Fill Out Your Secure Party Creditor Form

The Secure Party Creditor (SPC) form is a vital document for individuals seeking to establish their status as secured parties in financial transactions. This form requires specific personal details, such as full names, address, and contact information for both the secured party and the debtor. It also gathers essential identifiers like date of birth, physical characteristics, and a recent color photograph that meets strict guidelines to ensure accurate identification. Furthermore, the form includes important information regarding the Uniform Commercial Code (UCC) filing, including the date, expiration, and filing number, ensuring proper documentation. The process underscores the importance of providing accurate and comprehensive information, including signing and fingerprinting in designated areas, serving as a commitment to not misuse the privileges associated with the SPC role. By completing this form correctly, you not only adhere to requirements but also protect your rights and interests in financial matters.

Secure Party Creditor Example

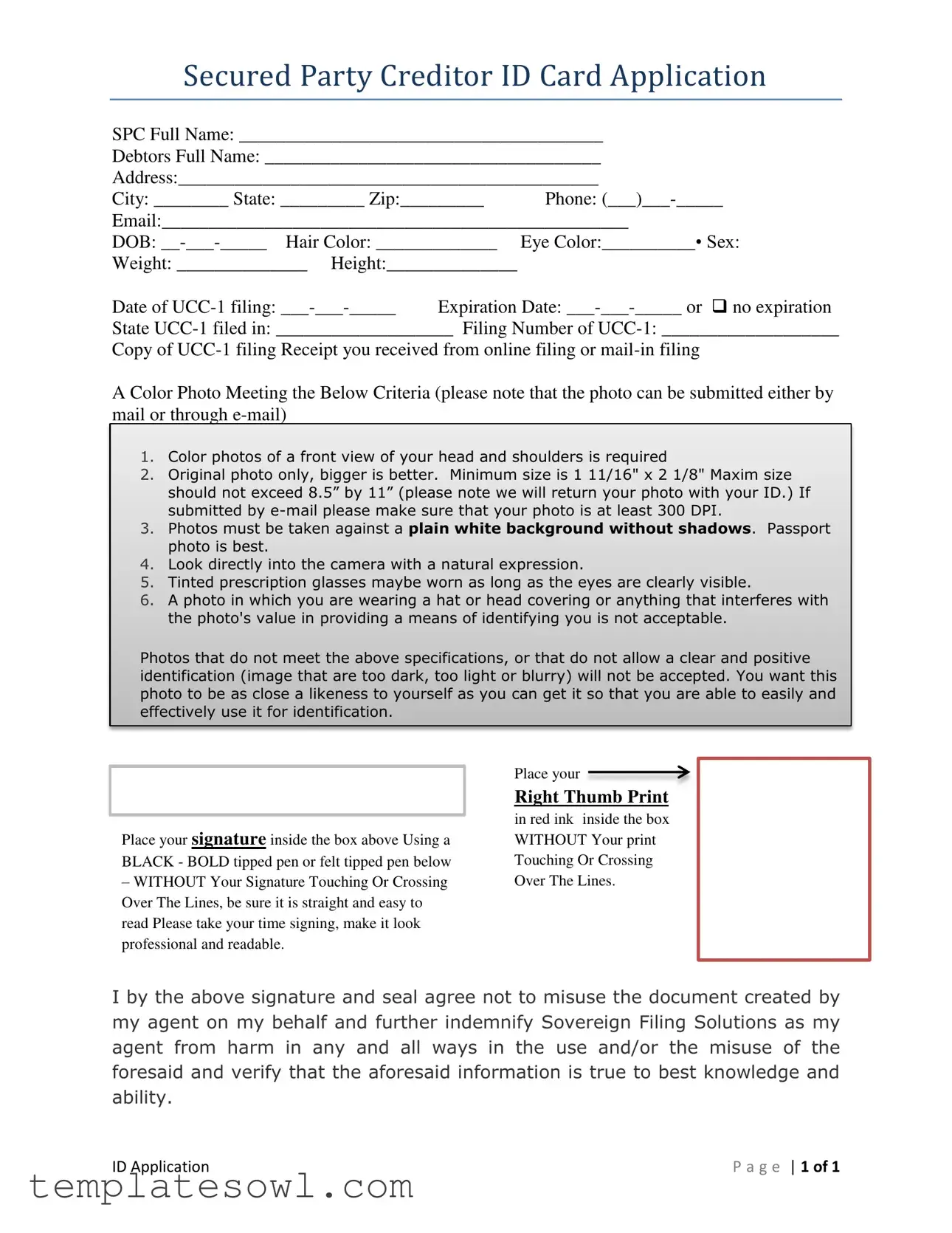

Secured Party Creditor ID Card Application

SPC Full Name: _______________________________________

Debtors Full Name: ____________________________________

Address:_____________________________________________

City: ________ State: _________ Zip:_________ |

Phone: |

|

Email:__________________________________________________ |

||

DOB: |

Eye Color:__________• Sex: |

|

Weight: ______________ Height:______________ |

|

|

Date of |

Expiration Date: |

|

State

Copy of

A Color Photo Meeting the Below Criteria (please note that the photo can be submitted either by mail or through

1.Color photos of a front view of your head and shoulders is required

2.Original photo only, bigger is better. Minimum size is 1 11/16" x 2 1/8" Maxim size should not exceed 8.5” by 11” (please note we will return your photo with your ID.) If submitted by

3.Photos must be taken against a plain white background without shadows. Passport photo is best.

4.Look directly into the camera with a natural expression.

5.Tinted prescription glasses maybe worn as long as the eyes are clearly visible.

6.A photo in which you are wearing a hat or head covering or anything that interferes with the photo's value in providing a means of identifying you is not acceptable.

Photos that do not meet the above specifications, or that do not allow a clear and positive identification (image that are too dark, too light or blurry) will not be accepted. You want this photo to be as close a likeness to yourself as you can get it so that you are able to easily and effectively use it for identification.

Place your signature inside the box above Using a BLACK - BOLD tipped pen or felt tipped pen below

–WITHOUT Your Signature Touching Or Crossing Over The Lines, be sure it is straight and easy to read Please take your time signing, make it look professional and readable.

Place your

Right Thumb Print

in red ink inside the box WITHOUT Your print Touching Or Crossing Over The Lines.

I by the above signature and seal agree not to misuse the document created by my agent on my behalf and further indemnify Sovereign Filing Solutions as my agent from harm in any and all ways in the use and/or the misuse of the foresaid and verify that the aforesaid information is true to best knowledge and ability.

ID Application |

P a g e | 1 OF 1 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Secure Party Creditor form is used to establish a secured interest in property and create a legal record of this standing. |

| Debtor Information | Applicants must provide the full name of both the debtor and the secured party to properly identify the involved parties. |

| UCC-1 Filing | The form references the UCC-1 filing, a legal document that secures a creditor’s interest in a debtor's asset. |

| Governing Laws | The UCC-1 filings are governed by state laws, specifically the Uniform Commercial Code (UCC), which varies by state. |

| Photo Requirements | Applicants must submit a color photo that meets specific criteria, including size, background, and clarity for identification purposes. |

| Signature Guidelines | Signatures must be placed inside a designated box, using a black, bold-tipped pen while avoiding any lines. Clear and legible is key. |

| Thumbprint Mandate | A right thumbprint in red ink is required on the form to authenticate the application and indicate the personal commitment of the applicant. |

| Expiration Information | Applicants can specify an expiration date for the secured interest or indicate that there is no expiration. |

| Truth Verification | The form includes an agreement where the applicant verifies the truthfulness of the information provided and indemnifies the agent from misuse. |

Guidelines on Utilizing Secure Party Creditor

Once you have gathered the necessary information, it is important to fill out the Secure Party Creditor form accurately. This form must include personal details, a color photograph, and your signature and thumbprint. Ensuring that all sections are complete will facilitate the processing of your application.

- Begin by entering your Full Name in the designated field at the top of the form.

- Next, provide the Debtor's Full Name in the corresponding space.

- Fill in your Address, including City, State, and Zip code.

- Indicate your Phone number and Email address.

- Record your Date of Birth, along with your Hair Color, Eye Color, Sex, Weight, and Height.

- Add the Date of UCC-1 filing and the Expiration Date. If applicable, check the option for "no expiration."

- Specify the State UCC-1 filed in and provide the Filing Number of UCC-1.

- Attach a copy of the UCC-1 filing receipt, either from online filing or mail-in filing.

- Prepare and submit a Color Photo that meets all listed specifications. Ensure the photo is taken against a plain white background and avoid any distractions.

- Sign your name inside the designated box using a BLACK - BOLD tipped or felt-tipped pen. Your signature should be clear and straight, without touching or crossing the lines.

- Place your Right Thumb Print in red ink inside the specified box, ensuring the print does not touch or cross the lines.

- Finally, provide the confirmation statement to indicate that you agree to the terms provided.

When you complete the form, ensure that every detail is accurate. Once submitted, you will await the processing of your application.

What You Should Know About This Form

What is the Secure Party Creditor form used for?

The Secure Party Creditor form is designed for individuals seeking to establish their status as a secured party creditor. This form helps you identify yourself and your rights regarding any debt you may have. By filing the UCC-1 form, you publicly declare your interest in specific collateral, thus securing your claim to that debt against third parties.

What information do I need to provide on the application?

You will need to fill out your full name, the debtor's full name, and your contact details, including address, phone number, and email. Additionally, the form requires personal information such as date of birth, physical characteristics, and details regarding the UCC-1 filing, including the date, location, and filing number.

How do I submit my photo with the application?

You can submit your photo either by mail or email. Ensure it meets the required criteria: a high-quality color photo against a plain white background, taken from the front. It should allow for clear identification and should not include any accessories that obstruct your features, like hats or sunglasses. If emailing, the image must be at least 300 DPI for clarity.

What happens if my photo does not meet the specifications?

If your photo does not meet the outlined specifications, it will be rejected. The goal is to ensure proper identification. Make sure your photo is clear, well-lit, and follows all guidelines closely to avoid delays in processing your application.

What does the signature and thumbprint section entail?

Your signature must be placed inside the designated box using a black bold pen without crossing over any lines. It should be clear and professional. Additionally, you must provide your right thumbprint in red ink, ensuring it also does not touch the lines. This serves as a means of further verifying your identity.

Is there a fee associated with filing the Secure Party Creditor form?

Filing fees can vary based on the state where you submit the UCC-1 filing. It’s important to check with your local filing office or the appropriate state registry for the exact fee. Make sure to include any necessary fees with your application submission to avoid delays.

What if I mistakenly provided incorrect information on my application?

If you realize that you've submitted incorrect information, it’s crucial to address it as soon as possible. You may need to correct and resend the application or, in some cases, file an amendment to the UCC-1 form. Always ensure your information is accurate to avoid complications later on.

Common mistakes

Completing the Secure Party Creditor form requires careful attention to detail. One common mistake occurs when individuals fail to provide complete personal information. Omitting critical details such as the full names of both the secured party and the debtor can lead to significant processing delays. Ensure that every section of the form is filled out accurately and with the necessary information.

Another significant error is related to the photo requirements. Many applicants do not adhere to the specified criteria for the color photo submission. For instance, submitting a photo that is too dark, blurry, or with shadows can result in rejection. A color photo that meets the outlined standards is crucial for proper identification. To avoid complications, follow the guidelines closely and select a professional-quality image.

Signature-related mistakes also frequently occur. The instructions specify that the signature must be clear, legible, and not cross the lines of the designated box. Failing to comply with this can jeopardize the form's acceptance. Take your time to ensure that the signature looks professional and readable. It is advisable to practice beforehand to meet the required standards.

Including accurate filing information is essential as well. Applicants often fail to input correct details regarding their UCC-1 filing, such as the filing number and the date of the filing. Inaccuracies in this section may cause confusion and delay in processing. Double-checking this information can save time and prevent potential issues.

Lastly, negligence in checking the overall format and clarity of the submitted documents can lead to mistakes. Illegibly filled forms or documents that are hard to read due to poor writing can lead to complications. It is important to ensure everything is neat and clear. This attention to detail will facilitate a smoother application process, enhancing the chances of successful approval.

Documents used along the form

The Secure Party Creditor form plays an important role in your financial and legal matters. Along with it, several other documents are often required or helpful. Each serves a unique purpose, contributing to the overall process. Below is a list of such forms and documents.

- UCC-1 Financing Statement: This form is filed with the Secretary of State to give public notice of a secured party's interest in specific assets. It establishes the priority of the creditor's claim against the debtor's property.

- UCC-3 Amendment: If changes occur to the original UCC-1, this form is used to amend, terminate, or continue the filing. It keeps the information current and accurate.

- ID Photo Requirements: Specific guidelines for photos used in ID applications. Following these guidelines is crucial for a valid photo submission, ensuring proper identification.

- Consent Form: This document may be required to establish that the debtor agrees to the secured party's claims. It shows the debtor's acknowledgment of the credit terms.

- Appointment of Agent: This paperwork appoints someone to act on behalf of the creditor in managing or enforcing the security interest. It's important for delegating certain responsibilities.

- Verification Affidavit: A sworn statement verifying the information provided on the UCC filings. This adds a layer of authenticity to the claims made by the creditor.

- Filing Receipts: After submitting various forms, you should retain receipts as proof of filing. These serve as documentation of the actions taken in the process.

Understanding these documents and their interactions can help navigate the process more effectively. Taking the time to ensure everything is in order will provide peace of mind as you proceed with your financial goals.

Similar forms

- Power of Attorney (POA): This document grants one person the authority to act on another's behalf. Like the Secure Party Creditor form, it creates legal standing for the agent to handle specific matters, such as financial transactions.

- UCC-1 Financing Statement: This is a public document filed to secure the interest in personal property. Similar to the Secure Party Creditor form, it establishes a security interest in specific collateral.

- Promissory Note: This document acknowledges a debt and the promise to repay it. The Secure Party Creditor form also involves elements of debt and repayment, reflecting an obligation between parties.

- Bill of Sale: This records the transfer of ownership of property. Just as the Secure Party Creditor form establishes rights over property, a Bill of Sale formalizes the ownership transfer of an asset.

- Trust Agreement: This document outlines the terms under which a trustee manages property for beneficiaries. It parallels the Secure Party Creditor form by detailing how assets are managed and rights are protected.

- Mortgage Agreement: This secures a loan by placing a lien on real estate. Similar to the Secure Party Creditor form, it involves encumbering property to secure repayment of debts.

- Release of Lien: This document terminates a lien on property once a debt is satisfied. Like the Secure Party Creditor form, it relates to the release and management of rights to specific assets.

- Assignment of Rights: This document transfers one party's rights under a contract to another. It shares similarities with the Secure Party Creditor form in that it establishes legal rights relating to financial or personal interests.

Dos and Don'ts

When completing the Secure Party Creditor form, it is essential to be meticulous and attentive to detail. Below is a list of dos and don’ts to guide the application process.

- Do provide your full legal name in the designated section.

- Do ensure accurate information for all fields, including contact details and personal identifiers.

- Do follow the photo requirements closely, including background and size specifications.

- Do use a black, bold-tipped pen for your signature and thumbprint.

- Do take your time to make sure your signature is clear and readable.

- Don’t submit a photo that is blurry or does not clearly represent your likeness.

- Don’t use a colored pen for signing; it should always be black and bold.

- Don’t include any head coverings in your photo that may obstruct your features.

- Don’t rush through the application; incomplete or incorrect forms can lead to delays.

- Don’t forget to check for any additional documentation that might be required, such as the filing receipt.

Misconceptions

Here are six common misconceptions about the Secure Party Creditor form:

- It Automatically Removes Debt: Many believe that filing this form automatically cancels or removes their debt. This is not the case. The Secure Party Creditor process is complex and does not eliminate financial obligations.

- Anyone Can File without Understanding: Some think that anyone can fill out and submit the form without any knowledge. However, it requires careful consideration and understanding of the implications involved.

- It Guarantees Protection from Creditors: It's a common belief that filing the form provides absolute protection from creditors. In reality, it does not prevent creditors from pursuing legitimate debts.

- Filing Is a One-Time Process: Many assume that the filing of this form is a one-and-done situation. In fact, periodic updates and renewals may be necessary to maintain its effectiveness.

- You Don't Need to Keep Records: Some people think they can file the form and forget about it. However, maintaining accurate records and documentation is crucial for any successful claim or protection.

- It's the Same as Chapter 7 or 11 Bankruptcy: There is a misconception that this process is similar to filing for bankruptcy. While both deal with debt, they are vastly different legal processes with different requirements and consequences.

Key takeaways

The Secure Party Creditor form is a vital document that helps establish one's status as a secured party. Here are key takeaways to keep in mind:

- Always provide your full name as well as the debtor's full name to ensure proper identification.

- Include accurate and complete contact information, including your address, phone number, and email.

- Ensure your color photo meets the specified criteria for size and clarity, helping to confirm your identity.

- Follow the instructions for the photo carefully; your image should be taken against a plain white background and should not feature shadows.

- When signing the form, use a black, bold-tipped pen. Your signature must be clear and legible, avoiding overlap with the box edges.

- It is crucial to provide your right thumbprint in red ink in the designated area for proper documentation.

- The date of your UCC-1 filing is important and must be included along with its expiration date or confirmation that there is none.

- The form requires you to agree to not misuse the document, ensuring accountability in your actions as a secured party.

- Review all the information for accuracy before submission, as incorrect details can complicate the process.

Browse Other Templates

Bill Payment Processing Center Po Box 7236 Sioux Falls Sd 57117 - Complete your enrollment within two business days of submission.

First Report of Injury Form - The completed form should be sent to the claim administrator associated with the employer’s insurance provider.