Fill Out Your Schwab Beneficiary Form

The Schwab Beneficiary form plays a critical role in estate planning for clients with Schwab One® Brokerage and Schwab Bank Investor Checking™ accounts. This form allows individuals to designate beneficiaries for their accounts, ensuring a fast and straightforward transfer of assets upon death. There are several key actions clients can take using this form, including establishing a new Designated Beneficiary Plan, adding beneficiaries to a new checking account, updating existing beneficiary designations, or even revoking a previous plan. It’s essential for account holders to understand that the designations made on this form generally supersede any instructions found in a will or trust. Additionally, there are specific requirements for eligibility, including account types and residency restrictions, which clients should note carefully. The form also allows clients to designate contingent beneficiaries and include instructions for minors, adding further layers of protection and clarity. Being proactive in completing or updating this form can make a significant difference in how assets are distributed, ensuring that the account holder’s wishes are honored efficiently and without delays.

Schwab Beneficiary Example

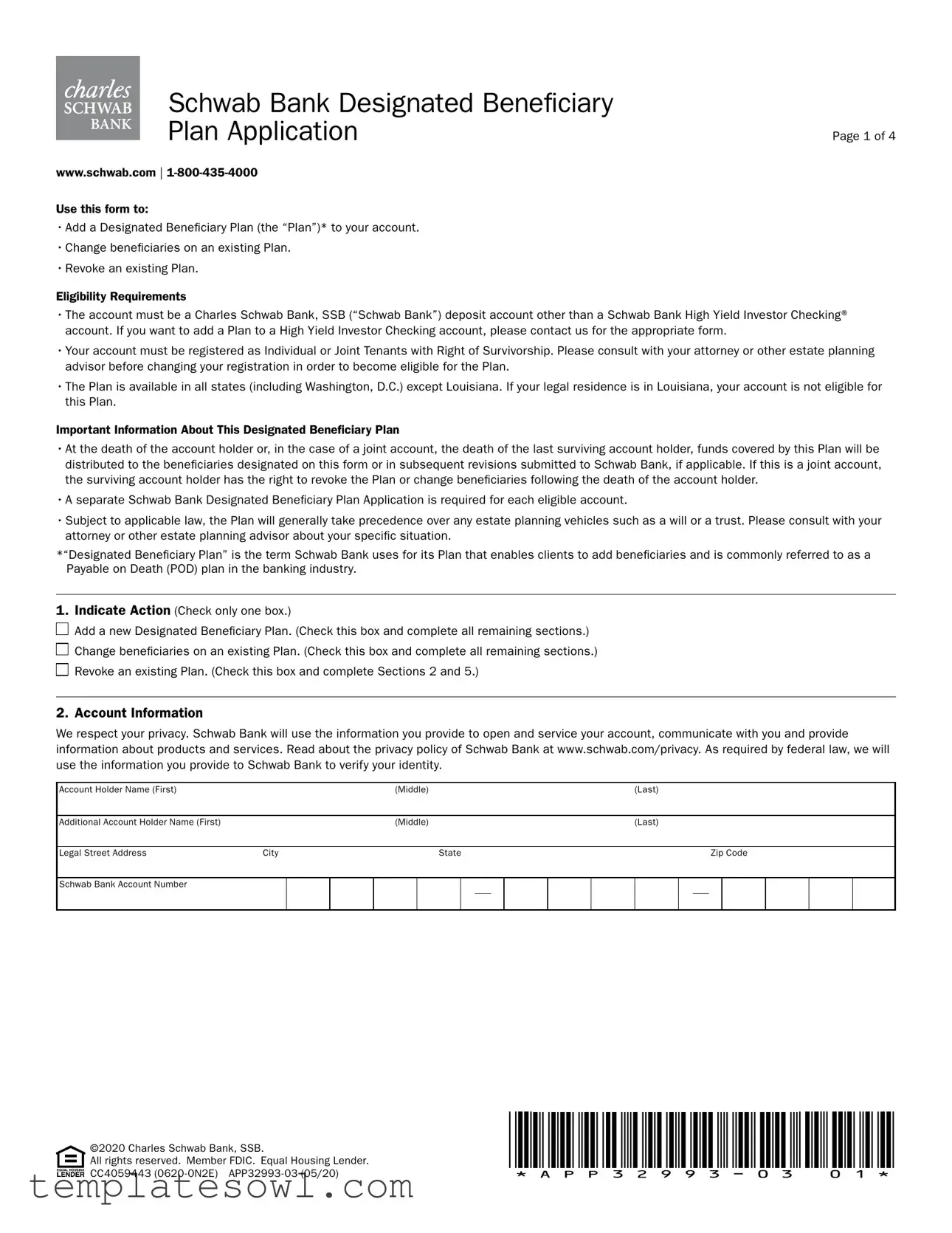

Schwab Bank Designated Beneficiary |

|

Plan Application |

Page 1 of 4 |

www.schwab.com |

Use this form to:

•Add a Designated Beneficiary Plan (the “Plan”)* to your account.

•Change beneficiaries on an existing Plan.

•Revoke an existing Plan.

Eligibility Requirements

•The account must be a Charles Schwab Bank, SSB (“Schwab Bank”) deposit account other than a Schwab Bank High Yield Investor Checking® account. If you want to add a Plan to a High Yield Investor Checking account, please contact us for the appropriate form.

•Your account must be registered as Individual or Joint Tenants with Right of Survivorship. Please consult with your attorney or other estate planning advisor before changing your registration in order to become eligible for the Plan.

•The Plan is available in all states (including Washington, D.C.) except Louisiana. If your legal residence is in Louisiana, your account is not eligible for this Plan.

Important Information About This Designated Beneficiary Plan

•At the death of the account holder or, in the case of a joint account, the death of the last surviving account holder, funds covered by this Plan will be distributed to the beneficiaries designated on this form or in subsequent revisions submitted to Schwab Bank, if applicable. If this is a joint account, the surviving account holder has the right to revoke the Plan or change beneficiaries following the death of the account holder.

•A separate Schwab Bank Designated Beneficiary Plan Application is required for each eligible account.

•Subject to applicable law, the Plan will generally take precedence over any estate planning vehicles such as a will or a trust. Please consult with your attorney or other estate planning advisor about your specific situation.

*“Designated Beneficiary Plan” is the term Schwab Bank uses for its Plan that enables clients to add beneficiaries and is commonly referred to as a Payable on Death (POD) plan in the banking industry.

1.Indicate Action (Check only one box.)

Add a new Designated Beneficiary Plan. (Check this box and complete all remaining sections.)

Add a new Designated Beneficiary Plan. (Check this box and complete all remaining sections.)

Change beneficiaries on an existing Plan. (Check this box and complete all remaining sections.)

Change beneficiaries on an existing Plan. (Check this box and complete all remaining sections.)

Revoke an existing Plan. (Check this box and complete Sections 2 and 5.)

Revoke an existing Plan. (Check this box and complete Sections 2 and 5.)

2. Account Information

We respect your privacy. Schwab Bank will use the information you provide to open and service your account, communicate with you and provide information about products and services. Read about the privacy policy of Schwab Bank at www.schwab.com/privacy. As required by federal law, we will use the information you provide to Schwab Bank to verify your identity.

Account Holder Name (First) |

|

|

|

(Middle) |

|

|

|

(Last) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Account Holder Name (First) |

|

|

|

(Middle) |

|

|

|

(Last) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal Street Address |

City |

|

|

|

State |

|

|

|

|

|

|

Zip Code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schwab Bank Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CC4059443 |

|

©2020 Charles Schwab Bank, SSB. |

|

All rights reserved. Member FDIC. Equal Housing Lender. |

|

Page 2 of 4

3. Designate Your Primary Beneficiaries

At the death of the account holder or, in the case of a joint account, at the death of the last surviving account holder, all of the funds in the account shall be distributed to the following beneficiaries who survive the last surviving account holder by 120 hours. Unless different percentages are indicated below, the funds in the account shall be divided equally among the primary beneficiaries. If you designate more than one primary beneficiary, please make sure the percentages add up to 100%.

If you would like to list additional primary or contingent beneficiaries, please attach the information to this form. Please make sure that you clearly indicate primary beneficiaries and any contingent beneficiaries and the percentages they are to receive.

If you later wish to change one or more beneficiaries, you must complete a new Schwab Bank Designated Beneficiary Plan Application, listing all beneficiaries and their respective percentages.

Designated % |

Social Security/Tax ID Number |

|

Name (or Name of Trust and Trustees and Date of Trust) |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Home/Legal Street Address (no P.O. boxes, please) |

|

|

|

City |

|

|

State |

Zip Code |

||

|

|

|

|

|

|

|

|

|

|

|

Relationship |

|

|

Telephone Number |

|

|

Date of Birth (mm/dd/yyyy) |

|

|||

|

|

|

|

|

|

|

|

|||

Country(ies) of Citizenship (Must list all.) |

|

|

|

Country of Legal Residence |

|

|||||

USA |

Other: ___________________________ |

Other: ___________________________ |

|

USA |

Other: ________________________________ |

|

||||

|

|

|

|

|

|

|

||||

|

|

|

|

|

||||||

Designated % |

Social Security/Tax ID Number |

|

Name (or Name of Trust and Trustees and Date of Trust) |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Home/Legal Street Address (no P.O. boxes, please) |

|

|

|

City |

|

|

State |

Zip Code |

||

|

|

|

|

|

|

|

|

|||

Relationship |

|

|

Telephone Number |

|

|

Date of Birth (mm/dd/yyyy) |

|

|||

|

|

|

|

|

|

|

||||

Country(ies) of Citizenship (Must list all.) |

|

|

|

Country of Legal Residence |

|

|||||

USA |

Other: ___________________________ |

Other: ___________________________ |

|

USA |

Other: ________________________________ |

|

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

||||||

Designated % |

Social Security/Tax ID Number |

|

Name (or Name of Trust and Trustees and Date of Trust) |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Home/Legal Street Address (no P.O. boxes, please) |

|

|

|

City |

|

|

State |

Zip Code |

||

|

|

|

|

|

|

|

|

|||

Relationship |

|

|

Telephone Number |

|

|

Date of Birth (mm/dd/yyyy) |

|

|||

|

|

|

|

|

|

|

||||

Country(ies) of Citizenship (Must list all.) |

|

|

|

Country of Legal Residence |

|

|||||

USA |

Other: ___________________________ |

Other: ___________________________ |

|

USA |

Other: ________________________________ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

CC4059443 |

|

©2020 Charles Schwab Bank, SSB. |

|

All rights reserved. Member FDIC. Equal Housing Lender. |

|

Page 3 of 4

4. Designate Your Contingent Beneficiaries (Optional)

If any primary beneficiary listed in Section 3 is not living at the death of the last surviving account holder, does not survive the last surviving account holder by 120 hours, or disclaims the funds, I want that beneficiary’s share to pass to (please check one):

A. The other primary beneficiary(ies) pro rata (proportionate to the designated percentages).

The other primary beneficiary(ies) pro rata (proportionate to the designated percentages).

B. My estate and go through probate.

My estate and go through probate.

C. The following contingent beneficiaries proportionate to the designated percentages indicated below.

The following contingent beneficiaries proportionate to the designated percentages indicated below.

If none of the boxes is selected, and my primary beneficiary listed in Section 3 is not living at the death of the last surviving account holder, does not survive the last surviving account holder by 120 hours, or disclaims the funds, that beneficiary’s share shall pass to the other primary beneficiary(ies) pro rata (proportionate to the designated percentages).

Unless different percentages are indicated, funds shall be divided equally among the contingent beneficiaries below.

Designated % |

Social Security/Tax ID Number |

|

Name (or Name of Trust and Trustees and Date of Trust) |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Home/Legal Street Address (no P.O. boxes, please) |

|

|

|

City |

|

|

State |

Zip Code |

||

|

|

|

|

|

|

|

|

|

|

|

Relationship |

|

|

Telephone Number |

|

|

Date of Birth (mm/dd/yyyy) |

|

|||

|

|

|

|

|

|

|

|

|||

Country(ies) of Citizenship (Must list all.) |

|

|

|

Country of Legal Residence |

|

|||||

USA |

Other: ___________________________ |

Other: ___________________________ |

|

USA |

Other: ________________________________ |

|

||||

|

|

|

|

|

|

|

||||

|

|

|

|

|

||||||

Designated % |

Social Security/Tax ID Number |

|

Name (or Name of Trust and Trustees and Date of Trust) |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Home/Legal Street Address (no P.O. boxes, please) |

|

|

|

City |

|

|

State |

Zip Code |

||

|

|

|

|

|

|

|

|

|||

Relationship |

|

|

Telephone Number |

|

|

Date of Birth (mm/dd/yyyy) |

|

|||

|

|

|

|

|

|

|

||||

Country(ies) of Citizenship (Must list all.) |

|

|

|

Country of Legal Residence |

|

|||||

USA |

Other: ___________________________ |

Other: ___________________________ |

|

USA |

Other: ________________________________ |

|

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

||||||

Designated % |

Social Security/Tax ID Number |

|

Name (or Name of Trust and Trustees and Date of Trust) |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Home/Legal Street Address (no P.O. boxes, please) |

|

|

|

City |

|

|

State |

Zip Code |

||

|

|

|

|

|

|

|

|

|||

Relationship |

|

|

Telephone Number |

|

|

Date of Birth (mm/dd/yyyy) |

|

|||

|

|

|

|

|

|

|

||||

Country(ies) of Citizenship (Must list all.) |

|

|

|

Country of Legal Residence |

|

|||||

USA |

Other: ___________________________ |

Other: ___________________________ |

|

USA |

Other: ________________________________ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

CC4059443 |

|

©2020 Charles Schwab Bank, SSB. |

|

All rights reserved. Member FDIC. Equal Housing Lender. |

|

Page 4 of 4

5. Account Holder Authorization

By signing below, you request Schwab Bank to accept the beneficiaries for your account, as specified in this application (or to revoke an existing Plan, if that box is checked in Section 1 of this application). You acknowledge, read and agree to the attached Designated Beneficiary Plan Terms of Agreement With Schwab Bank. You acknowledge that you have received a copy of the Terms of Agreement.

For purposes of this application, the terms “you,” “your,” and “account holder” refer to each person who signs this application. The terms “we,” “us,” “our,” and “Schwab Bank” refer to Charles Schwab Bank, SSB.

All account holders must sign in black or blue ink only.

Signature(s) and Date(s) Required

X

Account Holder SignaturePrint NameDate

X

Additional Account Holder Signature |

Print Name |

Date |

FOR SCHWAB BANK USE ONLY:

Approved by

Print Name of Approver

Date Approved

Source Code

Product Code

Schwab Bank Account Number

CC4059443 |

|

©2020 Charles Schwab Bank, SSB. |

|

All rights reserved. Member FDIC. Equal Housing Lender. |

|

Designated Beneficiary Plan

Terms of Agreement With Schwab Bank

These terms relate to your account and are part of the Account Agreement between each account holder and Schwab Bank. Please retain for your files.

Throughout this agreement, the words “you,” “your” and “yours” refer to each account holder. “Schwab Bank” “we,” “us” and “our” refer to Charles Schwab Bank, SSB. Any capitalized terms not defined in these Terms of Agreement with Schwab Bank can be found in your Schwab Bank Deposit Account Agreement.

A. Amendment and Account Agreement. This Designated Beneficiary Plan Terms of Agree- ment With Schwab Bank supplements and is part of the Schwab Bank Deposit Account Agreement, an arbitration provision that you received at account opening. The Designated Beneficiary Plan With Schwab Bank (the “Plan”) consists of the Schwab Bank Designated Beneficiary Plan Application and these Terms of Agreement With Schwab Bank. If there is a conflict between the terms of the Plan and the terms of any other agreement that applies to your Schwab Bank account, the terms in the Plan shall control.

B. Limited Availability. Only Schwab Bank deposit accounts with Individual or Joint Tenants with Rights of Survivorship registrations are eligible for the Plan. Other registration types are ineligible for the Plan. Your primary residence must be within the United States in a state where Schwab Bank’s Designated Beneficiary Plan is offered. If your primary residence subsequently changes to a state where Schwab Bank’s Designated Beneficiary Plan is not offered, this Plan and your beneficiary designa- tion will no longer be valid.

C. Designation of Beneficiaries: Revocation and Changes to Beneficiary Designation. You may designate your Schwab Bank account to be payable on your death to a designated beneficiary(ies) by naming them on, and executing, the Schwab Bank Designated

Beneficiary Plan Application. These designations will remain in effect until changed or cancelled by you. During your lifetime, this account belongs to you. You may close the account, remove or add a beneficiary, change the account type or account ownership, and withdraw all or part of the account balance. Any designation, revocation or change to a beneficiary designa- tion must be authorized by all surviving account holders.

D. Payment on Death. Upon the death of the holder or, if there are

If there is an Overdraft Credit Line (OCL) or if you owe the bank any other debts associated with any of your deposit accounts at Schwab Bank (“Other Debts”), we may use the funds in your account (or other accounts you hold at Schwab Bank) to pay all amounts owing on your OCL or Other Debts before we distribute any funds to the beneficiary(ies).

E. Suitability for You. You acknowledge that we have not advised you on whether the Plan is appropriate for you. You acknowledge that the Plan may have significant tax, estate planning or other legal consequences. We recommend that you seek advice from your tax or estate planning advisor prior to enrolling in the Plan. You further acknowledge that this Plan does not constitute a trust and that Schwab Bank is not a trustee. Furthermore, we have no fiduciary obligations to you under this Plan.

F. Indemnity. We shall incur no liability for any payment made in good faith under this Plan. You, on behalf of yourself, your estate and your

•your failure to notify us of a change in primary residence that may cause the Plan not to be applicable at the time of any account holder’s death;

•any conflicting designations of the funds in your Schwab Bank account by will, revocable living trust or any other instrument;

•any written change of designated beneficiaries that you have made that is not received by us during your lifetime; and

•any other claims or disputes not due to our fault or negligence.

G. Governing Law. The Plan and its provisions are effective immediately upon the execution of this application and receipt by us. These Terms of Agreement with Schwab Bank are governed by Nevada law and applicable federal law.

©2020 Charles Schwab Bank, SSB. All rights reserved. Member FDIC. Equal Housing Lender. CC4059443

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | This form establishes a Designated Beneficiary Plan for your Schwab One Brokerage account or Schwab Bank Investor Checking account. It allows you to add, change, or revoke beneficiaries. |

| Asset Distribution | Upon the death of the account holder or the last surviving account holder, the assets in the account will transfer to the designated beneficiary as specified on this form. |

| Revocation Rights | If the account is joint, the surviving account holder can revoke the plan or change beneficiaries after the death of the other holder. |

| Applicable Accounts | The plan only covers assets in the Schwab One account and Schwab Bank Investor Checking account specified in the form. |

| Precedence of Plan | Subject to state laws, the Designated Beneficiary Plan typically takes precedence over other estate planning tools, such as wills or trusts. |

| State-Specific Availability | This plan is not available in New York, North Carolina, and Louisiana. Consult your attorney if your primary residence changes to one of these states. |

Guidelines on Utilizing Schwab Beneficiary

Completing the Schwab Beneficiary form is a critical step in ensuring your desired beneficiaries are designated for your Schwab accounts. This process must be handled carefully to ensure that your instructions are followed correctly. Follow these steps to fill out the form accurately.

- Check the appropriate box to indicate the action you wish to take:

- Add a new plan

- Add the plan to a new Investor Checking account

- Change beneficiaries on an existing plan

- Revoke an existing plan

- Fill out your account information, including your name(s), legal residence address, account number(s), and indicate if you are opening a new Investor Checking account.

- Designate your primary beneficiaries by providing their name, Social Security number (or Trust's Tax ID), relationship, contact information, and percentage of distribution. Ensure the total percentages equal 100%.

- If necessary, designate your contingent beneficiaries in the same manner, specifying different distribution percentages if applicable.

- Indicate how distributions should be handled for any minor beneficiaries. Choose either a custodial account or confirm that none are minors.

- Read the terms of agreement thoroughly and sign to authorize your beneficiary designations, noting the date of your signature.

- Submit the completed form to Schwab as directed, ensuring you retain a copy for your records.

What You Should Know About This Form

What is the Schwab Beneficiary Form used for?

The Schwab Beneficiary Form is designed to establish a Designated Beneficiary Plan for your Schwab One® Brokerage account or a Schwab Bank Investor Checking™ account. This form lets you add beneficiaries, change beneficiaries on an existing plan, or revoke an existing plan. It’s a useful tool to ensure that your assets are distributed as you wish upon your passing.

How do I designate beneficiaries using this form?

To designate beneficiaries, fill out the relevant sections on the form. You should provide the names and details of your primary beneficiaries, including their relationship to you and contact information. If you have contingent beneficiaries, those should be listed as well. Make sure that the percentages you assign to each beneficiary add up to 100%. This ensures clear distribution instructions for your assets.

What happens if I want to change my beneficiaries later?

If you wish to change your beneficiaries after submitting the form, you will need to complete an entirely new Schwab Designated Beneficiary Plan Application. It’s important to include all beneficiaries and their respective percentages again, as prior designations are revoked when a new application is submitted.

Are there any restrictions on who can be designated as a beneficiary?

Yes, there are some eligibility requirements for beneficiaries. For instance, all beneficiaries must be individuals or trusts. If the designated beneficiary is a minor, additional steps may be required, such as opening a custodial account. Furthermore, certain states, like New York, North Carolina, and Louisiana, do not allow this plan, which means if you live there, you won't be able to use this form to designate beneficiaries.

What happens to the assets if there are no surviving beneficiaries?

In the unfortunate event that all designated beneficiaries pass away before you, the assets will go to your estate unless you've stated otherwise on the form. If no specific instructions are provided, the assets must go through probate according to the laws applicable in your state. It’s beneficial to communicate your wishes clearly through the form to mitigate any potential complications.

Common mistakes

Filling out the Schwab Beneficiary form can often be a straightforward process, yet mistakes are common. Here are seven key mistakes people frequently make when completing this form.

**1. Not Checking the Action Box:** One of the primary mistakes is failing to check the appropriate action box at the beginning of the form. This box indicates whether you are adding a new plan, changing beneficiaries, or revoking an existing plan. If this step is overlooked, it can lead to confusion and delays in processing your application.

**2. Incomplete Beneficiary Information:** Beneficiaries need to be designated with complete information. Some people forget to provide relevant details, such as date of birth, social security number, or contact information. Without this information, Schwab may not be able to process the beneficiary designation effectively.

**3. Failing to Specify Percentages:** When designating multiple beneficiaries, it’s crucial to specify what percentage of the account each person will receive. Some individuals neglect to do this, which can complicate the distribution process later. If the percentages do not add up to 100%, your beneficiaries may face issues when claiming assets.

**4. Ignoring Contingent Beneficiaries:** Many people focus solely on primary beneficiaries and overlook the importance of contingent beneficiaries. Contingent beneficiaries are crucial since they inherit the assets if the primary beneficiaries predecease the account holder. Not naming these individuals can lead to the assets going through probate, which prolongs the time it takes for beneficiaries to receive their inheritance.

**5. Not Updating the Form Regularly:** Life changes, such as marriages, divorces, or the birth of children, can significantly impact your beneficiary designations. Failing to update the form regularly can result in outdated information. This oversight can lead to unintended distributions, potentially excluding intended heirs or including ex-spouses as beneficiaries.

**6. Using Inaccurate Address Information:** Providing incorrect addresses for beneficiaries can lead to delivery issues. This mistake may prevent beneficiaries from receiving essential communications regarding their inherited assets. Always double-check to make sure that the addresses listed are current and accurate.

**7. Ignoring State-Specific Rules:** Some individuals may be unaware of specific legal rules that apply to their state regarding beneficiaries. For instance, certain states may not allow specific designations or have requirements for joint accounts. Failure to adhere to your state’s regulations can render the beneficiary designation invalid.

Being mindful of these common mistakes can ensure that the Schwab Beneficiary form is completed accurately and avoids complications for your beneficiaries in the future.

Documents used along the form

The Schwab Beneficiary form is a critical document for clients establishing a Designated Beneficiary Plan. However, it’s not the only paperwork that might come into play. Other related forms and documents can help clarify estate planning intentions and aid in the process of asset distribution. Below is a list of common documents often used in conjunction with the Schwab Beneficiary form.

- Will: A will serves as a legal document outlining how a person's assets should be distributed upon their death. It can provide guidance in case there are no designated beneficiaries or if specific conditions must be met for distribution.

- Power of Attorney: This document allows someone to make decisions on behalf of another individual. It’s particularly relevant if that individual becomes incapacitated, ensuring that financial and healthcare choices are made by someone they trust.

- Living Trust: A living trust is a legal arrangement where one party holds property for the benefit of another. It can help avoid probate and provide flexibility in asset management during an individual’s lifetime and after their passing.

- Transfer on Death (TOD) Deed: This deed allows individuals to transfer real estate immediately upon death without going through probate. It's a straightforward method to ensure specific property passes directly to designated beneficiaries.

- Affidavit of Domicile: Often required during the probate process, this affidavit verifies a deceased person's last residential address. This document can help to establish jurisdiction and assist in the distribution of assets in accordance with state laws.

Choosing appropriate documentation is essential for effective estate planning. Each of these forms serves a unique purpose, and together they can create a comprehensive estate plan, aiding in a smoother transition of assets to beneficiaries while reducing potential complications.

Similar forms

- Transfer on Death (TOD) Designation: Similar to the Schwab Beneficiary form, a TOD allows the account holder to designate beneficiaries to receive assets directly upon their death, bypassing probate court. This ensures a straightforward transfer of assets to the chosen beneficiaries.

- Payable on Death (POD) Agreement: Like the Schwab form, a POD allows individuals to name beneficiaries for bank accounts, ensuring that funds are transferred to the designated individuals upon the account holder's death without going through probate.

- Living Trust: Establishing a living trust serves a purpose akin to the Schwab Beneficiary form. Assets placed within a trust are passed directly to beneficiaries upon the grantor's death, avoiding probate and offering privacy regarding asset distribution.

- Will: Although generally requiring probate, a will functions similarly by designating beneficiaries. It specifies how an individual's assets should be distributed after death, but unlike the Schwab form, it lacks the immediacy of direct transfers.

- Joint Tenancy with Right of Survivorship: This form of ownership allows co-owners to automatically inherit the other’s share upon death. This process mirrors the transfer structure of the Schwab Beneficiary form, albeit applicable only to jointly held property.

- Health Savings Account (HSA) Beneficiary Designation: KSAs allow owners to name beneficiaries in a manner similar to Schwab. Upon the account holder's death, the designated beneficiaries receive the funds directly, free from probate complications.

- Life Insurance Beneficiary Designation: Like the Schwab form, this designation allows policyholders to name beneficiaries who will receive the policy's death benefit directly upon their passing, thus avoiding the probate process.

- Retirement Account Beneficiary Designation: Retirement accounts, such as IRAs and 401(k)s, allow the account owner to name beneficiaries. Upon the owner's death, these accounts are transferred directly to the beneficiaries, as is the case with the Schwab form.

- Charitable Gift Annuity: Similar to the Schwab Beneficiary form, a charitable gift annuity allows an individual to direct assets to a charity upon their death while potentially providing an income stream during their lifetime.

- Family Limited Partnership (FLP): An FLP enables individuals to pass assets to family members while retaining control over them during their lifetime. This arrangement functions similarly to the Schwab Beneficiary form by facilitating direct transfers of family wealth upon death.

Dos and Don'ts

When filling out the Schwab Beneficiary form, there are important dos and don'ts to keep in mind to ensure your wishes are properly recorded.

- Do clearly identify all primary beneficiaries, including their full names and percentages they will receive.

- Do ensure all information is complete and accurate to avoid delays or issues in the future.

- Do keep a copy of the completed form for your records.

- Do sign and date the form before submission to confirm your wishes.

- Don't leave any fields blank; even if a beneficiary is not applicable, indicate that explicitly.

- Don't use abbreviations or nicknames for beneficiaries to prevent confusion.

- Don't submit the form without checking for any required supporting documents.

- Don't assume that changes will automatically take effect without a new submission of this form.

Misconceptions

- Misconception 1: The Schwab Beneficiary form can apply to any type of account.

- Misconception 2: You can verbally tell Schwab your beneficiary preferences.

- Misconception 3: Once you name a beneficiary, you cannot change it.

- Misconception 4: Beneficiaries automatically inherit without any conditions.

- Misconception 5: The Schwab Beneficiary form overrides a will entirely.

- Misconception 6: Anyone can be added as a beneficiary without restrictions.

- Misconception 7: If your primary residence changes, your beneficiary designations remain valid.

- Misconception 8: Minor beneficiaries can receive assets directly without special arrangements.

- Misconception 9: The setup fee is the only cost associated with the Schwab Beneficiary Plan.

Not true. This form specifically applies to Schwab One® Brokerage accounts and Schwab Bank Investor Checking™ accounts. Other types of accounts require separate applications.

This is incorrect. Changes or designations must be in writing on the proper form. Oral declarations will not be recognized.

This is false. You have the option to change or revoke your beneficiary designations at any time by submitting a new form.

Actually, beneficiaries must survive the account holder by a specific time frame (120 hours) to inherit the assets. If they do not, the designation may not be valid.

This isn't necessarily the case. While the form generally takes precedence over most estate planning documents, consulting an attorney is advisable for your specific situation.

This is misleading. Certain eligibility requirements must be met, such as the relationship between the account holder and the beneficiary.

This is not correct. If you move from a state where the plan operates to one where it does not, then your designations will no longer be valid unless you update them.

This is incorrect. Assets designated for minors must often go into a custodial account until they reach legal age. You must specify custodians on the form.

There may be additional fees assessed at the time of distribution or transfer based on Schwab’s policies, not just the initial setup fee.

Key takeaways

Filling out and using the Schwab Beneficiary form is a crucial step in estate planning and asset distribution. Here are some key takeaways to consider:

- Purpose of the Form: The Schwab Beneficiary form helps establish a Designated Beneficiary Plan for your Schwab One Brokerage account or Schwab Bank Investor Checking account.

- Survivorship Rights: If the account is joint, the surviving account holder retains the right to change beneficiaries after your death.

- Revoking Changes: Any adjustments or revocations to the beneficiary designation must be made in writing.

- Eligible Accounts: This form is applicable only to Schwab One accounts and Schwab Bank Investor Checking accounts. Separate applications are necessary for other Schwab accounts.

- Precedence of Beneficiary Plan: The Designated Beneficiary Plan typically takes precedence over any estate planning documents, like wills or trusts.

- Residence Restrictions: This plan is not available in New York, North Carolina, and Louisiana. If your primary residence changes to these states, the designation becomes invalid.

- Minor Beneficiaries: If your beneficiaries include minors, you must specify how their assets will be managed, typically through a custodial account.

- Contact Information: Ensure that all beneficiaries' details, including names, dates of birth, and Social Security numbers, are correctly listed on the form.

- Rights of the Account Holder: Only the account holder or their legal representative can change or revoke the beneficiary designations as specified in the plan.

- Consultation Recommended: It is advisable to consult with legal or financial advisors when filling out this form to ensure it meets your estate planning needs.

By understanding these points, you can ensure that your intended beneficiaries are properly designated and protected in the event of your passing.

Browse Other Templates

Post Office Forms - Both agents and mailers are responsible for the mailing information.

Apl Life Insurance - If the injury resulted from an accident, an explanation of how it occurred is required.