Fill Out Your Ssa 455 Ocr Sm Form

The SSA 455 OCR SM form, often referred to as the Disability Update Report, plays a crucial role in the ongoing assessment of individuals receiving Social Security disability benefits. Each individual’s case is regularly reviewed by the Social Security Administration (SSA) to confirm that they continue to meet the criteria for disability. Within this form, recipients provide vital information about their current health status, any recent medical treatments, and details about work activities or training undertaken during a specified report period. Completing the form is not just a requirement; it helps the SSA decide whether a full medical review is necessary. Accuracy in the information provided is essential, as failure to respond or complete the report could lead to a suspension of benefits. Additionally, the form outlines how recipients can seek assistance if they find any of the questions confusing, ensuring that support is available throughout the process. Timeliness is of the essence; the completed report must be returned to the SSA within 30 days to avoid potential interruptions in payment. Understanding this form and its implications can empower individuals as they navigate the often complex landscape of disability benefits.

Ssa 455 Ocr Sm Example

Social Security Administration

Disability Update Report

Information and Completion Instructions

Why We Are

Writing To

You Now

The Social Security Administration must regularly review the cases of people getting disability beneits to make sure they are still disabled

under our rules. It is time for us to review this case. Enclosed is a Disability Update Report for you to answer to update us about

you (or the person for whom you are the representative payee), your health and medical conditions, any recent work activity, or any recent

training.

What To |

Please read the following information, and the instructions for |

|

Do First |

completing the report form, before you answer the questions. |

|

|

||

|

|

|

When to |

Please complete the report, sign it and send it to us in the enclosed |

|

Respond |

envelope within 30 days. If there is no return envelope with the report, |

|

please send the signed report to us at: |

||

|

||

|

Social Security Administration |

|

|

P.O. Box 4550 |

|

|

||

|

|

|

What We Do |

We consider the information you give us together with the information |

|

With Your |

in your claim record to decide if we need to do a full medical review. |

|

After we receive the completed report, we will notify you whether or not |

||

Answers |

||

we need to do a full medical review. |

||

|

|

|

If You Need |

It is important that information you give us is accurate. We have tried |

|

Help To |

to make report questions easy to understand and answer. But, if you |

|

ind that you do not understand a question or questions, please contact |

||

Answer The |

||

us, your authorized representative, a social service agency, your doctor |

||

|

||

Report |

or clinic, or some other person you trust. |

|

|

|

|

If You Need |

If you need to contact us, please call us |

|

To Contact |

or TTY for the hearing impaired at |

|

most questions over the telephone. If you prefer to visit or call one of |

||

Us |

||

our ofices, please use the 800 number to get the local ofice address |

||

|

and telephone number. Please have the Disability Update Report with |

|

|

you if you call or visit an ofice. It will help us answer your questions. |

|

|

Also, if you plan to visit an ofice, you should call ahead to make an |

|

|

appointment. This will help us serve you. |

|

|

|

|

We May Need |

Sometimes, we may need more information from you. If so, we will try |

|

To Contact |

to call you. If you do not have a telephone, please give us a number |

|

where we can leave a message for you. Please print the telephone |

||

|

||

You |

number in the section provided on the back of the report form. |

If We Don’t Hear From You

If you do not complete and return the report promptly, or tell us why you cannot respond, we may stop sending payments to you. If it is necessary to stop your payments, we will send you another letter telling you what we plan to do.

FORM |

Continued on the Reverse |

If We Do A

Full Medical

Review

If we decide to do a full medical review of your case, you can give us any information which you believe shows that you are still disabled,

such as medical reports and letters from your doctors about your health. Then, we look at all your information in your case, including the

new information you give us, and decide whether you continue to be disabled under our rules.

Appeals And |

When we review your case, we may ind that you are no longer disabled |

|

Continued |

under our rules, and your payments may stop. If your payments stop, |

|

Beneits |

you can appeal our decision or you can ask us to continue to make |

|

payments while you appeal. |

||

|

||

|

|

|

If You Want |

Do you want to work, but worry about losing your payments or |

|

To Work |

Medicare before you can support yourself? We want to help you go to |

|

work when you are ready. But, work and earnings may affect your |

||

|

beneits. Your local Social Security ofice can tell you more about work |

|

|

incentives, and how work and earnings can affect your beneits. |

The Privacy

And

Paperwork

Reduction

Acts

Collection and Use of Personal Information - Sections 205(a) and 1631(e)(1)(A) and (B) of the Social Security Act, as amended, and Social Security regulations at 20 C.F.R. 404.1589 and 416.989 authorize us to collect this information. We will use the information you provide to

further document your claim and permit a determination about continuing disability.

The information you furnish on this report is voluntary. However, failure to provide us with the requested information could prevent us from making an accurate and timely decision on your

claim.

We rarely use this information you supply for any purpose other than for reviewing your claim for Social Security beneits. However, we may use it for the administration and integrity of Social

Security programs. We may also disclose information to another person or to another agency in accordance with approved routine uses, which include but are not limited to the following:

1.To enable a third party or an agency to assist Social Security in establishing rights to Social Security beneits and/or coverage;

2.To comply with Federal laws requiring the release of information from Social Security records (e.g., to the Government Accountability Ofice and Department of Veterans’ Affairs);

3.To make determinations for eligibility in similar health and income maintenance programs at the Federal, State and local level; and

4.To facilitate statistical research, audit, or investigative activities necessary to assure the integrity and improvement of Social Security programs.

We may also use the information you provide in computer matching programs. Matching programs compare our records with records kept by other Federal, State, or local government agencies. Information from these matching programs can be used to establish or verify a person’s eligibility for

or delinquent debts under these programs.

A complete list of routine uses for this information are available in our Systems of Records Notices entitled, Claims Folders Systems

notices, additional information regarding this form, routine uses of information, and our programs and systems are available online at www.socialsecurity.gov or at your local Social Security ofice.

Paperwork Reduction Act Statement– This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Ofice of Management and Budget (OMB) control number. The OMB control number for this collection is

comments relating to our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD

FORM |

2 |

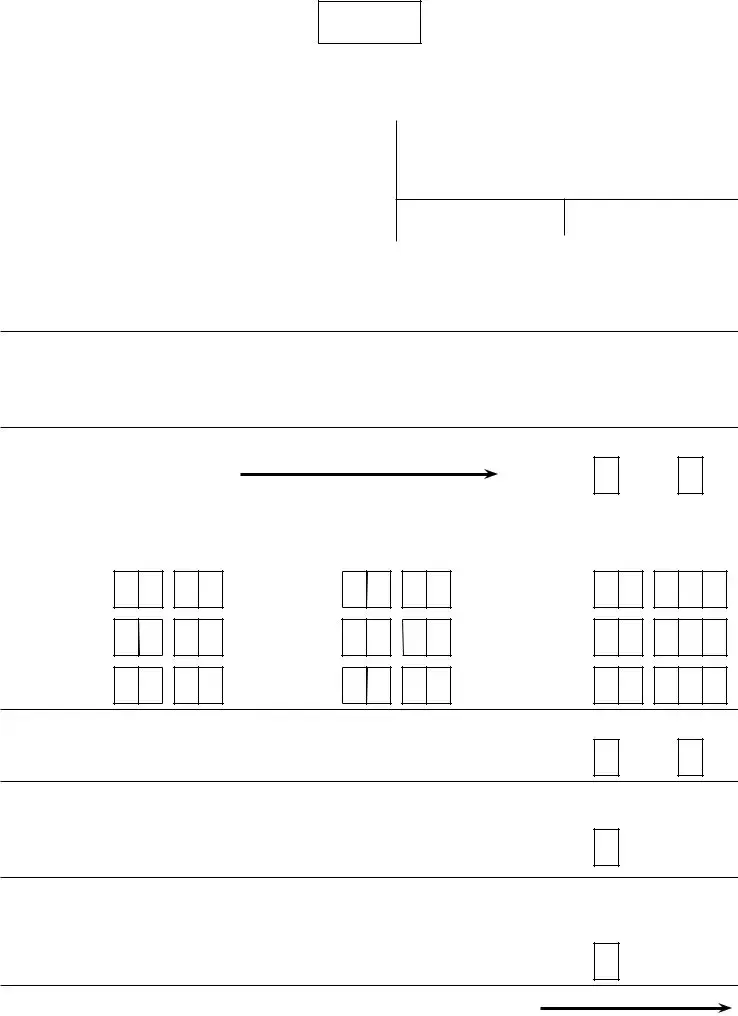

GENERAL INSTRUCTIONS

-HOW TO COMPLETE “SCANNABLE” FORMS

The Disability Update Report is a scannable form which can be “read” electronically. To help us process your report, please follow these instructions when you answer the questions on the report form:

1.USE BLACK INK OR A #2 PENCIL.

2.KEEP YOUR NUMBERS, LETTERS, AND “X’S” INSIDE THE BOXES.

3.NUMBERS: Try to make your numbers look like these:

0

1

1

2

2

3

3

4

4

5

5

6

6

7

7

8

8

9

9

4.LETTERS: Print in CAPITALS. Try to make your letters look like these:

A

B

B

C

C

D

D

E

E

F

F

G

G

H

H

I

I

J

J

K

K

L

L

M N

M N

O

O

P

P

Q

Q

R

R

S

S

T

T

U

U

V

V

W

W

X

X

Y

Y

Z

Z

5.MONEY AMOUNTS: Show dollars only. Do not use dollar signs

($), and do not show cents. For example, show $1,540.30 like this:

Dollars Only, No Cents

0 1 , 5

1 , 5 4

4 0

0

6.DATES: Put a number in each box. For example, show September

9, 2003, like this:

Month Year

0 9

9

0

0 3

3

7. THE REPORT PERIOD: The “report period” is the period of

|

|

time for which we need information. It is described at the top of |

|

|

|

the report form to the right of your name, and again in questions 1 |

|

|

|

through 6. Usually, the report period is the last 24 months, but it |

|

|

|

may be less. It is important that you keep the report period |

|

|

|

in mind when answering the questions. |

|

|

|

|

|

|

|

HOW TO FILL OUT THE REPORT FORM |

|

|

QUESTION 1.a. - |

If you have not worked during the report period, place an “X” in the |

|

|

Have You |

box below “NO”, and go on to question 2. If you have worked, mark the |

|

|

Worked? |

box below “YES”, and answer question l.b. |

|

|

|

|

|

|

QUESTION 1.b. - |

Describe your most recent work activity irst. Print the months |

|

|

When You |

and years you began and ended working in the boxes under “Work |

|

|

Worked And |

Began” and “Work Ended.” If you are working now, print the |

|

|

current month and year in the irst set of boxes under “Work Ended.” |

|

|

|

Your Monthly |

|

|

|

Print your gross monthly earnings for the periods you worked in the |

|

|

|

Earnings |

boxes. |

|

|

|

|

|

|

|

|

|

|

QUESTION 2 - |

Place an “X” in the box below “YES” if you have attended school and/or |

|

|

School Or Work |

a training program during the report period; otherwise, mark the box |

|

|

below “NO”. This could include high school equivalency programs, |

|

|

|

Training |

|

|

|

college courses, vocational evaluation or retraining programs, but |

|

|

|

|

|

|

|

|

generally would not include group therapy or hobbies. |

|

FORM |

3 |

Continued on the Reverse |

Tell us if you have discussed with your doctor whether you can return to any kind of work, and if so, whether the doctor told you that you can return to work, even if the work permitted is less physically demanding and/or less stressful than your usual work. Place an “X” in only 1 box.

We want to know how your overall health now compares to what it was

at the beginning of the report period. You may feel that your health has gotten worse, has improved, or you may feel that your health is about the same and has not gotten better or worse. Place an “X” in only 1 box.

A “doctor or clinic” can include treatment such as evaluations, checkups,

counseling, providing prescriptions or medicine by a doctor, visiting nurse, family health center, psychologist, licensed counseling service, physical therapist, a chiropractor or other licensed health provider. Treatment may be provided in person or by telephone or other contact.

If you have not been treated by a doctor or clinic during the report period, place an “X” in the box below “NO”, and go on to question 6. If you have gone to a doctor or clinic during the report period, mark the box below ‘’YES”, and answer question 5.b.

Please start with the most recent visit and then work backwards in time. Print as much information as will it, but keep a space between each word. Try to use the most important or key word(s), such as

ARTHRITIS or BAD BACK, or HYPERTENSION or HIGH BLOOD.

Your medical bills or doctor can provide a short, accurate description.

Print the month and year you were treated. Complete all 4 boxes. For example, print September 10, 2003, as 09 03.

NOTE: If needed, use the “REMARKS” section on side 2 of the form.

QUESTION 6.a -

Have You Been

Hospitalized Or

Had Surgery?

Question 6.b. -

Reason For

Treatment

Place an “X” in the box below “NO” if you have not been hospitalized or

not had surgery during the report period. If you have been hospitalized or had surgery during the report period, then place an “X” in the box below ‘’YES” and answer question 6.b.

Please report your most recent treatment irst and then work backwards in time. Try to provide the most important information. Keep a space between each word. Your medical bills or doctor can provide short, accurate words.

Date of Treatment

Print the month and year you were hospitalized or had surgery. Be sure to use all four spaces. If you were hospitalized more than one month, print last month you were hospitalized.

NOTE: If needed, use the “REMARKS” section on side 2 of the form.

Remarks Section

If you need more room to answer questions l.b., 5.b. and/or 6.b., or

there are any other facts or statements you want us to consider, place an “X” in the box and write in this section. If necessary, use an extra

piece of paper.

Signature, Date

and Telephone

Sections

Please sign the report form as you usually sign your name. Please provide a telephone number where you can be reached during the day.

FORM |

4 |

Printed on Recycled Paper |

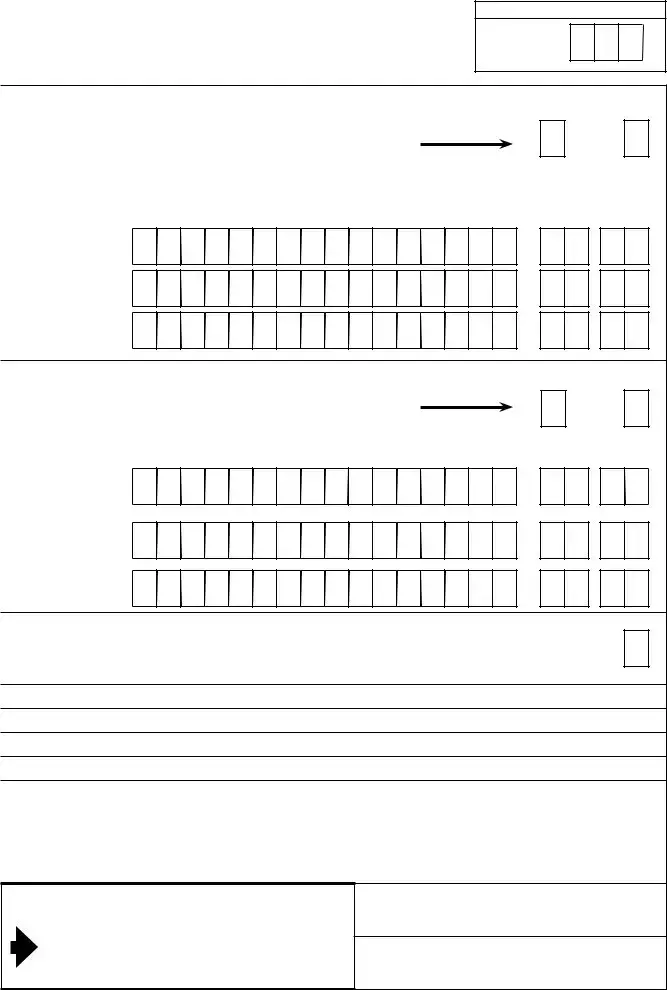

Disability Update*Report

DATE:

Social Security Administration, P.O. Box |

, |

FORM APPROVED |

||

OMB NO. |

||||

|

|

|

||

PAYEE’S NAME AND ADDRESS |

|

REPORT PERIOD |

|

|

|

|

From: |

To The Present |

|

|

|

|

||

|

|

|

|

|

|

|

BENEFICIARY |

|

|

PSC:

TELEPHONE NUMBER

CLAIM NUMBER

Please be sure to use black ink or a #2 pencil to print your answers. Also, read the enclosed instructions before completing the form. Finally, remember that when answering the questions, the “REPORT PERIOD” for

which we need information about you is fromto the present. If you have any questions, call

1. a. Since |

have you worked for someone |

or been

YES NO

b. If you answered “YES” to 1.a., please complete the information below.

WORK BEGAN |

WORK ENDED |

MONTHLY EARNINGS |

||

Month |

Year |

Month |

Year |

Dollars Only, No Cents |

Most

Recent

Work

1.

2.

3.

$

$

$

,

,

,

2. Have you attended any school or work training program(s)

since?

YES NO

3. Since |

to the present...(Please place an ‘X’ in one box only): |

|||

|

|

my doctor and I |

|

my doctor |

|

|

|

||

|

|

have not discussed |

|

told me I |

|

|

whether I can work. |

|

cannot work. |

my doctor told me I can work.

4. Place an “X” in only one box which best describes your health

now as compared to |

. |

|

|

||

|

|

BETTER |

|

|

SAME |

|

|

|

|

||

WORSE

Form |

Continued on the Reverse |

FOR SSA USE ONLY

AC?

5. a. Have you gone to a doctor or clinic for treatment

(including evaluations, checkups, counseling, |

|

|

prescriptions, or medicine) since |

? |

|

b. If you answered “YES” to 5.a., please list: |

|

|

|

Reason For Visit: |

|

Most |

|

|

Recent |

1. |

|

Visit |

|

|

|

|

|

|

2. |

|

|

3. |

|

YES NO

Month Year

6. a. Have you been hospitalized or had surgery

since?

b. If you answered “YES” to 6.a., please list:

YES NO

Reason For Hospitalization or Surgery: |

Month |

Year |

Most

Recent

1.

2.

3.

REMARKS: If you use this space to further answer questions 1. through 6., place an “X” in the box to the right and print on the lines below.

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge. I understand that anyone who knowingly gives a false or misleading statement about a material fact in this information, or causes someone else to do so, commits a crime and may be sent to prison, or may face other penalties, or both.

SIGN HERE |

TODAY’S DATE |

|

|

|

TELEPHONE NUMBER (include Area Code) |

Form |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the Form | The SSA 455 OCR SM form is used to update the Social Security Administration (SSA) on an individual's health, work activity, and training to assess ongoing disability eligibility. |

| Submission Deadline | Individuals must complete and return the form within 30 days of receipt to avoid disruptions in disability payments. |

| Contact Information | If assistance is needed, individuals can call the SSA toll-free at 1-800-772-1213 or TTY at 1-800-325-0778 for support. |

| Importance of Accuracy | Accurate information is crucial. Failure to provide the required information may lead to delays or cessation of benefits. |

| Hospitalization Reporting | Individuals must report any hospitalizations or surgeries that happened during the report period to ensure their case is thoroughly evaluated. |

| Applicable Laws | The information collection is authorized under Sections 205(a) and 1631(e)(1)(A) of the Social Security Act and related regulations. |

Guidelines on Utilizing Ssa 455 Ocr Sm

Completing the SSA 455 OCR SM form is an important step in updating the Social Security Administration about your disability status and any recent changes. By providing this information, you help ensure that your case is reviewed in a timely manner. Below are the steps to fill out this form accurately and efficiently.

- Begin by using black ink or a #2 pencil to complete the form.

- Enter your name and address in the designated section at the top.

- Fill in the report period dates, indicating the time for which you are providing information.

- In question 1.a, indicate whether you have worked during the report period by marking an “X” in the appropriate box.

- If you worked, complete question 1.b by providing the start and end dates of your employment and your gross monthly earnings.

- In question 2, indicate if you attended any school or training programs by marking “YES” or “NO”.

- For question 3, answer whether you and your doctor have discussed your ability to work by placing an “X” in the correct box.

- Question 4 requires you to compare your current health to your health at the beginning of the report period. Select “BETTER,” “SAME,” or “WORSE.”

- In question 5, indicate if you have received treatment from a doctor or clinic during the period. If “YES,” complete question 5.b with details.

- For question 6.a, indicate whether you have been hospitalized or had surgery during the report period with an “X.”

- If answered “YES” in question 6.a., provide relevant information in question 6.b, detailing the reason and dates of treatment.

- If you need additional space for responses, use the REMARKS section on the second page of the form.

- Sign the form where indicated, and include the date and a telephone number where you can be reached during the day.

- Once completed, ensure the form is sent to the appropriate address within 30 days using the enclosed return envelope or the provided mailing address.

What You Should Know About This Form

What is the SSA 455 OCR SM form?

The SSA 455 OCR SM form, known as the Disability Update Report, is a document provided by the Social Security Administration (SSA) for individuals receiving disability benefits. It allows the SSA to gather updated information regarding a beneficiary’s current health status, work activity, and any recent training they may have undertaken. The information collected helps determine if the beneficiary still qualifies for disability benefits under SSA rules.

Why did I receive the SSA 455 OCR SM form?

You received the SSA 455 OCR SM form because the Social Security Administration is conducting a review of your disability case. This is a routine process where the SSA reassesses whether you continue to meet the criteria for receiving disability benefits. Your response to the form is crucial in helping the SSA make an accurate determination.

How long do I have to complete and return the form?

You must complete and return the SSA 455 OCR SM form within 30 days of receiving it. If you do not send the completed form back on time, the SSA may stop your disability payments. Make sure to check if a return envelope is included; if not, you can mail it directly to the SSA at the address provided in the instructions.

What information do I need to provide on the form?

The form requires information regarding your work history, health status, treatment by healthcare providers, and any recent training or education you may have participated in. Specifically, you will need to indicate whether you have worked, attended any school or training programs, and provide details about your health and any medical visits during the designated report period.

What happens if I don’t return the form?

If you do not complete and return the SSA 455 OCR SM form, or if you do not provide a valid reason for not responding, the SSA may terminate your disability payments. In that event, the SSA will send you a letter explaining their actions and your options, which may include the chance to appeal the decision or provide additional information.

What if I don’t understand some of the questions on the form?

If you encounter questions on the SSA 455 OCR SM form that are confusing or unclear, you can seek help from a trusted individual. This may include your authorized representative, a social service agency, or your healthcare provider. Additionally, you can call the SSA at their toll-free number to ask for clarification on any aspects of the form.

Can I lose my benefits if I return the form?

Where can I find more information about the SSA 455 OCR SM form?

Additional information about the SSA 455 OCR SM form, including completion instructions, privacy policies, and the handling of personal information, can be found on the official Social Security Administration website or at your local SSA office. It is advisable to review all materials included with the form for comprehensive guidance.

Common mistakes

Filling out the SSA 455 OCR SM form can be daunting. It is crucial to ensure accuracy and completeness, as errors might result in significant delays or challenges in receiving benefits. One common mistake is neglecting to read the instructions thoroughly. Participants often skim the guidelines and miss key points, which could lead to misinformation. Understanding the specific requirements outlined by the Social Security Administration can make the process much smoother.

Another frequent error is incorrect formatting when writing numbers and letters. The form specifies that all entries must be made in black ink or pencil and within designated boxes. If someone does not follow this guideline, their responses may not be properly captured during the scanning process. Even something as simple as using lowercase letters instead of capital letters can lead to complications that detract from the clarity of the information provided.

Inaccuracies in reporting work activity represent yet another area where mistakes are common. Applicants should ensure they accurately indicate if they have worked during the report period and provide precise details about their employment. Leaving out monthly earnings or failing to report work could raise red flags. Furthermore, it is essential to detail all relevant work, as even part-time or temporary positions might affect benefits.

Additionally, individuals may mistakenly skip over essential health-related questions. The form's inquiries regarding how one’s health has changed during the report period are vital for determining ongoing eligibility. Answering these questions honestly and completely helps ensure that the Social Security Administration has a full understanding of the applicant's condition.

Failure to provide accurate contact information is another misstep. When completing the SSA 455 form, individuals must include a valid telephone number. If the Social Security Administration needs to reach them for clarification or further documentation, not having this information could delay the entire process. It is better to provide a phone number where messages can be left if necessary.

Moreover, some individuals overlook the importance of signatures on the form. Not properly signing the document can result in it being considered incomplete, thereby prolonging the review process. A clear and proper signature serves as confirmation that the information provided is true and accurate, an essential aspect of the submission.

Lastly, neglecting the 'Remarks' section of the form can be detrimental. If an applicant has additional relevant information that does not fit neatly into the provided questions, they should utilize this space. Failing to include supplemental details could mean missing out on important aspects that might favorably impact their case. Addressing these common missteps can significantly enhance the likelihood of a smoother and more successful submission of the SSA 455 OCR SM form.

Documents used along the form

The SSA 455 OCR SM form, also known as the Disability Update Report, plays a crucial role in keeping the Social Security Administration informed about an individual's ongoing eligibility for disability benefits. In addition to this form, several other documents may be required to provide comprehensive information about a beneficiary's health status and work activity. Below is a list of related forms and documents that are often used in conjunction with the SSA 455 OCR SM form.

- Form SSA-3368: This is the Disability Application form. It gathers detailed information about a person's medical condition, work history, and daily living activities. It serves as the initial request for Social Security disability benefits.

- Form SSA-827: This form, Authorization to Disclose Information to the Social Security Administration, permits medical professionals to share sensitive health information necessary for evaluating a disability claim.

- Form SSA-454: Known as the Continuing Disability Review Report, this document helps the SSA monitor ongoing eligibility for those already receiving benefits by asking about changes in health status and work capabilities since the last review.

- Form SSA-2506: This is the Disability Report – Adult. It is often used to provide updated information about an applicant's impairments, treatments, and how these conditions affect their ability to work.

Understanding these additional forms can help ensure that all necessary information is provided and that the process of eligibility review is smooth and efficient. Thorough completion of the SSA 455 OCR SM form, along with these related documents, is essential for demonstrating continued eligibility for disability benefits.

Similar forms

- Form SSA-3368-BK: This is the Adult Disability Report form, used when applying for Social Security disability benefits. Both forms collect essential information about the applicant's health and work history, helping assess ongoing eligibility for benefits.

- Form SSA-827: The Authorization to Disclose Information to the Social Security Administration form allows the SSA to obtain medical records. Like the SSA 455 OCR SM, it focuses on gathering detailed health information to evaluate disability claims.

- Form SSA-3881-BK: This form is a Function Report, which details an individual's daily activities and limitations. Both the Function Report and the SSA 455 represent a response to the necessity for current personal information regarding one's ability to work.

- Form SSA-541: This is the Child Disability Report form for children applying for benefits. Similar to the SSA 455, it collects data about the child’s functioning and health to establish ongoing disability status.

- Form SSA-3441: The Disability Update Report for individuals previously determined disabled ensures that their condition hasn’t changed significantly. It works in tandem with SSA 455 by also requiring updates on health and employment status.

- Form SSA-1171: This Request to be Reconsidered form comes into play when an applicant wants another look at a denial decision. Like the SSA 455, it gathers updated claims information pertinent to the original request.

- Form SSA-3290: This is the Claim for Disability Insurance Benefits form, which includes medical and work history much like the SSA 455, aiding the SSA in making informed benefit decisions.

- Form SSA-827-F6: This version of the Authorization to Disclose Information allows for even greater flexibility in data collection. It works with the SSA 455 to gather clear medical details to support the ongoing evaluation process.

- Form SSA-4926: This is an Employment Information form that details work status and earnings. Both forms seek to clarify the beneficiary's current work capabilities, linking it to disability benefits.

- Form SSA-461: This is the Work Incentives Planning and Assistance form, targeting individuals wanting to work alongside benefiting from Social Security. The focus on the impact of work, often seen in SSA 455, is a shared theme regarding benefit assessment.

Dos and Don'ts

When filling out the SSA 455 OCR SM form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Below is a list of do's and don'ts that you should keep in mind:

- Do: Use black ink or a #2 pencil for clarity.

- Do: Keep all letters, numbers, and marks within the designated boxes.

- Do: Print in capital letters to maintain legibility.

- Do: Provide all requested information accurately within the specified report period.

- Do: Sign and date the form before submission to confirm accuracy.

- Don’t: Use dollar signs or cents when documenting monetary amounts.

- Don’t: Leave any required fields blank; these must be completed to avoid delays.

- Don’t: Ignore the 30-day submission deadline for returning the report.

- Don’t: Provide vague or incomplete responses that may hinder the review process.

- Don’t: Forget to include your contact number to facilitate communication, if necessary.

Completing the form correctly is essential to ensure your disability benefits continue without interruption. Pay attention to each detail and refer to the instructions as needed.

Misconceptions

- Misconception 1: The SSA 455 OCR SM form is optional.

- Misconception 2: The form only needs to be submitted if one's condition has changed.

- Misconception 3: There is no specific time frame for returning the form.

- Misconception 4: The SSA will process the form without any additional information.

- Misconception 5: You only need to fill out the form if you have worked.

- Misconception 6: The form is used to decide eligibility for disability benefits.

- Misconception 7: There are no consequences for not returning the form on time.

- Misconception 8: You can fill out the form using any pen or pencil.

- Misconception 9: Supporting documents are not necessary unless requested.

Fact: Completing the Disability Update Report is required for individuals receiving disability benefits. Failure to do so may result in payments being stopped.

Fact: The form must be submitted even if the individual believes their condition has not changed. The Social Security Administration periodically reviews all cases regardless of the status of the recipient's health.

Fact: The form must be completed and returned within 30 days of receipt. This time frame is critical to ensure continued benefit payments.

Fact: If additional information is required after the form is reviewed, the SSA may contact the recipient for clarification or more details.

Fact: Every recipient must complete the form, not just those who have had work activity. The SSA wants updates on health and treatment, regardless of employment status.

Fact: While the information on the form is necessary for evaluations, it is not used to determine initial eligibility. Instead, it assesses whether a recipient continues to meet the criteria for benefits.

Fact: If the form is not returned promptly, the SSA may stop payments. The recipient will then receive a letter explaining the action taken.

Fact: The SSA specifies that only black ink or a #2 pencil should be used on the form to ensure proper electronic scanning and processing.

Fact: While the form itself should be filled out accurately, recipients are encouraged to provide any relevant medical documentation to support their continued eligibility for benefits.

Key takeaways

The SSA-455-OCR-SM form, also known as the Disability Update Report, is an essential part of the Social Security disability review process. Here are some key takeaways to keep in mind when filling it out:

- Update Requirement: This form is used to gather updated information to determine if you still meet the criteria for disability benefits.

- Timelines Matter: You must complete and return the form within 30 days of receiving it to avoid potential interruptions in your benefits.

- Contact Information: Always include a contact number where the Social Security Administration can reach you, especially if you do not have a phone number.

- Accuracy is Key: Providing accurate and honest information is crucial. This will help ensure that your review process goes smoothly.

- Understanding Questions: If you have difficulty understanding any questions, do not hesitate to contact the Social Security Administration, your doctor, or a trusted individual for assistance.

- Details on Work: Be clear about any work you have done during the report period, as this information can influence your benefits.

- Health Updates: Report any changes in your health status. If your condition has improved or worsened, this information can be significant for your case.

- Extra Space for Remarks: Use the "Remarks" section for any additional information or clarifications you’d like to provide outside the main questions.

- Print Legibly: When filling out the form, use black ink or a #2 pencil and print in capital letters to ensure your responses are easily read by the scanning equipment.

By following these takeaways, you can help streamline your report submission and avoid delays in your disability benefit review.

Browse Other Templates

Ft Sill - There are columns for listing room ranges and holding lines.

Nurse Notes - Summarize time spent with each patient for care evaluation.