Fill Out Your Ss4418 Form

The SS-4418 form is a vital document for anyone looking to establish a nonprofit corporation in Tennessee. This form serves as the official charter and outlines essential details that are necessary for the incorporation process. To file this form, applicants must pay a filing fee of $100, which can be submitted through various methods—online, by mail, or in person. When using the online option, there's a convenience fee, but those who opt for print and mail can avoid this extra charge. Regardless of the submission method chosen, accuracy is crucial; any mistakes or illegible entries will lead to rejection. The form requires specific information including the proposed name of the corporation, details about the initial registered agent and office, the fiscal year close month, and whether the corporation has perpetual duration or a defined end date. Additionally, it asks for information regarding the nonprofit's structure, including designations such as public benefit or mutual benefit corporations. Each incorporator's name and address must also be included. It’s important to note that all information provided in this form becomes public record. An understanding of these requirements can simplify the filing process and help ensure that your nonprofit corporation is set up correctly and in compliance with state laws.

Ss4418 Example

Business Services Division

Tre Hargett, Secretary of State

State of Tennessee

INSTRUCTIONS

CHARTER

NONPROFIT CORPORATION

Filing Fee: $100

A Nonprofit Corporation Charter may be filed using one of the following methods:

•

•Print and Mail: Go to http://tnbear.tn.gov/NewBiz and use the online tool to complete the charter. Print and mail the charter along with the required filing fee to the Secretary of State’s office at 6th FL – Snodgrass Tower ATTN: Corporate Filing, 312 Rosa L. Parks AVE, Nashville, TN 37243.

•Paper submission: A blank charter may be obtained by going to https://sos.tn.gov/sites/default/files/forms/ss- 4418.pdf, by emailing the Secretary of State at TNSOS.CORPINFO@tn.gov, or by calling (615)

•

A Nonprofit Corporation Charter must be accurately completed in its entirety. Forms that are inaccurate, incomplete or illegible will be rejected.

A Nonprofit Corporation Charter sets forth the items required under T.C.A. §

CHARTER

1.The name of the corporation is – Enter the proposed name of the corporation. The name of a new corporation must meet the requirements of T.C.A. §

If a corporation’s name contains the word ”bank”, “banks”, “banking”, “credit union” or “trust”, written approval must first be obtained from the Tennessee Department of Financial Institutions before documents can be accepted for filing with the Division of Business Services. You may contact the Tennessee Department of Financial Institutions at (615)

If a corporation’s name contains the phrase “insurance company”, written approval must first be obtained from the

Tennessee Department of Commerce & Insurance before documents can be accepted for filing with the Division

of Business Services. You may reach the Tennessee Department of Commerce & Insurance at (615)

2.Name Consent: (Written Consent for Use of Indistinguishable Name) – An applicant corporation can request to use a name that is not distinguishable from the name used by an existing business under certain circumstances detailed in T.C.A. §

3.This company has the additional designation of – If applicable to the specific nature of the corporation, enter any additional designation, including:

•Bank

•Captive Insurance Company

•Credit Union

•Insurance Company

•Litigation Financier

•Neighborhood Preservation Nonprofit Corporation

•School Support Organization

•Trust Company

4.The name and complete address of its initial registered agent and office located in the state of Tennessee is – Enter the name of the corporation’s initial registered agent, the street address, city, state and zip code of the corporation’s initial registered office located in Tennessee and the county in which the office is located. The address will be verified and formatted to United States Postal Service address deliverability guidelines. If the address cannot be recognized as deliverable by the United States Postal Service, the form will be rejected by the Division of Business Services. A post office box is not acceptable for the registered agent/office address.

5.Fiscal Year Close Month – Enter the month of the year that concludes the corporation’s fiscal year. If a fiscal year close month is not indicated, the Division of Business Services will list the fiscal year close month as December by default. Please note that T.C.A. §

Period of Duration if not perpetual – Indicate if the duration of the corporation is perpetual or has a specific end date by checking the appropriate box. If “other” is checked, indicate the specific date on which the duration of the corporation’s existence will end.

6.If the document is not to be effective upon filing by the Secretary of State, the delayed effective date and time is – If the existence of the corporation is to begin upon a future date, enter the future date. In no event can the future date or the actual occurrence of the specific event be more than ninety calendar days from the filing of the charter.

7.The corporation is not for profit – By signing the charter the filer acknowledges this statement to be true.

8.Please complete all of the following sentences by checking one of the two boxes in each sentence – By checking the appropriate boxes, indicate whether the corporation

•Is a public benefit corporation or a mutual benefit corporation.

•Is a religious corporation or is not a religious corporation.

•Has members or does not have members.

9.The complete address of its principal executive office is – Enter the street address, city, state and zip code of the principal executive office of the corporation and the county in which the office is located. The address will be verified and formatted to United States Postal Service address deliverability guidelines. If the address cannot be recognized as deliverable by the United States Postal Service, the form will be rejected by the Division of Business Services unless a deliverable mailing address is also provided. A post office box is not acceptable for the principal office address. Please provide a business email address. All reminders and notifications will be sent via email.

Page 2 of 3

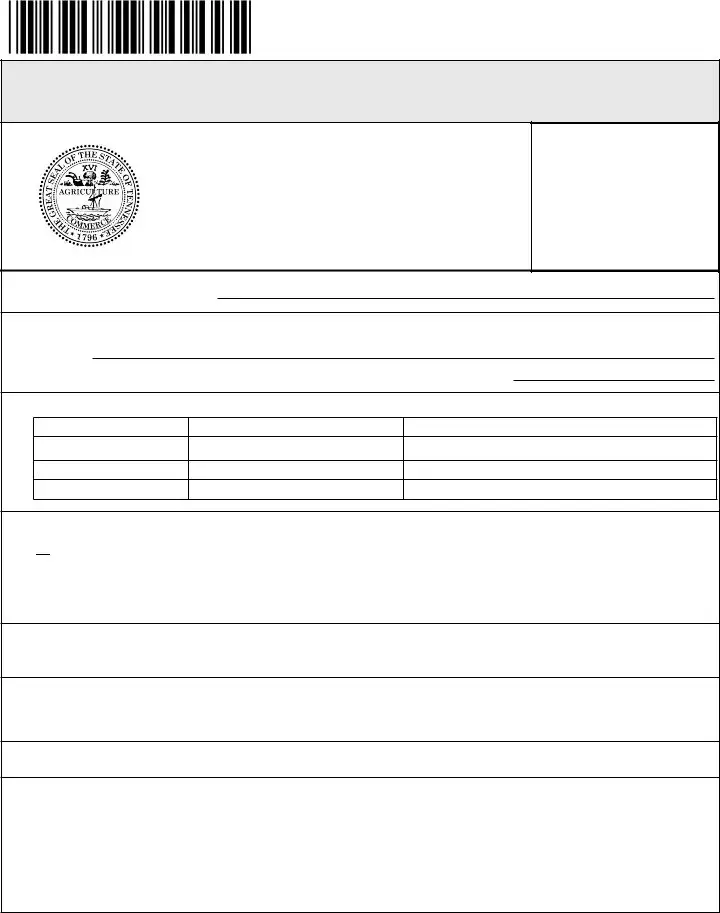

10.The complete mailing address of the entity (if different from the principal office) is – If notifications from the Division of Business Services should be sent to an address other than the principal office address, enter that address. The address will be verified and formatted to United States Postal Service address deliverability guidelines. If the address cannot be recognized as deliverable by the United States Postal Service, the form will be rejected by the Division of Business Services. A post office box address is acceptable for a mailing address.

11.List the name and complete address of each incorporator – Addresses should include street address, city, state and zip code. The signer of the charter must be an incorporator listed in this section.

12.School Organization – If “School Organization – Exempt” is indicated in section 3, check the box stating that “I certify that pursuant to T.C.A. §

§

•This nonprofit corporation is a “school support organization” as defined in T.C.A.

– Check this box if the nonprofit corporation is a booster club, foundation, parent teacher association, parent teacher organization, parent teacher support association, or any other nongovernmental organization or group of persons whose primary purpose is to support a school district, school, school club, or academic, arts, athletic or social activities related to a school, that collects or receives money, materials, property or securities from students, parents, or members of the general public.

•This nonprofit corporation is an educational institution as defined in T.C.A. §

13.Insert here the provisions regarding the distribution of assets upon dissolution – Enter the corporation’s provisions regarding the distribution of its assets upon its dissolution.

14.Other Provisions – Including any further information in this space is strictly optional. Use this section to set forth other details of the corporation that are not required to be included in the charter. Such items could include the initial board of directors, the business purpose of the corporation, the names of corporate management, and provisions regulating the powers and rights of the corporation, its board of directors and its shareholders.

SIGNATURE

•The person executing the document must sign it and indicate the date of signature in the appropriate spaces. The signer must be an incorporator listed in Section 11 of the charter. Failure to sign and date the application will result in the application being rejected.

•Type or Print Name. Failure to type or print the signature name and title of the signer will result in the application being rejected.

FILING FEE

•The filing fee for a charter is $100.

•Make check, cashier’s check or money order payable to the Tennessee Secretary of State. Cash is only accepted for

Page 3 of 3

CHARTER |

|

|

NONPROFIT CORPORATION |

Page 1 of 2 |

|

Business Services Division |

|

For Office Use Only |

|

|

|

Tre Hargett, Secretary of State |

|

|

State of Tennessee |

|

|

312 Rosa L. Parks AVE, 6th Fl. |

|

|

Nashville, TN |

|

|

(615) |

|

|

Filing Fee: $100.00 |

|

|

|

|

|

The undersigned, acting as incorporator(s) of a nonprofit corporation under the provisions of the Tennessee Nonprofit Corporation Act, adopt the following Articles of Incorporation.

1. |

The name of the corporation is: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Name Consent: (Written Consent for Use of Indistinguishable Name) |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

This entity name already exists in Tennessee and has received name consent from the existing entity. |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

This company has the additional designation of: |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

The name and complete address of the initial registered agent and office located in the state of Tennessee is: |

|||||||||||||||||||

|

Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

City: |

State: TN Zip Code: |

|

County: |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Fiscal Year Close Month: |

|

Period of Duration: |

Perpetual |

Other |

/ |

|

/ |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

|

Day |

|

Year |

|

|

6. If the document is not to be effective upon filing by the Secretary of State, the delayed effective date and time is:

|

(Not to exceed 90 days) Effective Date: |

|

/ |

|

|

/ |

|

|

|

|

Time: |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

Month |

|

Day |

|

Year |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

The corporation is not for profit. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

8. |

Please complete all of the following sentences by checking one of the two boxes in each sentence: |

|||||||||||||||||||||||

|

This corporation is a |

public benefit corporation / |

mutual benefit corporation. |

|||||||||||||||||||||

|

This corporation is a |

religious corporation / not a religious corporation. |

||||||||||||||||||||||

|

This corporation will |

have members / |

not have members. |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

9. |

The complete address of its principal executive office is: |

|

|

|

|

|

|

|||||||||||||||||

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

City: |

|

State: |

|

|

|

|

|

Zip Code: |

|

|

County: |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Note: Pursuant to T.C.A. § |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Submitter Information: Name: |

|

|

|

|

|

|

|

|

|

|

Phone #: ( |

|

) |

|

|

|

|

|

||||||

RDA 1678 |

CHARTER |

|

NONPROFIT CORPORATION |

Page 2 of 2 |

Business Services Division

Tre Hargett, Secretary of State

State of Tennessee

312 Rosa L. Parks AVE, 6th Fl.

Nashville, TN

(615)

Filing Fee: $100.00

For Office Use Only

The name of the corporation is:

10.The complete mailing address of the entity (if different from the principal office) is:

Address:

City: |

|

State: |

|

Zip Code: |

11. List the name and complete address of each incorporator:

Name

Business Address

City, State, Zip

12.School Organization: (required if the additional designation of "School Organization - Exempt" is entered in section 3.)

I certify that pursuant to T.C.A. §

I certify that pursuant to T.C.A. §

This nonprofit corporation is a "school support organization" as defined in T.C.A. §

This nonprofit corporation is a "school support organization" as defined in T.C.A. §

This nonprofit corporation is an educational institution as defined in T.C.A. §

This nonprofit corporation is an educational institution as defined in T.C.A. §

13.Insert here the provisions regarding the distribution of assets upon dissolution:

14.Other Provisions:

*Note: Pursuant to T.C.A. §

Signature Date |

|

Incorporator's Signature |

|

|

|

|

|

Incorporator's Name (printed or typed) |

RDA 1678 |

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Filing Fee | The fee for filing the SS-4418 form is $100. |

| Governing Law | This form is governed by the Tennessee Nonprofit Corporation Act, particularly T.C.A. § 48-51-303(a)(1). |

| Submission Methods | Applicants can submit the form online, by mail, in person, or through paper submission. Each method has specific instructions for completion and submission. |

| Registered Agent Requirements | The form requires the name and complete address of an initial registered agent located in Tennessee. A P.O. box is not acceptable. |

| Fiscal Year Information | The form asks for the month that concludes the corporation's fiscal year. If not provided, December will be used as the default month. |

| Public Record Notification | All information submitted using this form is considered public record, as stated in T.C.A. § 10-7-503. |

Guidelines on Utilizing Ss4418

Completing the SS-4418 form involves providing essential information necessary to establish a nonprofit corporation in Tennessee. Ensuring that all sections are filled out correctly is critical, as incomplete or inaccurate forms will be rejected. Following these steps carefully will help streamline the process.

- Enter the corporation's name: Fill in the proposed name of the corporation, ensuring it meets state requirements.

- Name Consent: If using a name similar to an existing entity, check the box indicating consent and submit the additional application with the fee.

- Additional Designation: If applicable, list any additional designations such as "Bank" or "Credit Union."

- Registered Agent Information: Provide the name and complete address of the initial registered agent, ensuring it is a deliverable address.

- Fiscal Year Close Month: Specify the month that concludes the fiscal year. The default will be December unless indicated otherwise.

- Duration of Corporation: Indicate if it is perpetual or specify a termination date if not.

- Delayed Effective Date: If the corporation will begin on a future date, provide that date, making sure it is within 90 days of filing.

- Acknowledgment: Confirm that the corporation is not for profit by signing in the designated area.

- Check Boxes: Complete the check boxes regarding the type of corporation, membership, and religious status.

- Principal Executive Office: Enter the address, ensuring it is a deliverable one.

- Mailing Address: If different from the principal office, fill in the complete mailing address where notifications should be sent.

- Incorporators: List the name and address for each incorporator, ensuring the signer is included.

- School Organization Certification: If applicable, check the box certifying the organization’s exemption and its designation.

- Distribution Provisions: Provide the provisions for distributing assets if the corporation is dissolved.

- Other Provisions: Optionally, include any additional relevant information about the corporation.

- Signature: The incorporator must sign and date the document, along with printing their name clearly.

- Filing Fee: Include the $100 fee via check or money order, made payable to Tennessee Secretary of State.

What You Should Know About This Form

What is the SS-4418 form used for?

The SS-4418 form is used to file a charter for a nonprofit corporation in Tennessee. Submitting this form officially establishes your organization as a nonprofit entity recognized by the state. The information required on the form includes the corporation's name, address, registered agent details, and the purpose of the organization. Proper completion of the form ensures compliance with the Tennessee Nonprofit Corporation Act.

How can I submit the SS-4418 form?

There are several methods available for submitting the SS-4418 form. You can e-file through the Tennessee Secretary of State's online portal by completing the necessary information and paying the $100 filing fee with a credit or debit card. If you prefer not to pay a convenience fee, you can print the completed form and mail it along with the fee to the Secretary of State’s office. Alternatively, you can obtain a blank charter form by visiting the office in person, calling, or emailing to request it. Each submission method requires accurate and legible information to avoid rejection.

What is the filing fee for the SS-4418 form?

The filing fee for the SS-4418 form is $100. This fee must be paid when submitting the form, whether through e-filing, mail, or in person. Cash is accepted only for walk-in filings. When mailing the form, ensure that payment is made by check, cashier’s check, or money order made out to the Tennessee Secretary of State. Any form submitted without the appropriate fee will be returned.

What happens if the SS-4418 form is not filled out correctly?

If the SS-4418 form is inaccurate, incomplete, or difficult to read, it will be rejected by the Division of Business Services. To avoid this, double-check all sections, including the corporation’s name and address, the registered agent’s information, and any required consents or additional designations. It’s crucial that every required element is clearly presented to ensure smooth processing of your nonprofit charter.

Common mistakes

When filling out the SS-4418 form for establishing a nonprofit corporation in Tennessee, applicants often encounter common pitfalls that can lead to delays or rejections. Understanding these mistakes can facilitate a smoother filing process and ensure compliance with state requirements.

One frequent error involves the choice of the corporation's name. Applicants may propose names that are indistinguishable from existing businesses. Without the appropriate written consent, the form will not be accepted. It's essential to check name availability and secure any necessary approvals from the Tennessee Department of Financial Institutions or the Tennessee Department of Commerce & Insurance when applicable.

Inaccurate or incomplete addresses are another common source of issues. The form requires the complete address of the initial registered agent and office, as well as the principal executive office. Failing to provide these addresses in a format recognized by the United States Postal Service may result in rejection. Remember that a post office box is not an acceptable address for the registered agent or office, which adds an additional layer of importance to ensure accurate and deliverable addresses.

Additionally, misunderstanding the fiscal year close month can lead to complications. If applicants do not specify this month, the Division of Business Services defaults to December. This oversight can impact the timing of required annual reports, illustrating the importance of adhering to proper timelines as set forth in Tennessee law.

Applicants might also neglect to check applicable boxes correctly in section eight regarding the corporation's characteristics. Each option must be reviewed carefully. If selections are omitted or incorrectly checked, this may lead to unnecessary delays as the application is scrutinized for completeness.

Another mistake involves the signature and date of execution. The signer must be one of the incorporators listed in the form. Failure to sign or date the application can be a critical error, as the form will be rejected if it risks the validity of the charter being filed.

The filing fee, currently set at $100, is a common oversight. If the payment is not included, or if it is made out to an incorrect payee, the form will also be rejected. It is vital to follow the specific payment instructions outlined in the form to avoid unnecessary complications.

Lastly, submitting an optional section without including the minimum required provisions regarding the distribution of assets upon dissolution can lead to rejection. If a nonprofit corporation intends to dissolve, clear provisions must be documented. Skipping this step can hinder the acceptance of the entire document.

By recognizing these common mistakes and addressing them proactively, applicants can significantly reduce the likelihood of encountering problems with their SS-4418 form filing.

Documents used along the form

The SS-4418 form is an essential document for establishing a nonprofit corporation in Tennessee. Along with this form, several other documents may be required or beneficial during the incorporation process. Below is a summary of up to five commonly used forms and documents.

- Application for Use of Indistinguishable Name: If your proposed nonprofit's name is similar to an existing corporation, you need this application to seek permission for use. It comes with an additional filing fee.

- Initial Report: Within a few months of incorporation, newly formed nonprofits must file this report detailing their activities and current status to keep the secretary of state's office informed.

- Bylaws: Nonprofit organizations must draft bylaws outlining the governance structure, rights and responsibilities of members, and rules for meetings. While not required for filing, they are critical for internal operations.

- IRS Form 1023: To obtain federal tax-exempt status, organizations must complete this form, which requires extensive information about the organization's structure and activities.

- Charitable Organization Registration: If planning to solicit donations, you may need to register as a charitable organization in Tennessee. This registration ensures compliance with state fundraising laws.

These additional documents play a supportive role in ensuring that your nonprofit corporation is compliant with both state and federal regulations. Collectively, they help to create a strong foundation for your organization's operations and financial responsibilities.

Similar forms

-

Articles of Incorporation: Like the SS-4418 form, Articles of Incorporation establish a corporation's existence. Both documents require information about the corporation’s name, registered agent, and purpose, making them essential for any new business entity.

-

Certificate of Formation: This document is similar in that it creates a legal entity under state law. Both the SS-4418 and the Certificate of Formation outline the corporation’s foundational elements, such as duration and purpose.

-

Nonprofit Bylaws: While not a filing requirement, bylaws complement the SS-4418 by outlining how a nonprofit will operate. Both documents serve as guidelines for governance but differ in their purpose and content.

-

Form 990: Nonprofits are required to file Form 990 annually with the IRS. Similar to the SS-4418, this form provides a snapshot of the organization, detailing its finances, mission, and activities.

-

State Business License Application: Just like the SS-4418 form, a business license application is necessary for legal operation. Both documents ensure compliance with state regulations, although the business license focuses on operational permission rather than formation.

-

Fundraising Registration: Many states require nonprofits to register before soliciting donations. Similar to the SS-4418, this registration documents the identity and purpose of the organization, ensuring transparency and accountability.

-

Annual Report: Like the annual report, the SS-4418 collects essential information about the corporation. Both require updates about the corporation's activities, although the annual report is more focused on financials and governance during the year.

-

Dissolution Certificate: If a nonprofit decides to close, it may file a dissolution certificate, much like the SS-4418. Both documents capture critical information regarding the status of the corporation but serve opposite functions—creation versus termination.

-

Federal Employer Identification Number (EIN) Application: Applying for an EIN is often necessary for nonprofits. Both the SS-4418 and the EIN application require fundamental organizational details, positioning them as foundational steps for operation.

-

Business Plan: Though not a legal requirement, a business plan serves a function similar to the SS-4418 by outlining the nonprofit’s mission, goals, and operational structure. Both documents are essential for guiding the organization’s direction but vary in purpose and scope.

Dos and Don'ts

When completing the SS-4418 form, adhere to the following guidelines:

- Review all requirements: Ensure you fully understand the form and its requirements before beginning.

- Provide complete information: Fill in all sections accurately. Incomplete forms will be rejected.

- Use a valid address: Enter the physical address of your registered office. P.O. boxes are not acceptable.

- Sign and date the form: Ensure the form is signed and dated by an incorporator listed in Section 11.

Conversely, avoid the following mistakes:

- Do not use a name without proper consent if it is indistinguishable from another business.

- Avoid mailing the form without the appropriate filing fee; it will be rejected.

- Do not forget to double-check for legibility and clarity; illegible forms will not be processed.

- Do not submit a document that specifies a delayed effective date more than ninety days from submission.

Misconceptions

- Misconception 1: The SS-4418 form can be submitted without a filing fee.

- Misconception 2: You can use a post office box for the registered agent's address.

- Misconception 3: The online submission process is the only method to file the form.

- Misconception 4: The information provided on the form is private and confidential.

Many believe that there are no fees associated with submitting the SS-4418 form. However, there is a required filing fee of $100. This fee must accompany the form, whether submitted online, by mail, or in person. Without this payment, the application will be rejected.

Some applicants think that a post office box suffices for the registered agent’s address. This is incorrect. The law requires a physical street address that can be verified by the United States Postal Service. Failing to provide this will lead to rejection of the form.

Another common belief is that the SS-4418 form must be filed electronically. In reality, there are several ways to file this form. Applicants have the option to print and mail it, submit a paper form, or even walk in to file. Each method has its own processes and requirements.

Many people are unaware that all information on the SS-4418 form is considered public record. Once filed, anyone can access that information. Applicants should therefore be cautious when providing details about their corporation or personal information.

Key takeaways

Here are some important points to understand about filling out and using the SS-4418 form for a Nonprofit Corporation Charter:

- The filing fee for the charter is $100.

- You can file online, print and mail, or submit a paper form by visiting the Secretary of State's office.

- If using the online option, remember there’s a convenience fee when paying by credit or debit card.

- The corporation's name must comply with Tennessee law, specifically T.C.A. § 48-54-101.

- If your proposed name is similar to an existing business, you may need written consent from other state departments.

- Ensure you provide a valid registered agent's address; a post office box is not acceptable.

- Indicate the end date for the corporation if it is not meant to last indefinitely.

- When specifying your corporation's type, accurately check the appropriate boxes between options like public benefit or mutual benefit.

- All relevant addresses must be complete and verifiable by the United States Postal Service to avoid rejection.

Browse Other Templates

Dmv Transcript - The form is an important tool for accessing DMV records for various needs.

What Are Architectural Drawings Called - Basics of residential design highlight essential planning principles.