Fill Out Your Sos 0017 Form

The SOS 0017 form, also known as the Certificate of Withdrawal, serves an essential function for foreign corporations wishing to cease their business operations in Oklahoma. This form not only facilitates the formal withdrawal process but also ensures compliance with state regulations. A filing fee of $100.00 is required when submitting this document to the Oklahoma Secretary of State. When a corporation has been dissolved in its home jurisdiction, it is critical to include a copy of the dissolution certificate issued by the appropriate authority. Likewise, if a court has dissolved the corporation, the official court order or decree must be attached, certified by the court clerk or another official body. The form outlines several key components, including the corporation’s name, any fictitious names used in Oklahoma, and the state of its formation. Upon submission, the corporation revokes its registered agent’s authority to accept legal service in Oklahoma, consentingly allowing process to be served through the Secretary of State. Proper signature and attestation by the corporation’s leadership bind the document, solidifying the withdrawal and fulfilling state requirements.

Sos 0017 Example

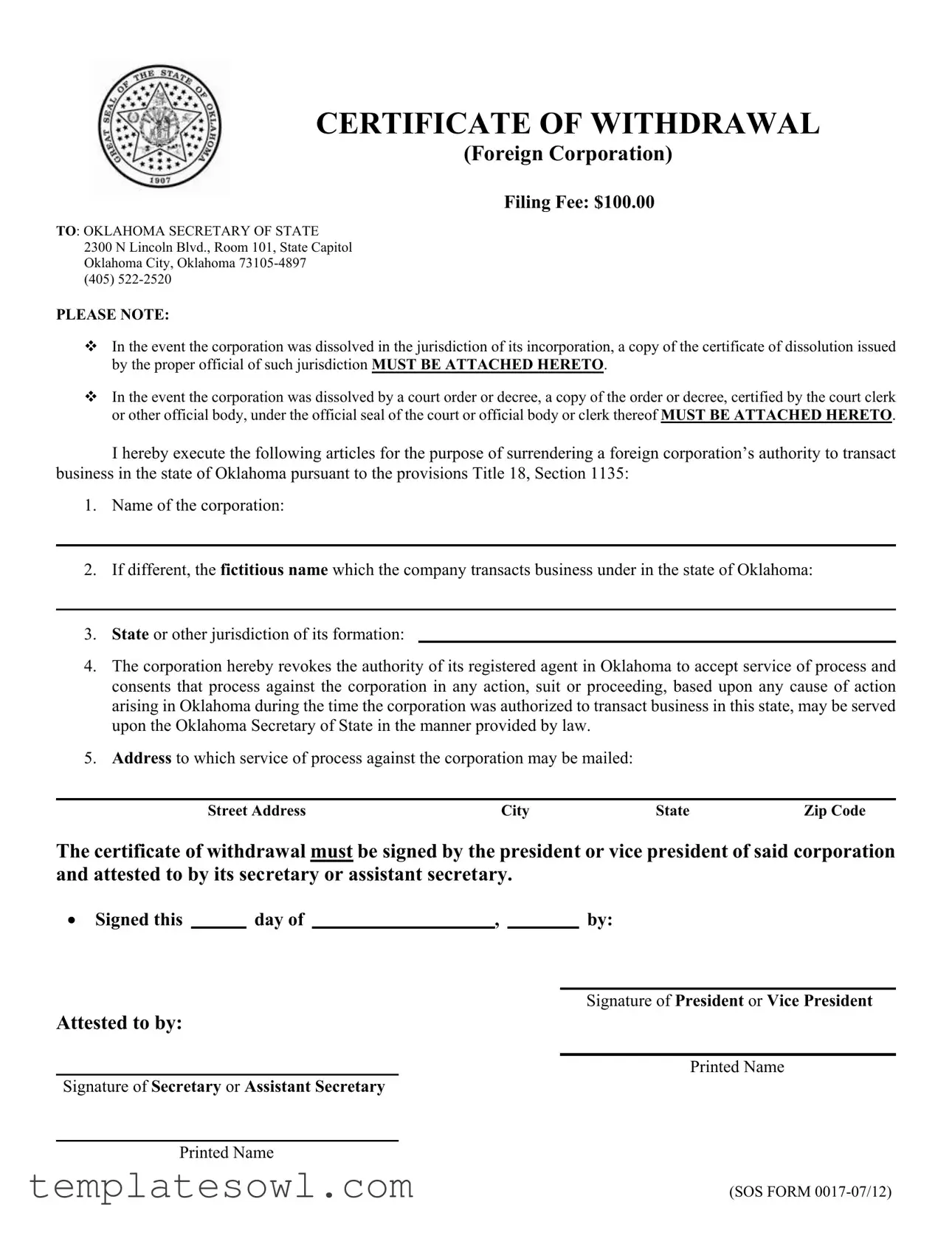

CERTIFICATE OF WITHDRAWAL

(Foreign Corporation)

Filing Fee: $100.00

TO: OKLAHOMA SECRETARY OF STATE 2300 N Lincoln Blvd., Room 101, State Capitol Oklahoma City, Oklahoma

PLEASE NOTE:

In the event the corporation was dissolved in the jurisdiction of its incorporation, a copy of the certificate of dissolution issued by the proper official of such jurisdiction MUST BE ATTACHED HERETO.

In the event the corporation was dissolved by a court order or decree, a copy of the order or decree, certified by the court clerk or other official body, under the official seal of the court or official body or clerk thereof MUST BE ATTACHED HERETO.

I hereby execute the following articles for the purpose of surrendering a foreign corporation’s authority to transact business in the state of Oklahoma pursuant to the provisions Title 18, Section 1135:

1.Name of the corporation:

2.If different, the fictitious name which the company transacts business under in the state of Oklahoma:

3.State or other jurisdiction of its formation:

4.The corporation hereby revokes the authority of its registered agent in Oklahoma to accept service of process and consents that process against the corporation in any action, suit or proceeding, based upon any cause of action arising in Oklahoma during the time the corporation was authorized to transact business in this state, may be served upon the Oklahoma Secretary of State in the manner provided by law.

5.Address to which service of process against the corporation may be mailed:

Street Address |

City |

State |

Zip Code |

The certificate of withdrawal must be signed by the president or vice president of said corporation and attested to by its secretary or assistant secretary.

• Signed this |

|

day of |

|

, |

|

by: |

Signature of President or Vice President

Attested to by:

Printed Name

Signature of Secretary or Assistant Secretary

Printed Name

(SOS FORM

Form Characteristics

| Fact Name | Details |

|---|---|

| Filing Fee | The fee to file the SOS 0017 form in Oklahoma is $100.00. |

| Submitting Authority | This form must be submitted to the Oklahoma Secretary of State's office located at 2300 N Lincoln Blvd., Room 101, State Capitol, Oklahoma City, Oklahoma 73105-4897. |

| Required Attachments | If the corporation was dissolved where it was incorporated, a certificate of dissolution must be attached. |

| Court Dissolution Documentation | If dissolved by court order, a certified copy of the order or decree, with the appropriate official seal, needs to be included. |

| Governing Law | The withdrawal process is governed by Title 18, Section 1135 of Oklahoma law. |

| Authority Revocation | The corporation must revoke the authority of its registered agent in Oklahoma to accept service of process. |

| Signatures Required | The form must be signed by the president or vice president and attested by the secretary or assistant secretary of the corporation. |

| Service of Process Address | The corporation must provide an address for serving process against it, including street address, city, state, and zip code. |

Guidelines on Utilizing Sos 0017

After gathering the necessary information, you can begin filling out the SOS 0017 form. Ensure you have all relevant documentation nearby, including any dissolution certificates if applicable. Follow the steps below to accurately complete the form.

- Enter the name of the corporation in the first blank line.

- If applicable, specify the fictitious name the corporation uses in Oklahoma.

- Indicate the state or jurisdiction of formation for the corporation.

- Check the box confirming the corporation revokes authority for its registered agent in Oklahoma to accept service of process.

- Fill in the address for service of process, including street address, city, state, and zip code.

- Have the president or vice president sign the form and enter the date.

- Request the secretary or assistant secretary to attest the signature, providing their printed name and signature.

Once complete, ensure all signatures are obtained and documentation is attached before submitting the form to the Oklahoma Secretary of State. The filing fee for this form is $100.00.

What You Should Know About This Form

What is the purpose of the SOS 0017 form?

The SOS 0017 form is known as the Certificate of Withdrawal for a foreign corporation wishing to cease its authority to conduct business in Oklahoma. This form is vital for companies that were originally formed in another state but wish to stop operations in Oklahoma legally. By filing this form, the corporation officially revokes its right to do business in the state and notifies the Oklahoma Secretary of State of this decision.

What filing fee is associated with the SOS 0017 form?

The filing fee for submitting the SOS 0017 form is $100.00. This fee is necessary to process your request and ensure that the withdrawal is appropriately recorded. It’s important to prepare this payment along with your submitted application to avoid any delays or complications in processing your withdrawal.

Are there any additional documents required when filing the SOS 0017 form?

Yes, additional documentation is often required. If the corporation has been dissolved in its state of incorporation, you must include a copy of the certificate of dissolution issued by the appropriate official. If the corporation was dissolved by a court order, an official copy of that order, certified by the court clerk, must also be included. These documents validate your request for withdrawal and affirm that the corporation has been properly dissolved in its original jurisdiction.

Who must sign the SOS 0017 form?

The SOS 0017 form must be signed by either the president or vice president of the corporation. Additionally, the signature must be attested by the secretary or assistant secretary of the corporation. This dual-signature requirement ensures that the decision to withdraw has been authorized at the highest levels of the corporation’s management and is properly documented.

Common mistakes

Filling out the SOS 0017 form can be a straightforward process, but there are common mistakes that individuals often make. One frequent error involves neglecting to include all required attachments. The form specifically states that if the corporation was dissolved, a copy of the dissolution certificate must be included. Failing to attach this document can lead to delays or rejection of the filing.

Another mistake is related to the corporation’s name. When entering the name of the corporation, ensure that it matches exactly as it appears in official records. Common discrepancies can occur if the name is written differently or if a fictitious name is used instead. Accurate representation is crucial for proper identification.

Additionally, completing the section regarding the address for service of process is often overlooked. The form requires a full street address, city, state, and zip code. Omitting any part of this information could impede the ability to receive important legal documents, leading to potential complications for the corporation.

Signature issues are also prevalent. The form must be signed by both the president or vice president and the secretary or assistant secretary. All signatories need to be current officials of the corporation. If the wrong individuals sign or if the signatures do not match the printed names, this can result in problems during processing.

Moreover, many applicants miss the importance of the filing fee. The form states a fee of $100.00 must accompany the submission. Failing to include this payment can result in immediate rejection. It is advised to check methods of payment accepted by the Oklahoma Secretary of State to ensure a smooth transaction.

Finally, some individuals overlook the date of signing. The form has a designated space for the date, which must be filled out correctly. An incomplete date can lead to questions about the validity of the submission, which can complicate the approval process. Attention to detail can prevent unnecessary delays.

Documents used along the form

The SOS 0017 form is primarily used for the withdrawal of a foreign corporation’s authority to conduct business in Oklahoma. To effectively process this withdrawal, several accompanying forms and documents might be required. The inclusion of these documents ensures compliance with state regulations and facilitates a smoother withdrawal process.

- Certificate of Dissolution - If the corporation was dissolved in its jurisdiction of incorporation, a copy of the certificate of dissolution must accompany the SOS 0017 form. This document serves as proof of legal dissolution and is usually issued by state authorities.

- Court Order or Decree - In cases where a corporation has been dissolved by court order, a certified copy of that order must be provided. The certification must include the court's seal and is essential to substantiate the legal status of the corporation.

- Registered Agent Resignation Form - This document may be needed if the registered agent is resigning. It formally relieves the agent of their responsibilities and ensures that the corporation has no further ties to them.

- Final Tax Return - Preparing and submitting the final tax return may be necessary for closure with the state and the IRS. This form documents the corporation's last earnings and liabilities.

- Statement of Assets and Liabilities - This document outlines the corporation’s remaining assets and liabilities at the time of withdrawal. It helps establish the financial status of the entity during the dissolution process.

- Shareholder Approval Documentation - If required, this document demonstrates that shareholders have approved the withdrawal. Such documentation can take the form of meeting minutes or written consents.

- Notification of Employees - While not always mandatory, notifying employees about the dissolution of the corporation helps fulfill any legal obligations regarding employee rights and benefits.

- Property Transfer Documentation - If the corporation holds property, documents detailing the transfer of any assets before withdrawal should be filed. This ensures that all assets are accounted for and properly transitioned.

Including these supporting documents with the SOS 0017 form enhances the likelihood of a successful withdrawal process. It is advisable to carefully verify the requirements specific to the situation and consult relevant authorities to ensure compliance with all applicable laws.

Similar forms

The SOS 0017 form, known as the Certificate of Withdrawal for Foreign Corporations, shares similarities with several other legal documents. Below is a list of five relevant forms that reflect common themes in corporate filings.

- Articles of Dissolution: This document officially ends a corporation's existence in its state of incorporation. Like the SOS 0017 form, it requires specific details about the corporation, including its name and jurisdiction. Both forms may need a certified copy of a dissolution certificate if the company was dissolved in its home state.

- Certificate of Revocation: This form is used when a domestic corporation decides to revoke its authority to do business. It operates similarly to the SOS 0017 in that it formally signifies the cessation of business activities in a particular state while also involving necessary signatures from corporate officers.

- Statement of Withdrawal: Similar to the SOS 0017, this document is filed when foreign entities wish to discontinue their business operations in a state. It requires information about the corporation and consent for service of process, just like the SOS 0017 does.

- Notice of Change of Registered Agent: This document serves to update the state regarding any changes to a corporation’s registered agent. Both it and the SOS 0017 involve the corporation’s authority concerning service of process, albeit in different contexts.

- Certificate of Formation: While this document is filed to create a corporation in a state, it shares common information requirements with the SOS 0017 form. Both documents will typically ask for the corporation's name and address, highlighting the importance of maintaining accurate records with the state.

Understanding these documents illustrates the various processes a corporation goes through concerning its authority to operate in different jurisdictions.

Dos and Don'ts

When filling out the SOS 0017 form, it's important to ensure accuracy and compliance with the requirements set forth by the Oklahoma Secretary of State. Below is a list of recommended actions and things to avoid:

- Do carefully read the entire form before completing it.

- Do include a copy of the certificate of dissolution if applicable.

- Do ensure the form is signed by the appropriate corporate officers.

- Do provide a valid mailing address for service of process.

- Don't leave any sections of the form blank unless specified.

- Don't forget to attach any court orders or decrees if the corporation was dissolved by a court.

- Don't use incorrect or outdated corporate names.

- Don't submit without verifying all signatures are present and legible.

Misconceptions

Misconceptions about the SOS 0017 form can lead to confusion and potential missteps in the withdrawal process for a foreign corporation in Oklahoma. Below is a list of common misconceptions along with explanations to clarify each point.

- Myth 1: The SOS 0017 form is optional for foreign corporations wishing to withdraw.

- Myth 2: Only the corporation's president can sign the SOS 0017 form.

- Myth 3: If a corporation is dissolved in its home state, the SOS 0017 form is not needed.

- Myth 4: The filing fee for the SOS 0017 form is negotiable.

- Myth 5: A registered agent can submit the SOS 0017 form on behalf of the corporation without authorization.

- Myth 6: The Oklahoma Secretary of State handles the dissolution of corporations automatically upon withdrawal.

This is inaccurate. Completing the SOS 0017 form is a formal requirement for any foreign corporation that wishes to surrender its authority to conduct business in Oklahoma. Without it, the corporation remains registered and liable for any associated obligations.

While the president or vice president must sign the form, it also requires the attestation of the secretary or assistant secretary. This step ensures proper validation of the document.

This misconception fails to recognize that even if the corporation has been dissolved elsewhere, the SOS 0017 form must still be filed. Additionally, a copy of the dissolution certificate must be attached to the form.

The filing fee is set at $100.00 and must be paid in full at the time of submission. This fee is non-negotiable and is a requirement for processing the withdrawal.

A registered agent cannot file the SOS 0017 form unless they have explicit authorization from the corporation’s officers. Proper signatures from the necessary corporate officers are required to validate the submission.

The Secretary of State does not dissolve a corporation automatically upon receipt of the SOS 0017 form. The form merely serves to withdraw the corporation's authority to transact business. Any dissolution procedures or obligations in the home state must be handled separately.

Key takeaways

Understanding the SOS 0017 form, or the Certificate of Withdrawal for a Foreign Corporation, is essential for any corporation looking to cease their business activities in Oklahoma. Below are key takeaways for effectively filling out and utilizing this form:

- The filing fee for submitting the SOS 0017 form is $100.00.

- All submissions should be directed to the Oklahoma Secretary of State located at 2300 N Lincoln Blvd., Room 101, Oklahoma City, OK 73105-4897.

- If the corporation has been dissolved in its home jurisdiction, you must attach a copy of the certificate of dissolution.

- In cases where a court order dissolves the corporation, include a certified copy of the order or decree.

- The form requires the Name of the corporation and, if applicable, the fictitious name under which the corporation operated in Oklahoma.

- You must indicate the state or other jurisdiction where the corporation was formed, which is crucial for validation.

- Revocation of authority for the registered agent in Oklahoma is declared within the form, ensuring no further service of process can be accepted by them.

- It is important to provide a mailing address for service of process, which should include street address, city, state, and zip code.

- Finally, the form must be signed by either the President or Vice President and attested by the Secretary or Assistant Secretary of the corporation.

Completing the SOS 0017 form accurately and attaching the necessary documentation will facilitate a smoother withdrawal process from conducting business in Oklahoma.

Browse Other Templates

Construction Selections Spreadsheet - Capture both interior and exterior selections in one spot.

Tarjeta Dorada Application Online - Applicants must include financial documents that detail household income sources.

Baseball Evaluation Sheets - Ensure detailed scoring to reflect all aspects of player performance.