Fill Out Your So 200 C Form

The So 200 C form, officially known as the Statement by Domestic Stock Corporation, plays a crucial role in the compliance landscape for corporations operating in California. This document is not just a requirement; it represents a commitment to transparency and accountability within the corporate framework. Corporations must file this statement with the California Secretary of State within 90 days of submitting their Articles of Incorporation and maintain compliance by filing biennially thereafter. The form gathers essential information, including the corporate name, addresses of principal offices, and the names and addresses of key officers and directors. A corporation must have a chief executive officer, a secretary, and a chief financial officer, ensuring that the organization maintains a structured leadership team. Additionally, this form also includes the provision for naming an agent for service of process, which is vital for legal and administrative purposes. The filing fee is set at $20.00 for initial and biennial statements, while amendments may not incur additional charges. Failure to file on time can result in hefty penalties, making timely submission imperative. Overall, the So 200 C form is designed to promote accountability and facilitate communication between corporations and state authorities, ensuring that stakeholders are well-informed about the corporate governance of these entities.

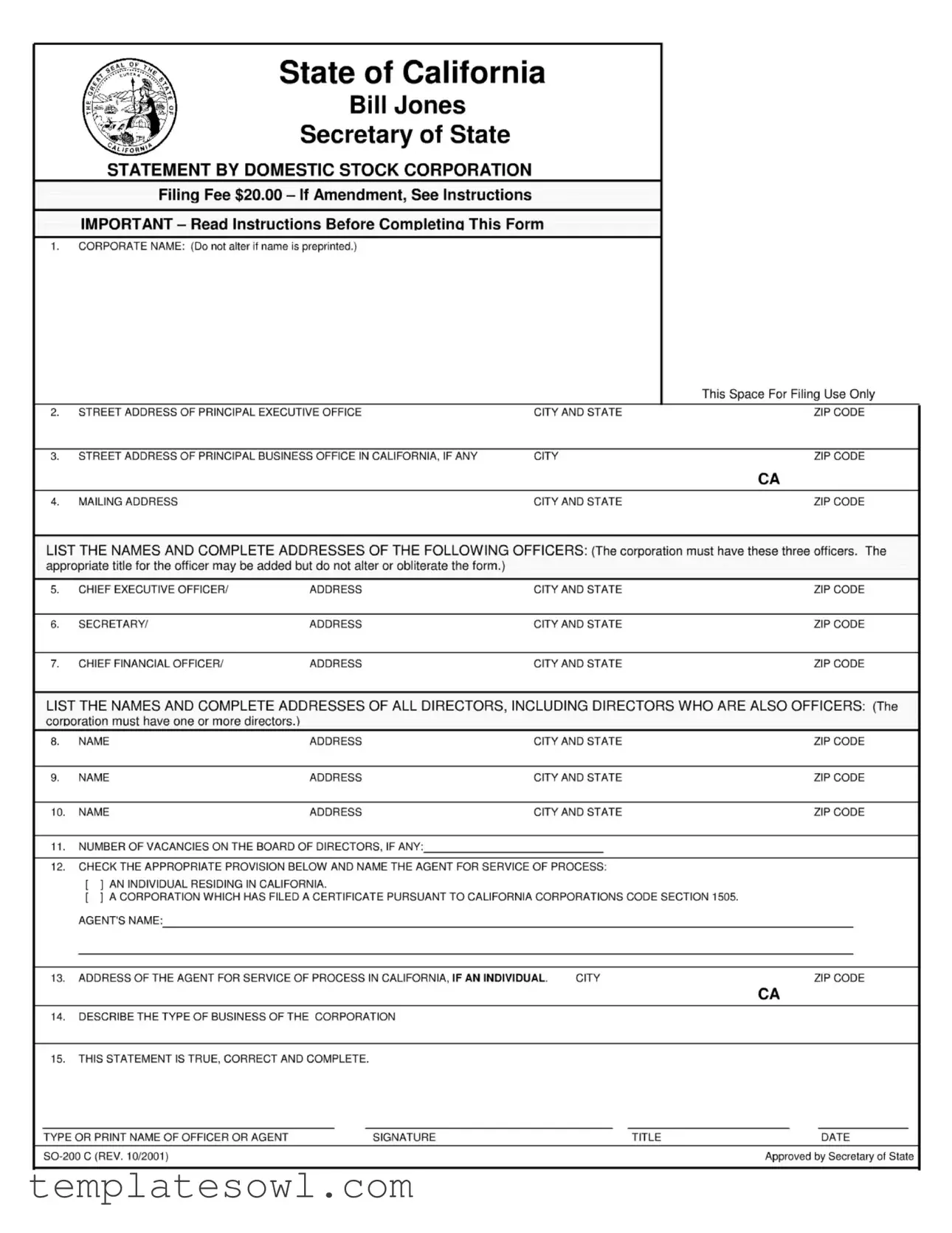

So 200 C Example

State of California

Bill Jones

Secretary of State

STATEMENT BY DOMESTIC STOCK CORPORATION

Filing Fee $20.00 - If Amendment, See Instructions

IMPORTANT - Read Instructions Before Comoletina This Form

1.CORPORATE NAME: (Do not alter if name is preprinted.)

|

|

|

This Space For Filing Use Only |

2. |

STREET ADDRESS OF PRINCIPAL EXECUTIVE OFFICE |

CITY AND STATE |

ZIP CODE |

3. |

STREET ADDRESS OF PRINCIPAL BUSINESS OFFICE IN CALIFORNIA, IF ANY |

CITY |

ZIP CODE |

|

|

|

CA |

4. |

MAILING ADDRESS |

CITY AND STATE |

ZIP CODE |

LIST THE NAMES AND COMPLETE ADDRESSES OF THE FOLLOWING OFFICERS: (The corporation must have these three officers. The appropriate title for the officer may be added but do not alter or obliterate the form.)

5. |

CHIEF EXECUTIVE OFFICER/ |

ADDRESS |

CITY AND STATE |

ZIP CODE |

6. |

SECRETARY/ |

ADDRESS |

CITY AND STATE |

ZIP CODE |

7. |

CHIEF FINANCIAL OFFICER/ |

ADDRESS |

CITY AND STATE |

ZIP CODE |

LIST THE NAMES AND COMPLETE ADDRESSES OF ALL DIRECTORS, INCLUDING DIRECTORS WHO ARE ALSO OFFICERS: (The corporation must have one or more directors.)

8. |

NAME |

ADDRESS |

CITY AND STATE |

ZIP CODE |

9. |

NAME |

ADDRESS |

CITY AND STATE |

ZIP CODE |

10. |

NAME |

ADDRESS |

CITY AND STATE |

ZIP CODE |

11.NUMBER OF VACANCIES ON THE BOARD OF DIRECTORS, IF ANY:

~I2. CHECK THE APPROPRIATE PROVISION BELOW AND NAME THE AGENT FOR SERVICE OF PROCESS:

[ |

] |

AN INDIVIDUAL RESIDING IN CALIFORNIA. |

|

|

[ |

] |

A CORPORATION WHICH HAS FILED A CERTIFICATE PURSUANT TO CALIFORNIA CORPORATIONS CODE SECTION 1505. |

|

|

AGENT'S NAME: |

|

|

||

13. ADDRESS OF THE AGENT FOR SERVICE OF PROCESS IN CALIFORNIA, IF AN INDIVIDUAL. |

CITY |

ZIP CODE |

||

CA

14.DESCRIBE THE TYPE OF BUSINESS OF THE CORPORATION

15.THIS STATEMENT IS TRUE, CORRECT AND COMPLETE.

TYPE OR PRINT NAME OF OFFICER OR AGENT______________SIGNATURE________________________________ TITLE__________________________ DATE___________

Approved by Secretary of State |

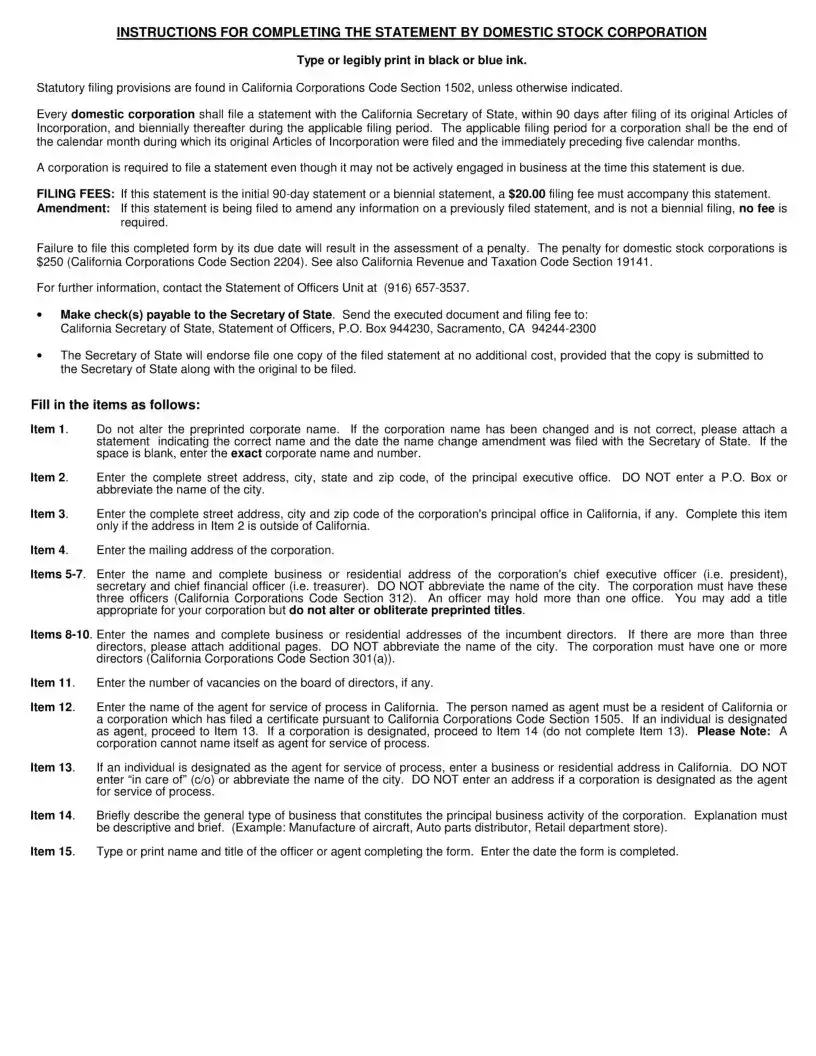

INSTRUCTIONS FOR COMPLETING THE STATEMENT BY DOMESTIC STOCK CORPORATION

Type or legibly print in black or blue ink.

Statutory filing provisions are found in California Corporations Code Section 1502, unless otherwise indicated.

Every domestic corporation shall file a statement with the California Secretary of State, within 90 days after filing of its original Articles of Incorporation, and biennially thereafter during the applicable filing period. The applicable filing period for a corporation shall be the end of the calendar month during which its original Articles of Incorporation were filed and the immediately preceding five calendar months.

A corporation is required to file a statement even though it may not be actively engaged in business at the time this statement is due.

FILING FEES: If this statement is the initial

Amendment: If this statement is being filed to amend any information on a previously filed statement, and is not a biennial filing, no fee is required.

Failure to file this completed form by its due date will result in the assessment of a penalty. The penalty for domestic stock corporations is $250 (California Corporations Code Section 2204). See also California Revenue and Taxation Code Section 19141.

For further information, contact the Statement of Officers Unit at (916)

•Make check(s) payable to the Secretary of State. Send the executed document and filing fee to: California Secretary of State, Statement of Officers, P.O. Box 944230, Sacramento, CA

•The Secretary of State will endorse file one copy of the filed statement at no additional cost, provided that the copy is submitted to the Secretary of State along with the original to be filed.

Fill in the items as follows:

Item 1. Do not alter the preprinted corporate name. If the corporation name has been changed and is not correct, please attach a statement indicating the correct name and the date the name change amendment was filed with the Secretary of State. If the space is blank, enter the exact corporate name and number.

Item 2. Enter the complete street address, city, state and zip code, of the principal executive office. DO NOT enter a P.O. Box or abbreviate the name of the city.

Item 3. Enter the complete street address, city and zip code of the corporation’s principal office in California, if any. Complete this item only if the address in Item 2 is outside of California.

Item 4. Enter the mailing address of the corporation.

Items

Items

Item 11. Enter the number of vacancies on the board of directors, if any.

Item 12. Enter the name of the agent for service of process in California. The person named as agent must be a resident of California or a corporation which has filed a certificate pursuant to California Corporations Code Section 1505. If an individual is designated as agent, proceed to Item 13. If a corporation is designated, proceed to Item 14 (do not complete Item 13). Please Note: A corporation cannot name itself as agent for service of process.

Item 13. If an individual is designated as the agent for service of process, enter a business or residential address in California. DO NOT enter “in care of” (c/o) or abbreviate the name of the city. DO NOT enter an address if a corporation is designated as the agent for service of process.

Item 14. Briefly describe the general type of business that constitutes the principal business activity of the corporation. Explanation must be descriptive and brief. (Example: Manufacture of aircraft, Auto parts distributor, Retail department store).

Item 15. Type or print name and title of the officer or agent completing the form. Enter the date the form is completed.

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The form is governed by the California Corporations Code, particularly Sections 1502, 2204, and 312. |

| Filing Fee | A fee of $20.00 is required for the initial statement or a biennial statement. No fee is needed for amendments. |

| Submission Timeline | Certain corporations must file this statement within 90 days after filing their original Articles of Incorporation. |

| Required Officers | The corporation must designate a Chief Executive Officer, a Secretary, and a Chief Financial Officer. |

| Agent for Service of Process | The corporation must name an agent for service of process who is either an individual resident in California or a corporation with a specific certificate. |

| Vacancy Disclosure | Corporations must indicate if there are any vacancies on their Board of Directors. |

Guidelines on Utilizing So 200 C

To successfully file the California Form So 200 C, you need to ensure that all information is accurate and clearly presented. This form is essential to maintain compliance with state requirements. Following the steps outlined below will help in completing the form efficiently.

- Locate the preprinted corporate name at the top of the form. Do not alter this name unless changes have been officially filed.

- Fill out the street address of the principal executive office, ensuring you include the city, state, and zip code.

- If applicable, provide the street address of the principal business office in California, including city and zip code.

- Enter the mailing address of the corporation, including city, state, and zip code.

- List the Chief Executive Officer's complete name and address, along with the city, state, and zip code.

- Provide the Secretary's complete name and address, including city, state, and zip code.

- Fill in the Chief Financial Officer's complete name and address, along with the city, state, and zip code.

- List the names and complete addresses of all directors, including city, state, and zip code.

- If there are more than three directors, attach additional pages as needed.

- Indicate the number of vacancies on the board of directors, if any.

- Check the appropriate box to indicate the agent for service of process, either an individual residing in California or a registered corporation, and provide the agent’s name.

- If the agent is an individual, fill out their address in California. If the agent is a corporation, skip this step.

- Briefly describe the type of business the corporation operates, using clear and concise language.

- Type or print the name and title of the officer or agent completing the form and ensure the date is included.

What You Should Know About This Form

What is the SO 200 C form?

The SO 200 C form is a Statement by Domestic Stock Corporation that domestic corporations in California must file with the Secretary of State. This form officially lists key information about the corporation, including the corporate name, officers, directors, agent for service of process, and business activities. It helps keep the state informed about the corporation's structure and activities.

Who needs to file the SO 200 C form?

Every domestic stock corporation in California must file the SO 200 C form. This is required within 90 days after filing the original Articles of Incorporation and then biennially thereafter. Even if the corporation is not currently active, this filing is still mandatory.

What is the filing fee for the SO 200 C form?

The filing fee for the SO 200 C form is $20.00 when it is the initial statement or a biennial filing. If you are amending a previously filed statement, there is no fee. It's important to submit the appropriate payment along with the form to ensure successful processing.

What happens if the form is not filed on time?

Failing to file the SO 200 C form on or before its due date can result in penalties. Specifically, the corporation may face a $250 penalty under California Corporations Code Section 2204. Timely filing is crucial to avoid these additional charges.

What information must be included on the SO 200 C form?

The form requires specific details such as the corporate name, addresses of the principal executive and business offices, names and addresses of the officers and directors, agent for service of process, and a brief description of the corporation's business activities. Accurate and complete information is vital for compliance.

Can one person hold multiple officer positions?

Yes, a single individual can serve in more than one officer capacity within the corporation. However, the corporation must have at least a chief executive officer, a secretary, and a chief financial officer. It's essential to ensure all required positions are filled, even if some are held by the same person.

Who can be the agent for service of process?

The agent for service of process must be either an individual residing in California or a corporation that has filed a certificate under California Corporations Code Section 1505. It's important to note that a corporation cannot name itself as its own agent for this purpose.

What should be done if the corporate name has changed?

If the corporate name has changed and is not correct on the preprinted form, do not alter the name on the document. Instead, attach a separate statement indicating the correct name and the date when the name change amendment was filed with the Secretary of State.

How can I get help if I have questions about the SO 200 C form?

If you have questions about completing the SO 200 C form, you can contact the Statement of Officers Unit at the Secretary of State’s office at (916) 657-3537. They can provide guidance and assistance to ensure your filing is correct and timely.

Common mistakes

Filling out the SO-200 C form can be challenging. One common mistake is forgetting to use the correct corporate name. If the name is preprinted on the form, do not change it. Any alterations can lead to unnecessary complications. Always check that the name is accurate and has not been changed without proper documentation.

Another frequent error involves the addresses. It is essential to provide the complete street address for the principal executive office. Avoid using P.O. Boxes or abbreviations for the city. A full address ensures that correspondence reaches the corporation without delay.

Many people also neglect to list all the required officers and their complete addresses. The form requires the names and addresses of the chief executive officer, secretary, and chief financial officer. If any of this information is missing, it could result in the form being rejected.

Directors' names and addresses must also be listed accurately. It is important to ensure that you include all current directors, and if there are more than three, attach additional pages. Failing to do so could create issues with compliance.

Another mistake surrounds the agent for service of process. Companies should designate an individual or corporation based in California. If an individual is chosen, ensure their address is included in Item 13. If a corporation is the agent, skip Item 13 entirely.

Moreover, inaccuracies in describing the type of business can lead to problems. The description should be clear and concise, reflecting the corporation's principal business activities. Generic or vague terms might not provide the necessary clarity.

Lastly, many individuals forget to sign and date the form. Item 15 must include the typewritten or printed name along with the signature of the officer or agent responsible for completing the form. Missing this step will delay processing and could lead to penalties for late filing.

Documents used along the form

The So 200 C form is an important document for domestic stock corporations in California. It provides essential information about the corporation's structure, including details about its officers and directors. Several other documents are commonly filed alongside the So 200 C form, each serving a distinct purpose in the corporate compliance process. Understanding these documents can help ensure that a corporation meets its legal obligations.

- Articles of Incorporation: This foundational document is filed to officially create a corporation. It includes basic information such as the corporate name, purpose, agent for service of process, and the number of shares authorized. Once approved, it establishes the corporation’s legal existence.

- Bylaws: Bylaws outline the internal rules and procedures for a corporation. They govern how the corporation operates, covering topics such as the duties of officers, the process for holding meetings, and how to handle conflicts of interest.

- Statement of Information (Form SI-100): This must be filed by every corporation within 90 days of incorporation and every two years thereafter. It provides updated information about the corporation’s addresses, officers, and directors to keep their records current with the Secretary of State.

- Board Resolutions: These are formal documents that record decisions made by the board of directors. Resolutions may pertain to various actions, such as approving corporate policies, authorizing expenditures, or ratifying contracts.

- Certificate of Status: Also known as a Certificate of Good Standing, this document verifies that a corporation is registered and compliant with state requirements. It can be requested from the Secretary of State and is often needed when conducting business with banks or entering contracts.

By filing the So 200 C form alongside these additional documents, a corporation can maintain compliance with California law and ensure its operations are well structured. Each of these papers plays a significant role in outlining the corporation's governance and maintaining transparency with state authorities.

Similar forms

- Articles of Incorporation: This document establishes the existence of a corporation and includes essential information about its structure, including its name and purpose.

- Statement of Information (Form SI-200): Similar to the So 200 C Form, this statement provides updated information about a corporation’s address, officers, and directors in California on a biennial basis.

- Bylaws: This document outlines the internal rules governing the management of the corporation, including duties of officers and procedures for meetings.

- Corporate Resolution: A formal document that records decisions made by the board of directors or shareholders, specifying actions such as appointing officers or approving financial actions.

- Certificate of Status: Also known as a Certificate of Good Standing, this document verifies that a corporation is legally registered and compliant with state requirements.

- Annual Report: Typically required by the state, this report updates shareholders on the corporation’s financial performance and includes information about its operations.

- Business License Application: A document required to operate a business legally within a particular city or county, usually detailing the nature of the business and its physical location.

Dos and Don'ts

When filling out the So 200 C form, adhere to these guidelines:

- Do ensure accurate information is provided. Double-check all names, addresses, and titles.

- Do use black or blue ink. This helps ensure clarity and legibility.

- Do include a full mailing address. Avoid P.O. boxes for the principal executive office.

- Do adhere to the deadlines. Submit your statement within 90 days or as per the biennial schedule.

- Don't alter the preprinted corporate name. If changes are needed, provide a separate statement.

- Don't abbreviate city names. Always write them in full to avoid confusion.

Following these dos and don’ts can help streamline the filing process and prevent delays. Ensure all requirements are met to avoid penalties.

Misconceptions

Here are some common misconceptions about the So 200 C form that many people have:

- It's only for new corporations. The So 200 C form is necessary for both new and existing domestic stock corporations to maintain compliance.

- You can file it anytime. This form must be submitted within 90 days of filing your Articles of Incorporation and biennially thereafter. Missing the deadline can lead to penalties.

- Any address can be used. You must provide specific street addresses for your principal executive office and business office in California. P.O. Boxes are not allowed.

- Only active corporations need to file. Even if your corporation is not actively engaged in business, you are still required to file the statement.

- There's no fee for filing. There is a $20 filing fee due with your initial or biennial submission. Amendments, however, may not require a fee if they are not part of the regular filing cycle.

- Directors can be from outside California. While you can have directors from outside the state, at least one of your officers must reside in California.

- Once filed, it’s never looked at again. The Secretary of State's office may review your submission for accuracy, and failing to make corrections when needed can lead to penalties.

Key takeaways

Filling out and utilizing the So 200 C form is a vital step for domestic stock corporations in California. The following key takeaways can help ensure a smooth process:

- Understand the Purpose: The So 200 C form is a statement required by the California Secretary of State to provide updated information about your corporation's key officers and directors.

- Timely Filing: This statement must be submitted within 90 days of the corporation's original Articles of Incorporation and biennially thereafter. Missing this deadline incurs a penalty.

- Correct Information: It is crucial to fill in accurate details. This includes the corporate name, addresses, and officer names. Do not alter any preprinted information.

- Agent for Service of Process: Designate a qualified individual or corporation as your agent for service of process. This agent must be a resident of California or an authorized corporation.

- Penalties for Non-Compliance: Be aware that a failure to file on time results in a $250 penalty, making adherence to deadlines essential.

- Filing Fee: A $20 filing fee accompanies the initial or biennial statements. If you are amending a previously submitted statement, no fee is required.

- Requesting Copies: You can submit a copy of the filed statement for endorsement by the Secretary of State at no additional cost. Ensure this is submitted alongside the original form.

- Clarity in Descriptions: When describing the type of business, keep it brief and precise. This clarity aids in properly categorizing your corporation's activities.

By following these takeaways, you can navigate the requirements of the So 200 C form with confidence while ensuring compliance with state regulations.

Browse Other Templates

What Is an Odometer Disclosure - Failure to complete the Odometer Disclosure Statement may cause delays in ownership transfer.

What's the Easiest Thing to Get Disability For? - Fraudulent claims can lead to severe legal consequences; honesty is imperative.

Master Job Application - Your telephone contacts allow for efficient communication during the application process.