Fill Out Your Settlement Motor Accident Form

When you find yourself involved in a motor accident, it’s essential to understand your options for resolving the situation, especially if it’s a minor incident without injuries. The Settlement Motor Accident form facilitates a private settlement between the parties involved, allowing for a straightforward resolution without the need for legal proceedings. This form must be submitted to the appropriate reporting centers within 24 hours of the accident, regardless of whether you intend to make an insurance claim or not. Failing to report on time can affect your No Claim Discount upon renewal of your motor policy, so timely submission is crucial. The form enables both parties to agree on compensation terms, ensuring that neither party will hold the other liable if they choose that route. By choosing this agreement, you create a legally binding understanding that can simplify the claims process. If you’re insured with NTUC Income, any necessary documentation can be sent via fax or email, allowing the company to handle potential claims that arise later. This proactive approach helps protect your No Claim Discount while ensuring your information is handled securely for insurance and claims administration purposes.

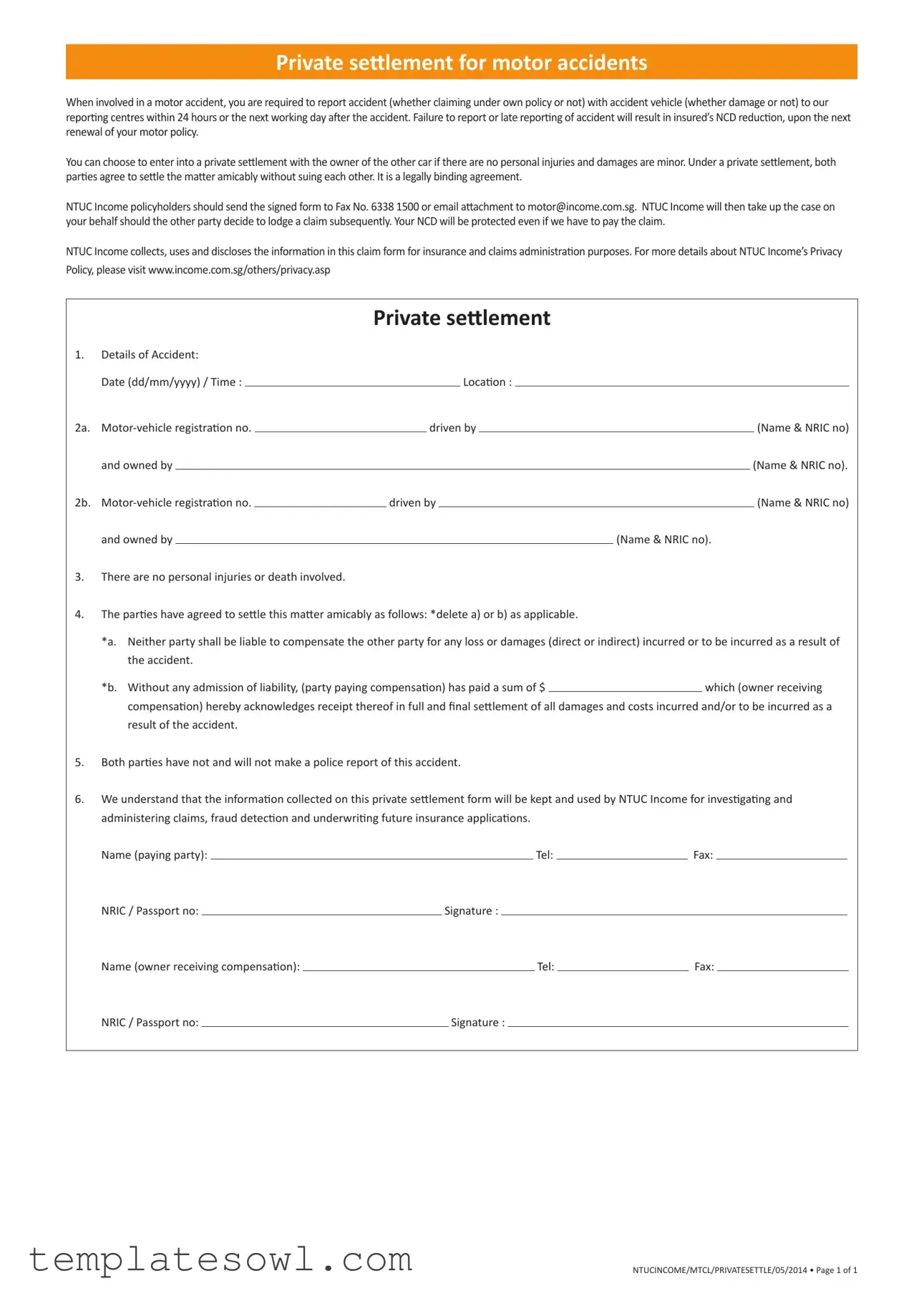

Settlement Motor Accident Example

PRIVATE SEtLEMENT FOR MOTOR ACCIDENTS

When involved in a motor accident, you are required to report accident (whether claiming under own policy or not) with accident vehicle (whether damage or not) to our reporing centres within 24 hours or the next working day ater the accident. Failure to report or late reporing of accident will result in insured’s NCD reducion, upon the next renewal of your motor policy.

You can choose to enter into a private setlement with the owner of the other car if there are no personal injuries and damages are minor. Under a private setlement, both paries agree to setle the mater amicably without suing each other. It is a legally binding agreement.

NTUC Income policyholders should send the signed form to Fax No. 6338 1500 or email atachment to motor@income.com.sg. NTUC Income will then take up the case on your behalf should the other party decide to lodge a claim subsequently. Your NCD will be protected even if we have to pay the claim.

NTUC Income collects, uses and discloses the informaion in this claim form for insurance and claims administraion purposes. For more details about NTUC Income’s Privacy

Policy, please visit www.income.com.sg/others/privacy.asp

PRIVATE SEtLEMENT

1.Details of Accident:

|

Date (dd/mm/yyyy) / Time : |

|

|

|

|

|

|

Locaion : |

|

|

|

|

|

||

2a. |

|

|

driven by |

|

|

|

|

|

(Name & NRIC no) |

||||||

|

and owned by |

|

|

|

|

|

|

|

|

|

|

(Name & NRIC no). |

|||

2b. |

|

|

driven by |

|

|

|

|

|

(Name & NRIC no) |

||||||

|

and owned by |

|

|

|

|

|

|

|

|

(Name & NRIC no). |

|||||

3.There are no personal injuries or death involved.

4.The paries have agreed to setle this mater amicably as follows: *delete a) or b) as applicable.

*a. Neither party shall be liable to compensate the other party for any loss or damages (direct or indirect) incurred or to be incurred as a result of the accident.

*b. Without any admission of liability, (party paying compensaion) has paid a sum of $ |

|

which (owner receiving |

compensaion) hereby acknowledges receipt thereof in full and final setlement of all damages and costs incurred and/or to be incurred as a

result of the accident.

5.Both paries have not and will not make a police report of this accident.

6.We understand that the informaion collected on this private setlement form will be kept and used by NTUC Income for invesigaing and administering claims, fraud detecion and underwriing future insurance applicaions.

Name (paying party): |

|

|

|

|

|

|

|

Tel: |

|

|

Fax: |

|

||

NRIC / Passport no: |

|

|

Signature : |

|

|

|

|

|

|

|

|

|||

Name (owner receiving compensaion): |

|

|

|

|

|

|

Tel: |

|

|

Fax: |

|

|||

NRIC / Passport no: |

|

|

Signature : |

|

|

|

|

|

|

|||||

NTUCINCOME/MTCL/PRIVATESETTLE/05/2014 • Page 1 of 1

Form Characteristics

| Fact Name | Description |

|---|---|

| Reporting Requirement | Accidents must be reported to the designated centers within 24 hours or by the next working day, regardless of insurance claims. |

| Consequences of Late Reporting | Failure to report within the time frame may lead to a reduction in the No Claim Discount (NCD) upon policy renewal. |

| Private Settlement Eligibility | Private settlements can occur only if there are no personal injuries and damages are minor. |

| Binding Agreement | A private settlement is a legally binding agreement, ensuring both parties resolve the matter amicably without legal action. |

| Information Use | NTUC Income collects and uses the information from the form strictly for insurance and claims administration. |

Guidelines on Utilizing Settlement Motor Accident

To properly fill out the Settlement Motor Accident form, follow these steps carefully. Ensure all relevant information is accurate, as this will facilitate the settlement process.

- Start with the Details of Accident. Enter the date in the format of dd/mm/yyyy and the time of the accident. Specify the location of the incident.

- For the Motor-vehicle registration details, provide information for both vehicles involved in the accident. Include the registration number, the name of the driver, and the NRIC number of both the driver and the vehicle owner.

- Confirm that there are no personal injuries or death involved in the accident. This is crucial for proceeding with a private settlement.

- The parties involved must agree on how to settle the matter. Select one of the following options and strike out the other:

- a. Neither party shall be liable to compensate the other party for any loss or damages (direct or indirect) incurred or to be incurred as a result of the accident.

- b. Without any admission of liability, the (party paying compensation) has paid a sum of $________, which the (owner receiving compensation) hereby acknowledges receipt thereof in full and final settlement of all damages and costs incurred and/or to be incurred as a result of the accident.

- Indicate that both parties have not and will not make a police report of this accident. This declaration is critical for the terms of the settlement.

- Lastly, fill in the personal details of both parties. This includes:

- Name of the paying party, along with their telephone number, fax number, and NRIC or passport number. Don't forget to include their signature.

- Name of the owner receiving compensation, also with their telephone number, fax number, and NRIC or passport number. Ensure their signature is included as well.

After completing these steps, send the signed form to the specified contact at NTUC Income through fax or email. This will initiate the processing of your claim.

What You Should Know About This Form

What should I do immediately after a motor accident?

It is essential to report the accident to your insurance provider within 24 hours or by the next working day, regardless of whether you are claiming under your own policy or the other party's. Delayed reporting may affect your No Claim Discount (NCD) upon renewal of your motor policy.

Can I choose to settle a motor accident privately?

Yes, if there are no personal injuries and damages are minor, both parties can agree to settle privately. This agreement allows you to resolve the matter amicably without pursuing legal action. Such a private settlement is legally binding.

How do I submit the Settlement Motor Accident form?

When you have completed the settlement form, send it to NTUC Income either via fax at 6338 1500 or as an attachment to motor@income.com.sg. Make sure all relevant information is accurately filled out to avoid delays in processing.

What happens if the other party claims later on?

NTUC Income will take up your case on your behalf if the other party decides to lodge a claim subsequently. Importantly, your No Claim Discount will remain protected even if a claim is filed, as long as proper procedures have been followed.

What information is collected in the Private Settlement form?

The form requires details including the date and time of the accident, vehicle registration numbers, details of the drivers, and a declaration that no personal injuries occurred. It also includes a section where both parties agree on the terms of the settlement.

Is it necessary to make a police report for a private settlement?

No, both parties must agree in the form that neither will file a police report regarding the accident. This is a critical condition for the private settlement to be valid.

How does NTUC Income use my information from the form?

NTUC Income collects and utilizes the information in the claim form for various purposes, such as claims administration, fraud detection, and underwriting future insurance applications. For specific details, you may refer to their Privacy Policy on their website.

What liabilities are involved in a private settlement?

In a private settlement, the parties involved typically agree that neither party will compensate the other for losses or damages resulting from the accident. Alternatively, there may be an agreement where one party compensates the other without admitting liability. This agreement effectively concludes all claims related to the incident.

Common mistakes

Filling out the Settlement Motor Accident form can be straightforward, but there are common mistakes that people often make. One significant error is failing to report the accident within 24 hours or the next working day. When individuals do not adhere to this timeline, they risk losing their No Claim Discount (NCD) upon renewal. Timeliness is critical, so it’s important to notify the proper reporting center as soon as possible.

Another mistake made by many is incomplete or incorrect information in the details of the accident. All required fields, including the date, time, and location, must be filled out accurately. Inaccurate information can lead to complications in processing claims. Double-checking this section ensures that all details reflect the situation correctly.

Many people overlook the necessity of including both motor vehicle registration numbers along with the names and NRIC numbers of the drivers and owners. Missing this information can delay the settlement process. Both parties must be identified clearly to create a legally binding agreement.

Another common error occurs when parties fail to acknowledge that there are no personal injuries or death involved. This statement is crucial for the private settlement to be valid. If personal injuries are present but not reported, it can affect the settlement agreement and legal rights of those involved.

When it comes to the agreement section, individuals sometimes misinterpret how to handle compensation. Deleting the incorrect option is essential, but not doing so may create confusion later. Parties must carefully indicate whether any compensation is being paid or if neither party is liable for damages.

Some individuals forget that they must state their intention not to report the accident to the police. This lack of clarification can lead to disputes in the future. Both parties should visibly agree on this point to prevent misunderstandings later on.

Finally, a fallible area is the submission of the form. People may neglect to send the signed form to the correct fax number or email address. Incorrect submissions can lead to delays in processing claims. It’s vital to ensure the form is sent to NTUC Income as indicated to avoid any issues.

Documents used along the form

When dealing with the aftermath of a motor accident, several additional forms and documents may be required to fully resolve the situation. Below is a list of commonly used documents that often accompany the Settlement Motor Accident form. Each document serves a specific purpose, helping to clarify the details of the accident, protect your interests, and facilitate the claims process.

- Accident Report Form: This document provides a detailed account of the accident, including the date, time, location, and circumstances. It is often used by both parties for their records and can be submitted to insurance companies.

- Claim Form: This form is needed when filing a claim with your insurance provider. It captures essential information regarding the accident, the involved parties, and any damages incurred.

- Witness Statement: If there were any witnesses to the accident, their signed statements can provide valuable evidence. These statements usually include their account of what occurred and can support your claim.

- Medical Report: If any injuries were sustained, a medical report detailing the injuries, treatment received, and prognosis may be required. This document helps substantiate any personal injury claims.

- Repair Estimates: To assess the cost of vehicle repairs, repair estimates from auto body shops are often needed. These estimates support the claims filed for damages to your vehicle.

- Insurance Policy Information: A copy of the relevant insurance policy, detailing coverage and terms of service, is important for verifying coverage during the claim process.

- Release of Liability Form: This document may be needed if one party agrees to waive their right to hold the other responsible for damages. It formalizes the agreement between both parties.

- Photographic Evidence: Photos of the accident scene, vehicle damage, and any injuries can serve as compelling evidence. These images often strengthen the position of the injured party.

- Notification Letter: Sending a letter to the insurance company to formally notify them of the accident could be beneficial. This ensures that all parties are informed and can take necessary actions.

- Settlement Agreement: If a settlement is reached, a settlement agreement outlines the terms agreed upon by both parties. It serves as an official record of the agreement and helps prevent future disputes.

Having these documents prepared and organized may significantly streamline the post-accident process. It is advisable to keep copies of all documents for your records, as they may be referenced in future discussions with your insurance company or other parties involved.

Similar forms

The Settlement Motor Accident form is not just a standalone document; it shares similarities with several other important documents used in the context of motor accidents and settlements. Understanding these parallels can clarify how they function within the insurance and accident resolution process.

- Insurance Claim Form: Similarities lie in documenting essential information about the accident, including parties involved and nature of damages. Both forms aim to facilitate processing claims, whether they are settled privately or through an insurer.

- Release of Liability Form: Like the Settlement Motor Accident form, this document is designed to protect one party from future claims. It confirms that both parties agree to settle without seeking further legal action, reflecting mutual consent to resolve the issue.

- Accident Report Form: This form provides a detailed account of the incident. While the Settlement form focuses on settling claims, the Accident Report lays out the facts, which may be referenced in further discussions or claims, establishing the groundwork for resolution.

- Mutual Settlement Agreement: Both this agreement and the Settlement Motor Accident form outline terms of resolution between parties. They serve to formalize the understanding that neither party will pursue further claims, underscoring the amicable nature of the resolution.

- Medical Release Form: While primarily utilized in cases involving personal injury, this document shares the same focus on consent and confidentiality. Both documents aim to protect the parties' rights and ensure information is handled with care, particularly relevant if injuries arise later.

- Non-Disclosure Agreement (NDA): Like the Settlement Motor Accident form, an NDA sets parameters around confidentiality. It prevents parties from discussing the settlement details publicly, ensuring that the resolution remains private, thus protecting both parties' interests.

- Claims Investigation Report: This report arises after an accident and provides insights into the facts leading to a claim. Its purpose parallels that of the Settlement Motor Accident form in assessing details essential for evaluating how the situation can be resolved without litigation.

By recognizing these similarities, individuals involved in motor accidents can better navigate the processes that follow an accident, ensuring they make informed decisions about their claims and settlements.

Dos and Don'ts

When filling out the Settlement Motor Accident form, following a few guidelines can help ensure a smooth process. Here are seven things to do and avoid:

- Do report the accident within 24 hours. It is crucial to notify the insurance company as soon as possible to avoid any penalties.

- Do ensure accuracy. Provide correct details about the accident, including the date, time, and location.

- Do communicate with the other party. Make sure both parties agree on the terms of the private settlement before signing anything.

- Do retain copies of the signed agreement. Keep a record of all documents related to the settlement for your own reference.

- Don't omit important information. Failing to include necessary details can lead to complications later.

- Don't rush through the form. Take your time to understand each part before making your entry.

- Don't ignore the implications of the law. Be aware that a private settlement is legally binding, so consider the terms carefully.

Misconceptions

When it comes to the Settlement Motor Accident form, several misconceptions can lead to confusion. Here are four common misunderstandings:

- It’s not necessary to report the accident. Some people believe that if they are settling privately, there's no need to report the accident. In fact, you are required to report any motor accident, even if you plan to handle it privately. Failing to do so could affect your insurance.

- Private settlements mean there is no documentation. Another misconception is that private settlements do not require any formal documentation. However, a signed agreement is crucial. This document acts as a legally binding contract between the parties involved, ensuring clarity and protection for both sides.

- Your No Claim Discount (NCD) is automatically lost when settling privately. Many people worry that opting for a private settlement will lead to a loss of their NCD. In reality, with NTUC Income, your discount is protected even if a claim is made against the policy.

- It’s fine to change details after the form is submitted. Some believe that once the Settlement Motor Accident form is turned in, any of its details can be modified later. This isn't true. The information included is critical and should be accurate at the time of submission to avoid complications with your claim.

Understanding these realities can help ensure a smoother process when dealing with motor accident settlements.

Key takeaways

When you fill out the Settlement Motor Accident form, keep these important points in mind:

- You must report any motor accident to your insurance provider within 24 hours or by the next working day, regardless of whether you intend to make a claim.

- Late reporting could lead to a reduction in your No Claims Discount (NCD) when renewing your policy.

- If there are no serious injuries and minor damages, you can opt for a private settlement with the other party involved.

- A private settlement is a legally binding agreement between both parties to resolve the matter without legal action.

- For NTUC Income policyholders, submit the signed form via fax at 6338 1500 or email it to motor@income.com.sg.

- NTUC Income will manage any future claims made by the other party, protecting your NCD even if a claim must be honored.

- The information provided will be used for insurance and claims administration purposes only.

- Be sure to include the date, time, and location of the accident in the required details.

- Clearly state whether either party will compensate the other, with options to select in the form.

- Both parties must confirm they will not file a police report regarding the accident.

Staying informed and following these guidelines can help ensure a smoother process after an accident.

Browse Other Templates

Register Car in Ma - Form MVU-26 is available for reproduction as approved by the Commissioner of Revenue.

Americo Insurance Customer Service - Your cooperation is essential throughout the claims processing time.