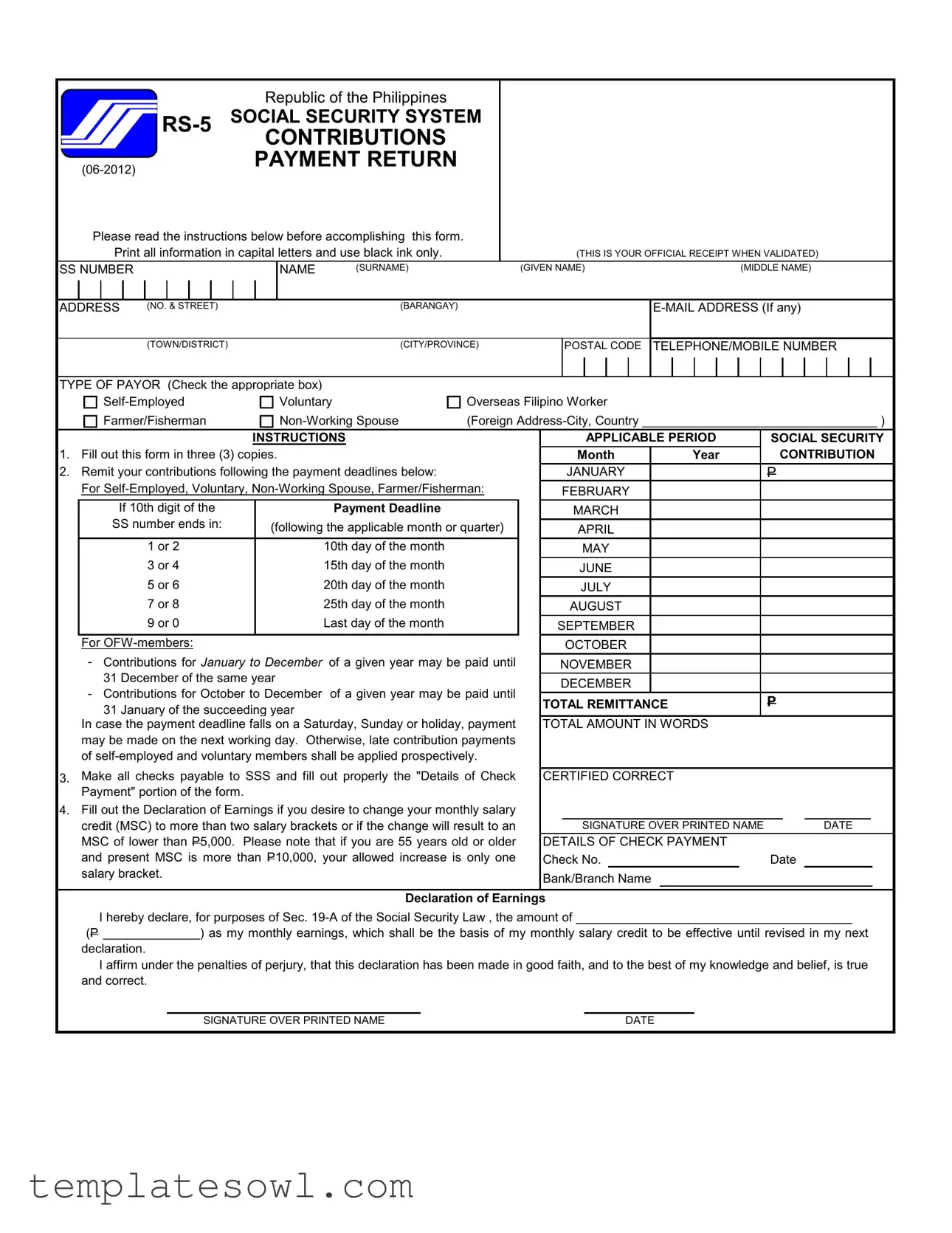

Fill Out Your Sss Rs 5 Form

The SSS RS-5 form is a vital document for contributors to the Social Security System in the Philippines, ensuring that contributions are reported and processed appropriately. This form is essential for various payor types, including self-employed individuals, voluntary members, Overseas Filipino Workers (OFWs), farmers, fishermen, and non-working spouses. Its proper completion and timely submission are crucial for maintaining accurate records of contributions and entitlements. The form requires personal information such as the contributor's Social Security number, name, address, and contact details. A section is designated for payment details, allowing contributors to specify the applicable month or quarter for their contributions. Key deadlines for payment are outlined to assist contributors in submitting their dues on time, with specific instructions based on the last digit of the Social Security number. Additionally, the form includes a declaration of earnings, enabling contributors to adjust their monthly salary credits in accordance with their earnings. Accurate completion of the RS-5 form not only serves as an official receipt upon validation but also plays a pivotal role in securing social security benefits for members and their beneficiaries.

Sss Rs 5 Example

Republic of the Philippines

CONTRIBUTIONS

PAYMENT RETURN

Please read the instructions below before accomplishing this form. |

|

Print all information in capital letters and use black ink only. |

(THIS IS YOUR OFFICIAL RECEIPT WHEN VALIDATED) |

SS NUMBER

NAME |

(SURNAME) |

(GIVEN NAME) |

(MIDDLE NAME) |

ADDRESS |

(NO. & STREET) |

(BARANGAY) |

(TOWN/DISTRICT) |

(CITY/PROVINCE) |

POSTAL CODE

TELEPHONE/MOBILE NUMBER

TYPE OF PAYOR (Check the appropriate box) |

|

|

Voluntary |

Overseas Filipino Worker |

|

Farmer/Fisherman |

(Foreign |

|

INSTRUCTIONS

1.Fill out this form in three (3) copies.

2.Remit your contributions following the payment deadlines below:

For

If 10th digit of the

SS number ends in:

1 or 2

3 or 4

5 or 6

7 or 8

9 or 0

For

-Contributions for January to December of a given year may be paid until 31 December of the same year

-Contributions for October to December of a given year may be paid until

31 January of the succeeding year

In case the payment deadline falls on a Saturday, Sunday or holiday, payment may be made on the next working day. Otherwise, late contribution payments of

3.Make all checks payable to SSS and fill out properly the "Details of Check Payment" portion of the form.

4.Fill out the Declaration of Earnings if you desire to change your monthly salary credit (MSC) to more than two salary brackets or if the change will result to an MSC of lower than P5,000. Please note that if you are 55 years old or older and present MSC is more than P10,000, your allowed increase is only one salary bracket.

|

APPLICABLE PERIOD |

|

SOCIAL SECURITY |

|||||||||

|

Month |

|

|

Year |

|

CONTRIBUTION |

||||||

|

JANUARY |

|

|

|

|

|

P |

|||||

FEBRUARY |

|

|

|

|

|

|

|

|

|

|

||

|

MARCH |

|

|

|

|

|

|

|

|

|

|

|

|

APRIL |

|

|

|

|

|

|

|

|

|

|

|

|

MAY |

|

|

|

|

|

|

|

|

|

|

|

|

JUNE |

|

|

|

|

|

|

|

|

|

|

|

|

JULY |

|

|

|

|

|

|

|

|

|

|

|

|

AUGUST |

|

|

|

|

|

|

|

|

|

|

|

SEPTEMBER |

|

|

|

|

|

|

|

|

|

|

||

|

OCTOBER |

|

|

|

|

|

|

|

|

|

|

|

NOVEMBER |

|

|

|

|

|

|

|

|

|

|

||

DECEMBER |

|

|

|

|

|

|

|

|

|

|

||

TOTAL REMITTANCE |

|

|

|

P |

||||||||

|

|

|

|

|

|

|

|

|

|

|||

TOTAL AMOUNT IN WORDS |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

||

CERTIFIED CORRECT |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OVER PRINTED NAME |

|

|

DATE |

||||||||

DETAILS OF CHECK PAYMENT |

|

|

|

|

|

|||||||

Check No. |

|

|

|

|

Date |

|

|

|||||

Bank/Branch Name |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Declaration of Earnings

I hereby declare, for purposes of Sec.

(P ______________) as my monthly earnings, which shall be the basis of my monthly salary credit to be effective until revised in my next

declaration.

I affirm under the penalties of perjury, that this declaration has been made in good faith, and to the best of my knowledge and belief, is true and correct.

SIGNATURE OVER PRINTED NAME |

DATE |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The RS-5 form is used for reporting and remitting contributions to the Social Security System (SSS) in the Philippines. |

| Submission Requirement | Three copies of the completed form must be submitted when remitting contributions. |

| Payment Deadlines | Payments are due on the 10th, 15th, 20th, 25th, or last day of the month, depending on the SS number. |

| Applicable Days | If a payment deadline falls on a Saturday, Sunday, or holiday, payment can be made the following working day. |

| Contribution Types | Contributions may be made by self-employed individuals, voluntary members, overseas Filipino workers, farmers, fishermen, and non-working spouses. |

| Check Payment | Checks should be made payable to SSS and must have the "Details of Check Payment" filled out correctly. |

| Declaration of Earnings | A declaration of monthly earnings is required if a member wishes to change their monthly salary credit. |

| Governing Law | The form is governed by the Social Security Law (Rep. Act No. 8282) of the Republic of the Philippines. |

Guidelines on Utilizing Sss Rs 5

Once you have the SSS RS-5 form, you are ready to provide your information to ensure your contributions are properly recorded. This will facilitate your payments and ensure compliance with the required deadlines. Paying attention to the details is crucial for a smooth submission process.

- Obtain three copies of the SSS RS-5 form.

- Print all information in capital letters using black ink only.

- Fill in your Social Security (SS) number accurately.

- Write your name, including your surname, given name, and middle name.

- Provide your complete address, including house number, street, barangay, town/district, city/province, and postal code.

- Add your email address, if applicable, and your telephone or mobile number.

- Check the appropriate box for your type of payor: Self-Employed, Voluntary, Overseas Filipino Worker, Farmer/Fisherman, or Non-Working Spouse.

- If your address is foreign, fill in the city and country.

- In the "Applicable Period," indicate the month and year for which you are making contributions.

- Fill in the contribution amounts for each month, ensuring the total remittance is accurate.

- Write out the total amount in words for clarity.

- Sign and print your name where required, along with the date.

- If you are paying by check, complete the "Details of Check Payment" section with the check number, date, and bank/branch name.

- If applicable, complete the "Declaration of Earnings" to declare your monthly earnings and indicate your desired monthly salary credit.

- Ensure you affirm the declaration is true and correct by signing again with your printed name and date.

What You Should Know About This Form

What is the SSS RS 5 form used for?

The SSS RS 5 form is used to report and remit contributions to the Social Security System (SSS) in the Republic of the Philippines. It serves as a record for self-employed individuals, voluntary members, Overseas Filipino Workers (OFWs), farmers, fishermen, and non-working spouses to declare their earnings and the total contributions they are remitting for a specific period. Completing the form accurately ensures proper crediting of contributions, which is important for eligibility to various SSS benefits.

What are the payment deadlines for submitting the SSS RS 5 form?

Payment deadlines for the SSS RS 5 form vary based on the type of contributor and the last digit of their Social Security (SS) number. For self-employed and voluntary members, deadlines are the 10th, 15th, 20th, 25th, and the last day of the month, depending on the last digit of their SS number. Overseas Filipino Workers can remit their contributions for the entire year up to December 31, with special extensions available for payments made in the following year for the last quarter. It’s essential to note that if a deadline falls on a holiday or weekend, payments can be made on the following working day.

How many copies of the form need to be filled out?

Three copies of the SSS RS 5 form must be filled out. This is necessary to ensure that one copy is submitted to the SSS while the others can be kept for personal records. It is important to print all the required information in capital letters and use black ink to ensure clear legibility and compliance with the submission process.

What should I do if I want to change my monthly salary credit?

To change your monthly salary credit (MSC), you should fill out the "Declaration of Earnings" section within the SSS RS 5 form. Provided you want to declare a different amount, this section allows you to specify your new monthly earnings. Keep in mind that if your current MSC is more than P10,000 and you are 55 years old or older, you can only increase it by one salary bracket. This ensures that adjustments align with SSS guidelines and requirements.

What are the payment methods for submitting contributions?

All contributions must be paid via checks made out to SSS. When submitting the RS 5 form, the "Details of Check Payment" section should be filled out properly. This includes information such as the check number, bank/branch name, and the date of the check. Alternatively, various payment channels may be available, but it is advised to verify with SSS for the most current payment methods accepted to ensure financial contributions are processed correctly.

Common mistakes

Filling out the SSS RS-5 form can seem straightforward, but many people encounter issues. One common mistake is leaving out the Social Security (SS) number. This essential piece of information is crucial for processing contributions correctly. Always double-check to ensure that the SS number is complete and correctly entered.

Another frequently overlooked error is not writing information in capital letters. The instructions clearly state that all information should be printed in uppercase. Failing to follow this guideline can lead to processing delays or rejections.

Providing an incomplete name is also a recurring mistake. Ensure that the full name includes the surname, given name, and middle name. Omitting parts of your name can lead to complications when your contributions are processed or when trying to access benefits.

Contact information must be accurate and complete. Many people forget to include their telephone or mobile number, which is essential for communication. Including an email address, if available, can also facilitate faster responses if there are questions about your form.

Missing the appropriate type of payor can lead to significant issues. Some individuals mistakenly check a box that does not apply to their situation. Take a moment to confirm that your designation—whether self-employed, voluntary, or otherwise—accurately reflects your status.

Inaccurate payment submission is another common issue. People sometimes miscalculate their contributions or fail to remit on time. Adhering to the payment deadlines specified is crucial to avoid penalties. Be aware of how the deadline may shift if it falls on a weekend or holiday.

Inconsistencies in the declared earnings can also cause problems. If changing the monthly salary credit, ensure that the Declaration of Earnings section is filled out correctly and accurately reflects your income. Failure to provide accurate earnings information can affect your monthly salary credit and, ultimately, your benefits.

Some individuals neglect to sign the form, a crucial oversight that can halt processing. Always include your signature over your printed name at the designated area to confirm the validity of the information provided.

Finally, failing to include payment details can delay processing. Filling out the Details of Check Payment section accurately—listing the check number, date, and bank/branch name—is vital for tracking your contribution.

By being mindful of these common mistakes, you can help ensure that filling out the SSS RS-5 form is a smooth and successful process. Take your time, review your entries, and verify all provided information to avoid unnecessary issues.

Documents used along the form

The SSS RS-5 form serves as a crucial document for making contributions to the Social Security System in the Philippines. When submitting this form, there are often additional documents or forms that may accompany it for clarity and compliance. Below is a list of related documents that individuals may frequently use alongside the SSS RS-5 form.

- SSS Form RS-1: This is the Member's Data Record. It is used to provide personal information and establish an individual's membership with the Social Security System.

- SSS Form RS-2: This document, known as the Member's Contributions, details contributions made by the member for specific periods. It is essential for tracking contribution history.

- Declaration of Earnings: This form is often filled out when individuals wish to adjust their monthly salary credit, providing necessary information about expected earnings.

- Certificate of Employment: This document can be issued by an employer to verify that a member is employed and to outline their earnings, which may influence their contribution status.

- Payroll Records: These are records maintained by employers detailing the earning statements of employees. They may be necessary if income verification is required.

- SSS Loan Application Form: If members are applying for a loan, this form documents their request and eligibility based on their contribution history.

- Payment Receipts: Receipts for payment made toward contributions serve as proof of payment and may be needed for future reference or in case of disputes.

Having these documents prepared can facilitate a smoother process when submitting the SSS RS-5 form. It is advisable to ensure that all accompanying documents are accurately filled out to meet the necessary requirements.

Similar forms

-

Tax Form 1040: This form is used by individuals to file their annual income tax returns with the IRS. Like the SSS RS-5 form, it collects essential information about income, deductions, and eligibility for credits.

-

W-2 Form: Employers use this form to report wages paid to employees and the taxes withheld. Similar to the RS-5, it requires precise personal details and reporting of amounts due to the government.

-

Employment Tax Returns (Form 941): Businesses utilize this quarterly form to report income taxes, Social Security tax, and Medicare tax withheld from employee salaries. The form mandates strict adherence to deadlines and accuracy, akin to the RS-5.

-

Form 1099: Independent contractors receive this form detailing income earned outside typical employment. This is also a reporting tool, much like the RS-5, where accurate income declaration is essential.

-

Form SS-4: This form is applied for an Employer Identification Number (EIN). Though it is for a different purpose, it involves collecting vital identification data, similar to the details required on the RS-5.

-

Form I-9: Employers complete this form to verify the identity and work authorization of employees. While the contexts differ, both forms focus on confirming identity and eligibility.

-

Form 5500: This form is filed for employee benefit plans to report on the status of financial conditions. It requires an accurate reflection of contributions, resembling the remittance aspect of the RS-5.

-

Form 4868: This application for an automatic extension of time to file an individual income tax return parallels the payment aspects of the RS-5, where deadlines are crucial to avoid penalties.

-

Business License Application: Just like the RS-5, this document requires comprehensive personal information and is essential for compliance with legal regulations, ensuring that businesses operate within the law.

Dos and Don'ts

Filling out the SSS RS-5 form requires attention to detail. Here’s a list of important dos and don'ts to ensure you complete the form correctly.

- Do fill out the form using capital letters and black ink.

- Do make three copies of the completed form for your records.

- Do check the payment deadlines carefully based on your SS number.

- Do ensure all checks are payable to SSS and filled out correctly.

- Don't wait until the last minute to submit your payment.

- Don't leave any fields blank; double-check to ensure all necessary information is provided.

- Don't ignore the requirements for the Declaration of Earnings if your earnings change.

Pay close attention to these tips to avoid costly mistakes. Timeliness and accuracy are essential!

Misconceptions

There are many misunderstandings surrounding the SSS RS-5 form used for contributions in the Philippines. Clarifying these misconceptions can help ensure that individuals fulfill their obligations accurately and efficiently. Here are ten common misconceptions, along with explanations:

- Only self-employed individuals need to use this form. This is not true. The SSS RS-5 form is also intended for voluntary members, Overseas Filipino Workers (OFWs), and non-working spouses, among others. Each category of payor can use this form to report their contributions.

- The payment deadlines are the same for everybody. This misconception can lead to late payments. Different groups of payors have specific deadlines based on the last digit of their Social Security (SS) number. For example, self-employed and voluntary payors have different due dates compared to OFWs.

- Payments can be made any time before the end of the year. Although OFWs may pay until the end of December for previous months, other categories may have strict deadlines depending on the last digit of their SS number. Knowing these deadlines is crucial to avoid penalties.

- This form does not need to be filled out in detail. In fact, accurate completion is essential. Instructions clearly indicate that all information must be printed in capital letters and that forms must be completed in triplicate. Omitting details can lead to delays or rejections.

- Checks can be made payable to anyone. This is incorrect. All checks must be made payable specifically to the SSS. Failure to adhere to this guideline can complicate the processing of payments.

- There is no requirement to declare earnings. This is an important step for some members. If you wish to change your monthly salary credit to more than two salary brackets, a Declaration of Earnings must be filled out. This declaration influences future contributions.

- Deadlines extend if they fall on weekends or holidays. While this aspect is true, clarity is needed. If a payment deadline falls on a Saturday, Sunday, or holiday, the payment can indeed be made on the next working day. However, it's crucial to schedule payments accordingly to avoid confusion.

- Individuals can drop their contributions at any time without consequences. The law requires ongoing contributions to maintain benefits. Failure to contribute regularly can jeopardize one’s eligibility for various claims later on.

- The total remittance does not need to be calculated. This is another misconception. Members must not only fill out their contributions for each month but also calculate and write the total remittance at the end of the form accurately.

- Once filled out, this form does not need to be retained. It is essential to keep a copy of the completed SSS RS-5 form as it serves as your official receipt when validated. Retaining it helps in future references or disputes regarding contributions.

Key takeaways

Filling out the SSS RS-5 form can feel overwhelming at first, but here are some key takeaways to help simplify the process:

- Fill in all sections: Make sure to complete every part of the form. Use capital letters and black ink only to ensure clarity.

- Know your deadlines: Payment deadlines vary depending on your SS number. Refer to the list provided on the form and plan ahead.

- Multiple copies required: Complete the form in three copies. This will help with record-keeping and ensure all necessary parties have the information.

- Payment methods: When paying by check, make it payable to SSS. Fill out the "Details of Check Payment" section correctly to avoid issues.

- Declare your earnings: If you want to change your monthly salary credit, fill out the Declaration of Earnings carefully. Ensure you understand the rules related to your age and current credit limits.

Following these takeaways can ease the process of using the SSS RS-5 form and ensure that all submissions are handled correctly.

Browse Other Templates

Colorado W4 - Retail and wholesale licenses have different fees based on the sales period.

How to Fill Claim Form - Part a - Take note of the phone number for inquiries related to the Disability Board.