Fill Out Your Signature Specimen Form

The Signature Specimen form is an essential document for companies engaging with Clearstream Banking S.A. It serves as a formal declaration of authorized signatories for a company's financial accounts. By filling out this form, representatives confirm the identities of individuals who may legally bind the company

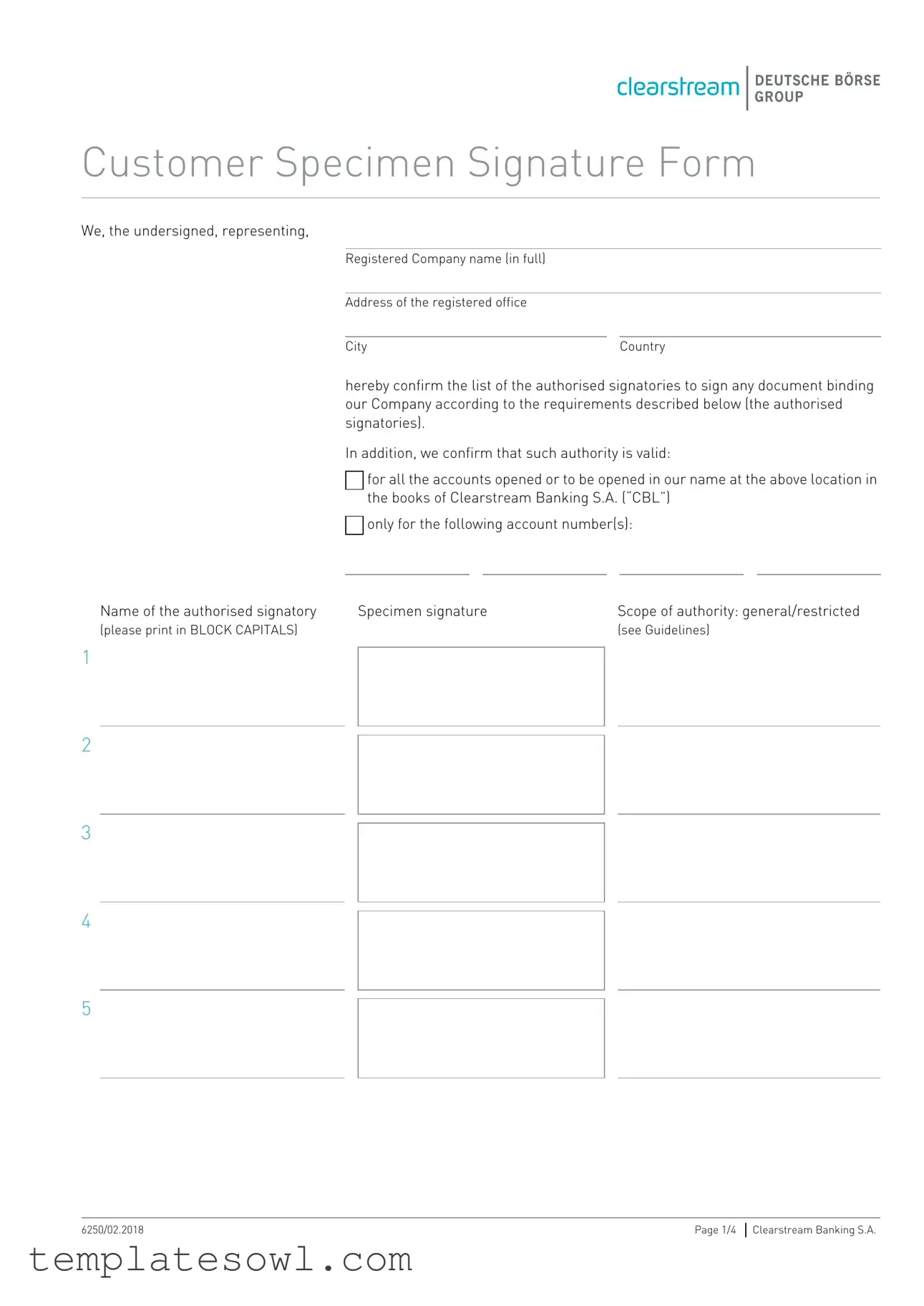

Signature Specimen Example

Customer Specimen Signature Form

We, the undersigned, representing,

Registered Company name (in full)

Address of the registered office

City |

|

Country |

hereby confirm the list of the authorised signatories to sign any document binding our Company according to the requirements described below (the authorised signatories).

In addition, we confirm that such authority is valid:

for all the accounts opened or to be opened in our name at the above location in the books of Clearstream Banking S.A. (“CBL”)

for all the accounts opened or to be opened in our name at the above location in the books of Clearstream Banking S.A. (“CBL”)

only for the following account number(s):

only for the following account number(s):

Name of the authorised signatory |

Specimen signature |

Scope of authority: general/restricted |

(please print in BLOCK CAPITALS) |

|

(see Guidelines) |

1

2

3

4

5

6250/02.2018 |

Page 1/4 |

Clearstream Banking S.A. |

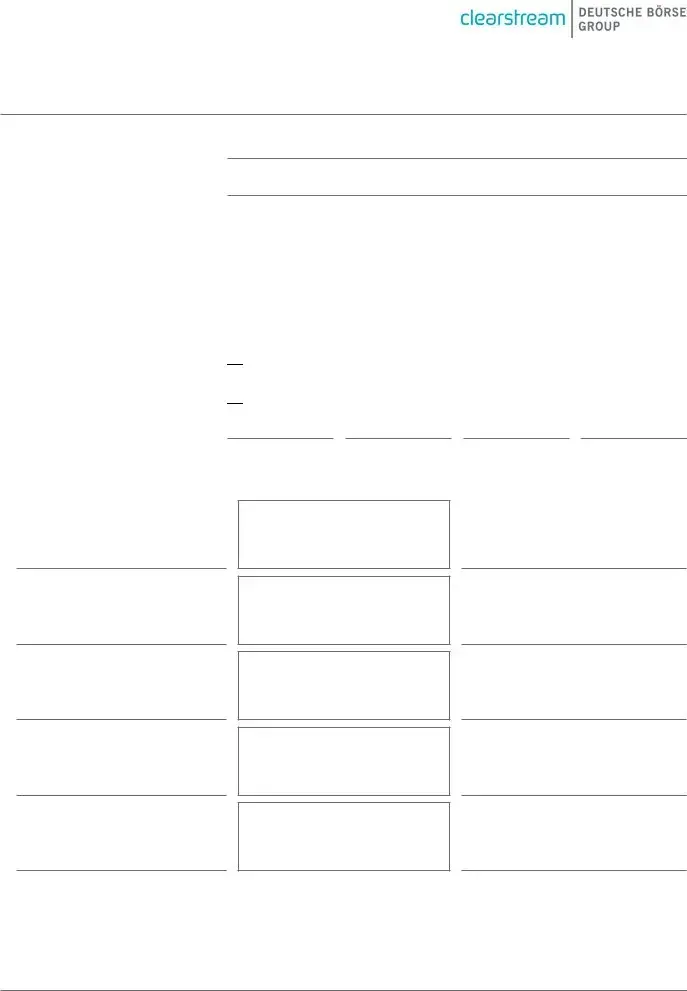

Customer Specimen Signature Form

2

Individual or joint signatories

(please tick the appropriate box(es))

The persons listed

from number: ____ to number: ____ may act as individual signatories.

One person listed

from number: ____ to number: ____ together with one person listed

from number: ____ to number: ____ may act as joint signatories.

Any two of the persons listed as authorised may act as joint signatories.

Supplement or replacement |

The submission of this form supersedes |

|||

(please tick one box only) |

|

The previous specimen |

|

Our official signature list dated |

|

|

signature form dated |

|

|

|

OR |

|

|

|

|

|

|

|

|

|

This specimen signature form supplements |

|||

|

|

The previous customer |

|

Our official signature list dated |

|

|

specimen signature form dated |

|

|

We hereby undertake, in accordance with Article 33 of CBL’s General Terms and Conditions, to provide written notification of deletions or modifications to signatures without delay and to submit an

Authorised signature(s)

Signature |

|

Signature |

|

|

|

Name |

|

Name |

|

|

|

Title |

|

Title |

|

|

|

Place |

|

Place |

|

|

|

Date |

|

Date |

6250/02.2018 |

Page 2/4 |

Clearstream Banking S.A. |

Customer Specimen Signature Form

3

Name of the authorised signatory |

Specimen signature |

Scope of authority: general/restricted |

(please print in BLOCK CAPITALS) |

|

(see Guidelines) |

6

7

8

9

10

11

12

13

Authorised signature(s)

Signature |

|

Signature |

|

|

|

Name |

|

Name |

|

|

|

Title |

|

Title |

|

|

|

Place |

|

Place |

|

|

|

Date |

|

Date |

6250/02.2018 |

Page 3/4 |

Clearstream Banking S.A. |

Customer Specimen Signature Form

4

Guidelines

Account numbers

–First box

Mark the first box only if all of your accounts are managed by the same office.

–Second box

Mark the second box only if all the accounts listed are covered by the signatures on this form. Please ensure that you have listed all relevant account numbers. Note: Please use another form or forms for accounts not covered by the signatures on this form.

Name of the authorised signatory

At least one signatory name is mandatory if he/she is authorised to sign alone. At least two signatories are mandatory if they are authorised to sign jointly. If completing by hand, please write names in BLOCK CAPITALS.

Specimen signature

Please sign within the box to facilitate scanning of your signature. Scope of authority

–General

Indicates authority to sign documentation binding the Company, including but not limited to deeds, contracts, agreements, power of attorney, requests for opening and closing of accounts, and any instructions or requests regarding day-

–Restricted

Indicates authority to sign any instructions or requests regarding

Individual or joint signatories

Please enter any individual signatories first. If no box is marked, we will assume that each signatory is authorised to sign alone.

This form and any continuation page must be numbered, dated and signed by a company director or other officer (two if acting jointly) authorised to appoint signatories. Should the appointers also be considered as authorised signatories, their names must be listed among the appointed persons. Adequate proof of their authority to appoint signatories must be attached to the form and any attachments must be duly certified. Certification must be done by a competent authority, whether under Luxembourg regulation or the national regulation of the customer's jurisdiction (such as a notary, police officer, embassy, or a government administration such as the mayor's office). Proof of the competence of an authority that is not under Luxembourg regulation must be attached.

Please return the completed form and attachments to the following address: Clearstream Banking S.A.

Attention: Account Administration Luxembourg 42, avenue JF Kennedy

6250/02.2018 |

Page 4/4 |

Clearstream Banking S.A. |

Form Characteristics

| Fact Name | Fact Description | Governing Law (if applicable) |

|---|---|---|

| Purpose | The Signature Specimen form is used to designate authorized signatories for a company, allowing specified individuals to bind the company in legal documents. | N/A |

| General vs. Restricted Authority | Signatories can be granted general authority, allowing them to sign a wide range of documents, or restricted authority, limiting their signing powers to specific types of documents. | N/A |

| Joint Signatories | Individuals can act as joint signatories, requiring more than one signer's signature for certain transactions, enhancing security and oversight. | N/A |

| Update Requirements | Companies must provide written notification to Clearstream Banking S.A. whenever there are deletions or modifications to the list of authorized signatories. | Article 33 of CBL General Terms and Conditions |

| Certification | The form must be signed by an authorized director or officer. Any attachments should be certified by a relevant authority. | Laws of Luxembourg or local jurisdiction |

| Submission Address | Completed forms and any required documents must be sent to Clearstream Banking S.A., Luxembourg, 42, avenue JF Kennedy, L-1855 Luxembourg. | N/A |

Guidelines on Utilizing Signature Specimen

Completing the Signature Specimen form is crucial for establishing authorized signatories for your company. After filling out this form, it will need to be submitted to the relevant banking institution to ensure all accounts are properly managed and authorized signatures are recognized. The instructions below will guide you through filling out the form accurately, allowing for a smooth submission process.

- Begin with the section for your company’s details. Enter the Registered Company name in full.

- Provide the Address of the registered office including street name and number.

- Add the City and Country where your registered office is located.

- List the authorized signatories by entering their names and corresponding specimen signatures in the provided spaces.

- Indicate whether the scope of each signatory's authority is general or restricted by selecting the appropriate option.

- For the sections labeled Individual or joint signatories, mark the appropriate checkboxes to specify if the persons listed can sign individually or jointly.

- In the Supplement or replacement section, tick the box to indicate whether this form supersedes a previous specimen or if it supplements existing forms.

- Each authorized signatory must sign, date, and print their name and title in the designated areas.

- Ensure adequate proof of authority for the signatories, if necessary, by attaching certified documents as required.

- Once complete, review the form to ensure all required fields are filled accurately.

- Return the completed form and any attachments to Clearstream Banking S.A. at the specified address.

What You Should Know About This Form

What is the purpose of the Signature Specimen form?

The Signature Specimen form is used to provide Clearstream Banking S.A. with a list of authorized signatories for a registered company. By completing this form, the company confirms who is authorized to sign documents on its behalf, which is essential for managing accounts and ensuring that only designated individuals can execute binding agreements.

Who should sign the Signature Specimen form?

The form must be signed by a company director or another officer who is authorized to appoint signatories. If signatories are acting jointly, two signatures are required. If the signatories who are appointing are also included as authorized signatories, their names must also appear on the form.

What types of authority can be designated on the form?

Two types of authority can be indicated: general and restricted. General authority allows signatories to execute any binding documents. Restricted authority limits signatories to day-to-day operational matters only. It's also important to ensure that at least one signatory has general authority if signing alone, or at least two do if signing jointly.

What should I do if the list of authorized signatories changes?

Notify Clearstream Banking S.A. in writing without delay if there are deletions or modifications to the authorized signatures. In such cases, submitting a new Signature Specimen form is necessary to maintain current records and authority levels.

Are there specific guidelines to follow when completing the form?

Yes, the form must be completed in BLOCK CAPITALS. At least one and two names are required if signatories are expected to act alone or jointly, respectively. Additionally, ensure that all relevant account numbers are listed, and provide adequate proof of authority if additional signatures are appointed.

Where should the completed form be sent?

The completed Signature Specimen form, along with any necessary attachments, should be sent to Clearstream Banking S.A., Attention: Account Administration, at 42, avenue JF Kennedy, L-1855 Luxembourg. Make sure the form is properly numbered, dated, and signed before submission.

Common mistakes

Filling out a Signature Specimen form may seem straightforward, but many individuals inadvertently make errors that can lead to significant delays or complications. Recognizing these common mistakes can save you time and ensure that your company's documents are processed without unnecessary hiccups.

One mistake is not providing all required signatory names. It’s crucial to ensure that at least one name appears if someone is authorized to sign alone. Similarly, if there are joint signatories, you must include at least two names. Omitting names may result in your form being deemed incomplete, delaying your transactions.

Another frequent oversight involves the specimen signatures themselves. You must sign within the designated box to facilitate proper scanning of your signature. If not done correctly, your signature might be misinterpreted, leading to potential issues down the line.

Failing to indicate the scope of authority is a common error as well. Individuals filling out the form often neglect to specify whether the authority is general or restricted. This can create confusion about what transactions signatories are allowed to approve and may delay processing time.

Additionally, many people forget to mark the boxes pertaining to individual or joint signatories. If this step is overlooked, the bank will assume that each signatory has the authority to sign documents independently. Be vigilant; clarity in this section is critical for smooth operations.

Another crucial mistake is the incorrect completion of account numbers. Make sure to mark the first box only if all accounts are managed by the same office. Marking the second box should be done only if all the accounts listed are covered by the signatures on the form. Missing or incorrectly marking these boxes can have significant repercussions.

People also often neglect to certify their authority to appoint signatories. Adequate proof of this authority must be attached to ensure compliance. Certification should come from a competent authority, and failure to follow this guideline can jeopardize the validity of the entire form.

Lastly, ensure that the form and any continuation pages are numbered, dated, and signed by a company director or an authorized officer. Forgetting to sign or date can result in the entire submission being rejected, thereby prolonging the authorization process. Attention to detail is paramount, and taking the time to double-check your work can make a tremendous difference.

Documents used along the form

The Signature Specimen form is essential for establishing the authorized signatories for a company. Alongside this form, certain supplementary documents are commonly required to ensure a comprehensive understanding of the corporate governance structure and the authority of the individuals involved. The following are important forms and documents often used in conjunction with the Signature Specimen form:

- Board Resolution: A formal document that records decisions made by the company's board of directors. It typically outlines the authority granted to specific individuals, including the authorization to execute the Signature Specimen form.

- Corporate Bylaws: These are the governing rules for the corporation, detailing the responsibilities of its members, the process for meeting, and how decisions are made within the organization. The bylaws set the framework for authorizing signatories.

- Power of Attorney (POA): This document grants an individual (the attorney-in-fact) the authority to act on behalf of the company for specified matters. A POA may be necessary if a signatory needs to perform certain transactions on behalf of the company without being physically present.

- Identification Documents: Valid photo IDs of the authorized signatories must be provided to verify their identities. This could include driver's licenses, passports, or other government-issued identification that confirms their capacity to act on behalf of the company.

- Certificate of Good Standing: This document certifies that the company is legally registered and recognized as operational in its jurisdiction. It is often required to assure that the entity is in compliance with local regulations before allowing signature authorities.

These documents collectively reinforce the legitimacy and authority of the company's authorized signatories. They serve to clarify roles, ensure compliance, and support smooth operational processes within the organization.

Similar forms

The Signature Specimen form plays a crucial role in identifying the individuals authorized to sign documents on behalf of a company. Several other documents serve similar purposes in establishing authority and signatory rights. Below are four documents that relate closely to the Signature Specimen form:

- Power of Attorney (POA): This legal document grants someone else the authority to act on behalf of another person or entity, similar to how the Signature Specimen form designates authorized signatories. Both documents outline the specific powers granted, whether general or limited.

- Corporate Resolutions: A corporate resolution is a formal document that records decisions made by the company's board of directors or shareholders. Like the Signature Specimen form, it identifies who has the authority to sign documents and conduct business on behalf of the company.

- Signature Authorization Form: This form is used to specify who is allowed to sign checks or other financial documents for a business. It closely mirrors the Signature Specimen form in that it lists authorized signers and may also define their scope of authority, whether restricted or general.

- Account Opening Form: When a business opens a new bank account, an account opening form is typically required. This document often includes information regarding authorized signatories, similar to the Signature Specimen form, ensuring that the bank knows who is authorized to act on the account.

Each of these documents plays a vital role in clear communication of authority within a business context, thus enhancing operational efficiency and ensuring legal compliance.

Dos and Don'ts

When filling out the Signature Specimen form, it's important to follow specific guidelines to ensure the process goes smoothly. Here’s a straightforward list of what you should and shouldn’t do.

- Do: Clearly print names in BLOCK CAPITALS.

- Do: Sign within the designated box to facilitate scanning.

- Do: Include at least one signatory if they are authorized to sign independently.

- Do: Indicate the scope of authority for each signatory.

- Don’t: Forget to notify Clearstream Banking about any changes to signatures promptly.

- Don’t: Leave out any relevant account numbers when completing the form.

- Don’t: Use the same form for accounts not covered by the signatures provided.

- Don’t: Overlook obtaining necessary certifications for the signatory's appointment authority.

Following these dos and don’ts will help ensure that your form is completed correctly and efficiently.

Misconceptions

- All signatories must be present to complete the form. It is not necessary for all designated signatories to be physically present when completing the form. One authorized representative can submit the form on behalf of the others.

- This form is only for new accounts. The Signature Specimen form can also update existing authorization, not just for new accounts. It serves as a means to manage and clarify authorization across all accounts associated with the organization.

- A signature is not required on the form. A specimen signature is indeed required. This is crucial for ensuring that Clearstream Banking can authenticate transactions and requests in the future.

- All signatories must have the same scope of authority. Different signatories can have varying levels of authority. Some may have general authority to sign all documentation, while others may be restricted to specific types of transactions.

- Changing a signatory is a lengthy process. While changes do require notification and documentation, the process is straightforward if all required documentation is included, ensuring prompt updates.

- The authorities granted through this form are permanent. The authority granted does not last indefinitely. It remains valid until Clearstream Banking receives written notification to revoke or amend the authorization.

- The form must be completed by a lawyer. There is no requirement for a lawyer to complete this form. However, it does need to be filled out accurately by an authorized representative of the company.

Key takeaways

When filling out the Signature Specimen form, these key takeaways are essential to ensure accuracy and compliance:

- Identify Authorised Signatories: Clearly list all individuals authorised to sign on behalf of your company. At least one signatory must be named for individual authority, while two must be named for joint authority.

- Signature Placement: It is crucial to sign within the designated box for each authorized signatory. This practice facilitates the proper scanning and verification of signatures.

- General vs. Restricted Authority: Specify the scope of authority for each signatory. General authority allows for signing various documents, while restricted authority is limited to day-to-day operational instructions.

- Account Coverage: Mark the appropriate boxes based on whether all accounts managed by your office are covered. Ensure that you accurately list all relevant account numbers within the form.

- Regular Updates Required: Commit to providing timely written notification of any changes to signatures. An updated specimen form should be submitted regularly to reflect these modifications.

- Certification Requirement: Attach adequate proof of authority when appointing signatories. This certification must come from a competent authority, either under Luxembourg regulation or your national jurisdiction.

By keeping these points in mind, you can effectively utilize the Signature Specimen form to establish clear and validated signing authority for your company.

Browse Other Templates

Uhc Global Claims Address - Each party involved in the transaction—the patient, member, and provider—has specific responsibilities in completing the form.

Tpad Summary Form 2022 Pdf - Overall, the Tpad form is a vital part of the teacher attendance monitoring process.

Application for Credit - Include the complete trading address as required.