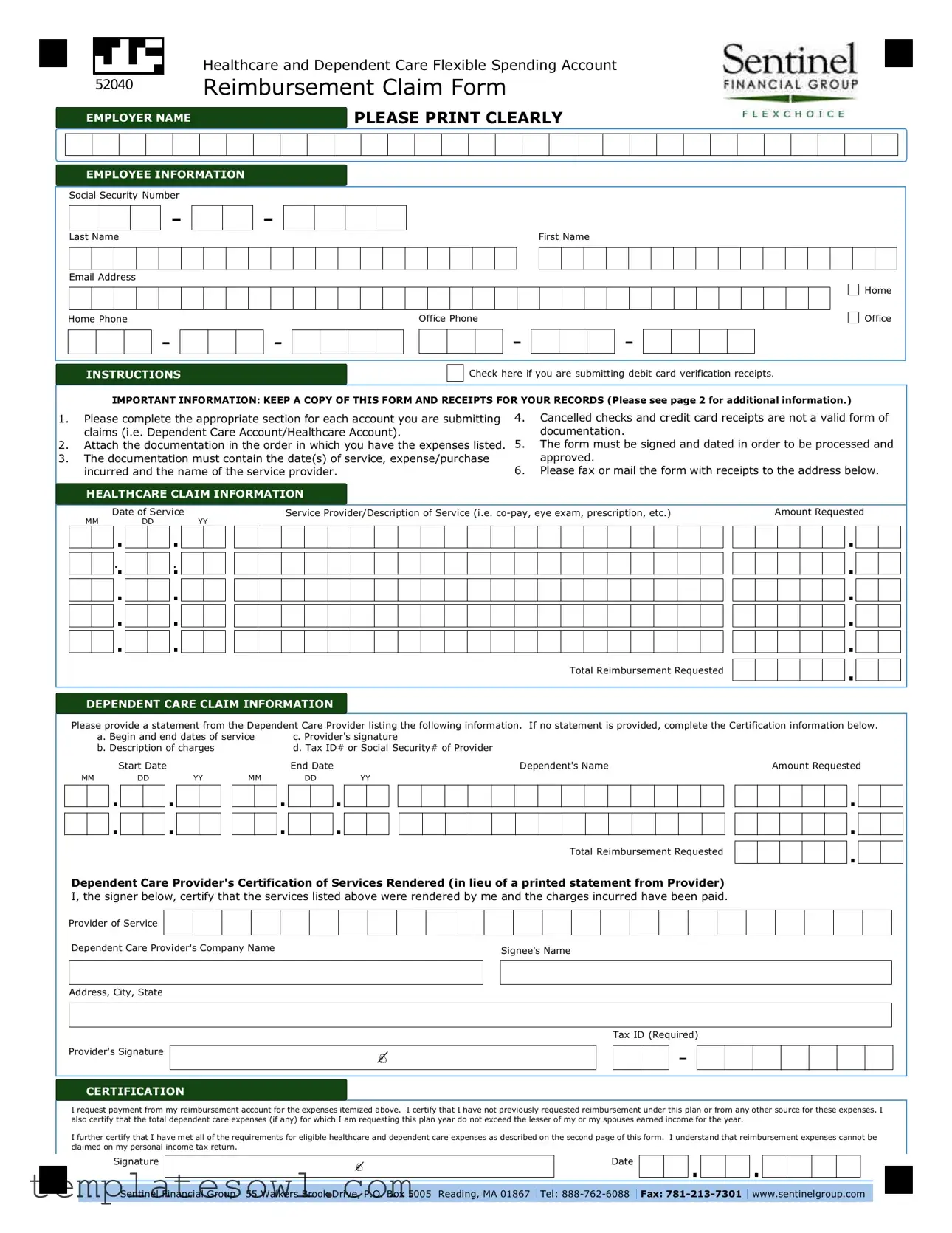

Fill Out Your Sentinel Benefits Reimbursement Claim Form

The Sentinel Benefits Reimbursement Claim form plays a crucial role for employees seeking reimbursement for healthcare and dependent care expenses. It’s essential to fill out this form accurately to ensure a smooth claims process. The form is divided into sections for Healthcare Claims and Dependent Care Claims. Each section requires specific information, including service details, expense amounts, and provider identification. Notably, claims must be accompanied by valid documentation such as receipts that clearly state the service date, description, amount, and provider’s name. In addition, some forms of documentation, like credit card receipts and cancelled checks, are deemed inadequate for claims. The claim form stresses the importance of signatures and dates, which are critical for processing. Moreover, it includes crucial eligibility information regarding what constitutes a reimbursable expense and outlines the maximum reimbursement limits. Participants are urged to keep copies of submitted forms and receipts for their records. Understanding the ins and outs of this form can significantly streamline the reimbursement process, allowing employees to access much-needed funds more efficiently.

Sentinel Benefits Reimbursement Claim Example

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Healthcare and Dependent Care Flexible Spending Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

52040 |

|

|

|

|

|

|

|

Reimbursement Claim Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

EMPLOYER NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE PRINT CLEARLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYEE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

INSTRUCTIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you are submitting debit card verification receipts. |

|

|

||||||||||||||||||||||||||||||||||||||||||||||

Home

Office

IMPORTANT INFORMATION: KEEP A COPY OF THIS FORM AND RECEIPTS FOR YOUR RECORDS (Please see page 2 for additional information.)

1.Please complete the appropriate section for each account you are submitting claims (i.e. Dependent Care Account/Healthcare Account).

2.Attach the documentation in the order in which you have the expenses listed.

3.The documentation must contain the date(s) of service, expense/purchase incurred and the name of the service provider.

HEALTHCARE CLAIM INFORMATION

4.Cancelled checks and credit card receipts are not a valid form of documentation.

5.The form must be signed and dated in order to be processed and approved.

6.Please fax or mail the form with receipts to the address below.

.

Date of Service |

Service Provider/Description of Service (i.e. |

Amount Requested |

MM. DD . YY

.

.

.

. .

.

.

.

.

. .

.

.

.

.

. .

.

.

.

.

. .

.

.

.

Total Reimbursement Requested |

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEPENDENT CARE CLAIM INFORMATION

Please provide a statement from the Dependent Care Provider listing the following information. If no statement is provided, complete the Certification information below.

a. Begin and end dates of service |

c. Provider's signature |

b. Description of charges |

d. Tax ID# or Social Security# of Provider |

Start Date

MMDDYY

.

. .

.

.

.

.

.

MM

.

.

End Date

DDYY

.

.

Dependent's Name |

Amount Requested |

.

.

.

.

Total Reimbursement Requested

.

.

Dependent Care Provider's Certification of Services Rendered (in lieu of a printed statement from Provider)

I, the signer below, certify that the services listed above were rendered by me and the charges incurred have been paid.

Provider of Service

Dependent Care Provider's Company Name |

|

Signee's Name |

|

|

|

|

|

|

|

|

|

Address, City, State |

|

|

|

|

|

|

|

|

Tax ID (Required)

Provider's Signature

CERTIFICATION

-

-

I request payment from my reimbursement account for the expenses itemized above. I certify that I have not previously requested reimbursement under this plan or from any other source for these expenses. I also certify that the total dependent care expenses (if any) for which I am requesting this plan year do not exceed the lesser of my or my spouses earned income for the year.

I further certify that I have met all of the requirements for eligible healthcare and dependent care expenses as described on the second page of this form. I understand that reimbursement expenses cannot be claimed on my personal income tax return.

Signature

Date

.

.

.

.

Sentinel Financial Group

55 Walkers Brook Drive, P.O. Box 5005 Reading, MA 01867 Tel:

Fax:

www.sentinelgroup.com

Draft

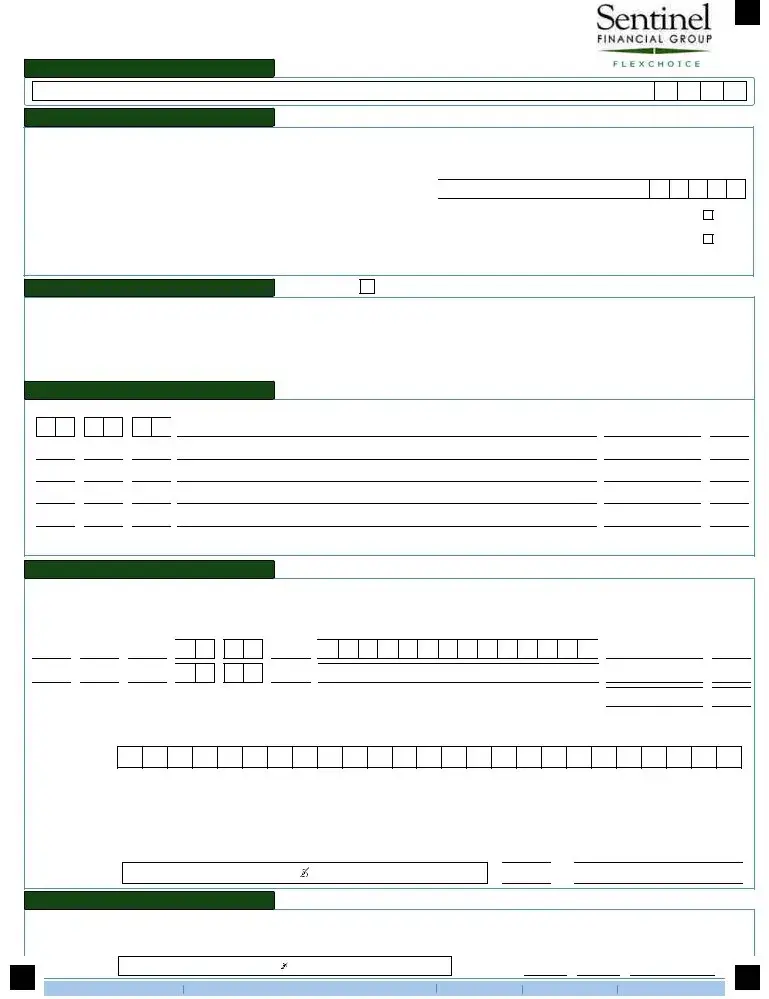

ADDITIONAL INFORMATION REGARDING REIMBURSEMENTS

HEALTHCARE ELIGIBLE EXPENSE INFORMATION

In general, an employee may be reimbursed for a healthcare expense which qualifies as a deduction on the federal income tax return, but which has not or will not be reimbursed by any other source and has not been or will not be deducted on the employee's income tax return. Some examples of eligible expenses include

More information about Healthcare Expenses, including eligible

Required Supporting Documentation

The following supporting documentation must be attached to this form:

Expenses covered by your Healthcare plan - medical, dental and vision expenses covered by your Healthcare plans must be submitted under that plan first. Attach a copy of the Explanation of Benefits statement to claim amounts not paid by your Healthcare Plan.

For all other expenses, attach bills that clearly state:

Date service was rendered or purchased

Date service was rendered or purchased

Description of service or item

Description of service or item

Name of provider of service

Name of provider of service

Amount charged

Amount charged

Name of the person receiving the service

Name of the person receiving the service

Proof of Purchase

Proof of Purchase

Dental Care

Receipts related to Dental claims must include a description of the service provided. Cosmetic services are not eligible for reimbursement.

DEPENDENT CARE ELIGIBLE EXPENSES

In general, the following rules apply to dependent care expenses:

No participant shall be allowed to defer more than $5,000, if married filing jointly, or $2,500 if married filing separately. The maximum that can be deferred under this program shall be the lesser of $5,000 or the earned income of the participant's spouse.

No participant shall be allowed to defer more than $5,000, if married filing jointly, or $2,500 if married filing separately. The maximum that can be deferred under this program shall be the lesser of $5,000 or the earned income of the participant's spouse.

Overnight camp and kindergarten are not eligible expenses.

Overnight camp and kindergarten are not eligible expenses.

The expenses must be employment related expenses for the care of a dependent of the employee who's entitled to a dependent deduction under the Internal Revenue Code section 151(e), or a dependent who is physically or mentally incapable of caring for himself or herself.

The expenses must be employment related expenses for the care of a dependent of the employee who's entitled to a dependent deduction under the Internal Revenue Code section 151(e), or a dependent who is physically or mentally incapable of caring for himself or herself.

Payments cannot be made to a person who is claimed as a dependent by the employee.

Payments cannot be made to a person who is claimed as a dependent by the employee.

If the services are provided by a Dependent Care center which provides care for more than six individuals, the center must comply with state and local laws.

If the services are provided by a Dependent Care center which provides care for more than six individuals, the center must comply with state and local laws.

Dependent Care expenses are reimbursed when payroll contributions are received and processed on our administration system.

Dependent Care expenses are reimbursed when payroll contributions are received and processed on our administration system.

Dependent Care Claim Checklist

1.Complete the requested information on the front of this form.

2.Have the Caregiver sign the front of this form.

3.Attach a cancelled check or receipt from the caregiver if one exists.

4.Provide the Tax ID# or Social Security Number of the Service Provider.

NOTE: DIRECT DEPOSIT IS THE QUICKEST WAY TO RECEIVE YOUR REIMBURSEMENT

Reimbursements will be faster if you have signed up for direct deposit. To request direct deposit, simply go to our website www.sentinelgroup.com, click on "customer service" and then click on "forms." Complete the FlexChoice Direct Deposit form and send it directly to Sentinel Benefits.

In an effort to provide you with faster notification of processed claims, we will send you an

Claims faxed in good order by 5:00 PM ET on Wednesday will be processed by Friday. (Holidays may impact this schedule.) Reimbursement checks are mailed via US Postal Service.

Sentinel Financial Group 55 Walkers Brook Drive, Suite 100, P.O. Box 5005 Reading, MA 01867 Tel:

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used to request reimbursement from Healthcare and Dependent Care Flexible Spending Accounts. |

| Claim Requirements | Documentation must include the date(s) of service, expense incurred, and the name of the service provider. |

| Valid Documentation | Cancelled checks and credit card receipts are not acceptable forms of documentation for reimbursement. |

| Signature Requirement | The form must be signed and dated by the employee for processing to occur. |

| Submission Methods | Employees may fax or mail the completed form and receipts to Sentinel Financial Group. |

| Dependent Care Provider's Information | A statement from the Dependent Care Provider is needed, listing specific details about the services rendered. |

| Certification | Employees must certify that they have not received prior reimbursement for the claimed expenses from any other source. |

| Eligibility for Expenses | Eligible healthcare expenses must qualify as a deduction on the federal tax return and cannot be reimbursed from another source. |

| Limits on Dependent Care | Participants may defer a maximum of $5,000 for dependent care if married filing jointly; otherwise, the limit is $2,500. |

| Direct Deposit Benefits | Opting for direct deposit speeds up the reimbursement process, with notifications sent upon processing. |

Guidelines on Utilizing Sentinel Benefits Reimbursement Claim

When filling out the Sentinel Benefits Reimbursement Claim form, you'll need to gather your necessary information and claim documentation. Completing the form accurately will help ensure that you receive the reimbursements you are entitled to without unnecessary delays.

- Print clearly in the EMPLOYEE INFORMATION section. Include your social security number, last name, first name, email address, and phone numbers.

- If using debit card receipts, check the box indicating you are submitting them.

- For each claim type (Healthcare or Dependent Care), complete the relevant sections. Provide dates of service, descriptions of services, providers' names, and amounts requested.

- Attach all necessary documentation in the order of your expenses. Ensure it includes the date of service, service description, and name of service provider, avoiding use of cancelled checks or credit card receipts.

- Double-check that the form is signed and dated. Without a signature, the claim cannot be processed.

- Fax or mail the completed form and attached receipts to the address provided on the form:

- Sentinel Financial Group

- 55 Walkers Brook Drive, P.O. Box 5005

- Reading, MA 01867

What You Should Know About This Form

What is the purpose of the Sentinel Benefits Reimbursement Claim form?

This form is designed for employees to request reimbursement for eligible healthcare and dependent care expenses. By filling out the form accurately and providing the necessary documentation, you can ensure that you receive the reimbursement you deserve for expenses that qualify under your employer's flexible spending accounts.

What types of expenses can I claim using this form?

You can claim a variety of healthcare and dependent care expenses. Eligible healthcare expenses include co-payments, dental and vision costs, and prescription drug costs not covered by your insurance. For dependent care, the expenses must be related to the care of your dependents, such as daycare services, but should not exceed certain limits based on your filing status. Detailed guidelines are provided in the form to help you determine what is eligible.

How should I document my expenses?

The form requires that you attach supporting documentation for each expense. This documentation should include the date of service, the name of the service provider, a description of the service, and the amount charged. Please note that cancelled checks and credit card receipts are not valid forms of documentation. If you're submitting for dependent care, a statement from the care provider is also necessary.

Is there a deadline for submitting the claim form?

What happens if my claim is denied?

If your claim is denied, you will receive a notification explaining the reasons for the denial. Common reasons might include missing documentation, expenses that are not eligible, or incomplete information on the claim form. Review the notification carefully and make sure to address any issues before resubmitting your claim.

Can I use my debit card for these expenses?

If you are using a debit card linked to your flexible spending account, you can submit validation receipts when requested. Indicate on the form that you are submitting debit card verification. This helps to streamline the reimbursement process, but remember that proper documentation is still necessary for compliance.

Do I need to sign the claim form?

Yes, your signature is required on the claim form. By signing, you certify that the information you've provided is accurate and that you have not previously requested reimbursement for the same expenses. This step ensures accountability and helps in the processing of your claim.

How will I receive my reimbursement?

You can receive your reimbursement either via a mailed check or through direct deposit. If you prefer the quickest method, signing up for direct deposit is highly recommended. You can initiate the process through the Sentinel Benefits website to ensure your funds are transferred directly into your bank account.

What should I do if I have questions or need assistance?

If you have any questions regarding the claim form or the reimbursement process, you can contact Sentinel Financial Group directly. Their customer service team is ready to assist you with your inquiries and provide you with guidance to ensure that your claims are processed smoothly.

Common mistakes

Filling out the Sentinel Benefits Reimbursement Claim form can be a straightforward process, but many individuals make common mistakes that can lead to delays or denials of their claims. One frequent error involves **incomplete personal information**. Applicants often forget to include critical details, such as their Social Security Number or an accurate email address. Omitting these can hinder communications regarding claims, leaving the employee in limbo.

Another common mistake is the **failure to attach proper documentation**. Many claimants don’t realize that not all forms of proof are acceptable. For example, submitting cancelled checks or credit card receipts is typically not valid. It’s essential to provide clear documentation that details the date of service, the type of service, and the provider’s name to ensure the claim is processed smoothly.

In addition, people frequently neglect to **organize their documentation correctly**. When multiple expenses are involved, it’s best to list them in the order they were incurred. If supporting documents are mixed up or not matched with the corresponding services claimed, the processing team could struggle to verify the expenses, delaying reimbursement.

Signing and dating the form is another critical step that is often overlooked. Without these signatures, the form cannot be processed. Some people mistakenly believe that they can send the form unsigned. It's imperative to remember that a missing signature can lead to outright rejection of the claim.

Misunderstanding the eligibility rules for healthcare and dependent care expenses can also cause issues. Employees sometimes claim expenses that don’t meet the criteria, such as overnight camp fees or cosmetic services. Familiarity with what expenses qualify for reimbursement is essential to avoid wasted time and effort.

Applicants can also trip up by neglecting to provide the **Tax ID number or Social Security number** of their dependent care provider. This detail is essential, as it ensures compliance with tax regulations. Without it, the form will likely be sent back for correction.

Lastly, many individuals fail to keep a copy of the claim form and all receipts for their own records. This oversight can lead to complications later if a claim needs to be tracked or referenced. By maintaining a personal copy, employees are better prepared for any follow-up that might be necessary, ensuring a smoother reimbursement experience.

Documents used along the form

The Sentinel Benefits Reimbursement Claim form is a crucial document for employees seeking to obtain reimbursements for healthcare and dependent care expenses. However, to ensure a smooth and successful claims process, it's often necessary to submit additional forms and documentation alongside it. Here are some key documents typically required when submitting a claim:

- Debit Card Verification Receipts: If an employee used a debit card linked to their flexible spending account, they must include receipts to verify the incurred expenses. These should clearly show the date, amount, and service provider.

- Explanation of Benefits (EOB): For healthcare expenses already submitted to an insurance plan, an EOB shows what costs were covered. Attach this document to claim any amounts that were not reimbursed.

- Dependent Care Provider Statement: A statement from the dependent care provider is often necessary. This should include the dates of service, description of services rendered, and the provider’s tax ID or Social Security number.

- Tax ID or Social Security Number of Provider: If the dependent care provider does not provide a statement, employees must supply this information for verification purposes to ensure compliance with IRS regulations.

- Direct Deposit Authorization Form: To expedite the reimbursement process, employees may choose to submit this form. It allows payments to be directly deposited into their bank account, often resulting in faster reimbursement.

- Receipts for Dependent Care Services: Employees should attach any receipts from caregivers detailing services provided. This includes a breakdown of charges, which helps in justifying the claims.

- Copy of Claim Form: Keeping a duplicate of the completed claim form is vital for record-keeping. This allows employees to track their submitted claims and offers a reference in case issues arise.

Submitting these additional documents along with the Sentinel Benefits Reimbursement Claim form can streamline the claims process, ensuring that employees receive the reimbursements they are entitled to in a timely manner. Being thorough with your documentation helps in avoiding delays and potential rejections of claims.

Similar forms

- Medical Expense Reimbursement Form: This document serves a similar purpose as the Sentinel Benefits Reimbursement Claim form, allowing employees to request reimbursement for qualified medical expenses. It also requires documentation and signature for processing, ensuring that claim submissions meet eligibility requirements.

- Flexible Spending Account (FSA) Claim Form: Just like the Sentinel form, this claim form is used by employees to claim reimbursements from their flexible spending accounts. Both forms demand itemized receipts and detailed expense information from the employee.

- Dependent Care Assistance Claim Form: Employees use this document to claim expenses related to dependent care. Similar to the Sentinel form, it requires specific details about the care provided, including the duration and costs, while also mandating a signed certification from the care provider.

- Health Reimbursement Arrangements (HRA) Claim Form: This document is intended for employees seeking reimbursement from an HRA. Like the Sentinel form, it necessitates detailed receipts and a clear breakdown of eligible expenses, aiming to streamline the reimbursement process.

- Claim for Reimbursement of Out-of-Pocket Health Expenses: This form can be submitted by employees seeking refunds for unreimbursed medical expenses. It mirrors the Sentinel form in requiring proof of expenses and adherence to guidelines regarding eligible costs.

- Health Savings Account (HSA) Reimbursement Request Form: Employees utilize this form to request reimbursements from their HSA for qualified medical expenses. Much like the Sentinel form, this document also necessitates the inclusion of supporting receipts and a declaration of the types of expenses submitted.

Dos and Don'ts

When filling out the Sentinel Benefits Reimbursement Claim form, accuracy and attention to detail are crucial. Below is a list of essential actions to take—and to avoid—to ensure a smooth reimbursement process.

- Do complete the appropriate section for each account you are submitting claims for, whether it’s the Dependent Care Account or Healthcare Account.

- Do attach the required documentation in the order of the listed expenses. This helps expedite the review process.

- Do ensure that your documentation includes essential details such as the date(s) of service, the nature of the expense, and the service provider's name.

- Do make sure to sign and date the form. A signature is required for processing and approval.

- Don't use cancelled checks or credit card receipts as your form of documentation. These will not be accepted.

- Don't forget to keep a copy of the completed form and receipts for your records. This is important for future reference.

- Don't submit any claims that have already been reimbursed through another source. This may lead to complications in your request.

By following these guidelines diligently, you can help ensure a quick and efficient reimbursement for your qualified healthcare and dependent care expenses.

Misconceptions

-

Misconception 1: Any receipt can serve as documentation.

Many people believe that any form of receipt is sufficient to support their claims. However, not all receipts meet the established requirements. The documentation must clearly specify the date of service, the service provided, and the provider's name. Only then can it be considered valid.

-

Misconception 2: Cancelled checks or credit card receipts are acceptable.

Some individuals think that cancelled checks or credit card receipts will suffice for their reimbursement claims. This is incorrect. These forms of documentation do not provide the necessary detail required for approval and are explicitly mentioned as insufficient.

-

Misconception 3: Submitting a claim once is enough.

There is a common belief that one claim submission will cover all expenses for a year. In truth, each expense must be submitted individually as they are incurred. This requirement helps maintain accurate records and ensures that all claims meet the necessary criteria.

-

Misconception 4: All expenses related to dependent care are reimbursable.

While many dependent care expenses are eligible, not all are. For instance, overnight camps or kindergarten costs do not qualify for reimbursement. Understanding what is eligible is crucial for accurate submissions.

-

Misconception 5: Direct deposit is just an optional convenience.

Some may view direct deposit as merely optional. In reality, it is the fastest way to receive reimbursements. Choosing this method expedites the process and minimizes delays compared to receiving a reimbursement check in the mail.

Key takeaways

Here are some important points to keep in mind when filling out and using the Sentinel Benefits Reimbursement Claim form:

- Complete all necessary sections: Make sure to fill out the sections for both Healthcare and Dependent Care as applicable. Each section needs specific information for the claim to be processed.

- Provide proper documentation: Keep in mind that submitted documentation must include the date of service, a description of the service, and the name of the provider. Incomplete documentation can delay processing.

- Sign and date your form: The reimbursement claim form needs to be signed and dated. Without your signature, it cannot be processed.

- Consider direct deposit: Opting for direct deposit can speed up the reimbursement process. Check the Sentinel website to find out how to set this up.

Browse Other Templates

How to Authenticate Birth Certificate - No alterations to the form are allowed, as this may result in rejection of the request.

3rd Party Subpoena - Recognizing a subpoena does not imply compliance; careful consideration of federal law is crucial.