Fill Out Your Seterus Short Sale Packet Form

The Seterus Short Sale Packet form serves as a crucial document for homeowners facing financial hardships and seeking to sell their property under challenging circumstances. This comprehensive packet gathers essential information that the mortgage servicer requires to evaluate a homeowner's situation. Starting with general applicant details, it prompts for information such as the borrower’s name, address, contact numbers, and loan specifics. One of the form's central elements is its hardship section, where homeowners can select the reason for their financial difficulty—ranging from death or illness to unemployment or excessive obligations. Moreover, it inquires about the property's current status, occupancy type, and any existing offers, adding further context to the homeowner's unique circumstances. The form also collects detailed income and expense information to paint a holistic picture of the applicant's financial state. This includes household income sources, monthly living expenses, assets, and other financial considerations, ensuring the servicer has a complete understanding to make informed decisions. Throughout this process, the Seterus Short Sale Packet is designed to protect the homeowner's interests while facilitating transparent communication with the lender, offering a structured path towards resolution amid financial uncertainty.

Seterus Short Sale Packet Example

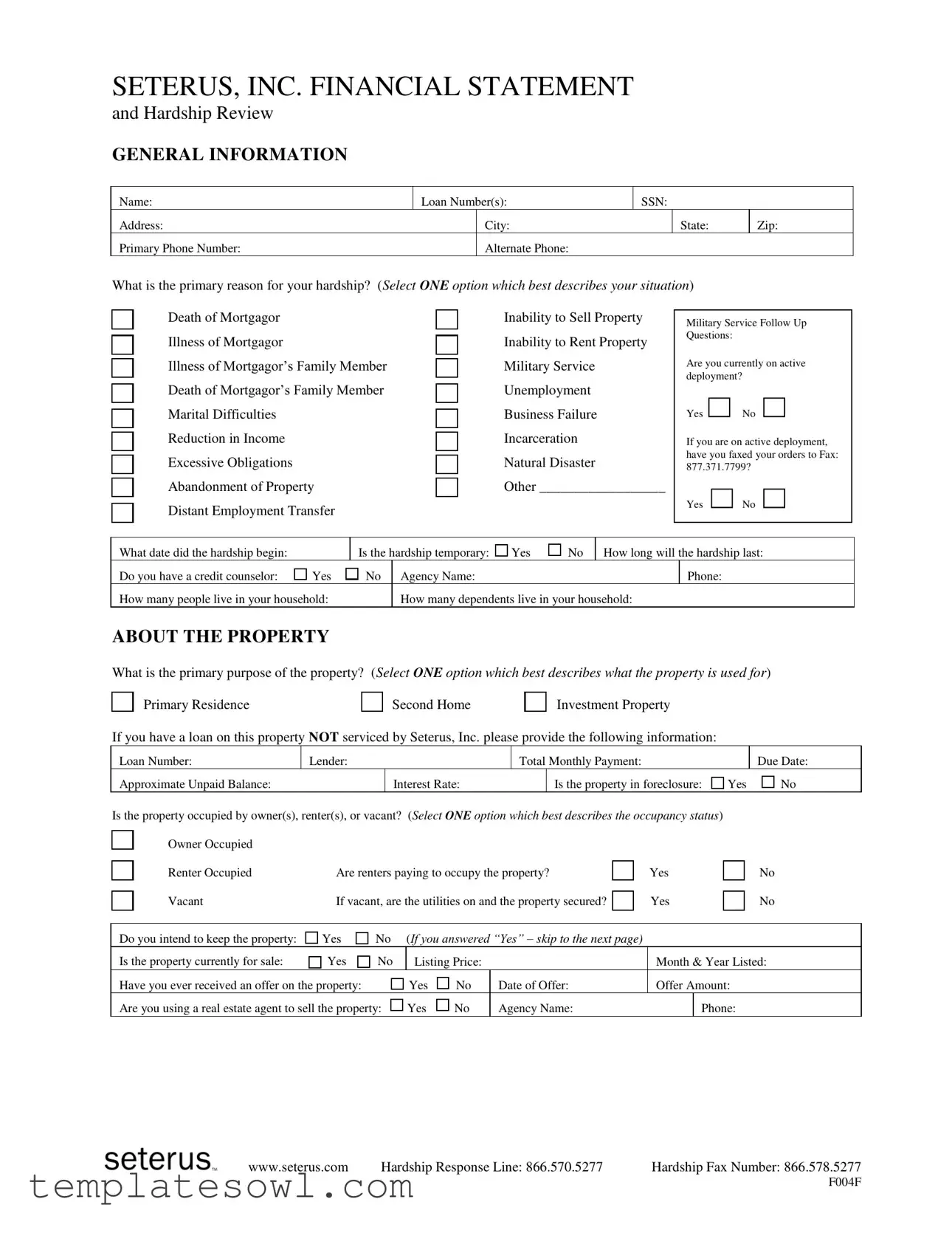

SETERUS, INC. FINANCIAL STATEMENT

and Hardship Review

GENERAL INFORMATION

Name: |

Loan Number(s): |

SSN: |

|

||

Address: |

|

City: |

|

State: |

Zip: |

Primary Phone Number: |

|

Alternate Phone: |

|

|

|

What is the primary reason for your hardship? (Select ONE option which best describes your situation)

Death of Mortgagor

Illness of Mortgagor

Illness of Mortgagor’s Family Member

Death of Mortgagor’s Family Member

Marital Difficulties

Reduction in Income

Excessive Obligations

Abandonment of Property

Distant Employment Transfer

Inability to Sell Property Inability to Rent Property Military Service Unemployment Business Failure Incarceration

Natural Disaster

Other __________________

Military Service Follow Up Questions:

Are you currently on active deployment?

Yes

No

No

If you are on active deployment, have you faxed your orders to Fax: 877.371.7799?

Yes

No

No

What date did the hardship begin: |

|

Is the hardship temporary: |

Yes |

No |

How long will the hardship last: |

||

Do you have a credit counselor: |

Yes |

No |

Agency Name: |

|

|

|

Phone: |

How many people live in your household: |

|

How many dependents live in your household: |

|||||

ABOUT THE PROPERTY

What is the primary purpose of the property? (Select ONE option which best describes what the property is used for)

Primary Residence

Primary Residence

Second Home

Second Home

Investment Property

Investment Property

If you have a loan on this property NOT serviced by Seterus, Inc. please provide the following information:

Loan Number: |

Lender: |

|

|

|

|

|

|

Total Monthly Payment: |

|

|

|

|

Due Date: |

||||

Approximate Unpaid Balance: |

|

|

|

Interest Rate: |

|

|

Is the property in foreclosure: |

Yes |

No |

||||||||

Is the property occupied by owner(s), renter(s), or vacant? (Select ONE option which best describes the occupancy status) |

|

|

|

||||||||||||||

|

Owner Occupied |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Renter Occupied |

Are renters paying to occupy the property? |

Ye |

|

Yes |

|

|

No |

|||||||||

|

Vacant |

If vacant, are the utilities on and the property secured? |

|

|

Yes |

|

|

No |

|||||||||

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you intend to keep the property: |

Yes |

No |

|

(If you answered “Yes” – skip to the next page) |

|

|

|

|

|

||||||||

Is the property currently for sale: |

Yes |

No |

|

Listing Price: |

|

|

|

|

|

Month & Year Listed: |

|||||||

Have you ever received an offer on the property: |

|

|

|

Yes |

No |

Date of Offer: |

|

|

Offer Amount: |

|

|||||||

Are you using a real estate agent to sell the property: |

|

Yes |

No |

Agency Name: |

|

|

|

Phone: |

|

||||||||

www.seterus.com |

Hardship Response Line: 866.570.5277 |

Hardship Fax Number: 866.578.5277 |

F004F

HOUSEHOLD INCOME

List any income from any members of the household who contribute to the mortgage. Indicate “self” if you are self employed.

Name of Individual: |

Gross Pay: |

Total Deductions: |

Net Pay (Less Deductions): |

||

Name of Employer: |

Payment Schedule: |

Weekly |

Biweekly |

Twice a Month |

Monthly |

Name of Individual: |

Gross Pay: |

Total Deductions: |

Net Pay (Less Deductions): |

||

Name of Employer: |

Payment Schedule: |

Weekly |

Biweekly |

Twice a Month |

Monthly |

Name of Individual: |

Gross Pay: |

Total Deductions: |

Net Pay (Less Deductions): |

||

Name of Employer: |

Payment Schedule: |

Weekly |

Biweekly |

Twice a Month |

Monthly |

Name of Individual: |

Gross Pay: |

Total Deductions: |

Net Pay (Less Deductions): |

||

Name of Employer: |

Payment Schedule: |

Weekly |

Biweekly |

Twice a Month |

Monthly |

Name of Individual: |

Gross Pay: |

Total Deductions: |

Net Pay (Less Deductions): |

||

Name of Employer: |

Payment Schedule: |

Weekly |

Biweekly |

Twice a Month |

Monthly |

OTHER MONTHLY INCOME

Overtime / Commissions / Bonuses:

Other Job(s) Not Previously Reported:

Child Support Received:

Alimony Received:

.00 |

Unemployment: |

.00 |

SSI / Disability: |

.00 |

Welfare / Food Stamps: |

.00 |

Other Income: |

.00

.00

.00

.00

Rental Income:

.00

MONTHLY EXPENSES

Total amount paid toward all car payments: Total amount paid on all credit cards:

Total amount paid on other loans / lines of credit:

.00

.00

.00

MONTHLY LIVING EXPENSES

Food:

Child Care:

Clothes:

Gas / Electric:

Water / Sewer / Garbage: Phone(s):

Gas / Fuel for Vehicle(s): Bus / Transit / Parking:

.00 |

HOA Dues / Fees: |

.00 |

Medical Bills: |

.00 |

Prescription Drugs: |

.00 |

Car Insurance: |

.00 |

Health Insurance: |

.00 |

Life Insurance: |

.00 |

Property Insurance: |

.00 |

Property Taxes: |

.00 Cable / Internet:

.00 Entertainment:

.00 Charitable Giving:

.00 Other:

.00 (Not deducted from payroll)

.00 (Not deducted from payroll)

.00 (Not escrowed in mortgage)

.00 (Not escrowed in mortgage)

.00

.00

.00

.00

www.seterus.com |

Hardship Response Line: 866.570.5277 |

Hardship Fax Number: 866.578.5277 |

F004F

ASSETS

Provide details of any property you own other than the loan serviced by Seterus, Inc.

Property Address: |

|

|

|

City: |

|

|

State: |

Zip: |

Is there a mortgage on this property: |

Yes |

No |

|

Loan Company Name: |

|

|||

Monthly Payment Amount: |

|

|

|

|

|

Month(s) Delinquent: |

|

|

Approximate Unpaid Balance: |

|

|

|

|

|

Approximate Value: |

|

|

Property Address: |

|

|

|

City: |

|

|

State: |

Zip: |

Is there a mortgage on this property: |

Yes |

No |

|

Loan Company Name: |

|

|||

Monthly Payment Amount: |

|

|

|

|

|

Month(s) Delinquent: |

|

|

Approximate Unpaid Balance: |

|

|

|

|

|

Approximate Value: |

|

|

List any cars you have completely paid off.

Make of Vehicle: |

Model: |

Year |

Make of Vehicle: |

Model: |

Year |

Make of Vehicle: |

Model: |

Year |

List any other significant assets such as boats, RV’s, valuable collections, jewelry or other real estate not previously reported.

Item Description:

Item Description:

Value:

Value:

CASH & ACCOUNT BALANCES

Cash On Hand: |

|

.00 |

401K / Retirement Account Balance(s): |

Checking Account Balance(s): |

|

.00 |

CD’s / Stocks / Mutual Funds: |

|

|||

|

|||

Savings Account Balance(s): |

|

|

|

|

.00 |

|

|

.00

.00

AUTHORIZATION & ACKNOWLEDGEMENT

I obtained a mortgage loan secured by the

By signing this Financial Statement, I hereby authorize the owner of the mortgage, my mortgage servicer and/or mortgage insurer to: 1) order credit reports from any credit reporting agency; 2) obtain a current property value review at my expense; 3) discuss with my real estate agent and/or credit counseling service representative and provide any information (regarding me or my loan); 4) release information regarding this or any other liens on any mortgaged properties.

THIS FINANCIAL STATEMENT IS FROM A DEBT COLLECTOR AS WE SOMETIMES ACT AS A DEBT COLLECTOR. WE ARE ATTEMPTING TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. HOWEVER, IF YOU ARE IN BANKRUPTCY OR RECEIVED A BANKRUPTCY DISCHARGE OF THIS DEBT, THIS LETTER IS NOT AN ATTEMPT TO COLLECT THE DEBT, BUT NOTICE OF POSSIBLE ENFORCEMENT OF OUR LIEN AGAINST THE COLLATERAL PROPERTY.

COLORADO: FOR INFORMATION ABOUT THE COLORADO FAIR DEBT COLLECTION PRACTICES ACT, SEE

WWW.COLORADOATTORNEYGENERAL.GOV/CA. Seterus, Inc. maintains a local office at 355 Union Boulevard, Suite 302, Lakewood, CO 80228. The office’s phone number is 888.738.5576. NEW YORK CITY: 1331537, 1340663, 1340148. TENNESSEE: This collection agency is

licensed by the Collection Service Board of the Department of Commerce and Insurance. Seterus, Inc. is licensed to do business at 14523 SW Millikan Way, Beaverton, OR. Our office hours are

___________________________________________ |

___________________________________________ |

||

BORROWER |

DATE |

DATE |

|

Nationwide Mortgage Licensing System and Registry |

S.A.F.E. Act Servicer ID Number: 2315 |

||

www.seterus.com |

Hardship Response Line: 866.570.5277 |

Hardship Fax Number: 866.578.5277 |

|

F004F

Form Characteristics

| Fact Name | Description |

|---|---|

| Primary Purpose | The form allows applicants to specify if the property is a Primary Residence, Second Home, or Investment Property. |

| Hardship Categories | Applicants must select one primary reason for their hardship from categories such as Death of Mortgagor, Illness, or Unemployment. |

| Income Information | Household income must be reported, including gross pay, deductions, and net pay for each contributing member. |

| Military Service Questions | The form includes specific questions regarding active military deployment, and whether deployment orders have been faxed. |

| State Compliance | For applicants in Colorado, the form adheres to the Colorado Fair Debt Collection Practices Act. |

| Authorization Clause | Signers authorize the mortgage owner and servicer to obtain credit reports and discuss details with specified parties. |

Guidelines on Utilizing Seterus Short Sale Packet

Completing the Seterus Short Sale Packet form is essential for processing your request. The following steps will guide you through filling out the necessary information accurately and efficiently. Make sure you have all related documents and information at hand for a smoother experience.

- General Information: Fill out your name, loan number(s), Social Security Number, address, city, state, zip code, primary phone number, and alternate phone number.

- Hardship Reason: Select one option that best describes your hardship situation from the list provided.

- Military Service Questions: If applicable, indicate whether you are on active deployment and if you have faxed your orders to the specified number.

- Hardship Details: Enter the date when your hardship began, whether it is temporary, and its expected duration. If you have a credit counselor, provide the agency name and phone number.

- Household Information: Indicate how many people live in your household and how many are dependents.

- Property Information: Choose the property’s primary purpose (primary residence, second home, or investment property) and give details about any additional loans on the property, if applicable.

- Occupancy Status: Select whether the property is owner-occupied or renter-occupied and provide information about the current occupancy status.

- Sale Information: Indicate if the property is for sale, including the listing price and listing date. Mention if you received any offers and provide details about your real estate agent if applicable.

- Household Income: List the names and income details of all household members contributing to the mortgage.

- Monthly Expenses: Itemize your total payments towards car loans, credit cards, and any other loans.

- Living Expenses: Provide details for various monthly living costs such as food, utilities, insurance, and entertainment.

- Assets: Outline any additional properties owned, vehicles, and other significant assets, including their value.

- Cash & Account Balances: Enter the balances of your cash on hand, checking, savings, and any retirement accounts.

- Authorization & Acknowledgment: Read the statement carefully. Sign and date the forms where indicated.

After completing the form, double-check all entries for accuracy. Submit the packet to the designated contact as provided on the form. It's crucial to act promptly since your situation may require immediate attention.

What You Should Know About This Form

What is the Seterus Short Sale Packet form used for?

The Seterus Short Sale Packet form is primarily used by homeowners who are experiencing financial hardship and are considering a short sale as a means to avoid foreclosure. This form collects essential information about the homeowner's financial situation, property details, and the reasons for their hardship. It helps Seterus, Inc. evaluate the homeowner's eligibility for a short sale and determine the best course of action.

What types of hardships are acceptable to qualify for a short sale?

Homeowners can select from several reasons for their hardship on the form. Acceptable reasons include, but are not limited to, unemployment, illness, marital difficulties, military service, and natural disasters. It is important for homeowners to choose the option that best reflects their situation, as this will influence the review process.

How do I fill out the household income section?

In the household income section, you should list all individuals contributing to the mortgage. Indicate each person’s gross pay, total deductions, and net pay. Additionally, detail their employment information and payment schedule—weekly, biweekly, twice a month, or monthly. This comprehensive overview helps in assessing the overall economic situation of your household.

What should I include in the monthly expenses section?

When filling out the monthly expenses section, include all recurring bills, such as car payments, credit card payments, and other loan repayments. Additionally, report living expenses, such as food, utilities, insurance, and any other relevant costs. A complete picture of your financial obligations is crucial for the review process.

Are there specific asset details that I need to provide?

Yes, the form requires information about any property owned outside of the loan with Seterus, Inc. List the address, mortgage details, and approximate values for each property. You should also include information about any cars that are owned outright, as well as other significant assets such as boats or expensive collections. This information helps clarify your financial standing.

What if I am currently deployed in the military?

If you are on active deployment, you must indicate this on the form and answer relevant follow-up questions. Additionally, you may need to provide a copy of your deployment orders by faxing them to Seterus at the specified number. Military personnel have specific protections and considerations during the short sale process.

Does filling out this form guarantee a successful short sale?

Completing the Seterus Short Sale Packet form does not guarantee that your request for a short sale will be approved. It serves as part of the application process. The final decision rests with Seterus, Inc., which will review all submitted information and determine whether the circumstances merit a short sale.

How do I submit the completed form?

Once the form is filled out completely, you can submit it via fax to the number provided by Seterus. Be sure to keep a copy for your records. The submission should be done promptly to ensure that your application is processed in a timely manner.

Who can I contact if I have questions about the form?

If you have any questions or need assistance while completing the form, you can contact the Hardship Response Line at 866.570.5277. Seterus representatives can provide guidance and clarify any uncertainties you may have regarding the short sale process.

What should I do if my hardship situation changes?

If your financial situation changes after submitting the form, it is important to update Seterus as soon as possible. Informing them of any changes can impact your eligibility for assistance and the review of your short sale application.

Common mistakes

Filling out the Seterus Short Sale Packet form can be a straightforward process, but several common mistakes can complicate matters. One frequent error occurs when individuals fail to provide complete personal information, such as their name, address, or Social Security number. Omitting these critical details might delay processing or even result in the rejection of the application.

Another common mistake involves selecting multiple reasons for hardship instead of the required single option. The form specifically asks for one primary reason, yet some applicants mistakenly check multiple boxes. This confusion could lead to a less clear understanding of the applicant's situation, prompting further questions from the lender.

Many people also overlook signing and dating the authorization section of the form. This oversight can render the application incomplete. Without a signature, the lender cannot verify the accuracy of the information provided, and this may stall progress on the application.

Some applicants forget to include all household income sources. This includes not only wages but also any other forms of income like unemployment benefits or child support. Incomplete income listings could lead to an underestimation of the household's financial situation, resulting in unfavorable outcomes.

Additionally, when reporting monthly living expenses, many applicants either underreport or neglect to include certain expenses altogether. For example, forgetting to list expenses such as insurance or utility costs can create an inaccurate financial picture. This may ultimately affect the lender’s assessment of the applicant’s ability to sustain mortgage payments.

Confusion often arises regarding the property occupancy status. Some individuals mistakenly indicate occupancy status in a manner that doesn’t accurately reflect the situation. For instance, if a property is vacant, it’s essential to clearly specify that rather than simply stating it is owner-occupied or renter-occupied, to avoid misinterpretation.

In some instances, applicants might not provide adequate details about additional properties owned, including mortgages on these properties. Complete information regarding any secondary loans, including payment details and the property's status, is essential for a thorough review.

Another repeated error is miscalculating or misreporting the amounts in financial statements, such as the total amount paid toward car payments or credit card bills. These discrepancies can lead to further inquiries and slow down the review process.

Some applicants also neglect to specify whether the hardship is temporary, or they misunderstand the actual duration of the hardship. Clearly stating whether the hardship is expected to last for a short or extended time helps the lender assess options more accurately.

Finally, thorough communication with a real estate agent or credit counselor is crucial. Many individuals fail to include this information, such as the agency name and contact number, which could be critical for the lender's assessment of the application.

Documents used along the form

When navigating the process of a short sale, several important forms and documents typically accompany the Seterus Short Sale Packet. Each of these documents plays a crucial role in assessing the borrower's financial situation and facilitating a smoother process.

- Hardship Letter: A personal letter from the borrower explaining the circumstances that led to the need for a short sale. It provides context for the financial difficulties and strengthens the case for approval.

- Listing Agreement: This document outlines the relationship between the borrower and the real estate agent selling the property. It includes details such as the listing price and duration of the agreement.

- Purchase Agreement: A formal contract between the buyer and seller of the property, indicating the terms of sale, purchase price, and any contingencies. This is crucial for indicating a valid buyer for the property.

- Tenant Lease Agreement: If the property is rented, this document provides details about the leasing terms and verifies rental income, which can impact the financial review.

- Financial Statements: Updated financial records that detail income, expenses, and assets. These documents help in assessing the borrower's financial situation comprehensively.

- Bank Statements: Recent bank statements provide a record of the borrower’s financial health and spending patterns, demonstrating both liquid assets and cash flow.

- Tax Returns: Recent tax returns can offer insights into the borrower’s overall financial picture and income stability, serving as a verification of reported income.

- Credit Report: A report detailing the borrower's credit history is often requested. It aids in evaluating the borrower’s creditworthiness and financial behavior.

- Authorization Form: This form grants permission for third parties, such as real estate agents or counsel, to communicate with the lender on behalf of the borrower. It streamlines the communication process.

Collectively, these documents work together to provide a thorough overview of the borrower's financial situation and support the short sale request. Ensuring that all relevant forms are completed and submitted can greatly enhance the chances of a successful short sale approval.

Similar forms

The Seterus Short Sale Packet form shares similarities with several other documents used in the real estate and mortgage industries. Below are five such documents and a brief description of the ways in which they are similar:

- Hardship Affidavit: Like the Seterus form, this document collects information about a borrower’s financial difficulties and reasons for requesting relief. Both require detailed disclosures about income, expenses, and the circumstances surrounding financial hardship.

- Loan Modification Application: Both documents assess the financial situation of the borrower in an effort to provide a different resolution to a distress situation. They both ask for detailed financial information to evaluate eligibility for alternative loan terms or repayment plans.

- Short Sale Agreement: This document outlines the terms and conditions under which the property will be sold for less than the owed mortgage balance. Similar to the Seterus packet, it requires a full disclosure of financial circumstances and details about the property.

- Credit Counseling Intake Form: This form gathers comprehensive information about a person's financial status, including income, debts, and expenses, akin to the data collected in the Seterus packet to evaluate the borrower's overall financial health and hardship.

- Bankruptcy Petition: While this document serves a different purpose, it similarly requires a full account of the borrower's financial situation including assets, liabilities, and income, aligning with the Seterus packet's intent to understand the borrower's overall financial distress.

Dos and Don'ts

When filling out the Seterus Short Sale Packet form, it's essential to be thorough yet cautious. Here’s a list of things you should and shouldn't do to ensure a smooth process.

- Do provide accurate information.

- Do clearly explain your hardship situation.

- Do keep copies of everything you submit.

- Do follow up with your mortgage servicer after submission.

- Don't leave any sections blank without a reason.

- Don't assume that verbal communication replaces the written form.

- Don't exaggerate or misrepresent your financial status.

- Don't forget to check for updated contact information on the form.

Filling out forms like these can be daunting. However, taking these steps seriously can help you navigate the process more effectively and ensure that your situation is understood correctly.

Misconceptions

Misconceptions about the Seterus Short Sale Packet form can create confusion. Below are eight common myths and clarifications.

- Myth 1: The packet guarantees a short sale approval.

- Myth 2: Only homeowners facing foreclosure can submit the packet.

- Myth 3: The information provided on the form is not kept confidential.

- Myth 4: You need to be late on payments to qualify.

- Myth 5: Once submitted, there’s no further communication needed.

- Myth 6: The packet only looks at current income.

- Myth 7: You have to hire a real estate agent to sell your property.

- Myth 8: The process will take an unreasonable amount of time.

Clarification: Completing the form does not guarantee approval for a short sale. It is only part of the process.

Clarification: Homeowners experiencing financial hardship, even if not in foreclosure, can submit this form.

Clarification: Information submitted is kept confidential and used solely for the purpose of evaluating your short sale request.

Clarification: You do not need to be delinquent. The form allows for preemptive action if hardships are affecting your ability to pay.

Clarification: You may be contacted for additional information or documentation after submission.

Clarification: It also considers any potential income changes and overall financial condition.

Clarification: While a real estate agent can assist, it is not mandatory to have one to complete the short sale process.

Clarification: While timing can vary, most requests are evaluated fairly quickly. Prompt response to requests can expedite the process.

Key takeaways

When dealing with the Seterus Short Sale Packet form, understanding the process and the necessary details can significantly impact your experience. Here are some key takeaways:

- Complete General Information: Ensure you fill out all personal details, such as your name, loan number, and contact information. This helps facilitate communication with your mortgage servicer.

- Clearly State Your Hardship: Identify the primary reason for your financial difficulties. Select from the provided options, as this will guide the review of your situation.

- Specify Property Details: Indicate whether the property is your primary residence, a second home, or an investment property. This classification plays a crucial role in the short sale process.

- Income Documentation: List all household income sources. This includes salaries, bonuses, and any other income to give a full picture of your financial situation.

- Accurate Expense Reporting: Record all monthly living expenses. Include items such as utility bills, groceries, and insurance payments to provide an honest representation of your financial obligations.

- Include Asset Information: Provide detailed information about other properties and significant assets you own. This transparency helps the lender in evaluating your request.

- Understand Authorization: By signing the form, you grant Seterus permission to obtain credit reports and assess property value. This is an important step towards processing your application.

- Check for Bankruptcy: If you are in bankruptcy, be aware that different rules apply. Use the appropriate channels for assistance in that case.

- Stay in Contact: Utilize the provided hardship response line for any questions or follow-ups regarding your short sale packet. Keeping communication lines open is essential.

By being thorough and precise when filling out the Seterus Short Sale Packet, you can enhance the chances of a favorable resolution to your situation. Take your time to ensure all information is accurate and up-to-date.

Browse Other Templates

What Is Mlq - Future research may build on these findings to explore best practices in school leadership.

Asq Test - Parents are encouraged to engage their child in activities before answering each question.