Fill Out Your Si 200 Form

The SI 200 form is a vital document for corporations operating in California, particularly domestic stock and agricultural cooperative corporations. This Statement of Information must be submitted within 90 days of filing the initial Articles of Incorporation, and annually thereafter. The form collects essential corporate information, including details about the corporation's principal business activities, agent for service of process, and the current board of directors. Additionally, it streamlines the filing process through an online E-file service, allowing corporations to request a free PDF copy of their filed statement at the time of submission. By providing an email address during filing, a confirmation email with the PDF is sent automatically, ensuring a seamless experience. Corporate officers, including the CEO, Secretary, and CFO, must be listed, alongside their complete addresses. Furthermore, changes to previously filed information can be made directly on this form. Penalties may be assessed for late filing, highlighting the importance of compliance. Completing the SI 200 accurately helps ensure transparency and accountability within the corporate framework.

Si 200 Example

Secretary of State

Business Programs Division

Statement of Information, P.O. Box 944230, Sacramento, CA

Free Electronic Copy for Statements of Information Filed Online

Effective October 14, 2013

The Secretary of State's office is excited to announce that Monday, October 14th, 2013, corporations who use our online

By simply providing an email address as part of the submission process, an image of the filed statement in PDF format is emailed automatically once the statement is successfully processed. The email address provided for purposes of receiving a free filed copy is not public information, and is deleted from our system once the image of the filed statement is sent.

The required Statement of Information for most corporations can be filed online and is processed generally in one business day. A free PDF copy of the submitted Statement of Information will be returned electronically following confirmation of payment, if an email address is provided. Additional plain copies and certified copies may be requested at a later time in person or by mail. Refer to Information Requests for information about obtaining additional copies.

Online Copies: Annual/Biennial Statements of Information (Rev. 10/31/2013) |

www.sos.ca.gov/business/be |

|

(916) |

State of California |

S |

Secretary of State |

|

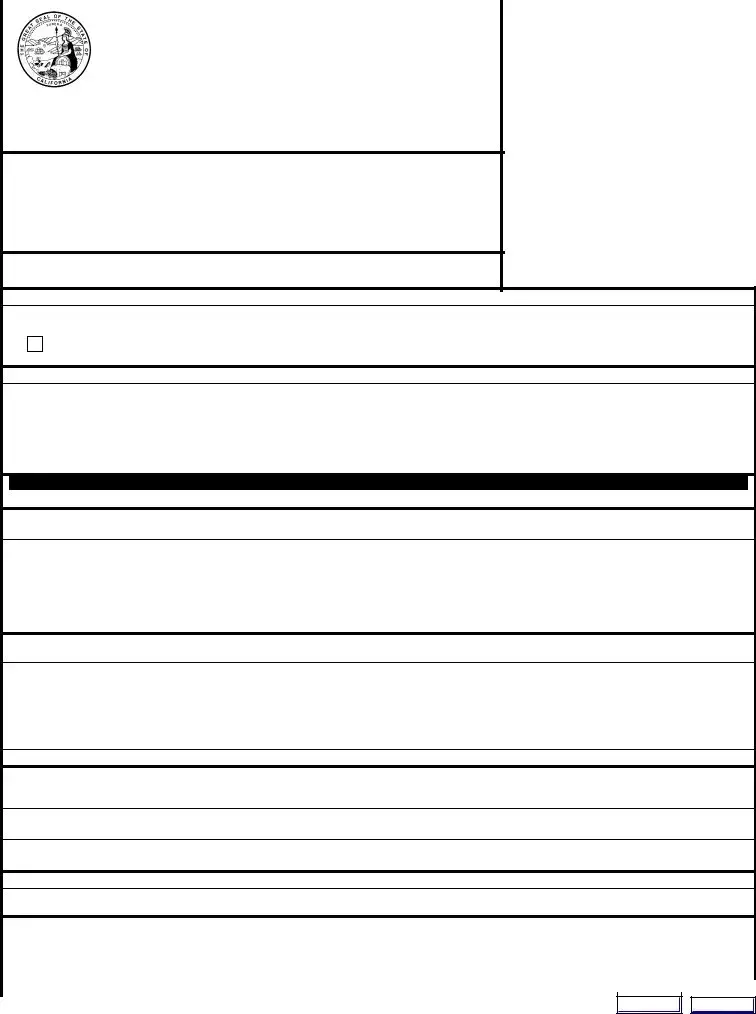

Statement of Information

(Domestic Stock and Agricultural Cooperative Corporations)

FEES (Filing and Disclosure): $25.00.

If this is an amendment, see instructions.

IMPORTANT – READ INSTRUCTIONS BEFORE COMPLETING THIS FORM

1.CORPORATE NAME

2.CALIFORNIA CORPORATE NUMBER

This Space for Filing Use Only

No Change Statement (Not applicable if agent address of record is a P.O. Box address. See instructions.)

3. If there have been any changes to the information contained in the last Statement of Information filed with the California Secretary of State, or no statement of information has been previously filed, this form must be completed in its entirety.

If there has been no change in any of the information contained in the last Statement of Information filed with the California Secretary of State, check the box and proceed to Item 17.

Complete Addresses for the Following (Do not abbreviate the name of the city. Items 4 and 5 cannot be P.O. Boxes.)

4. |

STREET ADDRESS OF PRINCIPAL EXECUTIVE OFFICE |

CITY |

STATE |

ZIP CODE |

|

|

|

|

|

5. |

STREET ADDRESS OF PRINCIPAL BUSINESS OFFICE IN CALIFORNIA, IF ANY |

CITY |

STATE |

ZIP CODE |

|

|

|

CA |

|

6. |

MAILING ADDRESS OF CORPORATION, IF DIFFERENT THAN ITEM 4 |

CITY |

STATE |

ZIP CODE |

7.EMAIL ADDRESS FOR RECEIVING STATUTORY NOTIFICATIONS

Names and Complete Addresses of the Following Officers (The corporation must list these three officers. A comparable title for the specific officer may be added; however, the preprinted titles on this form must not be altered.)

7. |

CHIEF EXECUTIVE OFFICER/ |

ADDRESS |

CITY |

STATE |

ZIP CODE |

|

|

|

|

|

|

8. |

SECRETARY |

ADDRESS |

CITY |

STATE |

ZIP CODE |

|

|

|

|

|

|

9. |

CHIEF FINANCIAL OFFICER/ |

ADDRESS |

CITY |

STATE |

ZIP CODE |

Names and Complete Addresses of All Directors, Including Directors Who are Also Officers (The corporation must have at least one director. Attach additional pages, if necessary.)

10. |

NAME |

ADDRESS |

CITY |

STATE |

ZIP CODE |

|

|

|

|

|

|

11. |

NAME |

ADDRESS |

CITY |

STATE |

ZIP CODE |

|

|

|

|

|

|

12. |

NAME |

ADDRESS |

CITY |

STATE |

ZIP CODE |

13. NUMBER OF VACANCIES ON THE BOARD OF DIRECTORS, IF ANY:

Agent for Service of Process If the agent is an individual, the agent must reside in California and Item 15 must be completed with a California street address, a P.O. Box address is not acceptable. If the agent is another corporation, the agent must have on file with the California Secretary of State a certificate pursuant to California Corporations Code section 1505 and Item 15 must be left blank.

14.NAME OF AGENT FOR SERVICE OF PROCESS [Note: The person designated as the corporation's agent MUST have agreed to act in that capacity prior to the designation.]

15. STREET ADDRESS OF AGENT FOR SERVICE OF PROCESS IN CALIFORNIA, IF AN INDIVIDUAL CITY |

STATE |

ZIP CODE |

CA

Type of Business

16.DESCRIBE THE TYPE OF BUSINESS OF THE CORPORATION

17.BY SUBMITTING THIS STATEMENT OF INFORMATION TO THE CALIFORNIA SECRETARY OF STATE, THE CORPORATION CERTIFIES THE INFORMATION CONTAINED HEREIN, INCLUDING ANY ATTACHMENTS, IS TRUE AND CORRECT.

|

DATE |

|

TYPE/PRINT NAME OF PERSON COMPLETING FORM |

|

TITLE |

|

SIGNATURE |

|

|

|

|

|

APPROVED BY SECRETARY OF STATE |

||||

Clear Form

Print Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The SI 200 form is used by domestic stock and agricultural cooperative corporations to file their Statement of Information with the California Secretary of State. |

| Filing Fee | A total fee of $25.00 is required upon submission, which includes a $20.00 filing fee and a $5.00 disclosure fee. |

| Filing Frequency | Corporations must file the SI 200 within 90 days after the initial Articles of Incorporation and annually thereafter during the applicable filing period. |

| Governing Law | This form is governed by California Corporations Code section 1502 and California Food and Agricultural Code section 54040. |

Guidelines on Utilizing Si 200

The process of completing Form SI 200 requires careful attention to detail to ensure all necessary information is accurately provided. Properly filling out this form enables a corporation to remain in good standing with the California Secretary of State. Here is a straightforward guide to assist in completing this form efficiently.

- Enter the corporate name exactly as recorded with the California Secretary of State in Item 1.

- Input the California corporate number in Item 2.

- If there have been any changes since the last Statement of Information or if no previous statement was filed, complete the whole form. Otherwise, check the box to proceed to Item 17.

- Provide the complete street address of the principal executive office in Item 4. Avoid using a P.O. Box.

- If applicable, enter the principal business office address in California in Item 5, ensuring it is not a P.O. Box.

- If the mailing address differs from the executive office, include it in Item 6 with a complete street address.

- In Item 7, list the chief executive officer’s name and address.

- Continue to Item 8 and enter the secretary's name and address.

- In Item 9, provide the name and address of the chief financial officer.

- List the names and addresses of directors in Items 10 to 12, ensuring at least one director is included. Attach additional pages if needed.

- Indicate any vacancies on the board in Item 13.

- In Item 14, enter the agent for service of process. Ensure the designated agent has agreed to act in that capacity.

- Provide the street address of the agent for service of process in Item 15, making sure it is not a P.O. Box.

- In Item 16, briefly describe the type of business conducted by the corporation.

- Complete Item 17 by typing or printing the name, title, and signature of the person completing the form, along with the date.

What You Should Know About This Form

What is the SI-200 form?

The SI-200 form is the Statement of Information required for domestic stock and agricultural cooperative corporations in California. This form provides essential information about a corporation, including details about its officers, directors, and primary business activity.

Who needs to file the SI-200 form?

Every domestic stock corporation and agricultural cooperative in California is required to file the SI-200 form within 90 days after their initial Articles of Incorporation. After the initial filing, corporations must file this statement annually during their applicable filing periods.

What information is included in the SI-200 form?

The SI-200 form requires detailed information such as the corporation's name, addresses of its principal offices, names of its officers and directors, and a description of the business activity. It also includes designation information for an agent for service of process.

How can I file the SI-200 form?

The preferred method of filing the SI-200 form is online through the Secretary of State's E-file service. This can expedite processing, and corporations can receive a free PDF copy of the submitted statement via email. You can also mail the completed form or deliver it in person to the Sacramento office.

What is the fee for filing the SI-200 form?

There is a total fee of $25.00 that must be submitted with the SI-200 form. This includes a $20.00 filing fee and a $5.00 disclosure fee. If you’re filing to amend information and it is outside the applicable period, no fee is required.

What happens if I do not file the SI-200 form on time?

Failure to file the SI-200 form by its due date can lead to a penalty of $250. It’s crucial to file on time to avoid these additional fees.

Can I amend the SI-200 form?

Yes. If there are changes to the information provided in a previously filed SI-200 form, a new form must be completed in its entirety. This amended form should be submitted during the allowed filing period to avoid extra fees.

What should I do if my business hasn’t changed since the last filing?

If there have been no changes to your information since the last filed Statement of Information, you can check the "No Change Statement" box on the form and proceed directly to the final item.

How can I obtain a copy of the filed SI-200 form?

You can request a copy of the filed SI-200 form by including a separate request for copy fees when submitting your statement. The fees are $1.00 for the first page and $.50 for each additional page. For certified copies, there is an additional $5.00 certification fee.

Common mistakes

Completing the SI-200 form can be straightforward, but many people make common mistakes that can delay processing. One such mistake is failing to provide a complete address for the agent for service of process. If an individual is designated as the agent, they must provide a residential or business street address in California. Using a P.O. Box is not acceptable, and this can cause the entire form to be rejected.

Another frequent error is the abbreviation of city names. The instructions clearly state that the full name of the city must be used and not abbreviated. This detail may seem minor, but it is crucial for ensuring the accuracy of the filing. Omitting such details could lead to confusion and potential processing delays.

Many individuals also forget to check for changes from the last filed statement. If there have been no changes, the form must explicitly indicate this by checking the appropriate box. Ignoring this step means the form may be filled out unnecessarily, which can lead to incorrect or outdated information being submitted.

Lastly, individuals sometimes overlook the requirement to include the corporation number. This number is essential for the Secretary of State's office to locate the corporation’s records. Without it, the processing of the filing could be significantly hindered, resulting in delays and possible penalties. Taking care to provide complete and accurate information when filling out the SI-200 form is vital to ensure timely processing.

Documents used along the form

The SI-200 form, or Statement of Information, is a crucial document for corporations in California. It provides vital information regarding a corporation's operations, officers, and directors. While the SI-200 is essential, several other documents may accompany it during the filing process or serve related purposes. Below is a list of forms and documents often used alongside the SI-200.

- Articles of Incorporation: This document establishes a corporation's existence. It includes the corporation's name, purpose, and details regarding its stock structure.

- Form SI-PT (Corporate Disclosure Statement): Required annually for publicly traded corporations, this form provides additional disclosure as defined under securities regulations, typically due within 150 days after the fiscal year ends.

- Certificate of Good Standing: Issued by the Secretary of State, this document verifies that a corporation is compliant with state requirements and authorized to conduct business.

- Bylaws: These internal rules govern a corporation's operations. Bylaws outline the responsibilities of directors, officers, and shareholders, and detail the procedures for meetings and decision-making.

- Statement of Information (form SI-100): Similar to the SI-200, this form is used by nonprofit corporations. It provides details about the nonprofit's directors, officers, and designated agent for service of process.

- Form LLC-12 (Statement of Information for LLCs): Limited liability companies also need to file a Statement of Information. This form shares similar requirements to the SI-200 but is tailored for LLC structures.

- Shareholder Agreements: These legal documents outline the rights and responsibilities of shareholders. They can dictate how shares are to be transferred and how decisions are made within the corporation.

- Form D (Notice of Exempt Offering of Securities): If a corporation is raising capital through securities offerings exempt from registration under federal securities laws, filing Form D with the SEC is essential.

Understanding these additional forms and documents can greatly benefit corporations in ensuring adherence to regulatory requirements. It is advisable for businesses to stay informed and comply with all necessary filings to maintain good standing and transparency in operations.

Similar forms

The SI 200 form, which serves as a Statement of Information for domestic stock and agricultural cooperative corporations in California, has similarities to several other documents. Here are seven documents that share key features with the SI 200 form:

- Statement of Information (Form SI-100): Like the SI 200, this form is required for corporations to provide updated information about their business activities and officers. Both emphasize the need for accurate and current details to comply with state regulations.

- Corporate Disclosure Statement (Form SI-PT): Publicly traded corporations must file this statement, which shares the objective of keeping state records updated. It similarly requires details about officers and business activities, ensuring transparency.

- Articles of Incorporation: When a corporation is formed, it must file these articles with the state. Both documents establish official recognition and require specific information about the business structure, though the Articles initiate the corporation while the SI 200 maintains ongoing compliance.

- Bylaws: These internal rules for managing a corporation must specify governance structures. Both the SI 200 and bylaws outline essential operational details and can affect the organization’s regulatory status.

- Statement of Officers (Form SI-350): This document focuses on the names and addresses of a corporation's officers and directors. Similar to the SI 200, it requires ongoing notification to the state regarding any changes in leadership.

- Annual Report: Many states require periodic annual reports detailing a corporation's financial performance and operational updates. The SI 200 serves a similar purpose by providing a snapshot of key corporate information to maintain good standing.

- Change of Agent Statement: Should a corporation need to change its registered agent, it must file this statement. Like the SI 200, this document ensures that the state has up-to-date information regarding who is responsible for receiving legal documents.

Dos and Don'ts

When filling out the SI 200 form, consider the following guidelines:

- Do ensure that you complete all required sections with accurate information.

- Do type or write legibly in black or blue ink if not filing online.

- Do verify that the addresses provided are not P.O. Box addresses and are formatted correctly.

- Do not alter the form in any way, including changing preprinted titles or instructions.

Further actions to avoid:

- Do not abbreviate names of cities or any required information.

- Do not submit the form without the appropriate fees attached.

- Do not forget to double-check the agent for service of process information; it must be a valid California address.

- Do not seal the form without signing it and dating it appropriately.

Misconceptions

There are many misconceptions about the SI 200 form that can lead to confusion. Here are ten common misunderstandings:

- Filing the SI 200 form is optional for active corporations. Many believe that only inactive corporations need to file. In reality, every domestic stock and agricultural cooperative corporation must file this statement annually.

- Only corporations with changes need to file the SI 200 form. Some think if no changes exist, they can skip the filing. However, all corporations must file, even if the information is unchanged.

- There are no penalties for late filing. It is often assumed that deadlines are flexible. Late submissions result in a $250 penalty.

- The form can be filed in any California office. Some people believe they can submit the form at any location. The SI 200 must be filed only in the Sacramento office.

- A P.O. Box can be used as an address for the agent for service of process. This is a common misconception. A physical street address in California is required.

- Online filing is not available for the SI 200 form. Many think that online services are not an option. In fact, corporations can easily file and receive a free PDF copy when done online.

- All directors must have an appointment or election recorded to be listed. Some believe this requirement exists. However, all directors must be named regardless of formal appointment procedures.

- Only one officer is necessary for filing. It’s often thought that having one officer suffices. In actuality, a corporation must list a president, a secretary, and a chief financial officer.

- There is no fee for filing amendments. Some assume that amendments can be filed without fees. While if it is within the filing period, no fee is required for amendments; otherwise, typical filing fees apply.

- The corporate number is optional on the form. It is commonly believed that this information can be omitted. However, entering the corporation number is essential for proper processing.

These misunderstandings can complicate the filing process, leading to potential penalties and delays. Understanding the requirements can help ensure a smooth experience when completing the SI 200 form.

Key takeaways

Filling out the SI 200 form, which is the Statement of Information required for corporations in California, can be a straightforward process when approached thoughtfully. Here are some important points to consider:

- Timely Submission: Corporations must submit the SI 200 form within 90 days of their initial Articles of Incorporation and then annually during the designated filing period.

- Accurate Information: Ensure that all the information provided on the form is accurate and up-to-date to avoid potential penalties.

- Online Filing Benefits: Filing online allows for faster processing and provides a free PDF copy of the filed statement, sent directly to the email provided during submission.

- Agent for Service of Process: Designate an agent who is a California resident or another corporation that has filed the required certificate. Avoid using a P.O. Box for the agent's address.

- Fees and Penalties: Understand the associated fees for filing. A missed deadline incurs a penalty of $250, and the total filing fee is $25, which includes both filing and disclosure fees.

Browse Other Templates

3602-ez - Mailers are responsible for confirming the presence of sufficient funds for the mailing.

Labour Board of Ontario - Health care providers are responsible for submitting only the relevant pages of the C-4.3 report.