Fill Out Your Sss Loan Application Form

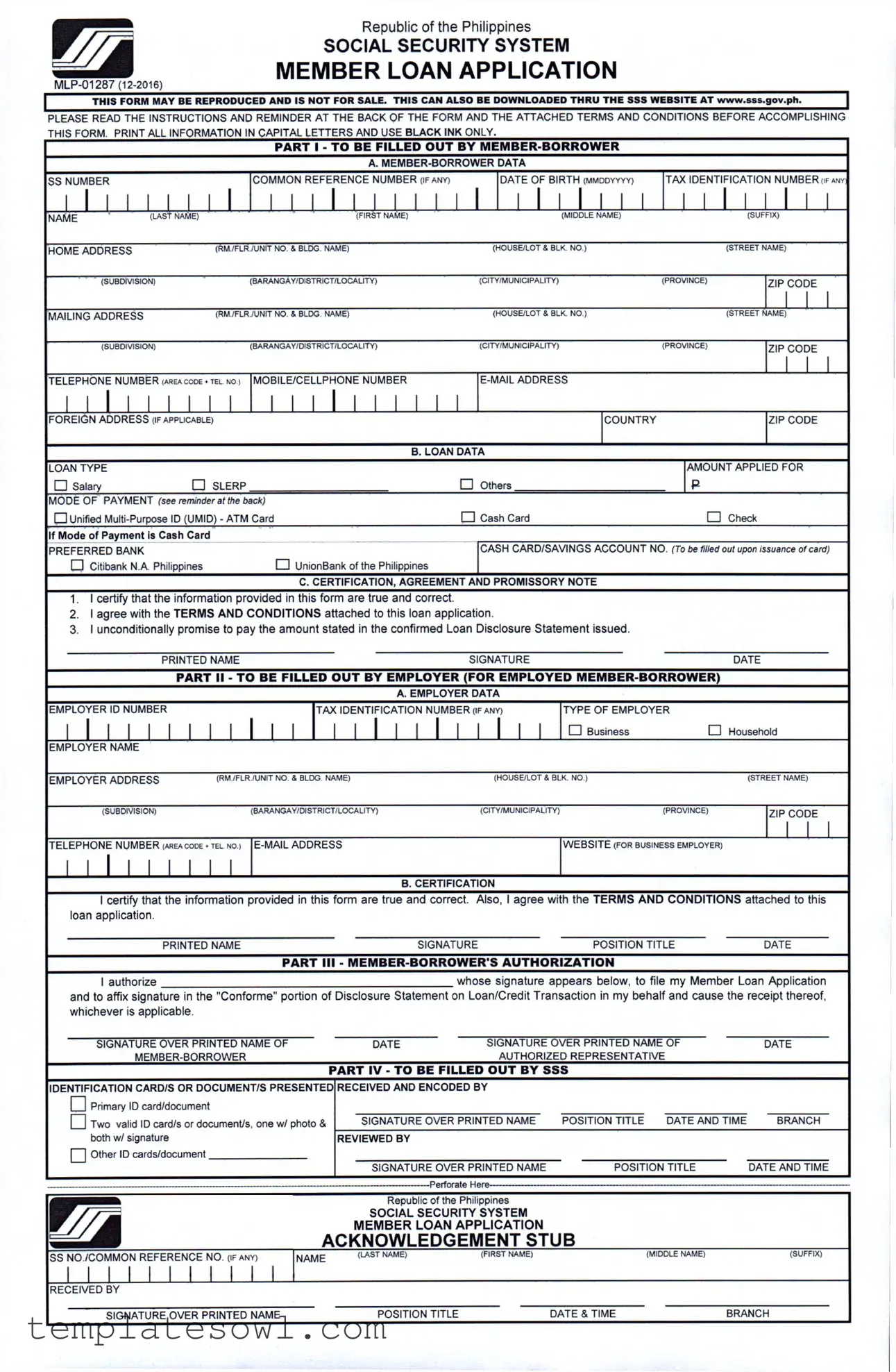

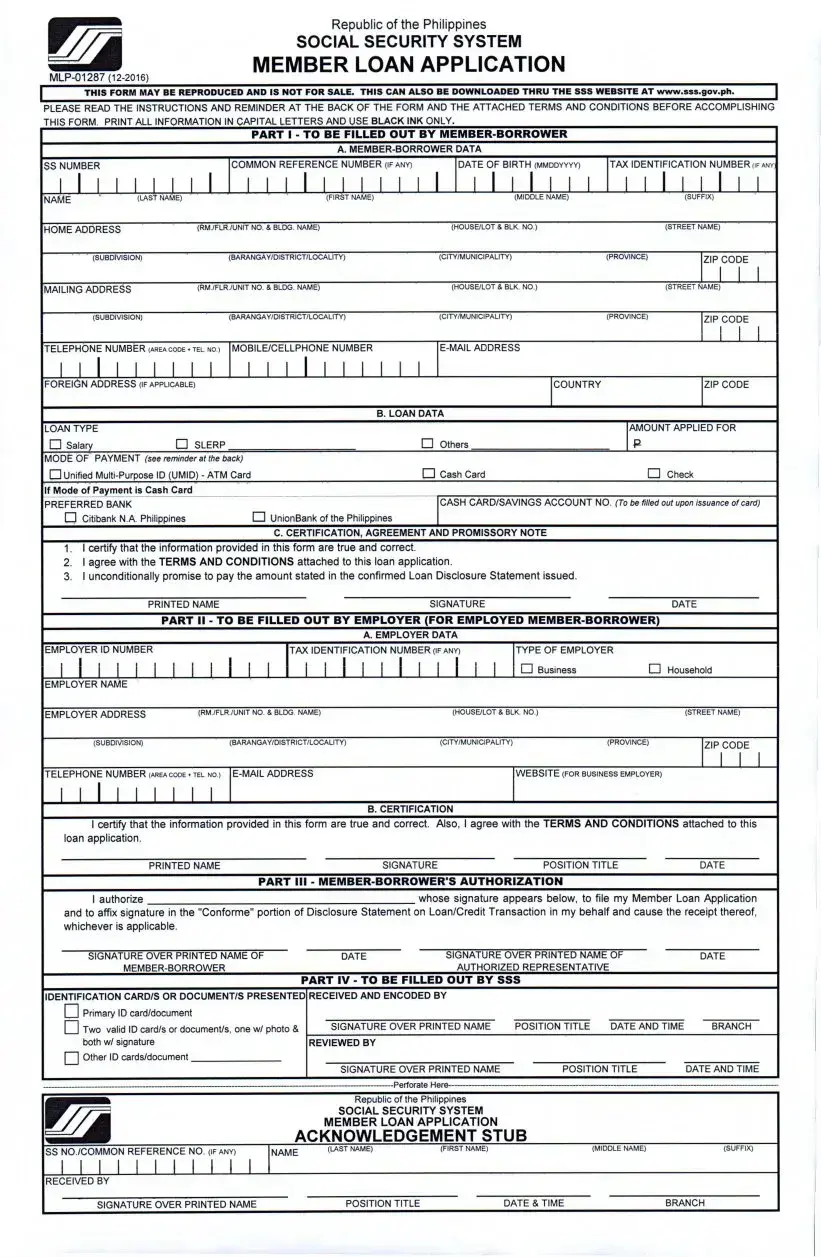

Applying for a loan through the Social Security System (SSS) in the Philippines requires careful completion of the SSS Loan Application form, designated as MLP-01287. This form is essential for member-borrowers seeking financial assistance, and it outlines each step necessary for a successful application. Initially, applicants must fill in personal information, providing their Social Security number, tax identification number, and contact details, which ensures accurate identification within the SSS database. Additionally, applicants need to specify loan type and amount, choosing from options such as a salary loan or Unified Multi-Purpose ID (UMID) ATM card payment method. The form also mandates a certification of the information provided, alongside an agreement to the applicable terms and conditions. Furthermore, employers are required to complete a section confirming the member-borrower's employment details, which include the employer’s identification number and address. Lastly, essential identification documentation must be presented, ensuring that all information submitted is verifiable. This introduction to the SSS Loan Application form aims to simplify the process, ensuring that members understand their responsibilities and the vital information needed to secure the loan they require.

Sss Loan Application Example

Republic of the Philippines

SOCIAL SECURITY SYSTEM

MEMBER LOAN APPLICATION

| |

T |

I |

F |

B |

REPRODUCED A |

I N |

|

|

SA . |

T |

I |

|

AL |

|

E DO NL |

|

|

T |

E S |

|

E I |

|

|

. . . . |

|

| |

|||||||

|

THIS FORM MAY BE REPRODUCED AND |

IS NOTT FOR |

SALE. |

THIS |

CAN ALSO BE DOWNLOADED |

THRU THE SSS WEBSITE AT www.sss.gov.ph. |

|

|

|||||||||||||||||||||||||

PLEASE READ THE INSTRUCTIONS AND REMINDER AT THE BACK OF THE FORM AND THE ATTACHED TERMS AND CONDITIONS BEFORE ACCOMPLISHING |

|||||||||||||||||||||||||||||||||

THIS FORM. PRINT ALL INFORMATION IN CAPITAL LETTERS AND USE BLACK INK ONLY. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

PART 1 - TO BE FILLED OUT BY |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

A. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

SS NUMBER |

|

|

|

|

COMMON REFERENCE NUMBER (ifany) |

|

L |

DATE OF BIRTH (MMDDYYYY) |

|

TAX IDENTIFICATION NUMBER(ifany: |

|||||||||||||||||||||||

1 1 1 1 Mill |

I |

I |

I |

I |

I |

I |

I |

I |

I |

I |

I |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

NAME |

|

|

(LAST NAME) |

|

|

|

|

|

|

(FIRST NAME) |

|

|

|

|

|

(MIDDLE NAME) |

|

|

|

|

|

|

(SUFFIX) |

|

|

||||||||

HOME ADDRESS |

|

|

(RM./flr./unit no. & bldg, name) |

|

|

|

|

|

|

|

(house/lot & blk. no.) |

|

|

|

|

|

(street name) |

|

|

||||||||||||||

|

|

(SUBDIVISION) |

|

|

(BARANGAY/DISTRICT/LOCALITY) |

|

|

|

|

|

(CITY/MUNICIPALITY) |

|

|

|

|

|

(PROVINCE) |

|

|

|

ZIP CODE |

|

|||||||||||

MAILING ADDRESS |

|

|

(RM./flr./unit no. & bldg, name) |

|

|

|

|

|

|

|

(house/lot & blk. no.) |

|

|

|

|

|

(street name) |

|

|

||||||||||||||

|

|

(SUBDIVISION) |

|

|

(BARANGAY/DISTRICT/LOCALITY) |

|

|

|

|

|

(CITY/MUNICIPALITY) |

|

|

|

|

|

(PROVINCE) |

|

|

|

ZIP CODE |

|

|||||||||||

TELEPHONE NUMBER (area code + tel. no.) |

MOBILE/CELLPHONE NUMBER |

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

1 |

1 |

1 |

1 |

1 1 1 |

1 |

1 |

I |

I |

I |

I |

I |

I |

I |

I |

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOREIGN ADDRESS (IF applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COUNTRY |

|

|

|

|

|

ZIP CODE |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. LOAN DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

LOAN TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMOUNT APPLIED FOR |

|

|

||||||

|

Salary |

|

|

|

|

SLERP |

|

|

|

|

|

|

|

|

|

|

|

Others |

|

|

|

|

|

|

|

R |

|

|

|

|

|

|

|

MODE OF PAYMENT (see reminder at the back) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Unified |

|

|

|

|

|

|

|

|

|

O Cash Card |

|

|

|

|

|

|

|

O Check |

|

|

|

|||||||||||

If Mode of Payment is Cash Card |

|

|

|

|

|

|

|

|

|

|

|

|

CASH CARD/SAVINGS ACCOUNT NO. (To be filled out upon issuance of card) |

||||||||||||||||||||

PREFERRED BANK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Citibank N.A. Philippines |

|

|

O UnionBank of the Philippines |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

C. CERTIFICATION, AGREEMENT AND PROMISSORY NOTE

1.I certify that the information provided in this form are true and correct.

2.I agree with the TERMS AND CONDITIONS attached to this loan application.

3.I unconditionally promise to pay the amount stated in the confirmed Loan Disclosure Statement issued.

PRINTED NAMESIGNATUREDATE

PART II - TO BE FILLED OUT BY EMPLOYER (FOR EMPLOYED

A. EMPLOYER DATA

EMPLOYER ID NUMBER |

I I ILll |

TAX IDENTIFICATION NUMBER (if an>9 |

TYPE OF EMPLOYER |

|

|

|

||||

I I I I I I I |

I I |

I I I |

I I |

I I |

|

|

|

|

|

|

|

|

|

Lll |

Business |

|

O Household |

|

|

||

|

|

|

|

|

|

|

|

|

||

EMPLOYER NAME |

|

|

|

|

|

|

|

|

|

|

EMPLOYER ADDRESS |

(rm./flr./unit no. & bldg, name) |

|

|

(house/lot & blk. no.) |

|

(street name) |

|

|||

(SUBDIVISION) |

(BARANGAY/DISTRICT/LOCALITY) |

|

(CITY/MUNICIPALITY) |

|

(PROVINCE) |

ZIP |

CODE |

|

||

|

|

|

|

|

|

|

|

1 |

||

|

|

|

|

|

|

|

|

1 |

1 |

|

TELEPHONE NUMBER (area code ♦tel. no.) |

WEBSITE (FOR BUSINESS EMPLOYER) |

I I I I I I I I I

B. CERTIFICATION

I certify that the information provided in this form are true and correct. Also, I agree with the TERMS AND CONDITIONS attached to this loan application.

PRINTED NAME |

SIGNATURE |

POSITION TITLE |

DATE |

|

PART III - |

|

|

I authorize |

whose siqnature appears below, to file mv Member Loan Application |

||

and to affix signature in the "Conforme" portio 1 of Disclosure Statement on Loan/Credit Transaction in my behalf and cause the receipt thereof, whichever is applicable.

SIGNATURE OVER PRINTED NAME OF |

|

DATE |

SIGNATURE OVER PRINTED NAME OF |

|

DATE |

||

|

|

AUTHORIZED REPRESENTATIVE |

|

|

|||

|

|

PART IV - TO BE FILLED OUT BY SSS |

|

|

|

||

IDENTIFICATION CARD/S OR DOCUMENT/S PRESENTED RECEIVED AND ENCODED BY |

|

|

|

|

|||

ZJ Primary ID card/document |

|

|

|

|

|

|

|

H Two valid ID card/s or document/s, one w/ photo & |

SIGNATURE OVER PRINTED NAME |

POSITION TITLE |

DATE AND TIME |

BRANCH |

|||

both w/ signature |

|

REVIEWED BY |

|

|

|

|

|

2] Other ID cards/document |

|

|

|

|

|

|

|

|

|

SIGNATURE OVER PRINTED NAME |

POSITION TITLE |

|

DATE AND TIME |

||

_______________________________________________________________________________ Perforate Here- |

|

|

|

|

|||

|

|

Republic of the Philippines |

|

|

|

|

|

|

|

SOCIAL SECURITY SYSTEM |

|

|

|

|

|

|

|

MEMBER LOAN APPLICATION |

|

|

|

|

|

|

ACKNOWLEDGEMENT STUB |

|

|

|

|||

SS NO./COMMON REFERENCE NO. (if any) |

NAME |

(^ST NAME) |

(FIRST NAME) |

|

(MIDDLE NAME) |

|

(SUFFIX) |

RECEIVED BY |

|

|

|

|

|

|

|

SIGNATURE OVER PRINTED NAME |

|

POSITION TITLE |

|

DATE & TIME |

|

BRANCH |

|

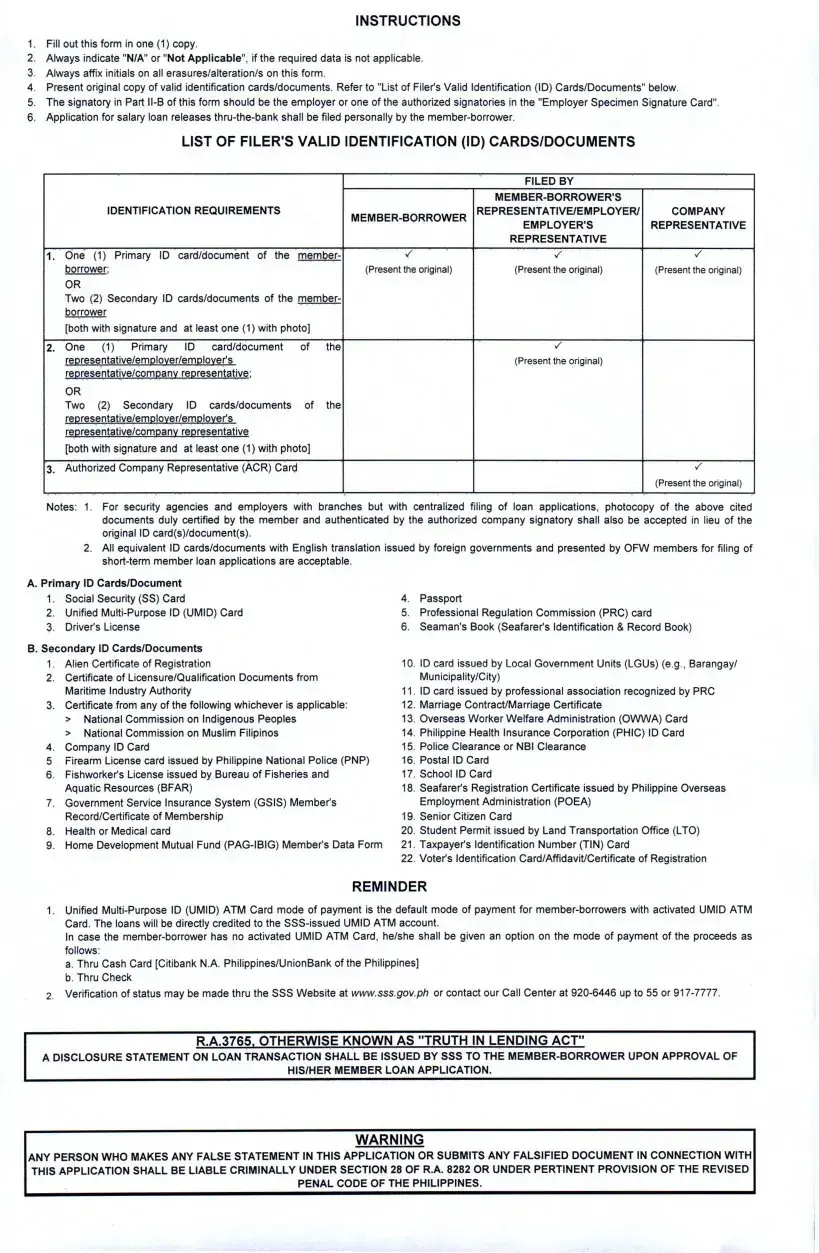

INSTRUCTIONS

1.Fill out this form in one (1) copy.

2.Always indicate "N/A" or "Not Applicable", if the required data is not applicable.

3.Always affix initials on all erasures/alteration/s on this form.

4.Present original copy of valid identification cards/documents. Refer to "List of Filer's Valid Identification (ID) Cards/Documents" below.

5.The signatory in Part

6.Application for salary loan releases

LIST OF FILER’S VALID IDENTIFICATION (ID) CARDS/DOCUMENTS

|

|

|

FILED BY |

|

|

IDENTIFICATION REQUIREMENTS |

|

|

|

|

REPRESENTATIVE/EMPLOYER/ |

COMPANY |

||

|

|

|

EMPLOYER’S |

REPRESENTATIVE |

|

|

|

REPRESENTATIVE |

|

1. |

One (1) Primary ID card/document of the member- |

Z |

Z |

Z |

|

borrower: |

(Present the original) |

(Present the original) |

(Present the original) |

|

OR |

|

|

|

|

Two (2) Secondary ID cards/documents of the member- |

|

|

|

|

borrower |

|

|

|

|

[both with signature and at least one (1) with photo] |

|

|

|

2. |

One (1) Primary ID card/document of the |

|

Z |

|

|

reoresentative/emolover/emolover's |

|

(Present the original) |

|

|

reoresentative/comoanv representative: |

|

|

|

|

OR |

|

|

|

|

Two (2) Secondary ID cards/documents of the |

|

|

|

|

representative/emplover/emplover's |

|

|

|

|

representative/companv representative |

|

|

|

|

[both with signature and at least one (1) with photo] |

|

|

|

3. |

Authorized Company Representative (ACR) Card |

|

|

Z |

|

|

|

|

(Present the original) |

Notes: 1. For security agencies and employers with branches but with centralized filing of loan applications, photocopy of the above cited documents duly certified by the member and authenticated by the authorized company signatory shall also be accepted in lieu of the original ID card(s)/document(s).

2.All equivalent ID cards/documents with English translation issued by foreign governments and presented by OFW members for filing of

A. Primary ID Cards/Document

1.Social Security (SS) Card

2.Unified

3.Driver's License

B. Secondary ID Cards/Documents

1.Alien Certificate of Registration

2.Certificate of Licensure/Qualification Documents from Maritime Industry Authority

3.Certificate from any of the following whichever is applicable:

>National Commission on Indigenous Peoples

>National Commission on Muslim Filipinos

4.Company ID Card

5 Firearm License card issued by Philippine National Police (PNP)

6.Fishworker's License issued by Bureau of Fisheries and Aquatic Resources (BFAR)

7.Government Service Insurance System (GSIS) Member's Record/Certificate of Membership

8.Health or Medical card

9.Home Development Mutual Fund

4.Passport

5.Professional Regulation Commission (PRC) card

6.Seaman's Book (Seafarer's Identification & Record Book)

10.ID card issued by Local Government Units (LGUs) (e.g., Barangay/ Municipality/City)

11.ID card issued by professional association recognized by PRC

12.Marriage Contract/Marriage Certificate

13.Overseas Worker Welfare Administration (OWWA) Card

14.Philippine Health Insurance Corporation (PHIC) ID Card

15.Police Clearance or NBI Clearance

16.Postal ID Card

17.School ID Card

18.Seafarer's Registration Certificate issued by Philippine Overseas Employment Administration (POEA)

19.Senior Citizen Card

20.Student Permit issued by Land Transportation Office (LTO)

21.Taxpayer's Identification Number (TIN) Card

22.Voter's Identification Card/Affidavit/Certificate of Registration

REMINDER

1.Unified

In case the

a.Thru Cash Card [Citibank N.A. Philippines/UnionBank of the Philippines]

b.Thru Check

2.Verification of status may be made thru the SSS Website at www.sss.gov.ph or contact our Call Center at

R.A.3765, OTHERWISE KNOWN AS "TRUTH IN LENDING ACT"

A DISCLOSURE STATEMENT ON LOAN TRANSACTION SHALL BE ISSUED BY SSS TO THE

HIS/HER MEMBER LOAN APPLICATION.

WARNING

ANY PERSON WHO MAKES ANY FALSE STATEMENT IN THIS APPLICATION OR SUBMITS ANY FALSIFIED DOCUMENT IN CONNECTION WITH THIS APPLICATION SHALL BE LIABLE CRIMINALLY UNDER SECTION 28 OF R.A. 8282 OR UNDER PERTINENT PROVISION OF THE REVISED PENAL CODE OF THE PHILIPPINES.

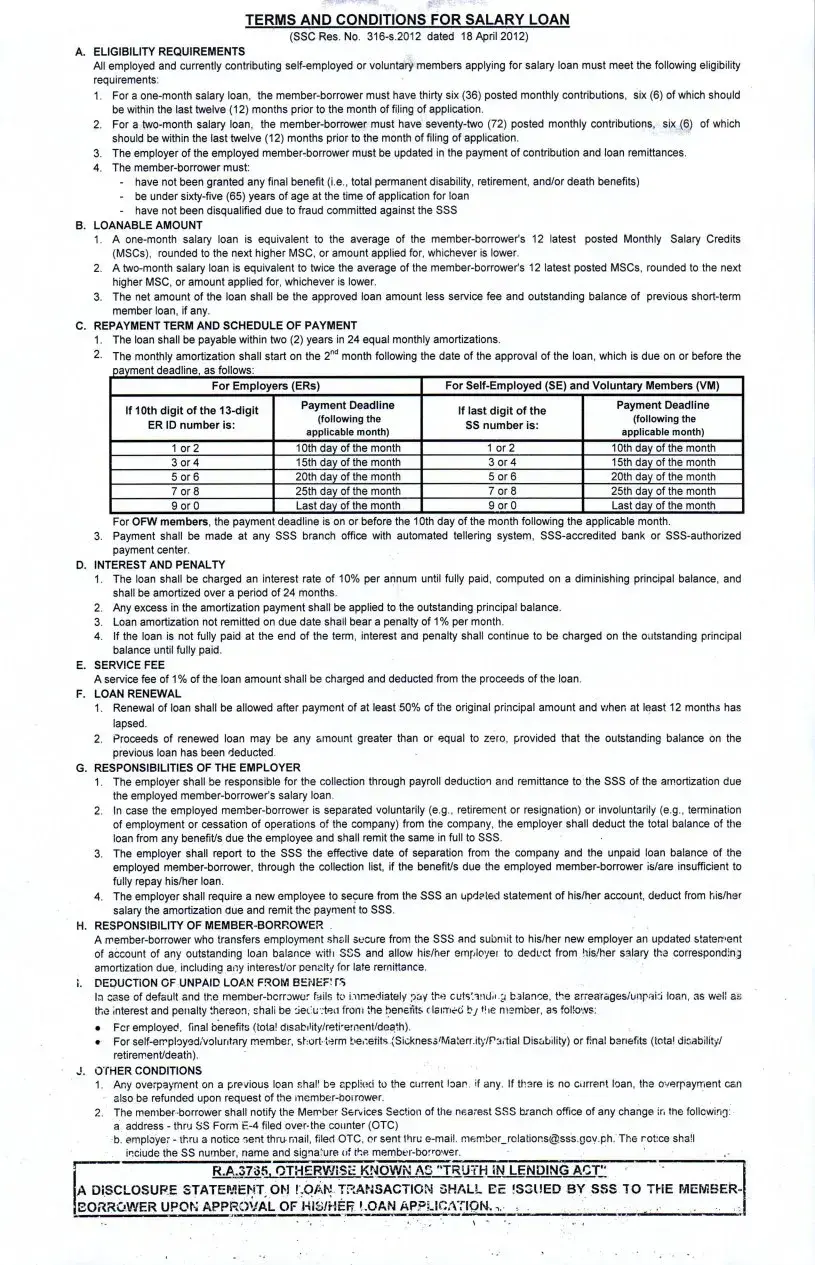

TERMS AND CONDITIONS FOR SALARY LOAN

(SSCRes. No.

A.ELIGIBILITY REQUIREMENTS

All employed and currently contributing

1.For a

2.For a

3.The employer of the employed

4.The

-have not been granted any final benefit (i.e., total permanent disability, retirement, and/or death benefits)

-be under

-have not been disqualified due to fraud committed against the SSS

B.LOANABLE AMOUNT

1.A

2.A

3.The net amount of the loan shall be the approved loan amount less service fee and outstanding balance of previous

C.REPAYMENT TERM AND SCHEDULE OF PAYMENT

1.The loan shall be payable within two (2) years in 24 equal monthly amortizations.

2.The monthly amortization shall start on the 2nd month following the date of the approval of the loan, which is due on or before the payment deadline, as follows:

|

For Employers (ERs) |

For |

||

|

If 10th digit of the |

Payment Deadline |

If last digit of the |

Payment Deadline |

|

(following the |

(following the |

||

|

ER ID number is: |

SS number is: |

||

|

applicable month) |

applicable month) |

||

|

|

|

||

|

1 or 2 |

10th day of the month |

1 or 2 |

10th day of the month |

|

3 or 4 |

15th day of the month |

3 or 4 |

15th day of the month |

: |

5 or 6 |

20th day of the month |

5 or 6 |

20th day of the month |

|

7 or 8 |

25th day of the month |

7 or 8 |

25th day of the month |

|

9 or 0 |

Last day of the month |

9 or 0 |

Last day of the month |

For OFW members, the payment deadline is on or before the 10th day of the month following the applicable month.

3.Payment shall be made at any SSS branch office with automated tellering system,

D.INTERESTAND PENALTY

1.The loan shall be charged an interest rate of 10% per annum until fully paid, computed on a diminishing principal balance, and shall be amortized over a period of 24 months.

2.Any excess in the amortization payment shall be applied to the outstanding principal balance.

3.Loan amortization not remitted on due date shall bear a penalty of 1% per month.

4.If the loan is not fully paid at the end of the term, interest and penalty shall continue to be charged on the outstanding principal balance until fully paid.

E.SERVICE FEE

A service fee of 1% of the loan amount shall be charged and deducted from the proceeds of the loan.

F.LOAN RENEWAL

1.Renewal of loan shall be allowed after payment of at least 50% of the original principal amount and when at least 12 months has lapsed.

2.Proceeds of renewed loan may be any amount greater than or equal to zero, provided that the outstanding balance on the previous loan has been deducted.

G.RESPONSIBILITIES OF THE EMPLOYER

1.The employer shall be responsible for the collection through payroll deduction and remittance to the SSS of the amortization due the employed

2.In case the employed

3.The employer shall report to the SSS the effective date of separation from the company and the unpaid loan balance of the employed

4.The employer shall require a new employee to secure from the SSS an updated statement of his/her account, deduct from his/her salary the amortization due and remit the payment to SSS.

H.RESPONSIBILITY OF MEMBER BORROWER

A

i. DEDUCTION OF UNPAID LOAN FROM BENER PS

In case of default and the

•Fcr employed, final benefits (tola! disabiHty/retrernent/dea*h).

•For

J.OTHER CONDITIONS

1.Any overpayment on a previous loan shall be applied to the current loan, if any. If there is no current loan, the overpayment can also be refunded upon request of the

2.The

b. employer - thru a notice sent thru mail, filed OTC, or sent thru

“ |

R.AJ3735, OTHERWISE KNOWN AS R1J:rH7N~LENDINGACT,: ” ' |

A DISCLOSURE STATEMENT ON LOAN TRANSACTION SHALL EE ’S3UED BY SSS TO THE MEMBER

BORROWER UPON APPROVAL OF HIS/HER LOAN APPLICATION, n. t |

. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The SSS Loan Application form is used by members of the Social Security System in the Philippines to apply for a loan. It requires personal and employment information. |

| Eligibility Requirements | Employed members need 36 monthly contributions for a one-month salary loan and 72 for a two-month salary loan. Other criteria may apply. |

| Loan Repayment | Loans are payable within two years, typically in 24 monthly installments starting two months after approval. |

| Governing Law | The loan application is regulated under the provisions of R.A. 3765, known as the Truth in Lending Act, and R.A. 8282. |

| Reproduction Policy | The form can be reproduced and downloaded for free from the SSS website. It is not for sale. |

Guidelines on Utilizing Sss Loan Application

Completing the SSS Loan Application form accurately is crucial to ensure your application is processed without delays. After you submit your application, the SSS will review the information you've provided and determine your eligibility based on the details submitted. Here’s how to effectively fill out the application form.

- Obtain the SSS Loan Application form from the SSS website or through a physical location.

- Use a black ink pen and print all information in capital letters to ensure clarity.

- In **Part 1** labeled "TO BE FILLED OUT BY MEMBER-BORROWER", input your SS Number and any Common Reference Number you may have.

- Complete your personal details including your date of birth, tax identification number (if applicable), and full name. Include your home and mailing addresses, along with your telephone number, mobile number, and email address.

- If applicable, provide your foreign address including the country and zip code.

- In the **Loan Data** section, select the appropriate loan type and write the amount you intend to apply for.

- Indicate the mode of payment by checking the corresponding option: Unified Multi-Purpose ID (UMID) ATM Card, Cash Card, or Check.

- If you selected Cash Card as your mode of payment, leave the Cash Card/Savings Account Number blank for now, as it only needs to be filled out upon issuance of the card.

- Specify your preferred bank for receiving the loan proceeds.

- In the **Certification, Agreement and Promissory Note** section, affirm that the information you provided is accurate and agree to the terms and conditions attached to the application.

- Print your name, sign the form, and include the date of your signature.

- If you are employed, complete **Part II** with your employer’s information, including the employer ID number and tax identification number (if applicable).

- In the **Certification** part of Section II, the employer or authorized representative must print their name, sign, and include their position title along with the date.

- For members allowing an authorized representative to file on their behalf, complete **Part III** by providing the details of the authorized person and obtaining their signature.

- Submit the form along with valid identification documents as specified. Make sure there are no erasures or alterations; initial any corrections made.

After submission, wait for feedback from SSS regarding your loan application. This communication will guide you on the next steps according to the outcome of your request.

What You Should Know About This Form

What is the SSS Loan Application Form?

The SSS Loan Application Form is a document used by members of the Social Security System in the Philippines to apply for salary loans. It collects personal information, loan details, and employer certification. This form ensures that the borrower meets the eligibility requirements before approval. Members can download the form from the SSS website or obtain a physical copy.

Who is eligible to apply for a loan using this form?

To be eligible for a salary loan, members must be employed or contributing self-employed individuals. Specific criteria include having a certain number of monthly contributions and being under 65 years old at the time of application. Additionally, the member's employer must be up-to-date with contributions and loan remittances.

How should I fill out the SSS Loan Application Form?

When filling out the application form, use capital letters and black ink only. Be sure to provide accurate information in all sections. If a particular field does not apply to you, indicate "N/A." Initially, you will complete Part 1, and if employed, your employer will fill out Part 2. Both parties must sign to certify the information is correct.

What supporting documents are needed with the application?

Members must present a valid identification card, either a primary ID or two secondary IDs, at the time of application. Employers also need to present identification documents as specified. Valid documents help verify the identity of the member and ensure smooth processing of the application.

How will the loan amount be determined?

The loanable amount depends on the member's Monthly Salary Credits (MSCs). For a one-month loan, it will be the average of the twelve latest MSCs, while for a two-month loan, it will be twice that amount. However, the loan cannot exceed the amount applied for. The net loan amount will be determined by deducting service fees and any outstanding loan balances from the approved loan amount.

What are the repayment terms for the loan?

Loan repayment is structured over a period of two years, divided into 24 equal monthly installments. Payments begin on the second month after loan approval, and specific due dates will vary based on the member's SS number or employer identification number. Timely payment helps avoid penalties and interest charges on the outstanding balance.

Can I renew my loan, and if so, what are the conditions?

Yes, loan renewal is possible after repaying at least 50% of the original principal amount and at least 12 months have passed since the last loan payment. The renewed loan amount must be greater than or equal to zero, with any outstanding balance from previous loans subtracted from the new amount.

What happens if I default on my loan repayment?

If a member defaults, unpaid loans, including interest and penalties, may be deducted from future benefits owed, such as retirement or disability benefits. It is important to communicate with the SSS regarding any difficulties in repayment as they may offer solutions to avoid default.

Common mistakes

Completing the SSS Loan Application form can be straightforward, but many individuals make common mistakes that can hinder the approval process. Being aware of these errors can save time and ensure a smoother application experience.

One significant mistake is not using capital letters. The instructions specify that all information must be printed in capital letters. Writing in lowercase can lead to confusion and misinterpretation of crucial details.

Another common error is failing to provide accurate personal information. Even minor discrepancies, such as a misspelled name or incorrect SS number, can delay processing. Always double-check the details before submitting the form.

Additionally, applicants sometimes neglect to include their tax identification number (TIN) when applicable. This omission can raise red flags and potentially result in rejection. If you do not have a TIN, marking it as "N/A" is advisable.

Many individuals also ignore the instruction to indicate "N/A" for non-applicable sections. Leaving blanks can create confusion for the processor. This practice signals that you have considered each section carefully.

Furthermore, applicants may forget to sign and date the application where required. Missing signatures can lead to automatic rejection or delays, so ensure that all required areas are signed before submission.

Some people fail to include valid identification documents as required. The application specifies that valid IDs must be presented. Not providing the correct identification can adversely affect loan approval.

Inadvertently, applicants may also confuse their preferred mode of payment. Selecting the wrong option can complicate the payment process later on. Make sure to understand the choices available and select one that suits your needs.

A less recognized mistake is not initialing changes or corrections made on the form. Any alterations should be initialed to confirm their legitimacy. Failing to do so may cast doubt on the integrity of your application.

Lastly, some applicants misinterpret eligibility requirements, leading them to apply when they do not meet the criteria. Familiarize yourself with the specifics, including contribution history and age limits.

By aligning with these guidelines and avoiding common pitfalls, applicants can improve their chances of securing an SSS loan smoothly and efficiently.

Documents used along the form

When applying for a loan with the Social Security System (SSS), several other forms and documents are commonly required alongside the SSS Loan Application Form. Understanding these documents can help ensure a smooth application process.

- ID Card/Document: This is a primary requirement that verifies the identity of the member-borrower. Acceptable forms include the Social Security (SS) Card, Unified Multi-Purpose ID (UMID), or a valid driver's license.

- Loan Disclosure Statement: Issued after the loan application approval, this document outlines the specifics of the loan, including amounts, terms, and repayment schedules, ensuring the borrower is fully informed.

- Employer Information Form: For employed member-borrowers, this form gathers details about the employer such as their tax identification number and business name, which is necessary for verifying employment and contribution status.

- Certification Document: A signed statement from the member-borrower confirming the truthfulness of the provided information and agreement to the loan's terms and conditions. This helps protect both parties legally.

- Authorization Letter: If a representative is applying on behalf of the member-borrower, this letter gives permission for that person to submit the loan application and necessary documents.

- Income Verification: A recent payslip or salary statement may be required to confirm income and employment status, demonstrating the member-borrower's ability to repay the loan.

Collecting and submitting these documents efficiently will speed up the loan application process. Familiarity with these requirements is essential for a successful application to the SSS.

Similar forms

- Personal Loan Application Form: Similar to the SSS loan application, this form collects personal details, financial information, and consent for borrowing. Both require accurate completion and necessary documentation.

- Bank Loan Application Form: This document requests information about the borrower’s identity and financial status. Like the SSS form, it includes sections on loan type and repayment terms.

- Credit Card Application Form: Just as with the SSS application, this form asks for personal information and financial details. It assesses eligibility based on the applicant's creditworthiness.

- Mortgage Application Form: This form is used for home loans and requires similar data about the applicant’s income, debts, and assets, reflecting the borrower’s financial reliability.

- Auto Loan Application Form: Capturing loan requests for vehicle purchases, this document parallels the SSS form in requiring personal information and loan terms acceptance.

- Student Loan Application Form: Designed for educational financing, this form shares traits with the SSS application by collecting relevant information regarding the borrower's educational and financial background.

- Microfinance Loan Application Form: Used for small loans, this document also gathers personal and financial information and evaluates eligibility, similar to the SSS loan process.

- Home Equity Line of Credit (HELOC) Application Form: This form assesses the equity in a home and requires comprehensive financial details, much like the SSS form in relation to loan evaluation.

- Payday Loan Application Form: Similar to the SSS loan application, this short-term loan form requests personal information and verification of income to determine eligibility for immediate borrowing.

Dos and Don'ts

When filling out the SSS Loan Application form, it's essential to follow specific guidelines to ensure that the application is completed correctly. Here are six important things you should and shouldn't do:

- Do: Print all information in capital letters and use black ink only.

- Don't: Leave any required fields blank. If information isn't applicable, write "N/A" instead.

- Do: Affix your initials on all erasures or alterations made on the form.

- Don't: Use unauthorized or colored ink for filling out the application.

- Do: Present the original copy of valid identification documents when submitting the application.

- Don't: Submit photocopies of identification documents unless specifically allowed.

Following these guidelines will help facilitate a smoother application process. It can save you time and prevent potential delays in loan approval.

Misconceptions

1. Misconception: The SSS Loan Application form is overly complicated and difficult to understand.

While the form may seem lengthy, it is designed to gather all necessary information efficiently. Clear instructions are provided throughout the document, ensuring that members can complete it correctly without confusion. Taking time to read the instructions can clarify any complex parts.

2. Misconception: Only certain individuals can apply for an SSS loan.

Many believe that only specific groups are eligible, but in reality, any employed or self-employed member who meets the outlined requirements can apply. It is crucial to check eligibility based on contribution history rather than assume restrictions.

3. Misconception: Submitting the form electronically is not allowed.

Some may think that paper submission is the only method accepted. However, the form can be downloaded from the SSS website and completed online before printing. Members are encouraged to utilize available technology to streamline the process.

4. Misconception: The processing time for the loan is excessively long.

While there may be variations based on the individual’s situation, most loan applications are processed in a timely manner. Members who ensure all information is complete and accurate can often expect quicker turnaround times.

5. Misconception: If I make a mistake on the form, it will automatically lead to rejection.

Errors do not necessarily result in application denial. The form has specific instructions for correcting mistakes, such as initialing any changes made. Addressing minor errors promptly can help keep the application on track.

Key takeaways

The SSS Loan Application form is an essential document for members seeking financial assistance. Understanding how to fill it out properly can streamline the application process. Here are key takeaways to keep in mind:

- Read Instructions Carefully: Review all provided instructions and terms associated with the loan before beginning the application.

- Use Capital Letters: Fill out the form using capital letters and black ink for clarity and legibility.

- Complete All Sections: Ensure all sections of the form are filled out completely; indicate "N/A" for any non-applicable fields.

- Provide Accurate Information: Verify that all personal and financial details, including the SS number and Tax Identification Number, are accurate.

- Signature Required: Sign and date the form to certify that all information provided is true and correct.

- ID Verification: Present valid identification, as specified in the application, to authenticate your identity when submitting the form.

- Employer's Cooperation: If employed, ensure your employer is informed and prepared to provide necessary details in Part II of the form.

- Acknowledge Responsibilities: Be aware of your responsibilities as a member-borrower, including the repayment conditions and potential penalties for late payment.

- Loan Disbursement Options: Choose a preferred mode of payment for receiving loan proceeds, such as through a cash card, check, or bank account.

- Know Your Eligibility: Familiarize yourself with the eligibility requirements for the loan to avoid delays in processing your application.

Awareness of these points can make the loan application experience more efficient and less stressful for the member-borrower.

Browse Other Templates

Satisfaction of Debt Letter - The signer may provide additional identifying information if necessary.

Faa Ferry Permit Form 8130-6 - Proper completion of this form demonstrates compliance with regulations, benefiting overall safety in aviation.