Fill Out Your Security Deposit Deductions Form

The Security Deposit Deductions form serves as a crucial document for tenants and landlords alike, facilitating a clear and organized process for handling security deposits following the end of a tenancy. This form outlines essential information about the resident, including their name, address, and details about the tenancy period such as the start date and the date the keys were returned. It provides an itemized statement concerning the deposit account, listing the total deposits paid and any deductions that may apply due to various factors—such as repairs, cleaning, or unpaid rent. Each deduction is described along with its associated cost, enabling tenants to see how the final amount to be refunded is calculated. Furthermore, the form details the time frame for payment, stipulating that the landlord must issue a check within 21 days of the statement's receipt. It's important to note that supporting documents for repairs or cleaning are not mandatory if the total deductions do not exceed $125. Overall, this form not only ensures transparency between parties but also reinforces the legal obligations regarding credit reporting in case of unpaid obligations, aligning with state regulations.

Security Deposit Deductions Example

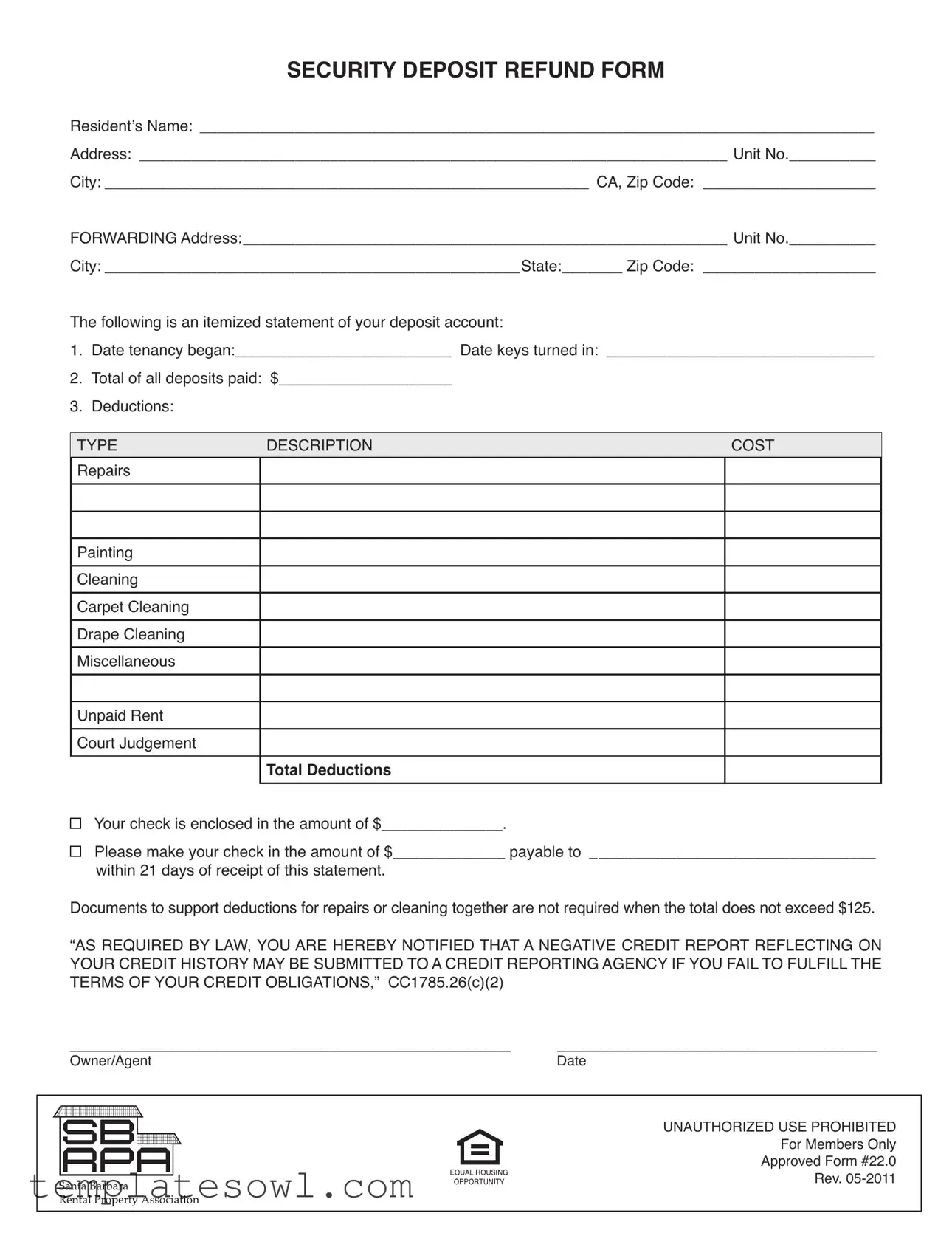

SECURITY DEPOSIT REFUND FORM

Resident’s Name: ______________________________________________________________________________

Address: ____________________________________________________________________ Unit No.__________

City: ________________________________________________________ CA, Zip Code: ____________________

FORWARDING Address:________________________________________________________ Unit No.__________

City: ________________________________________________State:_______ Zip Code: ____________________

The following is an itemized statement of your deposit account:

1.Date tenancy began:_________________________ Date keys turned in: _______________________________

2.Total of all deposits paid: $____________________

3.Deductions:

TYPE |

DESCRIPTION |

COST |

|

|

|

Repairs

Painting

Cleaning

Carpet Cleaning

Drape Cleaning

Miscellaneous

Unpaid Rent

Court Judgement

TOTAL DEDUCTIONS

Your check is enclosed in the amount of $______________.

Please make your check in the amount of $_____________ payable to _________________________________

within 21 days of receipt of this statement.

Documents to support deductions for repairs or cleaning together are not required when the total does not exceed $125.

“AS REQUIRED BY LAW, YOU ARE HEREBY NOTIFIED THAT A NEGATIVE CREDIT REPORT REFLECTING ON YOUR CREDIT HISTORY MAY BE SUBMITTED TO A CREDIT REPORTING AGENCY IF YOU FAIL TO FULFILL THE TERMS OF YOUR CREDIT OBLIGATIONS,” CC1785.26(c)(2)

___________________________________________________ |

_____________________________________ |

Owner/Agent |

Date |

UNAUTHORIZED USE PROHIBITED

For Members Only

Approved Form #22.0

Rev.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | This form is used by landlords to itemize deductions from a tenant's security deposit after they have moved out of the rental property. |

| Repair Documentation | If deductions for repairs or cleaning are less than $125, landlords do not need to provide supporting documents. |

| Payment Timeline | Landlords must issue a refund check or provide an itemized statement of deductions within 21 days of the tenant's move-out date, as required by California law. |

| Credit Reporting Notification | Tenants are informed that failing to meet the terms of their obligations may result in a negative credit report, as specified by California Civil Code § 1785.26. |

Guidelines on Utilizing Security Deposit Deductions

Completing the Security Deposit Deductions form is important for ensuring that all details regarding your deposit and any deductions are properly documented. This will help you understand what you may be entitled to after moving out, as well as clarify any deductions made from your original deposit. Follow the steps below to fill out the form correctly.

- In the first section, write your Resident’s Name and fill in your Address, including Unit Number and City.

- Next, complete the Zip Code field for your address.

- Provide your FORWARDING Address, including Unit Number, City, State, and Zip Code.

- Fill in the Date tenancy began and Date keys turned in to indicate crucial dates during your lease.

- Write the total of all deposits paid in the designated area.

- List each deduction under the Deductions section. Include the TYPE of deduction, DESCRIPTION, and COST for each item.

- Calculate the total deductions and write the amount in the TOTAL DEDUCTIONS field.

- Write the amount of the enclosed check in the space provided.

- Indicate the payee's name for the check.

- Sign and date the form at the bottom where indicated.

After completing the form, be sure to review it carefully to ensure all information is accurate. Keep a copy for your records, and send the form promptly to the designated owner or agent. This will set in motion the process of reconciling your security deposit.

What You Should Know About This Form

What is a Security Deposit Deductions form?

The Security Deposit Deductions form is a document provided by landlords or property managers to itemize any deductions made from a tenant's security deposit. This form outlines the costs associated with repairs, cleaning, and any other charges deducted from the original deposit upon the tenant's departure.

Why do landlords use this form?

Landlords use the Security Deposit Deductions form to provide transparency to tenants about how their security deposit is being utilized. By detailing each deduction, landlords ensure that tenants can clearly see and understand the reasons for the charges against their deposit.

What information do I need to provide on the form?

Tenants need to provide specific information, including their name, address, unit number, and forwarding address. Additionally, the form requires details about the tenancy, such as the start date and date when keys were returned, alongside an itemized statement of any deductions made from the deposit.

What types of deductions might I see on the form?

Common deductions include costs for repairs (like fixing damages), cleaning (for the apartment or carpets), miscellaneous charges, unpaid rent, or court judgments. Each type of deduction should be clearly listed with a corresponding cost.

How soon will I receive my security deposit refund?

According to California law, landlords are required to return the security deposit or provide an itemized statement of deductions within 21 days after the tenant vacates the premises. If you receive a check, make sure that the amount corresponds to what is indicated in the deductions section.

What if the deductions do not exceed $125?

If the total deductions for repairs or cleaning are less than or equal to $125, landlords are not required by law to provide supporting documents for those amounts. This means you may receive the deposit refund without additional paperwork in such cases.

Can I contest the deductions on the form?

Yes, tenants can contest any deductions they believe are unjust or incorrect. It is usually advisable to communicate with the landlord or property manager directly to discuss the discrepancies and seek resolution. Keeping records of the apartment's condition during move-out can be helpful.

What happens if I do not fulfill my credit obligations?

The form includes a notice about the potential for a negative credit report. If a tenant fails to fulfill their financial obligations, such as unpaid rent or other debts, landlords may report this to credit agencies, which can affect the tenant's credit history.

What should I do if I don’t receive my deposit refund?

If you have not received your deposit refund or an itemized statement after 21 days, it's important to reach out to your landlord or property manager. Document your attempts to communicate in case you need to take further action, such as contacting a local housing authority.

Is there an official template for the Security Deposit Deductions form?

Yes, the Security Deposit Deductions form is often based on approved templates. The one provided here, approved for use by members, is designed to meet legal requirements and ensure proper documentation is maintained during the refund process.

Common mistakes

When filling out the Security Deposit Deductions form, one common mistake is failing to provide accurate dates. The form requires both the start of tenancy and the date keys were returned. Forgetting to include these dates can complicate the review process and potentially delay the refund.

Another frequent oversight involves details regarding the total deposits paid. It’s essential to list the exact total amount, as any discrepancies may lead to confusion or disputes. Leaving this section blank or writing an incorrect number can result in delays or a reduction in the expected refund.

In the deductions section, many residents often miss specifying all types of deductions clearly. Not detailing what the deductions are for—such as repairs, cleaning, or unpaid rent—can lead to questions from the owner or agent. Including descriptions helps justify the costs and can prevent misunderstandings.

Additionally, forgetting to attach supporting documents can be problematic. The form notes that receipts for repairs or cleaning need not be provided if the total deductions do not exceed $125. However, it is still advisable to keep records for larger deductions. Ignoring to include these documents can weaken the justification for the deductions listed.

While calculating the total deductions, some residents incorrectly sum the costs. It’s crucial to double-check the math, as incorrect totals can create issues. Accurate calculations ensure the process remains straightforward and can facilitate timely processing of the refund.

Lastly, not completing the payment section fully can hinder the refund process. It’s important to ensure the check amount and payee are filled in correctly. Omitting details here can result in the check not being issued, further complicating the return of the security deposit.

Documents used along the form

When handling security deposits, several key documents are often utilized in conjunction with the Security Deposit Deductions form. These documents help clarify the financial aspects of the rental agreement and protect both landlords and tenants. Here’s an overview of five common forms and documents that might be used alongside the deductions form:

- Security Deposit Refund Form: This form is used to formally document the return of a tenant's security deposit. It outlines the total amount initially deposited, any deductions made, and the final refund amount. It helps ensure transparency in the refund process.

- A Notice of Intent to Deduct: Before any deductions are taken from the security deposit, landlords often send this notice to inform the tenant of any expected deductions. This document usually includes details about the reasons for deductions and allows the tenant an opportunity to dispute the charges before they are finalized.

- Repair Invoices or Receipts: These documents provide proof of any repairs or maintenance performed in the rental unit. They support the deductions claimed by the landlord and offer a clear breakdown of costs incurred for repairs, cleaning services, or replacements.

- Move-In/Move-Out Inspection Report: This form is typically filled out at the start and end of the tenancy. It records the condition of the rental property both when the tenant moves in and when they move out. Discrepancies noted in this report can be used to justify deductions related to damage or excessive wear.

- Lease Agreement: The original lease outlines the terms of the tenancy, including policies related to security deposits and the conditions under which deductions can be made. It serves as a reference for both parties to understand their rights and responsibilities regarding deposits.

Utilizing these forms appropriately can help facilitate a smoother interaction between landlords and tenants regarding security deposits. Proper documentation can minimize disputes and ensure that everyone involved is informed about their financial responsibilities and rights.

Similar forms

The Security Deposit Deductions form serves an important purpose in the landlord-tenant relationship by providing a clear account of any deductions made from a tenant's security deposit. Several other documents share similarities with this form in that they also outline financial transactions, rights, and obligations between parties. Below are nine documents that are comparable:

- Lease Agreement: This document establishes the terms of the rental arrangement, detailing rental amounts, responsibilities for maintenance, and conditions for security deposits. Like the Security Deposit Deductions form, it is essential for defining the financial relationship between tenant and landlord.

- Move-In Inspection Report: Often completed at the start of a lease, this report assesses the property's condition. It is similar to the Security Deposit Deductions form because both can serve as records to determine what constitutes ordinary wear and tear versus damage.

- Move-Out Inspection Report: Compiled when a tenant vacates, this report outlines the condition of the property and facilitates discussions about any necessary deductions from the security deposit. It, too, provides a written account of assessments that can help resolve disputes.

- Receipt for Security Deposit: This document confirms the amount paid by the tenant at the beginning of the tenancy. It aligns with the deductions form by documenting the initial financial commitment and serving as a reference point for any deductions made later on.

- Repair Request Form: Tenants may use this document to formally request repairs, which may later contribute to deductions if the tenant is deemed responsible for damages. Both forms emphasize accountability for property maintenance.

- Eviction Notice: If a tenant fails to meet their obligations, an eviction notice is issued. While not directly related to security deposits, both documents highlight important financial responsibilities and the repercussions of failing to meet them.

- Final Bill Statement: This document details any outstanding charges or balances due upon lease termination, including unpaid rent or damages. Much like the deductions form, it is a final accounting of amounts owed.

- Account Statement: Landlords may provide this document to summarize all financial transactions during a tenancy, similar to how the deductions form itemizes charges against a security deposit.

- Tenant Ledger: This ongoing record tracks all rent payments and any financial transactions throughout the lease. It serves a similar function to the deductions form by maintaining a comprehensive overview of the tenant's financial status.

Each of these documents helps facilitate transparent communication regarding financial matters between landlords and tenants. Understanding their similarities can assist both parties in navigating their rights and responsibilities more effectively.

Dos and Don'ts

When filling out the Security Deposit Deductions form, attention to detail is crucial. Below is a list of dos and don’ts to ensure accuracy and protect your interests.

- DO provide accurate information regarding your tenancy dates.

- DO itemize each deduction clearly, including descriptions and costs.

- DO keep copies of all documents related to the deductions you are claiming.

- DO submit the form within the specified timeframe to avoid delays.

- DON'T leave any sections of the form blank; incomplete forms may be rejected.

- DON'T submit claims for repairs or deductions without proper documentation, especially if they exceed $125.

- DON'T forget to double-check your forwarding address for accuracy.

- DON'T ignore the legal notification regarding credit reporting; it is important to adhere to your obligations.

Misconceptions

-

Misconception 1: Security deposits can be used for any purpose.

Many believe that a security deposit can be used for any type of expense, but that's not accurate. Security deposits are meant to cover specific damages or unpaid rent at the end of a lease. They are not a landlord's free money to spend as they wish.

-

Misconception 2: Landlords can deduct any amount for damages.

Some think landlords can deduct any amount they deem necessary, but there are limits. Deductions must be reasonable and documented, based on the actual cost of repairs or other allowed charges.

-

Misconception 3: Security deposits are refundable only if you have no damages.

This is untrue. While you will receive your deposit back if there are no damages, any necessary deductions will be clearly outlined on the itemized statement.

-

Misconception 4: You don't need to receive an itemized deduction list.

It's a common belief that landlords can withhold deposits without providing a breakdown. However, they are legally required to provide an itemized statement of deductions within a specific time frame.

-

Misconception 5: All types of damages can be deducted.

Not all damages are eligible for deduction. For instance, normal wear and tear is typically not deducted from the security deposit, whereas extensive damage caused by neglect or misuse may be.

-

Misconception 6: Landlords are not responsible for providing supporting documents.

This is incorrect. Landlords must provide documentation backing any significant deductions exceeding $125. This helps ensure transparency and fairness in the process.

-

Misconception 7: Security deposits can be used to cover unpaid utility bills.

This is a misunderstanding. Security deposits are generally only for covering damages or unpaid rent, not for utility payments. Tenants remain responsible for their utilities throughout the lease.

-

Misconception 8: You must accept whatever deductions are listed.

It is a misconception that tenants must accept the deductions without question. Tenants may dispute the deductions if they feel they are unfair. Communication with the landlord is key during this process.

-

Misconception 9: A verbal agreement is as good as a written one.

Many tenants believe a verbal agreement regarding security deposits is sufficient, but this isn't true. Written agreements protect both parties and outline clear terms, making them essential in any rental situation.

Key takeaways

When filling out and using the Security Deposit Deductions form, consider these key takeaways:

- Ensure that all personal information is accurate. This includes both your current address and the forwarding address.

- Document the start date of your tenancy and the date you returned your keys. This information is crucial for calculating your time in the rental unit.

- List each type of deduction clearly. Be specific about expenses such as repairs, cleaning, or unpaid rent.

- Keep in mind the $125 rule. If your deductions for repairs or cleaning do not exceed this amount, you won’t need to provide supporting documents.

- Be aware of the timeline for receiving your deposit. The check should be issued within 21 days after you receive the statement.

- Understand the consequences of not fulfilling your financial obligations. Note the warning regarding negative credit reports as required by law.

Browse Other Templates

Money Order Refund Western Union - Request to change the business address associated with the account.

Sample Letter for Leave of Absence From Work - Documentation may be required based on the reason for the leave requested.

Eopota Login - Upgrade to Adobe Reader 7.0 if you face issues viewing or printing the form.