties.

- Do include the taxpayer's signature and the preparer's contact information.

- Don't report negative sales and use tax amounts on this form.

- Don't omit any required attachments, particularly the ST-389 if local taxes apply.

- Don't forget to mail the form to the correct address based on the amount due.

- Don't delay filing; returns are delinquent if postmarked after the 20th day following the close of the period.

- Don't forget to label deductions accurately, especially for sales made during the "Sales Tax Holiday."

Misconceptions

There are several misconceptions about the SC ST-3 Sales form that can lead to confusion and errors in filing. Here are six common myths:

- Misconception 1: The ST-3 form can be used to report negative sales amounts.

- Misconception 2: Everyone qualifies for the taxpayer's discount.

- Misconception 3: Sales of unprepared foods are exempt from all taxes.

- Misconception 4: The form does not require additional tax forms for local taxes.

- Misconception 5: The filing deadline is flexible.

- Misconception 6: Catawba Tribal Sales are exempt from state Sales Tax.

This is incorrect. The ST-3 form explicitly states that filers should not report negative sales and use tax amounts. This can lead to an incorrect tax liability calculation.

Not all taxpayers are eligible for this discount. It only applies to timely filed and paid returns. Additionally, the discount rate varies based on the total tax liability.

While unprepared foods are exempt from the state Sales and Use Tax, local taxes may still apply. It's important to check local tax laws for specific exemptions.

In cases where local taxes are applicable, the ST-389 form must be completed and attached. Failure to do so can result in an incomplete filing.

No, the filing deadline is strict. Your return is considered delinquent if it is postmarked after the 20th day following the close of the reporting period. Timeliness is crucial to avoid penalties.

Catawba Tribal Sales Tax may apply to certain transactions. Specifically, deliveries over $100 onto the reservation incur this tax, while sales of $100 or less are subject only to the state Sales Tax.

Understanding these misconceptions can help ensure accurate and timely filings when using the SC ST-3 Sales form.

Key takeaways

When filling out the South Carolina ST-3 Sales form, it is essential to understand the following key points:

- Complete the Worksheet First: Before you begin filling out the ST-3 form, ensure you have completed the Sales and Use Tax Worksheet located on the reverse side. This provides necessary figures for the main form.

- Accurate Reporting of Gross Sales: Report the total gross proceeds from sales, rentals, and withdrawals for your own use. This amount is critical as it sets the foundation for calculating your tax obligation.

- Deduction Calculations: Deduct any allowable amounts from your gross sales. Be sure to itemize these deductions clearly to avoid errors that may lead to additional penalties.

- Penalties for Delinquency: Remember, your return is considered delinquent if postmarked after the 20th day following the close of the reporting period. Timeliness is vital.

- Understand Tax Breaks: If your combined tax liability is less than $100, you are eligible for a 3% discount for filing and paying on time. If it’s $100 or more, the discount reduces to 2%.

- Communication with the Director: You can authorize the Director of the South Carolina Department of Revenue to discuss your return with your preparer, if needed. This might be helpful for addressing complex issues.

As you proceed, double-check all entered information to ensure accuracy, and consult the detailed instructions if any uncertainties arise. Taking these steps will help facilitate a smoother filing process.

Browse Other Templates

Hvac Job /employment Application Template - Previous experience managing HVAC projects from conception to completion.

Da Form 3590 - Cost breakdowns help assess the value of repairs versus replacement.