Fill Out Your Scotia Banking Form

The Scotia Banking form, widely known as the Scotiabank Switch Kit, serves as an essential tool for individuals looking to transition their payroll deductions to a new bank account seamlessly. Designed with user convenience in mind, it streamlines the process by allowing employees to authorize their employers to redirect salary deposits directly to their new Scotiabank account. Completing this form requires providing key details such as your name, employee number, and the relevant bank account information, including the location transit number and the desired commencement date for the payroll transfer. It's particularly important to communicate the date you wish the change to take effect, as it ensures a timely transition without interruptions to your salary payments. In order to facilitate this process, you must also include a signature indicating your consent for the change. The form emphasizes the importance of notifying the bank should any issues arise, ensuring both the employee and the employer are on the same page during the transition. This straightforward yet effective form not only makes it easier for individuals to manage their finances but also reinforces the commitment of Scotiabank to support its customers during transitions.

Scotia Banking Example

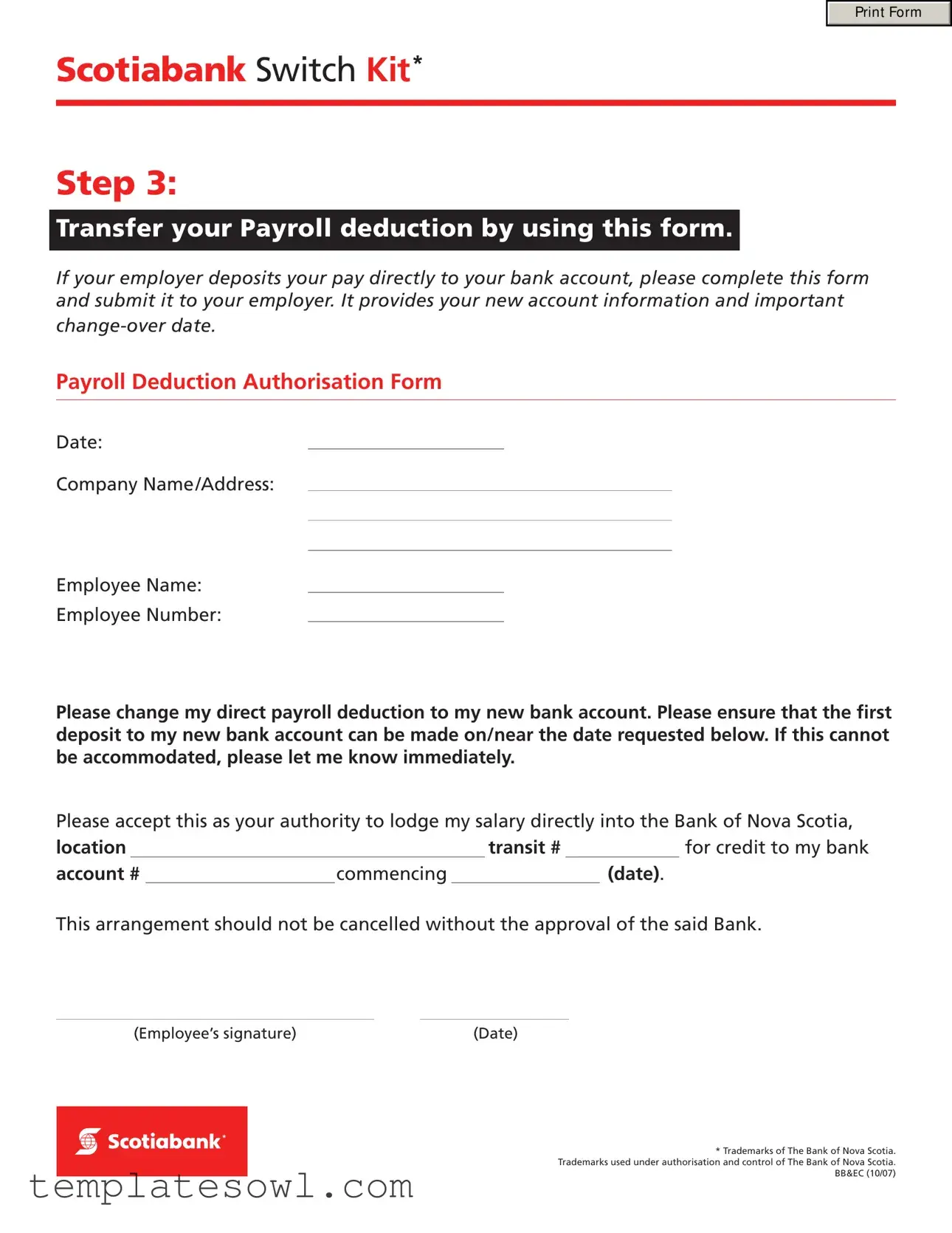

PRINT FORM

Scotiabank Switch Kit*

Step 3:

Transfer your Payroll deduction by using this form.

If your employer deposits your pay directly to your bank account, please complete this form and submit it to your employer. It provides your new account information and important

Payroll Deduction Authorisation Form

Date:

Company Name /Address:

Employee Name:

Employee Number:

Please change my direct payroll deduction to my new bank account. Please ensure that the first deposit to my new bank account can be made on/near the date requested below. If this cannot be accommodated, please let me know immediately.

Please accept this as your authority to lodge my salary directly into the Bank of Nova Scotia,

location |

|

|

|

|

transit # |

|

|

for credit to my bank |

account # |

|

commencing |

|

(date). |

||||

This arrangement should not be cancelled without the approval of the said Bank.

(Employee’s signature) |

(Date) |

*Trademarks of The Bank of Nova Scotia. Trademarks used under authorisation and control of The Bank of Nova Scotia.

BB&EC (10/07)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Scotia Banking form is designed for employees who want to transfer their payroll deductions to a new account at Scotiabank. |

| Employer Submission | Employees need to complete and submit this form to their employer in order to initiate the payroll deduction transfer. |

| Account Information | The form includes fields for the new bank account information and an important change-over date. |

| Direct Deposit | It allows employees to authorize their salary to be directly deposited into the new Scotiabank account. |

| First Deposit Timing | There is a request to ensure that the first deposit occurs on or near the date specified by the employee. |

| Approval Requirement | Cancellation of the payroll arrangement requires the approval of Scotiabank. |

| Employee Information | Employees must provide their name, employee number, and employer's name and address on the form. |

| Signature Requirement | An employee’s signature and date are necessary for the form to be valid. |

| Trademark Information | Scotiabank is a trademark owned by The Bank of Nova Scotia and used under authorization. |

Guidelines on Utilizing Scotia Banking

After gathering the necessary information, the next step is to accurately complete the Scotia Banking form. This document is essential for facilitating the change of your payroll deductions to your new bank account. Completing the form promptly and accurately will help ensure that your funds are transferred without delay.

- Begin by writing the Date in the designated area at the top of the form.

- Next, fill in the Company Name / Address section with your employer's details.

- Input your Employee Name as it appears on your payroll records.

- Enter your Employee Number in the appropriate field.

- Clearly state your request by marking the indication that you would like your direct payroll deductions changed to your new bank account.

- Specify the date that you would like the first deposit to your new bank account to occur.

- Provide the location transit # for The Bank of Nova Scotia in the allocated space.

- Write down your new bank account # for credit.

- Sign the form in the section marked Employee’s signature.

- Finally, include the Date of your signature at the end of the form.

What You Should Know About This Form

What is the Scotia Banking form and its purpose?

The Scotia Banking form, often referred to as the "Scotiabank Switch Kit," is designed to facilitate the transfer of payroll deductions from one bank account to another. This form must be completed by employees who wish to change their banking details for direct deposit of salaries. By filling out this form, employees provide their new account information to their employers, ensuring a smooth transition to the new bank account. It also specifies an important change-over date for when the new payments should begin.

How do I complete the Scotia Banking form?

To complete the Scotia Banking form, you first need to fill in specific details, including your employer's name and address, your name, and your employee number. Then, indicate your new banking details, including the bank account number and the transit number of the Bank of Nova Scotia. It is essential to specify the date when you would like the first deposit into your new account to occur. Finally, sign and date the form to authorize the change.

Where do I submit the completed form?

Once you have completed the Scotia Banking form, it should be submitted directly to your employer’s payroll or human resources department. They will handle the processing of your request and ensure that your salary is deposited into your new bank account as per your instructions.

What should I do if I need to cancel this arrangement?

If you need to cancel the direct deposit arrangement after submitting the Scotia Banking form, contact the Bank of Nova Scotia directly. Notably, such cancellations cannot be made without the bank’s approval, which is a safeguard to protect your financial transactions. It is advisable to initiate this conversation well ahead of any planned changes to avoid payment disruptions.

Is there a deadline for submitting the Scotia Banking form?

There is no universally fixed deadline; however, it is best to submit the form as early as possible. This ensures that your first deposit into the new bank account can be processed on or near your requested change-over date. If there are any complications or delays, your employer should inform you immediately, giving you time to address any issues prior to the pay date.

Common mistakes

Filling out the Scotia Banking form can seem straightforward, but a few common mistakes can lead to delays in your payroll deductions. Being aware of these mistakes will help ensure a smooth transition to your new account.

One frequent error is neglecting to include the correct company name or address. If your employer can't clearly identify you, it may slow down the process or even lead to rejection of your request. Always double-check that this information is accurate and reflects your current employer’s details.

Another common mistake is omitting your employee number. This unique identifier is crucial for your employer to process the request accurately. Without it, there may be confusion regarding your payroll account, causing unnecessary delays.

Many individuals also fail to specify the date for the first deposit into the new account. If you skip this step, it could result in your payroll being sent to your old account. Providing a clear date ensures your funds are directed to your new bank account without interruption.

Additionally, individuals sometimes misunderstand the authorization section, either by not signing it or forgetting to include the date next to their signature. This oversight can render the entire form invalid. Remember, your signature is confirmation that you authorize this transfer.

It's also essential to double-check the transit number and account number you've written down. A simple transposition error, like mixing up two digits, can lead to serious complications. Ensure each number is correct to avoid misdirected funds.

Another mistake is failing to inform your employer immediately if your requested transfer date cannot be accommodated. Keeping open lines of communication helps prevent misunderstandings and potential payroll errors.

For those who are not proactive about following up after submitting their form, this can be a significant problem. Always check in with your payroll department after a reasonable time to ensure the changes have been implemented.

Also, people often forget to keep a copy of the submitted form. Documentation is key! If any issues arise, having a copy of your request can help clarify what was intended.

In conclusion, filling out the Scotia Banking form requires careful attention to detail. By avoiding these common mistakes, you will facilitate a smoother transition to your new bank account and ensure your payroll deductions are processed without delay.

Documents used along the form

When transitioning to a new banking account, several forms accompany the Scotiabank Switch Kit to ensure a smooth process. Below is a list of typical documents that are often used in conjunction with it. Each document serves a specific purpose in managing your banking details, particularly when switching payroll deductions or updating account information.

- Payroll Deduction Authorization Form: This document instructs your employer to redirect your payroll deposits to your new bank account. It includes necessary details like account numbers and the date you want the changes effective.

- Account Closure Request Form: If you are closing your old bank account, this form notifies your previous bank of your decision and requests that they finalize any outstanding transactions before closing.

- Direct Deposit Form: This form is typically required by employers to establish the direct deposit of your paycheck into your new account. It usually requires your new bank’s account details and may need your signature for verification.

- Transfer of Banking Services Form: Use this form to facilitate the transfer of services and automatic payments from your old bank to your new account. This may include utilities, subscription services, and other recurring payments.

- Change of Address Form: If you are also changing your residence, this document ensures your bank and any institutions send correspondence to your new address.

- Beneficiary Designation Form: If desired, this form allows you to update or assign beneficiaries for your bank account. This is important for estate planning and ensuring the right people inherit funds.

- Tax Identification Number (TIN) Verification: Some banks require a TIN form to confirm your identity for tax purposes. This document is necessary when setting up new accounts, especially for businesses.

- Consumer Complaint Form: While not directly related to banking transitions, it’s good to keep this form on hand in case there are issues with your new bank that need to be addressed formally.

Ensuring you have these documents ready will streamline your transition to your new banking account, minimizing potential delays and ensuring your financial activities are not disrupted. It is crucial to keep communication open with both your old and new banks throughout this process.

Similar forms

The Scotia Banking form serves as a critical document for employees wishing to transfer their payroll deductions. It shares similarities with several other important documents commonly used for similar purposes. Here’s an overview of these documents:

- Direct Deposit Form: This document allows employees to set up direct deposit for their paychecks into a designated bank account. Like the Scotia form, it requires account details and authorization for payroll deposits.

- Payroll Change Request Form: Employees use this form to notify their employer of changes to their payroll information, such as banking details. It parallels the Scotia form in providing essential information for processing payroll changes.

- Authorization for Payroll Deduction: This document is used to authorize specific deductions from an employee’s paycheck, similar to how the Scotia form authorizes direct deposits. It includes details about amounts and frequencies of deductions.

- Bank Account Change Request Form: When an employee switches bank accounts, this form formally notifies the employer and updates payment information. Like the Scotia form, it includes necessary account information for smooth transitions.

- Employee Payroll Information Update: This form is essential for any updates to an employee’s payroll details, ensuring that the employer processes payments correctly, much like the Scotia form aims to facilitate changes in payroll deductions.

- W-4 Form: While primarily for tax withholdings, this document can affect the overall paycheck amount. It is similar in that it dictates how payments are processed, similar to how the Scotia form impacts payroll deposits.

- ACH Authorization Form: This allows employees to authorize automated transfers to their banks, akin to the Scotia form's function of facilitating payroll deposits. Both require clear instructions for banking transactions.

Understanding these forms helps streamline payroll processes. Ensure that when submitting any of these documents, complete and accurate information is provided to avoid delays in payment processing.

Dos and Don'ts

When filling out the Scotiabank Switch Kit form, it is essential to follow specific guidelines to ensure a smooth transition for your payroll deductions. Here are seven important things to do and avoid during the process:

- Do ensure that all personal information is accurate and complete.

- Do notify your employer about the change as soon as the form is completed.

- Do provide the correct bank account and transit numbers on the form.

- Do keep a copy of the completed form for your records.

- Don’t submit the form without double-checking for errors.

- Don’t forget to indicate the desired start date for the direct deposit.

- Don’t assume the change will take effect immediately; allow some processing time.

Following these guidelines will help ensure that your payroll deductions transition smoothly to your new bank account with Scotiabank.

Misconceptions

Many people have misunderstandings about the Scotia Banking form. Here are nine common misconceptions and clarifications for each:

- Misconception 1: You need to fill out the entire form in one go.

- Misconception 2: The form only applies to new employees.

- Misconception 3: You cannot specify a date for the payroll transfer.

- Misconception 4: The employer must process the request immediately.

- Misconception 5: Your old account will automatically be closed after submitting the form.

- Misconception 6: You don’t need your bank’s information to fill out the form.

- Misconception 7: There’s no need for an employee signature.

- Misconception 8: The change can happen at any time without notice.

- Misconception 9: The form is only valid for a certain period.

Many believe the form must be completed in a single sitting. In reality, you can fill it out at your own pace and come back to it later.

Some think this form is only for those starting a new job. However, existing employees can also use it to switch their payroll deductions to a new account.

People often assume that they cannot request a specific date for the first deposit. The form actually allows you to indicate your preferred effective date for the transfer.

It is a common belief that employers will act on the request without delay. Employers typically need some time to process these changes.

Some individuals think their previous bank account will close as soon as they submit the form. In reality, you need to close the old account separately.

Many people believe they can complete the form without their new bank account details. However, key information like the account number and transit number is essential for processing.

Some mistakenly think their authorization isn’t necessary. However, your signature is required to authorize the payroll deduction change.

It is often assumed that changes can be made whenever desired. Proper notice is necessary to ensure a smooth transition; employers usually need time to process the request.

Some believe the form has an expiration date. The form remains valid as long as your employment status is active and you continue to authorize the changes.

Key takeaways

The Scotia Banking form is essential for ensuring a smooth transition when changing your direct payroll deposit. Below are key takeaways that will help you navigate the process effectively.

- Complete the Form Accurately: Ensure that all required fields are filled out correctly, including your employer's name and your employee details.

- Use the Correct Date: Clearly indicate the date you want the first deposit to occur in your new account.

- Inform Your Employer: Submit the completed form to your employer promptly to facilitate the change.

- Direct Deposit Information: Confirm that the form contains your new bank account details, including the bank account number and transit number.

- Understand the Approval Requirement: Know that your direct deposit arrangement cannot be canceled without the bank's approval.

- Employer's Response: If your employer cannot accommodate the requested change date, they should inform you immediately.

- Keep a Copy: Retain a copy of the completed form for your records after submission.

- Employee’s Signature: Ensure you sign and date the form to authorize the payroll deduction change.

- Trademarks: Remember that Scotia Banking trademarks are used under authorization from The Bank of Nova Scotia.

Browse Other Templates

Va Residual Income Chart 2023 Pdf - Providing accurate information is crucial for loan approval chances.

Wildlife Management Plan Submission Form,Agricultural Valuation Wildlife Strategy Form,Open Space Wildlife Assessment Sheet,County Wildlife Management Plan,Wildlife Habitat Management Application,Ecoregion Wildlife Management Proposal,Landowner Wildl - The detailed requirements support the ecological and economic sustainability of the land.

Wire Money Transfer - For transfers to China, it's preferable to send US dollars.