Fill Out Your Sodexo Direct Deposit Form

The Sodexo Direct Deposit form is an essential tool for employees looking to streamline their payroll process. It allows individuals to add, change, or delete their direct deposit or pay card information with ease. This form ensures that employees can manage how their net pay is allocated, offering the flexibility to deposit funds into multiple bank accounts if needed. Completing the form requires accurate employee information, such as name, employee ID, and date of hire. Additionally, there are specific instructions regarding the account details, including the bank’s routing number and account number. Remember, if you're setting up a new account, there is a necessary pre-notification process that can take up to two pay cycles. Until everything is finalized, you will continue to receive your paychecks as normal. It’s important to keep this form until you confirm that your changes have been properly processed. With clear sections and straightforward instructions, the Sodexo Direct Deposit form helps ensure timely and accurate payments, making it easier for employees to manage their finances effectively.

Sodexo Direct Deposit Example

ADP Sodexo Payroll Service Center P.O. Box 17033

Augusta GA 30903

Direct Deposit/Pay Card Authorization Form (Add, Change, Delete)

Instructions: This form is completed to add a new, change or delete a Direct Deposit or Pay Card account. To ensure prompt processing, provide all required information. All fields with the (◄) symbol indicate information is required for processing. To modify more than three direct deposit or pay card accounts, use multiple forms as needed.

Note: Employees may have their net pay allocated and deposited into more than one bank account. New accounts must go through a “pre- notification process” (your bank account information must be validated with the bank before direct deposit can begin) , which will take up to two pay cycles. If you are currently receiving a Live Check, you will continue to do so until your request has been successfully processed. Keep this form until you have verified that your request has been processed.

Section 1: Employee Information

|

|

|

|

First Name ◄ |

Middle Initial |

Last Name ◄ |

Suffix |

Employee ID ◄ |

OR: |

Employee File Number ◄ AND |

|

Comp. Code (Pay Group) |

|

Date of Hire |

|

|

Note: "Employee ID" is a required field. If your "Employee ID" is not displayed on your Pay Statement (in the "Miscellaneous" section), you must provide your "Company Code (Paygroup)" AND "Employee File Number" (from the top left corner of your Pay Statement). If you do not have an "Employee ID" or "Employee File Number" please include your "Date of Hire".

By signing below, I authorize the

Employee Signature:

Signature ◄ |

|

Date of Request ◄ |

|

|

|

Contact Email Address ◄ |

Contact Telephone Number ◄ |

Section 2: Account Details

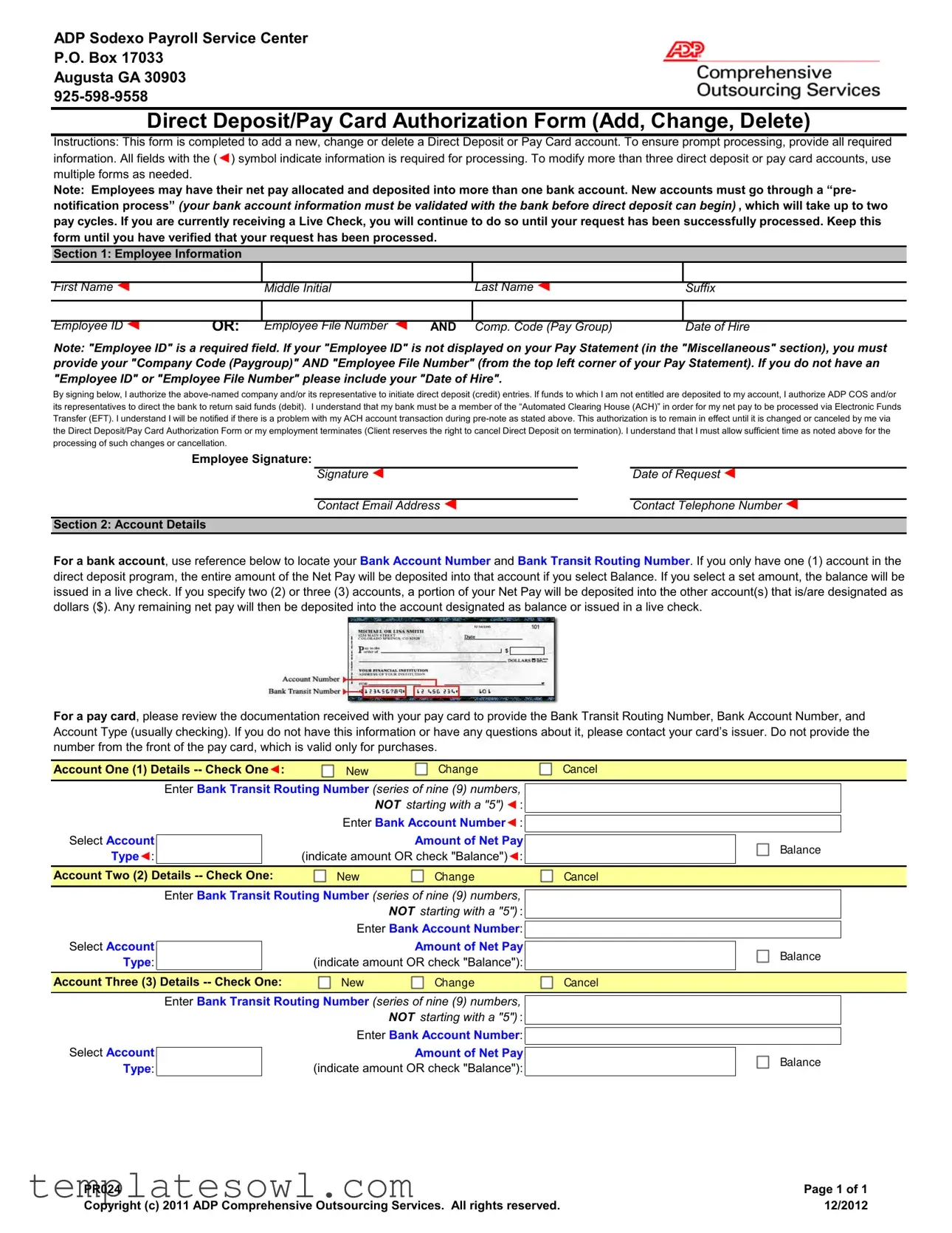

For a bank account, use reference below to locate your Bank Account Number and Bank Transit Routing Number. If you only have one (1) account in the direct deposit program, the entire amount of the Net Pay will be deposited into that account if you select Balance. If you select a set amount, the balance will be issued in a live check. If you specify two (2) or three (3) accounts, a portion of your Net Pay will be deposited into the other account(s) that is/are designated as dollars ($). Any remaining net pay will then be deposited into the account designated as balance or issued in a live check.

For a pay card, please review the documentation received with your pay card to provide the Bank Transit Routing Number, Bank Account Number, and Account Type (usually checking). If you do not have this information or have any questions about it, please contact your card’s issuer. Do not provide the number from the front of the pay card, which is valid only for purchases.

Account One (1) Details |

New |

Change |

Cancel |

||||

|

Enter Bank Transit Routing Number (series of nine (9) numbers, |

|

|

|

|||

|

|

|

|

||||

|

|

|

|

NOT starting with a "5") ◄: |

|

|

|

|

|

|

Enter Bank Account Number◄: |

|

|

|

|

|

|

|

|

|

|

||

Select Account |

|

|

|

Amount of Net Pay |

|

Balance |

|

|

|

|

|

||||

Type◄: |

|

|

(indicate amount OR check "Balance")◄: |

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Account Two (2) Details |

New |

Change |

Cancel |

||||

|

Enter Bank Transit Routing Number (series of nine (9) numbers, |

|

|

|

|||

|

|

|

|

||||

|

|

|

|

NOT starting with a "5") : |

|

|

|

|

|

|

Enter Bank Account Number: |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

||

Select Account |

|

|

|

Amount of Net Pay |

|

Balance |

|

|

|

|

|

||||

Type: |

|

|

(indicate amount OR check "Balance"): |

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Account Three (3) Details |

New |

Change |

Cancel |

||||

|

|

|

|

|

|

|

|

Select Account Type:

Enter Bank Transit Routing Number (series of nine (9) numbers, NOT starting with a "5") :

Enter Bank Account Number:

Amount of Net Pay

(indicate amount OR check "Balance"):

Balance

PR024 |

Page 1 of 1 |

Copyright (c) 2011 ADP Comprehensive Outsourcing Services. All rights reserved. |

12/2012 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | This form is used to add, change, or delete a Direct Deposit or Pay Card account for employees. |

| Required Information | To process the form, all fields marked with a (◄) require completion. |

| Pre-notification Process | New accounts go through a pre-notification process that takes up to two pay cycles to validate the bank account information. |

| Live Check Continuation | If currently receiving a live check, it will continue until the direct deposit request is fully processed. |

| Employee ID Requirements | Employees must provide either an Employee ID or, if unavailable, a Company Code and Employee File Number along with the Date of Hire. |

| Bank Membership Requirement | The employee's bank must be a member of the Automated Clearing House (ACH) for the direct deposit to work. |

| Authorization and Cancellation | The authorization remains effective until the employee cancels it or employment terminates. Changes require processing time. |

| Account Type Information | For a pay card, employees should refer to the documentation from the card issuer to provide necessary bank details. |

Guidelines on Utilizing Sodexo Direct Deposit

To proceed with your payroll setup, you will need to fill out the Sodexo Direct Deposit form. This process helps ensure your funds are directed accurately to your chosen accounts. Make sure to provide accurate information for smooth processing.

- Begin by entering your personal details in Section 1: Employee Information. Fill in your First Name, Middle Initial, Last Name, and Suffix as needed.

- Provide your Employee ID, or if that is not available, fill in your Employee File Number and Company Code (Pay Group). Make sure to also include your Date of Hire.

- Read the authorization statement carefully. Sign and date the form where indicated. Include your Contact Email Address and Contact Telephone Number.

- Move to Section 2: Account Details. For Account One, check whether you are adding a New, Change, or Cancel request.

- Enter the Bank Transit Routing Number (a series of nine digits not starting with a "5") and the Bank Account Number.

- Select the amount of your Net Pay Balance Type. Indicate the amount or check “Balance” if you wish the entire net pay deposited into this account.

- If needed, repeat the process for Account Two and Account Three. For each account, specify if it is a New, Change, or Cancel request, and fill in the required information.

- Double-check all entries for accuracy to avoid delays in processing your request.

What You Should Know About This Form

What is the purpose of the Sodexo Direct Deposit form?

The Sodexo Direct Deposit form allows employees to set up, change, or cancel their direct deposit or pay card accounts. By completing this form, employees can ensure that their net pay is electronically deposited into their chosen bank accounts or onto a pay card. This streamlines the payroll process, providing employees with reliable access to their earnings without needing to deposit checks manually.

What information is required on the form?

To process your request efficiently, the form requires specific information. Key details include your first name, last name, employee ID or employee file number, and company code. Additionally, you must provide your bank transit routing number, bank account number, the amount you wish to allocate for each account, and how you want your net pay distributed. Remember, all fields marked with a (◄) symbol are essential for processing.

How long will it take for the direct deposit to start after submitting the form?

After you submit the Sodexo Direct Deposit form, new accounts will undergo a pre-notification process. This validation with your bank may take up to two pay cycles. During this time, if you are currently receiving a live check, you will continue to do so until your direct deposit request has been processed successfully.

What happens if there is a problem with my direct deposit?

If any issues arise during the pre-notification process, you will be notified. This helps ensure that any potential problems can be addressed promptly. Additionally, if funds are mistakenly deposited into your account, you authorize the company to retrieve those funds, so your accounts remain accurate and correct.

Can I have my pay deposited into multiple accounts?

Yes, you can allocate your net pay into more than one bank account. You may specify up to three accounts on the form. If you choose multiple accounts, you can designate a specific amount to be deposited into each account or select one account to receive the balance of your net pay while the remainder may be issued as a live check.

What should I do if I need to modify my direct deposit information later?

If you wish to make changes to your direct deposit information, you must complete a new Sodexo Direct Deposit form. You can also use it to cancel existing accounts. Make sure to allow sufficient processing time for these changes to take effect as outlined in the instructions provided with the form.

Common mistakes

Filling out the Sodexo Direct Deposit form can be a straightforward task, but there are several common mistakes people make that may complicate the process. One frequent error is failing to fill in all required fields. Each field marked with a ◄ symbol is essential for processing your request. Omitting even one required detail can lead to delays or the outright rejection of your application.

Another common mistake involves using incorrect or outdated bank information. It’s vital to double-check your Bank Transit Routing Number and Bank Account Number for accuracy. Using numbers that don’t match your bank account can result in lost funds or delayed payments. This is where attentiveness pays off.

Many people overlook the importance of providing their Employee ID, especially if it's not readily visible on their pay statement. In such cases, it’s necessary to include both the Company Code (Paygroup) and Employee File Number. Forgetting to do this can lead to a significant delay in setting up your direct deposit account.

Choosing the wrong option when selecting how your paycheck is distributed can also cause issues. When specifying amounts or selecting “Balance,” it’s important to understand what these choices mean. Incorrectly designating funds could result in you not receiving your full paycheck, so take a moment to read and comprehend each option.

Another mistake to avoid is neglecting to authorize the company to initiate deposits. Failing to sign or date the form can lead to processing issues. Always remember that your signature and the date are crucial for the authorization to be valid.

Additionally, individuals often underestimate the time required for setting up a new direct deposit account. The form states clearly that a “pre-notification process” must occur, which may take up to two pay cycles. Thus, if transitioning from receiving a physical check, it’s essential to be patient while these changes are being finalized.

Errors can also arise when filling out information for multiple accounts. If you need to modify more than three accounts, using a single form can create confusion. It is advisable to complete separate forms for each set of changes, ensuring clarity and proper processing.

Do not forget to keep a copy of the form until you confirm that your request has been fully processed. This point may seem minor, but having proof of your application can be invaluable if any issues arise later.

Lastly, many people mistakenly provide their pay card number when it should not be used for this form. The card number is meant strictly for purchases, not for direct deposit setup. Always refer to the specific bank account details instead to avoid unnecessary complications.

Documents used along the form

When individuals are setting up or modifying their direct deposit information with Sodexo, several other forms and documents may be necessary to ensure a smooth process. Each of these documents plays a role in confirming the employee's identity and bank details, while also facilitating the management of payroll information.

- W-4 Form: This form is typically used for tax withholding purposes. Employees provide their identifying information and the number of allowances they claim, which determines how much federal income tax is withheld from their paychecks.

- Bank Account Verification Letter: This document is issued by the bank and verifies the employee's account details. It helps confirm that the account is valid for direct deposits and is especially important when setting up new accounts.

- Employment Verification Form: This form is often necessary for confirming an employee's employment status. It typically includes information about the employee's job title, hire date, and salary, which can be required by financial institutions.

- State Tax Withholding Form: Depending on the state of employment, this form may be needed to determine the appropriate state income tax withholding. Employees typically provide information similar to the W-4 for state tax purposes.

- Pay Card Authorization Form: If an employee opts for a pay card as a form of payment instead of traditional direct deposit, this form authorizes the payroll department to load funds onto the pay card on scheduled paydays.

Gathering these documents can help streamline the process of setting up direct deposit with Sodexo. It is crucial to ensure that all information is accurate and submitted promptly to avoid any interruptions in payment. By understanding the role of each form, employees can better navigate the process with confidence.

Similar forms

- Direct Deposit Authorization Form: Similar to the Sodexo form, this document allows employees to authorize deposits to their bank accounts without the need for physical checks. It also requires employee information and bank details for verification.

- Pay Card Enrollment Form: Like the Sodexo form, this document is used to enroll in a pay card program. It collects personal information and banking details to facilitate electronic deposits.

- W-4 Form: Both documents require personal information from the employee. The W-4 is for tax withholding allowances, while the Direct Deposit form is for managing payment methods.

- Change of Address Form: This document, like the Direct Deposit form, is used to update critical information within company records. Both require official processing to ensure employee details are current.

- Employee Termination Form: This form, similar to the Direct Deposit form, handles changes to an employee’s status. Both involve significant actions that must be processed by the company's HR department.

- Tax Exempt Status Form: This document requires similar information from the employee as the Sodexo form. Both involve authorization and details that affect how payroll processes funds.

- Direct Deposit Cancellation Form: Like the Sodexo form, this document allows an employee to request a cancellation. It also necessitates detailed instructions and employee consent.

- Expense Reimbursement Form: Both forms require submission for processing payments. The reimbursement form is for expenses incurred by employees, necessitating similar authentication mechanisms.

- Payroll Deduction Authorization Form: Similar to the Direct Deposit form, this document manages how an employee’s pay is allocated for various deductions to specific accounts.

- Employer Verification Form: Both documents require employee information for validation purposes. The verification form is used to confirm employment, similar to how the Direct Deposit form verifies banking information.

Dos and Don'ts

- Ensure Accuracy: Double-check all information before submitting. Mistakes in your employee ID or bank details can cause delays.

- Use the Correct Routing Number: Make sure the bank transit routing number is valid and does not start with a "5," as this could prevent processing.

- Keep a Copy: Retain a copy of the completed form for your records. This will help if you need to verify your request later.

- Ask Questions: If you are confused about any section, seek help. It is important to understand the process fully.

- Do Not Leave Fields Blank: All fields marked with a (◄) are mandatory. Incomplete forms will not be processed.

- Avoid Providing Incorrect Account Type: Ensure you select the right account type for each account, as this can affect where your funds are deposited.

- Don’t Rush the Process: Allow ample time for processing, especially if you are changing or adding accounts to avoid delays in receiving your funds.

- Do Not Ignore Notifications: Pay attention to any emails or messages regarding your direct deposit status. Promptly addressing issues will help maintain your cash flow.

Misconceptions

Many individuals hold misconceptions about the Sodexo Direct Deposit form. Understanding the details of this form is crucial for ensuring smooth payroll processing. Below are some of the most common misunderstandings:

- It is only for new employees. The form is not exclusively for new hires. Existing employees can also use it to modify or delete their direct deposit information.

- You can change direct deposit information anytime without delay. Changes require a pre-notification process, which may take up to two pay cycles for verification before the new details take effect.

- Multiple forms are not necessary for more than three accounts. If you wish to modify more than three direct deposit accounts, you must complete additional forms. This requirement ensures accurate processing.

- Your pay will start going to the new account immediately. If you currently receive a live check, you will continue to receive checks until the new direct deposit setup is confirmed.

- Providing incorrect information will not cause issues. Failing to provide accurate employee identification or bank details can delay processing of the request. Double-checking this information is critical.

- Direct deposits can be made to any bank. The bank must be a member of the Automatic Clearing House (ACH) to process electronic transfers. Ensure your bank meets this requirement.

- Your authorization is indefinite. Although the form authorizes direct deposits, this authorization ends if you cancel it or if your employment is terminated. Regularly review your account settings.

- Information does not need to be kept once processed. It is advisable to keep a copy of the form until you verify that the processing has completed successfully to have proof of your request.

- You can use any number from your pay card. Only the Bank Transit Routing Number and Bank Account Number are required for direct deposit. The number on the front of the pay card is only for purchases.

- All accounts can receive your entire net pay. If you designate multiple accounts, you have the option to specify how your pay is split between them, which may include issuing a live check for the remaining balance.

Key takeaways

Filling out the Sodexo Direct Deposit form can facilitate smoother and more efficient payroll transactions. Here are some important points to keep in mind:

- Complete Required Fields: Ensure all fields marked with (◄) are filled out. Missing information could lead to delays in processing your request.

- Multitude of Accounts: Remember that you can allocate your net pay to multiple bank accounts. If you need to make changes for more than three accounts, submit additional forms as needed.

- Pre-Notification Process: Newly added accounts will be subject to a pre-notification process. This validation usually takes up to two pay cycles before direct deposits can begin.

- Continued Live Check Receipts: If you currently receive a live check, this will continue until your new direct deposit request has been successfully processed.

Browse Other Templates

Sers Retirement Ct - The document requires signatures from both the Principal and witnesses to be valid.

Louisiana Overweight Permit Cost - The form is processed by the Truck Permit Section of the Louisiana DOTD.