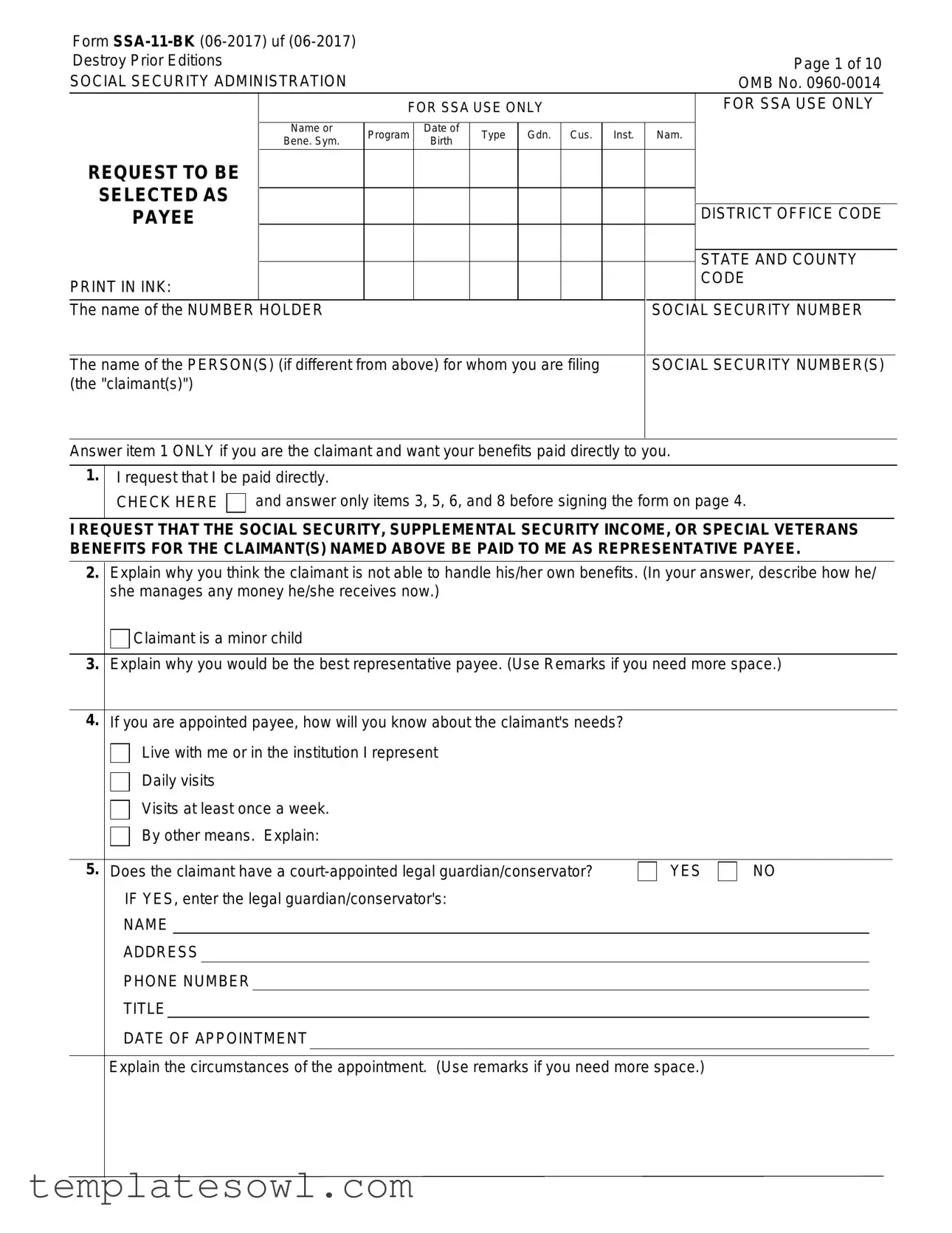

Fill Out Your Ssa 11 Form

When an individual is unable to manage their own social security benefits, a representative payee may be needed to help handle their financial matters. The SSA-11 form, officially called the "Request to be Selected as Payee," is the essential document used to designate someone as a representative payee. This form is crucial for situations involving Social Security Disability Insurance (SSDI), Supplemental Security Income (SSI), or even Veterans benefits. As you fill out the SSA-11, you will provide basic information about both the claimant and yourself, highlighting your relationship with the claimant and demonstrating your ability to manage their benefits responsibly. Sections of the form will prompt you to explain why the claimant needs assistance and why you believe you are the best fit for this role. You may also need to describe the claimant’s living situation and any relevant financial circumstances. Furthermore, providing information about any court-appointed guardianship is crucial. Completing this form accurately is important since the Social Security Administration will rely on the provided details to make a determination about your suitable appointment as a payee. Understanding what this form entails will empower you to proceed effectively and help secure the necessary support for those who need it. It's a step-by-step process that, when navigated thoughtfully, ensures the claimant’s financial needs are met with care and responsibility.

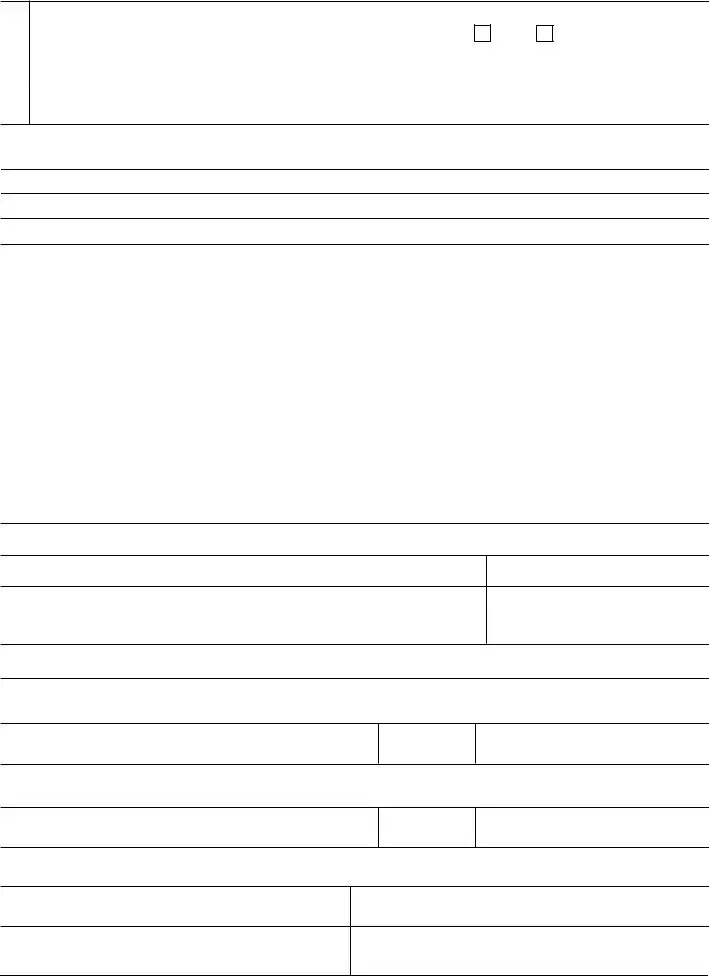

Ssa 11 Example

Form |

|

|

|

|

|

|

Destroy Prior Editions |

|

|

|

|

Page 1 of 10 |

|

SOCIAL SECURITY ADMINISTRATION |

|

|

|

|

OMB No. |

|

|

|

FOR SSA USE ONLY |

|

FOR SSA USE ONLY |

||

|

|

|

|

|

|

|

|

Name or |

Program |

Date of |

Type Gdn. Cus. Inst. |

Nam. |

|

|

Bene. Sym. |

Birth |

||||

|

|

|

|

|

||

REQUEST TO BE |

|

|

|

|

|

|

SELECTED AS |

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYEE |

|

|

|

|

DISTRICT OFFICE CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE AND COUNTY |

|

|

|

|

|

|

||

PRINT IN INK: |

|

|

|

CODE |

||

|

|

|

|

|

||

The name of the NUMBER HOLDER |

|

SOCIAL SECURITY NUMBER |

|

|||

|

|

|

|

|

|

|

The name of the PERSON(S) (if different from above) for whom you are filing |

|

SOCIAL SECURITY NUMBER(S) |

||||

(the "claimant(s)") |

|

|

|

|

|

|

Answer item 1 ONLY if you are the claimant and want your benefits paid directly to you.

1.I request that I be paid directly.

CHECK HERE  and answer only items 3, 5, 6, and 8 before signing the form on page 4.

and answer only items 3, 5, 6, and 8 before signing the form on page 4.

I REQUEST THAT THE SOCIAL SECURITY, SUPPLEMENTAL SECURITY INCOME, OR SPECIAL VETERANS BENEFITS FOR THE CLAIMANT(S) NAMED ABOVE BE PAID TO ME AS REPRESENTATIVE PAYEE.

2.Explain why you think the claimant is not able to handle his/her own benefits. (In your answer, describe how he/ she manages any money he/she receives now.)

Claimant is a minor child

Claimant is a minor child

3.Explain why you would be the best representative payee. (Use Remarks if you need more space.)

4.If you are appointed payee, how will you know about the claimant's needs?

Live with me or in the institution I represent

Live with me or in the institution I represent

Daily visits

Daily visits

Visits at least once a week.

Visits at least once a week.

By other means. Explain:

By other means. Explain:

5. Does the claimant have a |

YES |

NO |

|

||||||

IF YES, enter the legal guardian/conservator's: |

|

|

|

|

|||||

NAME |

|

|

|

|

|

||||

ADDRESS |

|

|

|

|

|

||||

PHONE NUMBER |

|

|

|

|

|

||||

TITLE |

|

|

|

|

|

||||

DATE OF APPOINTMENT |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Explain the circumstances of the appointment. (Use remarks if you need more space.) |

|

|

|

||||||

Form |

|

Page 2 of 10 |

||

|

|

|

|

|

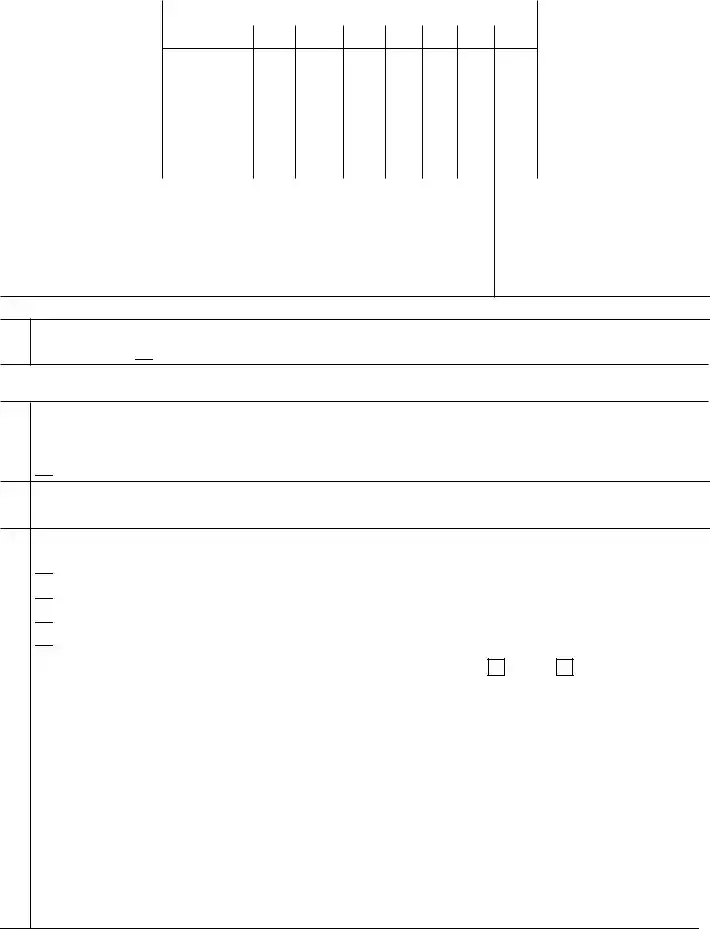

6. (a) Where does the claimant live? |

|

|

|

|

|

Alone |

|

|

|

|

In my home (Go to (b).) |

In a public institution (Go to (c).) |

||

|

With a relative (Go to (b).) |

In a private institution (Go to (c).) |

||

|

With someone else (Go to (b).) |

In a nursing home (Go to (c).) |

||

|

In a board and care facility (Go to (b).) |

In the institution I represent (Go to (c).) |

||

|

|

|

||

|

(b) Enter the names and relationships of any other people who live with the claimant. |

|

||

|

NAME |

|

RELATIONSHIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c) Enter the claimant's residence and mailing addresses (if different from yours). |

|

|

Residence: |

Mailing: |

Telephone Number: |

(d) Do you expect the claimant's living arrangements to change in the next year?

YES NO If YES, explain what changes are expected and when they will occur. (Use Remarks if you need more space.)

7.If you are applying on behalf of minor child(ren) and you are not the parent,

Does the child(ren) have a living natural or adoptive parent? |

YES |

NO |

||||

If YES, enter: (a) Name of parent |

|

|

|

|||

(b) Address of parent |

|

|

|

|||

(c) Telephone number |

|

|

|

|||

(d) Does the parent show interest in the child? |

YES |

NO |

||||

Please explain. |

|

|

|

|||

8.List the names and relationship of any (other) relatives or close friends who have provided support and/or show active interest with the claimant. Describe the type and amount of support and/or how interest is displayed.

NAME |

ADDRESS/PHONE NO. |

RELATIONSHIP |

DESCRIBE |

|

|

|

|

|

|

|

|

9.Check the block that describes your relationship to the claimant.

(a)

Official of bank, agency or institution with responsibility for the person. Enter below which you represent:

Official of bank, agency or institution with responsibility for the person. Enter below which you represent:

Bank

Bank

Social Agency |

|

|

Public Official |

|

|

Institution: |

|

|

Federal |

|

|

State/Local |

|

|

Private |

YES |

|

Private proprietary institution. Is the institution licensed under State law? |

NO |

IF (a) ABOVE CHECKED, COMPLETE ONLY QUESTIONS 10 AND 11 AND SIGN THE FORM ON PAGE 4.

(b) Parent

Parent

(c) Spouse

Spouse

(d) Other Relative - Specify

Other Relative - Specify

(e) Legal Representative

Legal Representative

(f) Board and Care Home Operator

Board and Care Home Operator

(g) Other Individual - Specify

Other Individual - Specify

IF (b), (c), (d), or (e) ABOVE CHECKED, GO ON TO QUESTION 12

Form |

Page 3 of 10 |

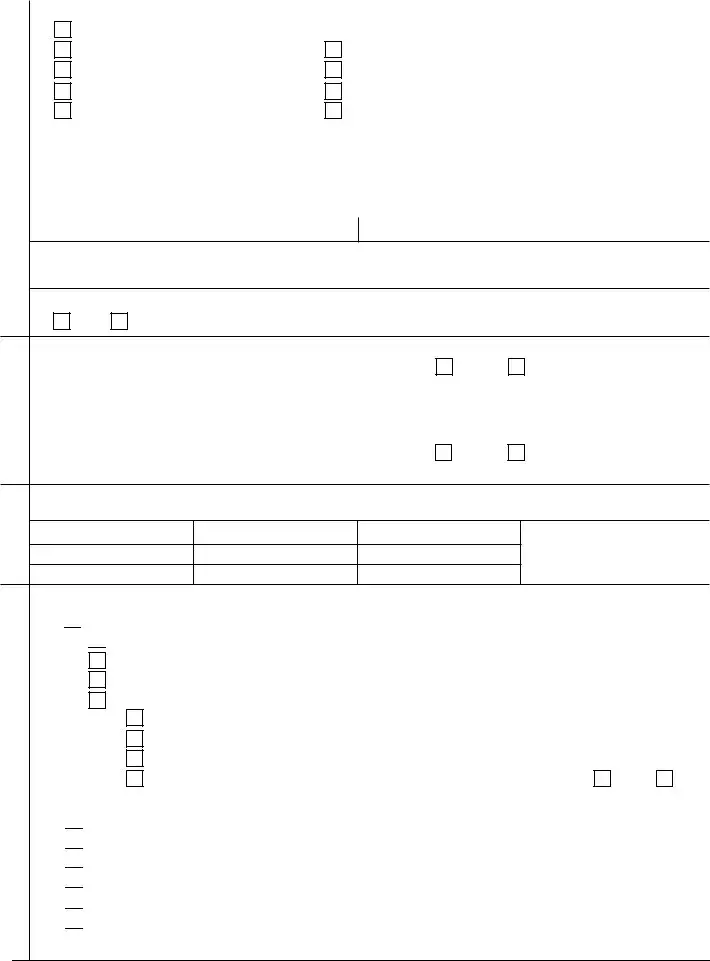

10.Does the claimant owe you/your organization any money now or will he/she owe you money in the future?

YES

YES

NO

NO

If YES, enter the amount he/she owes you/your organization, the date(s) was/will be incurred and describe why the debt was/will be incurred.

INFORMATION ABOUT INSTITUTIONS, AGENCIES AND BANKS APPLYING TO BE REPRESENTATIVE PAYEE

11.(a) Enter the name of the institution

(b) Enter the EIN of the institution

INFORMATION ABOUT INDIVIDUALS APPLYING TO BE REPRESENTATIVE PAYEE

12.Enter: YOUR NAME

DATE OF BIRTH

SOCIAL SECURITY NUMBER

ANY OTHER NAME YOU HAVE USED

OTHER SSN'S YOU HAVE USED

13.How long have you known the claimant?

14.If the claimant lives with you, who takes care of the claimant when work or other activity takes you away from home?

|

What is his/her relationship to the claimant? |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

(a) Main source of your income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Employed (answer (b) below) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

) |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Social Security benefits (Claim Number |

|

|

|

|

|

|

|

) |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pension (describe |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

||

|

Supplemental Security Income payments (Claim Number |

|

|

) |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Temporary Assistance For Needy Families (TANF |

|

|

|

|

|

) |

|

|||||||||||||

|

Other State or Public Assistance (describe |

|

|

|

|

|

|

|

) |

|

|||||||||||

|

Other (describe |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) Enter your employer's name and address: |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

How long have you been employed by this employer? |

|

|

|

|

|

|

|

|

|

|||||||||||

|

(If less than 1 year, enter name and address of previous employer in Remarks.) |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|||||||||||||||||

16. |

Do you give Social Security permision to conduct a criminal background check on you? |

YES |

NO |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

17. |

(a) Have you ever been convicted of a felony? |

YES |

NO |

|

|

|

|

|

|||||||||||||

|

If YES: What was the crime? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

On what date were you convicted? |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

What was your sentence? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

If imprisoned, when were you released? |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

If probation was ordered, when did/will your probation end? |

|

|

|

|

|

|

||||||||||||||

|

(b) Have you ever been convicted of any offense under federal or state law which resulted in imprisonment for |

|

|||||||||||||||||||

|

more than one year? |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

||||||||

|

If YES: What was the crime? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

On what date were you convicted? |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

What was your sentence? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

If imprisoned, when were you released? |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

If probation was ordered, when did/will your probation end? |

|

|

|

|

|

|

||||||||||||||

Form |

Page 4 of 10 |

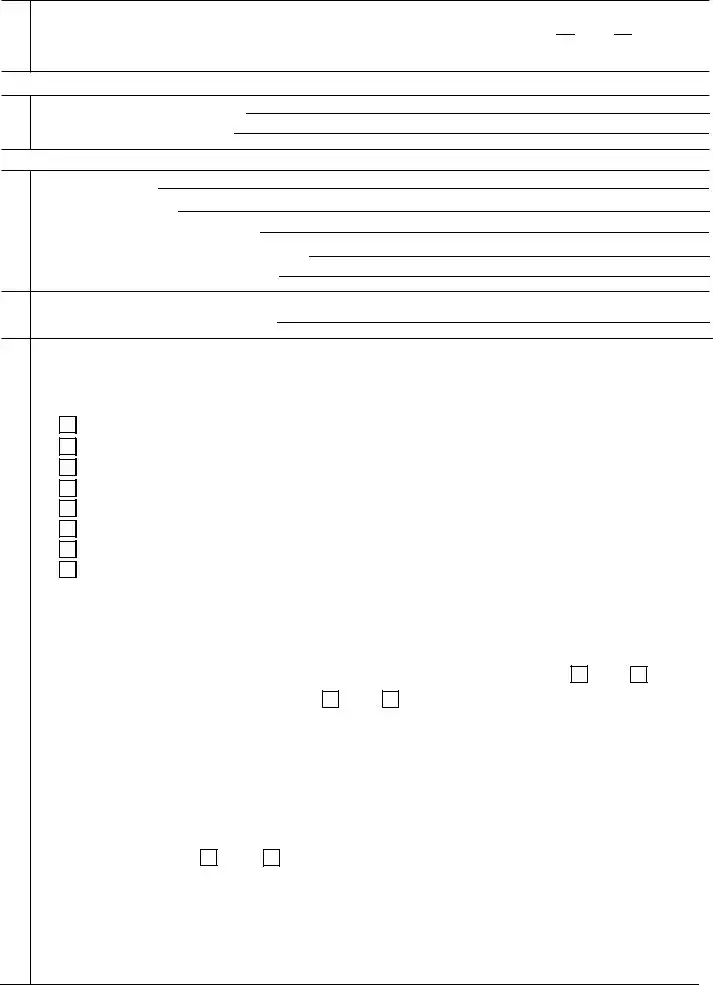

18.Do you have any unsatisfied FELONY warrants (or in jurisdictions that do not define crimes as felonies, a crime

punishable by death or imprisonment exceeding 1 year) for your arrest? |

YES |

NO |

|

||

If YES: Date of Warrant |

|

|

|

|

|

State where warrant was issued |

|

|

|

||

|

|

|

|

|

|

19. How long have you lived at your current address? (Give Date MM/YY) |

|

|

|

||

REMARKS: (This space may be used for explaining any answers to the questions. If you need more space, attach a separate sheet.)

PLEASE READ THE FOLLOWING INFORMATION CAREFULLY BEFORE SIGNING THIS FORM

I/my organization:

• Must use all payments made to me/my organization as the representative payee for the claimant's current needs or (if not currently needed) save them for his/her future needs.

• May be held liable for repayment if I/my organization misuse the payments or if I/my organization am/is at fault for any overpayment of benefits.

• May be punished under Federal law by fine, imprisonment or both if I/my organization am/is found guilty of misuse of Social Security or SSI benefits.

I/my organization will:

• Use the payments for the claimant's current needs and save any currently unneeded benefits for future use.

• File an accounting report on how the payments were used, and make all supporting records available for review if requested by the Social Security Administration.

• Reimburse the amount of any loss suffered by any claimant due to misuse of Social Security or SSI funds by me/my organization.

• Notify the Social Security Administration when the claimant dies, leaves my/my organization's custody or otherwise changes his/her living arrangements or he/she is no longer my/my organization's responsibility.

• Comply with the conditions for reporting certain events (listed on the attached sheets(s) which I/my organization will keep for my/my organization's records) and for returning checks the claimant is not due.

• File an annual report of earnings if required.

• Notify the Social Security Administration as soon as I/my organization can no longer act as representative payee or the claimant no longer needs a payee.

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge.

DATE (Month, day, year)

Telephone number(s) at which you may be contacted during the day

Print Your Name & Title (if a representative or employee of an institution/organization)

Mailing Address (Number and street, Apt. No., P.O. Box, or Rural Route)

City and State |

Zip Code |

Name of County

Residence Address (Number and street, Apt. No., P.O. Box, or Rural Route)

City and State

Zip Code

Name of County

Witnesses are only required if this application has been signed by mark (X) above. If signed by mark (X), two witnesses to the signing who know the applicant making the request must sign below, giving their full addresses.

1. SIGNATURE OF WITNESS |

2. SIGNATURE OF WITNESS |

ADDRESS (Number and street, City, State and ZIP Code) |

ADDRESS (Number and street, City, State and ZIP Code) |

Form |

Page 5 of 10 |

|

|

SOCIAL SECURITY |

|

Information for Representative Payees Who Recieve Social Security Benefits |

|

YOU MUST NOTIFY THE SOCIAL SECURITY ADMINISTRATION PROMPTLY IF ANY OF THE FOLLOWING EVENTS OCCUR AND PROMPTLY RETURN ANY PAYMENT TO WHICH THE CLAIMANT IS NOT ENTITLED:

•the claimant DIES (Social Security entitlement ends the month before the month the claimant dies);

•the claimant MARRIES, if the claimant is entitled to child's, widow's, mother's, father's, widower's or parent's benefits, or to wife's or husband's benefits as divorced wife/husband, or to special age 72 payments;

•the claimant's marriage ends in DIVORCE or ANNULMENT, if the claimant is entitled to wife's, husband's or special age 72 payments;

•the claimant's SCHOOL ATTENDANCE CHANGES if the claimant is age 18 or over and entitled to child's benefits as a full time student

•the claimant is entitled as a stepchild and the parents DIVORCE (benefits terminate the month after the month the divorce becomes final);

•the claimant is under FULL RETIREMENT AGE (FRA) and WORKS for more than the annual limit (as determined each year) or more than the allowable time (for work outside the United States);

•the claimant receives a GOVERNMENT PENSION or ANNUITY or the amount of the annuity changes, if the claimant is entitled to husband's, widower's, or divorced spouse's benefit's;

•the claimant leaves your custody or care or otherwise CHANGES ADDRESS;

•the claimant NO LONGER HAS A CHILD IN CARE, if he/she is entitled to benefits because of caring for a child under age 16 or who is disabled;

•the claimant is confined to jail, prison, penal institution or correctional facility;

•the claimant is confined to a public institution by court order in connection WITH A CRIME.

•the claimant has an UNSATISFIED FELONY WARRANT (or in jurisdictions that do not define crimes as felonies, a crime punishable by death or imprisonment exceeding 1 year) issue for his/her arrest;

•the claimant is violating a condition of probation or parole under State or Federal law.

IF THE CLAIMANT IS RECEIVING DISABILITY BENEFITS, YOU MUST ALSO REPORT IF:

•the claimant's MEDICAL CONDITION IMPROVES;

•the claimant STARTS WORKING;

•the claimant applies for or receives WORKER'S COMPENSATION BENEFITS, Black Lung Benefits from the Department of Labor, or a public disability benefit;

•the claimant is DISCHARGED FROM THE HOSPITAL (if now hospitalized).

IF THE CLAIMAINT IS RECEIVING SPECIAL AGE 72 PAYMENTS, YOU MUST ALSO REPORT IF:

•the claimant or spouse becomes ELIGIBLE FOR PERIODIC GOVERNMENTAL PAYMENTS, whether from the U. S. Federal government or from any State or local government;

•the claimant or spouse receives SUPPLEMENTAL SECURITY INCOME or PUBLIC ASSISTANCE CASH BENEFITS;

•the claimant or spouse MOVES outside the United States (the 50 States, the District of Columbia and the Northern Marian Islands).

In addition to these events about the claimant, you must also notify us if:

•YOU change your address;

•YOU are convicted of a felony or any offense under State or Federal law which results in imprisonment for more than 1 year;

•YOU have a UNSATISFIED FELONY WARRANT (or in jurisdictions that do not define crimes as felonies, a crime punishable by death or imprisonment exceeding 1 year) issued for your arrest.

BENEFITS MAY STOP IF ANY OF THE ABOVE EVENTS OCCUR. You should read the informational booklet we will send you to see how these events affect benefits. You may make your reports by telephone, mail, or in person.

REMEMBER:

•payments must be used for the claimant's current needs or saved if not currently needed;

•you may be held liable for repayment of any payments not used for the claimant's needs or of any over payment that occured due to your fault;

•you must account for benefits when so asked by the Social Security Administration. You will keep records of how benefits were spent so you can provide us with correct accounting;

•to tell us as soon as you know you will no longer be able to act as representative payee or the claimant no longer needs a payee.

Keep in mind that benefits may be deposited directly into an account set up for the claimant with you as payee. As soon as you set up such an account, contact us for more information about receiving the claimant's payments using direct deposit.

Form |

|

Page 6 of 10 |

|

|

|

|

|

|

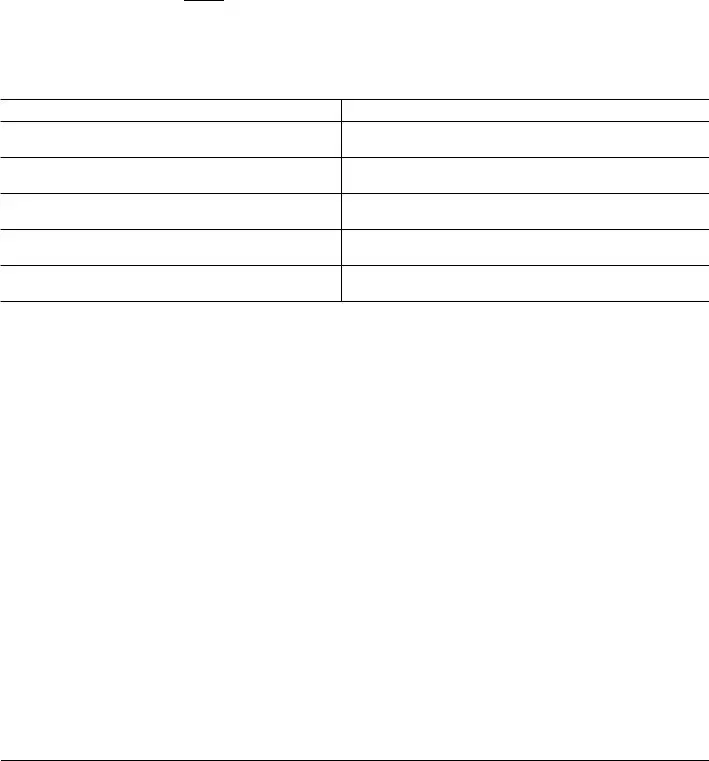

A REMINDER TO PAYEE APPLICANTS |

|

|

|

|

|

|

TELEPHONE |

BEFORE YOU RECEIVE A |

SSA OFFICE |

DATE REQUEST RECEIVED |

NUMBER(S) TO |

DECISION NOTICE |

|

|

|

|

|

|

CALL IF YOU HAVE |

|

|

|

A QUESTION OR |

AFTER YOU RECEIVE A |

|

|

SOMETHING TO |

DECISION NOTICE |

|

|

REPORT |

|

|

|

|

|

|

|

|

RECEIPT FOR YOUR REQUEST |

|

|

Your request for Social Security benefits on behalf of the individual(s) named below has been received and will be processed as quickly as possible.

You should hear from us within days after you have given us all the information we requested. Some claims may take longer if additional information is needed.

In the meantime, if you change your address, or if there is some other change that may affect the benefits payable,

you - or someone for you - should report the change. The changes to be reported are listed on the reverse.

Always give us the claim number of the beneficiary when writing or telephoning about the claim.

If you have any questions about this application, we will be glad to help you.

BENEFICIARY

SOCIAL SECURITY CLAIM NUMBER

Privacy Act Statement - Collection and Use of Personal Information

Sections 205(a), 205(j) and 1631(a)(2) of the Social Security Act, as amended, allow us to collect this information. We will use the information you provide to determine if you are eligible to serve as a representative payee. Furnishing us this information is voluntary. However, failing to provide all or part of the information may prevent us from making a determination to select you as a representative payee. We rarely use the information you supply for any purpose other than what we state above,however, we may use the information for the administration of our programs, including sharing information:

1.To comply with Federal laws requiring the release of information from our records (e.g., to the Government Accountability Office and Department of Veterans Affairs); and,

2.To facilitate statistical research, audit, or investigative activities necessary to ensure the integrity and improvement of our programs (e.g., to the Bureau of the Census and to private entities under contract with us). A list of when we may share your information with others, called routine uses, is available in our Privacy Act System of Records Notices,

Additional information about these and other system of records notices and our programs are available from our Internet website at www.socialsecurity.gov or at your local Social Security office. We may also use the information you provide in computer matching programs. Matching programs compare our records with records kept by other Federal, State, or local government agencies. Information from these matching programs can be used to establish or verify a person's eligibility for

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget (OMB) control number. We estimate that it will take about 11 minutes to read the instructions, gather the facts, and answer the questions. Send only comments relating to our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD

Form |

Page 7 of 10 |

SUPPLEMENTAL SECURITY INCOME

Information for Representative Payees Who Receive Social Security Benefits

YOU MUST NOTIFY THE SOCIAL SECURITY ADMINISTRATION PROMPTLY IF ANY OF THE FOLLOWING EVENTS OCCUR AND PROMPTLY RETURN ANY PAYMENT TO WHICH THE CLAIMANT IS NOT ENTITLED:

•the claimant or any member of the claimant's household DIES (SSI eligibility ends with the month in which the claimant dies);

•the claimant's HOUSEHOLD CHANGES (someone moves in/out of the place where the claimant lives);

•the claimant LEAVES THE U.S. (the 50 states, the District of Columbia, and the Northern Mariana Islands) for 30 consecutive days or more;

•the claimant MOVES or otherwise changes the place where he/she actually lives (including adoption, and whereabouts unknown);

•the claimant is ADMITTED TO A HOSPITAL, skilled nursing facility, nursing home, intermediate care facility, or other institution;

•the INCOME of the claimant or anyone in the claimant's household CHANGES (this includes income paid by an organization or employer, as well as monetary benefits from other sources);

•the RESOURCES of the claimant or anyone in the claimant's household CHANGES (this includes when conserved funds reach over $2,000);

•the claimant or anyone in the claimant's household MARRIES;

•the marriage of the claimant or anyone in the claimant's household ends in DIVORCE or ANNULMENT;

•the claimant SEPARATES from his/her spouse;

•the claimant is confined to jail, prison, penal institution or correctional facility;

•the claimant is confined to a public institution by court order in connection WITH A CRIME;

•the claimant has an UNSATISFIED FELONY WARRANT (or in jurisdictions that do not define crimes as felonies, a crime punishable by death or imprisonment exceeding 1 year) issued for his/her arrest;

•the claimant is violating a condition of probation or parole under State or Federal law.

IF THE CLAIMANT IS RECEIVING PAYMENTS DUE TO DISABILITY OR BLINDNESS, YOU MUST ALSO REPORT IF:

•the claimant's MEDICAL CONDITION IMPROVES;

•the claimant GOES TO WORK;

•the claimant's VISION IMPROVES, if the claimant is entitled due to blindness;

In addition to these events about the claimant, you must also notify us if:

•YOU change your address;

•YOU are convicted of a felony or any offense under State or Federal law which results in imprisonment for more than 1 year;

•YOU have an UNSATISFIED FELONY WARRANT (or in jurisdictions that do not define crimes as felonies, a crime punishable by death or imprisonment exceeding 1 year) issued for your arrest.

PAYMENT MAY STOP IF ANY OF THE ABOVE EVENTS OCCUR. You should read the informational booklet we will send you to see how these events affect benefits. You may make your reports by telephone, mail or in person.

REMEMBER :

•payments must be used for the claimant's current needs or saved if not currently needed. (Savings are considered resources and may affect the claimant's eligibility to payment.);

•you may be held liable for repayment of any payments not used for the claimant's needs or of any overpayment that occurred due to your fault;

•you must account for benefits when so asked by the Social Security Administration. You will keep records of how benefits were spent so you can provide us with a correct accounting;

•to let us know as soon as you know you are unable to continue as representative payee or the claimant no longer needs a payee

•you will be asked to help in periodically redetermining the claimant's continued eligibility or payment. You will need to keep evidence to help us with the redetermination (e.g., evidence of income and living arrangements).

•you may be required to obtain medical treatment for the claimant's disabling condition if he/she is eligible under the childhood disability provision.

Keep in mind that payments may be deposited directly into an account set up for the claimant with you as payee. As soon as you set up such an account, contact us for more information about receiving the claimant's payments using direct deposit.

Form |

|

Page 8 of 10 |

|

|

|

|

|

|

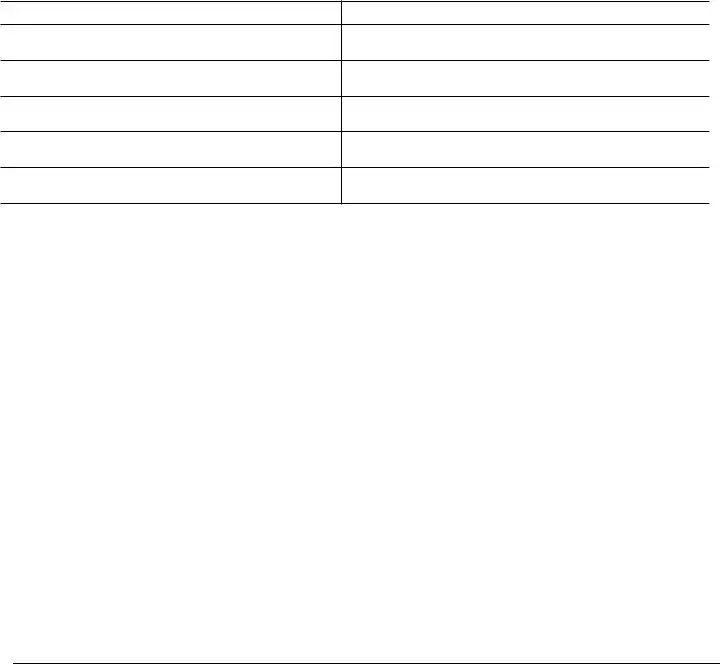

A REMINDER TO PAYEE APPLICANTS |

|

|

|

|

|

|

TELEPHONE |

BEFORE YOU RECEIVE A |

SSA OFFICE |

DATE REQUEST RECEIVED |

NUMBER(S) TO |

DECISION NOTICE |

|

|

|

|

|

|

CALL IF YOU HAVE |

|

|

|

A QUESTION OR |

AFTER YOU RECEIVE A |

|

|

SOMETHING TO |

DECISION NOTICE |

|

|

REPORT |

|

|

|

|

RECEIPT FOR YOUR REQUEST |

|

|

Your request for SSI payments on behalf of the individual(s) named below has been received and will be processed as quickly as possible.

you - or someone for you - should report the change. The changes to be reported are listed on the reverse.

You should hear from us within days after you have given us all the information we requested. Some claims may take longer if additional information is needed.

In the meantime, if you change your address, or if there is some other change that may affect the benefits payable,

Always give us the claim number of the beneficiary when writing or telephoning about the claim.

If you have any questions about this application, we will be glad to help you.

BENEFICIARY

SOCIAL SECURITY CLAIM NUMBER

Privacy Act Statement - Collection and Use of Personal Information

Sections 205(a), 205(j) and 1631(a)(2) of the Social Security Act, as amended, allow us to collect this information. We will use the information you provide to determine if you are eligible to serve as a representative payee. Furnishing us this information is voluntary. However, failing to provide all or part of the information may prevent us from making a determination to select you as a representative payee. We rarely use the information you supply for any purpose other than what we state above,however, we may use the information for the administration of our programs, including sharing information:

1.To comply with Federal laws requiring the release of information from our records (e.g., to the Government Accountability Office and Department of Veterans Affairs); and,

2.To facilitate statistical research, audit, or investigative activities necessary to ensure the integrity and improvement of our programs (e.g., to the Bureau of the Census and to private entities under contract with us). A list of when we may share your information with others, called routine uses, is available in our Privacy Act System of Records Notices,

Additional information about these and other system of records notices and our programs are available from our Internet website at www.socialsecurity.gov or at your local Social Security office. We may also use the information you provide in computer matching programs. Matching programs compare our records with records kept by other Federal, State, or local government agencies. Information from these matching programs can be used to establish or verify a person's eligibility for

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget (OMB) control number. We estimate that it will take about 11 minutes to read the instructions, gather the facts, and answer the questions. Send only comments relating to our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD

Form |

Page 9 of 10 |

SPECIAL BENEFITS FOR WORLD WAR II VETERANS

Information for Representative Payees Who Receive Special Benefits for WW II Veterans

YOU MUST NOTIFY THE SOCIAL SECURITY ADMINISTRATION PROMPTLY IF ANY OF THE FOLLOWING EVENTS OCCUR AND PROMPTLY RETURN ANY PAYMENT TO WHICH THE CLAIMANT IS NOT ENTITLED:

•the claimant DIES (special veterans entitlement ends the month after the claimant dies);

•the claimant returns to the United States for a calendar month or longer;

•the claimant moves or changes the place where he/she actually lives;

•the claimant receives a pension, annuity or other recurring payment (includes workers' compensation, veterans benefits or disability benefits), or the amount of the annuity changes;

•the claimant is or has been deported or removed from U.S.;

•the claimant has an UNSATISFIED FELONY WARRANT (or in jurisdictions that do not define crimes as felonies, a crime punishable by death or imprisonment exceeding 1 year) issued for his/her arrest;

•the claimant is violating a condition of probation or parole under State or Federal law.

In addition to these events about the claimant, you must also notify us if:

•YOU change your address;

•YOU are convicted of a felony or any offense under State or Federal law which results in imprisonment for more than 1 year;

•YOU have an UNSATISFIED FELONY WARRANT (or in jurisdictions that do not define crimes as felonies, a crime punishable by death or imprisonment exceeding 1 year) issued for your arrest.

BENEFITS MAY STOP IF ANY OF THE ABOVE EVENTS OCCUR. You can make your reports by telephone, mail or in person. You can contact any U.S. Embassy, Consulate, Veterans Affairs Regional Office in the Philippines or any U.S. Social Security Office.

REMEMBER:

•payments must be used for the claimant's current needs or saved if not currently needed;

•you may be held liable for repayment of any payments not used for the claimant's needs or of any overpayment that occurred due to your fault;

•you must account for benefits when so asked by the Social Security Administration. You will keep records of how benefits were spent so you can provide us with a correct accounting;

•to let us know, as soon as you know you are unable to continue as representative payee or the claimant no longer needs a payee.

Form |

Page 10 of 10 |

|

|

A REMINDER TO PAYEE APPLICANTS |

|

TELEPHONE NUMBER(S) TO CALL IF YOU HAVE A QUESTION OR SOMETHING TO REPORT

BEFORE YOU RECEIVE A DECISION NOTICE

AFTER YOU RECEIVE A DECISION NOTICE

SSA OFFICE |

DATE REQUEST RECEIVED |

RECEIPT FOR YOUR REQUEST

Your request for Special benefits for WW II Veterans on behalf of the individual(s) named below has been received and will be processed as quickly as possible.

You should hear from us within days after you have given us all the information we requested. Some claims may take longer if additional information is needed.

In the meantime, if you change your address, or if there is some other change that may affect the benefits payable,

you - or someone for you - should report the change. The changes to be reported are listed on the reverse.

Always give us the claim number of the beneficiary when writing or telephoning about the claim.

If you have any questions about this application, we will be glad to help you.

BENEFICIARY

SOCIAL SECURITY CLAIM NUMBER

Privacy Act Statement - Collection and Use of Personal Information

Sections 205(a), 205(j) and 1631(a)(2) of the Social Security Act, as amended, allow us to collect this information. We will use the information you provide to determine if you are eligible to serve as a representative payee. Furnishing us this information is voluntary. However, failing to provide all or part of the information may prevent us from making a determination to select you as a representative payee. We rarely use the information you supply for any purpose other than what we state above,however, we may use the information for the administration of our programs, including sharing information:

1.To comply with Federal laws requiring the release of information from our records (e.g., to the Government Accountability Office and Department of Veterans Affairs); and,

2.To facilitate statistical research, audit, or investigative activities necessary to ensure the integrity and improvement of our programs (e.g., to the Bureau of the Census and to private entities under contract with us). A list of when we may share your information with others, called routine uses, is available in our Privacy Act System of Records Notices,

Additional information about these and other system of records notices and our programs are available from our Internet website at www.socialsecurity.gov or at your local Social Security office. We may also use the information you provide in computer matching programs. Matching programs compare our records with records kept by other Federal, State, or local government agencies. Information from these matching programs can be used to establish or verify a person's eligibility for

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget (OMB) control number. We estimate that it will take about

11 minutes to read the instructions, gather the facts, and answer the questions. Send only comments relating to our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of SSA-11 Form | The SSA-11 form is used to apply to become a representative payee for someone who is unable to manage their own Social Security benefits. This could include minors or individuals with cognitive challenges. |

| Eligibility Criteria | To act as a representative payee, you must demonstrate that the claimant cannot manage their benefits. You should explain the claimant's situation and your relationship to them clearly on the form. |

| Required Information | The form collects personal information about both the claimant and the payee. This includes Social Security numbers, living arrangements, and financial details. |

| Governing Laws | The handling of Social Security benefits is governed by federal laws under Title II of the Social Security Act, as well as regulations established by the Social Security Administration (SSA). |

| Signature Requirement | All applicants must sign the form in ink. If the application is signed by someone who cannot write, two witnesses must also sign to validate the application. |

Guidelines on Utilizing Ssa 11

Filling out the SSA-11 form is a process that requires careful consideration and attention to detail. Once you have completed the form, it will be submitted to the Social Security Administration (SSA) for their review. Completing the SSA-11 form correctly is essential, as any inaccuracies can lead to delays in processing and receiving benefits.

- Begin by writing your name, Social Security number, and the name and number of the claimant in the designated areas at the top of the form.

- In question 1, check the box if you are the claimant requesting benefits be paid directly to yourself. If not, skip to question 2.

- For question 2, explain why the claimant cannot manage their own benefits, including details on how they handle any current funds.

- In question 3, articulate why you would serve as the best representative payee, using additional space if necessary.

- Question 4 asks how you will stay informed about the claimant's needs. Select the appropriate option (e.g., "Live with me" or "Daily visits") and provide any extra explanations as needed.

- In question 5, indicate whether a court-appointed legal guardian or conservator is involved, and fill in their details if applicable.

- Question 6 focuses on the claimant's living situation. Choose the appropriate answer and provide relevant details based on their living arrangement and any other individuals residing with them.

- Question 7 deals with minor children, including whether they have a living parent. Provide the required information if applicable.

- List any relatives or close friends who support or show interest in the claimant in question 8, including their names and addresses.

- For question 9, select your relationship to the claimant, checking the relevant box from the list provided.

- In question 10, disclose any debts owed by the claimant to you or your organization and provide details.

- If you are an institution or agency, complete question 11 with the institution's name and EIN. If an individual, answer question 12 with your information.

- Question 13 inquires about how long you have known the claimant; provide the duration.

- In question 14, if you live with the claimant, mention who looks after them when you are unavailable.

- For question 15, indicate your main source of income and any relevant details about your employment.

- Question 16 asks for your permission for the SSA to conduct a criminal background check.

- Answer questions 17 and 18 regarding past felony convictions or warrants, providing details as necessary.

- Finally, review the form for accuracy, and sign it on the designated line. Include the date and your contact information before submitting it.

With the information carefully compiled and filled out, it's time to double-check everything. A thorough review ensures that all areas are complete and correct, reducing the chance of errors that could lead to delays. When ready, submit the form to the SSA as instructed, keeping a copy for your records. This final step paves the way for the benefits to be processed appropriately and in a timely manner.

What You Should Know About This Form

What is Form SSA-11 and when is it used?

Form SSA-11 is a request form used by individuals to apply to become a representative payee for someone receiving Social Security benefits. A representative payee is responsible for managing the benefits of the claimant when they are unable to do so themselves. This form is typically filled out by family members, guardians, or institutions on behalf of the claimant.

Who can serve as a representative payee?

Any responsible adult can become a representative payee. This includes parents, relatives, friends, or legal guardians. Organizations, such as nursing homes or social agencies, can also serve in this role. The applicant must demonstrate their ability to responsibly manage the claimant's funds and fulfill their needs.

What information is required to complete the SSA-11 form?

The SSA-11 form requires various details, including personal information about both the claimant and the potential payee, the living situation of the claimant, and any existing court orders regarding guardianship. Additional information regarding the financial needs of the claimant and how the payee plans to manage the funds is also necessary.

How does the Social Security Administration assess a payee's capability?

The Social Security Administration reviews the submitted form and may require further documentation or an interview. They assess the payee’s relationship to the claimant, their financial acumen, and prior experience in managing someone else's benefits. This is to ensure that the claimant’s needs will be met responsibly.

What responsibilities does a representative payee have?

A representative payee must ensure that the benefits are used for the claimant's current needs or saved for future expenses. They are required to keep accurate records of expenditures and report back to the Social Security Administration as needed. This includes notifying the agency of any changes in circumstances, such as the claimant's death or change of address.

Can a person apply to become a payee if they have a criminal record?

Individuals with a felony conviction may be disqualified from becoming a representative payee, particularly if they have unsatisfied felony warrants. The form may ask about past convictions, and the Social Security Administration will evaluate this information when determining eligibility.

How can I check the status of my SSA-11 application?

After submitting the SSA-11 form, you can check the status of your application by contacting your local Social Security office. It may also be beneficial to keep a record of your submission for reference during follow-up communications.

What happens if the Social Security Administration denies my application?

If the application is denied, the applicant will receive a notice outlining the reason for the denial. You can request a reconsideration or appeal the decision if you believe that you meet the qualifications to serve as a representative payee. It’s advisable to gather additional evidence to support your request during this process.

Common mistakes

Filling out the SSA-11 form, which is necessary for requesting to be a representative payee, can be a straightforward process if you approach it carefully. However, many applicants make mistakes that can delay their application. Here are six common errors to watch out for.

First, many individuals forget to provide complete and accurate personal information. It's crucial to fill in all the required sections, such as your name, Social Security number, and contact details clearly. Missing or incorrect information can lead to processing delays or, in some cases, a rejection of the application.

Another common mistake is neglecting to explain why the claimant is unable to manage their own benefits adequately. This explanation should be thorough and specific. If this area is left vague or unanswered, the Social Security Administration may not fully understand the necessity of designating a representative payee.

Using vague language in responses can also cause issues. For instance, when stating how you will meet the claimant's needs, details matter. A simple “I will check in” doesn’t provide sufficient insight. Instead, be specific about how often you visit or communicate with the claimant to show you are actively involved in their care.

Many applicants overlook the section asking whether the claimant has a court-appointed guardian or conservator. Failing to disclose this information can complicate the approval process. It’s essential to be transparent about any existing legal arrangements to avoid confusion later.

Additionally, individuals often forget the importance of signatures. All necessary parties must sign the form where indicated. If the application is not signed correctly, it could lead to unnecessary delays in processing.

Finally, making sure to review the entire application before submission is vital. This last check can help catch any mistakes or omissions that may have been overlooked initially. Each of these common errors can hinder the timely receipt of benefits, so taking the time to double-check can make a significant difference.

Documents used along the form

The SSA-11 form, also known as the Request to be Selected as Payee, is a critical document for those seeking to manage Social Security benefits on behalf of another individual, often because that individual is unable to do so themselves. However, this form doesn’t stand alone; several other forms and documents are commonly used alongside it to ensure a smooth application process and compliance with Social Security regulations. Understanding these forms can help applicants navigate the complexities of the system more effectively.

- Form SSA-16: This is the Application for Disability Insurance Benefits. It's necessary for individuals seeking disability payments and provides essential information about the claimant's disability status and work history.

- Form SSA-827: The Authorization to Disclose Information to the Social Security Administration allows for the release of medical records and other personal information necessary for the determination of benefits.

- Form SSA-3881: This form is a Consent for Release of Information. It gives the Social Security Administration permission to share information about the claimant's benefits with third parties, which can be beneficial when coordinating care.

- Form SSA-815: The Report of Contact is used to document any interaction between the applicant and Social Security regarding the claim. This can help clarify situations or provide proof of conversations that occurred.

- Form SSA-827 (Revised): Similar to the original SSA-827, the revised version ensures that updated regulations regarding medical information disclosure are respected. This is essential for disability claims where medical evidence is needed.

- Form SSA-5: The Application for Widow's or Widower's Benefits collects necessary information for those seeking benefits after the death of a spouse, which may be applicable in situations where the deceased spouse held Social Security benefits.

- Form SSA-24: The Disability Update Report is required periodically to verify that beneficiaries continue to meet the criteria for receiving their benefits, ensuring compliance and accurate record-keeping.

Using these forms in conjunction with the SSA-11 can help facilitate a more streamlined experience for both payees and beneficiaries. It is vital to keep all documents organized and ensure that all information provided is accurate and up to date. Doing so will not only make the process smoother but also ensure that the rights and needs of those who cannot manage their benefits are respected and upheld.

Similar forms

- Form SSA-16: Similar to the SSA-11, Form SSA-16 is used by individuals to apply for Social Security Disability Insurance (SSDI) benefits. Both forms require detailed information about the claimant and their situation, emphasizing the need for a clear presentation of the claimant's circumstances.

- Form SSA-1: This form serves as an application for retirement benefits. Like the SSA-11, it gathers information about the applicant's personal details and their relationship to the claimant while focusing on their eligibility for benefits.

- Form SSA-827: Known as the Authorization to Disclose Information to the Social Security Administration, this form shares similarities with SSA-11 in that both facilitate necessary communication and evaluations regarding the claimant’s benefits and needs.

- Form SSA-393: This is the Request for Waiver of Overpayment Recovery. It resembles the SSA-11 by addressing the issues surrounding benefit payments, particularly in guiding the relevant authorities in determining the rightful management of funds and related matters.

- Form SSA-8: This form is used to request a change in the representative payee. Like the SSA-11, it involves an assessment of the claimant's needs and the capabilities of the payee to manage funds appropriately.

- Form SSA-55: The Request for Consideration of Representative Payee serves a similar purpose to SSA-11. It focuses on evaluating who is best suited to handle the claimant’s benefits, taking into account their living situation and support network.

Dos and Don'ts

- Do read the entire SSA-11 form carefully before completing it.

- Do provide accurate and complete information about the claimant’s circumstances.

- Do check your responses for consistency after filling out the form.

- Do ensure that you sign and date the form before submission.

- Do notify the Social Security Administration of any changes in the claimant’s situation promptly.

- Don't leave any required fields blank; provide explanations where necessary.

- Don't submit the form without proof of your identity or status as a payee.

Misconceptions

The SSA-11 form is utilized in the process of appointing a representative payee for Social Security benefits. Here are six common misconceptions regarding this form:

- It's only for parents of minor children. The SSA-11 form can be completed by various individuals, including friends, relatives, or professionals, who believe a claimant is unable to manage their own benefits.

- Completing the form guarantees approval as a payee. Submitting the SSA-11 form does not automatically ensure that the Social Security Administration will appoint the applicant as a representative payee. The SSA must review the circumstances and make a decision.

- You don't need to provide any supporting information. The form requires detailed explanations regarding the claimant's situation, the applicant's relationship to the claimant, and their capacity to manage the funds appropriately. Providing thorough and accurate information is crucial.

- Only family members can apply to be a payee. While family members often apply, any responsible adult or institution can request to be a representative payee, provided they meet specific criteria laid out by the SSA.

- The SSA-11 form is the only step in becoming a payee. There may be additional requirements after submitting the form, such as interviews, background checks, or providing further documentation to verify the applicant's capability as a payee.

- Once appointed, there's no oversight. Appointed payees must regularly account for how benefits are used and are subject to SSA oversight. Misuse of funds can lead to penalties or removal as a payee.

Key takeaways

Filling out and using Form SSA-11 can be straightforward if you keep a few key points in mind. Here are nine important takeaways:

- Understand the purpose: Form SSA-11 is used to request that Social Security benefits are paid to you as a representative payee for someone who cannot manage their benefits.

- Identify the claimant: Make sure to provide the full name and Social Security number of both the claimant and the number holder correctly.

- Justify your role: Explain clearly why the claimant cannot handle their benefits and why you are the best choice as a payee. Consider detailing how the claimant manages existing finances.

- Living arrangements matter: Describe the claimant’s living situation, including who resides with them, to give the Social Security Administration context on their needs.

- Report changes promptly: If the claimant’s circumstances change, such as a new living situation or death, you must notify Social Security immediately.

- Account for funds accurately: You are required to use payments for the claimant's needs or save them for future use. Misuse may result in legal consequences.

- Documentation is key: Keep detailed records of how benefits are spent. Be prepared to provide financial reports if requested by Social Security.

- Be aware of special regulations: Specific conditions, like jail time or changes in the claimant's medical status, must be reported, particularly if they affect benefit eligibility.

- Review reporting requirements: Familiarize yourself with which events necessitate notification to Social Security to avoid complications and potential benefit loss.

Browse Other Templates

Vehicle Maintenance Record Template - Highlight potential issues before they become major problems.

Business License Renewal California - Part-time employee fees are $5.00 per employee.