Fill Out Your Solicitation Contributions Form

The Solicitation Contributions form is a vital document for any organization in Florida intending to solicit donations. This form is mandated under the Solicitation of Contributions Act, outlined in Chapter 496 of the Florida Statutes. Its primary function is to collect essential information about the organization, including its legal name, physical and mailing addresses, and the type of organization. Applicants must indicate whether they are submitting a new application or renewing an existing one. The form also requires notifying the state of key personnel involved, including officers and anyone responsible for the organization's financial activities. Furthermore, organizations need to disclose whether they employ professional solicitors and provide detailed information about their fundraising practices. Financial transparency is crucial; thus, organizations must attach their most recent financial statements and calculate their registration fees based on last year's contributions. Each step in the form influences the approval of the application, making accuracy and timely submission paramount for compliance with state regulations.

Solicitation Contributions Example

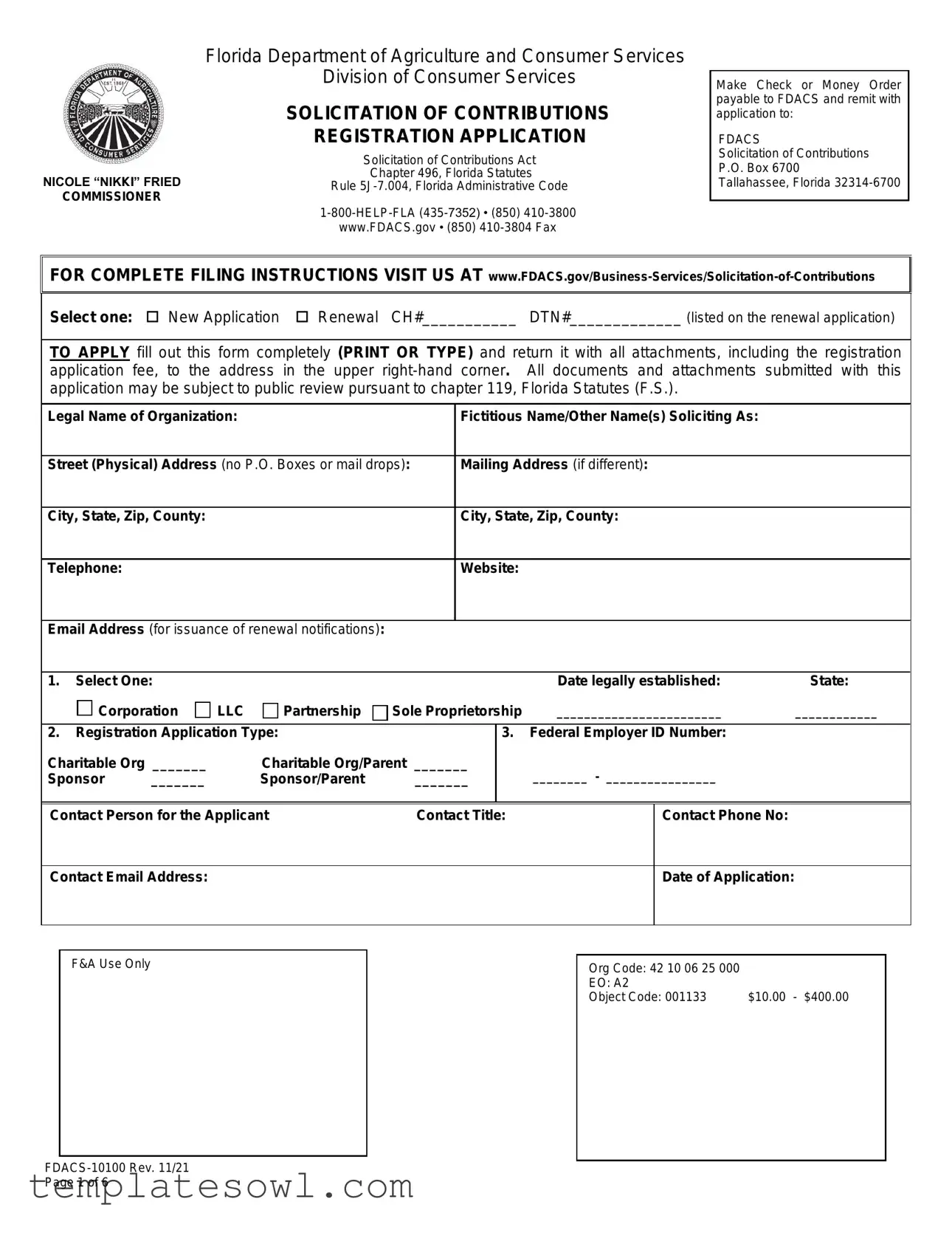

Florida Department of Agriculture and Consumer Services

Division of Consumer Services

SOLICITATION OF CONTRIBUTIONS

REGISTRATION APPLICATION

Solicitation of Contributions Act

Chapter 496, Florida Statutes

NICOLE “NIKKI” FRIEDRule

COMMISSIONER

Make Check or Money Order payable to FDACS and remit with application to:

FDACS

Solicitation of Contributions

P.O. Box 6700

Tallahassee, Florida

FOR COMPLETE FILING INSTRUCTIONS VISIT US AT

Select one: New Application Renewal CH#___________ DTN#_____________ (listed on the renewal application)

TO APPLY fill out this form completely (PRINT OR TYPE) and return it with all attachments, including the registration application fee, to the address in the upper

Legal Name of Organization:

Fictitious Name/Other Name(s) Soliciting As:

Street (Physical) Address (no P.O. Boxes or mail drops):

Mailing Address (if different):

City, State, Zip, County:

City, State, Zip, County:

Telephone:

Website:

Email Address (for issuance of renewal notifications):

1. |

Select One: |

|

|

|

|

Date legally established: |

State: |

|

|

Corporation |

LLC |

Partnership |

Sole Proprietorship |

________________________ |

____________ |

||

|

|

|

|

|

|

|||

2. |

Registration Application Type: |

|

3. |

Federal Employer ID Number: |

|

|||

Charitable Org _______ |

|

Charitable Org/Parent _______ |

|

________ - ________________ |

|

|||

Sponsor |

_______ |

|

Sponsor/Parent |

_______ |

|

|

||

|

|

|

|

|

|

|

|

|

Contact Person for the Applicant |

Contact Title: |

Contact Phone No:

Contact Email Address:

Date of Application:

F&A Use Only

Org Code: 42 10 06 25 000 |

|

EO: A2 |

|

Object Code: 001133 |

$10.00 - $400.00 |

4.List all officers, directors, trustees, and principal salaried executive personnel: Exemptions from public records apply to certain individuals. For a complete list of exemptions, see chapter 119, F.S. If you qualify for one of these exemptions, please list the organization’s address and phone number in lieu of home address and phone number. (Attach additional sheets as necessary using the same format.)

Name: |

|

|

Name: |

|

|

|

|

|

|

|

|

Title: |

|

|

Title: |

|

|

|

|

||||

Street (Physical) Address (no P.O. Boxes or mail drops): |

Street (Physical) Address (no P.O. Boxes or mail drops): |

||||

|

|

|

|

|

|

City: |

State: |

Zip: |

City: |

State: |

Zip: |

|

|

|

|

|

|

Telephone Number: |

|

|

Telephone Number: |

|

|

|

|

|

|

|

|

Compensated? |

|

|

Compensated? |

|

|

Yes |

No |

|

Yes |

No |

|

Name: |

|

|

Name: |

|

|

|

|

|

|

|

|

Title: |

|

|

Title: |

|

|

|

|

||||

Street (Physical) Address (no P.O. Boxes or mail drops): |

Street (Physical) Address (no P.O. Boxes or mail drops): |

||||

|

|

|

|

|

|

City: |

State: |

Zip: |

City: |

State: |

Zip: |

|

|

|

|

|

|

Telephone Number: |

|

|

Telephone Number: |

|

|

|

|

|

|

|

|

Compensated? |

|

|

Compensated? |

|

|

Yes |

No |

|

Yes |

No |

|

5. List any branch office, chapter or affiliates located in the state of Florida. If you are a parent organization that submits a consolidated financial statement, you may skip this question and list your branches or affiliates on the Supplemental

Consolidated Financial Statement. Visit our website for this form at www.FDACS.gov |

(Attach additional sheets as necessary using the |

||||

same format.) |

|

|

|

|

|

|

|

|

|

|

|

Name: |

|

|

Name: |

|

|

|

|

||||

Street (Physical) Address (no P.O. Boxes or mail drops): |

Street (Physical) Address (no P.O. Boxes or mail drops): |

||||

|

|

|

|

|

|

City: |

State: |

Zip: |

City: |

State: |

Zip: |

|

|

|

|

|

|

Telephone Number: |

Email: |

|

Telephone Number: |

Email: |

|

|

|

|

|

|

|

6. If the charitable organization or sponsor does not maintain an office in Florida, provide the name, street address, and telephone number of the person having custody of the financial records. [s. 496.405(2)(g)1., F.S.]

Name: |

|

Telephone Number: |

|

|

|

|

|

Street (Physical) Address (no P.O. Boxes or mail drops): |

|

||

City: |

State: |

Zip: |

|

|

|

|

|

7. List names of the individuals or officers who are in charge of any solicitation activities: |

|

||

Name: |

|

Street (Physical) Address: |

Telephone Number: |

|

|

|

|

Name: |

Street (Physical) Address: |

Telephone Number: |

|

|

|

8. List the name, address, and telephone number(s) of any person(s) responsible for the custody and final distribution of contributions:

Name: |

Street (Physical) Address: |

Telephone Number: |

|

|

|

Name: |

Street (Physical) Address: |

Telephone Number: |

|

|

|

9.Month/day fiscal year ends: [s. 496.405(2)(g)3. F.S.] Month___________ Day_________

10.Has your organization been granted tax exempt status by the Internal Revenue Service? [s. 496.405(2)(f), F.S.]

|

Yes |

501(c) ____________ |

If yes, you must attach a copy of the tax exemption determination letter from the IRS. |

|

No

Pending (a copy of such determination must be filed with the department within 30 days after receipt)

Revoked

11.Charitable purpose for which the charitable organization or sponsor is organized? (Briefly and concisely explain the purpose for which your organization was created, i.e., the organization’s mission. It is best to summarize this information in your own words. Please attach additional pages if necessary.) [s. 496.405(2)(b), F.S.]

12.What is the purpose for which the contributions to be solicited will be used? (Briefly and concisely explain how contributions will be used to further your organization’s mission. Please attach additional pages if necessary. Do not reference 990 or include an attachment.) [s. 496.405(2)(b), F.S.]

13.List major program activities: (Briefly and concisely list the main activities in which your organization participates. Please attach additional pages if necessary.) [s. 496.405(2)(g)4, F.S.]

14.Does the charitable organization or sponsor employ a professional solicitor or professional fundraising consultant?

Yes |

No |

If yes, attach a copy of the current contract, and provide the following information for each. |

|

||

|

|

(Attach additional sheets as necessary using the same format.) |

|

|

|

Name: |

|

|

Telephone Number: |

Florida Registration Number (FC/SS): |

|

|

|

|

|

||

Street (Physical) Address: |

City: |

State/Zip: |

|

||

|

|

|

|

||

Indicate Contract Type: |

Contract Begin Date: Month/Day/Year |

Contract End Date: Month/Day/Year |

|

||

Solicitor |

Consultant |

|

|

|

|

15.Does charitable organization or sponsor utilize a commercial

|

Yes No |

If yes, attach a copy of the current contract, and provide the following information for each. |

|

|

(Attach additional sheets as necessary using the same format.) |

Name:

Telephone Number:

Street (Physical) Address:

City:

State/Zip:

NOTE: Any change to the responses provided to Questions

16.Is applicant authorized by any other state to solicit contributions? [s. 496.405(2)(d)1., F.S.]

Yes No

17.Has the charitable organization/sponsor entered into an assurance of voluntary compliance (AVC) or agreement similar to that set forth in s. 496.420, F.S., in any jurisdiction? [s. 496.405(2)(d)4., F.S.]

Yes |

|

No |

If yes, attach a copy of the agreement. |

|

18.Has the charitable organization/sponsor or any of its officers, directors, trustees, or employees, regardless of adjudication, been convicted of, or found guilty of, or pled guilty or nolo contendere to, or been incarcerated within the last 10 years as a result of having previously been convicted of, or found guilty of, or pled guilty or nolo contendere to, any felony within the last 10 years?

[s. 496.405(2)(d)5., F.S.]

Yes No |

If yes, you must provide a copy of the court disposition and submit an explanation of the charge for review. |

19.Has the charitable organization/sponsor or any of its officers, directors, trustees, or employees, regardless of adjudication, been convicted of, or found guilty of, or pled guilty or nolo contendere to, or been incarcerated within the last 10 years as a result of having previously been convicted of, or found guilty of, or pled guilty or nolo contendere to, any crime involving fraud, theft, larceny, embezzlement, fraudulent conversion, misappropriation of property, or any crime enumerated in this chapter or resulting from acts committed while involved in the solicitation of contributions within the last 10 years? [s. 496.405(2)(d)6., F.S.]

Yes No |

If yes, you must provide a copy of the court disposition and submit an explanation of the charge for review. |

20.Has the charitable organization/sponsor or any of its officers, directors, trustees, or principal salaried executive personnel been enjoined in any jurisdiction from soliciting contributions or been found to have engaged in unlawful practices in the solicitation of contributions or administration of charitable assets or been enjoined from violating any law relating to a charitable solicitation? [s. 496.405(2)(d)2.,7., F.S.]

Yes No |

If yes, attach the name of such person, the date of the injunction, and the court issuing the injunction. |

21.Has the charitable organization/sponsor had its registration or authority denied, suspended, or revoked by any governmental agency? [s. 496.405(2)(d)3., F.S.]

Yes |

|

No |

If yes, attach the governmental agency action documents and an explanatory statement including the reason(s) for |

|

each denial, suspension, or revocation. |

||||

|

|

|

22.Select the financial statement you are filing for the immediately preceding fiscal year ending _____/_____/_______: Please Note: We do not accept

Please attach one of the following:

990 and all schedules |

|

Budget (newly formed organizations only) |

180 Day Extension request for financial statement only. (Failure to file a financial statement within the 180 days will result in an automatic suspension of your registration.)

Please provide the financial Information (must match the information listed on the immediately preceding fiscal year financial statement):

Total Revenue: |

$ ________________________ |

Total Expenses: |

$ ________________________ |

Program Service Expenses: |

$ ________________________ |

Management & General Expenses: |

$ ________________________ |

Fundraising Expenses: |

$ ________________________ |

23.Charitable organizations or sponsors that receive at least $500,000 in annual contributions must have their financial statement reviewed or audited by an independent certified public accountant. If annual contributions are more than $1 million, then the financial statement must be audited by an independent certified public accountant. If submitting an IRS form 990 or 990 EZ and contributions are $500,000 or more, those IRS forms must be prepared by a certified public account or another professional who prepares such forms or schedules in their ordinary course of business.

Attached is a copy of signed CPA review or audit Yes No

24.Calculation of Registration Fee:

Amount of contributions received in the immediately preceding fiscal year: $___________________

“Contribution” means the promise, pledge, or grant of money or property, financial assistance, or any other thing of value in response to a solicitation. The term includes, in the case of a charitable organization or sponsor offering goods and services to the public, the difference between the direct cost of the goods and services to the charitable organization or sponsor and the price at which the charitable organization or sponsor or a person acting on behalf of the charitable organization or sponsor resells those goods or services to the public. The term does not include:

(a)Bona fide fees, dues, or assessments paid by members if membership is not conferred solely as consideration for making a contribution in response to a solicitation;

(b)Funds obtained by a charitable organization or sponsor pursuant to government grants or contracts;

(c)Funds obtained as an allocation from a United Way organization that is duly registered with the department; or

(d)Funds received from an organization duly registered with the department that is exempt from federal income taxation under s. 501(a) of the Internal Revenue Code and described in s. 501(c) of the Internal Revenue Code. [s. 496.404(5) F.S.]

$10 fee: Less than $5,000

$10 fee: Less than $25,000 and no compensated directors/employees, no professional solicitors/consultants or commercial

$75 fee: $5,000 or more, but less than $100,000

$125 fee: $100,000 or more, but less than $200,000

$200 fee: $200,000 or more, but less than $500,000

$300 fee: $500,000 or more, but less than $1,000,000

$350 fee: $1,000,000 or more, but less than $10,000,000

$400 fee: $10,000,000 or more

Calculated Registration Fee: |

$________________________ |

Calculation of Late Fee (Renewals Only): + |

$________________________ |

($25 per month or any portion of a month following expiration date)

Total Fee Amount Enclosed: |

$________________________ |

MAKE CHECK OR MONEY ORDER PAYABLE TO: FDACS

*Submit your completed application along with the above registration fee and your financials with all attachments to:

FDACS

Solicitation of Contributions

Post Office Box 6700

Tallahassee, FL

Page 5 of 6

ONLY SPONSORS NEED TO ANSWER THE FOLLOWING QUESTIONS:

“Sponsor” means a group or person who is or holds herself or himself out to be soliciting contributions by the use of a name that implies that the group or person is in any way affiliated with or organized for the benefit of emergency service employees or law enforcement officers and the group or person is not a charitable organization. The term includes a chapter, branch, or affiliate that has its principal place of business outside the state if such chapter, branch, or affiliate solicits or holds itself out to be soliciting contributions in this state.

[s. 496.404(25), F.S.]

The organization must consist of members who are individuals of whom at least 10% or 100 members, whichever is less, are actively employed as law enforcement officers or emergency service employees by an agency of the United States, this state, a municipality, or a political subdivision of this state, and who personally sign written membership agreements with the organization and pay an annual membership of not less than $10 a member.

a.Total number of sponsor’s members:

b.Total number of members actively employed as law enforcement or emergency service employees:

c.Percentage of total net contributions (defined as the total amount of all contributions raised in Florida minus the total cost of expenses incurred in raising contributions solicited), which are disbursed in the state on behalf of its members in furtherance of its stated purpose

or programs: |

|

%. |

CERTIFICATION

I certify the following:

The organization has adopted a policy regarding conflict of interest transactions, and I certify that all directors, officers, and trustees of the charitable organization are in compliance with the adopted policy.

The information furnished in this application and all supplemental forms, reports, documents and attachments are true and correct to the best of my knowledge. [s. 496.405(2) F.S.]

__________________________________________________ |

____________________________________________ |

Printed Name |

Date |

__________________________________________________ |

____________________________________________ |

Signature |

Title |

__________________________________________________ |

____________________________________________ |

Telephone Number |

Email Address |

Page 6 of 6

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Solicitation of Contributions form is regulated by the Solicitation of Contributions Act, Chapter 496, Florida Statutes. |

| Registration Fees | The registration application fee varies based on the organization's annual contributions, ranging from $10 to $400. |

| Public Record | Documents submitted with the application may be subject to public review under Chapter 119, Florida Statutes. |

| Contact Information | For assistance, applicants can contact the Florida Department of Agriculture and Consumer Services at 1-800-HELP-FLA (435-7352). |

Guidelines on Utilizing Solicitation Contributions

Completing the Solicitation Contributions form requires careful attention to detail. Ensure all information is accurate and complete to avoid delays in processing your application. Each section must be filled out, and all required documents must be attached, including the appropriate registration fee.

- Start by selecting the type of application: New Application or Renewal.

- Fill in the CH# and DTN# if renewing.

- Provide the Legal Name of Organization and any Fictitious Name/Other Name(s) soliciting.

- Enter the full Street (Physical) Address (no P.O. Boxes), and if applicable, the Mailing Address.

- Complete the City, State, Zip, County for both address entries.

- Include your Telephone, Website, and Email Address for notifications.

- Select the date your organization was legally established and its state.

- Indicate the application type under registration (Charitable Organization, Sponsor, etc.).

- Provide your Federal Employer ID Number.

- Identify the contact person for your organization by filling in their title, phone number, and email address.

- List the officers, directors, trustees, and principal salaried executive personnel, including their titles and addresses.

- Document any branch offices, chapters, or affiliates in Florida if applicable.

- If your organization does not maintain an office in Florida, provide the contact details for the person holding the financial records.

- Name the individuals in charge of solicitation activities.

- List the names and contact information of those responsible for the custody and final distribution of contributions.

- State the month/day your fiscal year ends.

- Indicate whether your organization has been granted tax-exempt status by the IRS.

- Detail the charitable purpose of your organization and the intended use of solicited contributions.

- List major program activities that your organization undertakes.

- State whether you employ a professional solicitor or fundraising consultant and provide their details if applicable.

- Indicate the use of a commercial co-venturer if applicable and provide required details.

- Respond to questions regarding any legal issues or violations involving solicitation practices.

- Select the financial statement you will submit and ensure it is complete.

- Calculate the registration fee based on contributions received in the past fiscal year and include any late fees if renewing.

- Finally, make the check or money order payable to FDACS and submit your completed application to the provided address.

What You Should Know About This Form

What is the purpose of the Solicitation Contributions form?

The Solicitation Contributions form is used by organizations seeking to solicit donations in Florida. This form helps ensure compliance with Florida's Solicitation of Contributions Act. It requires detailed information about the organization, its activities, and its finances. Organizations must complete this form to receive approval to solicit contributions legally.

Who needs to fill out this form?

Any charitable organization or sponsor that intends to solicit contributions from the public in Florida must complete this form. This includes new applicants as well as those renewing their registration. The form gathers essential information about the organization, its officers, and its financial status.

What information is required to complete the form?

The form requires various details, including the organization’s legal name, physical and mailing addresses, contact information, date of establishment, tax-exempt status, and a description of the organization's charitable purpose. Additionally, information about officers, financial statements, and any professional solicitors must be included. Accurate and complete information is crucial for the review process.

What are the fees associated with filing this form?

The registration fees vary based on the amount of contributions received in the previous fiscal year. For instance, if total contributions are under $5,000, the fee is $10. Organizations that receive contributions over $10 million will pay a fee of $400. Renewal applications are subject to a late fee of $25 per month if submitted after the expiration date.

How can organizations submit the completed form?

Completed forms, along with the appropriate registration fee and any required financial documents, must be submitted to the Florida Department of Agriculture and Consumer Services. The mailing address for submission is FDACS Solicitation of Contributions, P.O. Box 6700, Tallahassee, Florida, 32314-6700.

What happens after submitting the form?

Once submitted, the application will be reviewed by the Florida Department of Agriculture and Consumer Services. Organizations can expect to receive a notification regarding the approval or denial of their application. If additional information or corrections are needed, the department may request further details before a final decision is made.

Common mistakes

Filling out the Solicitation Contributions form can be a straightforward task, but many individuals and organizations make common mistakes that can lead to delays or complications. One of the most frequent errors occurs when applicants do not provide complete information. For example, leaving out essential details such as the legal name of the organization or the Federal Employer ID Number can halt the process. Ensure all sections are filled out entirely, as missing information may require resubmission.

Another mistake involves the selection of the wrong application type. Applicants sometimes confuse whether they are applying as a new organization or renewing an existing registration. This is critical because the requirements and fee structures differ between new applications and renewals. Read the form carefully and select the correct option to avoid unexpected issues.

People often forget to include necessary attachments with their submission. For instance, if your organization has tax-exempt status, you must attach a copy of the tax exemption determination letter from the IRS. Failure to include these documents may lead to automatic denial of the application. Keep a checklist of required attachments to ensure nothing is overlooked.

Finally, many applicants miscalculate the registration fee. The fee structure is based on the organization's previous fiscal year contributions and is tiered. Understanding the correct amount due is vital, as submitting an incorrect payment can delay processing. Verify your revenue figures and calculate the corresponding fee accurately to ensure a smooth submission.

Documents used along the form

When submitting the Solicitation Contributions form, it is essential to accompany it with a few other key documents that provide further context and compliance information. Each of these forms has its purpose, which helps ensure that your organization adheres to state regulations regarding fundraising activities.

- IRS Tax Exemption Determination Letter: This document certifies that your organization has been granted tax-exempt status by the Internal Revenue Service (IRS). Including a copy of this letter assists in verifying that contributions made to your organization may be tax-deductible for donors.

- Financial Statement (Form 990 or 990-EZ): Charitable organizations are required to submit financial statements demonstrating their revenue and expenses. This form provides transparency around financial activities and is essential for public review.

- Supplemental Consolidated Financial Statement: If your organization is part of a larger parent organization and opts to file a consolidated financial statement, this form captures key financial data that reflects the overall operations of the group.

- Professional Solicitor Contract: If your organization employs a fundraising consultant or professional solicitor, a copy of the current contract must be submitted. This helps clarify the terms of the agreement and the scope of services being provided.

- Solicitation of Contributions Material Change Form: Should any significant changes occur after submitting the initial request, this form allows your organization to update the Department of Agriculture and Consumer Services about those changes in a timely manner.

- Branch Office or Affiliate Information: If your organization has branches or affiliates operating in Florida, it’s crucial to detail their names and addresses. This provides a fuller picture of your organization’s operational scope within the state.

By preparing these documents alongside the Solicitation Contributions form, organizations can better navigate the regulatory landscape surrounding charitable solicitations. Ensuring compliance aids in building trust with your donors and the community, ultimately supporting your organization's mission.

Similar forms

Charitable Organization Registration Form: This document is required for organizations seeking to operate as a charity. It demands similar details such as the organization's legal name, physical address, and type of organization. Just like the Solicitation Contributions form, it requires financial disclosure and identification of key personnel.

IRS Form 990: Nonprofits use this form to report their financial information annually. Both forms seek transparency regarding revenue, expenses, and how funds are allocated. In addition, both require disclosure about board members and executive compensation.

State Fundraising Registration Application: Many states have specific applications for groups that wish to solicit contributions. These applications mirror the Solicitation Contributions form in requesting information about solicitation methods, financial records, and compliance with state laws.

Annual Financial Report: This document summarizes an organization’s financial activities over the year. Similar to the Solicitation Contributions form, it demands clear reporting of revenue and expenses, ensuring that the organization remains transparent about its financial health.

Professional Fundraiser Disclosure Form: This document is mandatory when hiring outside fundraisers. Just like the Solicitation Contributions form, it requires that detailed information about the fundraising activities and contracted individuals is disclosed to ensure ethical practices in solicitation.

Dos and Don'ts

- Do: Fill out the form completely, using print or type to ensure readability.

- Do: Provide accurate and current contact information for all individuals listed.

- Do: Attach all required documentation, including the registration application fee.

- Do: Review your application for errors before submission.

- Don't: Use a P.O. Box as your physical address.

- Don't: Omit any relevant information that could delay processing.

- Don't: Wait until the last minute to submit your application, especially if a renewal is due.

Misconceptions

Understanding the Solicitation Contributions form can be tricky. Here are some common misconceptions that many people have:

- Misconception 1: You don't need to submit this form if you only raise funds occasionally.

- Misconception 2: All charities are automatically exempt from the registration requirement.

- Misconception 3: The application process is too complicated to complete without legal help.

- Misconception 4: You can submit the form without any financial records.

- Misconception 5: Renewal applications don’t require a full submission of documents.

- Misconception 6: Once you submit the application, you don't need to keep track of its status.

- Misconception 7: You can't solicit contributions while your application is pending.

Even if you solicit contributions infrequently, you may still need to register. Any solicitation that aims to obtain contributions generally requires registration.

This is not true. Charitable organizations must meet specific criteria to qualify for exemptions, and even then, they may still need to file certain documentation.

While the form may seem detailed, it is designed to be user-friendly. Many organizations successfully complete the application without professional assistance.

That’s a no-go. The form requires you to provide financial information, and failure to include these records may delay your application or result in denial.

Renewal applications still require attachments and specific information. Therefore, be prepared to provide required documents just as you would for a new application.

Staying informed about your application is crucial. If there are questions or additional requirements, the department may reach out for clarification.

This is incorrect. Soliciting contributions without approval is risky. Always wait for your registration to be finalized to avoid potential penalties.

By clarifying these misconceptions, organizations can navigate the registration process more smoothly.

Key takeaways

Here are some important points to remember when filling out and using the Solicitation Contributions form:

- Ensure the form is filled out completely; incomplete applications may delay the review process.

- Use printed text or type your responses for clarity.

- All submitted documents may be publicly reviewed, so make sure information is accurate.

- Choose the correct application type: a new application or a renewal.

- Keep detailed records of all officers and key personnel, as these need to be included in the application.

- Attach any required documentation such as the IRS tax exemption letter if applicable.

- Clearly explain your organization's charitable purpose and how contributions will be used.

- Understand the registration fees based on the total contributions received in the previous fiscal year.

- Be mindful of deadlines; renewals submitted late may incur additional fees.

Browse Other Templates

How to Get a Revoked License Back in Mn - The completed form should be submitted in a timely manner for the best chance of approval.

Hdfc Form - If you have an add-on credit card, provide the add-on cardholder's details as well.

Planilla De Pasaporte Cubano - Each section of the form is designed to gather specific and relevant information.