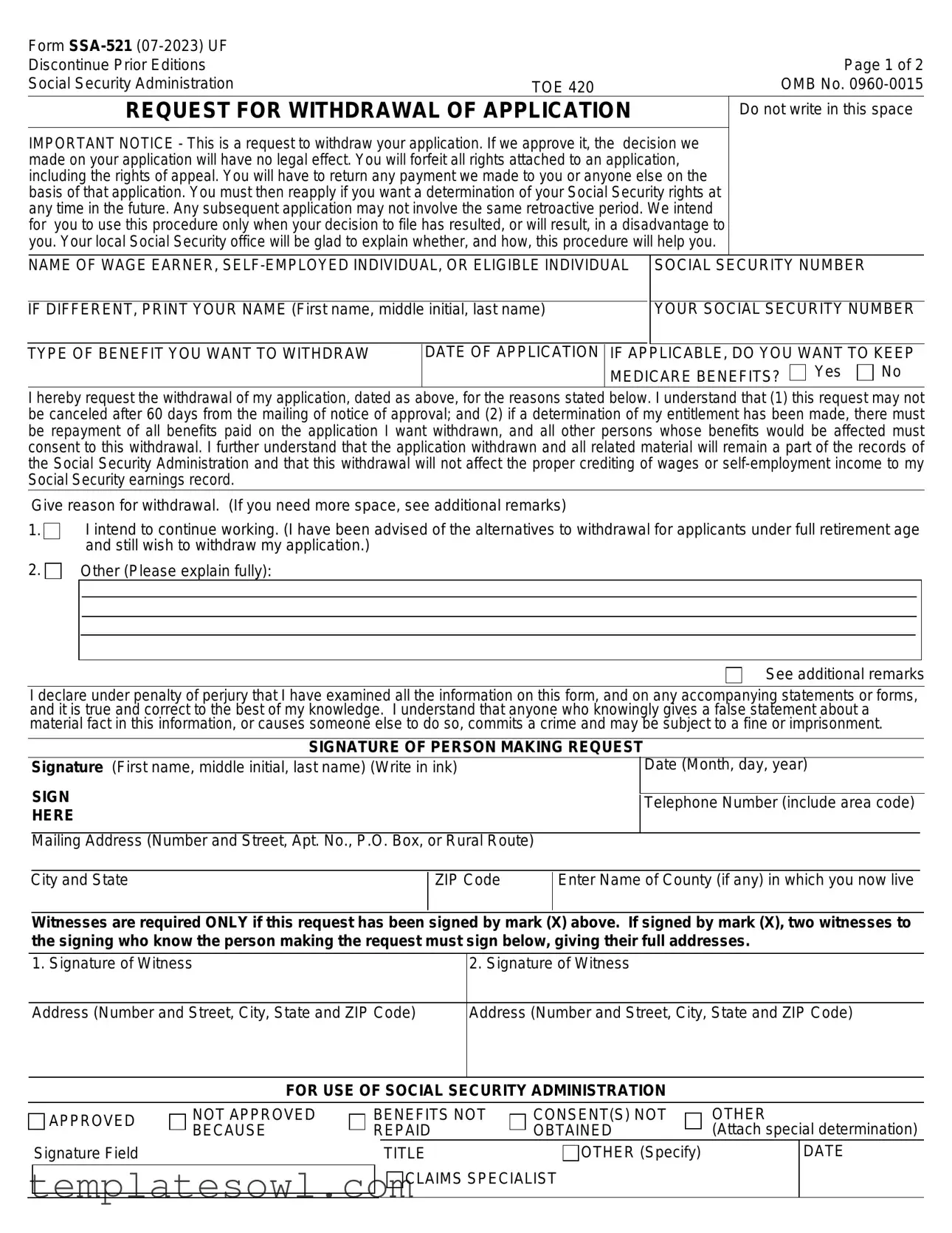

Fill Out Your Social Security Ssa 521 Form

The SSA-521 form is a vital document for anyone wishing to withdraw their application for Social Security benefits. This request is significant, as it revokes the initial decision made by the Social Security Administration, meaning that all rights attached to that application, including the right to appeal, are forfeited. When completing this form, applicants need to provide personal information such as their name, Social Security number, and details about the benefits they wish to withdraw. Additionally, they must specify the reasons for this withdrawal, which can include intentions to continue working or other personal circumstances. It's essential for applicants to understand the implications of their request; once approved, they cannot reverse it after 60 days, and any benefits already received will need to be repaid. This form ensures that all records remain intact while allowing individuals the opportunity to reassess their Social Security options. Clear guidance from the local Social Security office can further help individuals navigate this decision.

Social Security Ssa 521 Example

Form |

|

|

Discontinue Prior Editions |

|

Page 1 of 2 |

Social Security Administration |

TOE 420 |

OMB No. |

REQUEST FOR WITHDRAWAL OF APPLICATION |

Do not write in this space |

|

IMPORTANT NOTICE - This is a request to withdraw your application. If we approve it, the decision we made on your application will have no legal effect. You will forfeit all rights attached to an application, including the rights of appeal. You will have to return any payment we made to you or anyone else on the basis of that application. You must then reapply if you want a determination of your Social Security rights at any time in the future. Any subsequent application may not involve the same retroactive period. We intend for you to use this procedure only when your decision to file has resulted, or will result, in a disadvantage to you. Your local Social Security office will be glad to explain whether, and how, this procedure will help you.

|

NAME OF WAGE EARNER, |

|

|

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

|

||

IF DIFFERENT, PRINT YOUR NAME (First name, middle initial, last name) |

YOUR SOCIAL SECURITY NUMBER |

|||||

|

|

|

|

|||

TYPE OF BENEFIT YOU WANT TO WITHDRAW |

DATE OF APPLICATION IF |

APPLICABLE, DO YOU WANT TO KEEP |

||||

|

|

MEDICARE BENEFITS? Yes |

No |

|||

I hereby request the withdrawal of my application, dated as above, for the reasons stated below. I understand that (1) this request may not be canceled after 60 days from the mailing of notice of approval; and (2) if a determination of my entitlement has been made, there must be repayment of all benefits paid on the application I want withdrawn, and all other persons whose benefits would be affected must consent to this withdrawal. I further understand that the application withdrawn and all related material will remain a part of the records of the Social Security Administration and that this withdrawal will not affect the proper crediting of wages or

Give reason for withdrawal. (If you need more space, see additional remarks)

1.I intend to continue working. (I have been advised of the alternatives to withdrawal for applicants under full retirement age and still wish to withdraw my application.)

2. |

Other (Please explain fully): |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See additional remarks

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge. I understand that anyone who knowingly gives a false statement about a material fact in this information, or causes someone else to do so, commits a crime and may be subject to a fine or imprisonment.

|

|

|

|

|

|

|

|

|

SIGNATURE OF PERSON MAKING REQUEST |

||||

Signature (First name, middle initial, last name) (Write in ink) |

|

Date (Month, day, year) |

||||

|

SIGN |

|

|

|

|

|

|

|

|

Telephone Number (include area code) |

|||

|

HERE |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address (Number and Street, Apt. No., P.O. Box, or Rural Route) |

|

|

|

||

|

|

|

|

|

|

|

|

City and State |

|

ZIP Code |

Enter Name of County (if any) in which you now live |

|

|

|

|

|

|

|

|

|

Witnesses are required ONLY if this request has been signed by mark (X) above. If signed by mark (X), two witnesses to the signing who know the person making the request must sign below, giving their full addresses.

1. Signature of Witness

2. Signature of Witness

Address (Number and Street, City, State and ZIP Code)

Address (Number and Street, City, State and ZIP Code)

FOR USE OF SOCIAL SECURITY ADMINISTRATION

APPROVED Signature Field

APPROVED Signature Field

NOT APPROVED BECAUSE

BENEFITS NOT |

CONSENT(S) NOT |

OTHER |

||

REPAID |

OBTAINED |

(Attach special determination) |

||

|

TITLE |

OTHER (Specify) |

|

DATE |

|

CLAIMS SPECIALIST |

|

|

|

|

|

|

|

|

Form |

Page 2 of 2 |

||

|

|

|

|

Additional Remarks: |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Privacy Act Statement

Collection and Use of Personal Information

Sections 202, 205, 223 and 1872 of the Social Security Act, as amended, allow us to collect this information. Furnishing us this information is voluntary. However, failing to provide all or part of the information may prevent withdrawal of the application for benefits.

We will use the information you provide to cancel your application for benefits. We may also share the information for the following purposes, called routine uses:

•To contractors and other Federal Agencies, as necessary, for the purpose of assisting us in the efficient administration of our programs. We will disclose information under this routine use only in situations in which we may enter into a contractual or similar agreement to obtain assistance in accomplishing an SSA function relating to this system of records; and,

•To student volunteers, individuals working under a personal services contract, and other workers who technically do not have the status of Federal employees, when they are performing work for us, as authorized by law, and they need access to personally identifiable information (PII) in our records in order to perform their assigned agency functions.

In addition, we may share this information in accordance with the Privacy Act and other Federal laws. For example, where authorized, we may use and disclose this information in computer matching programs, in which our records are compared with other records to establish or verify a person's eligibility for Federal benefit programs and for repayment of incorrect or delinquent debts under these programs.

A list of additional routine uses is available in our Privacy Act System of Records Notice (SORN)

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take about 5 minutes to read the instructions, gather the facts, and answer the questions. SEND OR BRING THE COMPLETED FORM TO YOUR LOCAL SOCIAL SECURITY OFFICE. You can find your local Social Security office through SSA's website at www.socialsecurity.gov. Offices are also listed under U. S. Government agencies in your telephone directory or you may call Social Security at

You may send comments regarding this burden estimate or any other aspect of this collection, including suggestions for reducing this burden to: SSA, 6401 Security Blvd, Baltimore, MD

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of SSA-521 | The SSA-521 form is used to formally request the withdrawal of an application for Social Security benefits. Once approved, the withdrawal has no legal effect on the previous application. |

| Legal Implications | Withdrawing your application means forfeiting all rights associated with it, including any right of appeal. Repayment of any benefits received is required. |

| Medicare Benefits | Applicants may choose whether they want to keep their Medicare benefits following the withdrawal of their application. |

| Time Limit | Once the withdrawal request is approved, it cannot be canceled after 60 days. This emphasizes the importance of careful consideration before submission. |

| Reasons for Withdrawal | The form requires applicants to provide a reason for withdrawal. Common reasons include a decision to continue working or personal circumstances. |

| Witness Requirement | If the request is signed by mark (X), two witnesses must sign the form. This ensures accountability and validation of the request. |

| Filing Process | Once completed, the form should be sent or brought to the local Social Security office. Locations can be found on the SSA website or through government directories. |

Guidelines on Utilizing Social Security Ssa 521

When you are ready to fill out the Social Security Form SSA-521, it's important to understand the significance of your decision. Completing this form means you are officially requesting to withdraw a previous application for Social Security benefits. After submitting it, the next steps involve submitting the form to your local Social Security office, where they will review your request.

- Obtain the Form: Make sure you have the correct version of Form SSA-521. You can download it from the Social Security Administration's website or request a paper copy from your local office.

- Write Your Information: At the top of the form, enter your name, Social Security Number, and the name of the wage earner or eligible individual, if different.

- Specify the Benefit to Withdraw: Indicate the type of benefit you wish to withdraw. If the application was made for different types of benefits, be clear about which one you are referring to.

- Date of Application: Fill in the date when your original application was submitted.

- Medicare Benefits Choice: If applicable, choose whether you want to keep your Medicare benefits. Mark “Yes” or “No” clearly.

- State Your Reasons: Below your Medicare choice, explain why you want to withdraw your application. You may refer to the reasons provided on the form or expand on them as necessary.

- Signature: Sign the form using ink and include the date you are submitting the request.

- Contact Information: Provide your telephone number and your mailing address. Make sure it is accurate so that the Social Security Administration can reach you if needed.

- Witnesses (if applicable): If you signed the form with a mark (like an X), two witnesses must sign below your signature, providing their addresses as well.

- Review Before Submission: Carefully read through the completed form to ensure all entries are correct and complete.

- Submit the Form: Finally, send or bring your completed form to your local Social Security office. You can find your nearest office on the Social Security Administration's website or in your local directories.

What You Should Know About This Form

What is Form SSA-521?

Form SSA-521 is a request for the withdrawal of your application for Social Security benefits. If you choose to withdraw your application, it means the Social Security Administration (SSA) will not consider the application or any decisions made regarding it. This form is important to understand because withdrawing an application has significant consequences, including forfeiting rights to appeal and potentially having to repay any benefits you received based on that application.

Why would someone want to withdraw their Social Security application?

Individuals typically withdraw their application due to changes in personal circumstances or newfound understanding of their options. Common reasons include deciding to continue working instead of taking benefits or realizing that the current application may not be beneficial. The withdrawal process allows you to reassess your eligibility and benefits without having the previous application affect future applications.

What happens after I submit Form SSA-521?

Once you submit Form SSA-521, the SSA will review your request. If approved, your application will be withdrawn and treated as if it never existed. This means you cannot reverse the decision after 60 days from the date you receive the approval notice. If you had previously received benefits, you may need to return them. If you wish to apply again in the future, you will need to submit a new application, possibly under different terms or eligibility criteria.

Can I keep my Medicare benefits after withdrawing my application?

When filling out Form SSA-521, you will be asked whether you want to retain your Medicare benefits. You can elect to keep these benefits despite withdrawing your application for other Social Security benefits. If you choose to maintain Medicare, ensure you select "Yes" on the form. Note that retaining Medicare benefits does not impact the withdrawal of your other benefits.

How do I submit Form SSA-521?

You can submit Form SSA-521 by sending or bringing the completed form to your local Social Security office. It's beneficial to check the SSA website for the location of your nearest office. You may also contact Social Security directly at 1-800-772-1213 for assistance. To ensure there are no delays in processing your request, be thorough and accurate when filling out the form.

Common mistakes

When filling out the SOCIAL SECURITY SSA-521 form, it's easy to make mistakes that could delay or complicate your request. Understanding these common errors can help ensure a smooth process. Here are eight mistakes to avoid:

Many people forget to clearly state their reason for withdrawal. This section is crucial, as it explains your motivations to the Social Security Administration. Providing a vague or incomplete reason may lead to confusion or a request for further clarification.

Another common mistake is neglecting to check the box regarding Medicare benefits. Applicants often overlook this step, which can impact future healthcare coverage. Ensure you indicate whether you want to maintain your Medicare benefits or not.

A signature can easily be missed, especially under pressure. It is essential that the form includes an accurate and legible signature of the person making the request. An unsigned form will not be processed, leading to unnecessary delays.

Filling in the date can also pose problems. Ensure you enter the correct month, day, and year. An incorrect date could make the application invalid or provoke further inquiries from the administration.

Providing an invalid Social Security number is a frequent error. Always double-check your number against your official documents to avoid issues in processing your withdrawal request.

Contact information must be accurate and complete. Applicants sometimes provide outdated or missing phone numbers and mailing addresses. Ensure you include your current information to facilitate communication should the agency need to reach you.

Some individuals neglect to include the names of witnesses, particularly when the application is signed with a mark instead of a traditional signature. If this applies to you, two witnesses must provide their signatures and full addresses on the form.

Lastly, applicants forget to review the entire form for any errors before submission. A careful final check can catch typos or missing information that could delay the request. Paying attention to these details can prevent unnecessary delays in getting your application processed.

Documents used along the form

The Social Security Administration's Form SSA-521 is a crucial document for individuals requesting the withdrawal of their application for benefits. Several additional forms and documents often accompany the SSA-521 to ensure a smooth process. The following is a list of these documents along with brief descriptions of each.

- Form SSA-7004: This form is used to request a Social Security Statement, which provides an overview of an individual’s earnings history and estimated benefits.

- Form SSA-1: The Application for Retirement Insurance Benefits allows individuals to apply for retirement benefits under Social Security.

- Form SSA-16: This is the Application for a Period of Disability and Disability Insurance Benefits. It is used to initiate a claim for disability benefits.

- Form SSA-827: Authorization for the Social Security Administration to Disclose Information provides consent for the SSA to obtain medical records needed to evaluate claims for benefits.

- Form SSA-4814: This form is a request to change the method of payment for Social Security benefits, often used to set up direct deposit.

- Form SSA-5028: This is the Self-Employment Statement and is required when reporting earnings from self-employment for benefit calculations.

- Form SSA-3438: The Report of the Social Security Administration of Work Activity supports claims related to work and employment while receiving benefits.

- Form SSA-2458: This form is an appeal for reconsideration of a decision made by the Social Security Administration regarding benefit eligibility.

- Form SSA-7005: Notice of Award notifies individuals of their eligibility for benefits and provides details about payment amounts and schedule.

These forms and documents help streamline the process of managing Social Security benefits and ensure that applicants understand their rights and responsibilities. Proper completion of these forms helps avoid any delays in processing requests or claims.

Similar forms

-

Form SSA-824: This form is a request for reconsideration of an SSA decision. Similar to the SSA-521, it requires you to explain your reasons for wanting to change a previous application decision. Both forms are about changing your requested benefits, whether by withdrawing an application or seeking a reconsideration.

-

Form SSA-702: This form is used for requesting a statement of an alleged wage earner's earnings. Like the SSA-521, it involves official documentation and requires providing personal information. Both involve managing your benefits and ensuring you understand your rights.

-

Form SSA-3441: This form is for disability update reports. It gathers information needed to determine ongoing eligibility, similar to the SSA-521, which requests a withdrawal of an application that could affect benefit eligibility.

-

Form SSA-639: This document requests a change in payment options. Similar to the SSA-521, it requires you to notify the SSA of changes affecting how you receive your benefits. Both processes are focused on ensuring the SSA has the current and correct information about your situation.

-

Form SSA-8000: This form is used to apply for Supplemental Security Income (SSI). Like the SSA-521, it involves an application process and can be withdrawn or altered, emphasizing the importance of accurate information for benefits management.

Dos and Don'ts

When filling out the Social Security SSA-521 form, it’s essential to follow some guidelines to ensure the process goes smoothly. Here are nine key dos and don’ts to consider:

- Do clearly state your reasons for withdrawal in the designated space.

- Do double-check that your name and Social Security number are correct.

- Do ensure you sign the form using ink, not pencil.

- Do provide accurate contact information, including your phone number and mailing address.

- Do read all instructions carefully before completing the form.

- Don't forget to consider the implications of withdrawal; benefits may be forfeited.

- Don't submit the form without giving it a final review for completeness and accuracy.

- Don't ignore the 60-day window to cancel the request after approval.

- Don't provide false information, as this may have legal ramifications.

By keeping these dos and don’ts in mind, you can better navigate the process of withdrawing your application for Social Security benefits. Always consider seeking guidance if you have questions about filling out the form or the implications of your request.

Misconceptions

- Withdrawal Means Complete Cancellation: A common misconception is that withdrawing an application using the SSA 521 form completely cancels any previous decision made by the Social Security Administration. In reality, withdrawing an application means that the decision will have no legal effect, but it doesn’t erase past decisions.

- You Cannot Reapply: Some believe that once they withdraw their application, they can never apply again. However, individuals can reapply for Social Security benefits at a later time, even after a withdrawal.

- Deposit of Payments is Secured: There is a misconception that funds paid under the initial application can be kept even after withdrawal. It's important to know that all payments resulting from the application must be returned, which could significantly impact your finances.

- Medicare Benefits are Automatically Retained: People often think that withdrawing their application will keep their Medicare benefits intact. The form allows for a decision, but one must specifically express the wish to keep Medicare benefits.

- 60-Day Cancellation Period: Another false belief is that the withdrawal can be easily reversed anytime within 60 days. After 60 days from approval, the withdrawal request is final and cannot be canceled.

- All Benefits are Affected: Some assume that withdrawing an application affects every related benefit. In fact, only the benefits linked directly to the withdrawn application will be impacted.

- Witnesses are Mandatory: It is often thought that witnesses are needed on every withdrawal request. Witness signatures are only required if the request is signed by mark (X). Otherwise, they are not necessary.

Key takeaways

Here are key takeaways regarding the use of the Social Security SSA-521 form:

- Purpose: The SSA-521 form is a request to withdraw a previously submitted Social Security benefits application.

- Legal Implications: Once approved, the withdrawal has no legal effect on the previous application.

- Forfeiture: Withdrawing your application means losing all rights associated with it, including the right to appeal.

- Repayment Required: If any benefits were received based on the application, repayment will be necessary.

- Reapplication: After withdrawal, you must reapply to receive a new determination of your Social Security rights.

- Medicare Benefits: You can choose to keep your Medicare benefits even after withdrawing your application.

- Reasons for Withdrawal: It's essential to provide a clear reason for wanting to withdraw, such as a decision to continue working.

- Witness Requirement: If the form is signed by mark (X), two witnesses must sign to validate the withdrawal request.

- Submit Timely: You cannot cancel the withdrawal request after 60 days from the approval notice.

- Local Office Assistance: Your local Social Security office can provide guidance on whether this withdrawal is the right choice for you.

Ensure all information is accurate. Falsifying information can lead to serious consequences.

Complete the form and submit it to your local Social Security office for processing.

Browse Other Templates

Prime Mail - This program aims to streamline access to essential medications for members.

Work Order Completion Form - Ensure due diligence by documenting all aspects of the repairs.