Fill Out Your Ssa 6234 F6 Form

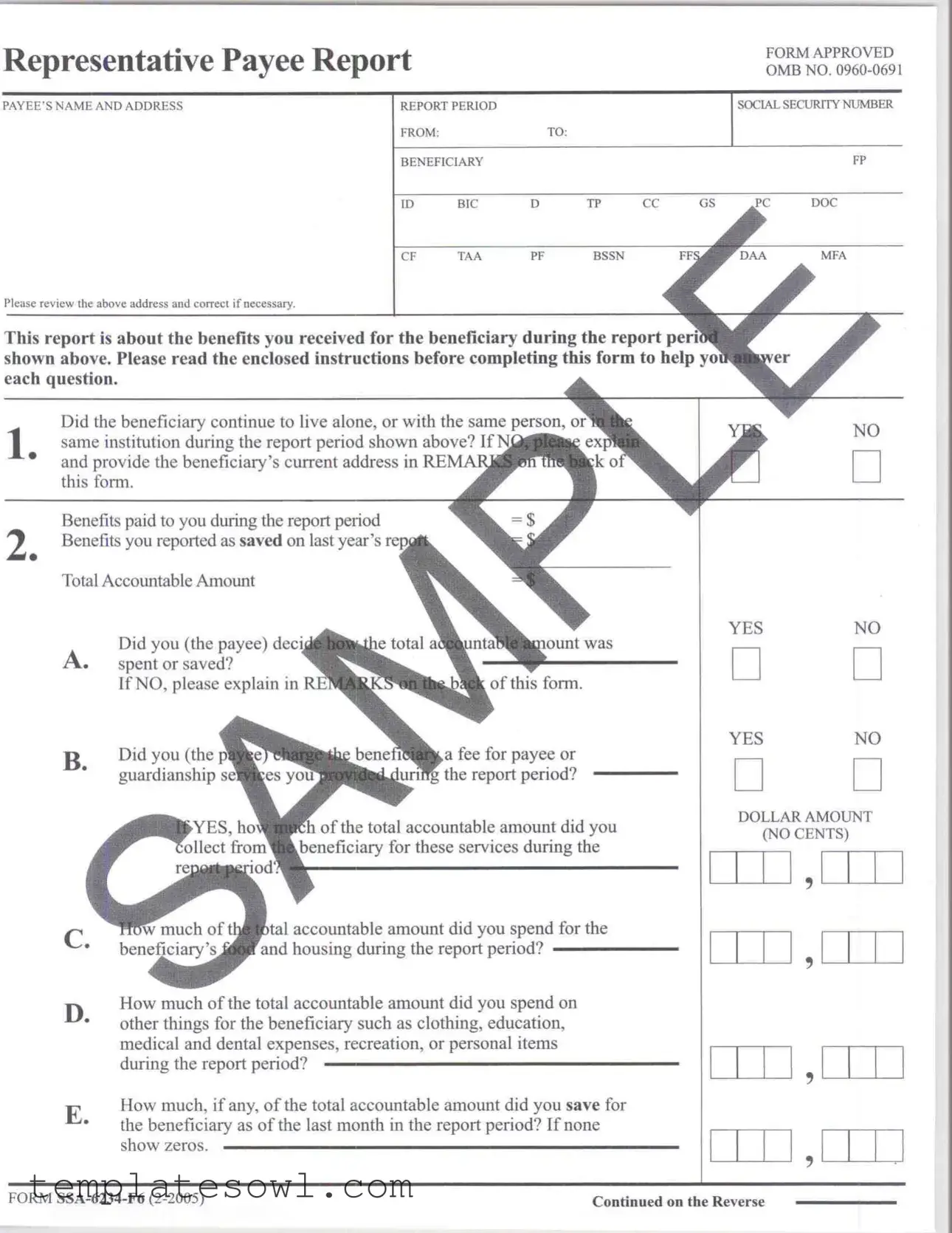

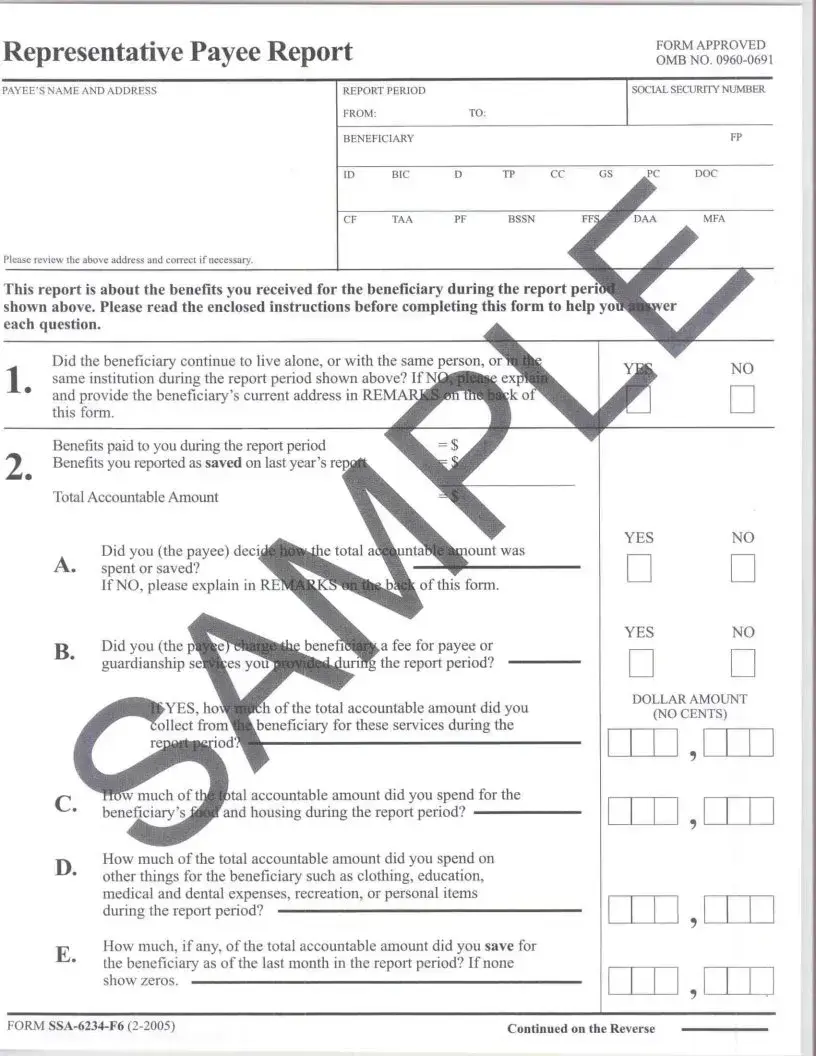

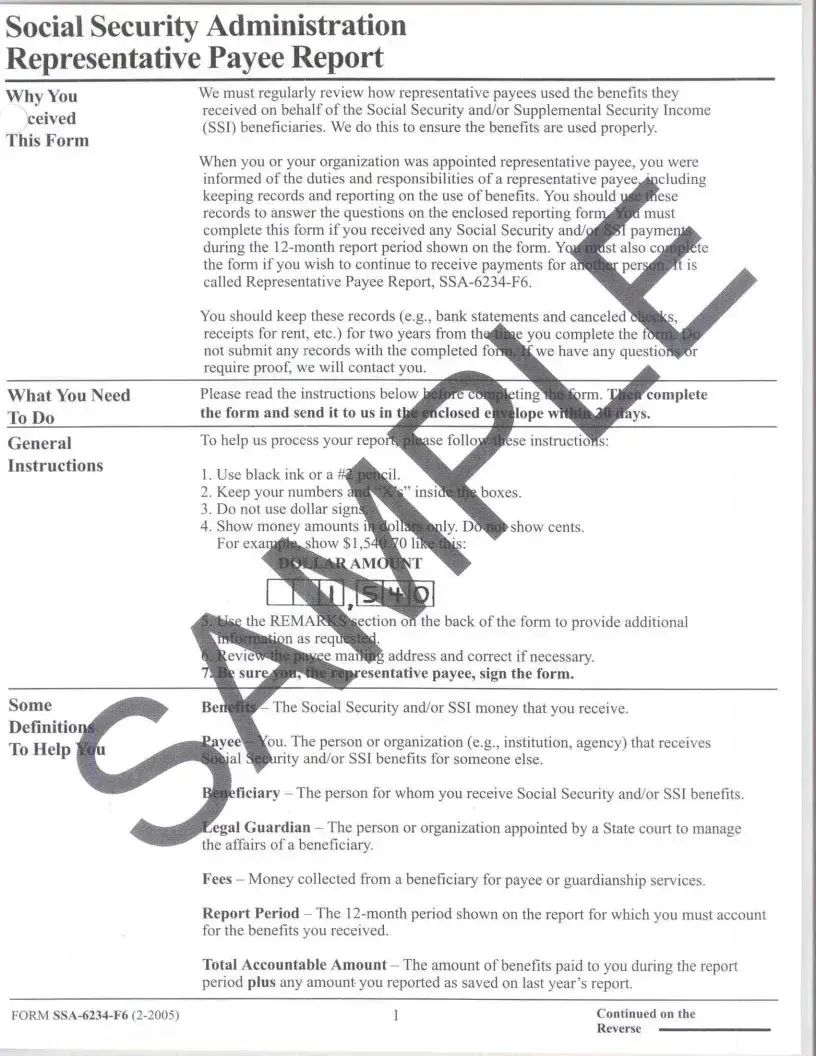

The SSA-6234-F6 form, known as the Representative Payee Report, plays a vital role in ensuring accountability for Social Security and Supplemental Security Income (SSI) benefits. Designed for individuals or organizations designated as payees, the form requires detailed reporting on how benefits were utilized over a specified 12-month period. Key aspects include reporting on whether the beneficiary lived alone or in a shared setting during this time. Payees must carefully account for the total amount received, any savings from the previous year, and how the money was spent, including expenses such as rent, medical bills, and other necessities. Additionally, the form asks for information on how any remaining funds are being saved, whether in bank accounts or other forms of deposits. By collecting this information, the Social Security Administration can ensure that benefits are used appropriately and that the financial needs of beneficiaries are met effectively. Proper completion of the form is imperative for continuing eligibility for benefits, and detailed instructions are provided to assist payees in navigating the reporting process.

Ssa 6234 F6 Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | This form is known as the Representative Payee Report, officially labeled SSA-6234-F6. |

| Purpose | The form is used to report on the benefits received on behalf of a Social Security or SSI beneficiary. |

| Approval Information | The form has been approved by the Office of Management and Budget (OMB) with the approval number 0960-0691. |

| Report Period | Users must indicate a specific 12-month report period during which they received benefits for the beneficiary. |

| Accountability | Representatives must account for how all benefits were used or saved during the designated report period. |

| Signature Requirement | The form requires a signature from the payee, verifying that all submitted information is accurate to the best of their knowledge. |

| Record Keeping | Payees must retain supporting records for a minimum of two years from the report date for auditing purposes. |

| Instructions | Detailed instructions accompany the form to aid users in properly completing it and ensuring accurate reporting. |

| State-Specific Forms | While this form is federal, payees in some states may need to comply with additional state laws on guardianship and reporting. |

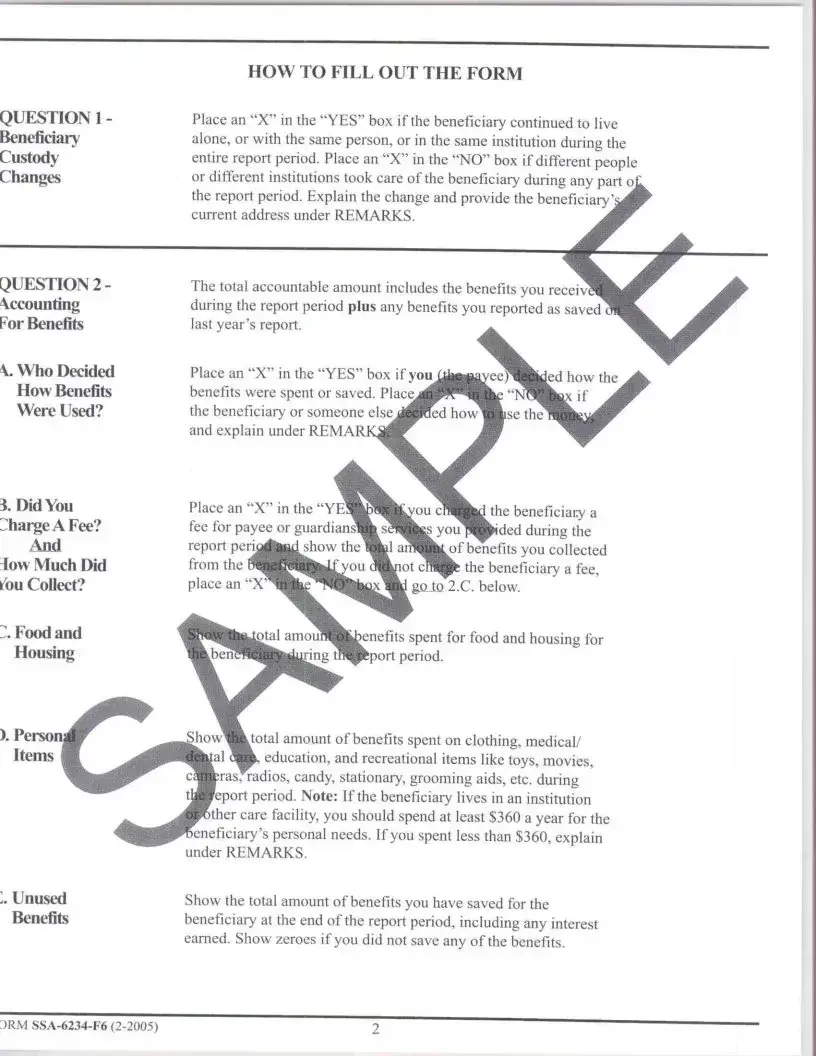

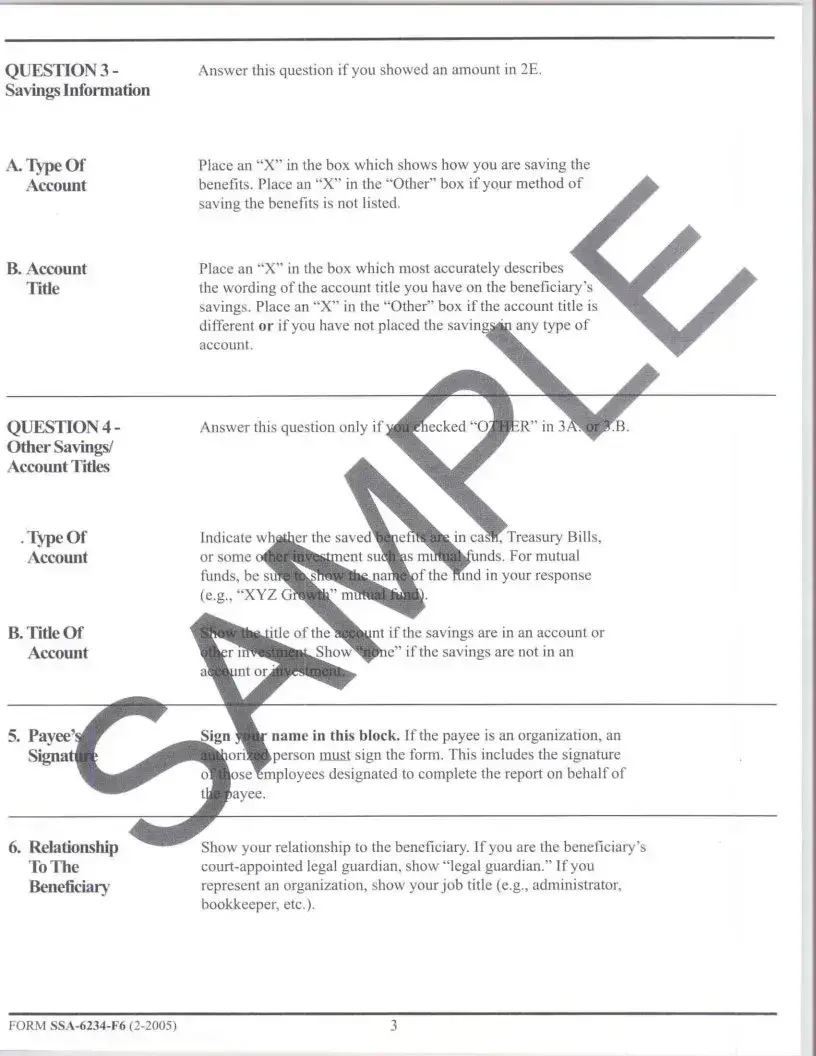

Guidelines on Utilizing Ssa 6234 F6

Filling out the SSA 6234 F6 form involves providing important details about the management of benefits on behalf of a beneficiary. This report ensures proper use and accounting of benefits received by the payee. Follow these straightforward steps to complete the form accurately.

- Begin by writing the payee’s name and address at the top of the form.

- Indicate the report period by filling in the 'From' and 'To' dates.

- Enter the beneficiary's social security number and other identification details in the appropriate boxes.

- Verify that the address provided for the beneficiary is correct. Make any necessary corrections.

- Answer whether the beneficiary continued living alone or with the same person or institution during the report period. If the answer is 'No', provide the current address in the remarks section.

- Document the benefits paid during the report period and any amount saved from the last year’s report.

- State whether you (the payee) decided to spend or save the benefits. If 'No', provide an explanation.

- Complete the section on how much was spent for services rendered to the beneficiary during the report period. Include specific details for housing, clothing, education, and other expenses.

- Include the amount saved for the beneficiary at the end of the report period. If none, enter zeros.

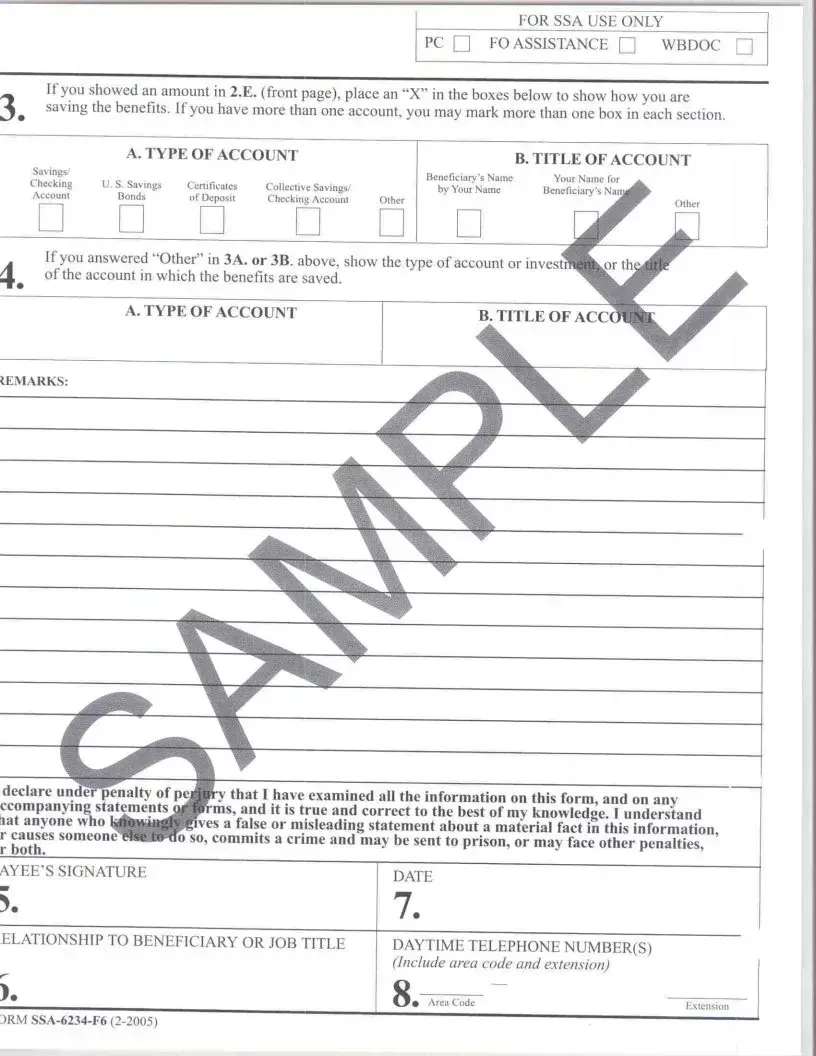

- Check the boxes to indicate the type and title of accounts where benefits are saved, using 'Other' as necessary.

- Provide any additional remarks related to the account or investments where benefits have been saved.

- Sign and date the form, confirming that all information provided is correct to the best of your knowledge.

- Fill in your relationship to the beneficiary or your job title, along with your daytime telephone number.

Once you have completed the form, review it for accuracy and clarity before submitting it to the Social Security Administration. Maintaining clear records of the benefits received and spent is essential for your accountability as a representative payee.

What You Should Know About This Form

What is the SSA-6234 F6 form?

The SSA-6234 F6 form, also known as the Representative Payee Report, is a document that representative payees must complete to report how they have used Social Security or Supplemental Security Income (SSI) benefits on behalf of a beneficiary. This annual report helps ensure that the benefits are being used appropriately and for the intended purpose of supporting the beneficiary’s needs.

Who needs to fill out the SSA-6234 F6 form?

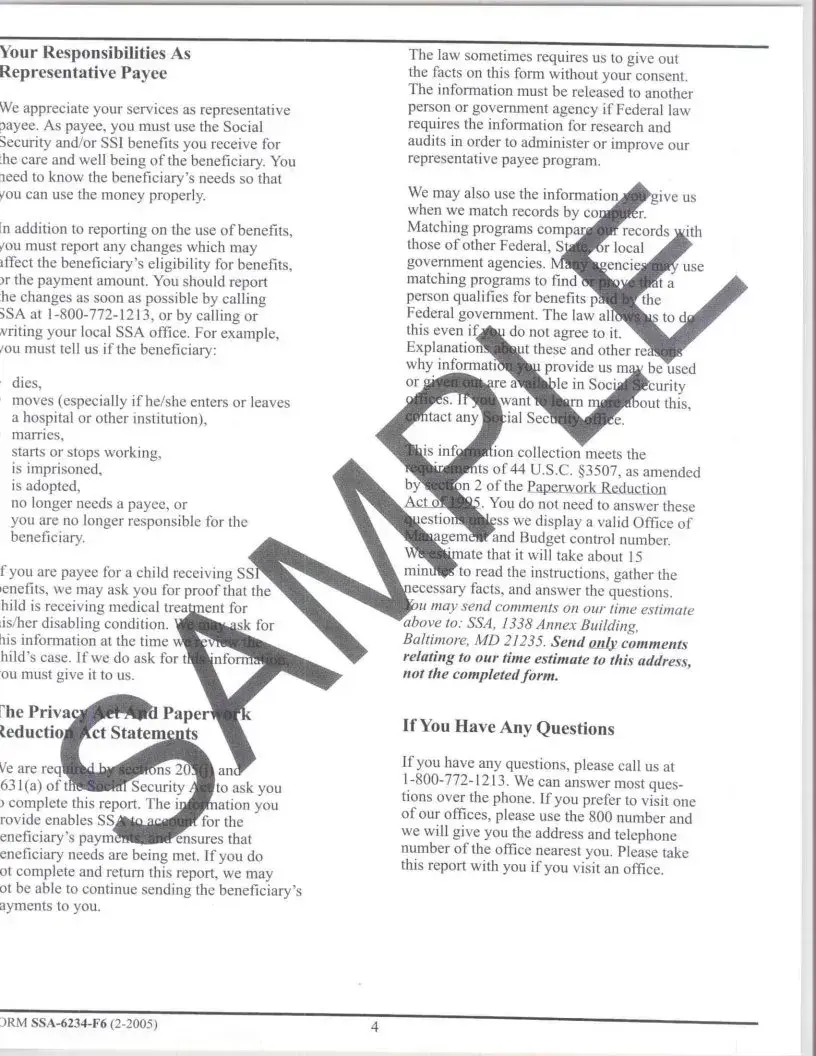

Any individual or organization designated as a representative payee who has received Social Security or SSI benefits on behalf of a beneficiary during the specified 12-month report period must complete this form. This report is crucial for maintaining transparency regarding the management and use of these funds.

What information is required on the form?

The form requires detailed information about the payee, the beneficiary, and how the funds were used during the report period. Payees must account for the total benefits received, how much was spent on the beneficiary’s living expenses, and any amounts that were saved. Additionally, payees must describe the types of accounts where the saved benefits are held.

What should I do if the beneficiary's living situation changed?

If the beneficiary no longer lives alone or with the same person, or if they’ve moved to a different institution during the report period, it is important to note this change on the SSA-6234 F6 form. Additionally, include the beneficiary's new address in the remarks section for clarity.

How do I report the total accountable amount?

To report the total accountable amount, combine the benefits you received during the report period with any amounts you reported as saved in last year’s report. This total should adequately reflect all the funds under your management as a representative payee.

What if I did not spend or save any of the benefits?

If you did not spend or save any benefits, you should still complete the form. Indicate that no funds were spent or saved in the relevant sections. Providing a brief explanation in the explanation area can help clarify your situation to the reviewers.

Is it necessary to keep records related to these benefits?

Yes, it is very important to keep accurate records, such as bank statements and receipts, for a period of at least two years. While you do not need to submit these records with the SSA-6234 F6 form, the Social Security Administration may request them later for verification purposes.

What should I do with the completed form?

Once you have completed the SSA-6234 F6 form, send it to the address provided in the instructions that accompany the form. Make sure to use black ink, write legibly, and avoid using dollar signs. Keep a copy for your own records as well.

What could happen if the information on the form is false or misleading?

Providing false information on the SSA-6234 F6 form can lead to serious consequences. Not only could the payee face civil penalties, but they may also risk criminal charges if it is determined that they intentionally misled authorities. Accuracy and honesty are crucial when filling out this report.

Common mistakes

When individuals fill out the SSA 6234 F6 form, they often encounter several common mistakes that can lead to delays or complications in the processing of their reports. One significant error is failing to provide accurate or current contact information. It is crucial for payees to double-check the name and address listed on the form. An incorrect address can hinder communication and create issues in receiving necessary updates related to benefits.

Another frequent mistake involves neglecting to clarify living arrangements for the beneficiary. Payees must accurately indicate whether the beneficiary continues to live alone or with someone else during the report period. Misrepresenting these circumstances can result in serious repercussions, including potential penalties for falsifying information.

Many payees fail to report all financial transactions accurately. Each amount spent or saved must be accounted for in the total accountable amount section. Payees should provide clear and complete information about expenditures, including rent, utilities, and personal items. Incomplete or vague explanations can lead to confusion and may prompt additional inquiries from the Social Security Administration.

In addition, payees sometimes overlook the necessity of marking how benefits are saved. The form requires specific checking of account types and titles. Not completing these sections may cause delays in processing or result in difficulties in understanding the status of saved funds.

Using unclear language or abbreviations is another common pitfall. It is essential to be clear and concise in all descriptions and answers. Jargon or vague terms may complicate the review process. Providing straightforward, detailed responses can help ensure that the form is processed efficiently.

Another error is failing to represent the relationship to the beneficiary accurately. The relationship affects the responsibilities of the payee. If this part is not completed accurately, it could complicate the verification of roles and duties associated with handling benefits.

Lastly, some payees neglect to sign and date the form. A missing signature could render the report invalid. Making sure to review, sign, and date the document before submission is critical. This final step confirms that the payee takes responsibility for the information provided.

Being aware of these mistakes can assist individuals in completing the SSA 6234 F6 form accurately. This awareness ensures a smoother process for verifying the use of benefits on behalf of the beneficiary.

Documents used along the form

When submitting the SSA 6234 F6 form, there are several other documents that may also be required or beneficial for providing complete information for the review. Here is a list of those forms and documents:

- SSA-11 - This form is the request for a representative payee. It provides information about the beneficiary and the reasons for needing a payee. This document is crucial when first establishing a payee relationship.

- SSA-827 - This form serves as a release of information to the Social Security Administration. It is often used to gain medical records and other relevant information regarding the beneficiary's condition.

- SSA-3355 - Known as the Adult Function Report, this form assesses how the beneficiary's condition affects daily living activities. It offers a comprehensive overview of the assistance needed.

- SSA-786 - This form allows the beneficiary or their payee to provide additional information. It often details expenses and how benefits are managed, enhancing the understanding of the beneficiary's needs.

- SSA-632 - The Request for Waiver of Overpayment, this form is used if the payee or beneficiary believes they have been overpaid benefits and seek to have that overpayment waived.

- Tax Returns or Other Financial Documents - These documents may provide a comprehensive view of the financial situation of the payee or beneficiary, showing how benefits are being used and the necessity for additional support.

Each of these documents plays a vital role in ensuring that the SSA has complete and accurate information to process reports and requests adequately. Being thorough in documentation can enhance the chances of a smooth review and approval of benefits.

Similar forms

- SSA-6233: Similar to the SSA-6234 F6, this form is also used for reporting how benefits were used by a representative payee. It focuses on the financial management of funds but is tailored for different reporting circumstances.

- SSA-16: This application for disability benefits requires input about financial resources. It shares the focus on ensuring rightful management and allocation of benefits, similar to the SSA-6234 F6.

- SSA-827: This consent form for release of information is important for representative payees. It helps in gathering necessary data about the beneficiary's finances, which is comparable to the data captured in the SSA-6234 F6.

- SSA-45: The report of representative payee's usage of funds resembles the SSA-6234 F6 in documenting how benefits are applied over a specified period.

- SSA-2930: This form analyzes the financial whereabouts for beneficiary funds. Like the SSA-6234 F6, it aims to ensure responsible handling of benefits.

- Form 1040: The IRS tax return form includes sections for reporting income, including benefits. This is similar in purpose to how the SSA-6234 F6 reports on the use of funds for beneficiaries.

- VA Form 21-4142: Used for authorizing the release of information, this document parallels the SSA-6234 F6 as it also collects financial information necessary for accurate benefits distribution.

- Form I-864: This Affidavit of Support is similar in that it requires information on the financial obligations of a sponsor, keeping track of benefit usage, much like the SSA-6234 F6 does for representative payees.

- CMS 2728: The End Stage Renal Disease Medical Evidence Reporting form also documents financial resources, providing a snapshot similar to the SSA-6234 F6 in monitoring how benefits are utilized for medical needs.

Dos and Don'ts

When filling out the SSA 6234-F6 form, it’s essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of important do's and don'ts to keep in mind.

- Do: Use black ink only to complete the form. This makes the document clear and legible.

- Do: Carefully review the beneficiary's address and correct any errors before submitting the form.

- Do: Report amounts accurately by showing the total without the dollar sign, ensuring you only use numbers in the designated boxes.

- Do: Include all necessary details about the account where benefits are managed, including account titles and types.

- Do: Save any records related to the expenses and benefits for at least two years after submission.

- Don't: Leave any required fields blank; if a question doesn't apply, clearly indicate that instead of omitting it.

- Don't: Submit records with the form unless specifically requested; any needed documentation will be obtained by the reviewing agency.

By adhering to these guidelines, the process of completing the SSA 6234-F6 form can be more streamlined and effective, ultimately ensuring that the beneficiary's needs are met accurately and promptly.

Misconceptions

Understanding the SSA 6234 F6 form can be crucial for representative payees. However, there are several misconceptions that often arise. Here are four of the most common misunderstandings:

- It is not necessary to submit the form if no benefits were received. Many believe that if they haven't received any benefits during the reporting period, they do not need to submit the form. However, the form must still be completed and submitted, even if the amount is zero. This ensures accurate record-keeping and compliance with Social Security Administration requirements.

- The form only needs to be filled out once. Some representatives think they only need to complete the SSA 6234 F6 form one time. In reality, this form is required annually for each reporting period to account for how benefits were used, and to ensure that the benefits are being managed appropriately.

- There are no penalties for providing false information. A common belief is that misinformation on the form won't result in any consequences. However, submitting false or misleading information can lead to serious repercussions, including potential criminal charges. It’s essential to ensure all information is accurate.

- All information regarding spending must be documented with receipts. Some are under the impression that every expense reported on the form needs to have a receipt attached. While it’s important to keep records of transactions, you do not need to submit receipts with the form. However, they should be maintained on file in case of an audit or request for verification.

Clarifying these misconceptions can help ensure that representative payees fulfill their responsibilities effectively and avoid complications.

Key takeaways

Filling out the SSA 6234 F6 form is a critical responsibility for those acting as representative payees. Understanding this process ensures that benefits are used appropriately and that required reports are submitted in a timely manner. Here are key takeaways for effectively using this form:

- The form must accurately reflect the beneficiary's living situation. Clarify if they continue to live alone or with others during the report period.

- Keep detailed records of all funds received and spent. This includes documenting amounts spent for housing, clothing, medical, and other necessary expenses.

- Always report any savings on behalf of the beneficiary. If no savings have occurred, indicate zeros on the form.

- When marking how funds are saved, be precise in describing the types of accounts and their titles. This enhances clarity in your reporting.

- Ensure that any explanations regarding spending or savings are clear and honest. Misrepresentations can lead to severe consequences.

- Complete the form using black ink and avoid dollar signs. Accuracy in each section is essential for approval.

- Submit the completed form promptly. Delays in submission may impact the continuation of benefit payments.

By adhering to these guidelines, you will facilitate a smoother review process, ensuring that the needs of the beneficiary are met responsibly and transparently.

Browse Other Templates

Walmart Weighted Grocery Settlement - Your Claim Form must be postmarked by October 29, 2021, to be considered valid.

Free Legal Forms Florida - This document ensures compliance with Florida Rule of Judicial Administration 2.545(d).