Fill Out Your Self Employment Ledger Form

The Self Employment Ledger form is a vital tool designed for individuals engaged in self-employment who need to report their financial information to the Iowa Department of Human Services. This form collects essential data, including the name of the individual, social security number, case worker, and case number, allowing for accurate tracking and reporting of income and expenses. It’s important that all information be submitted promptly upon request from the Department of Human Services. The form is organized monthly, prompting users to fill in the specific month and date, ensuring that income and expenses are clearly documented. The structure of the form is straightforward, with designated fields for recording income and expenses incurred throughout the month. Copies of the form are available for personal records and for the case file, making it easy to keep track of financial activities over time. Maintaining up-to-date and accurate records on this form can significantly impact eligibility for various assistance programs, reinforcing the importance of thorough and timely reporting. This article will delve into the intricacies of the Self Employment Ledger and provide guidance on its effective use.

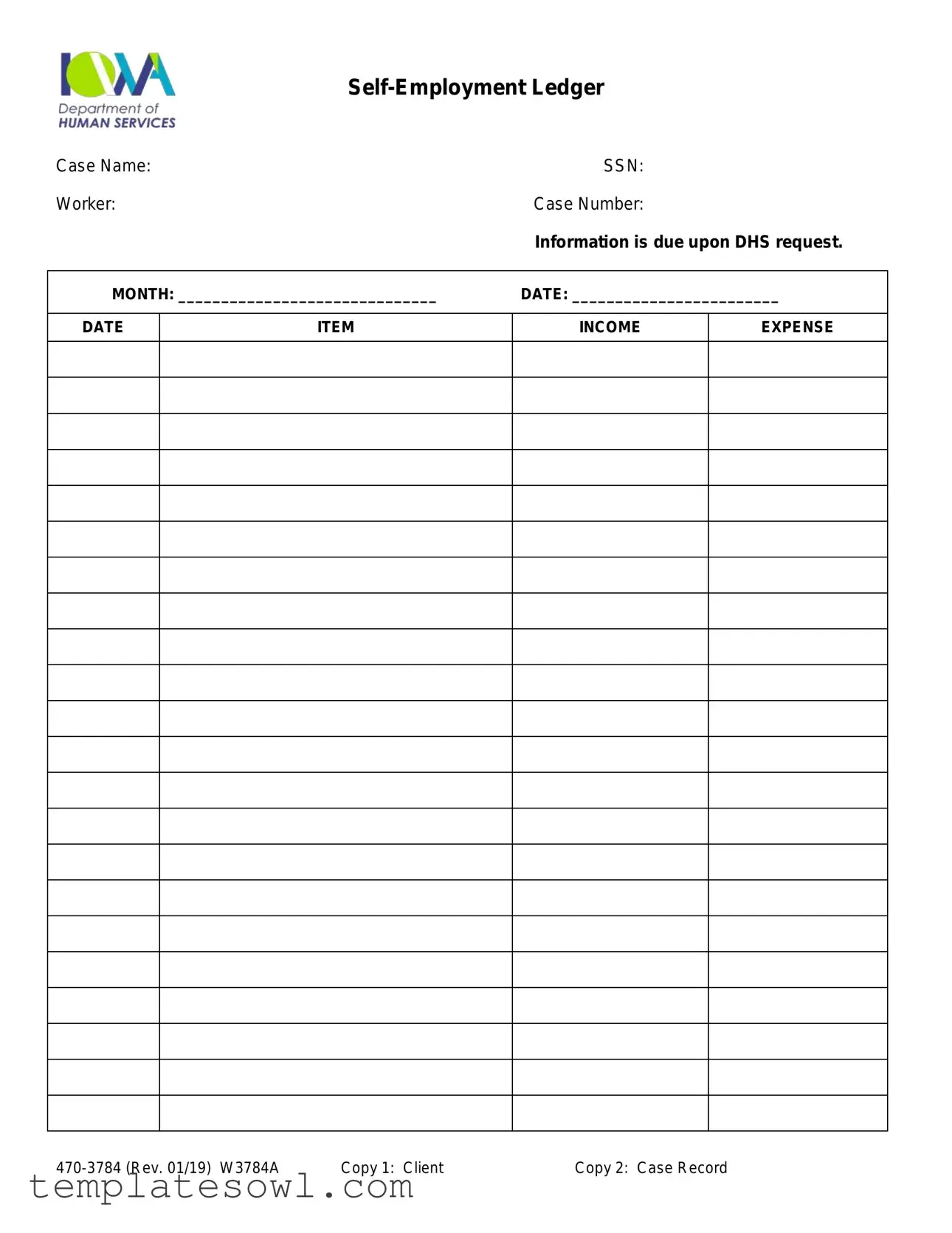

Self Employment Ledger Example

Case Name: |

|

SSN: |

|

Worker: |

|

Case Number: |

|

|

|

Information is due upon DHS request. |

|

|

|

|

|

MONTH: ______________________________ |

DATE: ________________________ |

||

|

|

|

|

DATE |

ITEM |

INCOME |

EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Copy 1: Client |

Copy 2: Case Record |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Self Employment Ledger is used by individuals to track and report income and expenses related to their self-employment activities. |

| Required Submission | This form must be submitted to the Iowa Department of Human Services (DHS) upon request. |

| Case Information | Essential identification details such as case name, social security number, worker, and case number must be filled out at the top of the form. |

| Monthly Reporting | The form requires reporting on a monthly basis, prompting users to specify the month and date related to the income and expenses. |

| Income and Expenses | There are designated sections for users to record income and expenses, helping to keep detailed financial records. |

| Governing Authority | The use of the Self Employment Ledger in Iowa is governed under Iowa’s administrative rules for the Department of Human Services. |

Guidelines on Utilizing Self Employment Ledger

Completing the Self Employment Ledger form is an important process that captures income and expenses for individuals who are self-employed. The following steps will guide you in accurately filling out the form to ensure all necessary information is recorded correctly.

- Begin by writing the **case name** at the top of the form in the designated area.

- Below the case name, fill in your **Social Security Number (SSN)**, ensuring that it is accurate.

- Next, enter the name of your **worker** or case manager in the space provided.

- Proceed to write your **case number**, which is typically assigned by the Department of Human Services.

- In the section labeled **MONTH**, indicate the month during which you are reporting your income and expenses.

- Below the month, fill in the **date** in the format required on the form.

- Look for the **INCOME** section. Enter all sources of income you received during the specified month.

- After completing the income section, move to the **EXPENSE** area and list all related expenses incurred during the same month.

- Double-check all entries for accuracy. Editing mistakes after submission may lead to complications.

- Finally, make copies of the filled-out form for your records and any additional requirements your case manager may have.

What You Should Know About This Form

What is the Self Employment Ledger form used for?

The Self Employment Ledger form is designed for individuals who earn income through self-employment. It helps you track your monthly income and expenses. This information is vital for the Iowa Department of Human Services (DHS), especially if you're receiving assistance or benefits. By providing a clear picture of your earnings and costs, you ensure that the department has the information it needs to evaluate your eligibility for services and support.

Who needs to fill out the Self Employment Ledger?

If you operate your own business or engage in freelance work, you should fill out the Self Employment Ledger. This form is especially important for those involved in programs overseen by DHS. Reporting your self-employment income accurately helps avoid issues with your benefits and ensures compliance with state requirements.

How do I fill out the Self Employment Ledger?

To complete the Self Employment Ledger form, start by entering your case name, Social Security Number (SSN), worker's name, and case number at the top. For each month, record the relevant date, your income, and your expenses. Make sure to keep your entries accurate and consistent. Remember, this form is a representation of your business finances, so clarity and precision are key.

When is the Self Employment Ledger due?

The Self Employment Ledger is due upon request from the Iowa Department of Human Services. Typically, you will need to submit this documentation during specific reviews or evaluations of your benefits. It’s important to keep an eye out for any notifications from DHS regarding when they require this information, ensuring that you remain compliant.

What happens if I don’t submit the Self Employment Ledger?

Failing to submit the Self Employment Ledger when requested can lead to complications with your case. It might result in delayed benefits or even discontinuation of your assistance. DHS needs this information to accurately assess your financial situation and adjust your benefits accordingly. Staying proactive and submitting your documents on time is essential to avoid unnecessary problems.

Common mistakes

Many individuals face challenges when completing the Self Employment Ledger form. One common mistake is failing to include all relevant information. Incomplete submissions can lead to delays in processing or inaccurate evaluations.

Another frequent error is not updating the monthly income and expense section regularly. Any variations in earnings or spending need to be recorded consistently to reflect the current financial status accurately.

Timing also matters. Some people overlook the importance of submitting this form promptly upon request from the Department of Human Services (DHS). Waiting too long can trigger unnecessary complications in case management.

It is essential to ensure that the dates entered are correct. Many individuals confuse the month and year, which can result in discrepancies in the records. Double-checking this information before submission is wise.

Many filers neglect to include supporting documentation, such as receipts or invoices, when detailing expenses. This omission might raise questions regarding legitimacy and can affect eligibility for certain benefits.

Another common mistake involves inconsistent naming conventions for companies. Using different names for the same business throughout various documentation can cause confusion and lead to complications in verification.

Some individuals often forget to sign and date the form. This simple step is crucial since submitting an unsigned or undated document can lead to it being returned or deemed incomplete.

Another pitfall involves miscalculating total income or expenses. An accurate total is important because it supports the financial claims being made. Mistakes could alter the assessment of finances leading to unfavorable outcomes.

Confusing income types can also be a significant error. Different categories of income, such as wages and freelance payments, need to be clearly distinguished to provide an accurate financial picture.

Lastly, failing to keep copies of submitted forms can become a problem later. Having a personal record can provide references and proof if any issues arise with the submission or processing of the Self Employment Ledger.

Documents used along the form

When managing self-employment income, certain documents can complement the Self Employment Ledger. These forms and records help to provide a clearer picture of finances, ensuring that all aspects of income and expenses are accounted for. Here’s a list of important forms and documents typically used alongside the Self Employment Ledger:

- Profit and Loss Statement: This document summarizes the income and expenses incurred during a specific period, helping to show the profitability of a business at a glance.

- Business License: A legal document issued by the government that permits you to operate a business. It confirms that your business complies with local laws and regulations.

- IRS Form 1040 Schedule C: Used by self-employed individuals to report income and losses from their business. It’s essential for tax reporting purposes and provides a detailed breakdown.

- Receipts and Invoices: Detailed records of transactions. Keeping these documents helps verify income and expenses listed in the Self Employment Ledger.

- Bank Statements: Monthly statements from your business bank account can provide evidence of income and expenditures, helping to track cash flow accurately.

- Tax Returns: Annual documents submitted to the IRS that report income, expenses, and other relevant tax information. They can demonstrate your business earnings over a longer term.

- Client Contracts: Agreements between you and your clients that outline the service terms. These contracts can support your reported income figures when verifying self-employment earnings.

Utilizing these documents alongside the Self Employment Ledger can facilitate smoother financial tracking and compliance with any required reporting. Proper organization and regular documentation will empower you to manage your self-employment effectively and transparently.

Similar forms

- Self-Employment Income Statement: Similar to the Self Employment Ledger, this document provides a summary of income earned from self-employment activities. It is typically formatted to show gross earnings and expenses, allowing for a clear view of net income.

- Profit and Loss Statement: This statement outlines the revenues and costs associated with a business over a specific period. Like the ledger, it highlights income and expenses, making it easier to assess the financial health of a self-employed individual.

- IRS Schedule C: This form is filed by sole proprietors and provides detailed information about income and expenses from self-employment. It shares the purpose of documenting earnings similar to the Self Employment Ledger.

- Business Expense Tracker: Used to monitor expenditures related to a business, this tracker helps in organizing expenses by category. Its organization resembles the systematic manner of entries in the Self Employment Ledger.

- Monthly Income Report: This document summarizes income received during a month from various sources. It serves a similar purpose to the Self Employment Ledger by tracking financial inflows over time.

- Bank Statements: These statements show deposits and withdrawals from a bank account. They can provide evidence of income, much like the ledger, although they are not specifically tailored for self-employment income.

- Cash Flow Statement: This statement tracks cash inflows and outflows over a period. It helps in understanding the liquidity of a self-employed individual, paralleling the Self Employment Ledger in its purpose of financial tracking.

- Personal Finance Worksheet: Similar to a budget, this worksheet allows individuals to manage both their personal and business finances. It organizes income and expenses like the Self Employment Ledger does for self-employment income.

Dos and Don'ts

When filling out the Self Employment Ledger form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are eight key dos and don'ts to consider:

- Do enter your full legal name as it appears on official documents.

- Do carefully record all sources of income, being specific about each type.

- Do keep copies of receipts and relevant documents to support your reported income and expenses.

- Do be honest and transparent about your income and expenses to avoid issues later on.

- Don't leave any sections blank; fill out all fields to the best of your ability.

- Don't exaggerate expenses; only include legitimate costs related to your self-employment.

- Don't submit the form without reviewing it for any errors or omissions.

- Don't ignore deadlines; submit your ledger promptly when requested by the DHS.

By following these guidelines, you can help ensure that your Self Employment Ledger is complete and accurate, ultimately supporting your case effectively.

Misconceptions

The Self Employment Ledger form is a crucial document for reporting income and expenses for self-employed individuals seeking assistance. However, various misconceptions exist about its usage and requirements. Here are nine common misunderstandings:

- The form is only for tax purposes. Many believe this form is solely for filing taxes. However, it is also essential for reporting income when applying for assistance programs.

- You only need to submit it once. Some think the form is a one-time requirement. In reality, updates may be needed whenever there are significant changes in income or expenses.

- Expenses can be reported without documentation. This misconception suggests that you can report expenses based only on memory. Adequate records, such as receipts or invoices, are necessary for validation.

- All income is acceptable without categorization. Not all income types may be reported without clear categorization. It's important to specify sources of income accurately.

- Only specific professions need to use this form. There is a belief that only certain self-employed individuals need to fill this out. However, anyone self-employed should complete the ledger.

- It’s non-essential for assistance eligibility. Some might think submitting the form isn't crucial for receiving assistance. In fact, it often is a key requirement.

- Only income above a certain limit needs to be reported. There’s confusion about whether to report all income or only that which exceeds a specific amount. All income must be reported.

- Assistance workers fill it out for you. There’s a misconception that case workers complete the form on behalf of the applicant. Each individual is responsible for their own submissions.

- You can alter the form as needed. Some users believe they can change the structure or layout of the form. It must be submitted as provided to maintain consistency.

Key takeaways

- The Self Employment Ledger is a form required by the Iowa Department of Human Services.

- Ensure to fill in your case name, social security number (SSN), the name of your worker, and your case number.

- Accuracy is crucial. Double-check all entries to avoid issues later.

- Keep records of both income and expenses for your self-employment activities.

- This ledger must be submitted upon request from the Department of Human Services.

- Use a separate ledger for each month to maintain a clear financial history.

- Retain a copy for your records, as it serves as proof of your financial activities.

- Provide a detailed breakdown of income and expenses to support your entries.

- Be aware of deadlines; timely submission is critical to maintain eligibility for benefits.

Browse Other Templates

Book Out - Adjustments for mileage can be recorded for a more accurate vehicle appraisal.

Diabetes Health Care Plan - This care plan reinforces the need for education around diabetes for both students and staff.