Fill Out Your Section 8 Rent Calculation Worksheet Form

The Section 8 Rent Calculation Worksheet is a crucial tool in the administration of the Housing Choice Voucher program, enabling public housing agencies (PHAs) to determine both the family’s share of housing costs and the amount of housing assistance provided. This form organizes extensive information about the applicant, including basic personal details and their income status, which drives the calculation of their total tenant payment (TTP). The first part of the worksheet guides users through calculating the minimum contribution a family must make toward their rent and utilities, employing various income metrics and adjustments to arrive at a fair TTP. The worksheet also sets forth maximum rent burdens and outlines how these figures tie back to both the family’s selected unit and the PHA’s established payment standards. Once a unit is chosen, the form transitions into determining the actual Housing Assistance Payment (HAP), making clear distinctions on how the HAP is not only calculated based on the gross rent of the selected unit but also capped by earlier mentioned limits. Furthermore, the worksheet facilitates the determination of utility allowances, thus allowing families to understand their total costs. By considering various allowances and limitations, the Section 8 Rent Calculation Worksheet provides a systematic approach to ensuring that families receive the appropriate level of support while maintaining transparency in the assistance process.

Section 8 Rent Calculation Worksheet Example

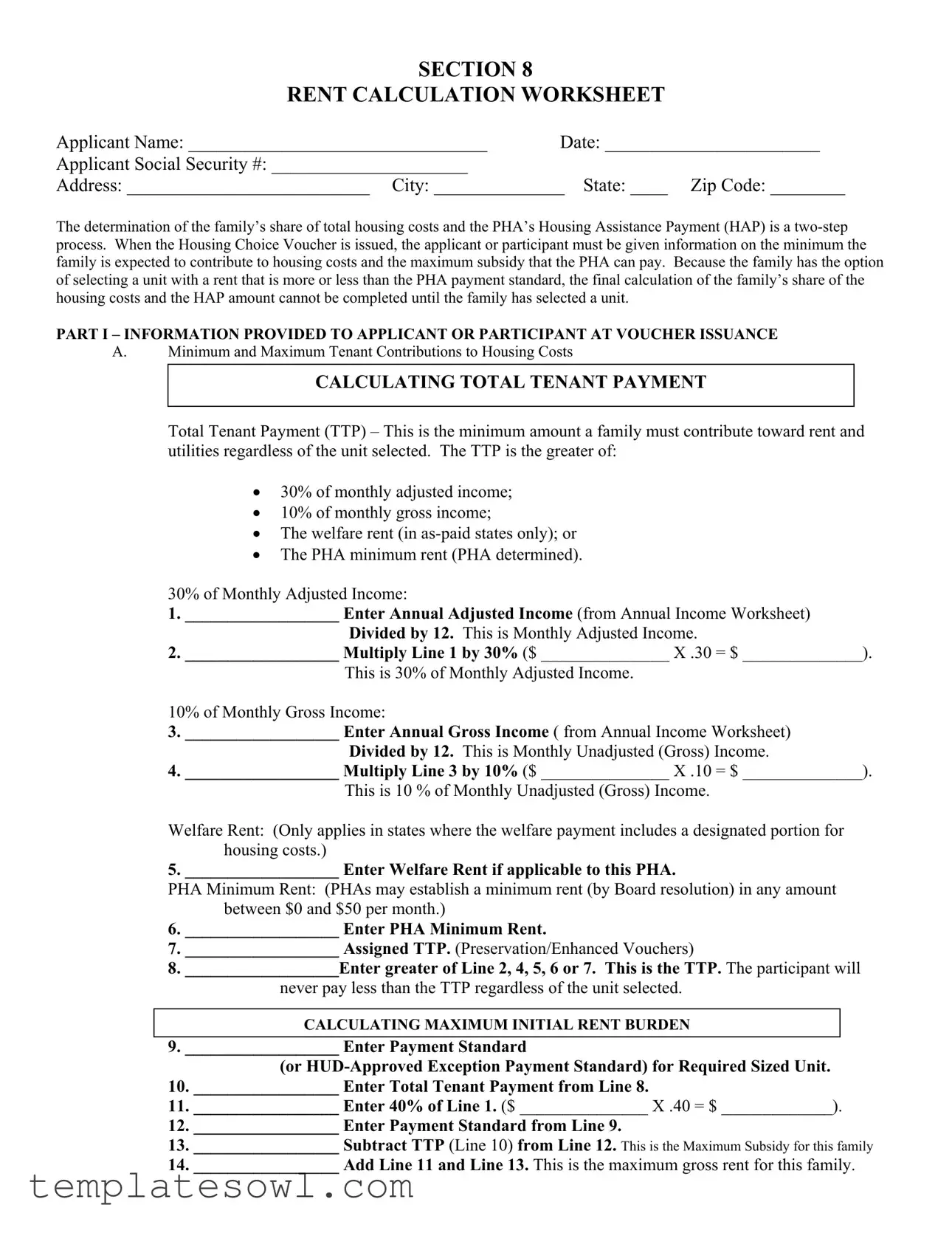

SECTION 8

RENT CALCULATION WORKSHEET

Applicant Name: ________________________________ |

Date: _______________________ |

Applicant Social Security #: _____________________ |

|

Address: __________________________ City: ______________ State: ____ Zip Code: ________

The determination of the family’s share of total housing costs and the PHA’s Housing Assistance Payment (HAP) is a

PART I – INFORMATION PROVIDED TO APPLICANT OR PARTICIPANT AT VOUCHER ISSUANCE

A.Minimum and Maximum Tenant Contributions to Housing Costs

CALCULATING TOTAL TENANT PAYMENT

Total Tenant Payment (TTP) – This is the minimum amount a family must contribute toward rent and utilities regardless of the unit selected. The TTP is the greater of:

•30% of monthly adjusted income;

•10% of monthly gross income;

•The welfare rent (in

•The PHA minimum rent (PHA determined).

30% of Monthly Adjusted Income:

1.__________________ Enter Annual Adjusted Income (from Annual Income Worksheet) Divided by 12. This is Monthly Adjusted Income.

2.__________________ Multiply Line 1 by 30% ($ _______________ X .30 = $ ______________). This is 30% of Monthly Adjusted Income.

10% of Monthly Gross Income:

3.__________________ Enter Annual Gross Income ( from Annual Income Worksheet) Divided by 12. This is Monthly Unadjusted (Gross) Income.

4.__________________ Multiply Line 3 by 10% ($ _______________ X .10 = $ ______________).

This is 10 % of Monthly Unadjusted (Gross) Income.

Welfare Rent: (Only applies in states where the welfare payment includes a designated portion for housing costs.)

5. __________________ Enter Welfare Rent if applicable to this PHA.

PHA Minimum Rent: (PHAs may establish a minimum rent (by Board resolution) in any amount between $0 and $50 per month.)

6.__________________ Enter PHA Minimum Rent.

7.__________________ Assigned TTP. (Preservation/Enhanced Vouchers)

8.__________________Enter greater of Line 2, 4, 5, 6 or 7. This is the TTP. The participant will never pay less than the TTP regardless of the unit selected.

CALCULATING MAXIMUM INITIAL RENT BURDEN

9. __________________ Enter Payment Standard

(or

10._________________ Enter Total Tenant Payment from Line 8.

11._________________ Enter 40% of Line 1. ($ _______________ X .40 = $ _____________).

12._________________ Enter Payment Standard from Line 9.

13._________________ Subtract TTP (Line 10) from Line 12. This is the Maximum Subsidy for this family

14._________________ Add Line 11 and Line 13. This is the maximum gross rent for this family.

CALCULATING AFFORDABLE RENT FOR THIS FAMILY

|

|

(a) |

|

(b) |

15. |

Family TTP from Line 8. (Minimum the family will pay.) |

$ ________ |

|

|

16. |

Maximum Initial Rent Burden (Line 11) |

|

|

$_________ |

17. |

Maximum Subsidy from Line 13 (put on 17a & 17b) |

$ ________ |

|

$ _________ |

18. |

Family may consider units with gross rents between |

$ ________ |

and |

$ _________ |

|

(Add 15a + 17a) and (Add 16b + 17b) |

|

|

|

If the family selects a unit with a gross rent at or below Line 18(a), the family will pay the amount on Line 15. If the family selects a unit with a gross rent higher than the amount on Line 18(a), the family will pay the amount on Line 15 plus the *difference between Line 18(a) and 18(b). (*NOTE: Family cannot pay the difference if more than 40% of Monthly Adjusted Income on Line 11.)

|

CALCULATING UTILITY ALLOWANCE |

|

CALCULATING GROSS RENT |

List appropriate utility allowances from the Utility allowance schedule in your |

28. |

______________ Rent to Owner |

|

briefing packet. |

29. |

______________ Add Utility Allowance (from Line 26) |

|

|

|

30. |

______________ Gross Rent |

19. |

________________ Space Heating |

|

|

20. |

________________ Air Conditioning |

|

|

21. |

________________ Cooking |

|

|

22. |

________________ Other Electric |

|

|

23. |

________________ Water Heating |

|

|

24. |

________________ Water |

|

|

25. |

________________ Sewer |

|

|

26. |

________________ Trash Collection |

|

|

27. |

________________ Total Utility Allowance (Enter here and on Line 28.) |

|

|

PART II – CALCULATING COMPLETED FOLLOWING UNIT SELECTION

A.HAP Subsidy - The actual HAP payment can be calculated only after the family has selected a unit and the gross rent for the unit is known. The subsidy cannot exceed the maximum subsidy calculated above (See Line 13) but may be less than the maximum subsidy if the gross rent for the unit is less than the payment standard amount. The HAP is the lower of:

(1) The payment standard for the family minus the TTP, or

(2) The gross rent minus the TTP.

CALCULATING THE HAP PAYMENT

31. |

Enter the Payment Standard (Line 9) |

$ __________ |

34. |

Enter Gross Rent (Line 30) |

$ _________ |

|

|

32. |

Subtract TTP (Line 8) |

$ __________ |

|

(Rent to Owner + Utility Allowance) |

|||

33. |

Result |

$ __________ |

35. |

Subtract TTP (Line 8) |

$ _________ |

|

|

|

|

|

36. |

Result |

$ _________ |

|

|

37. |

HAP Subsidy (Enter the lesser of Line 33 or 36) |

|

|

$ |

|

|

|

|

|

|

|

||||

|

|

|

|

||||

|

|

|

|

|

|||

|

CALCULATING FAMILY SHARE |

|

|

|

|||

38.Payment Standard for Selected Unit (Line 31) ………………………………………………….. $ ____________

39.Enter Amount (Line 2) ……………………………………………………………………........... $ ____________

40.Enter Amount (Line 4) ………………………………………………………………………...... $ ____________

41.Welfare Rent (Line 5) …………………………………………………………………………… $ ____________

42.PHA Minimum Rent ……………………………………………………………………………. $ ____________

43.Total Tenant Payment (TTP) (Line 32) ………………………………………………………… $ ____________

44.Maximum Initial Rent Burden (Line 11 plus Line 13) …………………………………………. $ ____________

45.Gross Rent (Rent to Owner plus Utility Allowance - Line 30) for Unit Selected ……………… $ ____________

46. If Line 45 is less than Line 38 the Family Share equals Line 43. …………………………… $

47.Line 45 minus Line 38 …………………………………………………………………………... $ ____________

48. Family Share (Line 43 plus Line 47) …………………………………………………………… $

RENT CALCULATION

B.Standard Rent Calculation (If prorated rent, skip to Line 56)

49.Total Family Share from Line 46 or 48 whichever applies………………………………………. $ ____________

50.Rent to Owner …………………………………………………………………………………… $ ____________

51.Lower of Line 38 or Line 45 …………………………………………………………………….. $ ____________

52.Line 51 minus Line 43 …………………………………………………………………………... $ ____________

53.HAP to Owner: lower of Liner 50 or Line 52 …………………………………………………… $ ____________

54.Tenant Rent to Owner: Line 50 minus Line 53 …………………………………………………. $ ____________

55.Utility Reimbursement to family: Line 52 minus Line 53, but do not exceed Line 27 …………. $ ____________

C.Prorated Rent Calculation – For families that include both members who are citizens or have eligible immigration status and members who do not have eligible immigration status (or elect not to state that they have eligibility status), the amount of assistance is prorated, based on the percentage of household members who are citizens or documented eligible immigrants. Use steps 56 through 64 to determine prorated assistance.

56.Norman Total HAP: coy from Line 52, but do not exceed Line 45 ……………………………… $ ___________

57.Total Number of Eligible …………………………………………………….. ____________

58.Total Number in Family ……………………………………………………… ____________

59.Proration Percentage: Line 45 divided by Line 56 ………………………….. ____________

60.Prorated Total HAP: Line 56 X Line 59 …………………………………….. $___________

61.Mixed Family total family contribution: Line 45 minus Line 60 …………… $ ___________

62.Utility Allowance if any: coy from Line 27 …………………………………. $ ___________

63.Mixed Family tenant rent to owner: Line 61 minus 62 – If positive or 0, put tenant rent ………….. $

If negative, credit tenant ………………… $

64.Prorated HAP to Owner: Line 50 minus Line 63. If Line 63 is negative, put Line 50 amount …….. $

SUMMARY

(For PHA Staf Use in completing

TOTAL TENANT PAYMENT (TTP) (Line 8) …………………………………………………….$ _____________

PAYMENT STANDARD (Line 31) ………………………………………………………………. $ _____________

MAXIMUM GROSS RENT (Line 14) ……………………………………………………………. $ _____________

GROSS RENT RANGE FOR THIS FAMILY (Line 18A & 18B) FROM $ ___________ TO $ ____________

UTILITY ALLOWANCE (Line 27) ………………………………………………………………. $ ____________

HAP SUBSIDY (LINE 37) ……………………………………………………………………..… $ ____________

FAMILY SHARE (Line 46 or 48, whichever applies) ……………………………………………. $ ____________

RENT TO OWNER (Line 50) ………………………………………………………………………$ _____________

HAP TO OWNER (Line 53 or Line 64) Enter here and on Line 7 of HAP Contract ……………… $ ____________

TENANT RENT TO OWNER (Line 54 OR Line 63) ………………………………………………$____________

INITIAL LEASE TERM From __________ To _________ (Enter here and on Line 5 of HAP Contract)

CONTRACT UNIT (Enter Unit information below and on Line 3 of HAP Contract):

Unit Size (Circle One) 1BR 2BR 3BR 4BR Other _____________

Unit Address: ______________________________ City: _______________ State: _____ Zipcode: _________

Name of Owner: ___________________________

Address: ______________________________ City: _______________ State: _____ Zipcode: _________

HOUSEHOLD (List names of persons who may reside in the unit here and on Line 4 of HAP Contract):

_____________________________________________ |

________________________________________ |

_____________________________________________ |

________________________________________ |

_____________________________________________ |

________________________________________ |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The Section 8 Rent Calculation Worksheet determines how much a family pays for housing and the amount of subsidy from the Public Housing Authority (PHA). |

| Calculation Steps | The calculation for tenant payment and subsidy is completed in two main steps: calculating the Total Tenant Payment (TTP) and determining the maximum initial rent burden. |

| Minimum Rent | The PHA can set a minimum rent between $0 and $50. Families must pay at least the established minimum rent. |

| TTP Calculation | The Total Tenant Payment is determined by the greater of 30% of monthly adjusted income, 10% of monthly gross income, welfare rent, or the PHA minimum rent. |

| Maximum Subsidy | The maximum rental subsidy provided by the PHA cannot exceed the payment standard minus the Total Tenant Payment calculated earlier. |

| Utility Allowance | Utility allowances can be added to the rent, providing an accurate measure of the total housing costs for the family. |

| State-Specific Regulations | Each state may have specific laws governing the administration of Section 8. It’s important to check local regulations for details. |

Guidelines on Utilizing Section 8 Rent Calculation Worksheet

Filling out the Section 8 Rent Calculation Worksheet is an important step in determining how much rent your family will contribute and what assistance will be provided. To ensure accuracy, gather your income documents and any other necessary information before starting. Follow these steps carefully to complete the form effectively.

- Write your name in the blank next to Applicant Name.

- Enter today's date next to Date.

- Fill in your Social Security number in the Applicant Social Security # field.

- Complete your address by entering your Address, City, State, and Zip Code.

Next, you will input financial information to calculate the Total Tenant Payment (TTP) and the Maximum Subsidy.

- For 30% of Monthly Adjusted Income, write down your Annual Adjusted Income and divide it by 12 to find Monthly Adjusted Income.

- Multiply the result by 30% for 30% of Monthly Adjusted Income.

- For 10% of Monthly Gross Income, enter your Annual Gross Income then divide by 12 to find Monthly Gross Income.

- Multiply this amount by 10% to calculate 10% of Monthly Gross Income.

- If applicable, enter the Welfare Rent for your area.

- Enter the PHA Minimum Rent as determined by your housing authority.

- For Line 7, write down the Assigned TTP if you have Preservation or Enhanced Vouchers.

- Enter the highest value from lines 2, 4, 5, 6, or 7 for your TTP.

Proceed with the calculation of the maximum initial rent burden and one for the affordable rent for your family.

- Enter the Payment Standard for the required size unit.

- Copy your Total Tenant Payment from the previous calculations.

- Multiply your Monthly Adjusted Income by 40% to find your 40% Threshold.

- Re-enter the Payment Standard from the previous step.

- Subtract your TTP from the Payment Standard to find the Maximum Subsidy.

- Add the result from the 40% Threshold and the Maximum Subsidy to get the Maximum Gross Rent.

Next, establish the appropriate Utility Allowances and Gross Rent values.

- List the utility allowances applicable to your situation in the respective spaces provided.

- Sum the utility allowances to establish your Total Utility Allowance.

After selecting your unit, you'll be required to calculate your HAP Subsidy and your Family Share. This is based on the specific rent of the unit you choose.

- Record the Payment Standard for the selected unit.

- Enter the Gross Rent for that unit.

- Subtract your TTP from the Gross Rent.

- Calculate the lesser amount between the payment standard minus TTP and the gross rent minus TTP for the HAP Subsidy.

- Start calculating your Family Share based on the Payment Standard and TTP values you've recorded.

- Complete the remaining calculations to determine the Rent to Owner and HAP to Owner figures.

Finally, complete the Summary section for PHA staff and provide unit and owner details. Ensure all names are listed that will reside in the unit.

- Fill in the TOTAL TENANT PAYMENT, PAYMENT STANDARD, MAXIMUM GROSS RENT, and GROSS RENT RANGE from your earlier calculations.

- Enter the HAP SUBSIDY amount and your FAMILY SHARE calculated earlier.

- Provide the RENT TO OWNER figure.

- Note the HAP TO OWNER amount, then enter the TENANT RENT TO OWNER from your calculations.

- Add the INITIAL LEASE TERM details and complete the unit and owner information.

Once you have entered all the information, review for accuracy before submitting the form. It ensures you receive the correct assistance based on your calculated amounts.

What You Should Know About This Form

What is the purpose of the Section 8 Rent Calculation Worksheet?

The Section 8 Rent Calculation Worksheet is used to determine how much a family must contribute towards their rent, and how much financial assistance they will receive from the Public Housing Authority (PHA). This process helps ensure a fair distribution of housing costs and makes affordable housing accessible to low-income families. The worksheet outlines the calculations necessary to arrive at the Total Tenant Payment (TTP) and the Housing Assistance Payment (HAP).

Who needs to fill out the Rent Calculation Worksheet?

Any applicant or participant who has been issued a Housing Choice Voucher under the Section 8 program will need to complete the Rent Calculation Worksheet. It's essential for ensuring that the family understands their financial responsibilities concerning rent and utilities before selecting a housing unit.

How is Total Tenant Payment (TTP) calculated?

The TTP is determined using several factors. It is the greater of: 30% of the monthly adjusted income, 10% of the monthly gross income, any applicable welfare rent, or the PHA minimum rent. The worksheet provides step-by-step calculations for each component to help determine the TTP accurately. Families will always pay at least this minimum amount regardless of the rent of the selected unit.

What is the Maximum Initial Rent Burden?

The Maximum Initial Rent Burden is the upper limit on the amount of rent a family can afford to pay when selecting a unit. It’s calculated using the payment standard for the required unit size, the TTP, and a percentage (40%) of the monthly adjusted income. This ensures that families do not exceed their financial capacity while looking for affordable housing.

What happens if a family selects a unit with a gross rent that exceeds the affordable rent range?

If a family chooses a unit with a gross rent higher than the calculated affordable rent range, they will pay their TTP plus the difference between the maximum gross rent and the affordable rent. However, this additional amount cannot exceed 40% of the family's monthly adjusted income, ensuring that housing costs remain manageable.

What is the Utility Allowance and how is it computed?

The Utility Allowance accounts for expected utility costs that renters will have to cover, in addition to their rent payments. This allowance varies by unit type and is based on local utility costs. It is calculated and listed in the Utility allowance schedule provided to families during the briefing process.

How does the HAP subsidy work after selecting a unit?

After a family selects a housing unit, the actual HAP subsidy is calculated based on the unit's gross rent and the previously determined TTP. The HAP is the lower amount between the difference of the payment standard and the TTP, or the gross rent minus the TTP. This ensures that the assistance remains consistent with the intended affordability parameters.

Can the rent calculation change over time?

Yes, the rent calculation can change. Changes in the family's income, household size, or the rent amount for the selected unit can affect the TTP and HAP. Therefore, it’s essential for families to report changes promptly to their PHA. Regular re-evaluations may also occur as part of the housing assistance program procedures.

Where can families get help if they have questions about the worksheet?

Common mistakes

Completing the Section 8 Rent Calculation Worksheet can be challenging. One common mistake is failing to accurately calculate the Monthly Adjusted Income. Applicants often skip this step or miscalculate by not properly dividing the annual income by 12. It's crucial to ensure this amount reflects all income streams. An incorrect Monthly Adjusted Income leads to an inaccurate Total Tenant Payment (TTP), which affects the entire rent calculation process.

Another mistake is not understanding the utility allowances. Some applicants may overlook the need to list specific utility expenses from the Utility allowance schedule. If this information is missing or filled inaccurately, it results in an incorrect Gross Rent. This is particularly problematic since the utility allowance affects how much rent a family can afford. Accurate utility amounts are essential to determine the family's total financial responsibilities.

Moreover, families often misinterpret the "maximum gross rent" guidelines. They may select a unit without thoroughly checking if the rent falls within the allowable range based on their financial calculations. This wrong assumption leads to choosing a unit that could exceed what the family can afford, placing unnecessary financial strain on them. Knowing the Gross Rent range is vital for making informed decisions about unit selection.

In addition, applicants might neglect to keep copies of necessary documents and worksheets used during calculations. When these documents are lost or not preserved, it can pose issues for future references or disputes. Keeping accurate records is an important part of the process to ensure clarity and accountability.

Finally, individuals may fail to follow through after unit selection. Many do not complete the final calculations for the Housing Assistance Payment (HAP) correctly. Once the unit is chosen, the rent amount can change, leading to a miscalculation of the HAP subsidy and the family share. Ensuring that calculations reflect the actual unit selected is essential to avoid any discrepancies that could affect payment and assistance eligibility.

Documents used along the form

The Section 8 Rent Calculation Worksheet is commonly used in conjunction with several other important documents that facilitate the housing assistance process. Understanding these additional forms can greatly assist applicants and housing authorities in ensuring compliance, accuracy, and clarity in calculations related to housing benefits. Below are five documents frequently associated with the Section 8 process.

- Annual Income Worksheet: This form collects detailed income information from the applicant or participant. It helps determine the total annual income, which is a crucial factor in the calculation of total tenant payment (TTP) and eligibility for housing assistance.

- Utility Allowance Schedule: This document lists the typical utility costs that residents can expect in their units. It’s essential for calculating the total gross rent by adding utility allowances to the rent to owner amount.

- HUD-52641 HAP Contract: This is the document that outlines terms related to housing assistance payments (HAP). It includes specifics about the agreement between the public housing authority and the property owner, detailing the HAP amount and unit information.

- Lease Agreement: The lease is a legally binding contract between the tenant and the landlord. It stipulates the terms of the rental arrangement and must be compliant with Section 8 program policies. It reflects the rental rate and conditions for the unit provided to the participant.

- Verification of Citizenship Status Form: This form verifies the immigration status of household members. It is particularly important in mixed families where assistance might be prorated based on the ratio of eligible and ineligible members.

By utilizing these documents in conjunction with the Section 8 Rent Calculation Worksheet, both applicants and housing authorities can ensure a smoother transition into supported housing. Understanding each of these forms aids in promoting transparency and efficiency in the overall process.

Similar forms

HUD Form 50058: Similar to the Rent Calculation Worksheet, this form collects details about family demographics and income. It serves as a systematic way to determine eligibility for housing assistance.

Form 52641: This form is pivotal for establishing the Housing Assistance Payment (HAP) contract. It requires input about payment amounts and unit information, mirroring aspects of the rent calculation details.

Utility Allowance Schedule: This document outlines allowable utility costs similar to the utility calculations found in the Rent Worksheet, highlighting the connections between utility costs and overall housing affordability.

Annual Income Worksheet: Much like the Rent Worksheet, this form measures income sources to establish financial eligibility, impacting the Total Tenant Payment calculations.

Form HUD-50059: Used for project-based assistance, this form also details tenants’ incomes and rents, paralleling the calculations conducted in the Section 8 Rent Calculation Worksheet.

Family Self-Sufficiency Action Plan: This plan outlines goals for financial independence, akin to the overall objectives of rent determination and assistance programs.

Lease Agreement: The lease outlines financial obligations of tenants. The calculations in the Rent Worksheet influence the terms of the lease by defining tenant contributions to housing costs.

Monthly Income Affidavit: Similar in function, this affidavit verifies monthly income which plays a crucial role in determining the Total Tenant Payment and assistive subsidies.

PHA Administrative Plan: This document details policies and procedures for calculating rents and tenant shares, parallel to the processes described in the Rent Calculation Worksheet.

Verification of Income Form: This form supports the documentation of income reviews and assists in the calculation process, working in tandem with the information presented in the Rent Worksheet.

Dos and Don'ts

When filling out the Section 8 Rent Calculation Worksheet, it's essential to do it correctly to avoid any delays or issues. Here are nine important things to consider.

- Do provide accurate income information. Make sure to include all sources of income, as inaccuracies can lead to incorrect calculations.

- Do carefully follow the calculation steps. Each line has a specific purpose, and skipping any could impact your subsidy.

- Do keep necessary documents on hand. Gather pay stubs, tax returns, and any relevant financial paperwork to support your information.

- Do check the Payment Standard for your area. This standard can vary, and knowing it helps ensure that you're applying for the right amount of assistance.

- Do review your completed form for errors. A second look can prevent mistakes that could affect your eligibility.

- Don't omit expenses when calculating the Total Tenant Payment. Ensure all relevant utility allowances are included in your final calculations.

- Don't ignore the 40% rule. Remember that the family cannot pay more than 40% of their monthly adjusted income towards rent.

- Don't guess the Welfare Rent amount. Only include it if applicable to your situation and supported by relevant documentation.

- Don't forget to double-check for any updates or changes in policy. Housing regulations can change, and staying informed is crucial.

Following this guidance will help streamline the process and ensure you receive the assistance you need.

Misconceptions

Understanding the Section 8 Rent Calculation Worksheet form is crucial for applicants and public housing authorities alike. However, several misconceptions can arise regarding its use and implications. Here are ten common misconceptions:

- Misconception 1: The TTP is the only payment the family has to worry about.

- Misconception 2: Families can select any unit without consideration of rent limits.

- Misconception 3: All families pay 30% of their income for housing costs.

- Misconception 4: Utility costs are always included in the rent calculation.

- Misconception 5: Once a family selects a unit, their TTP is fixed.

- Misconception 6: The HAP payment is predetermined and does not vary.

- Misconception 7: Families need to prove their eligibility again after lease selection.

- Misconception 8: Families with higher incomes always pay more rent.

- Misconception 9: Prorated rent calculations are only for those with extremely low income.

- Misconception 10: The form is only for new applicants.

While the Total Tenant Payment (TTP) establishes a baseline for what the family must contribute, additional costs may arise depending on the chosen unit’s rent and utility allowances.

In reality, families must choose units within specific rent ranges based on the payment standard set by the Public Housing Authority (PHA).

The 30% figure is a cap, not a uniform requirement. The TTP might be calculated using other factors, such as a family's gross income or the PHA's minimum rent.

Utility costs can significantly affect the overall expenses. The worksheet guides families to calculate gross rent, which includes both rent to the owner and utility allowances.

The TTP can change if there are variations in the unit's gross rent or if the payment standard changes, thereby affecting the family's share.

The Housing Assistance Payment (HAP) can fluctuate based on the unit selected and the lower of the two calculations: payment standard minus TTP or gross rent minus TTP.

Eligibility is verified when the voucher is issued. The worksheet is focused on calculating payments, not re-evaluating eligibility.

Income levels influence the TTP, but the specific circumstances of the family may yield different rent amounts based on the calculated TTP.

Proration applies when there are mixed households, including citizens and non-citizens, impacting assistance eligibility. It’s not limited to low-income families.

The worksheet serves ongoing participants as well, ensuring that their continued assistance is based on correct calculations reflecting their current housing situation.

Key takeaways

Filling out the Section 8 Rent Calculation Worksheet is a critical step in determining housing assistance. Here are some key takeaways to consider:

- The worksheet helps assess the tenant's share of housing costs and the amount the Public Housing Authority (PHA) will pay.

- The calculation is a two-step process that begins when a Housing Choice Voucher is issued.

- The Total Tenant Payment (TTP) is calculated based on the greater of several criteria, including monthly adjusted income and PHA minimum rent.

- Families can select units with rents higher or lower than the PHA payment standard, but their final calculations depend on their chosen unit.

- The calculation of Maximum Initial Rent Burden aids families in understanding their budget constraints related to rent.

- Families may consider a range of gross rents, which is determined by adding the TTP to the Maximum Subsidy.

- Utility allowances also play a crucial role in the gross rent calculation and should be accurately listed.

- The actual Housing Assistance Payment (HAP) is calculated only after a unit has been selected.

- The HAP subsidy, which can vary, will never exceed the maximum subsidy calculated before unit selection.

- For families with mixed immigration status, assistance is prorated based on the number of eligible family members.

Understanding each of these components helps ensure that families receive the proper assistance and guidance throughout the rental process.

Browse Other Templates

What Is Transcript Certificate - This authorization helps ensure that your academic records are accurate and timely.

Enlisted Performance Assessment,Airman Evaluation Form,Service Member Performance Report,Military Performance Review,Air Force Duty Evaluation,Enlisted Duty Performance Summary,AF Enlisted Performance Record,Service Member Review Document,Airman Effe - Management of personnel records through this form supports Air Force mission effectiveness.

Nc-4 Form 2023 - Checks should be made payable in U.S. currency to the N.C. Department of Revenue.