Fill Out Your Seterus Authorization Form

The Seterus Authorization Form serves an essential role for borrowers seeking to manage their loans effectively while designating trusted third parties to assist in negotiations and communications with Seterus, Inc. This form not only empowers individuals to authorize the release of comprehensive loan information—such as payment history, amounts due, and credit transactions—but also includes provisions to negotiate payment plans and other loss mitigation strategies. By identifying authorized agents, borrowers can ensure that specific individuals or entities are empowered to act on their behalf. Moreover, this authorization is designed to safeguard both parties: borrowers release Seterus, Inc. from liability resulting from these disclosures, streamlining the process of addressing escrow deficiencies and agreements necessary for certain loss mitigation options. It's important to note that this authorization remains valid until a written revocation is received, adding an element of control for borrowers. Understanding the nuances of this form can not only ease communication with lenders but may also provide vital assistance to those navigating financial difficulties.

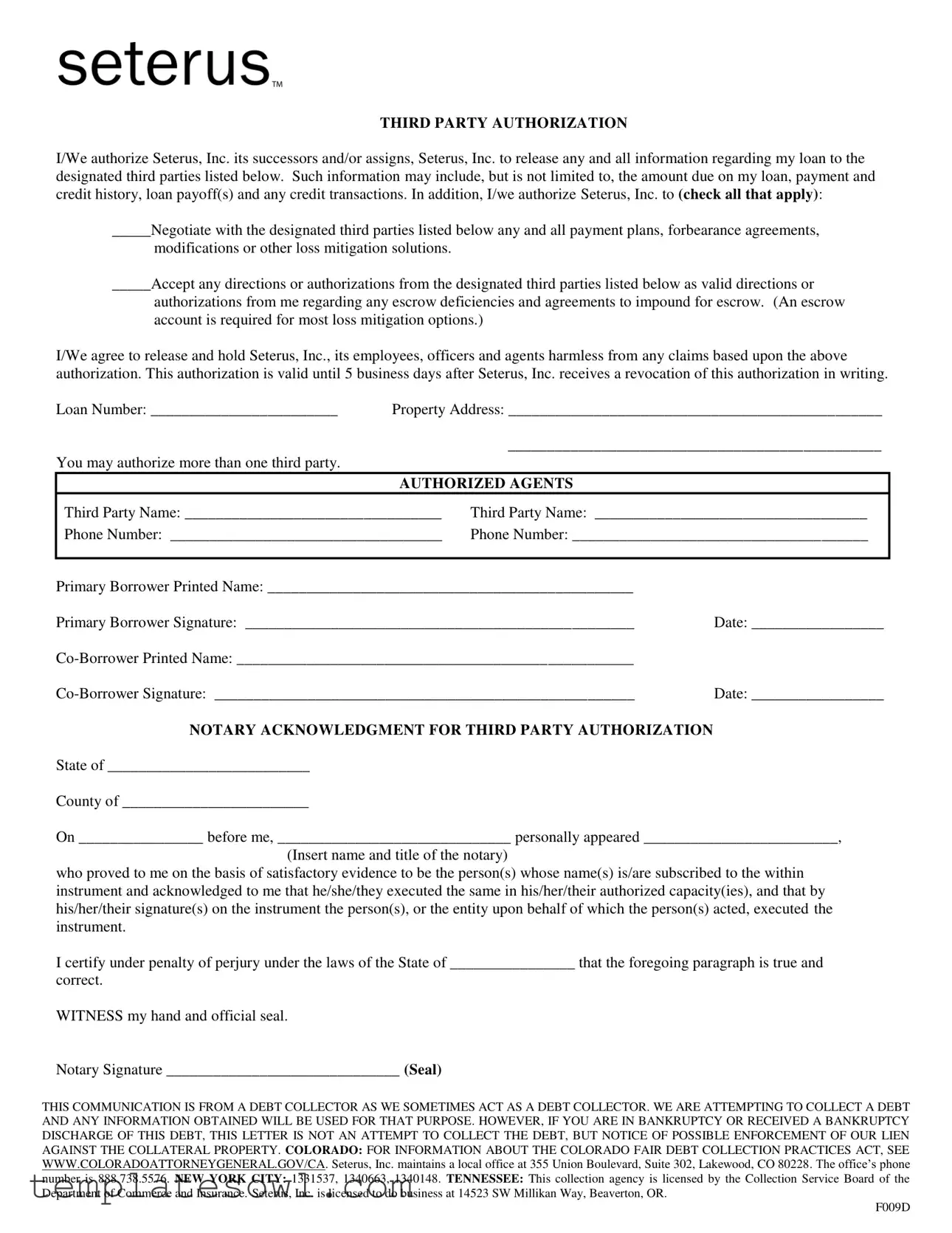

Seterus Authorization Example

THIRD PARTY AUTHORIZATION

I/We authorize Seterus, Inc. its successors and/or assigns, Seterus, Inc. to release any and all information regarding my loan to the designated third parties listed below. Such information may include, but is not limited to, the amount due on my loan, payment and credit history, loan payoff(s) and any credit transactions. In addition, I/we authorize Seterus, Inc. to (check all that apply):

_____Negotiate with the designated third parties listed below any and all payment plans, forbearance agreements,

modifications or other loss mitigation solutions.

_____Accept any directions or authorizations from the designated third parties listed below as valid directions or

authorizations from me regarding any escrow deficiencies and agreements to impound for escrow. (An escrow account is required for most loss mitigation options.)

I/We agree to release and hold Seterus, Inc., its employees, officers and agents harmless from any claims based upon the above authorization. This authorization is valid until 5 business days after Seterus, Inc. receives a revocation of this authorization in writing.

Loan Number: ________________________ |

Property Address: ________________________________________________ |

||

|

|

________________________________________________ |

|

You may authorize more than one third party. |

|

|

|

|

AUTHORIZED AGENTS |

|

|

Third Party Name: _________________________________ |

Third Party Name: ___________________________________ |

||

Phone Number: ___________________________________ |

Phone Number: ______________________________________ |

||

|

|

||

Primary Borrower Printed Name: _______________________________________________ |

|

||

Primary Borrower Signature: __________________________________________________ |

Date: _________________ |

||

|

|||

Date: _________________ |

|||

NOTARY ACKNOWLEDGMENT FOR THIRD PARTY AUTHORIZATION State of __________________________

County of ________________________

On ________________ before me, ______________________________ personally appeared _________________________,

(Insert name and title of the notary)

who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under penalty of perjury under the laws of the State of ________________ that the foregoing paragraph is true and

correct.

WITNESS my hand and official seal.

Notary Signature ______________________________ (Seal)

THIS COMMUNICATION IS FROM A DEBT COLLECTOR AS WE SOMETIMES ACT AS A DEBT COLLECTOR. WE ARE ATTEMPTING TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. HOWEVER, IF YOU ARE IN BANKRUPTCY OR RECEIVED A BANKRUPTCY DISCHARGE OF THIS DEBT, THIS LETTER IS NOT AN ATTEMPT TO COLLECT THE DEBT, BUT NOTICE OF POSSIBLE ENFORCEMENT OF OUR LIEN AGAINST THE COLLATERAL PROPERTY. COLORADO: FOR INFORMATION ABOUT THE COLORADO FAIR DEBT COLLECTION PRACTICES ACT, SEE WWW.COLORADOATTORNEYGENERAL.GOV/CA. Seterus, Inc. maintains a local office at 355 Union Boulevard, Suite 302, Lakewood, CO 80228. The office’s phone number is 888.738.5576. NEW YORK CITY: 1331537, 1340663, 1340148. TENNESSEE: This collection agency is licensed by the Collection Service Board of the Department of Commerce and Insurance. Seterus, Inc. is licensed to do business at 14523 SW Millikan Way, Beaverton, OR.

F009D

Form Characteristics

| Fact Name | Description |

|---|---|

| Third Party Authorization | The Seterus Authorization form allows borrowers to authorize Seterus, Inc. to share their loan information with designated third parties. |

| Information Shared | The authorization includes the release of loan payment history, amounts due, and details about credit transactions. |

| Negotiation Rights | Borrowers can authorize Seterus, Inc. to negotiate payment plans and forbearance agreements with third parties. |

| Release of Liability | By signing the form, borrowers agree to release Seterus, Inc. from any claims that may arise from the authorization. |

| Duration of Authorization | The authorization remains valid until five business days after a written revocation is received by Seterus, Inc. |

| Multiple Agents | Borrowers may designate more than one third party on the authorization form to receive information. |

| Notary Requirement | A notary acknowledgment is required to validate the third-party authorization in many jurisdictions. |

| State-Specific Laws | In Tennessee, Seterus, Inc. complies with the Collection Service Board regulations while handling transactions. |

Guidelines on Utilizing Seterus Authorization

Completing the Seterus Authorization form allows you to designate third parties to receive information related to your loan. Following the steps outlined below ensures accuracy and compliance with the process.

- Obtain the Seterus Authorization form from a reliable source.

- Enter your Loan Number in the designated section.

- Clearly write the Property Address associated with your loan.

- List the names of the Authorized Agents (third parties) in the provided spaces.

- Include the phone numbers for each authorized agent next to their names.

- Both primary and co-borrowers must print their names in the respective fields.

- Sign and date the form in the designated areas for both the primary and co-borrowers.

- Obtain a notary acknowledgment by having a licensed notary public witness the signatures.

Once all steps have been carefully followed, submit the completed form to Seterus, Inc. Ensure you keep a copy for your records. The authorization will remain valid until a written revocation is received by Seterus, Inc.

What You Should Know About This Form

What is the Seterus Authorization form used for?

The Seterus Authorization form allows you to give permission to Seterus, Inc. to share detailed information about your loan with specific third parties. This information can include the amount due, credit history, payment records, and any transactions related to your loan. You can also authorize Seterus to negotiate payment plans or modifications on your behalf.

Who can I authorize to receive information about my loan?

You can authorize multiple third parties to receive information regarding your loan. These could be financial advisors, family members, or anyone else you trust to assist you in managing your loan. Simply provide their names and contact numbers on the form, and make sure they are fully aware of the role they will be playing.

How long does this authorization last?

The authorization you give remains in effect until you decide to revoke it. You can revoke your authorization by providing Seterus with written notice, and it will only be terminated five business days after they receive your request.

Do I need a notary to sign the Seterus Authorization form?

Common mistakes

Filling out the Seterus Authorization form can seem straightforward, but several common mistakes can lead to delays or complications. One frequent mistake is failing to clearly list all authorized agents. If the names and contact information for third parties are missing or incomplete, Seterus may not be able to communicate appropriately with these individuals. Ensure that you provide accurate and thorough details for each authorized party.

Another common error is neglecting to sign the form where required. Both the primary borrower and co-borrower must sign and date the document. Missing signatures can render the authorization invalid. To avoid this pitfall, double-check that all necessary signatures are present before submitting the form.

Using incorrect or outdated information is also a significant mistake people often make. This includes inaccuracies in the loan number or property address. If the details do not match what Seterus has on file, it may lead to unnecessary delays. It's essential to verify all information before filling it in to ensure it is correct and current.

Lastly, not understanding the scope of authorization can lead to confusion. The form allows you to check options for negotiation and acceptance of directions from third parties. If you do not select these options, Seterus may be limited in what they can do on your behalf. Make sure you read through each section carefully and check all that apply to your situation, as this can significantly impact the effectiveness of the authorization.

Documents used along the form

When completing a Seterus Authorization form, several additional documents are often needed to enhance the process of authorizing third parties regarding your loan. These documents can streamline communication and ensure that all parties involved have the necessary information to make informed decisions. Below are a few key forms that are commonly used alongside the Seterus Authorization form.

- Power of Attorney: This legal document allows you to appoint someone else to make decisions on your behalf. In the context of loan management, it can empower your agent to negotiate with lenders and handle financial matters.

- Loan Modification Request Form: If you're seeking to change the terms of your loan, this form is essential. It details your request for a modification and includes information about your financial situation, which can help the lender assess your eligibility for changes.

- Hardship Letter: This is a personal letter expressing the reasons for your request for loan assistance or modification. It typically explains your financial difficulties and provides context for your situation. It’s often required to support your application for relief.

- Authorization to Release Information Form: Similar to the Seterus Authorization form, this document authorizes a specific entity to receive sensitive information about your loan. It helps ensure that your designated third parties are legally able to access your loan details.

By having these documents ready, you can facilitate smoother communication with your lenders and authorized third parties. This preparation can play a critical role in effectively managing your loan situation.

Similar forms

The Seterus Authorization form is similar to a variety of other documents that share the purpose of granting permission to third parties to access or handle a person's or entity's information regarding financial matters. Here are nine documents that exhibit comparable features:

- Power of Attorney (POA): This legal document allows an individual to appoint someone else to make decisions on their behalf, including financial transactions, similar to how the Seterus Authorization permits designated third parties to act regarding loan information.

- Health Care Proxy: A health care proxy allows an individual to designate someone to make medical decisions on their behalf. Both forms involve granting authority to act based on the principal’s needs.

- Release of Information Form: This document authorizes the release of specific information to third parties, much like the Seterus Authorization allows the sharing of loan details.

- Consent to Share Information Form: Similar to the Seterus form, this document is used to give permission for entities to share personal information with designated individuals or organizations.

- Loan Modification Agreement: This document outlines the terms of adjusting a loan, and it often requires authorization from the borrower, akin to how the Seterus Authorization allows third parties to negotiate loan modifications.

- Tenant Authorization to Release Rental History: This form permits property owners or landlords to share a tenant's rental history with another party, echoing the authorization concept in the Seterus form.

- Financial Power of Attorney for Real Estate: This variant of the POA is specifically designed for handling real estate transactions, paralleling the Seterus form in authorizing financial decisions.

- Escrow Instructions: This document provides guidance to a third party acting as an escrow agent, similar to the escrow directions permitted in the Seterus Authorization.

- Third-Party Payment Authorization: This document allows a third party to make payments on behalf of an individual, mirroring the Seterus Authorization in terms of allowing third-party involvement in financial matters.

Dos and Don'ts

When completing the Seterus Authorization form, there are specific actions to take and avoid. Below is a helpful list to guide you:

- DO ensure that all required sections are filled out completely, including loan number and property address.

- DO clearly list all authorized third parties and their phone numbers to avoid confusion.

- DO check the appropriate boxes for the services you authorize Seterus, Inc. to perform on your behalf.

- DO sign and date the form to make it valid before submitting it.

- DO keep a copy of the completed form for your records.

- DON'T leave any sections blank, especially those that require your signature and date.

- DON'T list unauthorized individuals, as this could lead to issues later.

- DON'T forget to have the document notarized if required—this step is crucial.

- DON'T provide false information; doing so could result in legal complications.

- DON'T assume your authorization is permanent; remember, it remains valid only until you revoke it.

Follow these guidelines to ensure a smooth and effective process when filling out your Seterus Authorization form.

Misconceptions

Understanding the Seterus Authorization form is critical for borrowers, yet various misconceptions surround its function and implications. Below are nine common misunderstandings, each explained for clarity.

- The Seterus Authorization form is only for one-time use. Many believe that this authorization is limited to a single instance. In reality, it is valid until the borrower revokes it in writing, offering ongoing flexibility.

- Signing the form means I have to give up complete control of my loan. This is false. While the form allows third parties to access information, you retain the ultimate decision-making power over your loan and any agreements made.

- Third parties cannot be multiple individuals or entities. The form allows the borrower to list multiple third parties, clarifying that more than one authorized agent can interact with Seterus on their behalf.

- This form eliminates the need for my involvement in loan negotiations. On the contrary, the authorization simply permits third parties to negotiate on one’s behalf; however, the borrower remains involved in the process.

- All information about my loan will be shared with third parties. Information shared is limited to what is specified in the authorization. Borrowers can choose the scope of the information shared, ensuring privacy where desired.

- I must have a notary witness my signature for the authorization to be valid. While notarization provides an added layer of verification, it is not strictly required to make the authorization effective.

- Once I provide authorization, I cannot change my mind. Borrowers have the right to revoke the authorization at any time. A simple written revocation sent to Seterus will suffice.

- The form could affect my credit score negatively. Signing the authorization does not inherently impact credit. The negotiations undertaken by authorized agents may affect terms, but not credit directly.

- Seterus will automatically take action on behalf of my third-party agent. The form grants the agent authority to act, but you must still authorize specific actions. Seterus will not proceed without clear directives from the borrower.

Accurate understanding of these points can significantly empower borrowers when navigating their loan agreements. Properly addressing these misconceptions ensures informed decisions are made regarding one’s financial obligations.

Key takeaways

When dealing with the Seterus Authorization form, there are essential points to consider to ensure you complete it correctly and fully understand its implications.

- Understand the Purpose: The form allows you to authorize Seterus, Inc. to share information about your loan with designated third parties. This information can include payment history and loan balance.

- Negotiate Payment Solutions: By checking the appropriate boxes, you can permit Seterus, Inc. to negotiate payment plans or loan modifications on your behalf with those third parties.

- Escrow Responsibilities: It’s important to note that directions from authorized third parties regarding escrow deficiencies will be considered valid, so choose your third parties carefully.

- Multiple Authorizations: You can list more than one third party on the form, providing flexibility in who can access your loan details.

- Revoke Authorization: This authorization lasts until you submit a written revocation, which must be received by Seterus, Inc. within five business days.

- Notary Acknowledgment: The form may require notarization to validate the authorization. Ensure you complete this step if applicable, as it confirms your identity and intent.

- Legal Implications: Be aware that signing the form holds Seterus, Inc., including its employees and agents, harmless from any claims based on the information you authorize to be shared.

Completing the Seterus Authorization form accurately is crucial for protecting your interests while ensuring a smooth process for any loan negotiations. Pay close attention to details, and don't hesitate to seek assistance if needed.

Browse Other Templates

Inheritance Tax Nj Parent to Child - Requesting an extension can ease the burden during a difficult time for families.

Bedbathandbeyond Careers - Upload your CV to support your application.