Fill Out Your Sf 3107 2 Form

The SF 3107-2 form is an essential document for retiring employees who are married and wish to make decisions regarding survivor annuities. This form specifically addresses the election of survivor benefits for current spouses. If an employee chooses not to elect a reduced annuity to maximize the survivor annuity for their spouse, they must complete Part 1 of the form. This section guides the retiring employee through various survivor annuity options, including the choice of no survivor annuity, a partial annuity, or a full annuity for their spouse or a former spouse. It is crucial for the current spouse to be involved in this process, as they must fill out Part 2, indicating their consent to the election made by the retiring employee. This consent must be given in the presence of a Notary Public or another authorized individual, who will complete Part 3 to certify the consent. Understanding the implications of these choices is vital; opting out of a survivor annuity can lead to the loss of health benefits and eligibility for long-term care insurance upon the retiree's passing. The law mandates this consent process to protect both the retirees and their spouses, ensuring that all parties are aware of the potential benefits and consequences involved in their decisions.

Sf 3107 2 Example

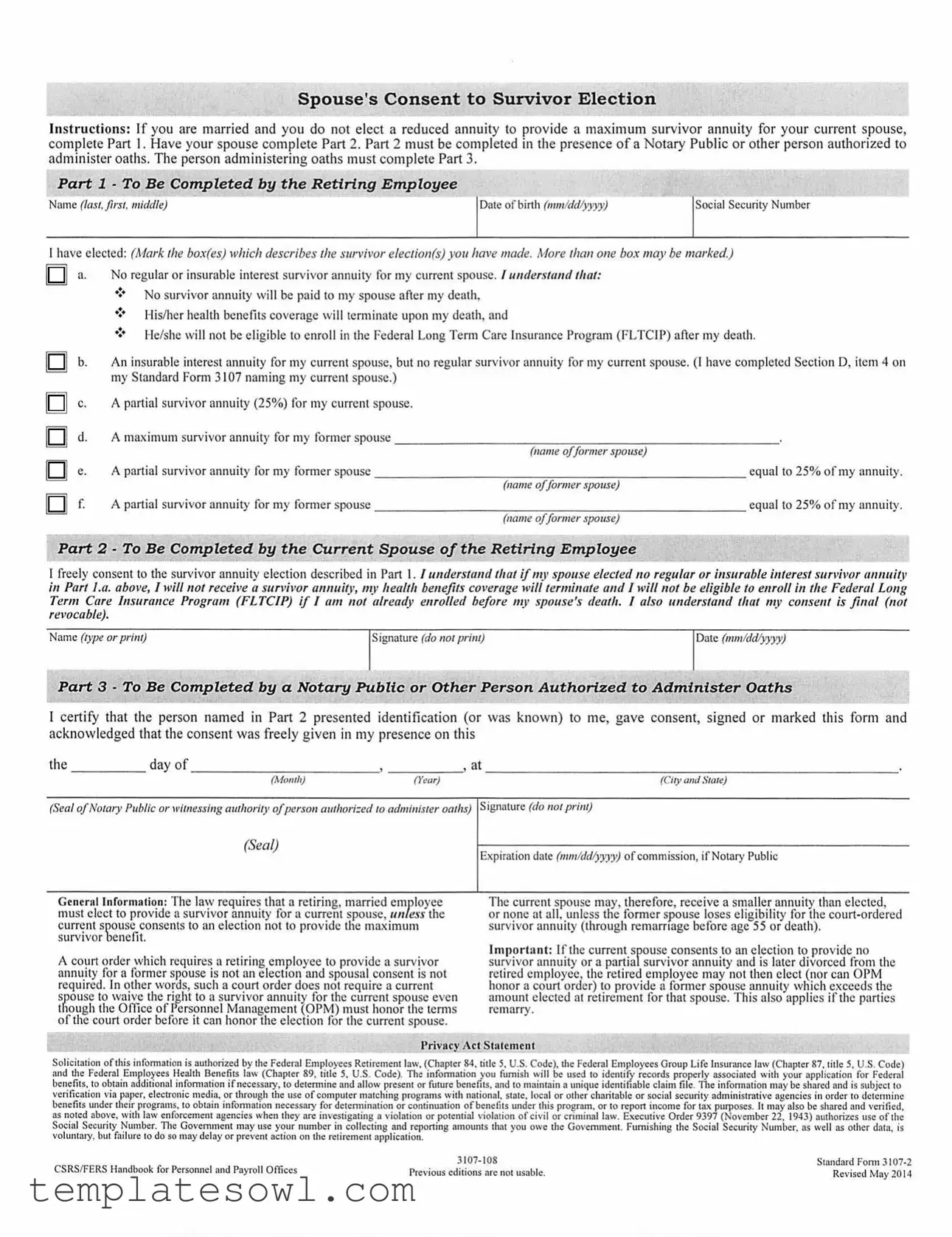

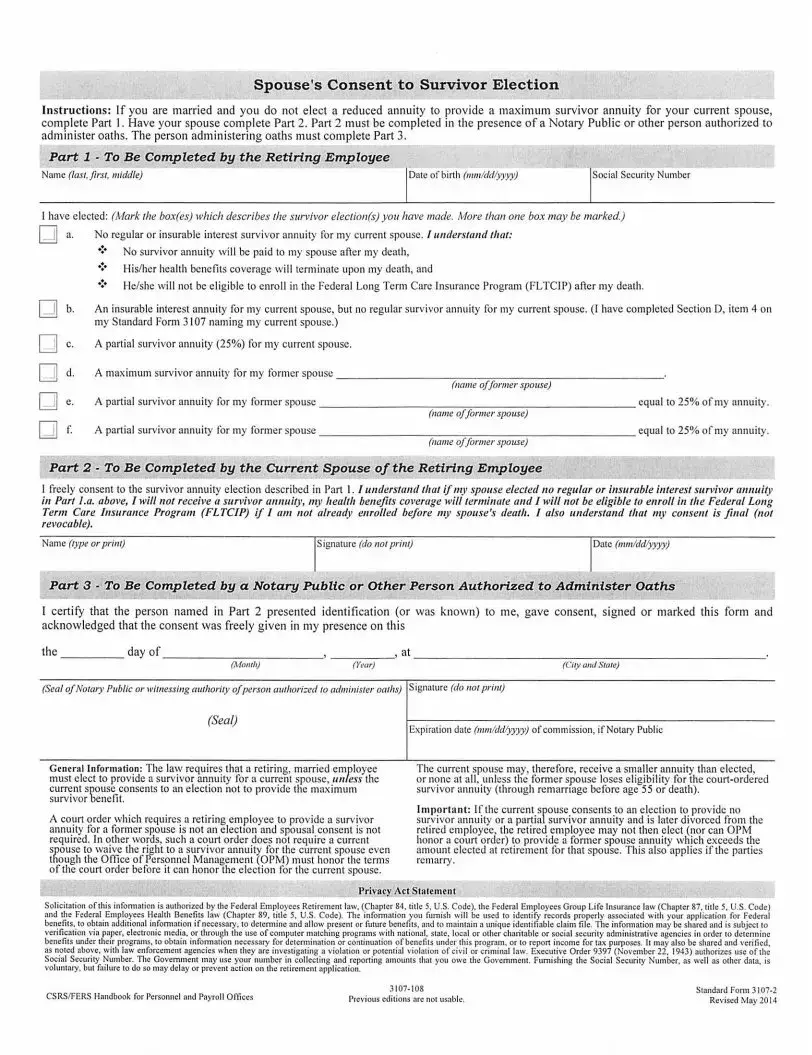

Spouse's Consent to Survivor Election

Instructions: If you are married and you do not elect a red uced annuity to provide a maximum survivor annuity for your current spouse, complete Part 1. Have your spouse complete Part 2. Part 2 must be completed in the presence of a Notary Public or other person authorized to administer oaths. The person administering oaths must complete Part 3.

Part 1 - To Be Completed by the Retiring Employee

Name (last.first. middle) |

Date of birth (111111/ddlyyYJ~ |

Social Security Number |

1 have elected: (Mark the box(es) which describes the survivor election(s) you have made. More than one box may be marked.)

Q a.

□d.

D e.

No regular or insurable interest survivor annuity for my current spouse. / understand that:

•!• No survivor annuity \viii be paid to 111y spouse after my death,

❖His/her health benefits coverage will term inate upon my death, and

❖He/she will not be eligible to enroll in the Federal Long Term Care Insurance Program ( l'LTCIP) after my death.

An insurable interest annuity for my current spouse, but no regular survivor annuity for my current spouse. (1have completed Section D, item 4 on my Standard Form 3 107 naming my current spouse.)

A partial survivor annuity (25%) for my current spouse.

A maximum survivor annuity for my fo rmer spouse |

|

|

(11ame offormer spouse) |

Apartial survivor annuity for my forme r spouse

□ f. A partial survivor annuity for my former spouse |

. , |

, |

|

(name offormer spouse) |

|

Part 2 - To Be Completed by the Current Spouse of the Retiring Employee

1 freely consent to the survivor annuity elect ion described in Part 1. / understand that if nu• spouse elected 110 regular or insurable interest survivor a111111i~)• in Part I.a. above, I will not recei ve a survivor annuity, my health benefits coverage will terminate and I will not be eligible to enroll in the Federal Long Term Care Insurance Program (FLTCIP) if I am not already enrolled bef ore my spouse's death. I also understand tlwt my consent is final (not revocable).

Name (rype or print) |

Signature (do not prim) |

Date (mm/ddlyyyy) |

Part 3 · To Be Completed by a Notary Public or Other Person Authorized to Administer Oaths

I certify that the person named in Part 2 presented identification (or was known) to me, gave consent, signed or marked this form and acknowledged that the consent was freely given in my presence on this

the _____ day of ________ ____,

(Mo111hJ |

(Year) |

(Ci1y atul S1a1e) |

(Seal ofNotary P11blic or witnessing awhority ofperson authori=ed to administer oaths)

(Seal)

Signature (do 1101 print)

Expiration date (111111/ddlyyyy) of commission, if Notary Public

Genera l Information: The law requires that a retiring, married employee must elect to provide a survivor annuity for a current spouse, unless the current spouse consents to an e lection not to provide the maximum survivor benefi t.

A court order which requires a retiring emp loyee to provide a survivor annuity for a former spouse is not an elecllon and spousal consent is not required. In other words, such a court order does not require a current spouse to waive the right to a survivor annuity for the current spouse even though the Office of Personnel Management (OPM) must honor the terms o f the court order be fore it can honor the election for the current spouse.

The current spouse may, therefore, receive a smaller annuity than elected, or none at all, un less the former spouse loses eligibility fo r the

Importan t: l f the current sf ouse consents to an election to provide no survivor annu ity or a partia survivor annuity and is later divorced from the retired employee1 the retired employee may not then e lect (nor can O PM honor a court oroer) to provide a fo rmer spouse annuity which exceeds the amount e lected at retirement for that spouse. This also applies if the parties remarry.

Privacy Act Statement

Solici1a1io11 of this infonnation is authorized by the Federal Employees Retirement law. (Chapter 84. title 5. U.S. Code), the Federal Employees Group Life Insurance law (Chapter 87. title 5, U.S. Code) and the Federal Employees Health Benefits law (Chapter 89, title 5. U.S. Code). 11,e infonnation you fumish will be used 10 identify records properly associated with your application for Federal

benefits. 10 obtain additional infonnalion ifnecessary, to dctcm1ine and allow present or future benefi1s, :rnd to maintain a unique identifiable claim fi le. The infonnation may be shared and is subject 10 vcrifica1ion via paper, electronic media, or throu~h the use of computer matching programs with national. slate, loc,11 or other charitable or social security administrative agencies in order to dctcnninc benefits under their programs. to obtain infonnnuon necessary for dctcnnination or continuation of benefits under this progr:un. or to repon income for tax purposes. It may also be shared :md \'Crificd, as noted abo\'e. with law enforcement agencies when they arc in\'cstigating a violation or potenlial violn1ion of civil or criminal law. Executive Order 9397 (November 22, 1943) authorizes use of the Social Security Number. 111c Govenunent may use your number in collecting and reponing amounts that you owe the Government. Furnishing the Social Security Number. as well as other data, is voluntary, but fai lure to do so may delay or prevent ac1ion on the rct ircmenl applicalion.

CSRS/FERS Handbook for Personnel nncl Payroll OfTices |

3 |

Standard Fonn |

Previous editions .uc not usnblc. |

Revised May 20 I4 |

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Purpose | The SF 3107-2 form is used to obtain a spouse's consent regarding the survivor annuity elections made by a retiring federal employee. |

| Part Completion | The form includes three parts: Part 1 for the employee's election, Part 2 for the spouse's consent, and Part 3 for notarization. |

| Notary Requirement | Part 2 must be completed in the presence of a Notary Public or another authorized person who can administer oaths. |

| Governing Law | This form is governed by specific provisions of the Federal Employees Retirement law (Chapter 84, title 5, U.S. Code). |

| Consent Finality | Once given, the spouse's consent regarding survivor annuity elections is final and cannot be revoked. |

| Impact of Divorce | If the spouse consents to no or reduced survivor annuity and later divorces, the retired employee cannot elect a higher annuity for a former spouse. |

Guidelines on Utilizing Sf 3107 2

Completing the SF 3107-2 form is an important step for a retiring employee who is married and wishes to make decisions regarding a survivor annuity for their current spouse. Follow the steps carefully to ensure that all necessary information is correctly provided.

- Begin by locating the top of the form. Fill out your name in the format of last name, first name, and middle initial.

- Enter your date of birth in the specified format (MM/DD/YYYY).

- Provide your Social Security Number in the designated section.

- In Part 1, mark the box or boxes that reflect the survivor election choices you are making. Be mindful: you can mark more than one box if applicable.

- Carefully read the implications of your chosen survivor annuity options, as outlined in the form.

- If you have selected a regular or insurable interest annuity for your current spouse, ensure that you complete the necessary parts of the form that support this choice.

- Next, your current spouse must fill out Part 2. They should print their name, sign the form, and enter the date. The signature must not be printed.

- The next step requires a Notary Public or another person authorized to administer oaths. This person will complete Part 3. They must certify that they witnessed your spouse signing the form.

- Ensure that the Notary or authorized person also provides their signature and any required seals, as well as the expiration date of their commission, if applicable.

- Finally, review the completed form for accuracy and ensure all necessary parts are filled out before submission.

What You Should Know About This Form

What is the SF 3107-2 form?

The SF 3107-2 form is a document used by retiring federal employees who are married. This form is necessary for the election of a survivor annuity for a current spouse. It requires consent from the spouse if the employee decides not to provide a maximum survivor annuity. The completion of this form involves multiple sections that must be filled out by both the retiring employee and the current spouse, including notarization.

When should I complete the SF 3107-2 form?

You should complete the SF 3107-2 form during the retirement process, typically as part of your retirement application package. This should be done as soon as you decide whether to elect a regular survivor annuity for your spouse or not. The timely completion of this form is crucial to ensure all parties understand their rights and benefits before the retirement becomes effective.

What happens if I do not elect a survivor annuity for my spouse?

If you do not elect a survivor annuity, your spouse must complete Part 2 of the form to consent to this decision. Without their consent, the law mandates that a survivor annuity must be provided to the current spouse. If the spouse does not consent, they will not receive any benefits after your death, and their health benefits will terminate.

Can I change my mind after completing the form?

The consent given by your spouse on the SF 3107-2 form is final and cannot be revoked. It is essential to discuss this matter thoroughly with your spouse before submitting the form. Once the form is completed, any decision made regarding the survivor annuity is binding.

What is the role of a Notary Public in the SF 3107-2 form?

A Notary Public or an authorized individual is required to witness the completion of Part 2 of the form. This person certifies that they have verified the identity of the spouse and confirmed that the consent was given freely. This notarization process adds an extra layer of authenticity and legal agreement to the consent provided.

What are the consequences of consenting to a smaller or no survivor annuity?

If your current spouse consents to a smaller or no survivor annuity, they may lose eligibility for certain benefits after your death. For example, their health benefits coverage will terminate, and they will not be eligible for enrollment in the Federal Long Term Care Insurance Program unless already enrolled. Consider these potential losses carefully before agreeing to a reduced annuity.

What is the significance of the Privacy Act Statement on the form?

The Privacy Act Statement on the SF 3107-2 form outlines how the personal information provided will be used and protected. It ensures that the information is collected to determine eligibility and benefits for federal programs. It also specifies that this information may be shared with other agencies for verification or law enforcement purposes if necessary.

Does a court order affect my decisions with the SF 3107-2 form?

Yes, a court order that requires you to provide a survivor annuity for a former spouse does influence your decisions. Even if a court mandates the provision of benefits to a former spouse, you are still required to provide a benefit to your current spouse unless they consent otherwise. The current spouse’s rights cannot be waived simply due to a prior order regarding a former spouse.

What information is required for Part 1 of the form?

In Part 1 of the SF 3107-2 form, you need to provide your name, date of birth, and Social Security number. You must also mark the appropriate boxes indicating your election regarding the survivor annuity options. This part requires careful consideration, as multiple selections can be made, but each choice carries different implications for your spouse's benefits.

Is the SF 3107-2 form applicable to all federal employees?

The SF 3107-2 form specifically applies to federal employees under the Civil Service Retirement System (CSRS) or the Federal Employees Retirement System (FERS). It is essential for married employees in these systems who are making decisions about survivor benefits. If you are unsure of your eligibility, it is advisable to consult your agency's human resources department.

Common mistakes

When filling out the SF 3107-2 form, individuals often make critical mistakes that can jeopardize their retirement benefits. One common error is overlooking the requirement for spousal consent. If you are married and fail to elect a reduced annuity to provide a maximum survivor annuity for your spouse, it's essential to complete Part 1 and have your spouse consent in Part 2. This consent is not merely a formality. Without it, your spouse risks losing survivor benefits, health coverage, and eligibility for long-term care insurance after your passing.

Another frequent mistake involves improperly completing Part 1 of the form. Retiring employees need to clearly indicate their choices regarding the survivor election. There are multiple options available, and marking the wrong box can lead to unintended consequences. For instance, if you indicate that no survivor annuity will be provided but later wish to change that decision, complications can arise—such as limited eligibility for benefits after divorce or death. Clarity in your decision-making process is crucial.

Additionally, some individuals neglect the notary requirement outlined in Part 2. The spouse’s consent must be affirmed in the presence of a Notary Public or an authorized individual. Skipping this step not only invalidates the consent but may also lead to delays or outright rejection of your retirement application. The form’s legal binding nature depends significantly on this notarization.

Lastly, a significant number of applicants fail to be fully aware of the implications of their choices. Each option presented in Part 1 carries weight and must be understood thoroughly before selecting it. For example, consenting to a reduced survivor annuity may seem harmless, but it can significantly affect the financial security of the surviving spouse. Therefore, it’s advisable to read all instructions carefully and consider consulting with a financial planner or legal expert to ensure that your decisions align with your long-term financial goals.

Documents used along the form

The SF 3107-2 form, known as the Spouse's Consent to Survivor Election, is a crucial document for retirement planning for federal employees. It ensures that a retiring employee's current spouse consents to the chosen survivor annuity options, which can significantly impact both parties' financial futures. Alongside this form, several other documents are typically required or utilized in the retirement process. Below is a list of those documents with a brief description of each.

- SF 3107: The standard form for applying for retirement benefits. Employees complete this to provide essential personal and employment information to the Office of Personnel Management (OPM).

- SF 2809: This form is used to enroll in the Federal Employees Health Benefits (FEHB) Program. It's crucial for employees to ensure health coverage during retirement.

- SF 2823: Designates beneficiaries for the Federal Employees Group Life Insurance (FEGLI) program. This form allows retirees to specify who will receive life insurance benefits upon their death.

- SF 1152: This form is a designation of beneficiary for Unpaid Compensation of Deceased Employees. It allows a retiring employee to specify who should receive any owed payments after their passing.

- Retirement Benefits Calculation: A document outlining the calculation of retirement benefits, detailing how annuities are computed in accordance with the employee's service and contributions.

- Final Pay Statement: This summarizes an employee's final earnings and deductions, ensuring accurate processing of retirement benefits.

- Spousal Notification Letter: Often included in retirement paperwork, this letter is used to inform the spouse about the retirement application, elections made, and any consent required.

Understanding these forms is essential for federal employees planning their retirement. Proper documentation helps ensure a smooth transition into retirement while safeguarding the interests of both the employee and their spouse.

Similar forms

The SF 3107-2 form is an important document in the context of federal retirement benefits. It serves to collect information and obtain consent regarding survivor annuities. Several other forms share similar functions and processes. Here are four documents that are comparable to the SF 3107-2:

- SF 3107: This form is the primary retirement application for federal employees. Like the SF 3107-2, it includes sections for the employee's personal information and options regarding survivor benefits. However, the SF 3107 does not specifically focus on spousal consent.

- SF 2801: This form is used by employees covered under the Civil Service Retirement System (CSRS) to apply for retirement benefits. Similar to the SF 3107-2, it includes provisions for spouses and lists options related to survivor benefits.

- SF 2823: This is known as the "Designation of Beneficiary" form for federal employees’ group life insurance. It allows employees to designate individuals who will receive death benefits. Both forms require spousal awareness and consent regarding beneficiary designations to ensure that survivor benefits are managed appropriately.

- SF 3110: This form is the "Application for Immediate Retirement" for federal employees under the Federal Employees Retirement System (FERS). It includes options for electing survivor benefits, thus mirroring the SF 3107-2 in its requirement for spousal consent and careful selection of benefits.

Dos and Don'ts

When filling out the SF 3107-2 form, there are several important do's and don'ts to keep in mind:

- Do ensure personal information is accurate, including names and Social Security numbers.

- Do mark all applicable boxes regarding the survivor election clearly.

- Do have your spouse complete Part 2 in front of a Notary Public.

- Do provide identification when your spouse is signing Part 2.

- Do keep a copy of the completed form for your records.

- Don't skip any sections of the form; each part is important.

- Don't complete the form without consulting your spouse if married.

- Don't forget the Notary Public needs to sign part 3; without it, the consent may not be valid.

- Don't assume that filling out Part 1 is enough without a spouse’s consent if applicable.

- Don't leave any blank or unclear markings on the form; this may delay processing.

Misconceptions

Understanding the Sf 3107 2 form can be challenging. Many common misconceptions can lead to confusion and potentially impact the decisions of those completing it. Here are four prevalent myths clarified:

- Myth 1: Completing the form is optional for married employees.

This is not true. If you are a retiring married employee, you must make an election regarding a survivor annuity for your spouse unless your spouse consents not to provide a maximum survivor benefit.

- Myth 2: A spouse's consent can be revoked later on.

Many believe that consent is revocable, but this is incorrect. Once your spouse consents to the election indicated in the form, that consent is final and cannot be changed after submission.

- Myth 3: A court order automatically grants benefits to a former spouse.

A court order requiring benefits for a former spouse does not negate the requirement for spousal consent for the current spouse. This means that the current spouse's rights may be affected by prior arrangements.

- Myth 4: Once consent is given, a retiring employee can later change their election.

This misconception can lead to complications. If a current spouse consents to a partial or no survivor annuity and later divorces the retiring employee, that employee cannot elect to provide a greater benefit for a former spouse than what was elected at retirement.

Clearing these misunderstandings is crucial to making informed decisions regarding survivor annuities and ensuring that your and your spouse's rights and benefits are correctly addressed.

Key takeaways

Filling out the SF 3107-2 form, which pertains to spousal consent for survivor annuity elections, is a crucial step for retiring employees who are married. Here are some key takeaways to keep in mind:

- Understand the Purpose: This form is required if you are a married retiring federal employee opting out of providing a maximum survivor annuity to your current spouse.

- Complete Part 1 First: The retiring employee must fill out Part 1, which covers their election regarding survivor annuities.

- Spouse's Role: Your spouse must complete Part 2 of the form in front of a Notary Public or an authorized person.

- Notary Requirement: Part 2 must be witnessed and verified by a notary or authorized official to ensure that consent was given freely.

- Multiple Elections: You can choose to elect various options regarding survivors, including no annuity, a partial annuity, or full survivor benefits.

- Understand Consequences: If you do not provide a survivor annuity, your spouse will lose health benefits and will not be eligible for long-term care insurance after your death.

- Final and Irrevocable Consent: The consent given by your spouse in Part 2 is final and cannot be revoked later, even if circumstances change.

- Court Orders Consideration: A court order requiring a survivor annuity for a former spouse does not affect the current spouse’s rights unless the former spouse loses eligibility.

- Divorce Implications: If your spouse consents to a reduced survivor annuity and then you divorce, you cannot later elect a higher survivor annuity for a former spouse.

- Privacy Matters: Understand that your personal information, including your Social Security number, will be used and protected as outlined by relevant laws.

Take the time to understand each section of the form carefully. Properly completing the SF 3107-2 can have significant implications for your financial and personal future, as well as that of your spouse.

Browse Other Templates

Real Id Maryland - The ICD-071 must be submitted promptly to avoid further legal complications related to insurance coverage.

Sellers Permit Florida - Filing this form is required for operations anticipating substantial tax on communications services.