Fill Out Your Schedule California 540 Form

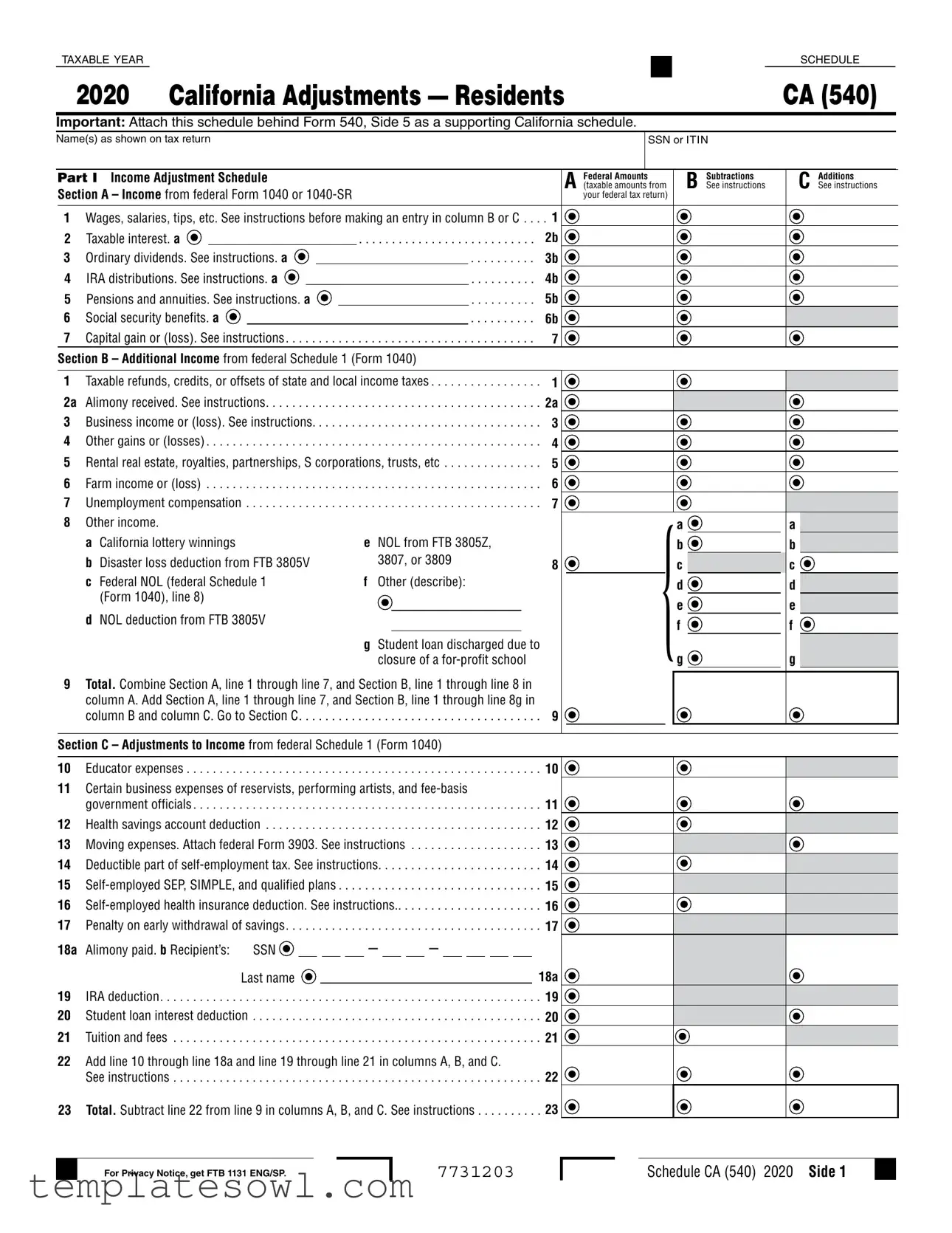

The Schedule California 540 form is a crucial document for residents filing their state income tax returns. It serves as the California Adjustments schedule for reporting income modifications derived from your federal tax return. This form addresses three primary areas: adjustments to income, adjustments to itemized deductions, and additional computations. Residents must accurately report their income as stated in various sections, including wages, interest, dividends, and retirement distributions. Furthermore, taxpayers have the opportunity to make specific subtractions and additions to their federal amounts to arrive at California taxable income. In addition to income adjustments, the Schedule CA (540) encompasses critical details regarding itemized deductions, offering taxpayers a chance to claim medical expenses, state taxes, interest paid, and contributions to charity that may differ from federal calculations. By carefully completing this form and attaching it to the main Form 540, residents can ensure that their tax return is comprehensive and compliant with California tax laws. Meeting the filing deadline is urgent, as errors or omissions can lead to unnecessary complications and delays in processing returns.

Schedule California 540 Example

TAXABLE YEAR |

|

|

SCHEDULE |

|

|

|

|

2020 California Adjustments — Residents |

CA (540) |

||

Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule.

Name(s) as shown on tax return

SSN or ITIN

|

Part I |

Income Adjustment Schedule |

|

|

|

|

|

|

A |

Federal Amounts |

B |

Subtractions |

C |

Additions |

|||||||||||

|

Section A – Income from federal Form 1040 or |

|

|

|

|

|

|

(taxable amounts from |

See instructions |

See instructions |

|||||||||||||||

|

|

|

|

|

|

|

|

|

your federal tax return) |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1 |

Wages, salaries, tips, etc. See instructions before making an entry in column B or C . . . |

. 1 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

2 |

Taxable interest. a |

|

. . . |

. . |

. . . . . . . . . . . . |

. . . . . . . . |

. . |

2b |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

3 |

Ordinary dividends. See instructions. a |

|

|

|

|

. . . . . . . . |

. . |

3b |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

4 IRA distributions. See instructions. a |

|

|

|

|

|

|

4b |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

. . . . . . . . |

. . |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

5 Pensions and annuities. See instructions. a |

|

|

|

|

. . . . . . . . |

. . |

5b |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

6 |

Social security benefits. a |

|

|

|

|

. . . . . . . . |

. . |

6b |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

7 |

Capital gain or (loss). See instructions |

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

. . . . . . . . . . . . . . |

. . . . . . . . |

. . |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Section B – Additional Income from federal Schedule 1 (Form 1040) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1 |

Taxable refunds, credits, or offsets of state and local income taxes |

1 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

2a |

. . . . . . . . . . . . . . . . .Alimony received. See instructions |

. . . . . . . . . . . . . . |

. . . . . . . . |

. . . |

2a |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

3 |

. . . . . . . . . .Business income or (loss). See instructions |

. . . . . . . . . . . . . . |

. . . . . . . . |

. . . |

3 |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

4 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Other gains or (losses) |

. . . . . . . . |

. . . |

4 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

5 |

. . . . . . . . . . . . . . .Rental real estate, royalties, partnerships, S corporations, trusts, etc |

5 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

6 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Farm income or (loss) |

. . . . . . . . |

. . . |

6 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

7 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Unemployment compensation |

. . . . . . . . |

. . . |

7 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

8 |

Other income. |

|

|

|

|

|

|

|

|

|

|

a |

|

|

|

a |

|

|

||||||

|

|

a |

California lottery winnings |

e |

NOL from FTB 3805Z, |

|

|

|

|

|

b |

|

|

|

b |

|

|

||||||||

|

|

b |

Disaster loss deduction from FTB 3805V |

|

3807, or 3809 |

8 |

|

|

|

|

c |

|

|

|

c |

|

|

||||||||

|

|

c |

Federal NOL (federal Schedule 1 |

f |

Other (describe): |

|

|

|

|

|

d |

|

|

|

d |

|

|

||||||||

|

|

|

(Form 1040), line 8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

e |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

d |

NOL deduction from FTB 3805V |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

f |

|

|

f |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

g |

Student loan discharged due to |

|

|

|

{g |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

closure of a |

|

|

|

|

|

g |

|

|||||||||

|

9 |

Total. Combine Section A, line 1 through line 7, and Section B, line 1 through line 8 in |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

column A. Add Section A, line 1 through line 7, and Section B, line 1 through line 8g in |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

column B and column C. Go to Section C |

. . . . . . . . . . . . . . |

. . . . . . . . |

. . . |

9 |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section C – Adjustments to Income from federal Schedule 1 (Form 1040)

10 Educator expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11Certain business expenses of reservists, performing artists, and

|

government officials |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 11 |

12 |

Health savings account deduction |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 12 |

|

13 |

Moving expenses. Attach federal Form 3903. See instructions . . . |

. . . . . . . . . . . . . . . . . 13 |

||

14 |

Deductible part of |

. . . . . . . . . . . . . . . . . 14 |

||

15 |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 15 |

||

16 |

||||

17 |

Penalty on early withdrawal of savings |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 17 |

|

18a |

Alimony paid. b Recipient’s: |

SSN |

– |

– |

|

|

Last name |

|

18a |

19 |

IRA deduction |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 19 |

20 |

Student loan interest deduction |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 20 |

|

21 |

Tuition and fees |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . . . . . . . . . . 21 |

22Add line 10 through line 18a and line 19 through line 21 in columns A, B, and C.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Total. Subtract line 22 from line 9 in columns A, B, and C. See instructions . . . . . . . . . . 23

For Privacy Notice, get FTB 1131 ENG/SP.

7731203

Schedule CA (540) 2020 Side 1

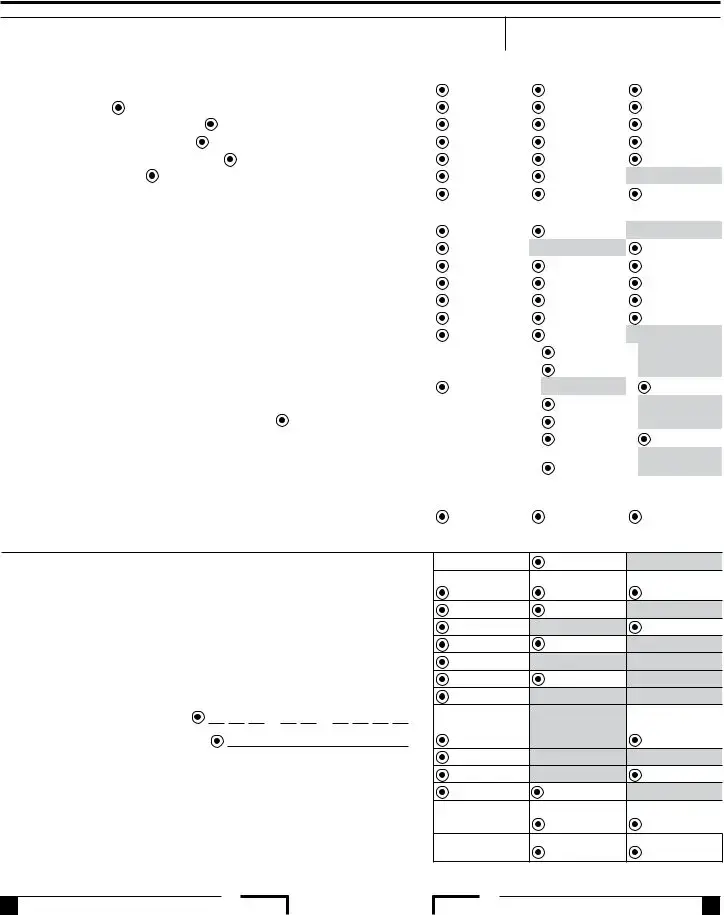

Part II Adjustments to Federal Itemized Deductions

Check the box if you did NOT itemize for federal but will itemize for California . . . . . . . . .

AFederal Amounts (from federal Schedule A (Form 1040)

BSubtractions See instructions

CAdditions

See instructions

Medical and Dental Expenses See instructions.

1 |

Medical and dental expenses |

1 |

2 |

Enter amount from federal Form 1040 or |

2 |

3 Multiply line 2 by 7.5% (0.075) |

3 |

|

4 |

Subtract line 3 from line 1. If line 3 is more than line 1, enter 0 |

. 4 |

Taxes You Paid |

|

|

5a State and local income tax or general sales taxes |

5a |

|

5b |

State and local real estate taxes |

5b |

5c |

State and local personal property taxes |

5c |

5d |

Add line 5a through line 5c |

5d |

5e |

Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) in column A . . |

|

|

Enter the amount from line 5a, column B in line 5e, column B |

|

|

Enter the difference from line 5d and line 5e, column A in line 5e, column C |

5e |

6 |

Other taxes. List type |

6 |

7 |

Add line 5e and line 6 |

7 |

Interest You Paid |

|

|

8a Home mortgage interest and points reported to you on federal Form 1098 . . . . . . . . . . . 8a  8b Home mortgage interest not reported to you on federal Form 1098. . . . . . . . . . . . . . . . . 8b

8b Home mortgage interest not reported to you on federal Form 1098. . . . . . . . . . . . . . . . . 8b  8c Points not reported to you on federal Form 1098. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8c

8c Points not reported to you on federal Form 1098. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8c  8d Mortgage insurance premiums . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8d

8d Mortgage insurance premiums . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8d  8e Add line 8a through line 8d. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8e

8e Add line 8a through line 8d. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8e  9 Investment interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

9 Investment interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9  10 Add line 8e and line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

10 Add line 8e and line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Gifts to Charity

11 Gifts by cash or check . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11  12 Other than by cash or check . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

12 Other than by cash or check . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12  13 Carryover from prior year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

13 Carryover from prior year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13  14 Add line 11 through line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

14 Add line 11 through line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Casualty and Theft Losses

15 Casualty or theft loss(es) (other than net qualified disaster losses). Attach federal |

|

Form 4684. See instructions |

15 |

Other Itemized Deductions |

|

16

17 Add lines 4, 7, 10, 14, 15, and 16 in columns A, B, and C . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Total. Combine line 17 column A less column B plus column C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  18

18

Side 2 Schedule CA (540) 2020

7732203

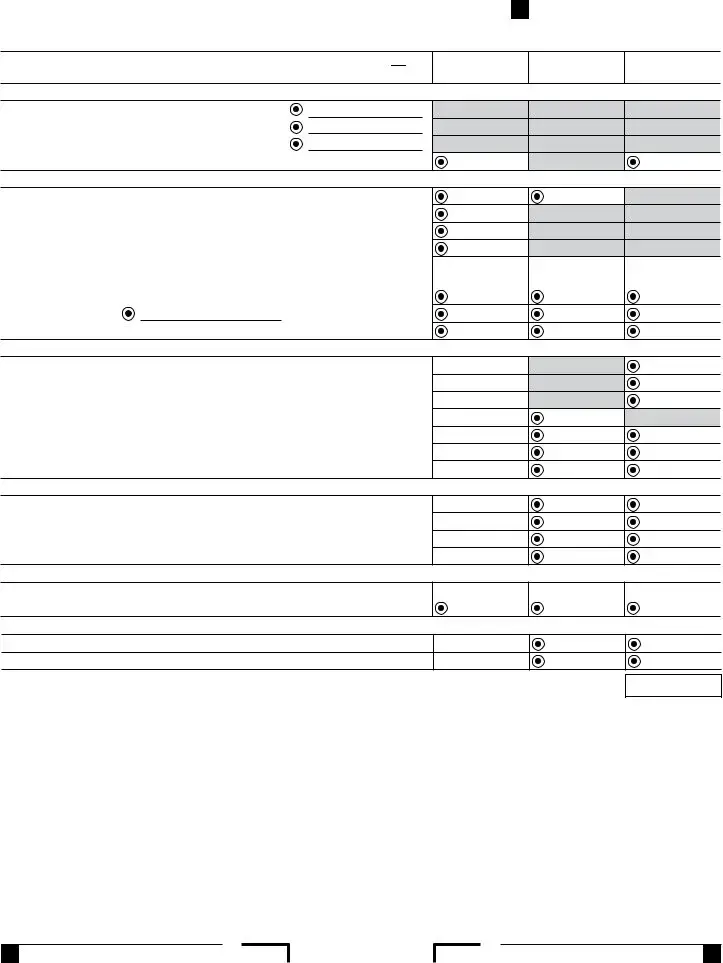

Job Expenses and Certain Miscellaneous Deductions

19Unreimbursed employee expenses - job travel, union dues, job education, etc.

Attach federal Form 2106 if required. See instructions. . . . . . . . . . . . . . . . . . . . . . . .  19

19

20 Tax preparation fees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  20

20

21 Other expenses - investment, safe deposit box, etc. List type |

|

21 |

22 Add line 19 through line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

22

23Enter amount from federal Form 1040 or

24 Multiply line 23 by 2% (0.02). If less than zero, enter 0. . . . . . . . . . . . . . . . . . . . . . .  24

24

25 Subtract line 24 from line 22. If line 24 is more than line 22, enter 0. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  25

25

26 |

Total Itemized Deductions. Add line 18 and line 25 |

. . . . . . . |

26 |

|

27 |

Other adjustments. See instructions. Specify. |

|

. . . . . . . |

27 |

28 Combine line 26 and line 27. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  28

28

29 Is your federal AGI (Form 540, line 13) more than the amount shown below for your filing status? Single or married/RDP filing separately . . . . . . . . . . . . . . . . . . . . . . . . . . . $203,341 Head of household . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $305,016 Married/RDP filing jointly or qualifying widow(er) . . . . . . . . . . . . . . . . . . . $406,687

No. Transfer the amount on line 28 to line 29.

Yes. Complete the Itemized Deductions Worksheet in the instructions for Schedule CA (540), line 29 . . . . . . . . . . . . . . . . . . . . .  29

29

30 Enter the larger of the amount on line 29 or your standard deduction listed below

Single or married/RDP filing separately. See instructions. . . . . . . . . . . . . . . . $4,601

Married/RDP filing jointly, head of household, or qualifying widow(er) . . . . . $9,202

Transfer the amount on line 30 to Form 540, line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  30

30

This space reserved for 2D barcode

This space reserved for 2D barcode

7733203

Schedule CA (540) 2020 Side 3

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The Schedule CA (540) is used by California residents to report California adjustments to income, comparing federal and state tax rules. |

| Filing Requirement | This form must be attached to Form 540 when filing your California tax return. |

| Tax Year | The facts presented are for the 2020 tax year, but the form is updated annually. |

| Income Adjustments | It allows tax filers to make specific subtractions and additions to their reported federal income. |

| Itemized Deductions | Use this form to adjust for itemized deductions that differ between federal and state calculations. |

| Federal Form Link | Schedule CA (540) references several federal forms, including Form 1040, Schedule 1, and Schedule A. |

| Governing Law | California Revenue and Taxation Code governs the Schedule CA (540) and its requirements. |

| Contact Information | If you have questions, you can contact the California Franchise Tax Board. |

| Privacy Notice | A privacy notice is included; refer to FTB 1131 ENG/SP for details. |

Guidelines on Utilizing Schedule California 540

Completing the Schedule California 540 form is an essential step in ensuring that your tax return accurately reflects your income, adjustments, and itemized deductions for California state taxes. Following this methodical approach will help you navigate the required sections with confidence.

- Gather Required Documents: Before starting, collect your federal Form 1040 or 1040-SR, W-2s, 1099s, and any other relevant financial records.

- Write Your Information: At the top of the form, fill in your name(s) and either your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Part I - Income Adjustment: In Section A, report your income as shown on your federal Form 1040. For each type of income, fill in the correct amounts in the Federal Amounts column (A).

- Subtractions and Additions: For any applicable subtractions (column B) or additions (column C) based on California law, refer to the instructions and complete those columns accordingly.

- Calculate Totals: Add up all entries in Section A and enter the totals in the provided spaces for column A. Repeat this step for columns B and C.

- Section B - Additional Income: Move to Section B and complete the same process by entering applicable additional income, documenting subtractions and additions as needed.

- Section C - Adjustments to Income: Complete Section C by entering the amounts for eligible deductions based on special circumstances like educator expenses or self-employment deductions.

- Part II - Adjustments to Federal Itemized Deductions: Check the box if planning to itemize for California despite not itemizing for federal. Fill in the appropriate columns based on your federal Schedule A data.

- Carry Over and Totals: Add up totals from various categories, including gifts to charity and other itemized deductions. Calculate those totals accordingly.

- Final Review: Go through each section to ensure all numbers are accurate and clearly written. Check that you've applied the appropriate California-specific adjustments.

- Attach and Submit: Finally, attach your completed Schedule CA behind Form 540 on Side 5, then submit your tax return by the deadline.

Completing the Schedule California 540 form accurately will help ensure that your tax return reflects your genuine tax obligation. Double-check each entry to minimize discrepancies and maximize any potential tax benefits.

What You Should Know About This Form

What is the Schedule California 540 form?

The Schedule California 540 form is a supplementary document that residents of California attach to their main income tax return, Form 540. It serves to adjust your federal income, showing any income that is either added or subtracted according to California tax laws. Essentially, it helps clarify how federal amounts compare to state taxable income.

Who needs to file the Schedule CA (540)?

If you're a resident of California and filing Form 540, you will need to complete the Schedule CA (540) if you have any adjustments to make. This includes situations where you earned income that might not be taxable in California or where you can claim additional deductions or credits specific to state rules. If your income includes things like specific types of interest or dividends, filling out this schedule is crucial.

How do I report my income on Schedule CA (540)?

When reporting income on Schedule CA (540), start with the federal income amounts from your Form 1040. You’ll break down this income into sections, noting any subtractions (like certain federal deductions) or additions (like California-specific income). Each income type is listed separately, allowing you to adjust your total income comprehensively based on California tax guidelines.

What adjustments can I make on Schedule CA (540)?

Schedule CA (540) allows for several adjustments. Some of these include educator expenses, health savings account deductions, and deductions for state taxes paid. You’ll detail these adjustments to show what lowers or increases your taxable income to arrive at the final figure you're taxed on in California.

Is it necessary to itemize deductions on Schedule CA (540)?

It isn’t necessary to itemize deductions on Schedule CA (540). If you didn’t itemize deductions federally but plan to for California, you can indicate this on the form. Nevertheless, if your itemized deductions exceed the standard deduction available, itemizing may help you reduce your taxable income more significantly.

Where do I submit the Schedule CA (540)?

You need to attach Schedule CA (540) behind Form 540, on Side 5, when you file your tax return. Ensure it is submitted to the California Franchise Tax Board if you are filing by mail, or upload it electronically if you’re using e-file. Prompt submission aids in processing your return without unnecessary delays.

How can I ensure I’m filling out Schedule CA (540) correctly?

To fill out Schedule CA (540) accurately, follow the specific instructions provided with the form. Double-check your entries against your federal return to guarantee consistency. Additionally, consider consulting tax preparation software or a tax professional if you're unsure. Accurate reporting is essential to avoid mistakes that could lead to penalties.

Common mistakes

Filling out the Schedule California 540 form can be a complex task, and many people make common mistakes. One significant error involves missing or incorrect identification information. Each taxpayer must ensure their name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) match the information on their federal tax return. A mismatch can lead to processing delays or even rejection of the tax return.

Another frequent mistake is failing to report all income sources accurately. Many taxpayers overlook certain income types, such as taxable refunds or alimony received, which should be included in the "Additional Income" section. It’s essential to review all your financial records to ensure every source of income is reported. Missing income can lead to penalties or an audit by the tax authorities.

Inaccurate subtractions and additions also present problems. Some individuals mistakenly enter incorrect figures in the "Subtractions" or "Additions" columns. Such errors can significantly affect the final tax calculation. Taxpayers should verify that they understand which amounts can be subtracted or added. Following the instructions carefully for these lines is crucial for an accurate tax return.

Omitting to check for adjustments can create additional headaches. Taxpayers who do not properly evaluate their eligibility for adjustments to income may overlook potential savings. For each itemized deduction or adjustment listed, ensure you review the specific requirements and calculations. Confirming all applicable deductions can maximize your refund or minimize what you owe.

Finally, not attaching the Schedule California 540 correctly can lead to delays or errors in processing your tax return. The form must be attached behind Form 540, specifically on Side 5. Missing this step means that even if the information is accurate, it may not be considered, leading to complications in tax processing.

Documents used along the form

The Schedule California 540 form is a crucial document for residents of California who are reporting their state income taxes. Alongside this form, there are various other documents that may be necessary to complete the state tax filing process accurately. These documents provide additional information or adjustments relevant to California's tax regulations. Understanding these documents can help in preparing a comprehensive tax return.

- Form 540: This is the primary income tax form that individual taxpayers in California need to file. It reports total income, deductions, credits, and tax liabilities for the year. Schedule CA is attached to this form to detail any adjustments necessary for California taxes.

- Federal Form 1040: This is the standard individual income tax return form used to report U.S. taxable income. Information from this form is often transferred to California's Schedule CA to identify differences between federal and state taxable income.

- Schedule 1 (Form 1040): This supplementary form details additional incomes, adjustments, and deductions that are not reported directly on the standard Form 1040. It is fundamental in determining what to include in California's income calculations and necessary adjustments.

- Form 3903: Used for reporting moving expenses, this form is important if you qualify for deductions related to relocating for work. Attach this form if there are relevant moving expenses to claim as part of the California tax filings.

These forms and documents, when prepared accurately, contribute to a seamless tax-filing experience. They help ensure that all eligible adjustments are considered, leading to potentially lower tax liabilities and compliance with state laws.

Similar forms

The Schedule California 540 form has certain similarities with other tax documents that typically deal with income adjustments, deductions, and tax calculations. Below are four such documents, along with an explanation of how each one relates to Schedule California 540.

- Form 1040: This is the standard federal income tax form used by individuals to report their income to the IRS. Both Schedule California 540 and Form 1040 require taxpayers to list their income, deductions, and calculate their total tax liability. However, Schedule CA 540 focuses specifically on California adjustments, while Form 1040 is primarily concerned with federal tax calculations.

- Schedule A (Form 1040): This is used for itemizing deductions at the federal level. Similar to Schedule California 540, which makes adjustments to itemized deductions for California, Schedule A allows taxpayers to report various deductions. Both schedules help taxpayers determine the most tax-efficient way to report their deductions and tax credits.

- Schedule 1 (Form 1040): This supplementary form addresses additional income and adjustments to income. It parallels the adjustments section found in Schedule California 540, where certain income types, like alimony or business income, are detailed. Both documents allow taxpayers to identify specific types of income that affect their overall tax calculations.

- Form FTB 3805Z: This form is dedicated to reporting net operating losses for California taxpayers. Like Schedule CA 540, it serves to adjust taxable income, focusing specifically on the unique state considerations. Taxpayers can use both to ensure proper reporting of their financial standing and tax liability in California.

Dos and Don'ts

- Do Carefully read the instructions for the California 540 form before starting. Understanding the requirements is crucial for accurate completion.

- Do: Gather all necessary documentation, such as your federal tax return and any supporting documents that verify your income and deductions.

- Do: Double-check your entries for accuracy, especially your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Do: Include all required adjustments from both federal and California sources, as this affects your final tax liability.

- Do: File the Schedule CA (540) as an attachment behind Form 540, ensuring it is correctly positioned on Side 5.

- Don’t: Leave blank spaces where information is required. If something does not apply, write “0” rather than skipping it.

- Don’t: Forget to review the specific lines related to additions and subtractions to ensure you're reporting the correct amounts.

- Don’t: Overlook the additional income categories that may apply to you; if in doubt, consult the instructions or a professional.

- Don’t: Submit your tax return without retaining a copy of all forms and documentation for your records.

Misconceptions

Here are ten common misconceptions about the Schedule California 540 form, along with explanations to clarify each one:

- Misconception 1: You do not need to file a Schedule CA if you only have California income.

- Misconception 2: The Schedule CA form is only for salaried employees.

- Misconception 3: You can ignore federal income adjustments on Schedule CA.

- Misconception 4: You don't need documents to complete the Schedule CA.

- Misconception 5: It is the same as the IRS Form 1040.

- Misconception 6: Everyone has to complete all parts of Schedule CA.

- Misconception 7: You can submit Schedule CA separately from Form 540.

- Misconception 8: All medical expenses are deductible on Schedule CA.

- Misconception 9: You cannot benefit from both standard and itemized deductions.

- Misconception 10: Filing Schedule CA guarantees a larger refund.

Even if all your income comes from California sources, you still need to complete the Schedule CA if you are a resident filing a California tax return.

The Schedule CA is applicable to everyone, including self-employed individuals, retirees, and those who receive income from various sources.

Federal adjustments matter. Schedule CA helps align your California tax return with federal figures before applying California-specific rules.

You should have your federal tax return and relevant documents at hand. These are crucial for accurate entries and adjustments.

While both forms include similar income information, Schedule CA specifically focuses on California adjustments that differ from federal requirements.

You only need to fill out sections relevant to your tax situation. Not all taxpayers will require every part of the form.

Schedule CA must be attached to Form 540. Failure to include it could result in delays or issues with your tax return.

Not all medical expenses qualify. Only expenses above the specified threshold can be deducted, so review the guidelines carefully.

You choose one deduction method for the tax year. If you itemize deductions on your federal return, you will do the same on your California return.

Filing Schedule CA does not guarantee refunds. It merely ensures your California taxes are calculated correctly based on your eligible adjustments.

Key takeaways

When filling out and using the Schedule California 540 form, keep these key takeaways in mind:

- Always attach the Schedule CA behind Form 540 on Side 5 as a supporting document.

- Ensure accuracy when reporting income from your federal tax return to avoid discrepancies.

- Watch closely for subtractions and additions in columns B and C; they can significantly impact your taxable income.

- Double-check your federal amounts as they directly influence your adjustments on Schedule CA.

- Remember that certain federal adjustments, such as educator expenses and self-employed health insurance deductions, are relevant for California tax purposes.

- Itemized deductions for California may differ from federal deductions. If you did not itemize federally but will for California, check the appropriate box.

- Keep necessary documentation handy, especially for deductions, including Schedule 1, to support your claims.

- Be aware of the income thresholds that may affect your deductions; know how your adjusted gross income plays into this.

- After completing Schedule CA, transfer the final calculated amount to the appropriate line on Form 540 to ensure all information aligns.

Browse Other Templates

Indiana Vehicle Title - The transaction process requires diligence in filling out this form correctly.

Support Payment Information Form,Child and Spousal Support Declaration,Caregiver Financial Disclosure Form,Family Financial Support Statement,Financial Responsibility Declaration,Support Calculation Disclosure,Joint Custody Financial Declaration,Inco - The form must be served to all relevant parties after filing.