Fill Out Your Small Business Self Certification Statement Form

The Small Business Self Certification Statement form serves as a vital tool for businesses aiming to establish their eligibility within various small business categories recognized by the Small Business Administration (SBA). By filling out this form, a small business can identify itself and affirm its status in categories such as Small Disadvantaged Business, Women-Owned Small Business, or Veteran-Owned Small Business, among others. Collecting key data, the form requests essential details like the company name, address, primary NAICS code, and DUNS number, helping to verify the business’s identity and size. Additionally, businesses are asked to specify their number of employees and check all relevant classifications that apply to them. It's important to remember that this self-certification is valid for one year, requiring businesses to re-certify and update their status if there are any changes during that period. To ensure continued compliance and prevent misrepresentation, which can lead to significant penalties, the form reminds users of the serious implications of providing inaccurate information. Finally, submitting the completed form via email to the specified contact ensures that prospective clients can efficiently verify a company’s eligibility within federal contracting opportunities.

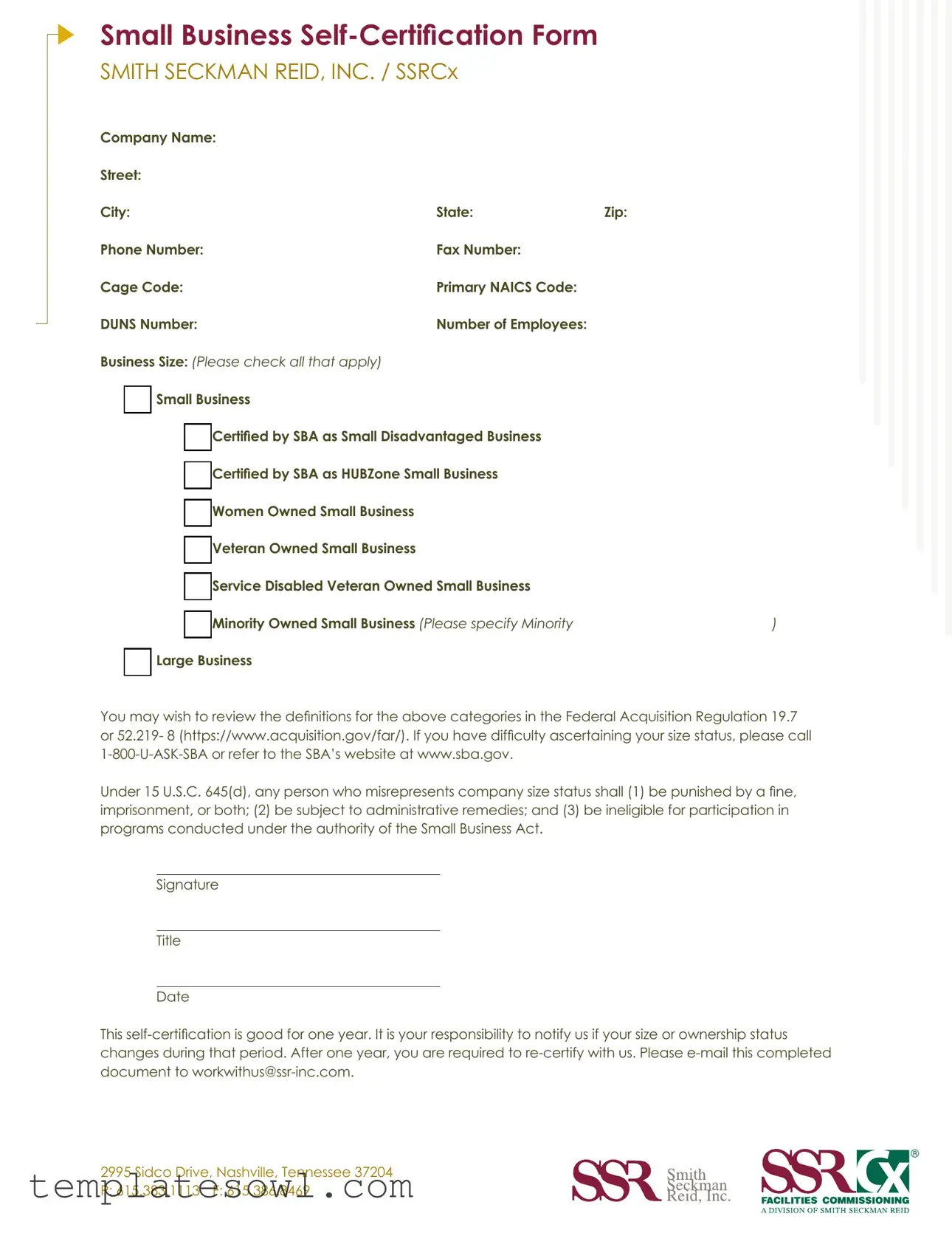

Small Business Self Certification Statement Example

Small Business

SMITH SECKMAN REID, INC. / SSRCx

Company Name: |

|

|

Street: |

|

|

City: |

State: |

Zip: |

Phone Number: |

Fax Number: |

|

Cage Code: |

Primary NAICS Code: |

|

DUNS Number: |

Number of Employees: |

|

Business Size: (Please check all that apply) |

|

|

Small Business

Small Business

Certiied by SBA as Small Disadvantaged Business

Certiied by SBA as Small Disadvantaged Business

Certiied by SBA as HUBZone Small Business

Certiied by SBA as HUBZone Small Business

Women Owned Small Business

Women Owned Small Business

Veteran Owned Small Business

Veteran Owned Small Business

Service Disabled Veteran Owned Small Business

Service Disabled Veteran Owned Small Business

|

Minority Owned Small Business (Please specify Minority |

) |

|

|

|

Large Business

Large Business

You may wish to review the deinitions for the above categories in the Federal Acquisition Regulation 19.7 or 52.219- 8 (https://www.acquisition.gov/far/). If you have dificulty ascertaining your size status, please call

Under 15 U.S.C. 645(d), any person who misrepresents company size status shall (1) be punished by a ine, imprisonment, or both; (2) be subject to administrative remedies; and (3) be ineligible for participation in programs conducted under the authority of the Small Business Act.

Signature

Title

Date

This

2995 Sidco Drive, Nashville, Tennessee 37204 P: 615.383.1113 F: 615.386.8469

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Small Business Self-Certification Statement is used by businesses to declare their size status and eligibility for small business programs. |

| Duration | This self-certification is valid for one year, after which businesses must re-certify their status. |

| Compliance | Failure to accurately represent business size status can result in penalties, including fines and ineligibility for certain programs, as outlined in 15 U.S.C. 645(d). |

| Submission | The completed form must be emailed to workwithus@ssr-inc.com for processing and verification. |

Guidelines on Utilizing Small Business Self Certification Statement

Completing the Small Business Self Certification Statement form is a straightforward process. This form requires specific information about your business, including its size and ownership status. Once the form is completed, it must be submitted via email to facilitate your certification.

- Begin by entering your Company Name in the designated field.

- Provide your Street address, followed by the City, State, and Zip code.

- Enter your Phone Number and Fax Number.

- Input your Cage Code and Primary NAICS Code in the specified sections.

- Fill in your DUNS Number.

- Indicate the Number of Employees at your business.

- Select your Business Size by checking all categories that apply, such as:

- Small Business

- Certified by SBA as Small Disadvantaged Business

- Certified by SBA as HUBZone Small Business

- Women Owned Small Business

- Veteran Owned Small Business

- Service Disabled Veteran Owned Small Business

- Minority Owned Small Business (specify if applicable)

- Large Business

- Review the Federal Acquisition Regulation for definitions if needed.

- After completing the form, sign it in the designated area, and provide your Title and Date.

- Keep in mind that the self-certification is valid for one year. If your size or ownership status changes, promptly notify the relevant party.

- Email the completed document to workwithus@ssr-inc.com.

Ensuring that all information is accurate and complete is essential for a smooth certification process. Once submitted, the review and approval process will begin, and your business can take advantage of the benefits associated with small business certification.

What You Should Know About This Form

What is the Small Business Self Certification Statement form?

This form is used by small businesses to self-certify their business size and ownership status. It collects essential information, including the company name, contact details, and the specific certifications that the business qualifies for, such as being a small disadvantaged business or a veteran-owned small business. Completing this form helps businesses participate in programs designed to support small enterprises.

Who needs to fill out this form?

This form should be filled out by small business owners seeking to establish or confirm their eligibility for small business programs. Businesses may include those that are certified as small by the Small Business Administration (SBA), HUBZone small businesses, women-owned businesses, and others. If your business falls into any of these categories, it's essential to complete the form accurately.

How long is the certification valid?

The self-certification is valid for one year from the date it is signed. After this period, it is crucial to re-certify your status. If there are changes to your business size or ownership during that year, you must notify the organization immediately. Keeping your information current ensures compliance and maintains your eligibility for relevant programs.

What should I do if my business size or ownership status changes?

If there are any changes in your business size or ownership status during the certification period, you have a responsibility to inform us promptly. Emailing the updated information helps us maintain accurate records and ensures you remain compliant with any regulations regarding small business participation.

Where do I send the completed form?

Once you have filled out the Small Business Self Certification Statement form, please email it to workwithus@ssr-inc.com. If you have any questions or require assistance, don't hesitate to reach out to the contact number provided: 615.383.1113.

Common mistakes

Filling out the Small Business Self Certification Statement form can feel overwhelming, but mistakes can lead to significant consequences. One common error is omitting vital contact information. Remember, accurate details such as your company's name, address, and phone number are crucial. Missing this information can delay processing or even result in rejection.

Another frequent mistake is selecting the wrong business size category. A business must clearly understand whether it qualifies as a small business or a large business. Misclassification can have serious repercussions. If uncertainty arises, it's best to consult the definitions provided in the Federal Acquisition Regulation or reach out to the Small Business Administration (SBA) for clarification.

Inaccuracies in the numerical data section, particularly the DUNS Number or Number of Employees, can be problematic. Many individuals either miscount their employees due to high turnover rates or forget to double-check the correct DUNS Number. This oversight can lead to confusion and hinder eligibility for various programs.

Some applicants fail to specify their minority status, if applicable. This is essential for any minority-owned business seeking certification. If you identify as a minority, be sure to provide specific details. Leaving this blank could prevent consideration for programs aimed at supporting minority enterprises.

Another area where errors commonly occur is in the certification of ownership status. Small business owners often neglect to provide information on whether their business is women-owned, veteran-owned, or service-disabled veteran-owned. Each of these categories has specific requirements and benefits that may apply to your business.

Ensure that all signature fields are completed. Failing to sign the form can result in needless delays. Review your form thoroughly. This final step is vital, as unsigned documents are typically rejected without further inquiry.

Additionally, submitting the form without proper documentation regarding previous certifications can raise red flags. If you’ve been certified before, ensure you include any related documents. Not doing so can raise doubts about your current status.

Lastly, don’t forget about the certification timeline. Some applicants overlook the requirement to re-certify annually. Ensure that you understand this timeline and are prepared to notify the appropriate parties if any changes to your size or ownership status occur during the certification period.

Documents used along the form

The Small Business Self-Certification Statement form is an essential document for businesses seeking to establish their eligibility for various procurement programs. However, it is just one piece of the puzzle. Several other forms and documents complement this certification, ensuring compliance and facilitating program participation. Here’s a look at some of those important documents:

- Business Plan: A detailed guide outlining your business objectives, target market, and financial forecasts. It serves as a roadmap for success and often is required for obtaining funding or grants.

- Financial Statements: These include balance sheets and income statements that provide a snapshot of your company's financial health. They are typically required to establish credibility and viability in business dealings.

- Tax Returns: Recent business tax returns demonstrate your company’s financial status and help confirm your eligibility for specific programs and contracts.

- Ownership Documentation: This includes proof of ownership structures such as partnership agreements or stock certificates. It is essential for validating ownership claims in self-certification.

- Proof of Certification: If you have other certifications (like Minority-Owned or Women-Owned), keep documentation such as certificates or letters of approval on hand. They strengthen your application and eligibility.

- DUNS Number Registration: A Data Universal Numbering System (DUNS) number is a unique identifier for your business. Registering for one is vital when applying for government contracts and grants.

- NAICS Code Documentation: The North American Industry Classification System (NAICS) codes classify your business type. Accurate coding is crucial as it affects your eligibility for specific opportunities.

- Compliance Certificates: Certificates confirming that your business adheres to various regulations, such as environmental or labor laws, ensure trustworthiness and reliability in line with program expectations.

Gathering these documents will not only streamline the self-certification process but also provide added credibility to your business as you seek opportunities within government contracting and other programs. Being well-prepared can make a significant difference.

Similar forms

- Self-Certification of Eligibility for Small Business Set-Asides: This document is similar in that it allows businesses to declare their eligibility for programs aimed at promoting small business participation in federal contracts. Like the Small Business Self Certification Statement, it requires businesses to provide information regarding their ownership, size, and status.

- Small Business Administration (SBA) 8(a) Certification Application: Similar to the self-certification form, this application is used for businesses seeking to gain access to the SBA’s 8(a) Business Development Program. Both documents require details about the business’s ownership structure and size classification, as well as an affirmation of compliance with the relevant eligibility criteria.

- SBA HUBZone Program Application: This application aims to validate a business's eligibility for the HUBZone program, similar to the self-certification statement. Both documents require information about the business location, ownership, and employee count, establishing the business's qualification for specific government contracts or incentives.

- Certification of Veteran-Owned Small Business (VOSB): This certification ensures that a business qualifies as a veteran-owned entity. Much like the Small Business Self Certification Statement, it asks for proof of ownership and management by veterans, and it is associated with specific federal programs designed to assist veteran entrepreneurs.

Dos and Don'ts

When filling out the Small Business Self Certification Statement form, there are certain things you should do and some you should avoid. Here are four recommendations:

- Do carefully check your business classification: Ensure that you accurately indicate all applicable categories that describe your business.

- Do provide complete contact information: Make sure your company name, address, and contact numbers are correct to facilitate communication.

- Don't rush the process: Take your time to read the instructions and definitions. Skipping over details may lead to mistakes.

- Don't misrepresent your business size: Avoid providing false information about your business status, as this could lead to serious penalties.

Filling out this form accurately is crucial for your business eligibility in various programs. By following these simple guidelines, you can ensure a smoother certification process.

Misconceptions

Misconceptions about the Small Business Self Certification Statement form can lead to confusion among potential applicants. Here are five common misconceptions clarified:

- Misconception 1: Completing the form guarantees that your business will be classified as a small business.

- Misconception 2: Self-certification is not taken seriously.

- Misconception 3: Once certified, there's no need to keep track of your status.

- Misconception 4: There are no specific guidelines to determine if your business qualifies.

- Misconception 5: Businesses must have prior certification from the SBA before using this form.

Simply filling out the form does not automatically qualify your business as a small entity. Qualification is based on specific size standards set by the Small Business Administration (SBA).

Self-certification is a legal declaration. Providing false information regarding size status can result in significant penalties, including fines and imprisonment.

Self-certification is valid for only one year. Businesses must re-certify annually and notify the relevant parties if there are changes in size or ownership.

Size standards are outlined in the Federal Acquisition Regulation, specifically under sections 19.7 or 52.219-8. Consult these resources for accurate definitions.

The Self Certification Statement allows businesses to certify their status without needing prior SBA certification. However, understanding your classification is essential for compliance.

Key takeaways

The Small Business Self Certification Statement form is essential for small businesses seeking to establish their status. Here are some key takeaways:

- Accurate Information is Crucial: Fill out the form with correct details regarding your company to avoid penalties.

- Categories of Business Size: Clearly check all applicable categories such as Small Disadvantaged Business or Women Owned Small Business.

- Understand Your Status: If uncertain about your business size classification, consult the definitions in the Federal Acquisition Regulation or reach out to the SBA.

- Signature Required: Ensure that the form is signed and dated by an authorized individual in your business.

- Validity Period: The certification is valid for one year; remember to re-certify when the year is up.

- Notify Changes: Inform relevant parties immediately if your size or ownership status changes during the certification period.

- Submit via Email: Send the completed form to the provided email address to ensure proper processing.

- Potential Penalties: Misrepresenting size status may lead to fines, imprisonment, and loss of eligibility for various programs.

Understanding these takeaways can enhance your experience with the Small Business Self Certification process and ensure compliance.

Browse Other Templates

Llc Charter Number - Reinstatement ensures entities can resume their business activities legally.

Jeans Warehouse Application - Provide your current address where you live.

Nurse Aide Employment Confirmation,Texas Nurse Aide Verification Form,CNA Employment Record,Texas Nurse Aide Certification Validation,Certified Nurse Aide Employment Affidavit,Nurse Aide Job History Form,CNA Registration Employment Verification,Texas - The explicit questions regarding misconduct aim to uphold the integrity of the nursing profession.