Fill Out Your Shps Reimbursement Form

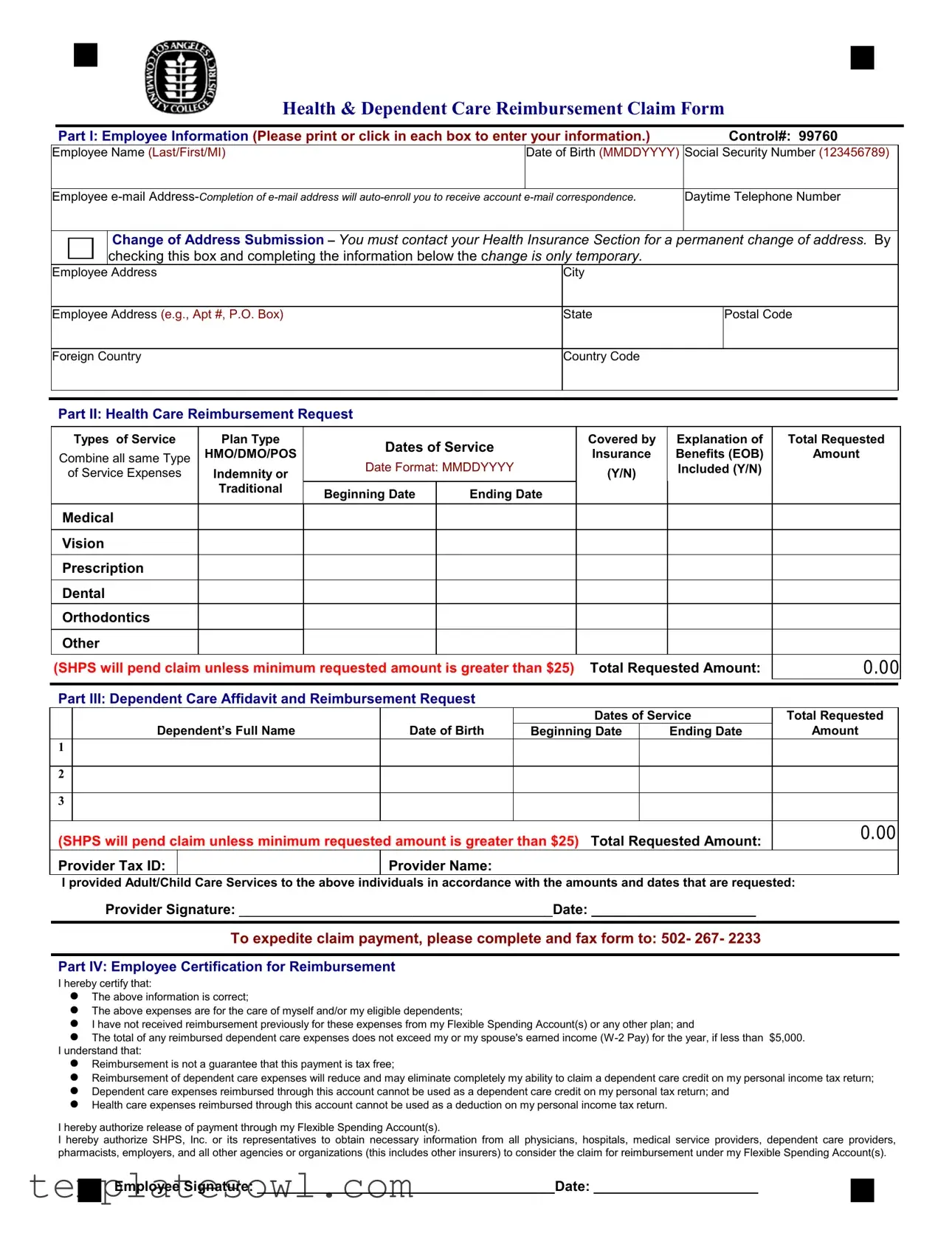

The SHPS Reimbursement Form is a crucial tool for employees seeking reimbursement for health and dependent care expenses via their Flexible Spending Accounts (FSAs). It breaks down into several important parts addressing specific areas of information. Part I collects essential employee details such as name, contact information, and social security number. This information also includes a section for reporting any temporary changes of address. In Part II, employees outline their health care reimbursement requests, including types of services provided, plan types, and associated costs. A clear total requested amount ensures proper processing of claims. Part III focuses on dependent care, allowing employees to detail expenses related to child or elder care, a necessary stipulation for those balancing work and family obligations. Part IV is where employees affirm the legitimacy of their claims, confirming that the expenses meet necessary guidelines. Completing the form correctly and submitting all required documentation is paramount to expedite the processing. Missteps in this phase can lead to delays or denials. Instructions for both fax and mail submissions guide users in efficiently submitting their claims. All in all, understanding how to effectively utilize this form is essential for employees to maximize their benefits and manage out-of-pocket expenses.

Shps Reimbursement Example

Health & Dependent Care Reimbursement Claim Form

|

|

Part I: Employee Information (Please print or click in each box to enter your information.) |

|

Control#: 99760 |

|

|||

|

Employee Name (Last/First/MI) |

Date of Birth (MMDDYYYY) |

Social Security Number (123456789) |

|

||||

|

|

|

|

|

|

|

|

|

|

Employee |

Daytime Telephone Number |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Change of Address Submission – You must contact your Health Insurance Section for a |

permanent change of address. By |

|

|||

|

|

|

checking this box and completing the information below the change is only temporary. |

|

|

|

||

|

Employee |

Address |

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee Address (e.g., Apt #, P.O. Box) |

|

State |

|

Postal Code |

|

||

|

|

|

|

|

|

|

|

|

|

Foreign Country |

|

Country Code |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part II: Health Care Reimbursement Request

|

|

Types of Service |

Plan Type |

|

Dates of Service |

|

|

Covered by |

Explanation of |

Total Requested |

||||

|

Combine all same Type |

HMO/DMO/POS |

|

|

|

Insurance |

Benefits (EOB) |

Amount |

||||||

|

Date Format: MMDDYYYY |

|

|

|||||||||||

|

of Service Expenses |

Indemnity or |

|

|

(Y/N) |

Included (Y/N) |

|

|||||||

|

|

|

|

Traditional |

Beginning Date |

Ending Date |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||||

|

Medical |

|

|

|

|

|

|

|

|

|

|

|

||

|

Vision |

|

|

|

|

|

|

|

|

|

|

|

||

|

Prescription |

|

|

|

|

|

|

|

|

|

|

|

||

|

Dental |

|

|

|

|

|

|

|

|

|

|

|

||

|

Orthodontics |

|

|

|

|

|

|

|

|

|

|

|

||

|

Other |

|

|

|

|

|

|

|

|

|

|

|

||

|

(SHPS will pend claim unless minimum requested amount is greater than $25) |

Total Requested Amount: |

0.00 |

|||||||||||

|

|

|

|

|

|

|

|

|||||||

|

Part III: Dependent Care Affidavit and Reimbursement Request |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Dates of Service |

Total Requested |

||

|

|

Dependent’s Full Name |

|

Date of Birth |

|

Beginning Date |

|

Ending Date |

Amount |

|||||

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(SHPS will pend claim unless minimum requested amount is greater than $25) |

Total Requested Amount: |

0.00 |

|||||||||||

|

|

|||||||||||||

|

Provider Tax ID: |

|

|

|

Provider Name: |

|

|

|

|

|

|

|||

I provided Adult/Child Care Services to the above individuals in accordance with the amounts and dates that are requested:

Provider Signature: ________________________________________Date: _____________________

To expedite claim payment, please complete and fax form to: 502- 267- 2233

Part IV: Employee Certification for Reimbursement

I hereby certify that:

The above information is correct;

The above expenses are for the care of myself and/or my eligible dependents;

I have not received reimbursement previously for these expenses from my Flexible Spending Account(s) or any other plan; and

The total of any reimbursed dependent care expenses does not exceed my or my spouse's earned income

Reimbursement is not a guarantee that this payment is tax free;

Reimbursement of dependent care expenses will reduce and may eliminate completely my ability to claim a dependent care credit on my personal income tax return;

Dependent care expenses reimbursed through this account cannot be used as a dependent care credit on my personal tax return; and

Health care expenses reimbursed through this account cannot be used as a deduction on my personal income tax return.

I hereby authorize release of payment through my Flexible Spending Account(s).

I hereby authorize SHPS, Inc. or its representatives to obtain necessary information from all physicians, hospitals, medical service providers, dependent care providers, pharmacists, employers, and all other agencies or organizations (this includes other insurers) to consider the claim for reimbursement under my Flexible Spending Account(s).

Employee Signature: ______________________________________Date: _____________________

SHPS, INC.

FSA Processing Center

PO Box 34700 |

FAX Number: |

Louisville, Kentucky |

Reimbursement Request Form Instructions

Claim Submission:

Fax Submission – To expedite your claim payment, fax the completed and signed reimbursement claim form, along with all documentation, to the number listed above. Please send only one claim per transmission. Faxing multiple claim forms with documentation in one transmission will impact the processing of your reimbursement. Please do not include this instruction page with your fax.

Mail Submission – Please mail the completed and signed reimbursement claim form, along with all documentation, to SHPS, INC. at the address listed above.

Fill out the claim form completely and correctly to expedite your claim payment.

Your reimbursement can be sent electronically directly to your banking establishment or mailed to the address of record. You can sign up to receive your reimbursements directly to your bank account via electronic payment, view account history, or learn about our services by accessing mySHPS online services at www.shps.net.

Employee Instructions

Please read these instructions before completing the information requested on the reimbursement claim form.

1.

2.

3.

Complete all areas of Part I, "Employee Information.”

Where applicable, complete Part II, "Health Care Expenses" and/or Part III "Dependent Care Expenses."

All health care expenses should first be filed under your employer's health care plan or any other coverage you may have before you request reimbursement from your Flexible Spending Account.

This form is to be used only to request reimbursement for:

Health Care Expenses

Allowable expenses covered, but not fully reimbursed by any benefit plans. Attach a copy of the plan's Explanation of Benefits statement (EOB) as documentation.

Allowable expenses not covered by any benefit plans. Attach bills or receipts that indicate the name and address of the provider of service. Please note on the form if the expenses are not covered by a health or dental plan.

Supporting Documentation - Health Care Expenses

In addition to the completion of the claim form, the documentation described under either A or B below must be attached.

A. Explanation of Benefits statement (EOB): This is the statement you receive each time you, or a health care provider, submit medical, dental or vision claims for payment to your health, dental or vision care plan. The EOB will show the amount of expenses paid by the plan and the amount you must pay. For expenses that are partially covered by your (or your dependent's) medical, dental or vision plans, you must attach the EOB. If you are covered under a HMO/DMO indicate

B. All Other Expenses: For expenses not covered at all by your (or your dependent's) medical, dental or vision plans, reimbursement requests will not be processed without acceptable evidence of your expenses. A cancelled check is not considered acceptable evidence. Acceptable evidence includes receipts, which contain the following information:

Type of service or product provided

Date expense was incurred

Name of employee or dependent for whom the service/product was provided

Person or organization providing the service/product

Amount of expense

Dependent Care Expenses

In general, the following rules apply to dependent care expenses:

Dependent care expenses qualify if they are for the care of children or other dependents that are physically or mentally incapable of caring for themselves. These expenses must be incurred so that you and your spouse, if married, can work or your spouse can attend school full time.

Children must be under age 13.

Services provided by a childcare or elder care center must comply with all state and local laws to be an eligible reimbursement expense.

The annual amount of dependent care claims cannot exceed:

Your annual deposit amount up to $5,000 ($2,500 if you and your spouse are filing separate returns), or

Your annual salary or your spouse's annual salary, if less than $5,000.

Supporting Documentation - Dependent Care Expenses

For allowable Dependent (Day) Care expenses, attach a copy of the bill or signed receipt, or have the provider complete Part III, "Dependent Care Affidavit and Reimbursement Request" on the reverse side.

Requests will not be processed without the Tax ID number for all providers.

4.Read the Employee Certification for Reimbursement statement, then sign and date the form where indicated.

Questions? Call the SHPS Customer Service Center at

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Control Number | The SHPS Reimbursement form has a unique control number for submission tracking, which in this case is 99760. |

| Health Care Reimbursement | Health care expenses can be reimbursed through this form if they are not fully covered by other benefit plans. Attach relevant documentation such as an Explanation of Benefits (EOB). |

| Dependent Care Eligibility | Dependent care expenses qualify if they are for dependents under age 13 or those unable to care for themselves. Claims are limited to $5,000 annually for married couples filing jointly. |

| Submission Methods | Claims can be submitted via fax or mail. To expedite processing, fax the completed form and documentation to the designated number. |

Guidelines on Utilizing Shps Reimbursement

Filling out the SHPS Reimbursement form is essential for receiving the funds you're entitled to for your health and dependent care expenses. Completing this form accurately ensures your reimbursement request is processed smoothly, allowing you to focus on what matters most—your health and family.

- Complete Part I: Employee Information. Fill in your control number, name, date of birth, social security number, email address, daytime telephone number, and address. Don’t forget to specify any changes in your address if necessary.

- Move on to Part II: Health Care Reimbursement Request. List the types of services you are requesting reimbursement for, along with the plan type and dates of service. Ensure you include explanations of benefits (EOB) for each relevant expense.

- Fill in Part III: Dependent Care Affidavit and Reimbursement Request. Provide details such as the dependent’s name, date of birth, the total amount requested, and the dates of service. Ensure the provider’s tax ID and name are included.

- Read through the Employee Certification for Reimbursement. This step is crucial. You need to certify that all information you’ve provided is true and that the costs were for eligible care for you and your dependents.

- Sign and date the form. This final touch is essential, as it authorizes SHPS to process your reimbursement request.

- Submit your claim. You have two options here. Fax your completed form and documentation to 502-267-2233 or mail it to the specified address in Louisville, Kentucky. Make sure to send only one claim per transmission if you're faxing.

If you have any questions, reaching out to the SHPS Customer Service Center at 1-800-678-6684 can provide assistance and ensure you have everything you need to move forward smoothly.

What You Should Know About This Form

What is the SHPS Reimbursement form used for?

The SHPS Reimbursement form is designed to request reimbursement for qualified health and dependent care expenses incurred by employees and their eligible dependents. It allows employees to claim amounts not fully covered by other insurance or expenses that are not reimbursable through any other plans.

How do I complete the Employee Information section?

To complete the Employee Information section, fill in your control number, name, date of birth, social security number, email address, daytime telephone number, and address. Make sure that all information is accurate and clearly printed. If your address changes, contact your Health Insurance Section, unless the change is temporary and indicated on the form.

What types of services can I claim in Part II?

Part II allows you to request reimbursement for various types of health care services, including medical, vision, prescription, dental, and orthodontics. You must specify the dates of service and include any Explanation of Benefits (EOB) provided by your insurance plan. Claims under this section will pend if the total requested amount is less than $25.

What is required for reimbursement of dependent care expenses?

To claim dependent care expenses, complete Part III, which includes the dependent's full name, date of birth, and service dates. Attach supporting documentation, such as bills or signed receipts, and ensure that the provider's Tax ID number is included. Claims will not be processed without the necessary Tax ID.

What are the guidelines for documentation?

Documentation is essential for both health and dependent care expenses. For health care claims, include an EOB for partially covered expenses or receipts for expenses not covered by insurance. For dependent care, provide a signed receipt or bill, along with the provider's Tax ID number. Proper documentation is necessary to process your claims efficiently.

How do I submit the completed reimbursement form?

You can submit the completed form via fax or mail. For fax submissions, ensure that you send only one claim per transmission to expedite processing. If mailing, include all required documentation and send it to the SHPS Processing Center. The fax number is 502-267-2233, and the mailing address is PO Box 34700, Louisville, Kentucky 40232-4700.

What does the Employee Certification for Reimbursement entail?

Before signing, carefully read the Employee Certification for Reimbursement statement. By signing, you certify that the information provided is accurate, that the expenses are for you or your eligible dependents, and that you have not previously received reimbursement for these expenses from any other plans. You also authorize SHPS to obtain necessary information from relevant parties to process your claims.

What limitations are there for dependent care reimbursement?

Dependent care expenses may not exceed specific limits based on your income or the amount of money you have contributed to your Flexible Spending Account. The total for dependent care claims cannot exceed $5,000 per year, or $2,500 if filing separately, and claims must be for services that allow you and your spouse to work or attend school full time.

Whom do I contact if I have questions about the form?

If you have questions or require assistance regarding the SHPS Reimbursement form, you can contact the SHPS Customer Service Center at 1-800-678-6684 for support.

Common mistakes

Filling out the SHPS Reimbursement form can seem straightforward, but many individuals make common mistakes that could potentially delay their claims. Understanding these pitfalls is crucial for ensuring a smooth reimbursement process.

One major mistake is incomplete information. It is essential to fill in all required sections, especially in Part I, which includes your name, Social Security number, and date of birth. Omitting any of these details can result in your claim being rejected outright. It’s easy to overlook something when you're in a hurry, but double-checking your entries can make a big difference.

Another frequent error involves incorrect documentation. Many people forget to include necessary supporting documents, such as the Explanation of Benefits (EOB) or receipts. It is crucial to attach these items when claiming for healthcare expenses. If you don’t provide adequate proof of your expenses, SHPS may pend your claim, leading to further delays.

People often misinterpret the minimum reimbursement requirement. Claims for both health care and dependent care must be at least $25. If your claims do not meet this threshold, SHPS will not process them. This can catch you off guard if you expect smaller amounts to be reimbursed.

Not understanding the rules surrounding dependent care expenses can also lead to mistakes. For instance, claiming expenses for children over the age of 13 or for services when you or your spouse aren’t working may result in immediate denials. It’s imperative to be aware of eligibility to ensure your claims hold up under review.

Another area where people slip up is the formatting of dates. The form specifically requests that dates be entered in MMDDYYYY format. Failure to adhere to this format could lead to confusion and delay in processing your claim. Consistency and attention to detail can help mitigate this issue.

Many claimants neglect the employee certification section. All claims must be certified by the employee, confirming that the information is accurate and that no other reimbursements have been received for the same expenses. Without a signature, the form is considered incomplete and will not be processed.

It’s also common for individuals to submit multiple claims in one transmission when faxing their forms. This not only complicates the processing but can also lead to confusion and significant delays. It's best practice to send one claim per fax to expedite the reimbursement process.

Finally, ignoring the contact information provided for assistance can be a mistake. If questions arise while filling out the form, reaching out to SHPS Customer Service is helpful. They can clarify any doubts and guide you through the process, preventing unnecessary mistakes that could hinder your claim.

Documents used along the form

The SHPS Reimbursement form is typically used in conjunction with other documents to ensure a smooth claims process. Below is a list of common forms and documents that may accompany the SHPS Reimbursement form, each designed to provide essential information regarding your claim.

- Explanation of Benefits (EOB): This document details the services provided and the amount covered by your insurance plan. It must accompany claims for expenses that were partially covered.

- Provider Receipt: A receipt from your doctor or care provider that includes the date of service, type of service, and the amount charged. This is crucial for reimbursement of expenses not covered by insurance.

- Dependent Care Provider Tax ID: A form that captures the Tax ID number of the dependent care provider. This is required for submitting claims for child or elder care expenses.

- Provider Signature Form: A document that captures the signature of the dependent care provider, confirming the services rendered in accordance with the claimed amounts.

- Employee Certification Form: A separate certification statement confirming that the information submitted is accurate and that the claimed expenses meet eligibility requirements.

- Claim Submission Cover Sheet: A cover sheet that outlines the contents of the submission. This can help organize the documents and ensure nothing is overlooked.

- Payroll Documentation: This includes pay stubs or W-2 forms as proof of income for determining eligibility for dependent care expense claims.

- Bank Account Information Form: If you prefer electronic payment, this form is used to provide your banking details for direct deposit of reimbursements.

These forms work together to streamline the reimbursement process. Having them ready can significantly reduce delays and improve the chances of a successful claim submission.

Similar forms

- Flexible Spending Account (FSA) Claim Form: This document also requests reimbursement for eligible medical and dependent care expenses. It requires similar employee information and supporting documentation, ensuring that expenses align with FSA guidelines.

- Health Reimbursement Arrangement (HRA) Claim Form: Like the SHPS form, the HRA form is used to claim reimbursement for health-related expenses that are not fully paid by insurance. Both forms ask for similar details about the expenses incurred.

- Dependent Care Tax Credit Form: This form helps individuals claim a tax credit for dependent care expenses. Similar to the SHPS Reimbursement form, it requires information about the provider and the nature of the expenses, but focuses on tax credit filing rather than reimbursement.

- Out-of-Pocket Expense Claim Form: Used for claiming refunds for expenses incurred outside insurance coverage, this form shares features with the SHPS Reimbursement form, including detailed expense tracking and provider information.

- Medical Expense Deduction Worksheet: Taxpayers use this worksheet to prepare for potential deductions on their income tax returns. It resembles the SHPS form in that it requires thorough documentation of each expense, but is aimed at tax preparation rather than reimbursement.

- Employee Benefits Enrollment Form: While primarily used for enrolling in benefits, this form shares similarities with the SHPS Reimbursement form in gathering essential employee information and outlining specific benefits covered.

- Claim for Payment of Medical Services: This form is used to request direct payment from an insurer for medical services rendered. The process for documenting expenses and need for provider verification mirrors that of the SHPS Reimbursement form.

- Tax Form 2441 – Child and Dependent Care Expenses: This IRS form is utilized for claiming child and dependent care expenses. It requires the same basic information regarding care provider and expenses, paralleling the SHPS form’s requirements.

Dos and Don'ts

Here are seven important tips for filling out the SHPS Reimbursement form, including what to do and what to avoid:

- Do complete all sections of Part I thoroughly, including your full name and contact information.

- Do attach all necessary supporting documentation, such as the Explanation of Benefits (EOB), receipts, or signed statements from providers.

- Do double-check that all expenses are eligible for reimbursement, and ensure they are not covered by other insurances first.

- Do check your total requested amount; claims for less than $25 will not be processed.

- Don’t forget to sign and date the form in the Employee Certification section to avoid delays.

- Don’t submit multiple claims in one fax transmission, as this can impact processing times.

- Don’t include this instruction page when faxing your completed claim form.

Misconceptions

Here are some common misconceptions about the SHPS Reimbursement form, along with clarifications for each:

- Claim submission is automatic. Many believe their claim will be processed without any additional steps. However, you must complete the form correctly and provide all necessary documentation.

- Multiple claims can be faxed together. Some think they can save time by sending multiple claims in one transmission. This is not advised. Each claim should be sent separately to ensure proper processing.

- Only medical expenses are eligible. There's a belief that only health care expenses qualify. In reality, both health care and dependent care expenses can be reimbursed under this form.

- Reimbursement guarantees tax-free payment. Many assume that any reimbursement received is tax-free. It’s important to understand that reimbursement does not guarantee that the payment won't be taxable.

- All dependent care expenses are covered. Some expect all childcare costs to be reimbursed. Eligible expenses must meet specific criteria, such as being necessary for work or school.

- Previous reimbursements affect current claims. There's a misconception that receiving reimbursement once invalidates future claims. Each submission is evaluated independently based on current eligibility.

- Providing a canceled check is sufficient documentation. It's a common misunderstanding that a canceled check meets documentation requirements. Acceptable evidence must include specific detailed receipts.

- Only services from licensed providers are accepted. While it’s vital to choose qualified providers, there’s a belief that unlicensed services can never be claimed. Not all services require licensing; they just need to be legitimate and meet criteria.

- Dependent care providers do not need a Tax ID number. Many think a Tax ID number is optional for providers. In fact, it is required to process dependent care claims.

Understanding these misconceptions can help ensure smoother processing of your reimbursement claims. If you have any questions about the form or the process, don't hesitate to reach out for assistance.

Key takeaways

Filling out and using the SHPS Reimbursement form effectively can streamline the reimbursement process for health and dependent care expenses. Here are five key takeaways to consider:

- Complete All Required Sections: Ensure that every section of the form is filled out accurately. This includes your personal information, details on health care expenses, and dependent care affidavit, if applicable.

- Provide Supporting Documentation: Attach necessary documentation, such as the Explanation of Benefits (EOB) for health care expenses or signed receipts for dependent care services. Without these attachments, claims may be delayed or denied.

- Understand the Minimum Requirements: Claims for both health care and dependent care expenses must exceed $25 to be processed. Claims below this amount will be pending until the minimum is achieved.

- Choose Your Submission Method Wisely: You can submit your claim via fax or mail. Faxing is generally quicker; however, ensure that you send only one claim per transmission to avoid processing issues.

- Register for Electronic Payments: Consider enrolling in electronic reimbursements for faster payments. You may also access account history and services via the mySHPS online platform.

Browse Other Templates

1-9 - The M-476 is an integral document in the journey to becoming a U.S. citizen.

Recovery Equipment Must Be; - This form aids in reducing harmful emissions from refrigerant systems.