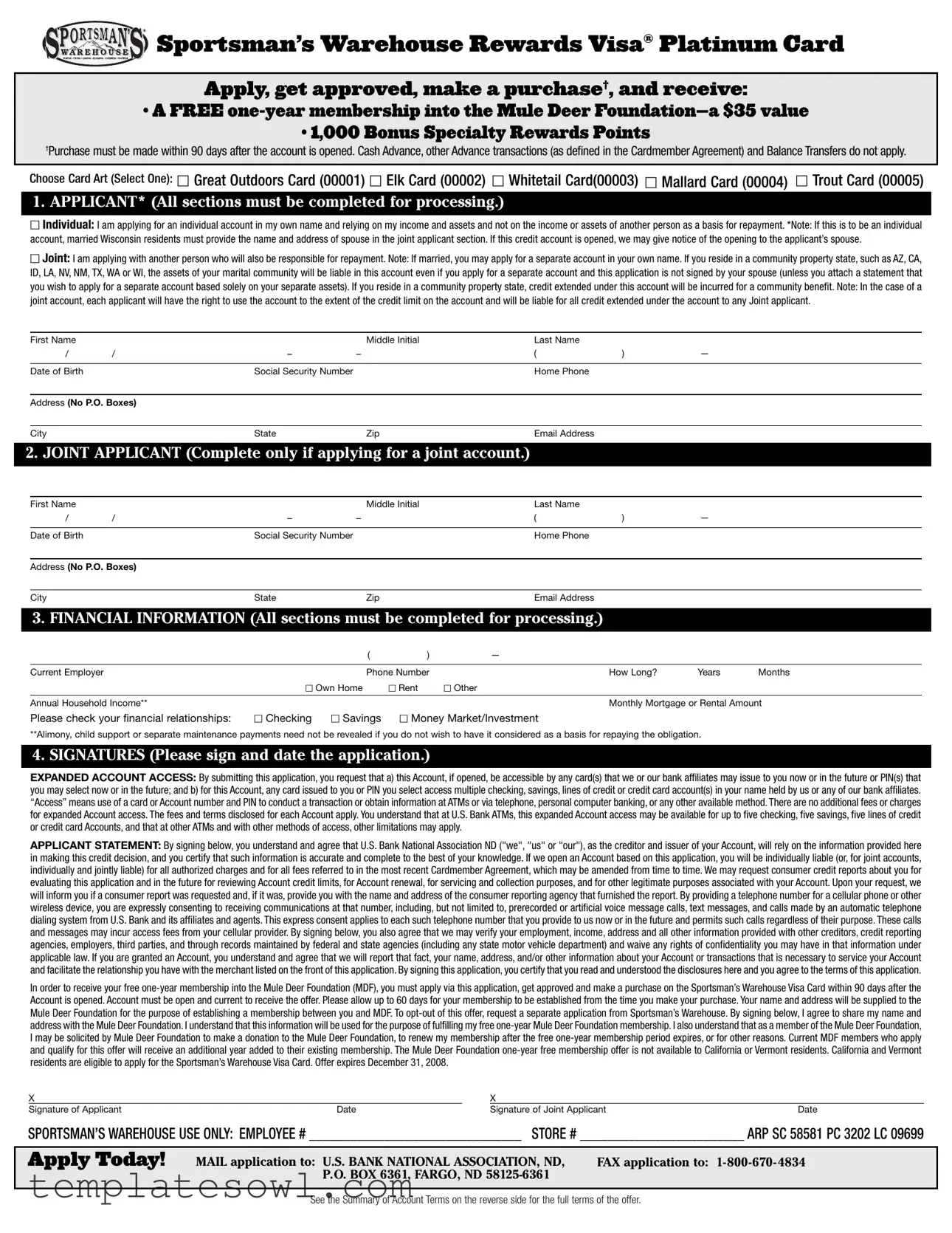

Fill Out Your Sportsmans Credit Card Form

The Sportsman’s Warehouse Rewards Visa Platinum Card application form offers outdoor enthusiasts a simple way to access credit while enjoying exclusive rewards. Upon approval, cardholders receive a free one-year membership to the Mule Deer Foundation, valued at $35, plus the opportunity to earn 1,000 bonus Specialty Rewards Points by making a purchase within 90 days of account activation. The application is straightforward but requires specific information, such as personal details and financial history. Applicants can choose from five card designs, each showcasing a different outdoor theme. Depending on individual or joint applications, obligations for repayment can differ, particularly in community property states. The form also prompts potential cardholders to provide their employment details, income, and any existing banking relationships. By signing the application, individuals agree to terms that include privacy considerations, potential credit checks, and the sharing of information necessary for account management and membership fulfillment. With no annual fee and competitive interest rates, this card caters to those who prioritize both financial benefits and their passion for the outdoors.

Sportsmans Credit Card Example

SportsmanÕs Warehouse Rewards Visa¨ Platinum Card |

Apply, get approved, make a purchase , and receive:

¥ A FREE

¥ 1,000 Bonus Specialty Rewards Points

†Purchase must be made within 90 days after the account is opened. Cash Advance, other Advance transactions (as defined in the Cardmember Agreement) and Balance Transfers do not apply.

CHOOSE CARD ART (SELECT ONE): 5 GREAT OUTDOORS CARD (00001) 5 ELK CARD (00002) 5 WHITETAIL CARD(00003) 5 MALLARD CARD (00004) 5 TROUT CARD (00005)

1. APPLICANT* (All sections must be completed for processing.)

5Individual: I am applying for an individual account in my own name and relying on my income and assets and not on the income or assets of another person as a basis for repayment. *Note: If this is to be an individual account, married Wisconsin residents must provide the name and address of spouse in the joint applicant section. If this credit account is opened, we may give notice of the opening to the applicant’s spouse.

5Joint: I am applying with another person who will also be responsible for repayment. Note: If married, you may apply for a separate account in your own name. If you reside in a community property state, such as AZ,CA, ID, LA, NV, NM, TX, WA or WI, the assets of your marital community will be liable in this account even if you apply for a separate account and this application is not signed by your spouse (unless you attach a statement that you wish to apply for a separate account based solely on your separate assets). If you reside in a community property state, credit extended under this account will be incurred for a community benefit. Note: In the case of a joint account, each applicant will have the right to use the account to the extent of the credit limit on the account and will be liable for all credit extended under the account to any Joint applicant.

First Name |

|

|

Middle Initial |

Last Name |

|

|

/ |

/ |

– |

– |

( |

) |

— |

|

|

|

|

|

|

|

Date of Birth |

|

Social Security Number |

|

Home Phone |

|

|

|

|

|

|

|

|

|

Address (NO P.O. BOXES) |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip |

Email Address |

|

|

2. JOINT APPLICANT (Complete only if applying for a joint account.)

First Name |

|

|

Middle Initial |

Last Name |

|

|

/ |

/ |

– |

– |

( |

) |

— |

|

|

|

|

|

|

|

Date of Birth |

|

Social Security Number |

|

Home Phone |

|

|

|

|

|

|

|

|

|

Address (NO P.O. BOXES) |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip |

Email Address |

|

|

3. FINANCIAL INFORMATION (All sections must be completed for processing.)

|

|

( |

) |

— |

|

|

|

|

|

|

|

|

|

Current Employer |

|

Phone Number |

How Long? |

Years |

Months |

|

|

5 Own Home |

5 Rent |

5 Other |

|

|

|

Annual Household Income** |

|

|

|

Monthly Mortgage or Rental Amount |

||

Please check your financial relationships: |

5 Checking |

5 Savings |

5 Money Market/Investment |

|

|

|

**Alimony, child support or separate maintenance payments need not be revealed if you do not wish to have it considered as a basis for repaying the obligation.

4. SIGNATURES (Please sign and date the application.)

EXPANDED ACCOUNT ACCESS: By submitting this application, you request that a) this Account, if opened, be accessible by any card(s) that we or our bank affiliates may issue to you now or in the future or PIN(s) that you may select now or in the future; and b) for this Account, any card issued to you or PIN you select access multiple checking, savings, lines of credit or credit card account(s) in your name held by us or any of our bank affiliates. “Access” means use of a card or Account number and PIN to conduct a transaction or obtain information at ATMs or via telephone, personal computer banking, or any other available method. There are no additional fees or charges for expanded Account access. The fees and terms disclosed for each Account apply. You understand that at U.S. Bank ATMs, this expanded Account access may be available for up to five checking, five savings, five lines of credit or credit card Accounts, and that at other ATMs and with other methods of access, other limitations may apply.

APPLICANT STATEMENT: By signing below, you understand and agree that U.S. Bank National Association ND ("we", "us" or "our"), as the creditor and issuer of your Account, will rely on the information provided here in making this credit decision, and you certify that such information is accurate and complete to the best of your knowledge. If we open an Account based on this application, you will be individually liable (or, for joint accounts, individually and jointly liable) for all authorized charges and for all fees referred to in the most recent Cardmember Agreement, which may be amended from time to time. We may request consumer credit reports about you for evaluating this application and in the future for reviewing Account credit limits, for Account renewal, for servicing and collection purposes, and for other legitimate purposes associated with your Account. Upon your request, we will inform you if a consumer report was requested and, if it was, provide you with the name and address of the consumer reporting agency that furnished the report. By providing a telephone number for a cellular phone or other wireless device, you are expressly consenting to receiving communications at that number, including, but not limited to, prerecorded or artificial voice message calls, text messages, and calls made by an automatic telephone dialing system from U.S. Bank and its affiliates and agents. This express consent applies to each such telephone number that you provide to us now or in the future and permits such calls regardless of their purpose. These calls and messages may incur access fees from your cellular provider. By signing below, you also agree that we may verify your employment, income, address and all other information provided with other creditors, credit reporting agencies, employers, third parties, and through records maintained by federal and state agencies (including any state motor vehicle department) and waive any rights of confidentiality you may have in that information under applicable law. If you are granted an Account, you understand and agree that we will report that fact, your name, address, and/or other information about your Account or transactions that is necessary to service your Account and facilitate the relationship you have with the merchant listed on the front of this application. By signing this application, you certify that you read and understood the disclosures here and you agree to the terms of this application.

In order to receive your free

X |

|

|

X |

|

Signature of Applicant |

Date |

|

Signature of Joint Applicant |

Date |

SPORTSMAN’S WAREHOUSE USE ONLY: EMPLOYEE # _______________________________ STORE # ________________________ ARP SC 58581 PC 3202 LC 09699

Apply Today! |

MAIL application to: U.S. BANK NATIONAL ASSOCIATION, ND, |

FAX application to: 1- |

|

P.O. BOX 6361, FARGO, ND |

|

|

|

|

See the Summary of Account Terms on the reverse side for the full terms of the offer.

|

SUMMARY OF ACCOUNT TERMS |

|

|

|

|

Annual Fee |

|

$0 |

Annual Percentage Rate (APR) for Purchases1 |

|

8.99% to 17.99% |

Other APRs1 |

|

Balance Transfer Variable: 8.99% to 17.99% |

|

|

Cash Advances Variable: 19.99% |

|

|

Delinquency Rate Variable: 28.99%2 |

|

|

|

Variable Rate Information |

|

Your Annual Percentage Rate may vary monthly. The rate will be determined by adding a |

|

|

Margin to the Prime Rate.3 The Margin used is as follows: |

|

|

Purchases and Balance Transfers: 3.99% to 12.99% |

|

|

Cash Advances: 14.99% (Subject to minimum APR of 19.99%) |

|

|

Delinquency Rate: 23.99% |

Grace Period |

|

|

|

|

|

Method of Computing the Balance for Purchases |

|

Average Daily Balance Method (including new purchases). |

|

|

|

Minimum or Fixed Finance Charge |

|

• $2.00 minimum finance charge when interest is due. |

|

|

• Account Management Fee: $2.50 per month if you voluntarily close your account |

|

|

with a balance. |

|

|

|

Other Fees |

|

• Cash Advance Fee: 3% of transaction amount, $10 minimum. |

|

|

• Balance Transfer Fee: 3% of transaction amount, $5 minimum. |

|

|

• Convenience Check Advance Fee: 3% of transaction amount, $5 minimum. |

|

|

• Overdraft Protection Advance Fee: 3% of transaction amount, $10 minimum. |

|

|

• Cash Equivalent Fee: 4% of transaction amount, $10 minimum. |

|

|

• Foreign Transaction Fee: Less than or equal to 3% of the amount of your |

|

|

transaction in U.S. dollars. |

|

|

• Late Payment Fee: Balances up to $100: $19, Balances from $100 up to $250: $29, |

|

|

Balances of $250 or more: $39. |

|

|

• Overlimit Fee: $39. |

THIS INFORMATION IS ACCURATE AS OF 10/09/08 AND MAY CHANGE. TO FIND OUT WHAT MAY HAVE CHANGED, CALL US AT

Your APR may increase if you fail to make timely payments to another creditor as reflected in your credit report. All Account terms are governed by the Cardmember Agreement sent with the Card. Account and Cardmember Agreement terms are not guaranteed for any period of time; we may change all terms, including APRs and fees, in accordance with the Cardmember Agreement and applicable law.

1Upon Account opening, your APR will be dependent on your credit history.

2The Delinquency Rate will apply to all balances in the event the Account is 15 calendar days past due once or if your Account has two overlimit occurrences during any period of 12 consecutive months.

3The Prime Rate used to determine your APR is a variable rate that is adjusted monthly based on the highest Prime Rate published in the ÒMoney RatesÓ column of the Midwest Edition of The Wall Street Journal in the last 90 days before the date on which the billing cycle closed (in other words, the ÒStatement DateÓ). (Currently 5.0%.)

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT: To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an Account. What this means for you: When you open an Account, we will ask for your name, address (P.O. Boxes are not allowed under Federal law), date of birth and other information that will allow us to identify you. We may ask to see your driverÕs license or other identifying documents.

Notice to New York Residents: NY residents may contact the NY State Banking Department at

Notice to California Residents: An applicant, if married, may apply for a separate account.

Notice to Married Wisconsin Residents: No provision of any marital property agreement, unilateral statement under section 766.59 of the Wisconsin statutes or court decree under section 766.70, adversely affects our interest unless we, prior to the time the credit is granted or an

Notice to Ohio Residents: The Ohio laws against discrimination require that all creditors make credit equally available to all credit worthy customers, and that credit reporting agencies maintain separate credit histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with this law.

Specialty Rewards Program: SportsmanÕs Warehouse Rewards Visa Platinum Cardmembers will receive three (3) Specialty Rewards Points for each dollar ($1) of Net ÒPurchasesÓ (purchases minus credits and returns) made at SportsmanÕs Warehouse and one (1) Specialty Rewards Point for each dollar ($1) of Net ÒPurchasesÓ made everywhere else Visa is accepted and charged to a SportsmanÕs Warehouse Rewards Visa Platinum Card Account. Points will not be awarded for net purchases during a statement period if the Account is not open and current on the statement date. Points will not be awarded for balance transfers, cash advances, other Account advances and other

We make a promise to deliver the highest level of customer service in the industry, and we boldly back this pledge up with the exclusive U.S. Bank Five Star Service Guarantee, which ensures the core service standards most important to our customers are met and exceeded. Exceeding your expectations is our number one priority, guaranteed.

U.S. Bank National Association ND is the creditor and issuer of the SportsmanÕs Warehouse Rewards Visa Platinum Card. ©2008 U.S. Bank, P.O. Box 6332, Fargo, ND

SW MDFA 10/08

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Card Type | Sportsman’s Warehouse Rewards Visa Platinum Card. |

| Membership Offer | Receive a free one-year membership to the Mule Deer Foundation, valued at $35. |

| Bonus Points | 1,000 Bonus Specialty Rewards Points awarded for purchases within 90 days of account opening. |

| Card Art Options | Choose from five designs: Outdoors, Elk, Whitetail, Mallard, and Trout cards. |

| Eligibility for Joint Account | Married applicants in community property states may need to involve their spouse in the application. |

| Income Reporting | Applicants must provide personal income details; alimony and child support do not have to be disclosed. |

| Account Access | Expanded account access includes multiple types of accounts linked to the card with no additional fees. |

| Annual Fee | The card has a $0 annual fee. |

| Balance Transfer Rate | The variable balance transfer APR ranges from 8.99% to 17.99%. |

| State-Specific Notice | Married Wisconsin residents must disclose spouse information; differentiation exists for California and Vermont residents. |

Guidelines on Utilizing Sportsmans Credit Card

Completing the Sportsmans Credit Card application form is a straightforward process designed to gather essential information for evaluation. By following these steps, you can ensure that your application is filled out correctly and submitted for review.

- Select Card Art: Choose one from the five card designs available.

- Complete Applicant Information: Fill out your first name, middle initial, last name, date of birth, social security number, home phone, address (no P.O. boxes), city, state, zip code, and email address. Indicate whether you are applying for an individual or joint account.

- If Joint Applicant: Provide similar information for the person you are applying with, including their first name, middle initial, last name, date of birth, social security number, home phone, address, city, state, zip code, and email address.

- Financial Information: Fill in the current employer's name, phone number, how long you have been employed (in years and months), your housing status (own home, rent, or other), your annual household income, and your monthly mortgage or rental amount. Also, indicate your financial relationships by checking the appropriate boxes.

- Signatures: Each applicant must sign and date the application to certify that the information provided is accurate.

Once the form is fully completed and signed, it needs to be submitted by mailing it to the address provided on the application or by faxing it. Your application will be reviewed, and you should receive a decision soon. Be sure to keep track of any deadlines associated with the benefits offered, such as obtaining your free membership for the Mule Deer Foundation.

What You Should Know About This Form

1. What are the benefits of applying for the Sportsman’s Warehouse Rewards Visa Platinum Card?

When you apply for and get approved for the Sportsman’s Warehouse Rewards Visa Platinum Card, you will receive some exciting benefits. First, you will get a free one-year membership to the Mule Deer Foundation, valued at $35. Additionally, you will earn 1,000 bonus Specialty Rewards Points if you make a purchase within 90 days after opening your account. Note that cash advances and balance transfers do not qualify for this bonus offer.

2. Can I apply for a joint account with someone else?

Yes, you can apply for a joint account with another person. Both applicants will share the responsibility for repayment. If you are married and live in a community property state, keep in mind that both of your assets may be considered in relation to this account, even if you apply as individuals. This means that both participants can use the account according to the credit limit and are liable for all charges made on it.

3. What if I don't make a purchase within 90 days of opening my account?

If you fail to make a purchase within the 90-day window after your account is approved, you will not qualify for the 1,000 bonus Specialty Rewards Points or the free membership with the Mule Deer Foundation. It is essential to make a qualifying purchase within that timeframe to take full advantage of these offers.

4. Are there annual fees associated with the Sportsman’s Warehouse credit card?

No, there is no annual fee for the Sportsman’s Warehouse Rewards Visa Platinum Card. This makes it an appealing option for those who want to earn rewards without an extra cost. However, be aware that other fees may apply, such as fees for cash advances and balance transfers. It is important to review all terms related to fees and charges before applying.

5. How do I earn Specialty Rewards Points with this card?

You can earn Specialty Rewards Points for purchases made with your Sportsman’s Warehouse Rewards Visa Platinum Card. For every dollar spent on eligible purchases at Sportsman’s Warehouse, you will earn three points. For purchases made elsewhere where Visa is accepted, you will earn one point per dollar. Remember, points will not be granted for non-purchase transactions like cash advances or balance transfers. Additionally, points expire five years from the date they are earned.

Common mistakes

Applying for the Sportsman's Credit Card can be an exciting opportunity, but completing the application form accurately is crucial. Many applicants make common mistakes that can lead to delays or even rejections. Understanding these pitfalls can help ensure a smooth application process.

One frequent mistake is leaving required fields blank. The application explicitly states that all sections must be completed for processing. If a field is not applicable, mark it clearly, rather than skipping it. Omitting information can lead to assumptions that could derail your application.

Another common error involves using a P.O. Box address. Applications must include a physical residential address. Submitting a P.O. Box violates federal regulations and could result in immediate rejection. Ensure that your address on the application reflects where you actually reside.

Many applicants forget to double-check the accuracy of their social security numbers. An incorrect number can lead to significant processing delays since it may affect credit checks. Always verify that this information is accurate before submitting your form.

Confusing employment information is another issue that may arise. Applicants sometimes provide their previous employer’s information instead of their current employer. This mistake can create discrepancies in the verification process. Make sure to include your current employer and the length of employment accurately.

Income declarations often lead to misunderstandings. Applicants may state annual income without clarifying if it includes bonuses or other considerations. It’s important to disclose only base income in the appropriate field to avoid inconsistencies during verification.

Missing signatures is a mistake many people overlook. The application must be signed by both the primary applicant and any joint applicant if applicable. Criteria around joint accounts can also be confusing, particularly for residents of community property states. Ensuring all required signatures are present is vital to avoid a stalled application.

Some applicants fail to provide a valid email address. This information is crucial for communication regarding account approval and other essential updates. Therefore, check that your email is entered correctly and is active.

Applicants sometimes overlook the need for clarity in choosing card art. Selecting an option without marking it can result in processing delays. To ensure your application is correctly addressed, double-check the card art selection before finalizing.

Lastly, make sure to review the terms carefully. Some applicants rush through this section and might be unaware of essential details regarding terms and fees. Understand these conditions completely to avoid future complications with the account once opened.

Documents used along the form

When applying for the Sportsman’s Warehouse Rewards Visa Platinum Card, a variety of other forms and documents may accompany the application. These documents help streamline the application process and ensure smooth account management. Here’s a brief overview of commonly used supplementary forms.

- Cardmember Agreement: This document outlines the terms and conditions associated with the credit card, including fees, interest rates, and borrower responsibilities. It's essential to understand these details before signing up.

- Consumer Credit Report Authorization: Applicants may need to sign an authorization form allowing the bank to obtain credit reports. This information is crucial for assessing creditworthiness.

- Membership Registration Form: If applying for benefits from affiliated organizations, a separate registration may be required to establish membership and access those perks.

- Income Verification Documents: These may include pay stubs or tax returns confirming your income. Providing accurate documentation helps in determining your eligibility for credit.

- Employment Verification Form: A form that confirms your current employment status. Employers may need to be contacted to verify this information.

- Joint Account Application: If applying for a joint account, additional paperwork may be necessary to include both applicants’ information and agreements.

- Address Verification Documents: These could be utility bills or lease agreements that confirm your residence. Validating your address is crucial to the application process.

- Opt-Out Request Form: If you wish to opt out of sharing your information with third parties, this form will allow you to express that preference clearly.

Having these documents in order can significantly expedite the application process and clarify your options once approved. Completing all necessary forms accurately ensures you receive the full benefits of the Sportsman’s Warehouse Rewards Visa Platinum Card.

Similar forms

- Credit Card Application Form: Like the Sportsman's Credit Card form, a standard credit card application collects personal and financial information, such as income, employment, and credit history, to assess the applicant's creditworthiness.

- Rewards Program Enrollment Form: This document is similar in that it registers individuals for a specific rewards program, often requiring personal details and consent to terms, mirroring the membership offer in the Sportsman’s application.

- Loan Application Form: Much like the credit card form, this document also demands personal and financial information to evaluate the borrower's ability to repay the loan.

- Membership Application: A membership application typically gathers personal information and preferences. This echoes the Sportsman's form, which includes an offer for a membership in the Mule Deer Foundation.

- Account Authorization Form: Similar to the Sportsman's Credit Card application, this form allows individuals to authorize access to their account information and grants permission for shared data, ensuring transparency in account management.

- Joint Account Application: Much like the section for joint applicants, this form typically allows two individuals to apply for an account together while understanding their shared responsibilities.

- Consent to Credit Check: This is analogous as it requires an applicant's consent for the lender to access credit reports, similar to the provisions in the Sportsman's Credit Card form regarding consumer credit reports.

- Business Credit Application: This document gathers essential business information to assess potential credit for companies, sharing commonalities with the individual-focused personal information request in the Sportsman’s form.

- Loan Disclosure Statement: This document outlines terms, fees, and assessments much like the summary of account terms in the Sportsman's form, providing transparency about what applicants can expect.

- Deposit Account Application: Similar in structure, this application gathers personal information and financial details but is intended for banking accounts rather than credit accounts, showcasing the regulation of both types of accounts.

Dos and Don'ts

When filling out the Sportsman's Credit Card application form, there are several important do's and don'ts to keep in mind to ensure smooth processing of your application.

- Do fill out all required sections completely and accurately to avoid delays.

- Do double-check your personal information, including your Social Security number and date of birth, for accuracy.

- Do select the card art you prefer by choosing one from the available options.

- Do provide your current employment information, including your employer's phone number.

- Don't use a P.O. Box for your address, as only physical addresses are accepted.

- Don't forget to sign and date the application, as it is essential for processing.

Misconceptions

Misconceptions about the Sportsman’s Credit Card Form

- Misconception 1: The credit card is only for hunters.

- Misconception 2: All residents can receive the free membership offer.

- Misconception 3: You must provide joint applicant information regardless of your choice.

- Misconception 4: You will automatically receive the rewards points.

- Misconception 5: There are hidden fees for expanded account access.

- Misconception 6: The credit card has an annual fee.

- Misconception 7: You cannot choose your card design.

- Misconception 8: Applying for the card will harm your credit score.

This card is designed for outdoor enthusiasts in general, not just hunters. Anyone who enjoys outdoor activities can benefit from the rewards program.

Residents of California and Vermont are not eligible for the free one-year membership to the Mule Deer Foundation, despite being able to apply for the card.

Joint applicant details are only needed if you are applying for a joint account. Individual applicants can skip this section.

Points are only granted for purchases made after your account is open and in good standing. Transactions such as cash advances do not qualify.

No additional fees are charged for expanded account access. However, standard fees for transactions still apply.

The Sportsman’s Credit Card has a $0 annual fee, which makes it an attractive option for many potential cardholders.

Applicants can select from different card art options, allowing for personalization based on personal interests.

While applying involves a credit inquiry, responsible usage of the card can improve your credit score over time.

Key takeaways

When filling out and using the Sportsman’s Credit Card form, keep these key points in mind:

- Required Information: Every section of the application must be completed to ensure processing. This includes full names, Social Security numbers, and financial details.

- Joint Accounts: If applying for a joint account, both applicants are equally responsible for repayments. It’s important to provide accurate information for both individuals.

- Reward Eligibility: To receive the bonus rewards and one-year membership to the Mule Deer Foundation, a purchase must be made within 90 days of account opening.

- Specific Card Art: Applicants can choose from various card designs. Select your preferred one during the application process.

- Consent for Communication: By providing a phone number, you agree to receive communications related to account management, which may include recorded calls or messages.

Browse Other Templates

Apl Life Insurance - Claimants must be aware of the nature and validity of the authorization they are signing.

Nis Forms - Factors like age and health may impact the need for a Life Certificate.

Roster Form in Maths - Capture details on attendees for reporting purposes.