Fill Out Your Ssa 2490 Bk Form

The SSA-2490-BK form serves as an essential application for benefits under U.S. international social security agreements, providing a framework for individuals seeking to claim social security benefits while navigating cross-border employment history. This form can be completed by or on behalf of a living worker, or by a survivor in the case of the worker's death. A key component of the SSA-2490-BK is its ability to gather detailed information about the worker’s social security credits, including periods of employment or self-employment in foreign countries. Applicants must meticulously document these details, alongside the worker's last place of residence. The form is structured into several parts, guiding users through information required for both U.S. and foreign country benefits, thereby ensuring all necessary data is collected efficiently. Applicants must also declare their eligibility for various benefit types, including retirement, survivors, or disability benefits. Additionally, family members, such as spouses or children, may also be entitled to claim benefits, which the form accounts for by requiring specific details about dependents. Completing the SSA-2490-BK accurately is vital for securing the benefits individuals are entitled to under international agreements.

Ssa 2490 Bk Example

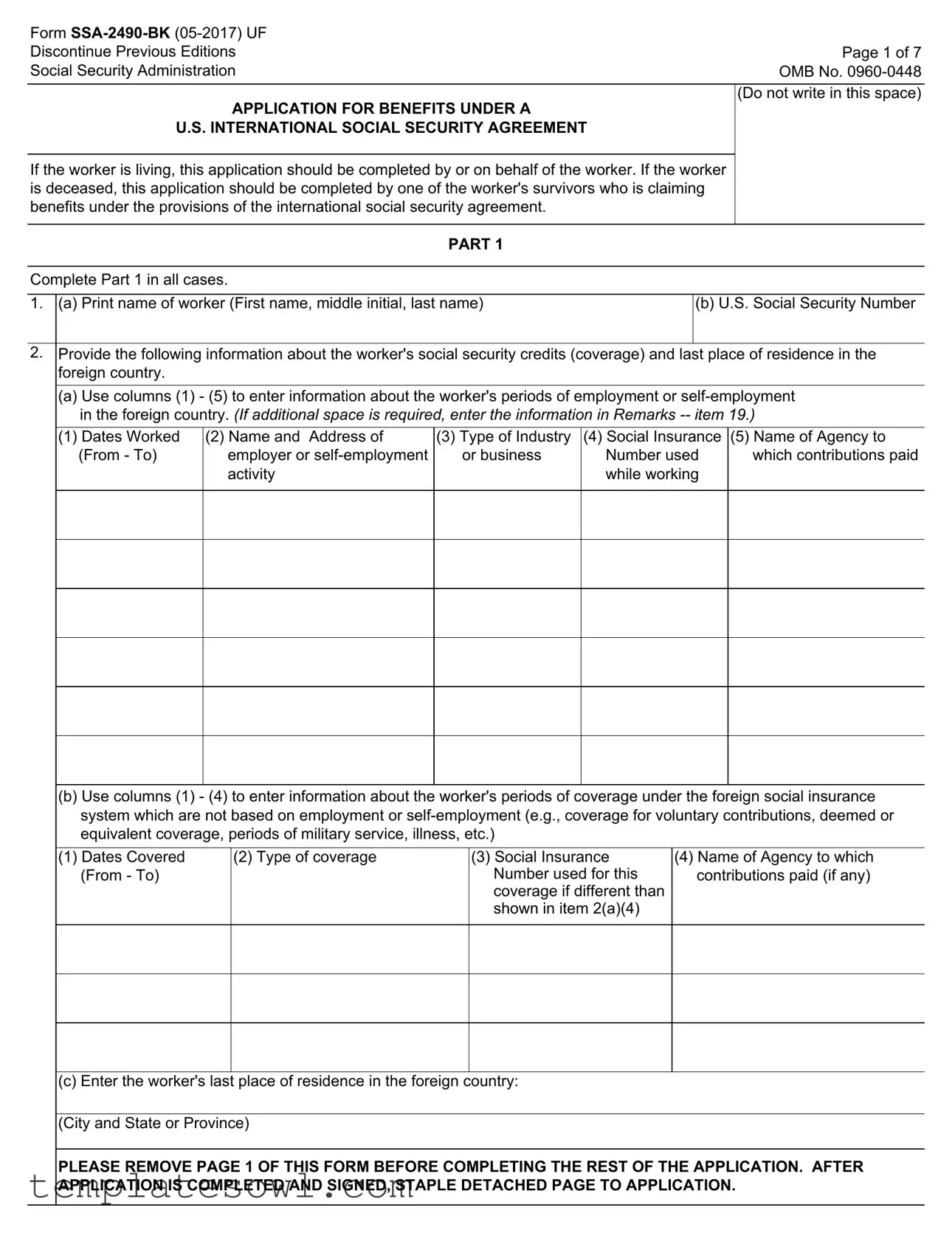

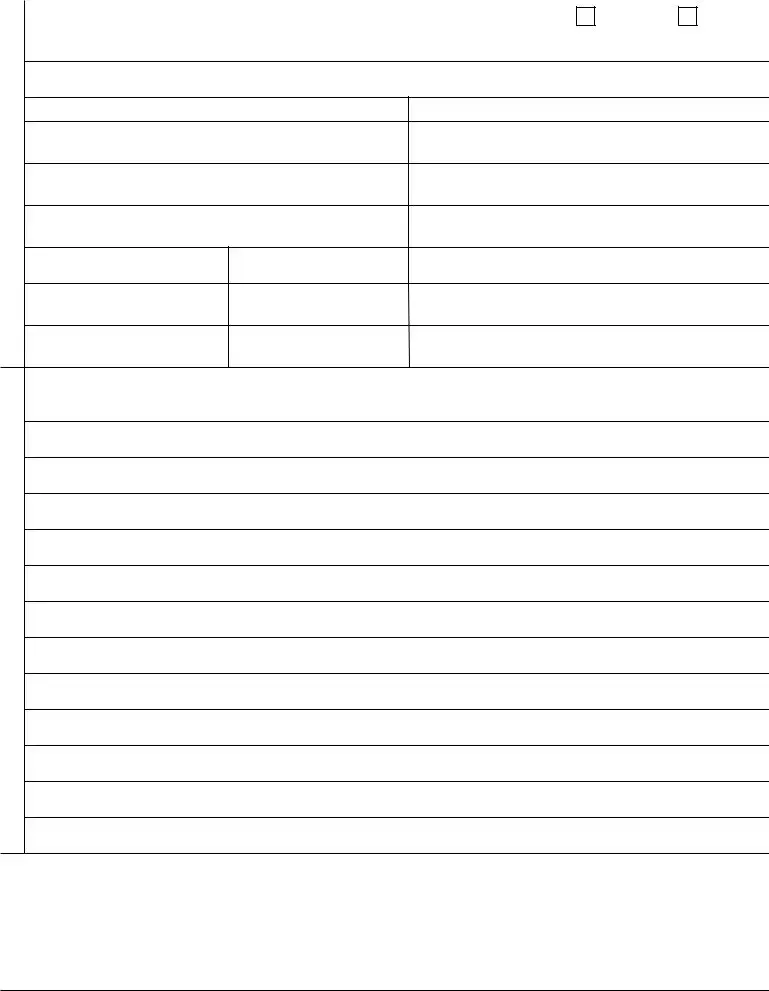

Form |

|

Discontinue Previous Editions |

Page 1 of 7 |

Social Security Administration |

OMB No. |

|

|

|

(Do not write in this space) |

APPLICATION FOR BENEFITS UNDER A |

|

U.S. INTERNATIONAL SOCIAL SECURITY AGREEMENT |

|

If the worker is living, this application should be completed by or on behalf of the worker. If the worker is deceased, this application should be completed by one of the worker's survivors who is claiming benefits under the provisions of the international social security agreement.

PART 1

Complete Part 1 in all cases.

1. (a) Print name of worker (First name, middle initial, last name) |

(b) U.S. Social Security Number |

|

|

2.Provide the following information about the worker's social security credits (coverage) and last place of residence in the foreign country.

(a)Use columns (1) - (5) to enter information about the worker's periods of employment or

(1) Dates Worked |

(2) Name and Address of |

(3) Type of Industry |

(4) Social Insurance |

(5) Name of Agency to |

(From - To) |

employer or |

or business |

Number used |

which contributions paid |

|

activity |

|

while working |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b)Use columns (1) - (4) to enter information about the worker's periods of coverage under the foreign social insurance system which are not based on employment or

(1) Dates Covered |

(2) Type of coverage |

(3) Social Insurance |

(4) Name of Agency to which |

(From - To) |

|

Number used for this |

contributions paid (if any) |

|

|

coverage if different than |

|

|

|

shown in item 2(a)(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c) Enter the worker's last place of residence in the foreign country:

(City and State or Province)

PLEASE REMOVE PAGE 1 OF THIS FORM BEFORE COMPLETING THE REST OF THE APPLICATION. AFTER APPLICATION IS COMPLETED AND SIGNED, STAPLE DETACHED PAGE TO APPLICATION.

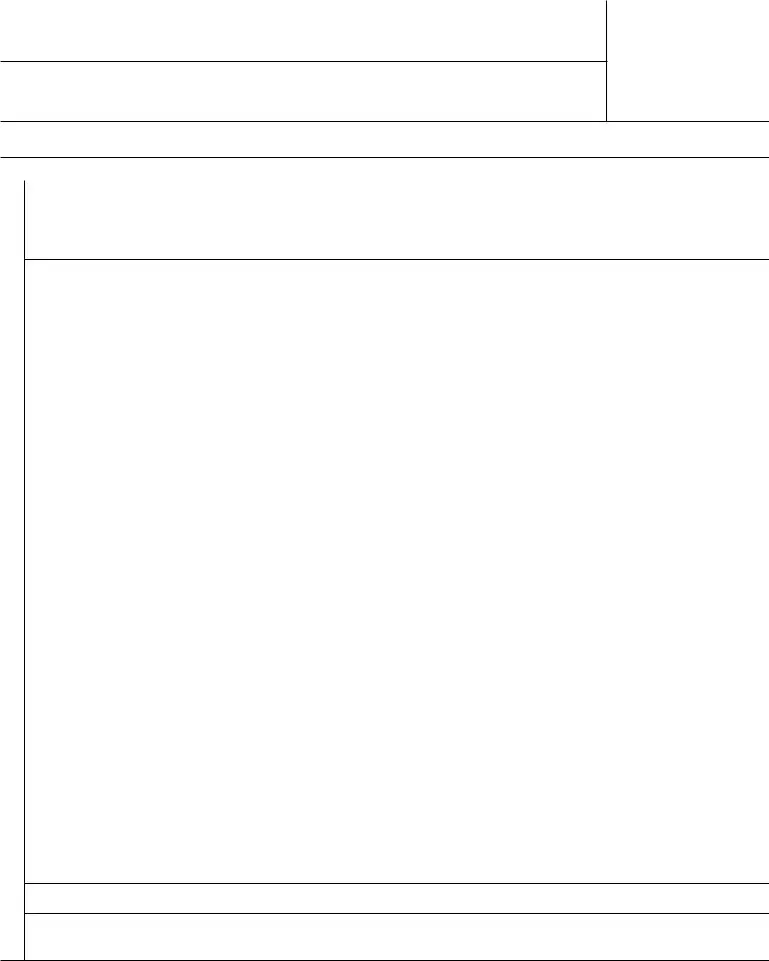

Form |

Page 2 of 7 |

|

|

|

(Do not write in this space) |

APPLICATION FOR BENEFITS UNDER A |

|

U.S. INTERNATIONAL SOCIAL SECURITY AGREEMENT |

|

If the worker is living, this application should be completed by or on behalf of the worker. If the worker is deceased, this application should be completed by one of the worker's survivors who is claiming benefits under the provisions of the international social security agreement.

PART 1

Complete Part 1 in all cases.

1. (a) Print name of worker (First name, middle initial, last name) |

(b) U.S. Social Security Number |

|

|

2.Provide the following information about the worker's social security credits (coverage) and last place of residence in the foreign country.

(a)Use columns (1) - (5) to enter information about the worker's periods of employment or

(1) Dates Worked |

(2) Name and Address of |

(3) Type of Industry |

(4) Social Insurance |

(5) Name of Agency to |

(From - To) |

employer or |

or business |

Number used |

which contributions paid |

|

activity |

|

while working |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b)Use columns (1) - (4) to enter information about the worker's periods of coverage under the foreign social insurance system which are not based on employment or

(1) Dates Covered |

(2) Type of coverage |

(3) Social Insurance |

(4) Name of Agency to which |

(From - To) |

|

Number used for this |

contributions paid (if any) |

|

|

coverage if different than |

|

|

|

shown in item 2(a)(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c) Enter the worker's last place of residence in the foreign country:

(City and State or Province)

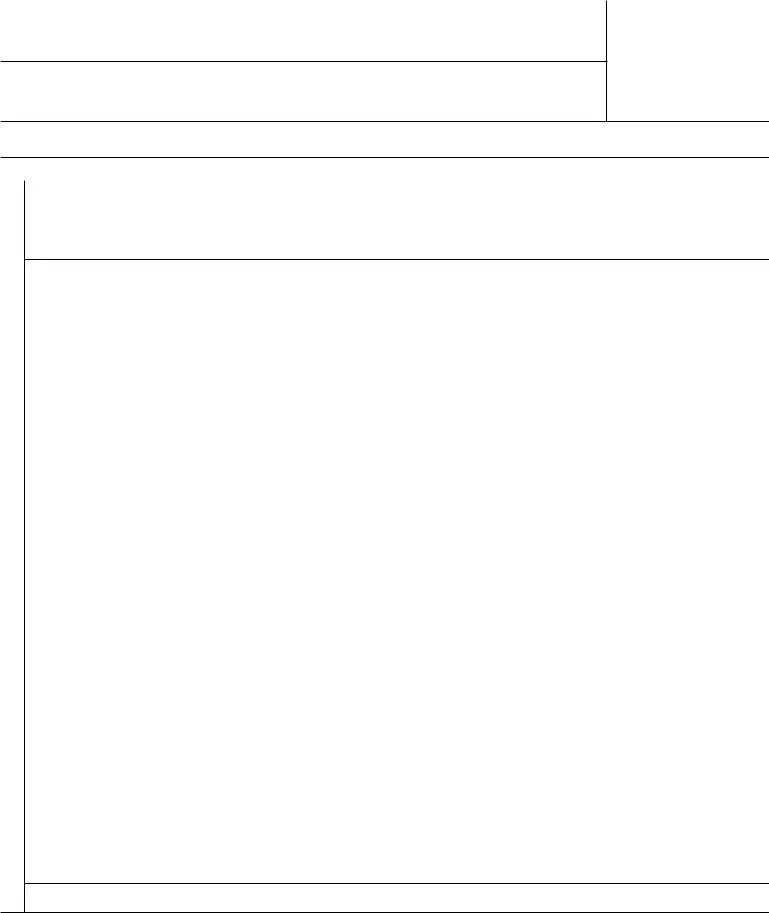

Form |

Page 3 of 7 |

|

|

3. I apply for all benefits for which I am eligible under the provisions of the social |

Name of country |

security agreement between the United States and |

|

|

|

4.This application may be used to claim benefits from the U.S. and/or the foreign country shown in item 3. Check (X) the block(s) indicating the type of benefit(s) for which you are applying under the country(ies) from which you are claiming the benefit(s).

BENEFIT CLAIMED FROM FOREIGN COUNTRY Type of Benefit Claimed From Foreign Country:

Survivors |

None |

|

|

||

Disability or Sickness/Invalidity |

Other (Specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BENEFIT CLAIMED FROM THE UNITED STATES |

|

|

|

|

|

|

|

|

|

|

|

(a) Are you presently receiving benefits from the United States? |

Yes |

No |

|||

|

|

|

(If "Yes" answer |

(If "No" answer |

|

|

|

|

(b) below.) |

(c) below.) |

|

|

|

|

|

|

|

(b) If you are already receiving U.S. benefits, do you wish to file for a different |

Yes |

No |

|||

type of U.S. benefit? |

|

|

|||

|

|

|

|

|

|

|

|

|

(If "Yes" answer |

(If "No" go on |

|

|

|

|

(d) below.) |

to item 5.) |

|

|

|

|

|

|

|

(c) If you are not presently receiving U.S. benefits, do you wish to file |

Yes |

No |

|||

for U.S. benefits at this time? |

|

|

(If "Yes" answer |

(If "No" go on |

|

|

|

|

|||

|

|

|

(d) below.) |

to item 5.) |

|

(d) Indicate the type of benefit you wish to claim from the United States:

Retirement |

|

Disability |

|

Survivors |

|

|

|

|

|

INFORMATION ABOUT THE WORKER

5. (a) Print worker's name at birth, if different from item 1(a)

(b) Check (X) one for the worker |

(c) Enter worker's social insurance number in the foreign country if different than |

|

Male |

Female |

shown in items 2(a)(4) or 2(b)(3) |

|

||

|

|

|

(d)If the worker's Social Security number in either the United States or the foreign country is not known, enter the worker's parents' names:

Mother's name (First name, middle initial, last name, maiden name)

|

Father's name (First name, middle initial, last name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(e) Enter the worker's citizenship (Enter name of country) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Do you want this application to protect an eligible spouse's and/or child's right |

|

|

|

Yes |

|

No |

|

|

|

|

|

||||

|

to Social Security benefits? |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. (a) Was the worker or any other person claiming benefits on this application a |

|

|

|

Yes |

|

No |

|

|

|

|

|

||||

|

refugee or stateless person at any time? |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

(If "Yes" answer |

(If "No" go on |

|||||

|

|

||||||

|

|

(b) below.) |

to item 8.) |

||||

|

|

|

|

|

|

|

|

|

(b) If "Yes" enter the following information about the person: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Dates of refugee or stateless status |

||||

|

|

|

|

|

|

|

|

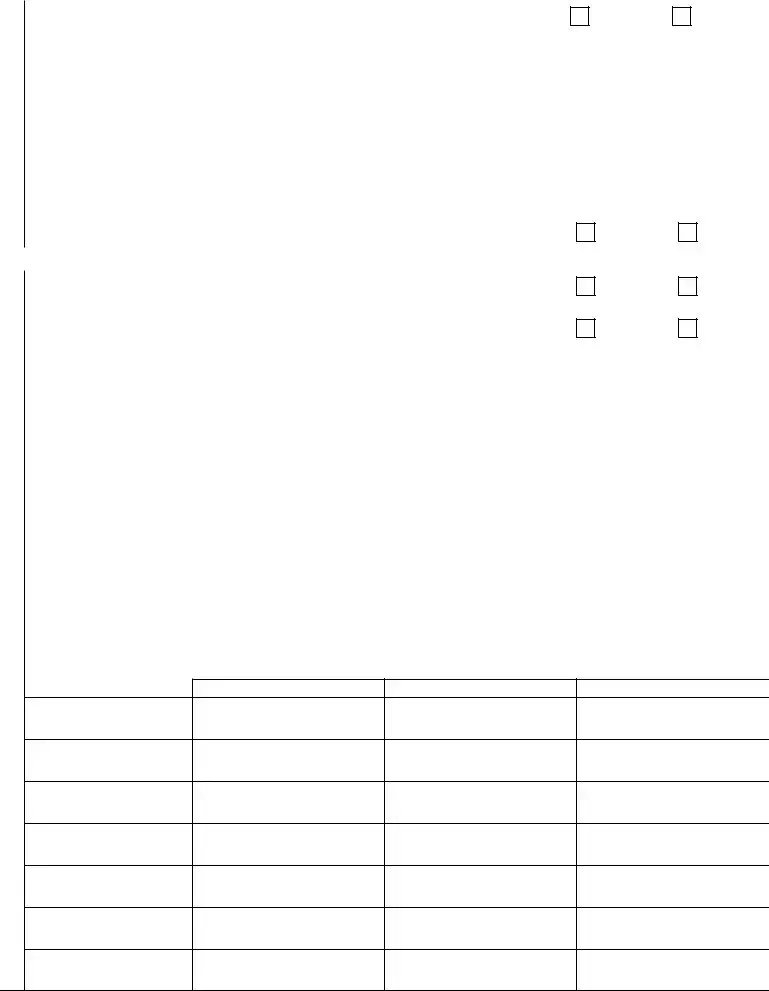

Form |

Page 4 of 7 |

|

|

PART 2

Complete Part II ONLY if you are claiming benefits from a foreign country.

8.If you are applying for sickness or disability/invalidity benefits, enter the date you became disabled. Date (MM/DD/YYYY) Otherwise enter ''N/A.''

9. (a) If you are applying for |

|

|

Yes |

|

No |

||

|

|

|

|||||

|

do you plan to stop working? |

|

|

|

|||

|

|

|

|

|

|

|

|

|

(If "Yes" answer |

(If "No" go on |

|||||

|

|

||||||

|

|

(b) below.) |

to item 10.) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Date (MM/DD/YYYY) |

||

|

(b) If ''Yes,'' enter the date you stopped or plan to stop working. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. (a) Are you applying for foreign social security benefits under a special |

|

|

Yes |

|

No |

||

|

|

|

|||||

|

system that covers a specific occupation (e.g., miners, seamen, farmers)? |

|

|

|

|||

|

|

|

|

|

|

|

|

|

(If "Yes" answer |

(If "No" go on |

|||||

|

|

||||||

|

|

(b) and (c) below.) |

to item 11.) |

||||

|

|

|

|

|

|

|

|

|

(b) What was your occupation in the foreign country? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c) Did you perform the same type of work in the U.S? |

|

|

Yes |

|

No |

|

|

|

|

|

||||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

INFORMATION ABOUT THE APPLICANT

Complete item 11 ONLY if you are not the worker. If you are the worker, leave this question blank and go on to item 12.

11. |

(a) Print your name (First name, middle initial, last name, maiden name) |

|

(b) What is your relationship to the |

||||||||

|

|

|

|

|

|

|

|

|

worker? |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(c) Enter your U.S. Social Security number |

|

(d) Enter your social insurance number in the foreign country |

||||||||

|

|

|

|

|

(if none or unknown, so indicate) |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

ADDITIONAL INFORMATION ABOUT THE WORKER |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|||||

12. (a) Enter worker's date of birth (MM/DD/YYYY) |

(b) Enter worker's place of birth (City, state, province, country) |

||||||||||

|

|

|

|

|

|

|

|

||||

13. If the worker is deceased, enter the date |

(a) Date (MM/DD/YYYY) |

(b) Place (City, state, province, country) |

|

||||||||

|

and place of death |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

14. (a) Was the worker in the active military or naval service of the U.S. |

|

Yes |

No |

||||||||

|

(including U.S. reserve or U.S. National Guard active duty for training) or |

|

|||||||||

|

|

|

|

|

|||||||

|

a foreign country after September 7, 1939? |

|

|

|

|

|

(If "Yes" answer |

(If "No"go on to |

|||

|

|

|

|

|

|

|

|

|

(b) thru (c) below.) |

item 15.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) Enter the name of country served |

Country |

|

|

|

|

|

Dates of Service |

|

||

|

and dates of service: |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

FROM: (MM/DD/YYYY) |

TO: (MM/DD/YYYY) |

|||

|

|

|

|

|

|

|

|

||||

|

(c) Has anyone (living or deceased) received, or does anyone expect to |

|

Yes |

No |

|||||||

|

receive, a benefit from any U.S. Federal agency based on the worker's |

|

|||||||||

|

|

|

|

|

|||||||

|

military or naval service? |

|

|

|

|

|

(If "Yes" answer |

(If "No" go on |

|||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

(d) below |

to item 15 |

|

(d)If ''Yes'' enter the following information for each person: (If additional space is required, enter the information in Remarks

|

Name |

U. S. Agency |

Claim No. |

|

|

|

|

|

|

|

|

|

|

|

|

Form |

|

|

Page 5 of 7 |

||

|

|

|

|

|

|

15. (a) During the past 24 months, did the worker engage in employment or |

|

Yes |

No |

||

|

|

||||

|

|

|

|

||

|

|

|

(If "Yes" answer |

(If "No" go on |

|

|

|

|

(b) and (c) below.) |

to item 16.) |

|

|

|

|

|

||

|

List the periods of work covered by the U.S. Social Security system and the name and address of the employer or self- |

||||

|

employment activity |

|

|

|

|

|

|

|

|

|

|

|

(b) Name and address of employer or |

|

Work Began |

|

Work Ended |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c) May we ask any employer listed above for wage information needed to |

Yes |

No |

||||

|

process this claim? |

|

|

|

|

||

|

|

|

|

|

|

|

|

INFORMATION ABOUT DEPENDENTS FOR WHOM BENEFITS ARE CLAIMED |

|

|

|||||

|

|

|

|

|

|

|

|

16. |

|

|

Under age 18 |

Yes |

No |

||

|

|

|

|||||

|

(a) Are there any children of the worker who are now, or were in the |

|

OR |

|

|

|

|

|

|

|

|

|

|||

|

past 12 months, unmarried and: |

|

Age 18 or over and a |

Yes |

No |

||

|

|

|

student or disabled |

||||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

If either block is checked "Yes", enter the information for each child. NOTE: Children include natural children, |

||||||

|

and adopted children plus grandchildren living in the same household as the worker. |

|

|

||||

|

|

|

|

|

|

|

|

|

(b) Name of child |

(c) Relationship to worker |

(d) Sex |

(e) Date of birth |

|||

|

(M or F) |

(MM/DD/YYYY) |

|||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17.The spouse, widow or widower of the worker may be eligible for a benefit. In addition, a former spouse of the worker may be eligible as a divorced spouse, widow or widower. Provide the following information about any spouse or former spouse of the

worker. |

SPOUSE |

FORMER SPOUSE |

FORMER SPOUSE |

|

(a)Name (including maiden name)

(b)Date of Birth (MM/DD/YYYY)

(c)Date of Marriage (MM/DD/YYYY)

(d)Date of Divorce (if any) (MM/DD/YYYY)

(e)Country of Citizenship

(f)Social Insurance Number in foreign country

(g)U. S. Social Security Number (if any)

Form |

|

Page 6 of 7 |

|

|

|

|

|

18. (a) Has the worker, or any other person listed on this application, ever previously |

Yes |

No |

|

applied for U.S. Social Security benefits or social insurance benefits from the |

(If "Yes" answer |

(If "No" go on |

|

country shown in item 3 of this application? |

|||

(b) thru (f) below.) |

to item 19.) |

||

|

If "Yes" enter the information requested for each person. I (If additional space is required, enter the information in Remarks

(b) Name |

(c) Type of benefit (e.g., Retirement) |

(d) Claim Number

(e)Amount of benefit (if benefit awarded)

(f) Agency which approved or denied claim

19.

REMARKS (You may use this space for any explanations. If you need more space, attach a separate sheet.)

Paperwork Reduction Act Statement

This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take about 30minutes to read the instructions, gather the facts, and answer the questions. SEND

THE COMPLETED FORM ALONG WITH ANY EVIDENCE TO YOUR LOCAL SOCIAL SECURITY OFFICE. The office is listed under U. S. Government agencies in your telephone directory or you may call Social Security at

Form |

Page 7 of 7 |

|

|

Privacy Statement

Collection and Use of Personal Information

Sections 205(a), 205(c)(2), and 233 of the Social Security Act, as amended, authorize us to collect this information. We will use the information you provide to determine potential eligibility for receiving benefits under an international agreement on social security or to determine if we need additional information to support any claims.

Furnishing this information is voluntary. However, failing to provide all or part of the information may prevent an accurate and timely decision on any claims. We rarely use the information you supply us for any purpose other than for the reasons explained above. However, we may use the information for the administration of our programs including sharing information:

1.To comply with Federal laws requiring the release of information from our records (e.g., to the Government Accountability Office and Department of Veterans Affairs); and,

2.To facilitate statistical research, audit, or investigative activities necessary to ensure the integrity and improvement of our programs (e.g., to the Bureau of the Census and to private entities under contract with us).

A complete list of when we may share your information with others, called routine uses, is available in our Privacy Act System of Record Notice entitled, Earnings Records and Self Employment Income System,

We may share the information you provide to other health agencies through computer matching programs. Matching programs compare our records with records kept by other Federal, State or local government agencies. We use the information from these programs to establish or verify a person’s eligibility for federally funded or administered benefit programs and for repayment of incorrect payments or delinquent debts under these programs.

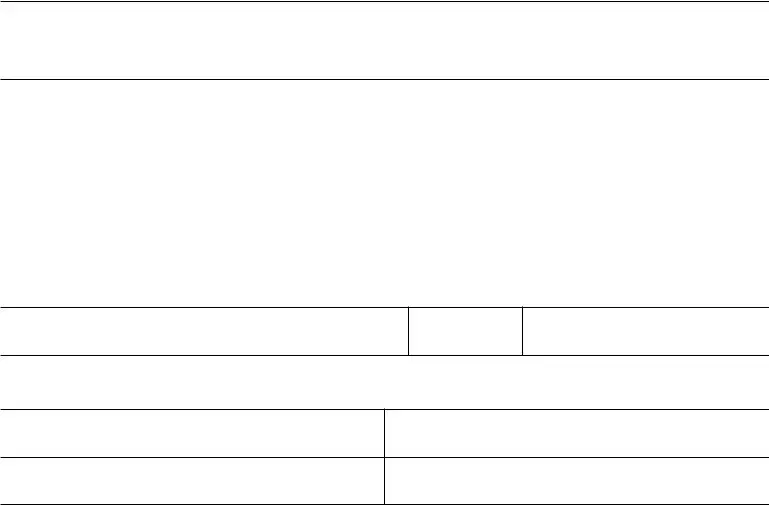

I hereby authorize the United States to furnish to the competent social insurance agency of the other country all of the information and evidence in its possession which relates or could relate to this application for benefits. I also authorize the agency(ies) of the other country to furnish the Social Security Administration or a United States Foreign Service post all of the information and evidence in its possession which relates to this application for benefits.

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge. I understand that anyone who knowingly gives a false or misleading statement about a material fact in this information, or causes someone else to do so, commits a crime and may be sent to prison, or may face other penalties, or both.

SIGNATURE OF APPLICANT |

Date (MM/DD/YYYY) |

|

|

|

|

Signature (First name, middle initial, last name) (Write in ink) |

Telephone number(s) at which you may be |

|

contacted during the day (include Area Code) |

|

|

Mailing Address (Number and street, Apt. No., P.O. Box, or Rural Route) (Enter resident address in "Remarks" if different)

City and State

ZIP Code

Country (if any) in which you now live

Witnesses are required ONLY if this application has been signed by mark (X) above. If signed by mark (X), two witnesses to the signing who know the applicant must sign below, giving their full addresses. Also, print the applicant's name in the Signature block.

1. Signature of Witness

2. Signature of Witness

Address (Number and street, City, State, and ZIP Code)

Address (Number and street, City, State, and ZIP Code)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The SSA-2490-BK is used to apply for benefits under U.S. international social security agreements. |

| Eligibility | Eligible applicants include workers, their survivors, or representatives claiming on behalf of the worker. |

| International Coverage | This form gathers information on the worker’s social security credits from both U.S. and foreign countries. |

| Governing Law | This form complies with the provisions set forth in various international social security agreements. |

| Documentation Requirement | Applicants must provide detailed employment history and social insurance information on the form. |

| Version Information | The current version of the SSA-2490-BK is dated May 2017, indicating the latest updates and revisions. |

Guidelines on Utilizing Ssa 2490 Bk

Filling out Form SSA-2490-BK is straightforward, but it requires attention to detail. This form is essential for individuals seeking benefits under international social security agreements. Make sure to provide accurate information as it affects your eligibility for benefits. Once the form is completed and signed, it is vital to attach the necessary documents and send the application to the appropriate agency.

- Start with Part 1: Fill in your name (First, middle initial, last) and your U.S. Social Security Number.

- Provide information about social security credits:

- List the dates worked in the foreign country and detail the employer, type of industry, social insurance numbers, and the agency to which contributions were paid. Repeat for any non-employment coverage.

- Record the last place of residence: Enter the city and state or province of residence in the foreign country.

- Specify the country for benefits: Clearly state the country related to the social security agreement from which you are applying.

- Indicate types of benefits claimed: Mark the checkboxes for retirement, disability, or survivors benefits, both from the foreign country and the U.S.

- Provide personal details of the worker: Enter their name at birth if different, gender, foreign social insurance number, citizenship, and parent’s names if necessary.

- Assess if the application protects dependents: Answer whether the application should protect an eligible spouse’s and/or child’s rights to benefits.

- Address specific circumstances: Indicate whether the worker or anyone else has been a refugee or stateless person, and fill in corresponding details if applicable.

- Complete additional information: If applicable, provide the worker's date and place of birth, as well as date and place of death if deceased.

- Military service questions: Note if the worker had military service after September 7, 1939, and provide the relevant country served and dates.

- Employment history: Describe any U.S. employment in the past 24 months, providing employers' names and addresses.

- Information about dependents: List any children and their details as required, along with information about any spouses or former spouses.

What You Should Know About This Form

What is the SSA-2490-BK form used for?

The SSA-2490-BK form is an application for benefits under a U.S. International Social Security Agreement. It enables workers who have lived or worked in a foreign country to apply for benefits from both the United States and that country. This form is necessary whether the worker is alive or deceased. In the case of a deceased worker, a survivor can submit the application on their behalf.

Who should complete the SSA-2490-BK form?

The form should be completed by or on behalf of the worker if they are living. If the worker is deceased, a survivor claiming benefits must fill out the application. The survivor may include a spouse, child, or anyone eligible to receive payment from the deceased worker’s benefits.

What information is required on the form?

The SSA-2490-BK form requires several key pieces of information. Applicants must provide the worker's name, Social Security number, periods of employment or self-employment in the foreign country, and details about their social security credits. This includes the names and addresses of employers, the type of industry, and any social insurance numbers used. The form also asks for information about children of the worker and any spouse or former spouse details relevant to the claim.

Are there any specific parts of the form that need to be completed based on the applicant’s situation?

Yes, the form has distinct parts that need to be filled out based on whether the application is for a living worker or the survivor of a deceased worker. Additionally, Part 2 should only be completed if the applicant is claiming benefits from a foreign country. Specific questions probe into the type of benefit requested, work history, and whether any periods of disability are relevant to the claim.

What should I do once I have completed the SSA-2490-BK form?

After filling out the SSA-2490-BK form thoroughly, you should remove the first page, which is intended as an instruction page. Attach the completed application to any required documents and then submit it according to the instructions provided by the Social Security Administration. Ensure all information is accurate to avoid delays in processing your application.

Common mistakes

When completing the SSA-2490-BK form, many individuals make simple yet significant mistakes that can complicate their application process. A common error is failing to provide complete information in Part 1. This section requires the worker’s name, Social Security number, and details about employment. Each of these elements is vital for the Social Security Administration to process benefits accurately. Omitting any information, even something seemingly minor, can lead to delays.

Another frequent oversight involves misunderstanding the sections regarding foreign employment. Workers often skip filling out the columns related to periods of employment or self-employment in a foreign country. This information is essential. Additionally, if there are periods of coverage under a foreign social insurance system, applicants might fail to report that data, which could affect their eligibility for benefits.

Many applicants neglect to carefully read the instructions accompanying the form. Each section has specific requirements and examples that can guide completion. For instance, misunderstanding the type of coverage or benefit being applied for can lead to incorrect information. It is crucial to check the boxes accurately and understand the implications of each selection.

Another common mistake occurs in the applicant information section. Applicants sometimes provide inaccurate information about their relationship to the worker or fail to include necessary details like Social Security numbers. Such inaccuracies can kick back the application or cause additional investigation, leading to longer wait times for benefits.

Finally, applicants often forget to double-check their form for clarity and completeness before submission. Handwriting should be clear, and all required fields must be filled in. Using proper formatting, such as consistently entering dates in MM/DD/YYYY format, helps ensure a smooth processing experience. Carefully reviewing the form minimizes the risk of errors and can significantly speed up the benefit application process.

Documents used along the form

When applying for benefits under international social security agreements, certain forms and documents are commonly submitted alongside Form SSA-2490-BK. Each of these documents plays an important role in supporting your application and ensuring that all relevant information is captured.

- SSA-827: This is the Authorization to Disclose Information to the Social Security Administration form. It gives the SSA permission to obtain necessary medical and other information from your healthcare providers.

- SSA-3367: This form is utilized for the Request for Hearing by Administrative Law Judge. If your application is denied, this form allows you to request a hearing to appeal the decision.

- SSA-H-2: This is the Application for Benefits under a Totalization Agreement. It is specifically used by individuals who have work credits in both the U.S. and a foreign country, ensuring that credits from both countries can be combined to qualify for benefits.

- W-2 Forms: You will typically need to submit your W-2 forms from previous employment. These forms provide financial information necessary to establish your work history in the U.S.

- Proof of Citizenship: It is essential to provide documentation that verifies your citizenship status, such as a birth certificate or passport. This supports your eligibility for benefits under U.S. agreements.

Each of these documents contributes to the robustness of your application for international social security benefits, helping to ensure a smoother processing experience. Ensure complete and accurate submission to avoid delays in your benefits claim.

Similar forms

The Form SSA-2490-BK is a crucial document for individuals applying for benefits under international social security agreements. It has several counterparts and similar forms that share some features. Here are eight documents comparable to Form SSA-2490-BK and a brief explanation of their similarities:

- Form SSA-1: This form serves as an application for Social Security benefits based on disability, retirement, or survivors. Both forms require basic personal information and details regarding eligibility and benefits sought.

- Form SSA-4: Known as the Application for Child’s Insurance Benefits, this form is used by a child's guardian to apply for benefits. Much like the SSA-2490-BK, it includes information about the worker and the dependent child.

- Form SSA-10: This application is used for getting benefits on a parent’s Social Security record. Similar to SSA-2490-BK, it asks for personal identifying details and eligibility criteria of the applicant.

- Form SSA-827: This form is a medical release used when applying for Social Security Disability benefits. Both forms can require submitting supporting documents regarding work history and medical conditions that could affect benefit eligibility.

- Form SSA-3441: This is a disability update report. It shares with SSA-2490-BK the goal of ensuring that eligible individuals receive benefits, and it also collects information on medical conditions and work history.

- Form SSA-788: This is a response to the request for information regarding an application for benefits. It has a similar purpose where verifying eligibility is fundamental.

- Form SSA-3373: This is a function report that gathers information about an individual's daily activities. Similar to SSA-2490-BK, it focuses on personal situations that could affect a claim.

- Form SSA-7050: This is a request for a Social Security earnings and benefits statement. Both forms require comprehensive details about employment history and how that relates to the applicant’s benefits.

When completing any of these forms, ensuring accurate and complete information is essential to facilitate the processing of claims and benefits.

Dos and Don'ts

When filling out the SSA-2490-BK form, it’s crucial to be careful and mindful of the details. Here’s a list to guide you on what to do and what to avoid:

- Do: Carefully read the entire form before beginning to fill it out.

- Do: Use black or blue ink for legibility.

- Do: Print clearly, especially when entering names and numbers.

- Do: Double-check all answers for accuracy before submitting.

- Do: Include your Social Security Number as instructed.

- Don’t: Leave any sections blank; if a question doesn’t apply, write 'N/A'.

- Don’t: Use abbreviations; write out full names and terms.

- Don’t: Forget to sign and date the application before submission.

- Don’t: Submit without making sure you’ve attached any required documents.

- Don’t: Assume the application is correct without reviewing it multiple times.

Taking the time to follow these guidelines can help ensure that your application is processed swiftly and accurately.

Misconceptions

Misconceptions about the SSA-2490-BK form can lead to confusion during the application process for benefits under a U.S. international social security agreement. Here are seven common misconceptions, along with explanations to clarify them.

- The form can only be filled out by the worker themselves. This is not true. If the worker is deceased, a survivor can complete the application on their behalf.

- All sections of the form must be completed regardless of the circumstances. While some parts are mandatory, only Part II needs to be completed if claiming benefits from a foreign country.

- The SSA-2490-BK only applies to retirement benefits. This form can also be used to claim disability, survivor benefits, and other support types under international agreements.

- Only workers with a U.S. Social Security Number can apply. Workers who have social insurance numbers in other countries may still be eligible to use this form.

- Previous editions of the form can still be used. It is important to use the current version of the SSA-2490-BK, as earlier editions may not be accepted.

- Submitting the application guarantees benefits approval. Completing the SSA-2490-BK does not guarantee benefits; eligibility is determined through additional review processes.

- Once the form is submitted, no further information can be provided. Applicants may be contacted for additional details or clarification as necessary even after the application has been filed.

Understanding the accurate use of the SSA-2490-BK form creates a smoother process for claiming benefits. Make sure to follow the instructions carefully and provide all required information for the best chances of success.

Key takeaways

Filling out the SSA-2490-BK form is a crucial step in applying for benefits under a U.S. international social security agreement. Here are key takeaways to guide you through the process:

- Understand Who Should Complete the Form: The worker, or a survivor if the worker is deceased, must complete the application.

- Complete All Required Information: Part 1 must be filled out in all cases, including personal identification and social security credit details.

- Use Provided Columns Wisely: Ensure you accurately provide information about periods of employment or self-employment in a foreign country using the designated columns.

- Provide Extra Information When Needed: If more space is needed for employment records, use the Remarks section in Item 19 to continue your descriptions.

- Be Clear About Benefit Claims: You can claim benefits from both the U.S. and foreign countries; mark the appropriate benefits you're applying for in the form.

- Check Eligibility for a Spouse or Child: Indicate if you wish to protect a spouse's or child's rights to benefits as part of your application.

- Mention Military Service: If the worker has military service, this information must be included as it may affect eligibility.

- Gather Necessary Supporting Documents: Collect any required documents ahead of time to expedite the process, like Social Security numbers or employment records.

- Submit the Correct Version: Only use the most current version of the form and remove page 1 after filling it out as instructed.

By keeping these points in mind, you will navigate the SSA-2490-BK form more confidently and accurately, paving the way for potential benefits under international agreements.

Browse Other Templates

What Gpa Do You Need to Get Into Clark Atlanta University - Vendor space is limited, so early application submission is encouraged.

Exclusive Listing - This agreement aims to create a collaborative environment during property searches.