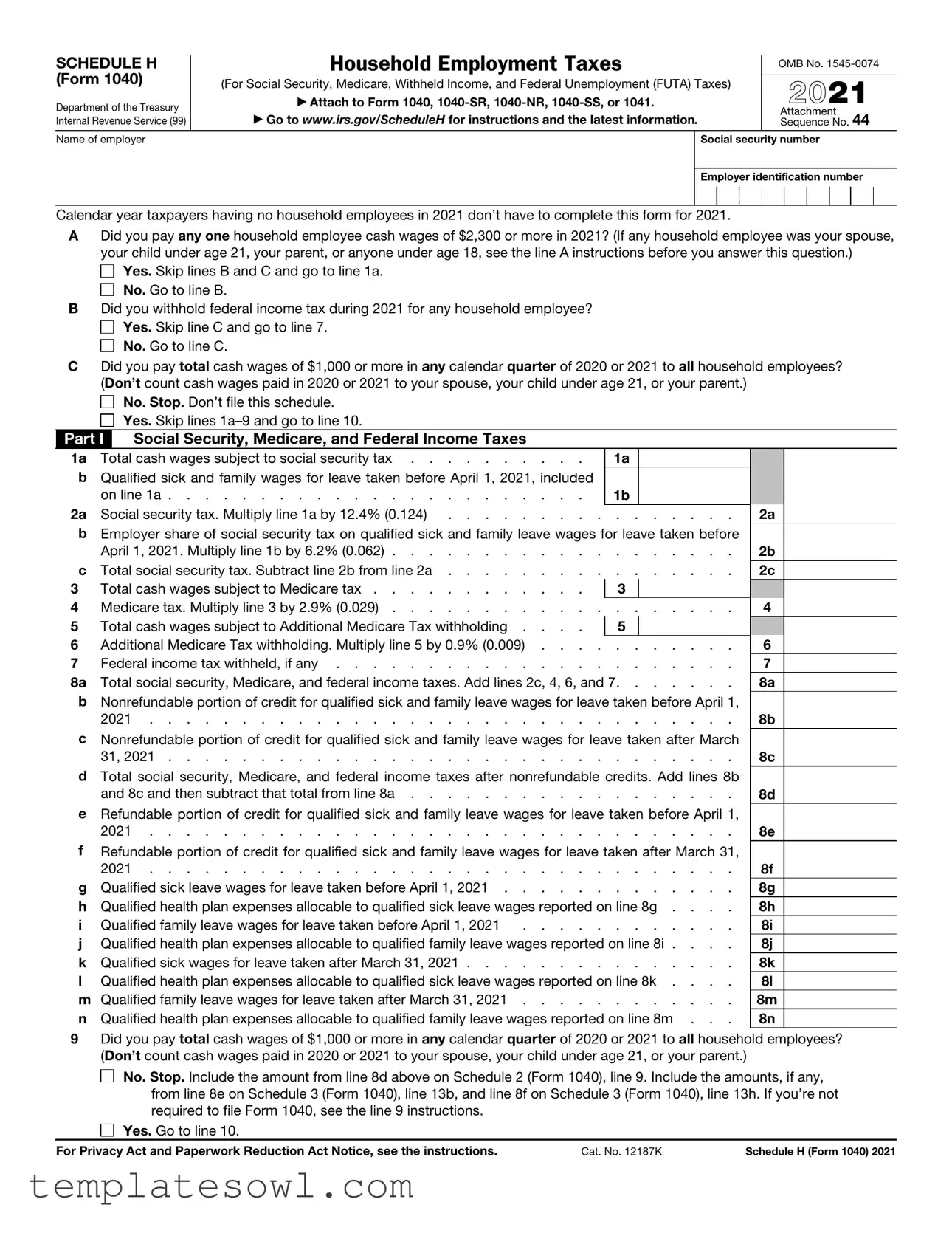

Fill Out Your Schedule H Form

The Schedule H form is a crucial document for households employing workers in a domestic capacity who earn above specific thresholds. It allows employers to report and pay household employment taxes, including Social Security, Medicare, and Federal Unemployment Tax Act (FUTA) taxes. For the year 2021, the form requires employers to disclose if they have paid a household employee cash wages of $2,300 or more or if they withheld federal income tax during the year. This form emphasizes the responsibilities of employers regarding wage reporting and tax withholding, indicating the importance of compliance with federal regulations. The detailed instructions and calculations found within the form guide users through various tax obligations, including the appropriate percentages to apply for Social Security and Medicare taxes. Moreover, Schedule H also addresses state unemployment contributions, providing employers with a structured process for reporting these payments. For households that did not engage any employees who meet the payment criteria, the form can be bypassed entirely for that tax year. In summary, Schedule H serves as a comprehensive framework for managing household employment taxes, ensuring clarity and compliance for both employers and the Internal Revenue Service.

Schedule H Example

SCHEDULE H |

|

Household Employment Taxes |

|

|

OMB No. |

||||||

|

|

|

|||||||||

(Form 1040) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||

|

(For Social Security, Medicare, Withheld Income, and Federal Unemployment (FUTA) Taxes) |

2021 |

|

||||||||

Department of the Treasury |

|

▶ Attach to Form 1040, |

|

|

|

||||||

|

|

▶ Go to www.irs.gov/ScheduleH for instructions and the latest information. |

|

|

Attachment |

||||||

Internal Revenue Service (99) |

|

|

|

Sequence No. 44 |

|||||||

Name of employer |

|

|

|

Social security number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer identification number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calendar year taxpayers having no household employees in 2021 don’t have to complete this form for 2021.

ADid you pay any one household employee cash wages of $2,300 or more in 2021? (If any household employee was your spouse, your child under age 21, your parent, or anyone under age 18, see the line A instructions before you answer this question.)

Yes. Skip lines B and C and go to line 1a.

No. Go to line B.

BDid you withhold federal income tax during 2021 for any household employee?

Yes. Skip line C and go to line 7.

No. Go to line C.

CDid you pay total cash wages of $1,000 or more in any calendar quarter of 2020 or 2021 to all household employees? (Don’t count cash wages paid in 2020 or 2021 to your spouse, your child under age 21, or your parent.)

No. Stop. Don’t file this schedule.

Yes. Skip lines

Part I Social Security, Medicare, and Federal Income Taxes

1a Total cash wages subject to social security tax |

1a |

bQualified sick and family wages for leave taken before April 1, 2021, included

on line 1a |

1b |

2a Social security tax. Multiply line 1a by 12.4% (0.124) . . . . . . . . . . . . . . . .

bEmployer share of social security tax on qualified sick and family leave wages for leave taken before

April 1, 2021. Multiply line 1b by 6.2% (0.062) . . . . . . . . . . . . . . . . . . .

c |

Total social security tax. Subtract line 2b from line 2a |

||

3 |

Total cash wages subject to Medicare tax |

3 |

|

4 |

Medicare tax. Multiply line 3 by 2.9% (0.029) |

||

5 |

Total cash wages subject to Additional Medicare Tax withholding . . . . |

5 |

|

6 |

Additional Medicare Tax withholding. Multiply line 5 by 0.9% (0.009) |

||

7 |

Federal income tax withheld, if any |

||

8a |

Total social security, Medicare, and federal income taxes. Add lines 2c, 4, 6, and 7 |

||

bNonrefundable portion of credit for qualified sick and family leave wages for leave taken before April 1,

2021 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

cNonrefundable portion of credit for qualified sick and family leave wages for leave taken after March

31, 2021 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

dTotal social security, Medicare, and federal income taxes after nonrefundable credits. Add lines 8b

and 8c and then subtract that total from line 8a . . . . . . . . . . . . . . . . . .

eRefundable portion of credit for qualified sick and family leave wages for leave taken before April 1,

2021 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

fRefundable portion of credit for qualified sick and family leave wages for leave taken after March 31,

2021 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

g |

Qualified sick leave wages for leave taken before April 1, 2021 |

h |

Qualified health plan expenses allocable to qualified sick leave wages reported on line 8g . . . . |

i |

Qualified family leave wages for leave taken before April 1, 2021 |

jQualified health plan expenses allocable to qualified family leave wages reported on line 8i . . . .

k |

Qualified sick wages for leave taken after March 31, 2021 |

l |

Qualified health plan expenses allocable to qualified sick leave wages reported on line 8k . . . . |

m |

Qualified family leave wages for leave taken after March 31, 2021 |

n |

Qualified health plan expenses allocable to qualified family leave wages reported on line 8m . . . |

2a

2b

2c

4

6

7

8a

8b

8c

8d

8e

8f

8g

8h

8i

8j

8k

8l

8m

8n

9Did you pay total cash wages of $1,000 or more in any calendar quarter of 2020 or 2021 to all household employees? (Don’t count cash wages paid in 2020 or 2021 to your spouse, your child under age 21, or your parent.)

No. Stop. Include the amount from line 8d above on Schedule 2 (Form 1040), line 9. Include the amounts, if any, from line 8e on Schedule 3 (Form 1040), line 13b, and line 8f on Schedule 3 (Form 1040), line 13h. If you’re not required to file Form 1040, see the line 9 instructions.

No. Stop. Include the amount from line 8d above on Schedule 2 (Form 1040), line 9. Include the amounts, if any, from line 8e on Schedule 3 (Form 1040), line 13b, and line 8f on Schedule 3 (Form 1040), line 13h. If you’re not required to file Form 1040, see the line 9 instructions.

Yes. Go to line 10.

Yes. Go to line 10.

For Privacy Act and Paperwork Reduction Act Notice, see the instructions. |

Cat. No. 12187K |

Schedule H (Form 1040) 2021 |

Schedule H (Form 1040) 2021 |

Page 2 |

|

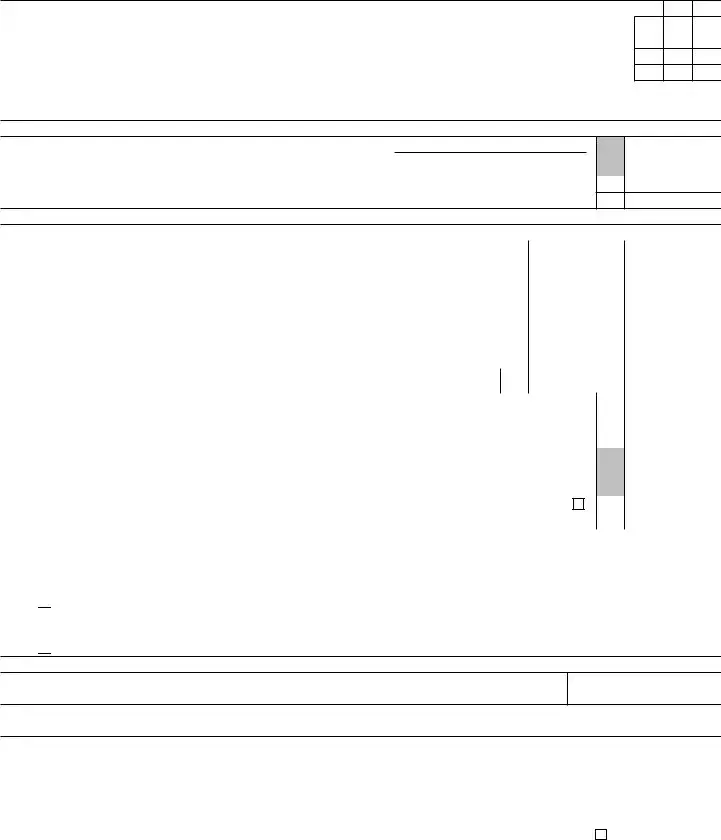

Part II |

Federal Unemployment (FUTA) Tax |

|

10Did you pay unemployment contributions to only one state? If you paid contributions to a credit reduction

state, see instructions and check “No” . . . . . . . . . . . . . . . . . . . . . . .

11Did you pay all state unemployment contributions for 2021 by April 18, 2022? Fiscal year filers, see instructions

12Were all wages that are taxable for FUTA tax also taxable for your state’s unemployment tax? . . . . .

Next: If you checked the “Yes” box on all the lines above, complete Section A.

If you checked the “No” box on any of the lines above, skip Section A and complete Section B.

Yes No

10

11

12

Section A

13Name of the state where you paid unemployment contributions ▶

14 |

Contributions paid to your state unemployment fund |

14 |

|

15 |

Total cash wages subject to FUTA tax |

||

16 |

FUTA tax. Multiply line 15 by 0.6% (0.006). Enter the result here, skip Section B, and go to line 25 . |

||

|

Section B |

|

|

15

16

17Complete all columns below that apply (if you need more space, see instructions):

(a) |

(b) |

|

(c) |

(d) |

(e) |

(f) |

(g) |

(h) |

|

Name of state |

Taxable wages |

State experience |

State |

Multiply col. (b) |

Multiply col. (b) |

Subtract col. (f) |

Contributions |

||

|

(as defined in |

rate period |

experience |

by 0.054 |

by col. (d) |

from col. (e). |

paid to state |

||

|

state act) |

|

|

|

rate |

|

|

If zero or less, |

unemployment fund |

|

|

From |

|

To |

|

|

|

enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

Totals |

. |

. |

18 |

|

|

|

19 |

Add columns (g) and (h) of line 18 |

|

19 |

|

|

|

|

|

|

|

|

||||

20 |

Total cash wages subject to FUTA tax (see the line 15 instructions) . . . . |

. |

. . |

. . . . . |

20 |

|

|

21 |

Multiply line 20 by 6.0% |

(0.06) |

. |

. . |

. . . . . |

21 |

|

22 |

Multiply line 20 by 5.4% |

(0.054) |

|

22 |

|

|

|

23Enter the smaller of line 19 or line 22.

|

(If you paid state unemployment contributions late or you’re in a credit reduction state, see instructions |

|

|

|

|

and check here) |

23 |

|

|

24 |

FUTA tax. Subtract line 23 from line 21. Enter the result here and go to line 25 |

24 |

|

|

Part III |

Total Household Employment Taxes |

|

|

|

25 |

Enter the amount from line 8d. If you checked the “Yes” box on line C of page 1, enter |

25 |

|

|

26 |

Add line 16 (or line 24) and line 25 |

26 |

|

|

27Are you required to file Form 1040?

Yes. Stop. Include the amount from line 26 above on Schedule 2 (Form 1040), line 9. Include the amounts, if any, from line 8e, on Schedule 3 (Form 1040), line 13b, and line 8f on Schedule 3 (Form 1040), line 13h. Don’t complete Part IV below.

Yes. Stop. Include the amount from line 26 above on Schedule 2 (Form 1040), line 9. Include the amounts, if any, from line 8e, on Schedule 3 (Form 1040), line 13b, and line 8f on Schedule 3 (Form 1040), line 13h. Don’t complete Part IV below.

No. You may have to complete Part IV. See instructions for details.

No. You may have to complete Part IV. See instructions for details.

Part IV Address and Signature — Complete this part only if required. See the line 27 instructions.

Address (number and street) or P.O. box if mail isn’t delivered to street address

Apt., room, or suite no.

City, town or post office, state, and ZIP code

Under penalties of perjury, I declare that I have examined this schedule, including accompanying statements, and to the best of my knowledge and belief, it is true, correct, and complete. No part of any payment made to a state unemployment fund claimed as a credit was, or is to be, deducted from the payments to employees. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

▲ |

|

|

|

▲ |

|

|

|

|

|

|

Employer’s signature |

|

Date |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

Paid |

Print/Type preparer’s name |

Preparer’s signature |

|

Date |

|

Check |

if |

PTIN |

||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

||||

Preparer |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

Firm’s name ▶ |

|

|

|

|

Firm’s EIN ▶ |

|

|

|||

Use Only |

|

|

|

|

|

|

||||

Firm’s address ▶ |

|

|

|

|

Phone no. |

|

|

|||

|

|

|

|

|

|

|

|

|||

Schedule H (Form 1040) 2021

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | Schedule H is used to report household employment taxes, including Social Security, Medicare, and Federal Unemployment tax. |

| Filing Requirement | Taxpayers must file Schedule H if they paid a household employee cash wages of $2,300 or more in a year. |

| Exemptions | Individuals with no household employees during the year do not need to complete this form for that year. |

| Tax Rates | The Social Security tax rate is 12.4%, Medicare is 2.9%, and FUTA tax is typically 6.0%. |

| Line A Decision | Line A asks whether you paid any employee cash wages of $2,300 or more to determine the next steps for completing the form. |

| State-Specific Laws | Employers must comply with state unemployment laws. Each state has its own requirements for filing and contributions to unemployment funds. |

| Nonrefundable Credits | The form allows for nonrefundable credits for qualified sick and family leave wages. This includes separate credits for leave taken before and after April 1, 2021. |

Guidelines on Utilizing Schedule H

Filling out Schedule H is an essential step for employers who have household employees. This form allows you to report household employment taxes, such as Social Security, Medicare, and federal unemployment taxes. After completing Schedule H, ensure that you submit it with your Form 1040 as required by the IRS.

- Gather your information: Collect the necessary details, such as your name, Social Security number, and employer identification number. Make sure you also have the wages paid to each employee.

- Check if you need to file: Answer the question in line A to determine if you paid any household employee cash wages of $2,300 or more in the calendar year.

- Work through the questions: If you answer "No" to line A, go to line B and continue following the instructions as directed.

- Complete Part I: Calculate and enter total cash wages subject to Social Security and Medicare taxes, working through lines 1 through 9, and complete each calculation.

- Proceed to Part II: If applicable, fill out questions 10 through 12 regarding federal unemployment taxes, determining whether state contributions are required.

- Complete sections A or B: Depending on your answers from Part II, fill out either Section A or Section B related to the state for unemployment contributions. Include necessary data such as taxable wages and contributions paid.

- Finalize Part III: Total your household employment taxes on line 25 and line 26. Ensure you note whether you are required to file Form 1040.

- Address and Signature: If required, complete the address and signature section. Sign and date the form to validate your information.

- Submit the form: Attach Schedule H to your Form 1040 and file it with the IRS by the due date.

What You Should Know About This Form

What is the Schedule H form?

Schedule H is a tax form used to report household employment taxes. It is attached to various forms like Form 1040, 1040-SR, and others. This form calculates Social Security, Medicare, and Federal Unemployment taxes for individuals who hire domestic workers, such as nannies or housekeepers. Employers must use this form if they pay household employees cash wages above a certain amount.

Who needs to file Schedule H?

If you paid a household employee cash wages of $2,300 or more in 2021, you must file Schedule H. Additionally, you need to file if you withheld federal income tax for any household employee or if you paid total cash wages of $1,000 or more in any calendar quarter of 2020 or 2021. If none of these conditions apply, you do not need to file.

What types of taxes are reported on Schedule H?

Schedule H includes calculations for Social Security tax, Medicare tax, and Federal Unemployment Tax (FUTA). These taxes are calculated based on the total cash wages paid to household employees. Employers should also account for any withholdings for federal income tax during the tax year.

What if I didn't have any household employees in 2021?

If you had no household employees in 2021, you do not need to file Schedule H for that year. It's important to remember that the requirements can change annually, so always check the latest guidelines to stay informed about any updates.

How do I submit Schedule H?

Schedule H should be attached to your income tax return, such as Form 1040. Make sure to complete the form fully and accurately before submission. If you are filing electronically, ensure the e-filing software you choose supports Schedule H. You can find detailed instructions on the IRS website for the most current filing options and requirements.

Common mistakes

Filling out the Schedule H form can seem straightforward, but many people make common mistakes that lead to complications. One of the biggest errors is failing to report all household employees. If cash wages of $2,300 or more were paid to any employee, that needs to be reported. Skipping this line could result in penalties later.

Another frequent mistake is incorrectly calculating Social Security and Medicare taxes. The form requires you to multiply specific amounts by designated rates, such as 12.4% for Social Security and 2.9% for Medicare. Mistakes in these calculations can lead to an underreporting of taxes owed, prompting the IRS to request the difference.

People often overlook the requirements for filing if they are not sure of the definitions of family members. For example, if someone pays wages to a spouse or a child under 21, special instructions must be followed. Ignoring these regulations can lead to incomplete or inaccurate filings, creating confusion.

Moreover, individuals sometimes fail to account for state-specific unemployment taxes. It is crucial that all state unemployment contributions are accurately reported by the required deadlines. Missing this can lead to paying more state taxes than necessary or incurring fines.

Some filers do not double-check to see if they are eligible for any credits, especially when it comes to health plans or leave wages. Not including qualified sick leave credits can reduce potential tax credits and increase the overall taxes owed.

Lastly, people often neglect to sign and date the form. This might seem minor, but an unsigned form can be deemed invalid, resulting in delays in processing and potential penalties. Always ensure that the form is complete before submission.

Documents used along the form

The Schedule H form is a vital document for employers of household employees, detailing their obligations regarding household employment taxes. Along with this form, several other documents are frequently utilized to ensure compliance and facilitate accurate reporting of employment taxes. Below is a list of those forms and documents, along with brief descriptions of each.

- Form 1040: This is the individual income tax return form that taxpayers use to report their annual income. Schedule H must be attached to this form when filing.

- Schedule 2 (Form 1040): This schedule is used to report additional taxes, including self-employment tax, alternative minimum tax, and household employment taxes reported on Schedule H.

- Schedule 3 (Form 1040): Taxpayers use this form to report nonrefundable and refundable credits. It is connected to Schedule H when credits related to household employment taxes are claimed.

- Form W-2: Employers must provide this form to household employees, reporting their annual wages and the taxes withheld. A copy of Form W-2 must also be submitted to the Social Security Administration.

- Form W-3: This is a transmittal form that accompanies Form W-2 when sent to the Social Security Administration. It summarizes the total earnings and taxes withheld for all employees.

- Form 941: This is the Employer’s Quarterly Federal Tax Return, which reports income taxes, Social Security tax, and Medicare tax withheld from employees’ pay. It may be required in conjunction with household employment taxes.

Understanding these additional forms is crucial for household employers to fulfill their tax obligations correctly. Together, they ensure that reporting and compliance with federal tax requirements are handled efficiently.

Similar forms

- Form W-2: This form reports wages paid to employees and the taxes withheld. Like Schedule H, it deals with household employment taxes, helping you keep track of what you owe.

- Form W-3: This is the transmittal form for W-2s. It summarizes the total wages and taxes withheld, similar to how Schedule H summarizes your household employment taxes.

- Form 1040: This is the individual income tax return form. Schedule H is an attachment to this form, reporting specific household employment taxes.

- Schedule SE: This schedule is for self-employment tax. If you hire household employees, you may also need to consider self-employment taxes, just as you do with Schedule H.

- Form 941: This form is used to report income taxes, Social Security tax, and Medicare tax withheld from employees. It is similar in its purpose of tracking withholding but is used for non-household employees.

- Form 944: This is an annual tax return for small employers to report payroll taxes. Like Schedule H, it simplifies the reporting process for smaller household employers.

- Form 1099-MISC: This form is used to report payments made to non-employees. It has a different purpose but also deals with compensation, similar to Schedule H.

- Form 1040-ES: This form is used to pay estimated taxes. It relates to tax obligations, much like the obligations defined in Schedule H.

- Form 8889: This form reports Health Savings Account contributions and distributions. While not related to employment, it addresses tax and healthcare in a manner similar to employee compensation forms.

- Schedule C: This is used to report income or loss from a business. If household employers also run businesses, they may find both forms relevant to their tax situation.

Dos and Don'ts

When filling out the Schedule H form, it’s essential to proceed carefully. This process ensures that you accurately report household employment taxes. Here’s a list of what you should and shouldn’t do while completing this form.

- Do ensure that you have your social security number and employer identification number ready before you start filling out the form. These numbers are necessary for accurate reporting.

- Don’t skip any lines or questions that apply to you. It’s crucial to answer every relevant question to avoid delays or penalties.

- Do check the most recent instructions on the IRS website to confirm that you are using the updated form and guidelines.

- Don’t forget to report total cash wages correctly. Mistakes in wage reporting can lead to significant issues later on.

- Do review your completed form carefully before submitting it. Look for any errors or omissions that could affect your tax filings.

- Don’t submit the form without attaching it to your appropriate Form 1040. Ensure all documents are submitted together to prevent processing delays.

Misconceptions

- Misconception 1: You must fill out Schedule H if you have household employees.

- Misconception 2: Schedule H is only for wealthy households.

- Misconception 3: Only full-time household employees count.

- Misconception 4: If you withhold taxes, you do not need to fill out Schedule H.

- Misconception 5: The form is only relevant for Social Security and Medicare taxes.

- Misconception 6: Filing taxes on Schedule H guarantees you won’t face penalties.

Not all taxpayers need to complete Schedule H. If you paid no household employees cash wages of $2,300 or more in a calendar year, there is no requirement to file this form. This exemption applies even if you had household employees.

Schedule H serves all households that employ workers, regardless of income level. If you pay someone for services in your home, you could be responsible for employment taxes, making it important to understand the form.

Both part-time and full-time workers are included in the regulations surrounding Schedule H. Even if someone works only a few hours a week and earns $2,300 or more, you may be required to report and pay taxes.

Withholding taxes does not relieve you from your obligation to file Schedule H. It is necessary to complete the form if you pay your household employees enough to meet the reporting thresholds, regardless of withholding.

Schedule H addresses multiple tax responsibilities, including federal income tax and federal unemployment tax (FUTA). Understanding all components is vital to ensure compliance.

While filing Schedule H can help you comply with the law, it does not protect against penalties for other tax obligations or mistakes. It remains essential to accurately report all data and calculations.

Key takeaways

- When hiring household employees, if you paid them cash wages of $2,300 or more in a calendar year, you must fill out Schedule H.

- The form is crucial for reporting taxes related to Social Security, Medicare, and federal unemployment taxes.

- If you did not have any household employees in the reporting year, you can skip this form entirely.

- You need to be aware that if you withheld federal income tax from any household employee's wages, you must indicate this, as it affects how you complete the form.

- It's essential to keep track of your employees' wages, as the total cash wages paid will determine your tax obligations.

- Complete Part II of Schedule H to report any federal unemployment (FUTA) tax, ensuring you've paid all required state unemployment contributions.

- After completing the form, carefully review it before submission; inaccuracies can lead to penalties or delays in processing.

Filling out Schedule H might feel overwhelming, but understanding these key points can help simplify the process. Take your time to review your records and consult the IRS website for any updates or additional guidance.

Browse Other Templates

52665 - The information obtained through the HUD 52665 facilitates appropriate billing and funding for housing assistance.

Hvcc Appraisal - The HVCC aims to improve the reliability of appraisals, thereby protecting consumer interests.

Boiler Engineer Affidavit,Minnesota Boiler License Declaration,License Experience Verification Form,Boiler Operation Certification,Engineer Operating Experience Affidavit,Steam Engineer Affidavit,Boiler Qualification Statement,Thermal Systems Experie - The form requires specific dates for the periods of operating experience reported.