Fill Out Your Sedgwick Direct Deposit Form

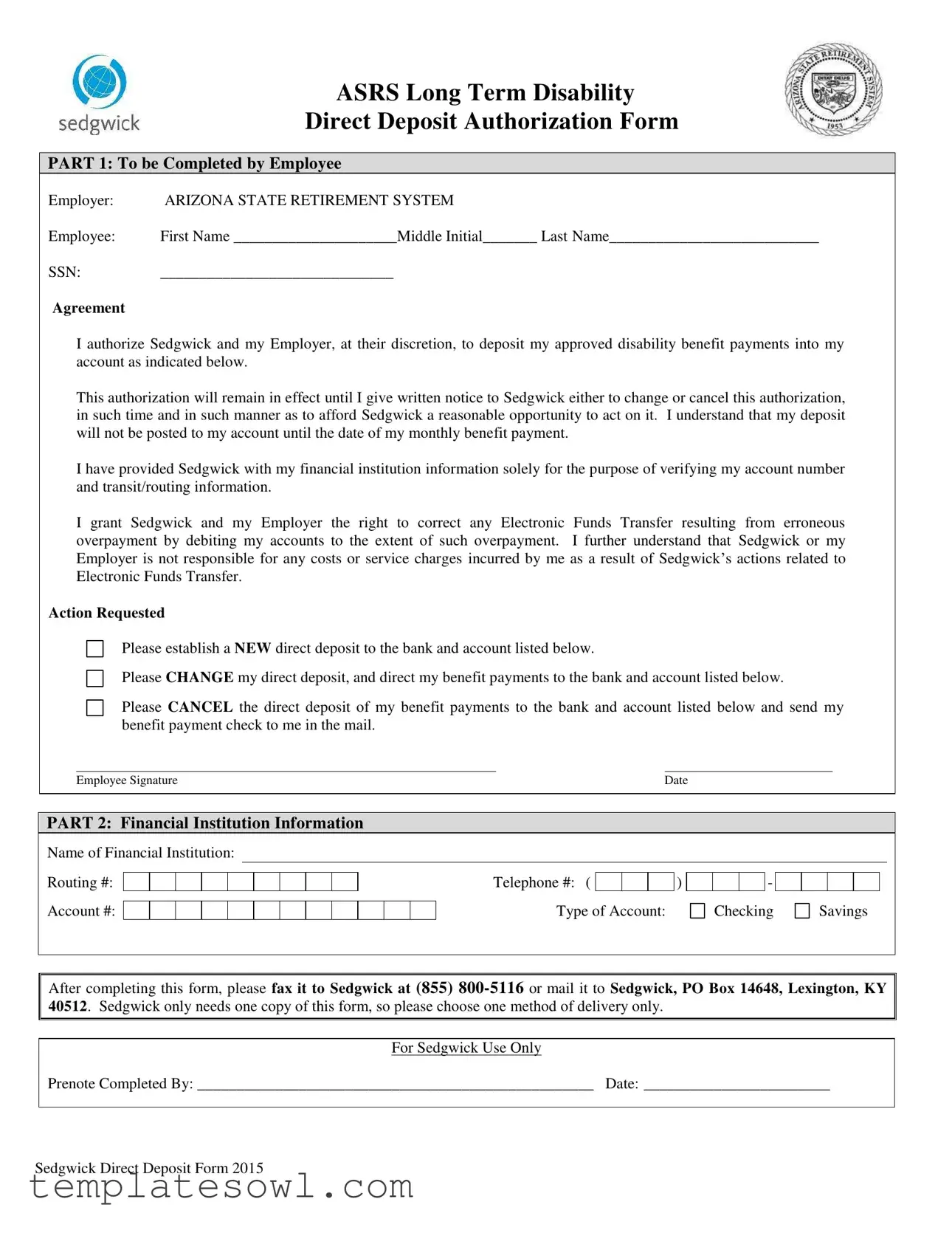

The Sedgwick Direct Deposit form is a crucial tool for employees receiving long-term disability benefits through the Arizona State Retirement System (ASRS). Designed to streamline payments, this form allows individuals to authorize the seamless deposit of their approved benefit payments directly into their bank accounts. To begin the process, an employee must fill out their basic information, including their name, Social Security Number, and details about their financial institution. Key to this process is understanding the choice between establishing new direct deposits, changing existing bank information, or canceling the current deposit arrangement altogether. The form also addresses important stipulations regarding the electronic transfer of funds, such as acknowledging that deposits aren’t posted until the payment date and granting Sedgwick the authority to rectify any overpayment issues directly through the employee’s account. Important as it is to maintain control over payment methods, this form emphasizes the necessity for written notice should any changes be required in the future. After completion, the form can be submitted via fax or mail, ensuring that Sedgwick efficiently receives your authorization to manage your payments. Understanding both the function and requirements of this form will facilitate a hassle-free experience in receiving long-term disability benefits.

Sedgwick Direct Deposit Example

ASRS Long Term Disability

Direct Deposit Authorization Form

PART 1: To be Completed by Employee

Employer: |

ARIZONA STATE RETIREMENT SYSTEM |

Employee: |

First Name _____________________Middle Initial_______ Last Name___________________________ |

SSN: |

______________________________ |

Agreement

I authorize Sedgwick and my Employer, at their discretion, to deposit my approved disability benefit payments into my account as indicated below.

This authorization will remain in effect until I give written notice to Sedgwick either to change or cancel this authorization, in such time and in such manner as to afford Sedgwick a reasonable opportunity to act on it. I understand that my deposit will not be posted to my account until the date of my monthly benefit payment.

I have provided Sedgwick with my financial institution information solely for the purpose of verifying my account number and transit/routing information.

I grant Sedgwick and my Employer the right to correct any Electronic Funds Transfer resulting from erroneous overpayment by debiting my accounts to the extent of such overpayment. I further understand that Sedgwick or my Employer is not responsible for any costs or service charges incurred by me as a result of Sedgwick’s actions related to Electronic Funds Transfer.

Action Requested

Please establish a NEW direct deposit to the bank and account listed below.

Please CHANGE my direct deposit, and direct my benefit payments to the bank and account listed below.

Please CANCEL the direct deposit of my benefit payments to the bank and account listed below and send my benefit payment check to me in the mail.

Employee SignatureDate

PART 2: Financial Institution Information

Name of Financial Institution:

Routing #: |

|

|

|

|

|

|

|

|

|

|

|

|

Telephone #: ( |

|

|

|

) |

|

|

|

- |

|

|

|

|

Account #: |

|

|

|

|

|

|

|

|

|

|

|

|

Type of Account: |

|

|

Checking |

|

Savings |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

After completing this form, please fax it to Sedgwick at (855)

For Sedgwick Use Only

Prenote Completed By: ___________________________________________________ Date: ________________________

Sedgwick Direct Deposit Form 2015

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form allows employees to authorize direct deposit of Long Term Disability benefit payments into their bank accounts. |

| Authorization Duration | The authorization remains in effect until the employee provides written notice to Sedgwick for a change or cancellation. |

| Financial Institution Details | Employees must provide the name of their financial institution, routing number, account number, and account type (checking or savings). |

| Erroneous Overpayment | In case of an overpayment, Sedgwick is authorized to debit the employee's account to correct any errors. |

| Service Charges | Sedgwick and the employer are not responsible for any service charges incurred from the Electronic Funds Transfer. |

| Delivery Method | Employees can submit one copy of the form via fax or mail to Sedgwick, choosing only one method of delivery. |

| Governing Law | The Sedgwick Direct Deposit form is governed by Arizona state law pertaining to retirement benefits. |

Guidelines on Utilizing Sedgwick Direct Deposit

After filling out the Sedgwick Direct Deposit form, you can send it to Sedgwick for processing. Make sure all the information is accurate to ensure a smooth transition to direct deposit. Follow the steps below to complete the form correctly.

- In Part 1, write your first name, middle initial, and last name in the provided spaces.

- Enter your Social Security Number (SSN) in the designated section.

- Read the agreement carefully and understand that it will remain in effect until you choose to change or cancel it.

- In the action requested section, select one of the options: establishing a new direct deposit, changing an existing direct deposit, or canceling the direct deposit.

- Sign and date the form at the bottom of Part 1.

- Move to Part 2 to provide your financial institution information.

- Write the name of your financial institution in the appropriate space.

- Fill in the routing number for your bank.

- Provide your bank's telephone number.

- Enter your account number in the designated area.

- Select the type of account you have (either checking or savings).

- Once completed, choose whether to fax the form to Sedgwick at (855) 800-5116 or mail it to Sedgwick, PO Box 14648, Lexington, KY 40512. Remember, only send one copy of the form.

What You Should Know About This Form

What is the purpose of the Sedgwick Direct Deposit form?

The Sedgwick Direct Deposit form enables employees to authorize the electronic deposit of their long-term disability benefit payments directly into their bank accounts. This ensures that payments are received in a timely manner, providing convenience and security for the employees receiving benefits.

How long does the direct deposit authorization remain in effect?

The authorization remains in effect until the employee provides written notice to Sedgwick indicating a desire to change or cancel it. It is important to ensure that this notice is given in a timely fashion, allowing Sedgwick reasonable time to process the request.

What information is required to complete the form?

To complete the Sedgwick Direct Deposit form, employees must provide their name, Social Security Number, and specific financial institution information, including the bank's name, routing number, account number, and type of account (checking or savings). This detailed information is vital for setting up accurate electronic fund transfers.

What if I want to change or cancel my direct deposit?

To change or cancel your direct deposit, you must send written notification to Sedgwick. This notification should specify the desired changes and be submitted with enough advance notice to allow Sedgwick to process the request timely.

Are there any fees associated with using direct deposit?

While Sedgwick facilitates direct deposits, they do not cover any associated fees or service charges that may arise from your financial institution. It's essential for employees to inquire about potential fees from their banks related to electronic fund transfers.

How should I submit the completed Sedgwick Direct Deposit form?

The completed form can be submitted either by faxing it to Sedgwick at (855) 800-5116 or by mailing it to Sedgwick at PO Box 14648, Lexington, KY 40512. It is advisable to choose only one submission method to avoid confusion and ensure that the form is processed efficiently.

What happens if there is an overpayment made to my account?

In the event of an erroneous overpayment, Sedgwick and your employer retain the right to rectify this mistake by debiting your account for the amount of the overpayment. This ensures that funds are accurately managed and reduces potential financial discrepancies.

What should I do if I have questions about filling out the form?

If you have questions regarding the completion of the Sedgwick Direct Deposit form, it is recommended to reach out directly to Sedgwick or your HR department. They can provide guidance and ensure that the submission process is smooth and accurate.

What is the prenote process mentioned on the form?

The prenote process verifies the accuracy of the bank account information provided before actual funds are transferred. It generally involves sending a zero-dollar transaction through the banking system to ensure that the routing and account numbers are correct. The form's section for "Sedgwick Use Only" allows for documentation of this process by Sedgwick personnel.

Common mistakes

Filling out the Sedgwick Direct Deposit form correctly is crucial to ensure timely receipt of disability benefit payments. Many individuals make mistakes that can delay the process. One common error is omitting important personal information, such as the middle initial or full last name. Providing incomplete details can lead to confusion or unnecessary delays in processing the application.

Another frequent mistake occurs when filling out the Social Security Number (SSN) section. Individuals often miswrite or transpose numbers, which can hinder the submission process. This error could result in the inability to verify the applicant’s identity or account, causing a delay in the establishment of direct deposit.

Failing to specify the type of account is a significant oversight. Applicants sometimes forget to indicate whether the account is a checking or savings account. This oversight is critical, as financial institutions require this information to process deposits accurately.

Some individuals misunderstand the instructions regarding changes to their existing direct deposit. They may select multiple options, such as establishing a new account while also indicating a cancellation. Doing this may lead to confusion and a delay in processing the request. Clarity in selection is essential to avoid miscommunication.

Additionally, not providing accurate financial institution information can create complications. Misstating the name of the bank or providing an incorrect routing number will result in failed transactions. It's essential to double-check these details before submission to ensure they match official documents from the bank.

Disregarding the signature and date at the end of the form is another mistake that can halt progress. An unsigned form may be considered invalid, leading to rejection. Ensuring that these sections are completed is essential to validate the authorization.

Some applicants send multiple copies of the form instead of one. Sedgwick specifies that only one copy is necessary. Sending more than one can clutter the processing queue and may confuse the personnel handling the requests.

Finally, neglecting to follow up after submission can lead to uncertainty about the status of the application. Not confirming with Sedgwick can mean missing out on essential updates or corrections that need to be addressed. A proactive approach in verifying receipt or any issues will aid in a smoother process.

Documents used along the form

When managing your benefits, certain forms and documents complement the Sedgwick Direct Deposit form. Each document plays a critical role in ensuring your benefits are handled properly, allowing for a smooth transaction process. Below is a list of commonly used forms, briefly explained.

- W-4 Form: This document determines the amount of federal income tax withheld from your paycheck. Completing a W-4 form is essential for accurate tax deductions.

- Direct Deposit Authorization Form: Often used by various employers, this form enables employees to provide their banking details for direct deposit of salaries or wages.

- Benefit Claim Form: Required to claim various benefits, this form outlines the specifics of the benefits being requested, such as disability or unemployment compensation.

- Employment Separation Agreement: This form outlines the terms of separation from the company, including any benefits or payments due upon termination of employment.

- Payroll Schedule: A document detailing the payroll dates and frequency (weekly, bi-weekly, etc.), which can help you anticipate when your benefits will be deposited.

- Health Insurance Enrollment Form: This form is necessary for enrolling in or making changes to health insurance coverage, essential for managing your healthcare benefits.

- Tax Documents (1099/ W-2): These forms report income for tax purposes. They provide necessary information for completing your annual tax return.

- Retirement Plan Enrollment Form: For those looking to enroll in employer-sponsored retirement plans, this form captures your preferences and contribution details.

- Change of Address Form: Not only does this form notify your employer of a new address, but it also ensures all important documents, including payment information, reach you accurately.

Using these forms in conjunction with the Sedgwick Direct Deposit form facilitates effective management of your benefits and ensures that necessary financial transactions are processed without hiccups. If you're uncertain about how to complete these forms, don't hesitate to reach out to your HR department or a financial advisor for guidance.

Similar forms

- Bank Account Authorization Form: Similar to the Sedgwick Direct Deposit form, this document also authorizes a bank to manage and execute transactions involving a specific account. It ensures that funds can be deposited or withdrawn as per the account holder's instructions.

- Payroll Direct Deposit Authorization: This document is used by employees to allow their employer to deposit their wages directly into their bank accounts. It functions much like the Sedgwick form, ensuring timely access to funds.

- Automatic Payment Authorization Form: This is a directive to a company to withdraw funds automatically on specified dates. Similar to the Sedgwick form, it streamlines payments, minimizing the need for manual entries.

- Social Security Direct Deposit Authorization: This allows recipients of Social Security benefits to have their payments deposited directly into their bank accounts. Like the Sedgwick form, it secures a reliable payment method for individuals.

- Pension Plan Direct Deposit Form: Used by retirees, this document authorizes regular pension benefit deposits into their chosen bank accounts, echoing the intent of the Sedgwick form to ensure consistent financial support.

- Vendor Direct Deposit Agreement: Businesses use this form to set up electronic payments to suppliers. It shares the same goal as the Sedgwick form: ensuring timely, hassle-free transactions while providing essential account information.

- Government Benefits Direct Deposit Form: Individuals can use this document to authorize the government to pay benefits directly into their bank accounts. It reflects a commitment to timely payments, akin to the objectives in the Sedgwick form.

Dos and Don'ts

When filling out the Sedgwick Direct Deposit form, here are six important things to remember.

- Do: Make sure to provide complete and accurate personal information, including your full name and Social Security Number.

- Do: Clearly indicate whether you want to establish a new direct deposit, change an existing one, or cancel it.

- Do: Double-check the routing and account numbers. Errors can prevent your payment from being deposited correctly.

- Do: Sign and date the form to authorize the request.

- Don't: Submit more than one copy of the form. Choose either fax or mail for delivery.

- Don't: Forget to contact Sedgwick if you need to change or cancel your authorization in the future.

Misconceptions

Misconceptions about the Sedgwick Direct Deposit form can lead to confusion. Here are ten common misunderstandings:

- Direct Deposit Is Mandatory: Many people believe they must use direct deposit. However, participation is voluntary. You can choose to receive your benefits by check.

- Changes to Direct Deposit Are Automatic: There is a misconception that a change of bank account will happen without submitting a new form. You must complete and submit a new Sedgwick Direct Deposit form to make changes.

- The Form Is Only for New Accounts: Some think the form is only necessary for starting direct deposit. In fact, it is equally important for changing or canceling existing deposits.

- Incorrect Information Cannot Be Fixed: It is often believed that errors on the form cannot be corrected. If an error occurs, Sedgwick has the authority to rectify any mistakes related to your account information.

- Deposits Will Be Made Immediately: People may assume that once the form is submitted, payments will be deposited right away. Deposits will only post on the scheduled monthly benefit payment date.

- Only One Submission Is Needed: There is a belief that submitting the form once is enough for a lifetime. However, you must submit a new form whenever you change your bank account or wish to update your information.

- All Financial Institutions Are Accepted: Some assume any bank can be listed. Sedgwick may only accept direct deposits from verified financial institutions. Always check if your bank qualifies.

- Direct Deposit Means You Cannot Get a Check: Many think that selecting direct deposit means checks are no longer an option. You can still receive checks by canceling your direct deposit on the form.

- Service Charges Are Fully Covered: There is a notion that all costs related to using direct deposit will be absorbed. However, Sedgwick is not responsible for any fees your bank may impose.

- Form Submission Is Irrelevant After Sending: Lastly, some think once the form is submitted, they should not follow up. It’s important to verify that Sedgwick has processed your request, especially for changes.

Key takeaways

1. Accurate Information is Essential: Ensure that all your personal details, like your name, Social Security Number, and account information, are filled out correctly. Any mistakes could delay your access to funds.

2. Choose Your Action Wisely: Decide whether you're establishing a new direct deposit, changing an existing one, or canceling it. Only one option can be selected at a time, so take your time to make the right choice.

3. Understand the Authorization Process: By signing the form, you're giving Sedgwick and your employer permission to deposit your benefits directly into your bank account. This authorization remains in effect until you provide written notice of any changes.

4. Delivery Matters: After you complete the form, send it to Sedgwick either by fax or mail. Remember, only send one copy, and don’t forget to choose the delivery method that works best for you.

Browse Other Templates

Types of Advance Directives - The completed proxy gives your agent clear authority to act without legal complications.

Pathos Ethos Logos - LOGOS: The logical presentation of military findings and predictions create a strong case for the need for urgent action against climate disruptions.

Working Papers Nj - The employer must fill in information regarding job title, hours, and wages on the form.