Fill Out Your Schwab Contribution Transmittal Form

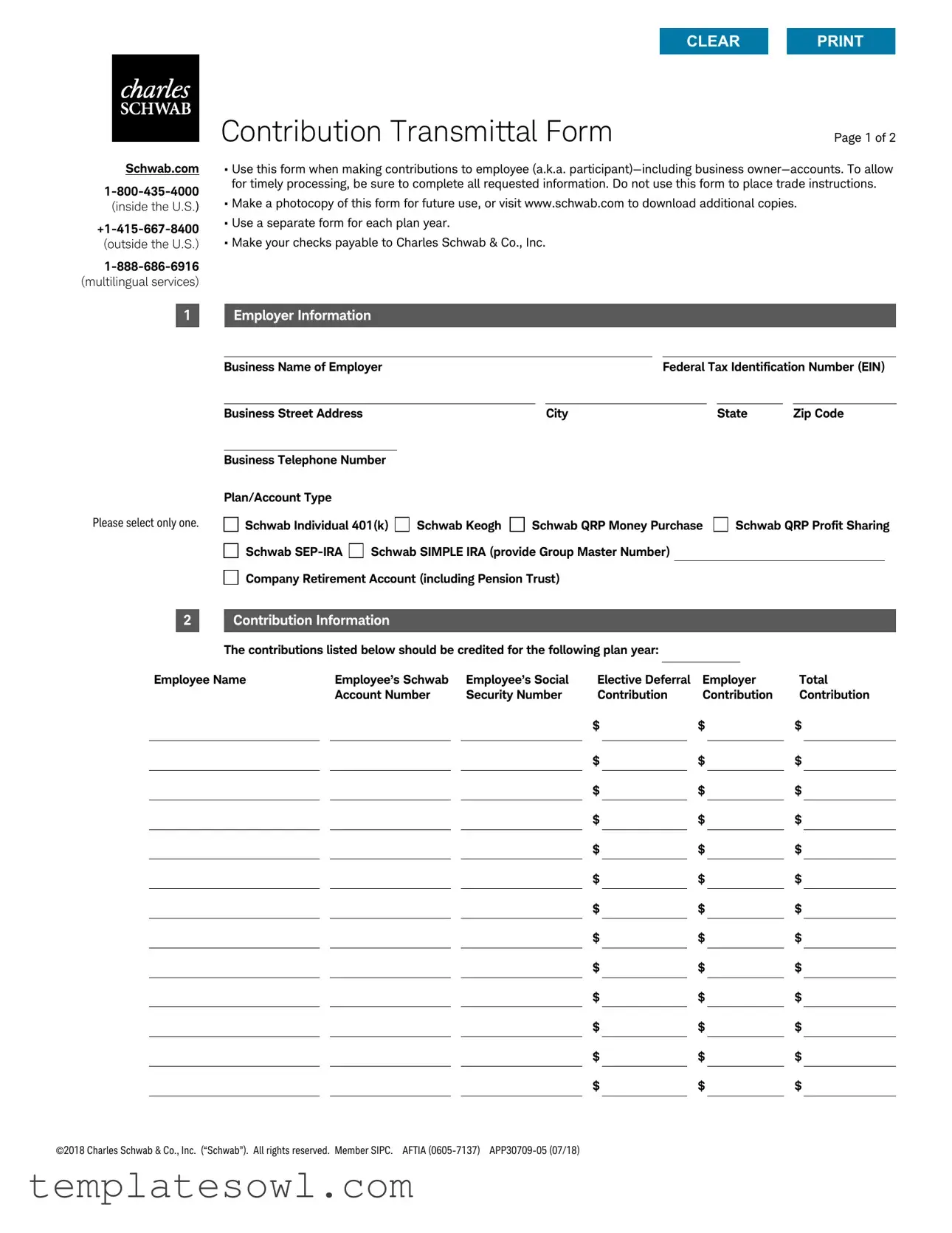

The Schwab Contribution Transmittal form is an essential tool for employers and business owners looking to make contributions to various retirement accounts, ensuring that these funds are allocated properly and in a timely manner. This two-page document includes important sections for both contribution details and employer authorization. Users should complete all requested information to avoid processing delays; for this reason, it is advisable to make photocopies of the form for future use or download extras directly from the Schwab website. Each contribution applies specifically to a single plan year, and it's important to note that checks must be made payable to Charles Schwab & Co., Inc. Among the information required are the employer's business name, tax identification number, contact details, and the specific type of retirement plan being utilized, whether it’s an Individual 401(k), Keogh, SEP-IRA, or another option. Additionally, employees must provide their individual details, ensuring accurate processing of both elective deferrals and employer contributions. Finally, the form must be signed and dated, indicating the employer's authorization for Schwab to act on the submitted instructions. Understanding how to properly fill out and submit the Schwab Contribution Transmittal form can help streamline the retirement funding process for all parties involved.

Schwab Contribution Transmittal Example

Schwab.com

1

CLEAR PRINT

Contribution Transmittal Form |

Page 1 of 2 |

•Use this form when making contributions to employee (a.k.a.

•Make a photocopy of this form for future use, or visit www.schwab.com to download additional copies.

•Use a separate form for each plan year.

•Make your checks payable to Charles Schwab & Co., Inc.

Employer Information

Business Name of Employer |

|

|

Federal Tax Identification Number (EIN) |

||||

|

|

|

|

|

|

|

|

Business Street Address |

|

City |

|

|

State |

|

Zip Code |

Please select only one.

Business Telephone Number |

|

|

|

Plan/Account Type |

|

|

|

Schwab Individual 401(k) |

Schwab Keogh |

Schwab QRP Money Purchase |

|

Schwab |

Schwab SIMPLE IRA (provide Group Master Number) |

||

Company Retirement Account (including Pension Trust)

Schwab QRP Profit Sharing

|

2 |

|

Contribution Information |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

The contributions listed below should be credited for the following plan year: |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Employee Name |

|

Employee’s Schwab |

|

Employee’s Social |

Elective Deferral |

Employer |

Total |

|||||||||

|

|

|

|

|

Account Number |

|

Security Number |

Contribution |

Contribution |

Contribution |

||||||

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

©2018 Charles Schwab & Co., Inc. (“Schwab”). All rights reserved. Member SIPC. AFTIA

Contribution Transmittal Form |

Page 2 of 2 |

3 Employer Authorization

I authorize and direct Schwab to deposit the dollar amounts as designated above. I understand that it is my responsibility to ensure that the contribution instructions are correct and submitted to Schwab in a timely manner. I agree that Schwab will not be held responsible for delays in depositing contributions if Schwab finds the contribution instructions unclear or incomplete. I indemnify and hold Schwab harmless for any loss, claim, expense or other liability that may arise from Schwab acting upon my instructions and complying with any applicable laws and regulations that require reporting of contributions.

Signature and Date Required

Today’s Date mm/dd/yyyy

Print Name |

Title |

4Return Instructions

•Upload online with secure messaging (if you are an existing client and have online access to your account).

1.Go to Schwab.com and log in to your account.

2.Click the Message Center link (under Service), and then click the Upload Document link.

3.Upload your form as an attachment by clicking the Add File button.

4.When your message is complete, click Send.

•Fax to

•Bring to your nearest Schwab branch (visit Schwab.com/branch for locations).

•Mail to any of the following addresses:

Regular Mail (West) |

Regular Mail (East) |

Overnight Mail (West) |

Overnight Mail (East) |

|

Charles Schwab & Co., Inc. |

Charles Schwab & Co., Inc. |

Charles Schwab & Co., Inc. |

Charles Schwab & Co., Inc. |

|

P.O. Box 982600 |

P.O. Box 628291 |

1945 Northwestern Drive |

1958 Summit Park Dr., Ste. 200 |

|

El Paso, TX |

Orlando, FL |

El Paso, TX 79912 |

Orlando, FL 32810 |

|

|

|

|

|

|

|

|

|

|

|

©2018 Charles Schwab & Co., Inc. (“Schwab”). All rights reserved. Member SIPC. AFTIA

This page is intentionally blank.

©2018 Charles Schwab & Co., Inc. (“Schwab”). All rights reserved. Member SIPC. AFTIA

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used to make contributions to employee accounts, including those of business owners. |

| Complete Information Required | To ensure timely processing, fill out all requested details completely. |

| One Form Per Year | A separate form must be used for each plan year. |

| Payment Instructions | Checks should be payable to Charles Schwab & Co., Inc. |

| Contribution Credit | Contributions are credited to the specified plan year by the employer. |

| Employer Authorization | The employer must authorize Schwab to deposit the contributions as designated. |

| Submission Methods | Submit online, fax, in person at a branch, or by mail to designated addresses. |

Guidelines on Utilizing Schwab Contribution Transmittal

Completing the Schwab Contribution Transmittal form is essential for ensuring accurate and timely processing of contributions to employee accounts. Follow these steps to fill out the form correctly, and make sure all necessary information is provided.

- Obtain the Schwab Contribution Transmittal form from Schwab.com or make a photocopy for your records.

- In the Employer Information section, fill in the following:

- Business Name of Employer

- Federal Tax Identification Number (EIN)

- Business Street Address

- City

- State

- Zip Code

- Business Telephone Number

- Under Plan/Account Type, select only one option regarding the type of account.

- In the Contribution Information section, enter details for each employee:

- Employee Name

- Employee’s Schwab Account Number

- Employee’s Social Security Number

- Elective Contribution

- Deferral Contribution

- Employer Contribution

- Total Contribution

- Complete the Employer Authorization section by signing and dating the form. Provide your printed name and title.

- Decide on the method of submission. You can:

- Upload the form online through Schwab's secure messaging after logging in to your account.

- Fax the document to 1-888-526-7252.

- Bring the form to a local Schwab branch.

- Mail it to the appropriate address based on your region.

What You Should Know About This Form

What is the purpose of the Schwab Contribution Transmittal form?

The Schwab Contribution Transmittal form is designed for making contributions to employee accounts, including those belonging to business owners. It ensures that contributions are processed timely by providing a structured way to submit required information. It's important to note that this form should not be used for placing trade instructions.

How should I complete the form?

When filling out the form, it's essential to provide all requested information accurately. Each plan year requires a separate form, so make sure you use the correct one for the current year. Once completed, consider making a photocopy for your records or downloading additional copies from Schwab’s website for future use.

Who is responsible for the accuracy of the contribution instructions?

The responsibility for the accuracy of the contribution instructions lies with the employer. It is vital to ensure that all information is correct and submitted in a timely manner. Schwab will not assume responsibility for delays caused by unclear or incomplete instructions, and they do not guarantee the processing of contributions if the required information is missing.

What methods can I use to submit the form?

You can submit the completed Schwab Contribution Transmittal form in several ways. If you are an existing client with online access, you may upload the form through Schwab's secure messaging. Alternatively, you can fax it to the designated number, deliver it in person to a nearby Schwab branch, or mail it to one of the specified regular or overnight addresses. Make sure to choose the method most convenient for you.

Are there specific accounts or plans eligible for contributions using this form?

Yes, the form can be used for different types of retirement accounts, such as Schwab Individual 401(k), Schwab Keogh, Schwab SEP-IRA, and Schwab SIMPLE IRA, among others. It's crucial to select the appropriate account type so that your contributions are applied correctly.

What information do I need to provide for contribution amounts?

You will need to specify the contribution amounts for both the employee's elective deferral and the employer's total contribution. Each amount must be designated clearly to avoid any potential confusion. This information ensures that the contributions are credited accurately for the intended plan year.

Can I use this form for multiple employees?

This form is intended for use with individual employee contributions, so you should complete a separate form for each employee. This approach keeps the information organized and ensures that each employee's contributions are recorded properly.

What happens if the form is submitted improperly?

If the form is submitted with inaccuracies or is incomplete, the processing of contributions may be delayed. Schwab will inform you if any issues arise due to unclear instructions. Therefore, reviewing the form carefully before submission is important to ensure a smooth process.

Common mistakes

Filling out the Schwab Contribution Transmittal form can seem straightforward, yet there are common pitfalls that can lead to delays in processing. One frequent mistake is not completing all the required fields. Each section of the form must be fully filled out to ensure timely processing of contributions. Omitting details, even seemingly minor ones, may result in the form being returned or delayed.

Another common error is using the wrong form for the specific plan year. The guidelines clearly state that individuals should use a separate form for each plan year. Many people mistakenly try to use the same form from a previous year, which not only creates confusion but also complicates the processing of contributions.

Incorrect calculations can further complicate matters. When filling in the contribution amounts, ensure that all figures are accurate. Double-checking the numbers can prevent issues related to under or over-contributions, which can lead to the need for additional paperwork to correct errors later on.

Additionally, there can be confusion surrounding the payment method. It’s essential to make checks payable to Charles Schwab & Co., Inc., as specified in the form. Failing to do so can lead to the rejection of the payment and further delays in processing. Clarity in instructions helps avoid misunderstandings that could hinder the contribution process.

Finally, ensure that all necessary authorizations are completed at the end of the form. The employer’s signature and date are mandatory, and any missing authorization can result in the form being deemed incomplete. Taking the time to review the entire form before submission can save significant headaches down the road.

Documents used along the form

The Schwab Contribution Transmittal form facilitates contributions to various retirement accounts. When using this form, several other documents may also be necessary for effective processing. Below is a list of commonly associated forms and documents that can assist in managing contributions and ensuring compliance with regulations.

- Employer Identification Number (EIN) Application (Form SS-4): This form is used to apply for an EIN, which is required for businesses that have employees or are required to pay certain federal taxes. The IRS uses this number to identify the business entity.

- Retirement Plan Document: This document outlines the terms and conditions of the retirement plan, including eligibility, contribution limits, and administrative procedures. It must be maintained and updated to ensure compliance with federal regulations.

- Payroll Deduction Authorization Form: This form allows employees to authorize their employer to deduct certain contributions directly from their paychecks. It simplifies the contribution process and ensures contributions are made consistently.

- Annual Reporting Forms (Form 5500): This form is filed annually to report the financial condition and operations of pension and welfare benefit plans. It's required by the Department of Labor and provides transparency regarding plan assets and compliance.

Using these documents in conjunction with the Schwab Contribution Transmittal form can help streamline the contribution process and promote compliance with applicable regulations.

Similar forms

- Contribution Agreement: This document outlines the specific terms and conditions under which contributions to retirement accounts are made, similar to how the Contribution Transmittal form details individual contributions.

- Retirement Plan Enrollment Form: This form collects similar information to register individuals for a retirement plan, including personal details and plan options, just as the contribution form collects details about contributions.

- Direct Deposit Authorization Form: Like the Schwab form, this document requires specific account information to ensure contributions are deposited accurately and timely into an account.

- Beneficiary Designation Form: This document allows account holders to specify beneficiaries for their accounts. It shares a focus on important account management just as the Contribution Transmittal form focuses on contributions.

- Withdrawal Request Form: This form details the request process for withdrawing funds, focusing on ensuring clarity and completeness, paralleling the need for accuracy on contribution instructions.

- 401(k) Plan Amendment Form: Required for changes to a 401(k) plan, this form requires information about existing plans similar to the information required in the contribution transmittal.

- Annual Contribution Limits Documentation: This document outlines the maximum contribution limits for various retirement accounts, akin to how the Schwab form specifies the amounts to be contributed.

- Plan Termination Form: When terminating a retirement plan, this form must be completed similarly to ensure all contributions and account details are processed appropriately.

- Investment Direction Form: This document allows account holders to specify how their contributions are invested, much like how the Contribution Transmittal Form outlines where contributions are directed.

- Change of Investment Strategy Form: This form allows account holders to change their investment strategy, paralleling the Schwab form's role in defining how and where contributions are made.

Dos and Don'ts

When completing the Schwab Contribution Transmittal form, it is important to follow certain guidelines to ensure accurate and timely processing. Here are six key dos and don’ts to consider:

- Do complete all requested information to facilitate timely processing.

- Do use a separate form for each plan year to avoid confusion.

- Do make checks payable to Charles Schwab & Co., Inc..

- Do authorize the amounts accurately for contribution crediting purposes.

- Don’t use this form to place trade instructions, as it is solely for contributions.

- Don’t forget to make a photocopy of the completed form for your records.

Misconceptions

- Only Employees Can Use the Form: Some believe that only employees can submit contributions using this form. In fact, business owners can also use it for their accounts.

- It Can Be Used for Trading: A misconception is that this form can place trade instructions. This form is strictly for contributions, not for trading purposes.

- Incomplete Forms Are Accepted: Many assume that Schwab will process forms without complete information. However, incomplete forms may lead to delays in processing contributions.

- Only One Contribution Per Form: Some think they can list multiple contributions for different employees on the same form. It's important to use a separate form for each account.

- Online Submission Is Not Available: People often believe they must mail or fax their forms. In reality, existing clients can easily upload their forms through secure messaging on the Schwab website.

- Signature Is Optional: There is a misunderstanding that a signature is not required. A signature and date are mandatory to authorize the contributions.

- Any Check Is Acceptable: Some individuals think they can write checks to any entity. Checks must be made payable specifically to Charles Schwab & Co., Inc.

Key takeaways

Here are some key takeaways about filling out and using the Schwab Contribution Transmittal form:

- Complete all requested information to ensure timely processing of contributions. Missing information can cause delays.

- Make a photocopy of the completed form for your records or download additional copies from Schwab's website.

- Use a separate form for each plan year to maintain accurate records.

- When submitting, ensure checks are made payable to Charles Schwab & Co., Inc. for proper processing.

- After filling out the form, you can submit it through various methods such as online upload, fax, or mailing it to the appropriate address.

Browse Other Templates

Sales and Use Tax License Maryland - Taking care in filling out this form can prevent future tax complications.

What Is an Hvac System - Confirm that the biocide treatment in the cooling tower is effective.

Grand Parents Rights - The form features essential information about the petitioner's contact details.