Fill Out Your Separation Notice For Ga Form

The Separation Notice for Georgia, officially known as DOL-800, is a vital document that employers must provide when an employee leaves their position. This notice is important for establishing the circumstances surrounding the employee's separation, whether due to lack of work or other reasons. The form requires detailed information including the employee's name, Social Security Number, and the dates of their last employment. Additionally, employers must specify the reason for the separation and any payments made to the employee such as severance or separation pay. It is crucial to remember that vacation pay or earned wages should not be included in this section. Another key aspect involves confirming the employee's earnings during their employment, ensuring compliance with state requirements. Employers must complete the form accurately and send it to the employee, as it plays a significant role in any subsequent claims for unemployment benefits. The completed Separation Notice should be kept on file, as it may be requested for verification purposes. Understanding the details of this form is essential for both employers and employees to navigate the process of separation effectively and ensure that all legal obligations are met.

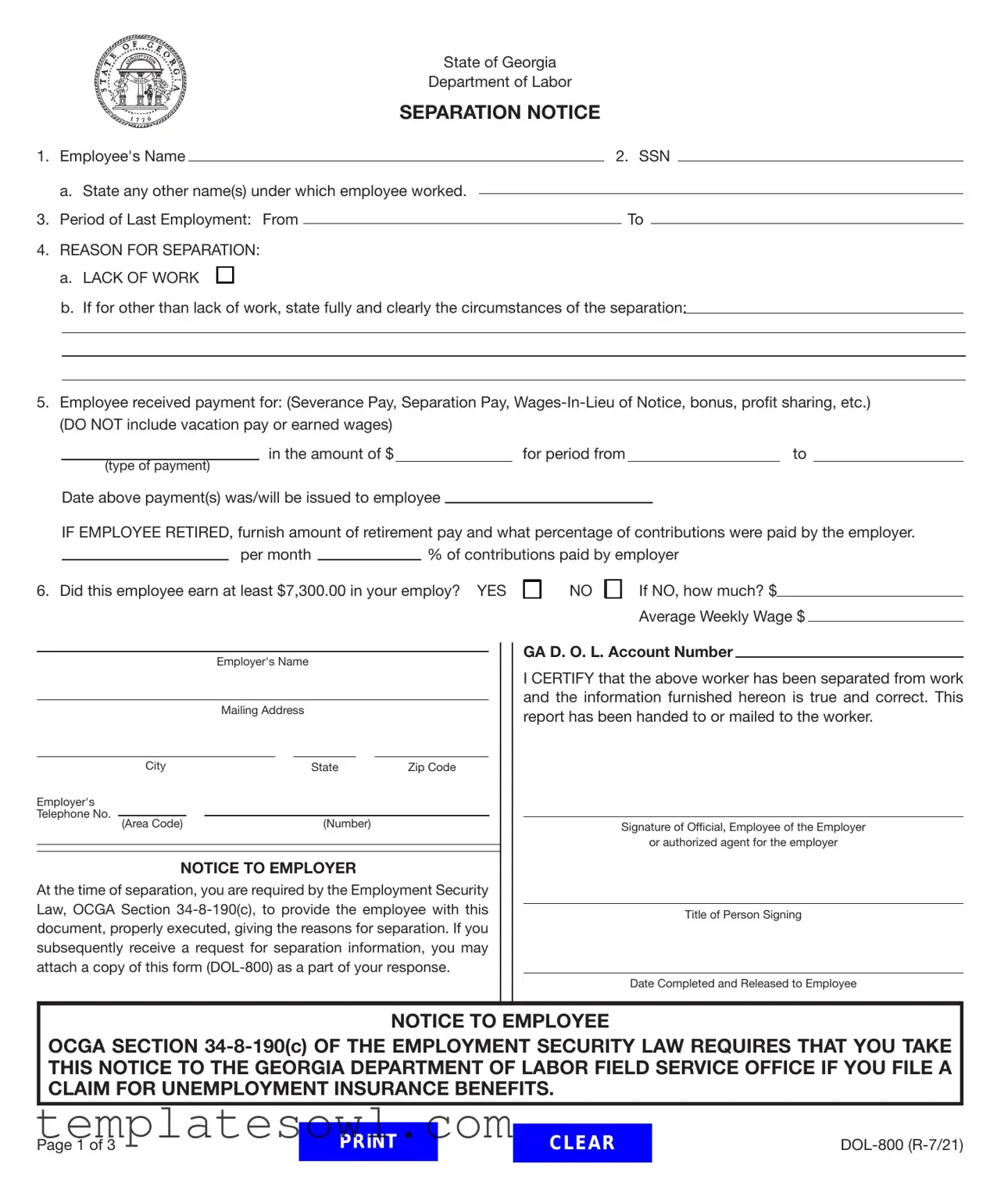

Separation Notice For Ga Example

State of Georgia

Department of Labor

SEPARATION NOTICE

1. |

Employee's Name |

|

|

|

2. SSN |

|

||

|

|

|

|

|||||

|

a. State any other name(s) under which employee worked. |

|

|

|

|

|

||

|

|

|

|

|

|

|||

3. |

Period of Last Employment: From |

|

|

To |

|

|

||

|

|

|

|

|||||

4.REASON FOR SEPARATION:

a.LACK OF WORK

b.If for other than lack of work, state fully and clearly the circumstances of the separation:

5.Employee received payment for: (Severance Pay, Separation Pay,

(DO NOT include vacation pay or earned wages)

(type of payment)

in the amount of $for period fromto

Date above payment(s) was/will be issued to employee

IF EMPLOYEE RETIRED, furnish amount of retirement pay and what percentage of contributions were paid by the employer.

per month |

|

% of contributions paid by employer |

|

6. Did this employee earn at least $7,300.00 in your employ? YES

NO

If NO, how much? $

Average Weekly Wage $

Employer's Name

Mailing Address

|

City |

|

State |

|

Zip Code |

||

Employer's |

|

|

|

|

|||

Telephone No. |

|

|

|

|

|

|

|

(Area Code) |

|

|

(Number) |

|

|||

NOTICE TO EMPLOYER

At the time of separation, you are required by the Employment Security Law, OCGA Section

GA D. O. L. Account Number

I CERTIFY that the above worker has been separated from work and the information furnished hereon is true and correct. This report has been handed to or mailed to the worker.

Signature of Official, Employee of the Employer

or authorized agent for the employer

Title of Person Signing

Date Completed and Released to Employee

NOTICE TO EMPLOYEE

OCGA SECTION

Page 1 of 3

CLEAR

INSTRUCTIONS TO EMPLOYER FOR COMPLETION

OF THIS SEPARATION NOTICE

In accordance with the Employment Security Law, OCGA Section

Item 1. Enter employee’s name as it appears on your records. If it is different from the name appearing on the employee’s Social Security Card, report both names.

Item 2. Enter the employee’s Social Security Number. Verify for accuracy.

Item 3. Enter the dates of employee’s most recent work period.

Item 4. a. If the reason for separation is for “LACK OF WORK,” check box indicated.

b. If the reason for separation is OTHER THAN “lack of work,” give complete details about the separation in space provided. If needed, add a separate sheet of paper.

Item 5. If any type payment, (i.e. Separation Pay,

Item 6. Check the appropriate block YES or NO to indicate whether this employee earned at least $7,300.00 in your employ. If you check NO, enter amount earned in your employ. Give average weekly wage (without overtime) at the time of separation.

Employer’s Name. |

Give full name of employer under which the business is operated. |

Address. Give full mailing address of the employer where communications are to be sent regarding a potential claim.

GA DOL Account Number Employer’s

Your state DOL Unemployment Insurance Account Number as it appears on your Quarterly Tax and Wage Report.

Signature. This notice must be signed by an officer or employee of the employer or authorized agent for the employer, and this person’s title or position held with the employer must be shown.

Date. This notice must be dated as of the date it is handed to the worker. If the employee is no longer available at the time employment ceases, mail this form

OCGA Section

PENALTY FOR OFFENSES BY EMPLOYERS. “Any employing unit or any officer or agent of an employing unit or any other person who knowingly makes a false statement or representation or who knowingly fails to disclose a material fact in order to prevent or reduce the payment of benefits to any individual entitled thereto or to avoid becoming or remaining subject to this chapter or to avoid or reduce any contribution or other payment required from an employing unit under this chapter or who willfully fails or refuses to make any such contributions or other payment or to furnish any reports required under this chapter or to produce or permit the inspection or copying of records as required under this chapter shall upon conviction be guilty of a misdemeanor and shall be punished by imprisonment not to exceed one year or fined not more than $1,000.00 or shall be subject to both such fine and imprisonment. Each such act shall constitute a separate offense.”

OCGA Section

PRIVILEGED STATUS OF LETTERS, REPORTS, ETC., RELATING TO ADMINISTRATION OF CHAPTER. “All letters, reports, communications, or any other matters, either oral or written, from the employer or employee to each other or to the department or any of its agents, representatives, or employees, which letters, reports, or other communications shall have been written, sent, delivered, or made in connection with the requirements of the administration of this chapter, shall be absolutely privileged and shall not be made the subject matter or basis for any action for slander or libel in any court of the State of Georgia.”

Page 2 of 3 |

EMPLOYER NOTIFICATION TO EMPLOYEES OF THE

AVAILABILITY OF UNEMPLOYMENT COMPENSATION

Unemployment Insurance (UI) benefits are available to workers who are unemployed and who meet the state UI eligibility laws. You may file a UI claim the first week that your employment stops or your work hours are reduced.

For assistance or more information about filing a UI claim visit the Georgia Department of Labor’s website at dol.georgia.gov. You will need to provide the following information in order for the state to process your claim:

•Your legal name as it appears on your Social Security card

•Social Security Number

•Georgia Driver’s License, if applicable

•Work authorization documents, if you are not a U.S. citizen

•Bank’s routing number and your account number, if you want to receive your benefit payments via direct deposit

•Work history information for the last 18 months, to include your separation notice, if provided by your employer You can file your claim online using any Internet accessible device. Follow these steps to file your claim online:

1.Go to dol.georgia.gov.

2.Select Apply for Unemployment Benefits.

3.Answer the questions completely.

4.Download and read the UI Claimant Handbook. Information in this handbook provides detailed instructions regarding the unemployment insurance (UI) program and the “Next Steps” to follow after submitting your claim.

5.Record your Confirmation Number. A confirmation email will be sent to the email address provided when completing the claim application. (If you do not receive a confirmation number, the application was not successfully completed. It remains on the system for 24 hours. Log in again and make sure you select FINISH to receive a confirmation number.)

If you have questions about the status of your claim, you can check the status of your claim online at dol.georgia.gov by using My UI (Check My UI Claim Status).

For assistance, contact UI Customer Service at 1.877.709.8185

Page 3 of 3 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The Separation Notice for Georgia is used to document the reasons for an employee's separation from work. |

| Governing Law | This form is mandated by the Employment Security Law, OCGA Section 34-8-190(c). |

| Completion Requirement | Employers must complete this notice for every worker who leaves employment, regardless of the reason. |

| Employee Information | Key details required include the employee's name, Social Security Number, and period of last employment. |

| Payment Information | Includes details on any payments made to the employee, excluding vacation pay and earned wages. |

| Separation Reasons | Employers must specify if the separation is due to lack of work or other reasons, and provide full details when applicable. |

| Minimum Earnings | The form requires confirmation of whether the employee earned at least $7,300.00 during their employment. |

| Submission Instructions | Upon completion, this notice should be provided to the employee, and should accompany any unemployment insurance claims. |

Guidelines on Utilizing Separation Notice For Ga

After completing the Separation Notice for Georgia form, it is important to provide the employee with a copy. They may need it for filing an unemployment insurance claim. Here are straightforward steps to fill out the form accurately.

- Write the employee's name as it appears in your records.

- Fill in the employee's Social Security Number and verify its accuracy.

- Enter the dates for the employee's last period of employment, indicating both the start and end dates.

- Select the reason for separation. If it is "LACK OF WORK," check the box. If it's for another reason, provide detailed explanations.

- Document any payments made to the employee, such as severance or wages-in-lieu of notice. Specify the type of payment and the amount.

- Indicate if the employee earned at least $7,300 during their employment. If not, specify the amount and their average weekly wage.

- Provide the employer's name and complete mailing address, including city, state, and zip code.

- Include the employer's telephone number with area code.

- Complete the employer's DOL account number.

- Sign the form, providing the title of the person signing it, and date the completion.

What You Should Know About This Form

What is the purpose of the Separation Notice for Georgia form?

The Separation Notice serves as an official documentation that informs both employees and the Georgia Department of Labor about the reasons behind an employee's separation from their job. This information is essential for determining eligibility for unemployment benefits and ensuring that processes align with state regulations.

Who is required to complete the Separation Notice?

Employers are responsible for completing the Separation Notice for every worker who leaves their employment, regardless of the reason. This includes separations due to layoffs, resignations, terminations, or any other circumstances affecting the employer-employee relationship.

What information must be included in the Separation Notice?

The form requires several key details, including the employee's name, Social Security Number, period of last employment, reason for separation, and information regarding any severance or other payments made. Additionally, the employer’s name and contact information must be provided.

What are acceptable reasons for separation listed on the form?

The form specifies several reasons for separation, among them “lack of work” and other circumstances that need to be detailed clearly. If a reason other than lack of work applies, it is crucial for the employer to provide complete and accurate information to avoid potential issues with unemployment claims.

What are the consequences of providing false information on the Separation Notice?

Providing false or misleading information can lead to serious legal consequences for the employer. Penalties may include fines or even imprisonment. The law is strict about transparency and accuracy, aiming to protect workers’ rights to unemployment benefits.

How should the Accuracy of information be ensured?

Employers should verify the accuracy of all information, especially the employee’s name and Social Security Number. Double-checking these details can prevent unnecessary complications or delays in processing unemployment claims.

What should an employee do if they need to file for unemployment benefits?

Employees should take the Separation Notice to the local Georgia Department of Labor field office when filing a claim for unemployment benefits. This document serves as crucial evidence of their employment status and reason for separation.

How can an employee file a claim for unemployment insurance benefits?

To file a claim, individuals should visit the Georgia Department of Labor’s website. They will need to provide personal information such as their Social Security Number and work authorization documents, along with their work history for the past 18 months.

Is direct deposit available for unemployment benefits?

Yes, employees can opt to receive their unemployment benefit payments via direct deposit. To do this, they will need to provide their bank's routing number and their account number during the claim process.

Who can employees contact if they have questions about their unemployment claim?

Employees may reach out to the Georgia Department of Labor’s Customer Service at 1-877-709-8185 for assistance or email Customer.Service@gdol.ga.gov. They are available Monday through Friday from 8:00 a.m. to 4:30 p.m. EST.

Common mistakes

Completing the Separation Notice for Georgia can be straightforward, but there are common mistakes that may cause delays or complications. One major error occurs when the employee’s name is not accurately reported. It is crucial to enter the name as it appears in official records. If the name on the Social Security card differs, both names should be listed. Failing to do this can lead to confusion during processing.

Another frequent mistake involves the reporting of the employee's Social Security Number. Employers should verify the accuracy of the SSN before submitting the form. An incorrect number will result in issues when the employee applies for unemployment benefits, which can prolong the process of obtaining assistance. This step requires careful attention to detail.

Additionally, improperly citing the reason for separation can create significant problems. When an employer checks the box for “LACK OF WORK,” they need to ensure it genuinely reflects the circumstances. If the separation was for a different reason, that should be clearly stated in the provided space. If the details exceed the available space, including a separate sheet may be necessary. Misrepresentation here can lead to inquiries or disputes later.

Lastly, many employers fail to check the earnings box correctly. This means confirming if the employee has earned at least $7,300 during their employ. If the answer is “NO,” the actual amount earned must be filled in. Errors in this section can affect the employee’s eligibility for unemployment benefits. Accurate reporting protects both the employer and the employee.

Documents used along the form

When completing a Separation Notice in Georgia, several other forms and documents may also be necessary. These documents help both employers and employees navigate the situation more effectively. Here’s a brief overview of essential forms that are often used alongside the Separation Notice.

- Unemployment Insurance Claim Form: This form is submitted by employees seeking unemployment benefits after job loss. It collects personal and work history information relevant to eligibility.

- Wage Verification Form: Employers use this document to confirm the wages earned by employees over a specific period. Accurate wage verification assists in determining benefit amounts.

- Employee Rights Notice: This notice informs employees of their rights regarding unemployment benefits and related procedures. Employers must provide this information at the time of separation.

- Severance Agreement: If applicable, this agreement outlines the terms of any severance pay or benefits that may be given to the separated employee. It helps to clarify expectations on both sides.

- Final Pay Stub: Employers must issue the final paycheck to employees, which indicates the last wages earned, including any deductions or withholdings.

- IRS Form W-2: This tax form must be provided to employees showing wages paid and taxes withheld during the tax year. Employees need this document for tax filing purposes.

- COBRA Notice: For employees who may qualify for continued health insurance after separation, this notice explains their rights under the Consolidated Omnibus Budget Reconciliation Act (COBRA).

- Record of Employment: Employers may need to provide a document detailing the employee’s position, dates of employment, and any significant contributions. This record can be helpful for the employee's future job searches.

Having these documents on hand can streamline the separation process and ensure that both parties have the necessary information for future actions. Understanding these accompanying forms is essential for a smooth transition during employment separation.

Similar forms

- Employee Termination Checklist: Similar to the Separation Notice, this document outlines the necessary steps and items that need to be completed when an employee leaves an organization. It ensures compliance with company policies and labor laws.

- Final Pay Calculation Sheet: This form details the final pay owed to an employee upon termination, including accrued vacation, severance, and other compensations, making it an essential part of processing the end of employment.

- Unemployment Insurance Claim Form: This document is submitted by employees seeking benefits after separation. It requires information about the employee's prior work, similar to what is documented in the Separation Notice.

- Notice of Employment Separation: This is another format for employers to communicate an employee’s departure, including reasons and final compensation information, paralleling the purpose of the Separation Notice.

- Exit Interview Form: Used to document the employee’s feedback during their exit interview, it serves as a tool for understanding the reasons behind the separation, informative for future workforce decisions.

- Severance Agreement: This legal document outlines the terms, benefits, and considerations for an employee when they leave a company, often including similar financial details as found in the Separation Notice.

- IRS Form 1099-MISC: When applicable, this form is used to report various types of payments to employees after separation, ensuring accurate reporting of what they receive, which can be recorded in the Separation Notice.

- Employee Reference Request Form: A template utilized by prospective employers to verify the previous employment information of the individual, corresponding with the details provided in the Separation Notice.

- Employment Verification Letter: Issued by employers, this letter confirms employment status and details, which may include reasons for separation, much like the data captured in the Separation Notice.

- Employer’s Responsibility Notice: A document outlining the legal responsibilities of the employer regarding the termination process, highlighting the obligations similar to the instructions provided in the Separation Notice.

Dos and Don'ts

Filling out the Separation Notice for Georgia (DOL-800) is essential for both employers and employees. Here are nine important do's and don'ts to keep in mind:

- Do ensure you have the employee’s full name as it appears on official documents.

- Do check the accuracy of the employee’s Social Security Number before submitting.

- Do clearly state the reason for separation, choosing the appropriate box or providing full details if necessary.

- Do provide the specific payment details, including amounts and types, if any payments were made at separation.

- Do date the notice accurately, reflecting the day it was handed to or mailed to the employee.

- Don't include vacation pay or any wages already earned in the payment details section.

- Don't forget to sign the notice; this step is mandatory for its validity.

- Don't submit the notice until you've reviewed all entries thoroughly to avoid errors.

- Don't treat this form as optional; it is a legal requirement for all separations.

By following these guidelines, you can help ensure a smooth process for all parties involved. Properly completing the Separation Notice not only fulfills legal obligations but also aids in maintaining clear communication regarding the separation of employment.

Misconceptions

Understanding the Separation Notice for Georgia is crucial for both employers and employees. However, several misconceptions can lead to confusion. Below is a list of common misconceptions and clarifications.

- Misconception 1: The Separation Notice is only required for employees who are laid off.

- Misconception 2: Employers can skip the Separation Notice if the employee quits.

- Misconception 3: The Separation Notice only needs to be provided if the employee requests it.

- Misconception 4: The details in the notice regarding separation reasons do not matter.

- Misconception 5: There is no deadline for providing the Separation Notice.

- Misconception 6: Only the most recent employer needs to fill out a Separation Notice.

- Misconception 7: The Separation Notice does not include information about payments made to the employee.

- Misconception 8: The form can be signed by anyone in the company.

- Misconception 9: Employees do not need the Separation Notice for unemployment claims.

- Misconception 10: Once the notice is completed, it does not need to be kept on file.

The form must be completed for all employees who leave the company, regardless of the reason, including resignations or terminations.

This is incorrect. Employers are still obliged to fill out the notice to document the separation regardless of the circumstances.

Employers must provide the notice as part of the separation process, regardless of whether the employee asks for it.

All details are crucial. Accurate reasons for separation affect future unemployment claims and potential liability.

The notice must be given immediately upon separation to ensure compliance with state laws.

Each employer who has engaged the employee must complete a notice for their specific period of employment.

It is essential to document any payments, such as severance or bonuses, in the notice to ensure clarity about compensation post-employment.

The form must be signed by an authorized agent, such as an officer or an HR representative, to be valid.

The notice is necessary as it acts as proof of employment history and separation for filing unemployment claims.

Employers should keep copies of the completed Separation Notices for their records, as they may be needed for future unemployment disputes or audits.

Key takeaways

When completing the Separation Notice For Ga form, it is essential to follow certain guidelines to ensure accurate and efficient processing. Here are key takeaways to consider:

- Complete Accuracy is Essential: Enter the employee's name and Social Security Number as they appear on official records to prevent any discrepancies.

- Detail the Employment Period: Clearly specify the dates of the employee's most recent work period, as this information is vital for processing claims.

- Specify the Reason for Separation: Choose "LACK OF WORK" if applicable. For any other reason, provide a comprehensive explanation in the designated space or attach a separate sheet if more room is needed.

- Payment Information: Document any payments made to the employee, such as severance or wages in lieu of notice, but avoid including vacation pay.

- Income Verification: Confirm whether the employee earned at least $7,300 during their employment. If not, input the actual amount earned and record the average weekly wage.

- Sign Off: Ensure that the form is signed by an authorized representative of the employer, along with their title and the date of completion.

- Employee's Responsibility: Employees must take this notice to the Georgia Department of Labor if they intend to file a claim for unemployment insurance benefits.

Following these guidelines not only facilitates the claims process but also ensures compliance with state regulations. Employers should prioritize accuracy, clarity, and timeliness when submitting this important notice.

Browse Other Templates

How to Write a Letter Requesting Donations - Enter your email address to facilitate digital communication with the Diamonds Direct Foundation.

Caqh Pro - Current practice in the state must be indicated for state licenses.

Transcript Retrieval Request,Academic Record Request Form,Official Transcript Order,Student Transcript Application,Transcript Delivery Request,Bluefield College Transcript Form,Transcription Request Document,Educational Record Request Form,Transcript - Date the form to indicate when the request was made.