Fill Out Your Ssa 1724 Form

The SSA-1724 form serves as a vital tool for families and legal representatives seeking to claim benefits owed to a deceased individual. When a person who was receiving Social Security benefits passes away, there may be pending payments or refunds due, particularly in instances involving Medicare premiums. This form streamlines the process of identifying who is entitled to these amounts based on the priorities established in the Social Security Act. Through the SSA-1724, applicants provide key details, including the deceased's information, relationships within the family, and the names and addresses of surviving kin or legal representatives. It captures significant data, such as the Social Security numbers of the deceased, their children, and surviving parents, ensuring that proper verification takes place. By gathering this information, the Social Security Administration can facilitate timely and accurate distributions of any funds owed, alleviating some of the financial burdens that often accompany the loss of a loved one. Completing the form correctly is essential, as it will influence the decision regarding eligibility for any due payments.

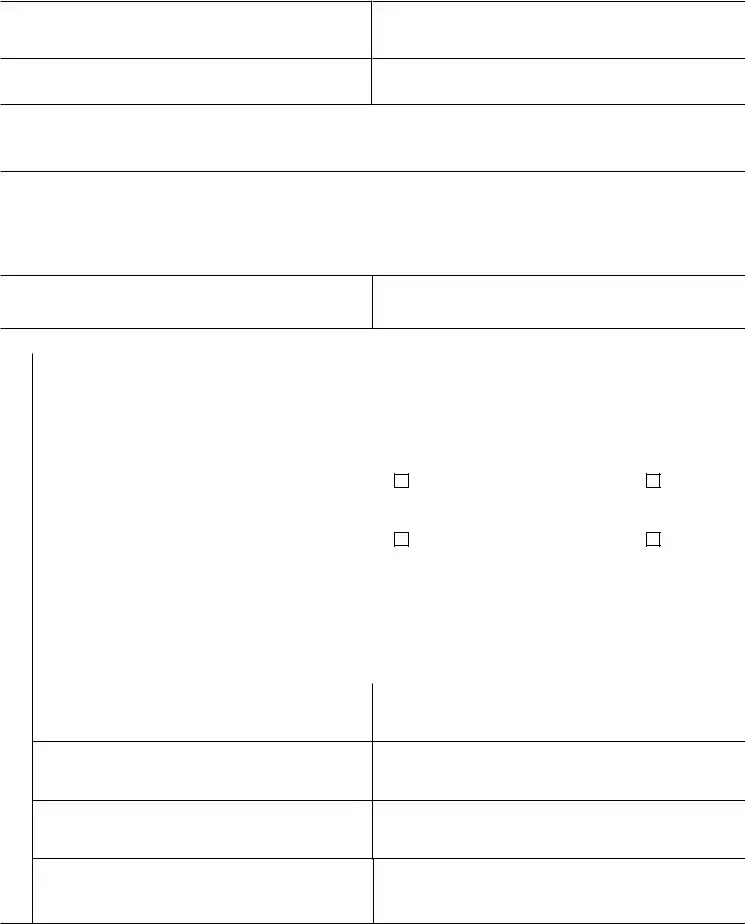

Ssa 1724 Example

|

Form Approved |

Social Security Administration |

OMB No. |

|

|

CLAIM FOR AMOUNTS DUE IN THE CASE OF A DECEASED BENEFICIARY

PRINT NAME OF DECEASED

If the deceased received benefits on another person's record, print name of that worker

SOCIAL SECURITY NUMBER OF DECEASED

NAME OF THE WORKER

The deceased may have been due a Social Security payment and/or a Medicare Premium refund. The Social Security Act provides that amounts due a deceased may be paid to the next of kin or the legal representative of the estate under priorities established in the law. To help us decide who should receive any payment due, please COMPLETE THIS ENTIRE FORM and RETURN it to us in the enclosed envelope.

This claim for the amounts due is being made on behalf of the family or the estate of |

|

|

_________________________ who died on ______________ day of ________________ |

_________________ |

|

(name of deceased) |

(month) |

(year) |

and who lived in the state of _________________________ .

PRINT NAME OF APPLICANT

RELATIONSHIP TO DECEASED (Widow, Son, Legal Representative, etc.)

THE FOLLOWING ARE THE NEXT OF KIN OR LEGAL REPRESENTATIVE OF THE DECEASED NAMED ABOVE:

1. |

NAME OF SURVIVING WIDOW(ER) |

ADDRESS OF SURVIVING WIDOW(ER) (Please print house number, |

||

|

(Please print. If none, state "NONE") |

street, apt. number, P.O. Box, rural route, city, state, and ZIP code) |

||

|

|

|

|

|

|

|

|

|

|

|

ENTER SOCIAL SECURITY NUMBER(S) OF WIDOW(ER) |

|

|

|

|

NAMED ABOVE. |

|

|

|

|

|

|

|

|

|

WAS THE WIDOW(ER) NAMED ABOVE LIVING IN THE |

YES |

If "YES", then |

NO |

|

SAME HOUSEHOLD WITH THE DECEASED AT THE TIME |

|

SKIP items 2,3,4,5 and |

|

|

OF DEATH? |

|

SIGN at bottom of page 2. |

|

|

|

|

|

|

|

WAS HE OR SHE ENTITLED TO A MONTHLY BENEFIT |

YES |

If "YES", then |

NO |

|

|

|

|

|

|

ON THE SAME EARNINGS RECORD AS THE DECEASED |

|

SKIP items 2,3,4,5 and |

(Go on to item 2) |

|

AT THE TIME OF DEATH? |

|

SIGN at bottom of page 2. |

|

|

|

|

|

|

|

|

|

|

|

2. |

ENTER NUMBER OF LIVING CHILDREN OF THE DECEASED. INCLUDE ADOPTED CHILDREN AND |

NUMBER |

||

|

STEPCHILDREN; INCLUDE GRANDCHILDREN AND |

|

||

|

DISABLED OR DECEASED; OR IF THEY HAVE BEEN ADOPTED BY THE SURVIVING SPOUSE OF THE |

|

||

|

DECEASED. IF NONE OF THE ABOVE, SHOW "NONE" AND GO ON TO ITEM 4. |

|

|

|

|

|

|

||

|

PRINT NAME AND COMPLETE ADDRESS OF EACH CHILD |

|

||

|

Remarks |

|||

|

|

|

||

|

NAME OF CHILD |

ADDRESS OF CHILD (Include house number, street, apt. number, |

||

|

|

P.O. Box, rural route, city, state, and ZIP code) |

|

|

RELATIONSHIP TO DECEASED (Grandchild, stepchild, etc.)

SOCIAL SECURITY NUMBER OF CHILD

NAME OF CHILD

ADDRESS OF CHILD (Include house number, street, apt. number, P.O. Box, rural route, city, state, and ZIP code)

RELATIONSHIP TO DECEASED (Grandchild, stepchild, etc.)

SOCIAL SECURITY NUMBER OF CHILD

Form |

Page 1 |

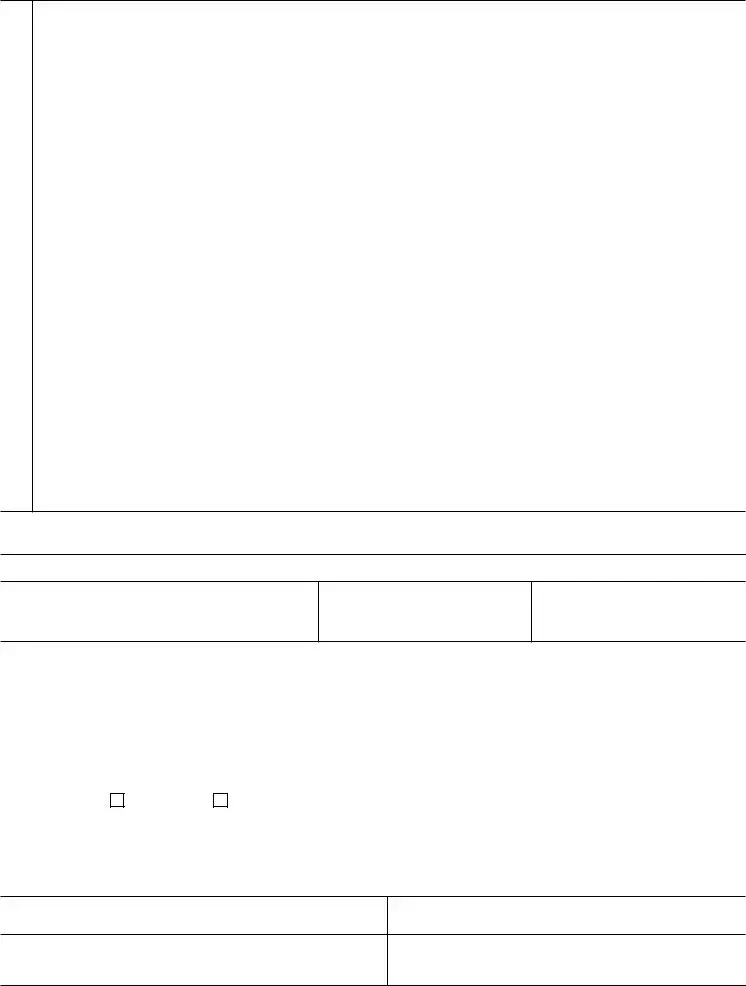

3.If any child listed in item 2 has a different name from that given at birth, attach a separate sheet with the following information: Child's Present Name, Name Given At Birth, and a brief explanation for the difference (e.g. Marriage or Court Order).

4. ENTER NUMBER OF LIVING PARENTS OF THE DECEASED |

|

NUMBER |

|

|

|

||

|

(Include adopting parents and stepparents. If none, show "None") IF THERE ARE NO LIVING PARENTS, GO |

|

|

|

ON TO ITEM 5. |

|

|

|

|

|

|

|

PRINT NAME AND COMPLETE ADDRESS OF EACH PARENT |

||

|

|

|

|

|

NAME OF LIVING PARENT |

ADDRESS OF LIVING PARENT (Include house number, street, apt. |

|

|

|

number, P.O. Box, rural route, city, state, and ZIP code) |

|

|

|

|

|

|

ENTER SOCIAL SECURITY NUMBER OF PARENT NAMED |

|

|

|

|

|

|

|

NAME OF LIVING PARENT |

ADDRESS OF LIVING PARENT (Include house number, street, apt. |

|

|

|

number, P.O. Box, rural route, city, state, and ZIP code) |

|

|

|

|

|

|

ENTER SOCIAL SECURITY NUMBER OF PARENT NAMED. |

|

|

|

|

|

|

5.LEGAL REPRESENTATIVE OF THE DECEASED'S ESTATE (Skip this item if relatives are listed in 1, 2, or 4.)

NAME OF LEGAL REPRESENTATIVE (Please print) |

ADDRESS OF LEGAL REPRESENTATIVE (Please print house |

|

number, street, apt. number, P.O. Box, rural route, city, state, and |

|

ZIP code.) |

|

|

NOTE: If you are applying as legal representative, please submit a certified copy of your letters of appointment.

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge.

SIGNATURE OF APPLICANT

SIGNATURE (First name, middle initial, last name)

DATE (Month, day, year)

TELEPHONE NUMBER (Include area code)

MAILING ADDRESS (House number and street, apt. number, P.O. Box, or rural route)

CITY |

STATE |

NAME OF COUNTY |

ZIP CODE |

|

|

|

|

|

Direct Deposit Payment Address (Financial Institution) |

|

|

|

|

||

Type of Account |

Nine Digit Routing Number |

||

|

|

|

|

Checking |

Savings |

|

|

|

|

|

|

Account Number |

|

|

|

|

|

|

|

WITNESSES ARE REQUIRED ONLY IF THIS APPLICATION HAS BEEN SIGNED BY MARK (X) ABOVE. IF SIGNED BY MARK (X), TWO WITNESSES TO THE SIGNING WHO KNOW THE APPLICANT MUST SIGN BELOW GIVING THEIR FULL ADDRESSES.

SIGNATURE OF WITNESS

SIGNATURE OF WITNESS

ADDRESS (House number and street, city, state, and ZIP code)

ADDRESS (House number and street, city, state, and ZIP code)

Form |

Page 2 |

PRIVACY ACT NOTICE

Section 204(d) of the Social Security Act, as amended, authorizes us to collect this information. We will use this information to help us determine the beneficiary’s payment.

Furnishing us the information is voluntary. However, failing to provide us with all or part of the requested information may prevent us from making an accurate and timely decision on your claim, which may result in the loss of payments.

We rarely use the information you supply for any purpose other than for determining problems in Social Security programs. However, we may use it for the administration and integrity of Social Security programs. We may also disclose information to another person or to another agency in accordance with approved routine uses, which include, but are not limited to the following:

1)To contractors and other Federal agencies, as necessary, for the purpose of assisting the Social Security Administration in the efficient administration of its programs;

2)To comply with Federal laws requiring the release of information from Social Security records (e.g., to the Government Accountability Office and Department of Veteran's Affairs);

3)To make determinations for eligibility in similar health and income maintenance programs at the Federal, State, and local level; and,

4)To facilitate statistical research, audit, or investigatory activities necessary to assure the integrity and

improvement of Social Security programs.

We may also use the information you provide in computer matching programs. Matching programs compare our records with records kept by other Federal, State, or local government agencies. We use the information from these matching programs to establish or verify a person's eligibility for

A complete list of routine uses for this information is available in our Privacy Act Systems of Records Notices,

This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget (OMB) control number. We estimate that it will take about 10 minutes to read the instructions, gather the facts, and answer the questions. Send only comments relating to our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD

Form |

Page 3 |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose of Form | The SSA 1724 form is used to claim amounts due to a deceased Social Security beneficiary, ensuring the due payments are directed to the correct individual or estate. |

| Eligibility | Eligible claimants include the next of kin or the legal representative of the deceased’s estate, determined by the Social Security Act's established priorities. |

| Documentation Requirement | Applicants must provide thorough information, including names, relationships, and Social Security numbers of the deceased and surviving family members, to support the claim. |

| Governing Law | The form operates under the Social Security Act, particularly Section 204(d), which governs the disbursement of payments due to deceased beneficiaries. |

Guidelines on Utilizing Ssa 1724

After gathering the necessary information, complete the SSA 1724 form carefully. Providing accurate details will help in the timely processing of the claim related to the deceased beneficiary.

- Print the name of the deceased at the top of the form.

- If applicable, also print the name of the worker whose record the deceased received benefits from.

- Enter the Social Security number of the deceased beneficiary.

- Fill in the relationship of the applicant to the deceased. Indicate if the applicant is a widow, son, etc.

- Provide the state of residence of the deceased at the time of death.

- List the name and complete address of the surviving widow(er), if applicable. If none, indicate "NONE."

- Input the Social Security number of the surviving widow(er).

- Answer if the widow(er) was living with the deceased at the time of death. If "YES," skip to the signature section.

- Answer whether the widow(er) was entitled to a monthly benefit on the same earnings record as the deceased. If "YES," skip to the signature section.

- If applicable, enter the number of living children of the deceased. Include adopted children and stepchildren.

- For each child listed, provide their name, complete address, relationship to the deceased, and Social Security number.

- If any child has a different name from birth, attach a separate sheet with the new name, original name, and the reason for the change.

- Enter the number of living parents of the deceased. If none, indicate "NONE."

- For each living parent, provide their name, complete address, and Social Security number.

- If there are no living parents, list the name and address of the legal representative of the deceased's estate, if applicable.

- Complete the declaration statement, signing and dating the form. Include your telephone number and mailing address.

- If the application has been signed with a mark (X), have two witnesses sign and provide their addresses.

What You Should Know About This Form

What is the SSA 1724 form?

The SSA 1724 form is used to claim amounts that may be due to a deceased Social Security beneficiary. This includes any outstanding Social Security payments or Medicare Premium refunds. The form helps ensure that the rightful next of kin or legal representative receives the funds in accordance with Social Security law.

Who can fill out the SSA 1724 form?

Any next of kin or legal representative of the deceased can complete this form. This includes spouses, children, parents, and legal representatives of the deceased’s estate. It’s important that the applicant provides accurate information to ensure proper processing of the claim.

What information is required on the form?

You will need to provide the name of the deceased, their Social Security number, and details about their living relatives. This includes information about spouses, children, and parents. If the applicant is a legal representative, a certified copy of the letters of appointment must also be provided. It’s important to fill out all sections of the form completely.

What happens once the form is submitted?

After submitting the SSA 1724 form, the Social Security Administration will review the information provided. This process may take some time. If there are any issues or missing information, the SSA will reach out to you for clarification. It’s crucial to ensure all details are accurate to avoid delays.

What should I do if there are multiple claimants for the deceased’s benefits?

If there are multiple claimants, the SSA will follow established priorities under the law to decide who will receive the payments. It can help to discuss with other potential claimants to ensure that all necessary information is included and to avoid potential disputes.

Is assistance available if I need help completing the form?

Yes, if you feel unsure about completing the SSA 1724 form, assistance is available. You can visit your local Social Security office for help, or call the Social Security Administration's helpline. Additionally, there are many community resources that may offer guidance in filling out the form.

Common mistakes

Completing the SSA 1724 form accurately is essential for obtaining the amounts due to a deceased Social Security beneficiary. Unfortunately, people often make mistakes while filling out this form that can delay processing or even lead to rejection. One common error occurs when applicants forget to provide the complete and accurate name of the deceased. Rather than just writing the first and last name, it is critical to ensure that any middle names and initials are included as well. The Social Security Administration requires precise identification to avoid confusion with other beneficiaries.

Another frequent mistake involves the social security number of the deceased. Submitting an incorrect number can severely hinder the processing of the claim. Applicants must double-check this information against official records. If the wrong number is listed, the form may not be linked to the correct case, and this could result in a longer wait time for the payment due.

Additionally, many people overlook the importance of detailing the relationship to the deceased. When filling out the form, specifying whether one is a child, spouse, or legal representative is vital. This information helps the Social Security Administration understand the priority of claims and ensures that payments go to the appropriate individual or estate. Failing to clarify this relationship can lead to unnecessary complications and confusion during the claims process.

Finally, individuals often forget to include vital contact information at the end of the form. Providing your mailing address and telephone number is crucial for effective communication. If the Social Security Administration needs additional information or clarification, having accurate contact details will facilitate smooth communication. Without this information, applicants might miss important updates or requests that could delay the payment they are due.

Documents used along the form

When filing the SSA-1724 form, additional documents may be required for a complete application. Each of these documents serves a specific purpose in helping the Social Security Administration process claims effectively. Below is a list of commonly used forms and documents that can accompany the SSA-1724.

- Death Certificate: This document verifies the death of the beneficiary and provides essential details like the date and place of death.

- Form SSA-21 (Organizational Representative Payee Statement): Used if a legal organization is making the claim for benefits due to the deceased.

- Letters of Administration: This document is issued by a court confirming the person’s authority to act as the representative of the deceased’s estate.

- Proof of Relationship Documents: Items like marriage certificates or birth certificates to establish the applicant’s relationship to the deceased.

- Form SSA-11 (Application for Widow’s or Widower’s Benefits): This form may be required if the widow or widower is applying for benefits on their own behalf.

- Form SSA-1099: This statement details the benefits the deceased was receiving, which can clarify any amounts still due.

- Financial Institution Direct Deposit Form: If benefits are to be deposited directly into an account, this form provides necessary banking details.

- Identification Documents: A copy of the applicant's government-issued ID may be needed to confirm their identity.

- Power of Attorney (if applicable): This document may be necessary if someone other than the next of kin is handling the claim.

Gathering these documents can help streamline the claims process. Having all necessary information at hand will ensure a smoother interaction with the Social Security Administration, potentially speeding up any payments due.

Similar forms

Understanding the SSA 1724 form can be simplified by looking at documents that serve similar purposes. Each of the following documents facilitates the processing of claims or benefits following the death of a beneficiary. Here’s a comparison:

- SSA 823: This form is used to claim benefits for a deceased individual's minor children. Like the SSA 1724, it focuses on establishing eligibility based on family relationships.

- SSA 24: This document is for applying for survivor benefits. It requires similar information about the deceased and the claimant's relationship to them, just as the SSA 1724 does.

- Form SF-1179: This government form is necessary for claiming refund payments due to a deceased federal employee. It shares the same purpose of settling claims related to a deceased person's benefits.

- VA Form 21-534: Used to apply for burial benefits from the Veterans Administration, this form also seeks to confirm the relationship between the applicant and the deceased in a similar context.

- IRS Form 706: The estate tax return requires detailed information about heirs and beneficiaries. Like the SSA 1724, it establishes entitlement and relationships in the context of payments due after death.

- Form 40-1008: This is used for life insurance claims. It provides a mechanism to claim payment after a beneficiary has passed away, paralleling the claims process in the SSA 1724.

- Certificate of Death: This document is critical in establishing proof of death. It is a common requirement across many similar claims, including those made with the SSA 1724.

- Form 4506-T: Used to request a transcript of tax return information, it might be needed in situations where income or benefits are in question after someone’s death, much like the SSA 1724.

- Legal Will or Testament: This document outlines the deceased’s final wishes and distribution of their estate. Establishing beneficiaries often goes hand-in-hand with the processes described in the SSA 1724.

- Form SSA-623: A declaration of the status of a disabled child. While focused on the child's benefits, it still deals with documentation similar to the SSA 1724 when verifying relationships for claims.

Dos and Don'ts

The SSA 1724 form is essential for claiming amounts due for a deceased beneficiary. Completing this form accurately is crucial to avoid delays. Here are some important things to consider:

- Do fill out every section of the form completely. Incomplete forms can lead to processing delays.

- Don't assume any information is known. Provide detailed descriptions, especially for names and addresses.

- Do use clear and legible handwriting. This will ensure that your information is read correctly.

- Don't forget to include all surviving children and their Social Security numbers if applicable.

- Do check the eligibility of the widow or widower. If they lived with the deceased, be sure to indicate that appropriately.

- Don't skip submitting required documents as a legal representative, such as certified letters of appointment.

- Do double-check all numbers and entries before submission. Mistakes can mean the difference between acceptance and denial.

- Don't leave out your contact information. This will help the Social Security Administration reach you if necessary.

- Do sign and date the form. An unsigned form will not be processed.

Misconceptions

- Misconception 1: The SSA 1724 form is only for spouses.

- Misconception 2: You cannot claim benefits if the deceased was not receiving Social Security at the time of death.

- Misconception 3: You need to submit the form in person.

- Misconception 4: All family members must sign the form.

- Misconception 5: The process is instantaneous.

- Misconception 6: You cannot file the form unless you're named as an executor.

- Misconception 7: There are fees associated with filing the SSA 1724.

- Misconception 8: You need to provide proof of death to submit the form.

Many people believe that only surviving spouses can use this form. In reality, the form is available to the next of kin, which includes children, siblings, and even legal representatives of the deceased’s estate.

This is not true. Even if the deceased was not actively receiving benefits, amounts may still be due, such as back payments or Medicare Premium refunds.

Many people think that the SSA 1724 must be submitted in person at a Social Security office. In fact, you can simply complete the form and mail it using the enclosed envelope.

Only the applicant, who is making the claim, needs to sign the form. Other family members or beneficiaries do not need to provide their signatures.

Some individuals expect immediate approval and payment upon submission of the form. However, processing can take time, as the Social Security Administration needs to verify the information provided before issuing any payments.

This is a common concern. While a legal representative may file on behalf of the estate, any next of kin can also submit the SSA 1724, regardless of whether they hold that title.

Many individuals mistakenly think that submitting the form incurs fees. Fortunately, filing the SSA 1724 is free of charge, as it is a service provided by the government.

While it may seem logical to provide a death certificate, it is not a requirement to submit this form. The SSA generally relies on the information you provide in the application.

Key takeaways

Understanding the SSA-1724 form is essential for claiming amounts due for a deceased beneficiary. Here are eight key takeaways to help navigate the process:

- Complete All Sections: Ensure that every part of the form is filled out to avoid delays in processing.

- Priorities Matter: The Social Security Act defines who can receive payments. It typically goes to the next of kin or the deceased’s legal representative.

- Living Arrangements: Indicate whether the surviving spouse was living with the deceased at the time of death. This affects the claims process.

- Child Information Required: Report on all living children, including adopted and stepchildren, to ensure accurate claims processing.

- Document Changes in Names: If any child has a different name from birth, provide a separate explanation to clarify.

- Legal Representatives: If you're the legal representative of the estate, attach a certified copy of your appointment letters.

- Signature Requirement: The applicant must sign the form, declaring the information is true. If signed by a mark, two witnesses are needed.

- Submit Promptly: After completing the form, return it as instructed to ensure timely processing of the claim.

Browse Other Templates

Urar - The report summarizes the appraiser’s opinion of market value based on thorough inspections.

Pos 010 - In summary, the POS-010 is a vital component in ensuring due process within California's legal framework.

Dhb 5003 - Ample details regarding the duration of Medicaid coverage are provided in the form.