Fill Out Your Scc819 Form

The SCC819 form serves as a critical document for anyone looking to establish a Virginia Nonstock Corporation, encapsulating the foundational elements necessary for incorporation. When preparing this form, it is vital to note that the name of the corporation must not imply any unauthorized business activities, ensuring it stands out in the records of the State Corporation Commission. Furthermore, the form requires details about the registered agent, whose primary duty is to receive legal documents on behalf of the corporation. This agent must have an office that coincides with the registered office listed on the form. Incorporators must also indicate whether the corporation will have members and describe their rights. Notably, the inclusion of initial directors is necessary unless otherwise specified in the articles. With a filing fee of $75, applicants can choose to file online or submit paper documents, but they are advised against sending cash. Importantly, those considering nonstock incorporation are encouraged to consult with accounting or tax professionals, especially if tax-exempt status is desired. Additionally, the form mandates qualities such as legibility and paper specifications, making it essential to adhere to these guidelines to avoid complications. Overall, the SCC819 form represents a gateway to forming nonstock corporations in Virginia, making due diligence and attention to detail imperative in its completion.

Scc819 Example

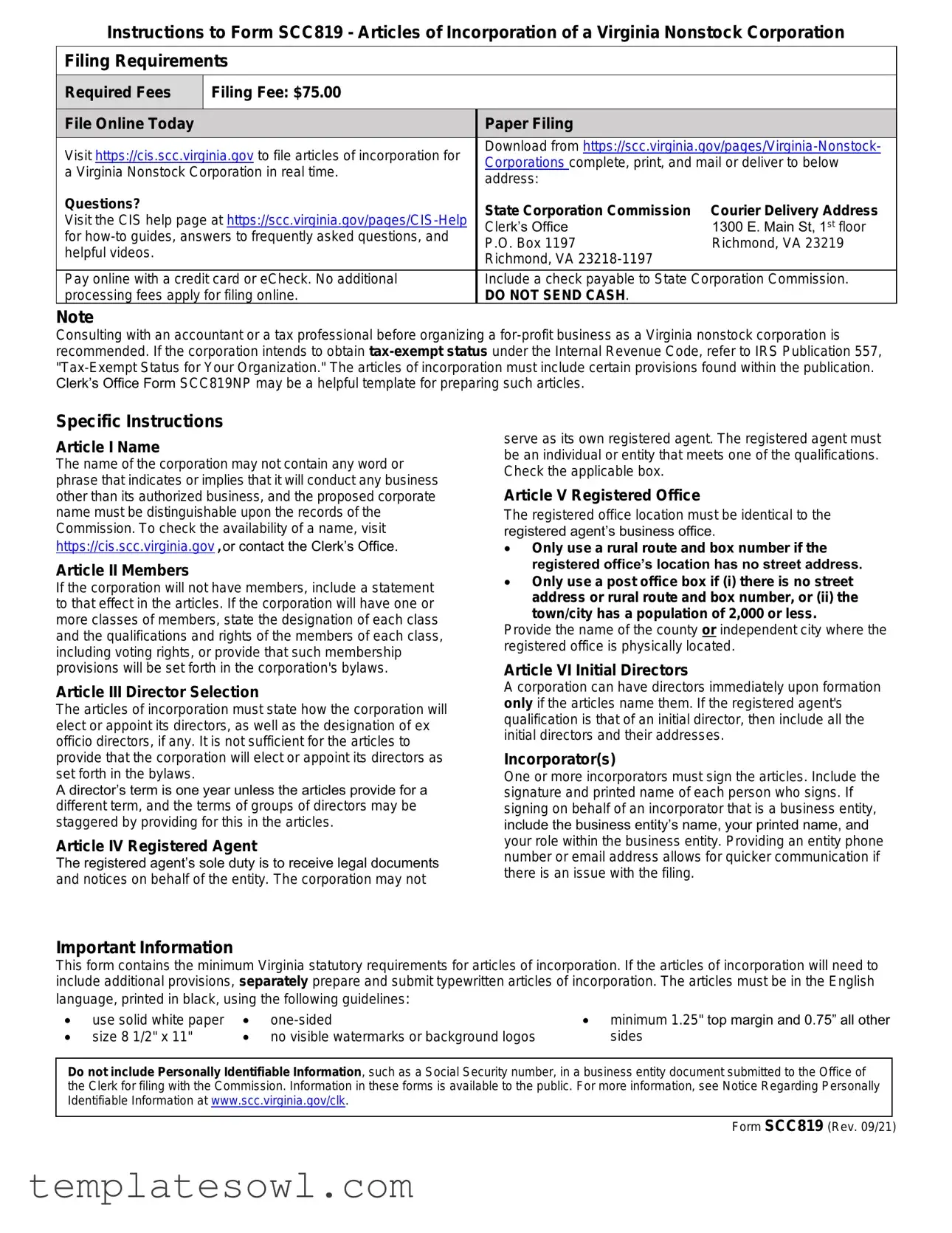

Instructions to Form SCC819 - Articles of Incorporation of a Virginia Nonstock Corporation

Filing Requirements

|

Required Fees |

Filing Fee: $75.00 |

|

|

|

|

|

|

|

|

|

|

File Online Today |

|

|

Paper Filing |

|

|

|

|

|

|

|

|

Visit https://cis.scc.virginia.gov to file articles of incorporation for |

|

Download from |

||

|

|

Corporations complete, print, and mail or deliver to below |

|||

|

a Virginia Nonstock Corporation in real time. |

|

|||

|

|

address: |

|

||

|

|

|

|

|

|

|

Questions? |

|

|

State Corporation Commission |

Courier Delivery Address |

|

Visit the CIS help page at |

|

|||

|

|

Clerk’s Office |

1300 E. Main St, 1st floor |

||

|

for |

|

P.O. Box 1197 |

Richmond, VA 23219 |

|

|

helpful videos. |

|

|

||

|

|

|

Richmond, VA |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Pay online with a credit card or eCheck. No additional |

|

Include a check payable to State Corporation Commission. |

||

|

processing fees apply for filing online. |

|

DO NOT SEND CASH. |

|

|

Note

Consulting with an accountant or a tax professional before organizing a

Specific Instructions

Article I Name

The name of the corporation may not contain any word or phrase that indicates or implies that it will conduct any business other than its authorized business, and the proposed corporate name must be distinguishable upon the records of the Commission. To check the availability of a name, visit

https://cis.scc.virginia.gov, or contact the Clerk’s Office.

serve as its own registered agent. The registered agent must be an individual or entity that meets one of the qualifications. Check the applicable box.

Article V Registered Office

The registered office location must be identical to the registered agent’s business office.

•

Article II Members

If the corporation will not have members, include a statement to that effect in the articles. If the corporation will have one or more classes of members, state the designation of each class and the qualifications and rights of the members of each class, including voting rights, or provide that such membership provisions will be set forth in the corporation's bylaws.

Article III Director Selection

The articles of incorporation must state how the corporation will elect or appoint its directors, as well as the designation of ex officio directors, if any. It is not sufficient for the articles to provide that the corporation will elect or appoint its directors as set forth in the bylaws.

A director’s term is one year unless the articles provide for a different term, and the terms of groups of directors may be staggered by providing for this in the articles.

Article IV Registered Agent

The registered agent’s sole duty is to receive legal documents and notices on behalf of the entity. The corporation may not

•Only use a post office box if (i) there is no street address or rural route and box number, or (ii) the town/city has a population of 2,000 or less.

Provide the name of the county or independent city where the registered office is physically located.

Article VI Initial Directors

A corporation can have directors immediately upon formation only if the articles name them. If the registered agent's qualification is that of an initial director, then include all the initial directors and their addresses.

Incorporator(s)

One or more incorporators must sign the articles. Include the signature and printed name of each person who signs. If signing on behalf of an incorporator that is a business entity, include the business entity’s name, your printed name, and your role within the business entity. Providing an entity phone number or email address allows for quicker communication if there is an issue with the filing.

Important Information

This form contains the minimum Virginia statutory requirements for articles of incorporation. If the articles of incorporation will need to include additional provisions, separately prepare and submit typewritten articles of incorporation. The articles must be in the English language, printed in black, using the following guidelines:

• |

use solid white paper |

• |

• minimum 1.25" top margin and 0.75” all other |

|

• |

size 8 1/2" x 11" |

• |

no visible watermarks or background logos |

sides |

Do not include Personally Identifiable Information, such as a Social Security number, in a business entity document submitted to the Office of the Clerk for filing with the Commission. Information in these forms is available to the public. For more information, see Notice Regarding Personally Identifiable Information at www.scc.virginia.gov/clk.

Form SCC819 (Rev. 09/21)

Form

SCC819

(Rev. 09/21)

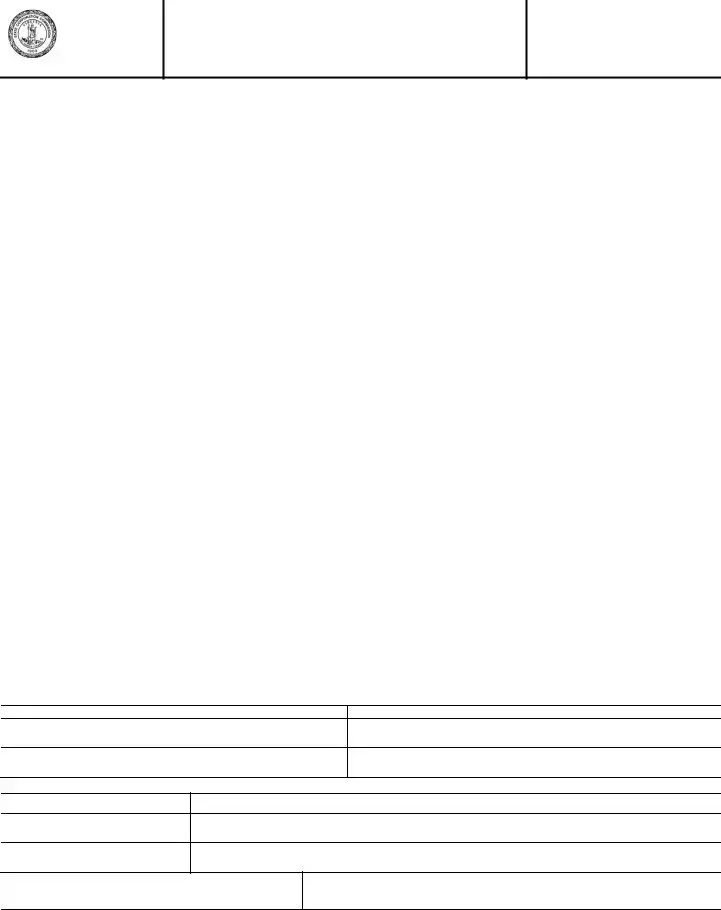

State Corporation Commission

Articles of Incorporation

of a Virginia Nonstock Corporation

Pursuant to Chapter 10 of Title 13.1 of the Code of Virginia, the undersigned state(s) as follows:

Article I The corporation’s name:

______________________________________________________________________________________

______________________________________________________________________________________

Article II (Mark appropriate box or insert applicable provisions.) The corporation shall have no members. OR

The corporation shall have one or more classes of members with such designations,

qualifications and rights as set forth in the bylaws. |

OR |

The designation of the class(es) of members and the members’ qualifications and rights are as follows:

______________________________________________________________________________________

______________________________________________________________________________________

Article III (Mark appropriate box or insert applicable provisions.)

The directors shall elect their successors. OR

The directors shall be elected by the members. OR

The directors shall be elected or appointed as follows:

________________________________________________________________________________________________

________________________________________________________________________________________________

Article IV A. The name of the corporation's initial registered agent:

______________________________________________________________________________________

B. The initial registered agent is: (Mark appropriate box.) |

|

|

(1) an individual who is a resident of |

OR (2) |

a domestic or foreign stock or |

Virginia and |

|

nonstock corporation, limited liability |

an initial director of the corporation. |

|

company or registered limited liability |

a member of the Virginia State Bar. |

|

partnership authorized to transact |

|

|

business in Virginia. |

Article V A. The corporation's initial registered office address, including the street and number, if any, which is identical to the business office of the initial registered agent, is

_____________________________________________________________, VA _____________________

|

(number/street) |

(city or town) |

|

(zip) |

|

B. The registered office is located in the |

county OR city of _________________________________ |

||

(Optional) |

The corporation's principal office address, including the street and number (if any), is |

|

||

|

______________________________________________________________________________________ |

|||

|

(number/street) |

(city or town) |

(state) |

(zip) |

Article VI The initial directors are:

Name

Address

Signature

Incorporator(s):

Printed Name |

Date |

Tel. # (optional) |

Email Address (optional) |

|

|

|

|

Business Tel. # (optional)

Business Email Address (optional)

Required Fees: $75.00

Form Characteristics

| Fact Name | Details |

|---|---|

| Document Purpose | The SCC819 form is used for filing Articles of Incorporation of a Virginia Nonstock Corporation. |

| Filing Fees | A filing fee of $75.00 is required for submitting the SCC819 form. |

| Filing Methods | Filing can be done online or by submitting a paper form. Online filing is available at https://cis.scc.virginia.gov. |

| Registered Office Requirement | The registered office must match the business office of the registered agent; a post office box is only permitted under specific conditions. |

| Article Specifications | Articles must include provisions regarding the corporate name, registered agent, initial directors, and membership, if applicable. |

| Consultation Recommendation | Consultation with an accountant or tax professional is recommended before forming a Virginia nonstock corporation, especially for tax-exempt status. |

| Directorship Terms | The articles must specify how directors are elected or appointed and their term length, defaulting to one year unless otherwise stated. |

| Incorporator Signatures | One or more incorporators must sign the SCC819 form, providing their names and roles if signing on behalf of a business entity. |

| Governance Law | The SCC819 form is governed by Chapter 10 of Title 13.1 of the Code of Virginia. |

Guidelines on Utilizing Scc819

Completing the SCC819 form is essential for establishing a Virginia Nonstock Corporation. After filling out the form accurately, filing can be done online or through traditional mail. Prepare all information thoroughly to avoid any delays in the process.

- Visit the Virginia State Corporation Commission website at this link to access the SCC819 form.

- Enter the corporation's proposed name in Article I. Ensure the name complies with state regulations and is distinguishable from existing entities.

- In Article II, mark the appropriate box indicating whether the corporation will have members, list classes of members, or state that there will be no members.

- For Article III, indicate how directors will be selected by marking the right option. Ensure that the articles provide clarity on the selection process.

- Fill out Article IV by providing the name of the initial registered agent and marking whether it is an individual or a business entity. Ensure the agent meets state qualifications.

- In Article V, include the address of the initial registered office. The address must match the registered agent’s business office.

- List the initial directors in Article VI, including their names and addresses.

- Ensure all incorporators sign the form. Provide their printed names and optionally include contact information such as email addresses and phone numbers.

- Review the completed form for accuracy and compliance with the requirements.

- Prepare to submit the $75.00 filing fee. Payment can be made online with a credit card or eCheck, or by mailing a check to the appropriate address.

- File the completed form online or print it to submit via mail to the Clerk’s Office at 1300 E. Main St, 1st floor, Richmond, VA 23219.

What You Should Know About This Form

What is the SCC819 form?

The SCC819 form is the Articles of Incorporation for a Virginia Nonstock Corporation. It is used to officially establish a nonstock corporation in Virginia by filing with the State Corporation Commission. This form includes essential information about the corporation, such as its name, registered agent, members, directors, and other organizational details.

What are the filing requirements for the SCC819 form?

To file the SCC819 form, you must pay a filing fee of $75.00. You can file online through the Virginia State Corporation Commission’s website or submit a paper filing by downloading, completing, and mailing the form to the designated address. Be sure your submission includes the correct information, as inaccuracies may delay the processing of your application.

How do I check the availability of a corporation name?

You can check the availability of your proposed corporation name by visiting the State Corporation Commission’s website. The name must be distinguishable from existing corporations in Virginia. This step is crucial to ensure you can use the name you want without conflicts.

Can I use a post office box as my registered office address?

A post office box can only be used if there is no street address or if the town has a population of 2,000 or less. It is essential that the registered office location matches the registered agent’s business office address to comply with the requirements.

What must I include in the Articles of Incorporation?

Your Articles of Incorporation must include the corporation name, registered agent, registered office, and the structure relating to members and directors. If your corporation will have different classes of members, clearly state these designations, their rights, and any voting procedures. It's important to follow the guidelines carefully to meet the statutory requirements.

What is a registered agent, and what is their role?

A registered agent is an individual or business entity designated to receive legal documents and official notices on behalf of the corporation. The registered agent must have a business office that is identical to the registered office of the corporation. It is their responsibility to ensure the corporation receives important communications promptly.

What are the guidelines for completing the SCC819 form?

The form should be completed in English, printed on solid white paper, and submitted one-sided. Margins should be maintained at a minimum of 1.25 inches on the top and 0.75 inches on the other sides. The document must be 8.5 inches by 11 inches in size. Ensure that no personally identifiable information is included to protect privacy.

Can I file the SCC819 form online?

Yes, you can file the SCC819 form online through the State Corporation Commission's website. Online filing is recommended for its speed and convenience. Payments can be made using a credit card or eCheck, with no additional processing fees for online submissions.

Do I need to consult a professional before filing the SCC819 form?

While not required, it is advisable to consult with an accountant or tax professional before organizing a nonstock corporation. Seeking guidance can help ensure compliance with tax laws, particularly if you seek tax-exempt status. Resources are available to assist you in understanding the requirements under the Internal Revenue Code.

Common mistakes

Filling out the SCC819 form for the Articles of Incorporation of a Virginia Nonstock Corporation can be straightforward, but mistakes can lead to delays or complications. Here are seven common errors people make when completing this form.

Firstly, many individuals fail to check the availability of the corporation name beforehand. The name must not suggest that the corporation will engage in activities outside its authorized business. Conducting a name search early on can prevent having to alter the name after submission, which can be time-consuming.

Secondly, people often overlook the requirement for the registered office information. The registered office must belong to the registered agent and cannot be a post office box unless specific conditions are met. This mistake can result in a rejection of the application or additional requests for information.

Another common error is the incomplete definition of membership within the corporation. If the corporation will have members, the articles must clearly state the classes, qualifications, and voting rights. Omitting this information can lead to confusion later, particularly during the initial organizational meeting.

Incorrectly stating how directors are selected is also a frequent mistake. The articles must specify the method for electing or appointing directors; simply stating that this will be covered in the bylaws is insufficient. Clarity in this section helps avoid potential disputes regarding leadership roles.

Some applicants neglect to include all required signatures, particularly from the incorporators. Every person who signs must provide their printed name and the position held if signing on behalf of a business. This oversight can lead to processing delays due to lack of proper authorization.

Additionally, applicants sometimes fail to provide a contact number or email address. Including this information facilitates quick communication if any issues arise during the filing process. Without these details, it may take longer to resolve questions or clarify information.

Lastly, many people ignore the formatting guidelines specified in the instructions. The articles must adhere to the required paper size, margins, and printing specifications. Submissions that do not meet these criteria may be returned for correction, prolonging the filing timeline.

Avoiding these mistakes can enhance the efficiency of the filing process and improve the chances of a successful submission of the SCC819 form.

Documents used along the form

The SCC819 form, which is used to file Articles of Incorporation for a Virginia Nonstock Corporation, is often accompanied by several other documents to ensure compliance with state regulations. Below is a list of forms and documents that may be used in conjunction with the SCC819 form.

- Form SCC819NP: This form serves as a template for drafting the articles of incorporation. It provides additional guidance for meeting the necessary statutory requirements of a Virginia nonstock corporation, particularly regarding membership and governance structures.

- Form IRS 1023: Organizations seeking tax-exempt status under Internal Revenue Code Section 501(c)(3) must submit this form to the IRS. It collects information about the organization’s structure, governance, and programs to determine eligibility for exemption from federal income tax.

- Form SCC930: This document serves as the Initial Business Registration form required by the Virginia State Corporation Commission. It includes essential details about the business such as its name, address, and registered agent.

- Bylaws Document: Bylaws outline the rules and procedures for the internal governance of the corporation. They define the roles of members and directors, as well as how meetings should be conducted and decisions made.

- Form SCC601: This is known as the Initial Registered Agent form. It is used to officially designate the registered agent for the corporation, confirming their acceptance of the role and outlining their responsibilities.

- Form SCC932: This document, known as the Annual Report form, is required for maintaining good standing with the Virginia State Corporation Commission. It updates the Commission on the corporation’s address, registered agent, and other vital information annually.

- Form SCC637: This is the Application for a Certificate of Authority for foreign corporations wishing to conduct business in Virginia. This form must be completed when forming a new business entity that already exists in another state.

- Form W-9: While not exclusive to Virginia nonstock corporations, the W-9 is needed for tax purposes by organizations seeking to open bank accounts or establish relationships with vendors. It provides the requester with the corporation's taxpayer identification number.

Understanding these additional documents is important for anyone involved in establishing a nonstock corporation in Virginia. Completing the required forms accurately and completely will help facilitate the incorporation process and ensure compliance with legal requirements.

Similar forms

The SCC819 form, used for the Articles of Incorporation of a Virginia Nonstock Corporation, shares similarities with several other important documents in the business formation process. Here’s a look at four documents that are comparable, along with a brief explanation for each:

- Form SCC631: This document, known as the Articles of Organization for Limited Liability Companies (LLCs) in Virginia, also lays out the fundamental details of a business entity. Both forms require key information about the corporation or LLC name, registered agent, and initial directors or members. They ensure compliance with state laws.

- Form SCC835: Used for the formation of a Virginia Stock Corporation, Form SCC835 similarly necessitates details such as the corporation's name, registered office, and initial directors. Like the SCC819, it ensures the entity is appropriately registered and adheres to statutory requirements.

- Form SCC801: This is the Application for a Certificate of Authority for Foreign Corporations. When a corporation from outside Virginia wants to do business in the state, it must fill out this form. Similar to the SCC819, it requires information about the corporation’s registered agent and proposed name.

- Form IRS 1023: This form is used to apply for tax-exempt status under the Internal Revenue Code. While it serves a different purpose, both the SCC819 and IRS 1023 require the organization to provide detailed information regarding its structure, governance, and activities. They are essential for ensuring compliance with regulations governing nonprofits.

Dos and Don'ts

When completing the SCC819 form, it's essential to follow certain guidelines to ensure a smooth filing process. Here are seven important dos and don’ts:

- Do verify the name of your corporation for availability before submission.

- Don't include any Personally Identifiable Information, such as Social Security numbers.

- Do state clearly whether your corporation will have members or not.

- Don't send cash; use a check payable to the State Corporation Commission or pay online.

- Do ensure the registered agent’s address matches their business office address.

- Don't assume that all business needs will be covered; consider consulting professionals for tax advice.

- Do provide accurate contact information for quicker communication about your filing.

Adhering to these guidelines can greatly assist in the successful completion of your SCC819 form submission. Planning ahead often pays off.

Misconceptions

Misconceptions about the SCC819 form can lead to mistakes in the incorporation process. Here are eight common misconceptions along with clarifications:

- Anyone can file the SCC819 form without prior guidance. Many opt to file without understanding the document's complexities. It's wise to consult a professional, especially regarding tax-exempt status.

- Registered agents can work anywhere. The registered agent must have a business office identical to the registered office location. This is a strict requirement.

- A post office box can be used for any address. A post office box should only be used if there is no street address or if the town's population is 2,000 or less.

- The form can be submitted in any format. The articles must be printed on solid white paper, one-sided, and meet specific margin sizes.

- Directors don’t need to be named at the formation. The articles must state the election or appointment process for directors. You can't state that this will be decided in the bylaws.

- The corporation does not need to disclose membership details. If there are classes of members, their qualifications and rights must be outlined directly in the articles.

- The SCC819 form is the only requirement for nonstock corporations. This form meets minimum statutory requirements. Additional provisions may be needed based on specific organizational goals.

- Identifying information can be included without concern. Avoid including personally identifiable information, such as Social Security numbers, in the submission. This information is publicly accessible.

Key takeaways

When filling out and using the SCC819 form for Articles of Incorporation of a Virginia Nonstock Corporation, keep these key takeaways in mind:

- Understand the Purpose: The form establishes your Virginia Nonstock Corporation and outlines its basic structure.

- Correct Address Usage: Use a rural route and box number only if no street address exists.

- Filing Fees: A filing fee of $75 is required. You can pay online or via mail.

- Registered Agent: You must designate a registered agent who receives legal documents for the corporation.

- Naming the Corporation: Ensure the name is unique and does not suggest activities outside of the authorized business.

- Provisions for Members: Clearly state if the corporation will have members and their rights, or assert that there will be none.

- Directors' Roles: Specify how directors are chosen; they can be elected by members or as defined in your bylaws.

- Incorporator's Signature: At least one incorporator must sign the form. Their printed name and role must be included if signing on behalf of a business entity.

- Privacy Matters: Do not include personal information like Social Security numbers in the filing, as this data will be public.

By following these guidelines, you can navigate the process of forming a Virginia Nonstock Corporation more effectively.

Browse Other Templates

Neisd Transcript - Students must provide their unique student ID number on the form.

Free Certificate Maker - Questions about the convocation schedule can be directed to the university’s contact information.

Aoa Rental Agreement Pdf - Outlines conditions for potential legal actions regarding the lease.