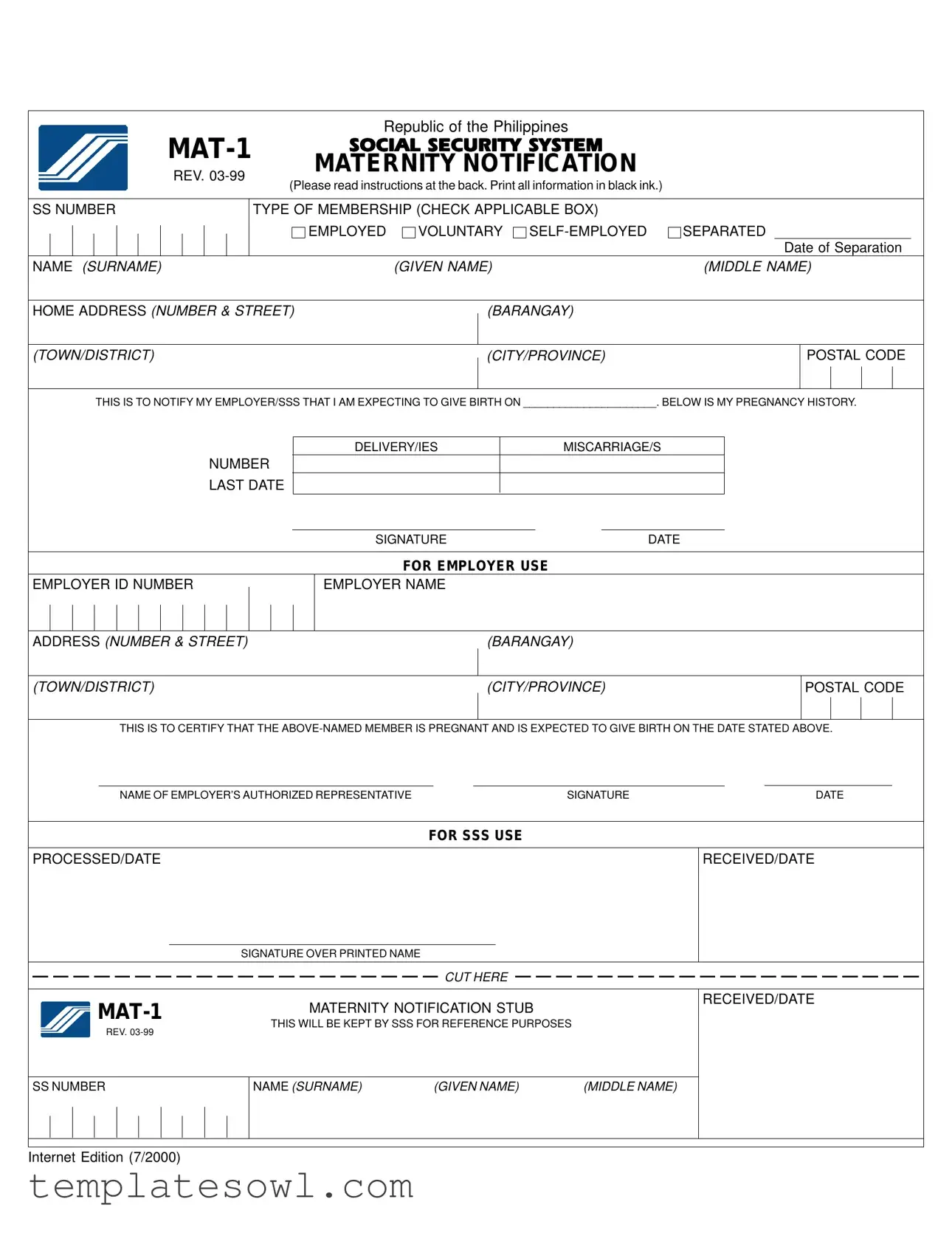

Fill Out Your Mat 1 Form

The MAT-1 form is a crucial document within the Philippine Social Security System designed for notifying employers and the SSS of an expecting member's maternity status. It serves not only as an official announcement of pregnancy but also initiates the processes necessary for maternity benefits. Members must provide essential details, including their social security number, type of membership, and personal information, such as date of separation if applicable. Anticipating the expected delivery date is pivotal, as the form explicitly necessitates notification of when a member expects to give birth. In addition, members are required to outline their pregnancy history, including past deliveries and miscarriages. Completing the form accurately is important; it must be submitted together with documentation such as a pregnancy test report or ultrasound to ensure compliance with the necessary timelines. Employers are tasked with acting promptly, as they must submit the completed MAT-1 to the SSS within 15 days of receipt. Ultimately, this form not only protects the rights of expecting mothers but also facilitates the provision of crucial benefits during an impactful period of their lives.

Mat 1 Example

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Republic of the Philippines |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOCIAL SECURITY SYSTEM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MATERNITY NOTIFICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REV. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Please read instructions at the back. Print all information in black ink.) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

SS NUMBER |

|

|

TYPE OF MEMBERSHIP (CHECK APPLICABLE BOX) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYED |

|

|

|

VOLUNTARY |

|

|

|

|

SEPARATED |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Separation |

||||||||||||||||

NAME (SURNAME) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(GIVEN NAME) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(MIDDLE NAME) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

HOME ADDRESS (NUMBER & STREET) |

|

|

|

|

|

|

|

|

(BARANGAY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

(TOWN/DISTRICT) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(CITY/PROVINCE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

POSTAL CODE |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THIS IS TO NOTIFY MY EMPLOYER/SSS THAT I AM EXPECTING TO GIVE BIRTH ON ______________________. BELOW IS MY PREGNANCY HISTORY. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DELIVERY/IES |

|

|

|

|

|

MISCARRIAGE/S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAST DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR EMPLOYER USE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

EMPLOYER ID NUMBER |

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS (NUMBER & STREET) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(BARANGAY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(TOWN/DISTRICT) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(CITY/PROVINCE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

POSTAL CODE |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THIS IS TO CERTIFY THAT THE |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF EMPLOYER’S AUTHORIZED REPRESENTATIVE |

|

|

|

SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR SSS USE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROCESSED/DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECEIVED/DATE |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OVER PRINTED NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUT HERE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MATERNITY NOTIFICATION STUB |

|

|

|

|

|

|

|

RECEIVED/DATE |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

THIS WILL BE KEPT BY SSS FOR REFERENCE PURPOSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

REV. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SS NUMBER |

|

|

NAME (SURNAME) |

|

|

|

|

(GIVEN NAME) |

|

|

|

|

|

(MIDDLE NAME) |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Internet Edition (7/2000)

INSTRUCTIONS

1.Accomplish and submit this form in one (1) copy.

2.Any alterations should be initialed by the member or the employer’s authorized representative, if employed.

3.The female member should submit this form together with the Pregnancy Test or Ultrasound Report at least 60 days from the date of conception, to her employer if employed, or to the SSS, if

4.The employer must submit the maternity notification

5.The maternity notification

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The MAT-1 form is used to notify employers and the Social Security System (SSS) in the Philippines of a member's pregnancy. |

| Eligibility | This form is applicable to employed, voluntary, self-employed, and separated members of the SSS. |

| Notification Requirement | Members must submit the MAT-1 at least 60 days from the date of conception. |

| Supporting Documents | The form should be accompanied by a Pregnancy Test or Ultrasound Report. |

| Submission Timeline | Employers are required to submit the MAT-1 within 15 days of receiving the notification from the employee. |

| Form Copies | Only one copy of the MAT-1 needs to be accomplished and submitted. |

| Alterations | Any changes or alterations on the form must be initialed by the member or the employer’s authorized representative. |

| Use of Information | The information on the MAT-1 is kept by the SSS for reference purposes. |

| Maternity Reimbursement | The duly stamped MAT-1 must be attached to the Maternity Reimbursement form (MAT-2). |

Guidelines on Utilizing Mat 1

Filling out the MAT 1 form requires attention to detail to ensure all information is accurately provided. After completing this form, it needs to be submitted along with other necessary documentation, such as a pregnancy test or ultrasound report. Submitting the form on time is crucial, as it plays a role in maternity benefits and obligations.

- Start by writing your Social Security Number (SS Number) at the top of the form.

- Select your type of membership by checking the applicable box: Employed, Voluntary, Self-Employed, or Separated.

- If applicable, indicate your Date of Separation.

- Provide your full name in the respective sections: Surname, Given Name, and Middle Name.

- Fill in your Home Address, including number and street, barangay, town or district, city or province, and postal code.

- State the expected delivery date by writing it in the space provided for “I am expecting to give birth on”.

- Document your pregnancy history by entering the number of deliveries and miscarriages, as well as the last date of either event.

- Sign the form in the designated area, and include the date of signing.

- If you are employed, provide your employer’s information: Employer ID Number, Name, and Address.

- For employer use, ensure that the employer’s authorized representative provides their name, signature, and date.

Once the form is completed, review all entries for accuracy. The form should then be submitted according to the specified requirements. Be mindful of timeframes for submission to ensure compliance with the SSS guidelines.

What You Should Know About This Form

What is the purpose of the MAT-1 form?

The MAT-1 form serves as a Maternity Notification for members of the Social Security System (SSS) in the Philippines. Its primary purpose is to officially inform the employer or the SSS about a member's pregnancy and upcoming delivery date. By submitting this form, the member can begin the necessary procedures to avail of maternity benefits, which include paid leave and other privileges related to childbirth. It helps the employer and SSS prepare for any financial responsibilities associated with supporting the member during her maternity period.

Who is required to submit the MAT-1 form?

The MAT-1 form must be submitted by female members of the SSS who are expecting a baby. This includes those who are employed, self-employed, voluntarily contributing, or separated from their jobs. The key is to notify the relevant parties according to your employment status. If a member is employed, she should submit the form to her employer. If she is self-employed, voluntarily contributing, or separated, she should submit it directly to the SSS. It is recommended to submit this form along with a Pregnancy Test or Ultrasound Report within 60 days from the date of conception to ensure that benefits can be accessed promptly.

What happens after the MAT-1 form is submitted?

After the submission of the MAT-1 form, the employer or SSS will process the notification. For employed members, the employer is required to send the MAT-1 form to the SSS within 15 days of receiving it. Both parties will keep a record of the notification. The SSS will then use this information to adjust any maternity benefits and will ideally provide further instructions on how to claim these benefits. It’s also important for members to be aware that a duly stamped and processed MAT-1 form should be attached to the subsequent Maternity Reimbursement form, MAT-2, to receive financial support.

Are there any specific instructions for filling out the MAT-1 form?

Yes, there are several important instructions to keep in mind when completing the MAT-1 form. First, make sure to write in black ink and accurately print all required information, including your Social Security number, type of membership, and personal details. If any corrections are necessary, they should be initialed by either the member or the employer's authorized representative. Submit one copy of the completed form along with the required Pregnancy Test or Ultrasound Report at least 60 days from the conception date. Always retain a copy of the MAT-1 form for your records, as the submission involves processing by both your employer and the SSS.

Common mistakes

Filling out the MAT 1 form can be a straightforward process, but several common mistakes can lead to delays or complications. One of the most frequent errors is not providing the correct Social Security Number (SS number). This number is crucial for identifying the member within the Social Security System. If the SS number is incorrect or missing, it can impede the progress of the notification and any subsequent benefits.

Another frequent oversight is failing to check the appropriate type of membership. Whether an individual is employed, self-employed, voluntary, or separated must be clearly indicated. Omitting this information often results in confusion, causing unnecessary delays in processing.

Members sometimes leave out essential personal information, such as their full name or home address. Accuracy in these areas is vital, as any mistakes may lead to difficulties in communication. The details provided should exactly match official documents to ensure consistency and reliability.

Continuing with accuracy, another mistake involves the estimated date of childbirth. Many members forget to fill in this date completely or provide an estimate that does not reflect reality. This information impacts planning for benefits and maternity leave, hence precision is essential.

Additionally, some applicants neglect to provide their pregnancy history, including earlier deliveries or miscarriages. This information supports the application but is often overlooked, which can lead to an incomplete application status.

Furthermore, alterations made on the form must be initialed by the member or an authorized representative. Failing to initial changes can raise red flags during processing, causing delays or outright rejection of the form.

Finally, submitting the form past the provided deadlines is a significant mistake. Members need to pay attention to submission timelines. The expectation is to submit the form within 60 days from conception for pregnant members. Adhering to these timelines ensures that benefits are not missed and supports a smoother application experience.

Documents used along the form

The MAT 1 form, known as the Maternity Notification, is a critical document for individuals in the Philippines who are expecting. In conjunction with the MAT 1 form, several other documents may be required to ensure that the maternity benefits and reimbursements are processed efficiently. Below is a list of these forms, along with a brief description of each.

- Pregnancy Test Report: This document provides proof of pregnancy, confirming the member's eligibility for maternity leave and benefits.

- Ultrasound Report: An ultrasound report may be requested to verify pregnancy details, including gestational age, which helps in calculating the expected delivery date.

- Maternity Reimbursement (MAT-2): This form is submitted by the employer to claim reimbursement for paid maternity benefits after the MAT-1 form has been processed.

- Employer's Certification: This document is provided by the employer to certify that the employee is eligible for maternity leave and benefits, based on the MAT-1 submission.

- Laboratory Test Results: Additional tests related to the pregnancy might be required, which validate the health status of the mother and fetus and may support the maternity claim.

- Leave Application: This form is submitted to formally request maternity leave from the employer. It outlines the dates for leave and provides necessary details for planning.

- Proof of Contribution: A record showing that the member has made the required contributions to the Social Security System, an essential requirement for qualifying for maternity benefits.

- Identification Documents: Generally, a valid ID is necessary for confirming the identity of the member and for processing her claims efficiently.

These documents collectively support the application for maternity benefits and help streamline the process for both the member and the employer. Proper submission ensures that all parties are on the same page and that the member receives the benefits she is entitled to in a timely manner.

Similar forms

Form I-485: Application to Register Permanent Residence or Adjust Status – Similar to the MAT 1 form, the I-485 is a notification form that alerts authorities to a significant life event (in this case, a change in immigration status). Both require personal details and specific documentation, such as proof of eligibility.

Form W-4: Employee's Withholding Certificate – Just like the MAT 1, the W-4 form informs employers of important information. It specifies how much tax should be withheld from an employee’s paycheck based on their situation.

Form 1040: U.S. Individual Income Tax Return – The 1040 form, like the MAT 1, collects personal information and declares significant life events. Both serve as official notifications to government bodies regarding individual circumstances.

Form DS-260: Immigrant Visa Electronic Application – The DS-260 is used to apply for an immigrant visa and requires details about personal and family history. This parallels the MAT 1 in that both forms are essential notifications for a vital life change.

Form 1099: Miscellaneous Income – The 1099 form notifies the IRS about various types of income that may not come from traditional employment. It acts as a declaration, similar to how the MAT 1 is a declaration of a pregnancy.

Form N-400: Application for Naturalization – The N-400 is a key document that indicates an applicant's willingness to become a U.S. citizen. It also requires comprehensive personal background details, mirroring the requirements of the MAT 1.

Form 941: Employer's Quarterly Federal Tax Return – This form serves to notify the IRS about employment taxes withheld from employees. Like the MAT 1 form, it is a formal document that manages an important aspect of employment and benefits.

Form I-9: Employment Eligibility Verification – The I-9 checks a person's eligibility to work in the U.S. It similarly asks for detailed personal information and verifies a significant aspect of employment, akin to the notification purpose of the MAT 1.

Form 4506-T: Request for Transcript of Tax Return – This form allows individuals to request a transcript of tax returns. Just like the MAT 1, it facilitates the processing of important personal information for administrative purposes.

Dos and Don'ts

When filling out the MAT 1 form, you should keep the following in mind:

- Always print all information in black ink to ensure clarity.

- Submit the form in one complete copy without any missing pages.

- Initial any alterations that you make on the form to confirm accuracy.

- Attach the Pregnancy Test or Ultrasound Report if applicable.

Here are some things you should avoid:

- Do not leave any sections blank; complete all required fields.

- Avoid submitting the form late; do it within the specified timeframes.

- Do not forget to inform your employer or SSS about your pregnancy as required.

- Do not ignore the instructions on the back of the form for additional guidance.

Misconceptions

-

It is only for employed members. The MAT 1 form is applicable to all types of members including voluntary and self-employed individuals.

-

Submission can be delayed without consequences. It must be submitted within specific time frames, with serious implications for late submission.

-

Only the member needs to fill it out. The employer must also fill in specific sections and certify the notification.

-

The MAT 1 form is not necessary for miscarriages. It is important to document all pregnancies, including miscarriages, for potential benefits.

-

Submitting the form is the final step. It must be accompanied by a Pregnancy Test or Ultrasound Report to be considered valid.

-

Employers do not need to notify the SSS. Employers are required to submit the MAT 1 notification to the SSS within 15 days of receiving it from the employee.

-

Altering the form is allowed without restrictions. Any changes must be initialed by either the member or the employer's authorized representative.

-

The form only serves as a notification. It is also necessary for processing maternity benefits, tying it to the Maternity Reimbursement (MAT-2).

-

One submission is enough for multiple pregnancies. Each pregnancy requires a separate MAT 1 form to be submitted.

-

Only one copy of the form is acceptable. Members must submit the MAT 1 form in one original copy for processing.

Key takeaways

Filling out and using the MAT-1 form is essential for notifying your employer or the Social Security System (SSS) about your maternity leave. Here are some key takeaways:

- The form should be completed in black ink for clarity.

- Provide accurate information, including your SS number and type of membership.

- Submit the form to your employer or SSS within a specific time frame based on your employment status.

- Include your expected delivery date prominently on the form.

- Attach a Pregnancy Test or Ultrasound Report if you are employed.

- Any changes to the information must be initialed by you or the employer's representative.

- Employers have 15 days to submit the MAT-1 after receiving it from the employee.

- Keep a copy of the MAT-1 submission receipt for reference and future claims.

Browse Other Templates

Florida Notice of Commencement Form - Proper execution of this form can prevent future disputes related to payment.

Register Car in Ma - Individuals must specify the vehicle identification number and title number on the form.

Sales and Use Tax License Maryland - Buyers should communicate clearly with sellers about resale intentions.