Fill Out Your Short Mortgage Application Form

The Short Mortgage Application form, commonly referred to as the Mini-1003, serves as an essential tool for borrowers and lenders alike in the home financing process. This condensed version of a standard mortgage application collects critical information in a streamlined format, making it easier and more efficient to assess borrowing eligibility. Key elements of the application include the purpose of the loan, whether for refinance, purchase, construction, or an equity line. It requires personal details from both the primary borrower and any co-borrowers, such as names, dates of birth, Social Security numbers, and various contact numbers. Current address information is vital, providing context for the loan request, along with details about the property type and estimated market value. The form also addresses financial aspects, including employment history, gross income, and existing mortgage obligations, ensuring that lenders can evaluate the borrower’s financial stability accurately. Additionally, it covers any outstanding debts, credit history, and available assets, allowing for a comprehensive picture of the borrower's financial situation. By condensing crucial information into a manageable format, the Short Mortgage Application form facilitates the loan approval process while capturing the critical data needed for responsible lending decisions.

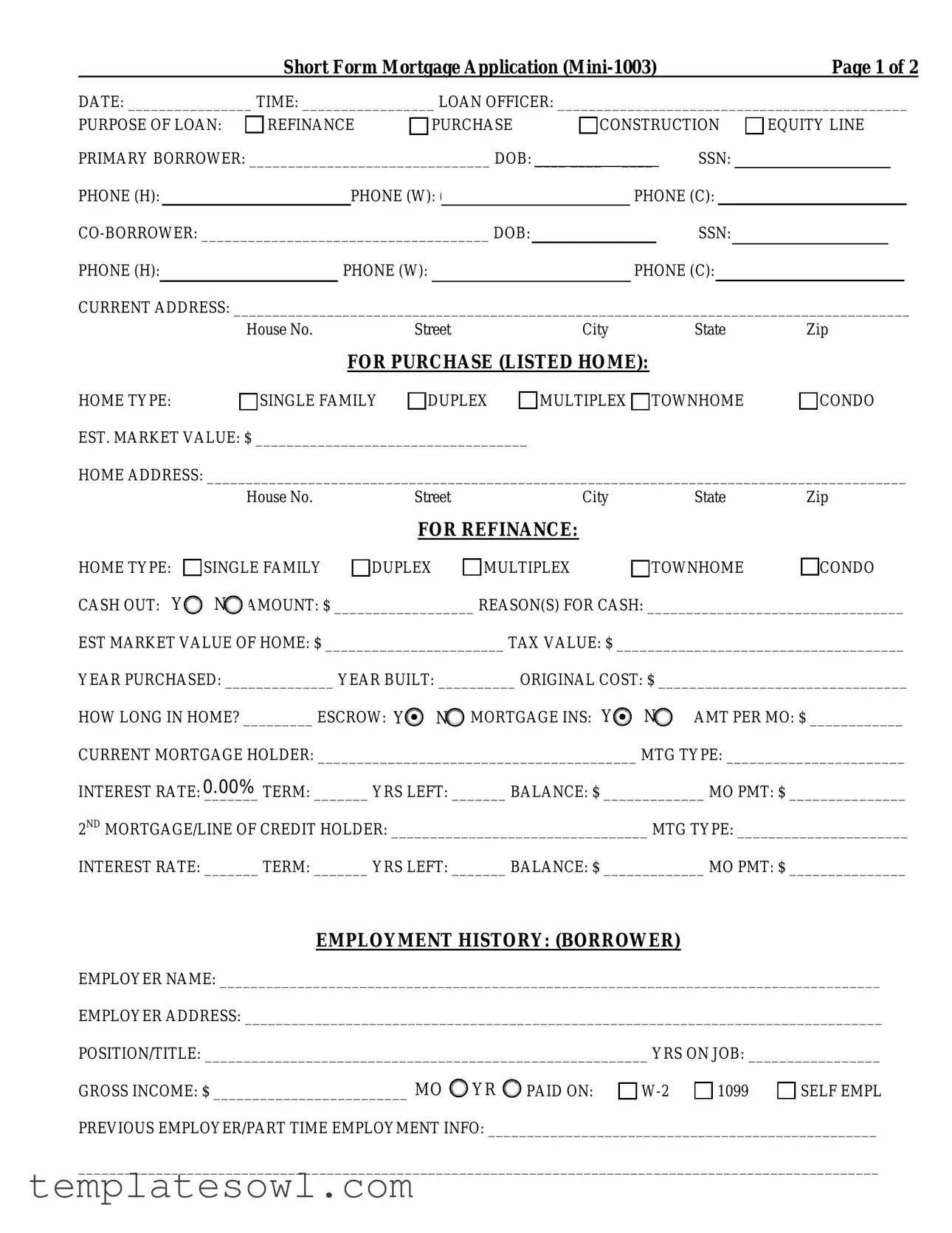

Short Mortgage Application Example

|

|

|

|

Short Form Mortgage Application |

|

|

Page 1 of 2 |

||||||

DATE: ________________ TIME: _________________ LOAN OFFICER: _____________________________________________ |

|||||||||||||

PURPOSE OF LOAN: |

REFINANCE |

PURCHASE |

|

CONSTRUCTION |

EQUITY LINE |

||||||||

PRIMARY BORROWER: _______________________________ DOB: ____/____/19____ |

SSN: |

||||||||||||

PHONE (H): (______) |

|||||||||||||

SSN: |

|||||||||||||

PHONE (H): (______) |

|||||||||||||

|

|

|

|

|

|||||||||

CURRENT ADDRESS: _______________________________________________________________________________________ |

|||||||||||||

|

|

|

|

House No. |

|

Street |

|

|

City |

State |

Zip |

||

|

|

|

|

|

FOR PURCHASE (LISTED HOME): |

|

|

|

|

||||

HOME TYPE: |

|

|

SINGLE FAMILY |

DUPLEX |

MULTIPLEX TOWNHOME |

CONDO |

|||||||

EST. MARKET VALUE: $ ___________________________________ |

|

|

|

|

|

|

|||||||

HOME ADDRESS: __________________________________________________________________________________________ |

|||||||||||||

|

|

|

|

House No. |

|

Street |

|

|

City |

State |

Zip |

||

|

|

|

|

|

|

FOR REFINANCE: |

|

|

|

|

|

||

HOME TYPE: |

SINGLE FAMILY |

DUPLEX |

MULTIPLEX |

TOWNHOME |

CONDO |

||||||||

CASH OUT: Y / N |

N |

AMOUNT: $ __________________ REASON(S) FOR CASH: _________________________________ |

|||||||||||

|

Y |

|

|

|

|

|

|

|

|

|

|

|

|

EST MARKET VALUE OF HOME: $ _______________________ TAX VALUE: $ _____________________________________

YEAR PURCHASED: ______________ YEAR BUILT: __________ ORIGINAL COST: $ ________________________________

HOW LONG IN HOME? _________ ESCROW: Y / NN MORTGAGE INS: Y / N N AMT PER MO: $ ____________

CURRENT MORTGAGE HOLDER: _________________________________________ MTG TYPE: _______________________

0.00%

INTEREST RATE: _______ TERM: _______ YRS LEFT: _______ BALANCE: $ _____________ MO PMT: $ _______________

2ND MORTGAGE/LINE OF CREDIT HOLDER: _________________________________ MTG TYPE: ______________________

INTEREST RATE: _______ TERM: _______ YRS LEFT: _______ BALANCE: $ _____________ MO PMT: $ _______________

EMPLOYMENT HISTORY: (BORROWER)

EMPLOYER NAME: _____________________________________________________________________________________

EMPLOYER ADDRESS: __________________________________________________________________________________

POSITION/TITLE: _________________________________________________________ YRS ON JOB: _________________

GROSS INCOME: $ _________________________ (MO / YR ) PAID ON: |

1099 |

SELF EMPL |

|

YR |

|

|

|

PREVIOUS EMPLOYER/PART TIME EMPLOYMENT INFO: __________________________________________________

_______________________________________________________________________________________________________

Short Form Mortgage Application |

Page 2 of 2 |

EMPLOYMENT HISTORY: |

|

EMPLOYER NAME: _____________________________________________________________________________________

EMPLOYER ADDRESS:__________________________________________________________________________________

POSITION/TITLE: _________________________________________________________ YRS ON JOB: _________________

GROSS INCOME: ___________________________ ( MO / YR ) PAID ON: |

1099 |

SELF EMPL |

|

MO |

|

|

|

PREVIOUS EMPLOYER/PART TIME EMPLOYMENT INFO: __________________________________________________

_______________________________________________________________________________________________________

REVOLVING DEBT/MONTHLY OBLIGATIONS:

Majority of this information will be obtained via the credit report.

DO YOU PAY CHILD SUPPORT OR ALIMONY?: YY / N N |

AMOUNT/MO: $ ________________________ |

|

REAL ESTATE TAXES: Y / N N |

YEARLY: $ ___________ |

MO (IF KNOWN): $ ______________________ |

HOME INSURANCE: Y / NN |

YEARLY: $ ___________ |

MO (IF KNOWN): $ ______________________ |

CREDIT HISTORY: EXCELLENT GOOD AVERAGECHALLENGED

AGREE TO CREDIT CHECK: |

Y |

N |

|

SCORE: ________________ |

|

/ N DATE: ____________ TIME: ___________ |

|

||

HAVE YOU HAD ANY LATE PAYMENTS ON YOUR MORTGAGE (PAST 12 MO) |

Y |

Y / N |

||

|

|

|

N |

|

DESCRIBE CREDIT ISSUES (JUDGEMENTS, BANKRUPTCY, COLLECTIONS): _________________________________

_______________________________________________________________________________________________________

ASSETS:

CASH IN BANK ACCOUNTS (include savings & checking): ______________________________________________________

INVESTMENTS (including 401K, brokerage accounts, stocks, bonds Etc…): __________________________________________

PROPERTY (including rental units, cabins, 2nd homes & land): _____________________________________________________

NOTES:

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

Form Characteristics

| Fact | Details |

|---|---|

| Name of Form | Short Form Mortgage Application (Mini-1003) |

| Purpose | The form is used for various loan purposes, including refinancing, purchasing, construction, or an equity line. |

| Primary Information | It requires personal details such as name, date of birth, Social Security number, and various phone numbers for both the primary borrower and the co-borrower. |

| Property Type | Applicants must specify the type of home, including options like single-family homes, duplexes, and condos. |

| Financial Information | The application collects financial details, including gross income, current mortgage holder, and existing debts. |

| Credit Check Consent | Borrowers must agree to a credit check and provide information regarding their credit history quality. |

| State-Specific Laws | Compliance may vary by state, and applicable governing laws should be reviewed for specific requirements. |

| Duration of Completion | While it’s a short form, the accuracy of the provided information is crucial to avoid delays in processing the application. |

Guidelines on Utilizing Short Mortgage Application

Completing the Short Mortgage Application form is an essential step in the mortgage process. Once filled out, this form helps lenders gather necessary information to evaluate loan eligibility. Below are the steps to effectively complete each section of the form.

- Date: Enter the current date in the designated space.

- Time: Fill in the time of day when the application is being completed.

- Loan Officer: Write the name of the loan officer who will be processing the application.

- Purpose of Loan: Check the appropriate box for refinance, purchase, construction, or equity line.

- Primary Borrower: Fill in the full name of the primary borrower.

- Date of Birth: Provide the DOB in the format (MM/DD/YYYY).

- Social Security Number: Enter the primary borrower's SSN in the correct format.

- Phone Numbers: Fill in the home, work, and cell phone numbers for the primary borrower.

- Co-Borrower: If applicable, fill in the co-borrower's full name and their personal details including DOB, SSN, and phone numbers.

- Current Address: Write the complete address (house number, street, city, state, zip code) for the primary borrower.

- For Purchase: If applicable, check the home type and list the estimated market value and home address.

- For Refinance: Indicate the home type and other required details such as cash out amount, reason for cash, estimated market value, tax value, year purchased, year built, original cost, and how long in home.

- Escrow and Home Insurance: Indicate yes or no for escrow and home insurance, and provide amounts as necessary.

- Current Mortgage Holder: Fill in the details for the current mortgage, including the type, interest rate, term, and remaining balance.

- Second Mortgage/Line of Credit Holder: If applicable, provide similar information for any second mortgage or line of credit.

- Employment History for Borrower: List the employer's name, address, position/title, years on the job, and gross income details.

- Employment History for Co-Borrower: If applicable, fill in the same details for the co-borrower.

- Revolving Debt/Monthly Obligations: State if child support or alimony payments apply and list any amounts.

- Real Estate Taxes and Home Insurance: Indicate if applicable and provide yearly/monthly amounts.

- Credit History: Select options regarding credit status and agree to a credit check.

- Assets: Provide details about cash in bank accounts, investments, and properties.

- Notes: Use this section for any additional relevant information.

What You Should Know About This Form

What is the purpose of the Short Mortgage Application form?

The Short Mortgage Application form, also known as the Mini-1003, is designed to collect essential information from borrowers who are seeking a mortgage. This can include requests for refinancing, purchasing a new home, or obtaining a line of credit. It helps lenders evaluate a borrower’s financial situation and determine their eligibility for a mortgage or loan.

What information is required from the primary and co-borrower?

The form requires personal information from both the primary borrower and any co-borrower. This includes name, date of birth, Social Security number, and contact information. Additionally, details about current employment, income, and credit history are needed. This information allows lenders to assess both borrowers’ financial capabilities and responsibilities.

How is the employment history section structured in the application?

The employment history section requires information about the primary borrower’s and the co-borrower's current and previous jobs. This includes the employer's name and address, position or title, years of employment, and gross income. Borrowers indicate whether they are paid on a W-2, 1099, or are self-employed. This helps lenders understand each borrower’s stability and income sources.

What does the application ask about debt and monthly obligations?

To evaluate an applicant's financial commitments, the form requests information regarding any revolving debts and monthly obligations, such as child support or alimony. It also requires the borrower to indicate whether they pay real estate taxes and home insurance. Most of this data will be obtained from a credit report, but borrowers should provide all relevant details to ensure accuracy.

What types of assets should be reported on the application?

Borrowers are asked to disclose various assets they hold. This includes cash in bank accounts (savings and checking), investments such as 401Ks or stocks, and any property owned, like rental units or land. Detailing these assets will give the lender a clearer view of the borrower’s overall financial health.

Can credit history affect loan approval?

Yes, credit history plays a significant role in the loan approval process. The application form includes a section where borrowers assess their credit history as excellent, good, average, or challenged. Borrowers must also agree to a credit check. Any issues like late payments, judgments, or bankruptcies should be disclosed, as they can impact the lender's decision regarding approval and terms of the mortgage.

Common mistakes

When filling out the Short Mortgage Application form, people often make several common mistakes that can delay the process or even jeopardize their loan approval. One frequent error is leaving sections blank. Each part of the application is designed to gather specific information, and omitting details can create confusion and lead to delays.

Another mistake is misreported financial information. Borrowers sometimes underestimate or overestimate their income and assets, which can raise red flags for lenders. Providing accurate figures is crucial for a clear understanding of financial standings, allowing the lender to make informed decisions.

Some applicants also fail to indicate the purpose of the loan correctly. Whether it’s for refinancing, purchasing a new home, construction, or establishing an equity line, clarity in the purpose helps lenders assess risk and appropriately categorize the application.

Incompleteness can further extend to contact information. When filling in phone numbers, borrowers may forget to include their area codes or mistakenly enter their information incorrectly. This oversight can hinder communication, which is necessary during the mortgage approval process.

Applicants often skip providing accurate employment details. This includes not just the employer's name and address but also essential info like job title and duration of employment. Incorrect or incomplete employment history can affect the lender’s evaluation of the borrower’s stability and reliability.

Another mistake revolves around failing to disclose existing debts accurately. Borrowers sometimes overlook obligations like child support or alimony payments, leading to an incomplete view of their financial obligations. Transparency about all financial commitments can significantly enhance the likelihood of approval.

Some individuals incorrectly check the boxes regarding mortgage insurance or escrow options. Misrepresenting whether these components apply to their current mortgage situation can confuse lenders and may require additional follow-up.

Not all borrowers understand the importance of providing a complete credit history. Some might forget to mention late payments or ongoing credit issues that could influence their credit score. Being upfront about these questions can facilitate a smoother approval process.

Lastly, many people neglect to provide comprehensive information about their assets. This includes not only cash in bank accounts but also investments and other properties. Comprehensive disclosures can paint a clearer picture of financial health, giving lenders confidence in their assessment.

Avoiding these common pitfalls can streamline the application process and foster better communication with lenders, ultimately leading to a more favorable loan outcome.

Documents used along the form

The Short Mortgage Application form is a critical first step in the process of applying for a mortgage. It gathers essential information about the borrower and the purpose of the loan. However, this application is often accompanied by other important documents that provide a more comprehensive overview of the applicant's financial situation and the property in question. Below is a list of commonly used forms and documents that complement the Short Mortgage Application.

- Income Verification Documents: These include pay stubs, W-2 forms, or tax returns. Lenders require them to assess an applicant's income stability and overall financial health.

- Credit Report: A credit report provides detailed information about an applicant's credit history, including outstanding debts and payment history. It helps lenders evaluate the risk of lending money.

- Property Appraisal Report: An appraisal report assesses the market value of the property being purchased or refinanced. A qualified appraiser will conduct this evaluation to ensure that the loan amount is justified.

- Loan Estimate: This document outlines key loan terms, including the estimated monthly payment, interest rate, and closing costs. It helps borrowers understand the potential financial commitment involved in the mortgage.

- Credit Authorization Form: This form allows the lender to obtain the applicant's credit report and may also include permission to access other financial records. It is a necessary step in verifying the applicant's financial background.

These accompanying documents provide further insights into an applicant's financial circumstances and their ability to meet mortgage obligations. Together with the Short Mortgage Application form, they help lenders make informed decisions about loan approvals and terms. Being prepared with these documents can facilitate a smoother mortgage application process.

Similar forms

The Short Mortgage Application form shares similarities with several other documents used in the mortgage process. Each of these documents serves to gather essential information about the borrowers and the loan intended. Here are five documents that are comparable:

- Standard Mortgage Application (1003 Form): This is a more detailed version of the Short Mortgage Application. It captures comprehensive financial information, including details about assets and liabilities, to assess the borrower’s eligibility for a loan.

- Loan Estimate (LE): This document provides borrowers with key details about their loan, such as the estimated monthly payment and closing costs. It builds upon the information shared in the Short Mortgage Application, clarifying the loan’s terms and costs.

- Debt and Income Verification Form: Similar to the Short Mortgage Application, this form collects information about the borrower’s financial obligations and income sources. It helps lenders evaluate the borrower's ability to repay the loan.

- Credit Authorization Form: This form allows lenders to obtain the borrower’s credit report. It complements the information provided in the Short Mortgage Application by giving lenders insight into the borrower’s creditworthiness.

- Property Information Form: This document collects data about the property being purchased or refinanced. It is akin to sections within the Short Mortgage Application that inquire about the home type and market value, ensuring that the property meets lender requirements.

Dos and Don'ts

When filling out the Short Mortgage Application form, it is essential to approach the task thoughtfully and carefully. Here are some guidelines to help you navigate the process smoothly:

- Do double-check all entries: Ensure that every section is completed accurately to avoid processing delays.

- Don't rush through the application: Take your time to read each question carefully, providing clear and concise answers.

- Do provide documentation when needed: If the application requests supporting documents, have them readily available to ensure a smooth submission.

- Don't leave sections blank: If a question does not apply to you, indicate that it is not applicable rather than skipping it entirely.

By following these simple yet effective steps, applicants can facilitate a more efficient and successful mortgage application process. Careful completion of the form reflects attention to detail and enhances the overall experience for both the borrower and the lender.

Misconceptions

Misconceptions about the Short Mortgage Application form (Mini-1003) can create confusion for borrowers. Here are some common myths:

- It's only for first-time homebuyers. Many believe this form is exclusively for beginners in the housing market. In reality, it is suitable for anyone seeking a mortgage, whether for a new purchase, refinancing, or other loan purposes.

- It's a lengthy and complicated process. Some think that filling out the Short Form is identical to the standard mortgage application, which is often more extensive. The Short Form is meant to streamline the process and collect only essential information.

- You can't apply online. There's a misconception that this form must be completed on paper. While traditional paper applications exist, many lenders now offer online submission options for convenience and speed.

- It guarantees loan approval. Borrowers might assume that submitting this form will automatically lead to approval. Approval depends on various factors, including creditworthiness and financial history, even if the form is filled out correctly.

Key takeaways

Filling out the Short Mortgage Application form can feel overwhelming, but understanding it can make this process much smoother. Here are seven key takeaways to keep in mind.

- Be Prepared with Documentation: Gather necessary documents like your Social Security Number, proof of income, and details about your existing mortgage. This will help you fill out the application accurately.

- Know Your Purpose: Indicate the purpose of your loan clearly, whether it is for refinancing, purchasing, construction, or an equity line. This sets the tone for your application and the review process.

- Accurate Personal Information: Enter all required personal information about both the primary borrower and co-borrower, including dates of birth and contact numbers. Make sure every detail is correct to avoid delays.

Browse Other Templates

Bingo Game Boards,Bingo Sheets,Bingo Templates,Custom Bingo Cards,Game Night Bingo,Playful Bingo Grids,Educational Bingo Layouts,Bingo Challenge Cards,Fun Bingo Cards,Interactive Bingo Boards - Encourage healthy competition with Bingo tournaments.

What Is a Polst - A completed POLST form serves as a physician's legally valid order for treatment.

Fbi Ic3 - It asks if any submitted information was acquired under specific regulations or duties.