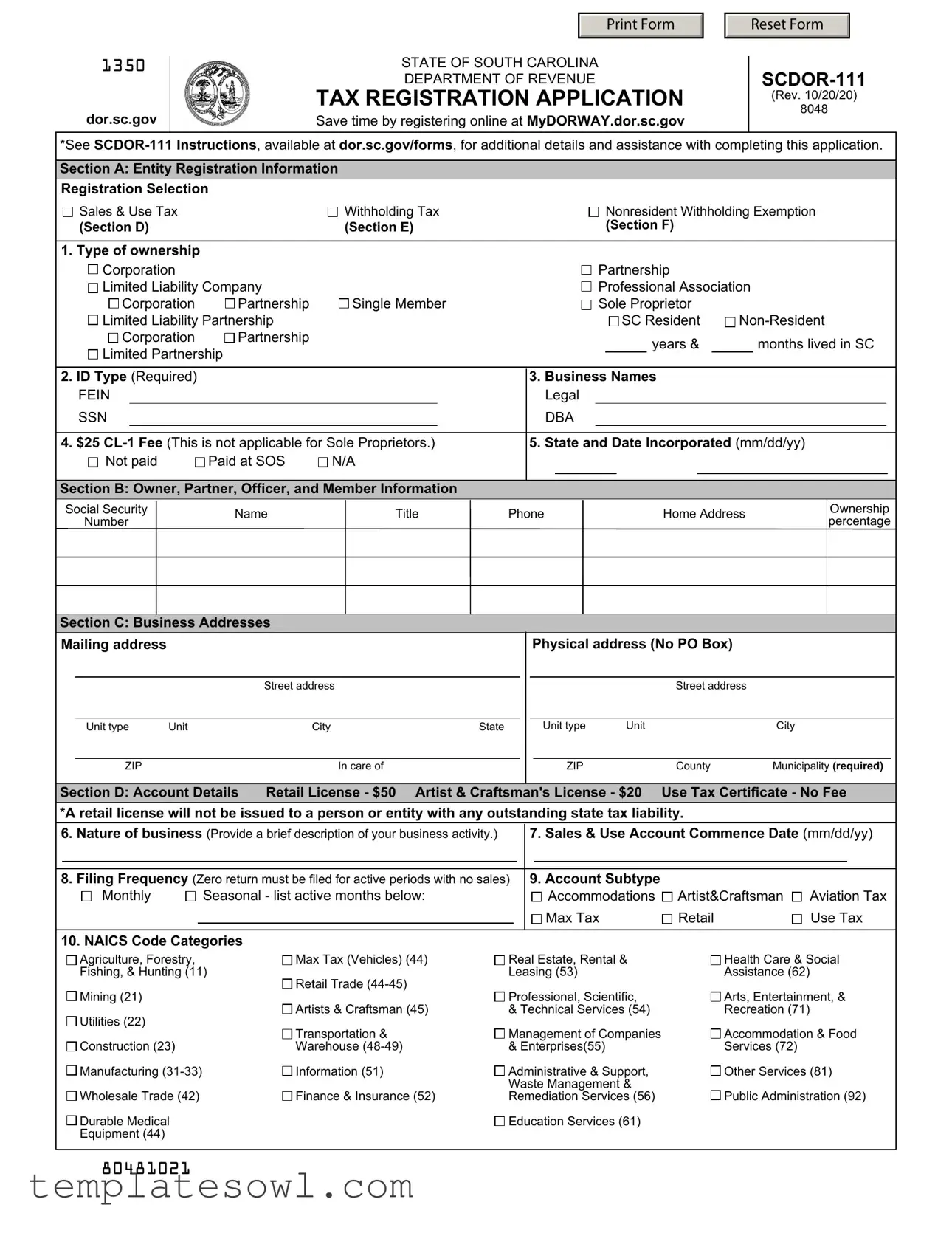

Fill Out Your Scdor 111 Form

The SCDOR 111 form is an essential document that serves as a tax registration application for businesses operating in South Carolina. It facilitates the registration for various tax accounts including Sales and Use Tax, Withholding Tax, and Nonresident Withholding Exemptions. The form comprises different sections, starting with Basic Entity Registration Information where applicants must specify their type of business ownership, business names, and incorporation details. Business owners must also provide crucial financial and operational information, including nature of business, filing frequencies, and account details for retail licenses. Additionally, the form captures information about owners, partners, and officers, outlining their roles and contact details. Properly registering ensures compliance with state tax laws and may include a $25 application fee for certain business entities. For employers, the form mandates the registration of withholding accounts if they have employees earning wages in South Carolina. Consequently, understanding the requirements and accurately completing the SCDOR 111 form is vital for business owners to navigate the regulatory landscape smoothly.

Scdor 111 Example

1350

dor.sc.gov

Print Form

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

TAX REGISTRATION APPLICATION

Save time by registering online at MyDORWAY.dor.sc.gov

Reset Form

(Rev. 10/20/20)

8048

*See

Section A: Entity Registration Information

Registration Selection

|

|

Sales & Use Tax |

|

|

|

|

|

|

Withholding Tax |

|

|

|

|

|

|

|

|

|

Nonresident Withholding Exemption |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

(Section D) |

|

|

|

|

|

|

(Section E) |

|

|

|

|

|

|

|

|

|

(Section F) |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Type of ownership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

Corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partnership |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

Limited Liability Company |

|

|

|

|

|

|

|

|

|

|

|

|

Professional Association |

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

Corporation |

|

|

Partnership |

|

|

|

Single Member |

|

|

|

|

|

|

|

Sole Proprietor |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

Limited Liability Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SC Resident |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

Corporation |

|

|

Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

years & |

|

|

months lived in SC |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

Limited Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. ID Type (Required) |

|

|

|

|

|

|

|

|

|

|

3. Business Names |

|

|

|

|

|

|||||||||||||||||||||||

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

Legal |

|

|

|

|

|

|

||||||||||||||||||

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

DBA |

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

4. $25 |

|

5. State and Date Incorporated (mm/dd/yy) |

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

Not paid |

|

Paid at SOS |

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section B: Owner, Partner, Officer, and Member Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Social Security |

|

|

Name |

|

|

|

Title |

Phone |

|

|

|

|

|

|

|

|

|

|

|

Home Address |

Ownership |

|||||||||||||||||

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

percentage |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Section C: Business Addresses

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

Physical address (No PO Box) |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address |

|

|

|

|

|

|

|

|

|

|

|

Street address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit type |

Unit |

City |

State |

|

|

|

|

|

Unit type |

Unit |

|

|

City |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ZIP |

|

|

|

|

In care of |

|

|

|

|

|

|

|

|

ZIP |

|

|

County |

Municipality (required) |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Section D: Account Details |

Retail License - $50 Artist & Craftsman's License - $20 |

Use Tax Certificate - No Fee |

|||||||||||||||||||||||||

*A retail license will not be issued to a person or entity with any outstanding state tax liability. |

|

|

|

|

|

|

|||||||||||||||||||||

6. Nature of business (Provide a brief description of your business activity.) |

|

7. Sales & Use Account Commence Date (mm/dd/yy) |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. Filing Frequency (Zero return must be filed for active periods with no sales) |

|

9. Account Subtype |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

Monthly |

|

|

|

Seasonal - list active months below: |

|

|

|

|

|

|

|

|

Accommodations |

|

Artist&Craftsman |

|

Aviation Tax |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Max Tax |

|

|

Retail |

|

|

Use Tax |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. NAICS Code Categories |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Agriculture, Forestry, |

|

Max Tax (Vehicles) (44) |

|

|

|

Real Estate, Rental & |

|

|

|

|

|

|||||

|

Fishing, & Hunting (11) |

|

Retail Trade |

|

|

|

Leasing (53) |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

Mining (21) |

|

|

|

|

Professional, Scientific, |

||

|

|

|

|

|

|

|||

|

Utilities (22) |

|

|

Artists & Craftsman (45) |

|

|

|

& Technical Services (54) |

|

|

|

|

|

||||

|

|

|

Transportation & |

|

|

|

Management of Companies |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

Construction (23) |

|

|

Warehouse |

|

|

|

& Enterprises(55) |

|

||||||||

|

Manufacturing |

|

|

Information (51) |

|

|

|

Administrative & Support, |

|

||||||||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Waste Management & |

|

Wholesale Trade (42) |

|

|

Finance & Insurance (52) |

|

|

|

Remediation Services (56) |

|

|

|

|

|

||||

|

Durable Medical |

|

|

|

|

|

Education Services (61) |

|

|

|

|

||||||

|

|

|

|

|

||||

|

Equipment (44) |

|

|

|

|

|

|

|

Health Care & Social

Assistance (62)

Arts, Entertainment, &

Arts, Entertainment, &

Recreation (71)

Accommodation & Food

Accommodation & Food

Services (72)

Other Services (81)

Other Services (81)

Public Administration (92)

Public Administration (92)

80481021

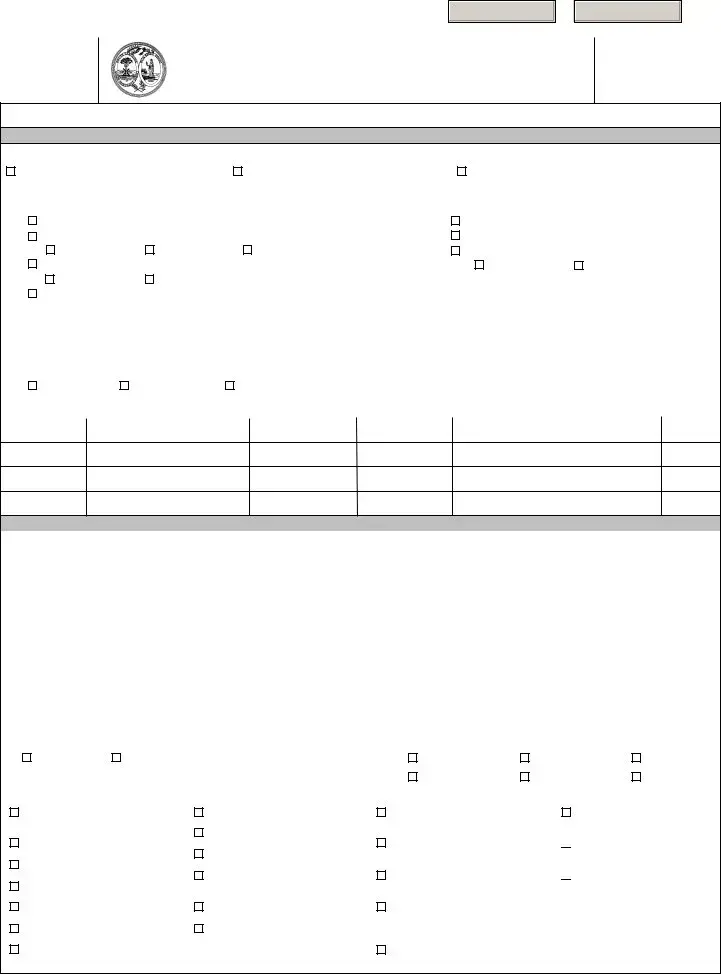

11. |

Additional Sales Selections (check all that apply) |

|

|

|

|

|

|

|

||||||

|

|

|

Large appliances |

|

|

Motor oil |

|

Prepaid wireless cards |

|

Rental surcharge |

||||

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|||||||||

|

|

|

Lead acid batteries |

|

|

|

Tires |

|

Service to cellular and personal communications users |

|||||

|

|

|

|

|||||||||||

|

|

|

||||||||||||

|

|

|

|

|||||||||||

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

12. |

Sales Methods (check all that apply) |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Art shows, craft shows, or festivals |

|

|

|

|

Physical storefront |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Flea market |

|

|

|

|

Online website: |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Online marketplace (which does not collect sales tax) |

|

Other: |

|

|

|

||||||

|

|

|

|

|

|

|

||||||||

|

|

|

Examples include Craigslist, Facebook Marketplace) |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

Section E: Account Details - Withholding

Every employer with employees earning wages in South Carolina must register for Withholding. Other types of payments also require state tax Withholding. See instructions for more information.

13. Withholding account date of first payroll (mm/dd/yy) |

14. Sole Proprietor FEIN (required) |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. Residency status of employer or Withholding agent |

|

|

|

||||||||

|

|

|

|

Resident business |

|

Nonresident business |

|

|

|

||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

16. Filing frequency for Withholding returns (See Form 105 for Withholding payment frequencies) |

|||||||||||

|

|

|

|

Quarterly |

|

|

Annual (Must meet specific requirements. See instructions.) |

||||

|

|

|

|

|

|

||||||

Section F: Nonresident Withholding Exemption

Nonresident businesses who have activity but no employees in South Carolina can be granted exemption from Withholding Tax. See instructions for more information.

Nature of business

|

|

|

I agree to file a South Carolina tax return |

|

|

|

I am not subject to South Carolina Tax Jurisdiction (no NEXUS) |

||

|

|

|

|

||||||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

||

Section G: Banking Information |

|

|

|

|

|

|

|||

17. Financial Institution |

|

Phone number |

|

||||||

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Section H: Business Contact Information |

|

***POAs must submit completed and signed SC2848 |

|||||||

18. Contact's name |

|

Phone number |

|

||||||

Notice of automatic additional account creation: Due to NAICS Code requirements, the applied for account may automatically generate a Business Personal Property Account. Additional notification by mail occurs when applicable.

I certify that all information on this application, including any attachments, is true and correct to the best of my knowledge.

Section I: Signatures, Titles, Dates

Signature of owners, all partners, officers, and members |

|

Title |

Date signed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For more information on starting and running your business in South Carolina, visit scbos.sc.gov.

Make checks payable to SCDOR.

Mail to: SCDOR, PO Box 125, Columbia, SC

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i) permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation

80482029

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The SCDOR-111 form is utilized for tax registration purposes in South Carolina, specifically for sales and use tax, withholding tax, and nonresident withholding exemption applications. |

| Governing Laws | This form is governed by the South Carolina Code of Laws Title 12, which relates to taxation, including specific regulations on sales and use tax and withholding tax obligations. |

| Fees | A registration fee of $25 is applicable, except for sole proprietors. Additional fees may apply depending on the type of licenses selected, such as a $50 retail license. |

| Residency Status | The form includes a designation for the residency status of the business, as it affects tax obligations and withholding requirements for South Carolina businesses. |

| Social Security Requirement | Individuals must provide their Social Security Number on the form as it is required for tax identification purposes under federal and South Carolina regulations. |

Guidelines on Utilizing Scdor 111

Completing the SCDOR-111 form is a straightforward process that requires specific information about your business and its owners. This form is essential for tax registration in South Carolina. Following the steps carefully will ensure that you submit all necessary details accurately.

- Begin with Section A, where you will select the type of registration needed (Sales & Use Tax, Withholding Tax, or Nonresident Withholding Exemption).

- Indicate the type of ownership by checking the appropriate box (Corporation, Partnership, Limited Liability Company, etc.).

- Provide the required identification type, which can be Federal Employer Identification Number (FEIN), Social Security Number (SSN), or Doing Business As name (DBA).

- If applicable, include the $25 CL-1 fee. Note that this fee does not apply to Sole Proprietors.

- State and date of incorporation (mm/dd/yy) should be filled out next.

- Complete Section B by providing information for the owner, partner, officer, or member including name, title, phone, home address, and ownership percentage.

- Move to Section C and list both the mailing and physical addresses of your business. Make sure not to use a P.O. Box for the physical address.

- In Section D, indicate details about account types and fees, such as the nature of your business and the sales and use account commence date.

- Provide account subtype and filing frequency as required in this section.

- If applicable, check the additional sales selections and sales methods that apply to your business.

- In Section E, provide details for withholding including the first payroll date, FEIN for sole proprietors, and residency status of the employer or withholding agent.

- Complete Section F by confirming your agreement to file a tax return, and specify whether you have tax jurisdiction in South Carolina.

- Fill out Section G by listing your financial institution along with its contact information.

- Provide business contact information in Section H, including the contact's name, phone number, and email address.

- Lastly, Section I requires signatures from all owners, partners, officers, and members, along with their titles and the date signed.

Once completed, ensure all information is accurate. You can then send the form along with any required payment to the South Carolina Department of Revenue at the provided mailing address. If you have questions or need further assistance, consider visiting the South Carolina Business One Stop website for more resources.

What You Should Know About This Form

What is the SCDOR 111 form used for?

The SCDOR 111 form is a Tax Registration Application used in South Carolina. It allows businesses to register for various state tax accounts, including Sales and Use Tax, Withholding Tax, and Nonresident Withholding Exemption. By completing this form, businesses can ensure they comply with state tax regulations and maintain proper tax accounts.

Who needs to fill out the SCDOR 111 form?

Generally, any business entity operating in South Carolina that intends to collect sales tax or withhold income tax from employees must complete this form. This includes corporations, partnerships, sole proprietors, and other business structures. Additionally, nonresident businesses conducting activities in the state may need to register as well.

What information do I need to provide on the form?

When filling out the SCDOR 111 form, you will need to provide various details, such as your business structure and ownership type, as well as names, addresses, and contact information. You will also specify your business activities, tax account details, and filing frequency. Ensure all sections are completed accurately to avoid delays in processing.

Is there a fee associated with the SCDOR 111 form?

Yes, there is a fee for certain registrations. For example, a retail license costs $50, while an Artist & Craftsman's License is $20. Notably, there is no fee for obtaining a Use Tax Certificate. It’s also important to mention that the $25 CL-1 fee does not apply for Sole Proprietors.

How do I submit the SCDOR 111 form?

You can submit the SCDOR 111 form in one of two ways: online or by mail. For a quick process, consider registering online at MyDORWAY.dor.sc.gov. If you prefer to submit a physical form, print the completed document and mail it to the SCDOR at PO Box 125, Columbia, SC 29214-0850.

What if I make a mistake on my SCDOR 111 form?

If you discover an error after submission, it is important to correct it promptly. Depending on the type of mistake, you may need to contact the SCDOR for guidance on how to amend your application or make the necessary adjustments to your business tax accounts.

What is the tax identification number needed on the SCDOR 111 form?

The form requires you to provide a Federal Employer Identification Number (FEIN) or your Social Security Number (SSN) as the ID type. This number is essential for tax purposes and helps the state identify your business accurately.

Where can I find more information about the SCDOR 111 form?

To find additional details about completing the SCDOR 111 form, you can visit the South Carolina Department of Revenue's official website at dor.sc.gov/forms. They offer guidelines and resources to assist you in the registration process, ensuring your application is filled out correctly.

Common mistakes

Filling out the SCDOR-111 form can seem straightforward, but there are common mistakes that applicants frequently make. One significant error is forgetting to provide accurate identification numbers. This form requires important identifiers, such as a Federal Employer Identification Number (FEIN) or Social Security Number (SSN). Omitting this information will delay processing.

Another common pitfall is not specifying the correct type of ownership. The options range from corporations to sole proprietors. If the form is not filled out correctly, it could lead to complications in the registration process. Ensuring that the right ownership type is checked is crucial for proper classification.

Many individuals neglect the fees associated with the application. For instance, there’s a $25 CL-1 fee that does not apply to sole proprietors. Failing to pay the requisite fee can result in the application being rejected until the payment is made.

Additionally, applicants may overlook the necessity of providing both a mailing and a physical address. It is crucial to input an accurate street address instead of a P.O. Box. Not complying with this requirement may lead to issues with correspondence regarding your application.

People often mistakenly choose the wrong filing frequency for their tax accounts. It’s essential to understand whether your business requires monthly, quarterly, or annual returns. This choice directly impacts how often you will need to submit tax returns, and selecting the wrong option can create unnecessary complications or penalties.

Lastly, many applicants fail to provide a brief description of their business activities in the nature of business section. This information is essential for classification purposes and can determine the tax rate or other obligations of the business. Incomplete descriptions can lead to misunderstandings with the Department of Revenue.

Documents used along the form

When completing the SCDOR-111 form for tax registration in South Carolina, several other forms and documents may be required. Understanding these additional requirements can facilitate a smoother process for your business registration.

- SCDOR 105: This is the Withholding Tax Return form. Employers use it to report and pay withheld state income taxes from employee wages.

- SC2848: This form is used for Power of Attorney. It allows an individual to authorize someone else to represent them before the South Carolina Department of Revenue.

- CL-1: The Corporate License Application form is required for businesses incorporated in South Carolina. It assists in obtaining a corporate license after registration.

- SC501: This is the Retail License application. Retailers must complete this to collect sales tax from customers.

- Form 150: This document is for business personal property tax. It is necessary for businesses to report their personal property for taxation purposes.

- Certificate of Good Standing: This document certifies that a business is legally registered in South Carolina and is compliant with state regulations.

Familiarity with these forms helps ensure full compliance with state tax regulations. Properly completing and submitting these documents can prevent unnecessary delays in the registration process.

Similar forms

-

SCDOR-101: This form is also a tax registration application for businesses in South Carolina. It serves similar purposes, including the collection of owner details and business information for state tax purposes. Like the SCDOR-111, it requires information about the type of business entity and contact information.

-

SCDOR-105: The Withholding Tax Return form is related in function, as it requires information from employers for tax obligations concerning employee wages. Both forms gather essential data for the correct processing of a business's tax responsibilities.

-

SCDOR-114: This is the Business Personal Property Tax Return. It aligns with the SCDOR-111 by collecting value information about business personal property for taxation purposes. Both forms require similar identification details and information about ownership.

-

SCDOR-148: This form, the Application for a Sales Tax Exempt Certificate, is similar as it pertains to tax registration and requires information about the type of entity and tax obligations. Both ensure compliance with state tax requirements.

-

SCDOR-223: Used for filing an Amended Return, this form is akin to SCDOR-111 as it addresses tax-related issues and requires the taxpayer's identification information, ensuring accurate tax reporting.

-

IRS Form SS-4: This form, used for applying for an Employer Identification Number (EIN), shares similarities in terms of the information required about the business structure and ownership. Both forms collect details to facilitate legal and tax compliance.

-

SCDOR-160: The Application for a Nonprofit Status form is similar to SCDOR-111, as both require detailed entity information and support registration for tax-exempt purposes. They focus on accurately identifying the type of entity applying.

-

IRS Form 1040: This individual income tax return form correlates with SCDOR-111 as both collect vital information regarding tax obligations, although the SCDOR-111 is specifically for business entity registration.

-

SCDOR-1141: This form is for the Filing of Property Tax Returns and is similar in that it demands information related to property ownership and business operations in South Carolina, akin to what SCDOR-111 requests.

Dos and Don'ts

When filling out the SCDOR 111 form, follow these guidelines to ensure a smooth application process.

- Do use accurate identification numbers, such as your Social Security Number (if applicable) or FEIN.

- Do register online at MyDORWAY.dor.sc.gov when possible to save time.

- Do provide a complete description of your business activity in the designated section.

- Do review all information carefully before submitting to avoid errors.

- Do include the appropriate fees, unless you are a Sole Proprietor where the fee might not apply.

- Don't leave any required sections blank; incomplete forms can delay processing.

- Don't submit a mailing address that is a P.O. Box; provide a physical street address instead.

- Don't underestimate the importance of filing frequency; choose the option that accurately reflects your situation.

- Don't ignore the residency status question; this is critical for withholding tax purposes.

- Don't forget to sign the application; incomplete signature sections will result in rejection.

Misconceptions

- Misconception 1: The SCDOR 111 form is only for new businesses.

- Misconception 2: Sole proprietors do not need to file the SCDOR 111 form.

- Misconception 3: Section E of the form is only for large corporations.

- Misconception 4: Once submitted, the form cannot be changed or updated.

- Misconception 5: The SCDOR 111 form can be completed without any prior knowledge of tax registrations.

- Misconception 6: Filing frequency for sales tax is the same for all businesses.

- Misconception 7: Only South Carolina residents can apply using the SCDOR 111 form.

- Misconception 8: The form is not required if the business does not have physical sales locations.

This form is used not just for new businesses. Existing businesses that need to register for sales tax or withholding tax also must complete it.

While the $25 CL-1 fee does not apply to sole proprietors, they still need to fill out the form to register for sales tax or withholding tax if applicable.

This section applies to any business entity that has employees in South Carolina, regardless of size.

Businesses can update their information by contacting the South Carolina Department of Revenue after the initial submission.

Although the form is straightforward, it is highly recommended to review the instructions thoroughly to ensure proper completion.

The filing frequency varies based on the business's volume of sales, so it is essential to choose the correct option on the form.

Non-residents can also apply. They may need to indicate their residency status and should check for requirements specific to non-residents.

Regardless of whether a business has a physical storefront, all entities engaging in sales in South Carolina must comply with registration requirements.

Key takeaways

When filling out the SCDOR-111 form, there are several essential points to consider. Understanding these can help streamline the process and ensure compliance with state regulations.

- Online Registration: Consider registering online through MyDORWAY.dor.sc.gov to save time and minimize errors.

- Entity Type: Clearly identify your business structure, whether it is a corporation, partnership, or sole proprietorship, as this affects your application.

- Identify Your Business: Provide both your Federal Employer Identification Number (FEIN) and any "Doing Business As" (DBA) names.

- Registration Fees: Be aware of the applicable fees, such as the $25 CL-1 fee, which does not apply to sole proprietors.

- Accurate Addresses: Ensure that your physical address is complete and does not include a P.O. Box, as this is crucial for official correspondence.

- Sales Tax Information: Include details on your sales and use tax accounts, specifying the type of sales and the filing frequency.

- Withholding Requirements: If you have employees, it is mandatory to register for withholding tax. This applies to various payment types.

- Nonresident Exemptions: Nonresident businesses without employees in South Carolina may qualify for exemption from withholding tax.

- Signature and Certification: All owners and partners must sign the application, certifying that the information provided is accurate.

By paying attention to these key points, you can navigate the form more effectively and ensure that your business complies with South Carolina tax regulations.

Browse Other Templates

Does a Trust Override a Beneficiary on a Bank Account - Completing this form is crucial, as it has important implications for estate planning and asset distribution.

Alabama Child Support Modification Forms - Parents are encouraged to keep all related financial documentation handy for reference.