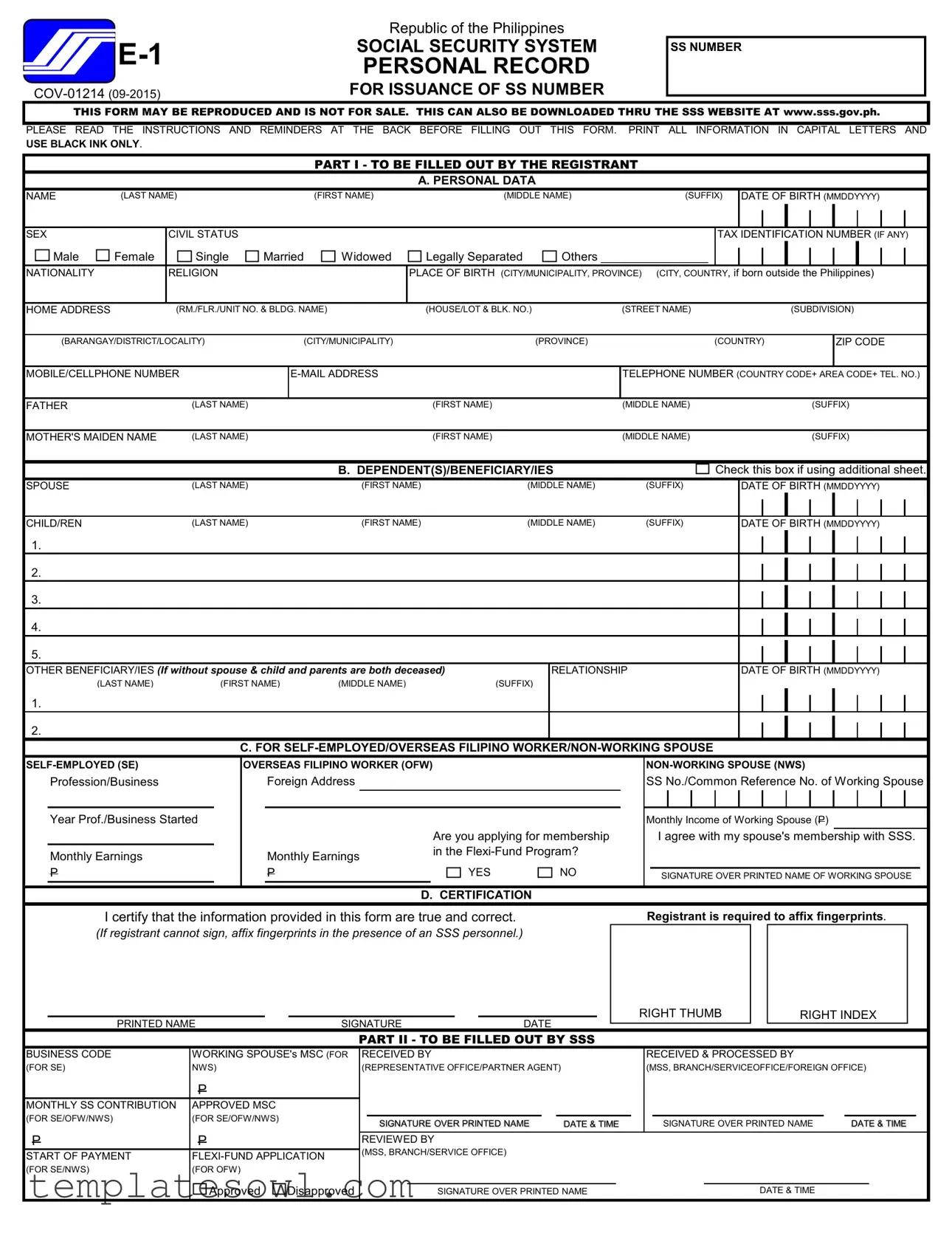

Fill Out Your Sss Registration E1 Form

The SSS Registration E1 form is a crucial document for individuals seeking to obtain a Social Security Number in the Philippines. This form captures essential personal details such as the registrant's name, date of birth, sex, civil status, and nationality. It also requires the registrant to provide information about their family members, including dependents and beneficiaries. For those who are self-employed or Overseas Filipino Workers (OFWs), the form includes sections for reporting their profession, monthly earnings, and foreign addresses. The E1 form emphasizes accuracy, mandating that all data be printed in capital letters and submitted along with supporting documents, like birth certificates or marriage contracts. Registrants must certify the truthfulness of the information provided and affix their fingerprints, ensuring that their registration is both legitimate and secure. Additionally, anyone over sixty years old without specific qualifying status should be aware that they are not eligible to apply for an SS number. Clear instructions for completion and submission guide applicants through the process, minimizing potential confusion. Understanding these key aspects of the E1 form allows individuals to navigate their application more effectively and ensures that they receive the benefits intended by the Social Security System.

Sss Registration E1 Example

Republic of the Philippines

SOCIAL SECURITY SYSTEM |

||

PERSONAL RECORD |

||

|

SS NUMBER

FOR ISSUANCE OF SS NUMBER |

THIS FORM MAY BE REPRODUCED AND IS NOT FOR SALE. THIS CAN ALSO BE DOWNLOADED THRU THE SSS WEBSITE AT www.sss.gov.ph.

PLEASE READ THE INSTRUCTIONS AND REMINDERS AT THE BACK BEFORE FILLING OUT THIS FORM. PRINT ALL INFORMATION IN CAPITAL LETTERS AND

USE BLACK INK ONLY.

PART I - TO BE FILLED OUT BY THE REGISTRANT

A. PERSONAL DATA

NAME |

(LAST NAME) |

(FIRST NAME) |

(MIDDLE NAME) |

(SUFFIX) |

DATE OF BIRTH (MMDDYYYY) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEX |

|

CIVIL STATUS |

|

|

|

|

|

TAX IDENTIFICATION NUMBER (IF ANY) |

||||||||

Male |

Female |

Single |

Married |

Widowed |

Legally Separated |

Others ________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

NATIONALITY |

|

RELIGION |

|

|

PLACE OF BIRTH (CITY/MUNICIPALITY, PROVINCE) (CITY, COUNTRY, if born outside the Philippines) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

HOME ADDRESS |

|

(RM./FLR./UNIT NO. & BLDG. NAME) |

|

(HOUSE/LOT & BLK. NO.) |

|

(STREET NAME) |

|

|

|

(SUBDIVISION) |

||||||

(BARANGAY/DISTRICT/LOCALITY) |

(CITY/MUNICIPALITY) |

(PROVINCE) |

(COUNTRY) |

ZIP CODE

MOBILE/CELLPHONE NUMBER

TELEPHONE NUMBER (COUNTRY CODE+ AREA CODE+ TEL. NO.)

FATHER |

(LAST NAME) |

(FIRST NAME) |

(MIDDLE NAME) |

(SUFFIX) |

|

|

|

|

|

MOTHER'S MAIDEN NAME |

(LAST NAME) |

(FIRST NAME) |

(MIDDLE NAME) |

(SUFFIX) |

|

|

B. DEPENDENT(S)/BENEFICIARY/IES |

|

Check this box if using additional sheet. |

||||||||

SPOUSE |

(LAST NAME) |

(FIRST NAME) |

(MIDDLE NAME) |

(SUFFIX) |

DATE OF BIRTH (MMDDYYYY) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHILD/REN |

(LAST NAME) |

(FIRST NAME) |

(MIDDLE NAME) |

(SUFFIX) |

DATE OF BIRTH (MMDDYYYY) |

|||||||

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER BENEFICIARY/IES (If without spouse & child and parents are both deceased) |

RELATIONSHIP |

|

DATE OF BIRTH (MMDDYYYY) |

|||||||||

(LAST NAME) |

(FIRST NAME) |

(MIDDLE NAME) |

(SUFFIX) |

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.

C. FOR

Profession/Business

Year Prof./Business Started

Monthly Earnings

P

OVERSEAS FILIPINO WORKER (OFW)

Foreign Address

|

Are you applying for membership |

|

Monthly Earnings |

in the |

|

|

|

|

P |

YES |

NO |

|

|

|

SS No./Common Reference No. of Working Spouse

Monthly Income of Working Spouse (P)

I agree with my spouse's membership with SSS.

SIGNATURE OVER PRINTED NAME OF WORKING SPOUSE

D. CERTIFICATION

I certify that the information provided in this form are true and correct.

(If registrant cannot sign, affix fingerprints in the presence of an SSS personnel.)

Registrant is required to affix fingerprints.

RIGHT THUMB |

RIGHT INDEX |

PRINTED NAME |

SIGNATURE |

DATE |

PART II - TO BE FILLED OUT BY SSS

BUSINESS CODE |

WORKING SPOUSE's MSC (FOR |

(FOR SE) |

NWS) |

|

P |

|

MONTHLY SS CONTRIBUTION |

APPROVED MSC |

|

(FOR SE/OFW/NWS) |

(FOR SE/OFW/NWS) |

|

P |

P |

|

START OF PAYMENT |

||

(FOR SE/NWS) |

(FOR OFW) |

|

|

Approved |

Disapproved |

RECEIVED BY |

|

|

|

RECEIVED & PROCESSED BY |

|

|

|

||||||

(REPRESENTATIVE OFFICE/PARTNER AGENT) |

|

|

|

(MSS, BRANCH/SERVICEOFFICE/FOREIGN OFFICE) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OVER PRINTED NAME |

DATE & TIME |

|

SIGNATURE OVER PRINTED NAME |

|

DATE & TIME |

|||||||

REVIEWED BY |

|

|

|

|

|

|

|

|

|

||||

(MSS, BRANCH/SERVICE OFFICE) |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

SIGNATURE OVER PRINTED NAME |

|

|

DATE & TIME |

|

|

|

|||||

INSTRUCTIONS

1.Fill out this form and submit to the nearest SSS branch office together with the required documents.

2.Fill out the applicable portions as follows:

Parts

Parts

-For Part

3.Always indicate "N/A" or "Not Applicable", if the required data is not applicable.

4.If this form is to be downloaded from the internet, please

REMINDERS

1.New registrant who is over sixty (60) years old and not a surviving spouse pensioner/guardian of a pensioner, is not qualified to apply for an SS number.

2.Your SS number is your lifetime number. You should not have more than one SS number.

3.The following required documents should be the original or certified true copy issued by the City or Municipal Civil Registrar or Philippine Statistics Authority/National Statistics Office:

3.1Birth Certificate

3.2Marriage Contract/Marriage Certificate

3.3Death Certificate

4.All identification (ID) cards and/or documents with English translation issued by foreign government are acceptable.

LIST OF DOCUMENTARY REQUIREMENTS

Always present the original or certified true copy/ies when submitting the photocopy/ies of the required ID card(s) and/or document(s).

A. |

ID Cards and/or Documents for the Issuance of SS Number |

‒ |

Marriage Contract/Marriage Certificate |

|||||||||||||||

Birth Certificate, or in its absence, any of the following |

National Bureau of Investigation (NBI) Clearance |

|||||||||||||||||

|

documents: |

|

|

|

‒ |

Overseas Worker Welfare Administration (OWWA) card |

||||||||||||

|

‒ |

Baptismal Certificate or its equivalent |

|

|

‒ |

Philippine Health Insurance Corporation (PHIC) ID |

||||||||||||

|

Driver's License |

|

|

|

‒ |

card/Member's Data Record |

||||||||||||

|

‒ |

Passport |

|

|

|

‒ |

Police Clearance |

|

|

|

||||||||

|

‒ |

Professional Regulation Commission (PRC) card |

|

Postal ID card |

|

|

|

|

|

|

||||||||

|

‒ |

Seaman's Book (Seafarer's Identification and Record Book) |

‒ |

School ID card |

|

|

|

|

|

|

||||||||

|

‒ |

|

|

|

|

‒ |

Seafarer's Registration Certificate issued by Philippine |

|||||||||||

|

In the absence of the above ID cards and/or documents, any two |

‒ |

Overseas Employment Administration (POEA) |

|||||||||||||||

|

(2) of the following documents both with the correct name and at |

‒ |

Senior Citizen card |

|

|

|

||||||||||||

|

least one (1) with date of birth: |

|

|

|

Student Permit issued by Land Transportation Office (LTO) |

|||||||||||||

|

‒ |

Alien Certificate of Registration |

|

|

|

‒ |

Taxpayer's Identification Number (TIN) card |

|||||||||||

|

ATM card (with cardholder's name) |

|

|

‒ |

Transcript of Records |

|

|

|

||||||||||

|

‒ |

Bank Account Passbook |

|

|

|

‒ |

Voter's ID card/Affidavit/Certificate of Registration |

|||||||||||

|

‒ |

Baptismal Certificate of child/ren or its equivalent |

|

B. Additional Supporting Documents |

||||||||||||||

|

|

|

|

|

‒ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

‒ |

Birth Certificate of child/ren |

|

|

|

|

For married |

|

|

|

|

|

|

|||||

|

‒ |

|

|

|

|

|

|

|

|

|

|

|||||||

|

Certificate of Confirmation issued by National Commission on |

|

‒ |

Marriage Contract/Marriage Certificate or a copy of |

||||||||||||||

|

‒ |

Indigenous Peoples (formerly Office of Southern Cultural |

|

Member Data Change Request form (SS Form |

||||||||||||||

|

‒ |

Community and Office of Northern Cultural Community) |

|

|

|

of the spouse duly received by the SSS where the |

||||||||||||

|

Certificate of Licensure/Qualification Documents from Maritime |

|

|

name of the |

registrant is reported as the spouse |

|||||||||||||

|

Industry Authority |

|

|

|

|

For widowed |

|

|

||||||||||

|

‒ |

Certificate of Muslim Filipino Tribal Affiliation issued by |

|

‒ |

Marriage Contract/Marriage Certificate |

|||||||||||||

|

National Commission on Muslim Filipinos |

|

|

|

Marriage Contract/Marriage Certificate and Death |

|||||||||||||

|

‒ |

Company ID card |

|

|

|

|

‒ |

Certificate of spouse or Court Order on the |

||||||||||

|

Court Order granting petition for change of name or date of |

|

|

Declaration of Presumptive Death, if previously |

||||||||||||||

|

‒ |

birth |

|

|

|

|

|

reported spouse is presumed dead |

||||||||||

|

‒ |

Credit card |

|

|

|

|

For legally separated |

|

|

|

|

|||||||

|

Firearm License card issued |

by Philippine |

National |

Police |

|

|

Decree of Legal Separation |

|||||||||||

|

‒ |

(PNP) |

|

|

|

|

For annulled or with void marriage |

|||||||||||

|

|

|

|

|

‒ |

|

|

|

|

|

|

|

|

|

|

|

||

|

‒ |

Fishworker's License issued by Bureau of Fisheries and |

|

‒ |

Certificate |

|

of Finality of Annulment/Nullity or |

|||||||||||

|

Aquatic Resources (BFAR) |

|

|

|

|

annotated |

Marriage Contract/Marriage Certificate |

|||||||||||

|

‒ |

Government Service Insurance System (GSIS) card/ |

|

For divorced |

|

|

|

|

|

|

|

|||||||

|

Member's Record/Certificate of Membership |

|

|

|

‒ |

Decree of Divorce and Certificate of Naturalization |

||||||||||||

|

‒ |

Health or Medical card |

|

|

|

|

(granted before divorce) or its equivalent |

|||||||||||

|

Home Development Mutual Fund |

|

For divorced Muslim member |

|

||||||||||||||

|

‒ |

card/Member's Data Form |

|

|

|

|

|

Certificate of Divorce (OCRG Form No. 102) |

||||||||||

|

Homeowners Association ID card |

|

|

|

For reporting child/ren |

- whichever is applicable |

||||||||||||

|

‒ |

|

|

|

|

|

‒ |

|

|

|

|

|

|

|

|

|||

|

ID card issued by Local |

Government |

Units |

(LGUs) |

|

‒ |

Birth Certificate/s or Baptismal Certificate/s or its |

|||||||||||

|

‒ |

(e.g., Barangay/ Municipality/ City) |

|

|

|

equivalent |

|

|

|

|

|

|

||||||

|

‒ |

ID card issued by professional association recognized by |

C. |

|

Decree of Adoption |

|||||||||||||

|

PRC |

|

|

|

|

Documents for local enrolment in the |

||||||||||||

|

|

|

|

|

|

Valid‒ |

Overseas Employment Certificate (OEC) or E- |

|||||||||||

|

‒ |

Life Insurance Policy |

|

|

|

|

receipt issued by POEA |

|||||||||||

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The SSS Registration E1 form is used to apply for an SS number in the Philippines. |

| Governing Authority | This form falls under the Republic Act No. 8282, the Social Security Law of the Philippines. |

| Document Reproduction | This form may be reproduced and is not for sale, allowing easy access for applicants. |

| Eligibility Criteria | Applicants over 60 years old who are not pensioners cannot apply for an SS number. |

| Required Age Limit | The new registrant must be at least 15 years old to apply for an SS number. |

| Identification Requirements | Applicants must provide a birth certificate or other specified IDs as proof of identity. |

| Form Submission | The completed form must be submitted to the nearest SSS branch office along with required documents. |

| Signature Requirement | The registrant must sign the form, or if unable to, must affix fingerprints in the presence of SSS personnel. |

| Data Accuracy | Applicants must ensure that all information provided is truthful and accurate to avoid delays in processing. |

Guidelines on Utilizing Sss Registration E1

After filling out the SSS Registration E1 form, you will submit it along with the necessary documents to your nearest SSS branch office. Make sure to prepare all materials beforehand to ensure a smooth submission process.

- Begin filling out Part I - Personal Data.

- Write your name, including last name, first name, and middle name, as well as any suffix if applicable.

- Enter your date of birth in the format MMDDYYYY.

- Select your sex by checking the appropriate box.

- Indicate your civil status. Options include Single, Married, Widowed, Legally Separated, and Others.

- If applicable, provide your Tax Identification Number.

- Fill in your nationality and religion.

- Complete your place of birth, specifying city/municipality and province, along with city and country if born outside the Philippines.

- Input your home address in detail, including unit number, building name, street name, barangay, municipality, province, and ZIP code.

- Add your mobile/cellphone number, email address, and telephone number.

- Input your parents’ names in the designated fields, including their suffixes.

- If applicable, fill out the section for dependents/beneficiaries. You may need an additional sheet if there are many dependents.

- For self-employed or OFW applicants, provide your profession or business information and monthly earnings.

- In the certification section, affix your signature and print name, along with the date.

- Submit the form along with the required documents to the nearest SSS office.

What You Should Know About This Form

What is the SSS Registration E1 form?

The SSS Registration E1 form is the official document used by individuals applying for a Social Security System (SSS) number in the Philippines. This form collects personal information and is necessary for obtaining an SS number, which serves as a lifetime identifier within the SSS. Individuals can download this form from the SSS website or reproduce it, as it is not for sale.

Who should fill out the SSS Registration E1 form?

The form should be completed by individuals who are applying for an SS number. This includes first-time applicants, self-employed individuals, Overseas Filipino Workers (OFWs), and non-working spouses seeking membership in the SSS. Part I of the form must be filled out by the registrant, while relevant sections should also be completed as applicable.

What personal information is required on the form?

The form requires various personal details, such as the applicant's name, date of birth, sex, civil status, nationality, and home address. Additionally, applicants must provide their tax identification number, phone numbers, email address, and information about their parents, spouse, and dependents if applicable. The form must be filled out in capital letters and black ink only.

What supporting documents must accompany the SSS Registration E1 form?

Accompanying documents include a birth certificate, marriage contract, or in some cases, other identification such as an NBI clearance or passport. These documents must be original or certified true copies. Always present the originals when submitting photocopies. Additional documents may be required depending on the applicant's circumstances, such as certificates of separation or divorce.

What should I do if I cannot sign the registration form?

If the registrant is unable to sign the form, they can affix their fingerprints in the presence of SSS personnel. This ensures that the registration process remains valid and secure, despite the inability to provide a traditional signature.

Where do I submit the completed SSS Registration E1 form?

The completed form must be submitted to the nearest SSS branch office. It is advised to bring all required documents along to ensure a smooth registration process. Make sure to follow any specific instructions provided on the form or by the SSS personnel.

Can I obtain multiple SSS numbers?

No, an individual should only have one SSS number throughout their lifetime. It is crucial to maintain this number for all future transactions related to social security benefits and contributions. If someone has lost their SS number, they should contact SSS for assistance in retrieving it rather than applying for a new one.

What should I do if I have more questions about the SSS Registration E1 form?

If further assistance is needed, it is advisable to contact SSS directly through their official website or visit a local branch. SSS representatives can provide detailed information and answer additional questions regarding the registration process and related requirements.

Common mistakes

Filling out the SSS Registration E1 form can be a straightforward process, but many people make mistakes that can delay their application. One common error occurs in the personal data section, where individuals fail to use capital letters as instructed. Using lowercase letters can lead to misinterpretations and processing delays. It's essential to follow the instructions carefully and use black ink to ensure legibility.

Another frequent mistake is in the date of birth entry. Many registrants either miscalculate their birth date or incorrectly format it. The required format is MMDDYYYY, and failing to adhere to this can result in a rejection of the application. Ensure all dates are accurate and properly formatted to avoid unnecessary setbacks.

People also often overlook providing complete information, especially in the address section. Omitting details such as the barangay, zip code, or even the province can lead to confusion during processing. Double-check that every line of the address is filled out correctly to prevent complications.

Another area where mistakes can occur is when adding dependents or beneficiaries. Registrants sometimes neglect to list all relevant dependents, or they fail to use the additional sheet for more complex family structures. Be sure to include all eligible individuals to ensure your application is fully processed.

Finally, individuals may forget to sign the certification section of the form. Not signing is a common oversight that can render the whole application invalid. Always check to make sure that your signature is present, as well as any required fingerprints if applicable.

Documents used along the form

When completing the SSS Registration E1 form, several additional documents often accompany the submission. These documents provide necessary supporting information for the registration process. Below is a concise list of commonly required forms and documents.

- Birth Certificate: This document verifies the registrant's date of birth and identity. An original or certified copy is typically required.

- Marriage Contract/Certificate: For married applicants, this document affirms marital status. It should be an original or certified true copy.

- Death Certificate: Required for widowed applicants to confirm the spouse's passing and to support claims for benefits.

- Government-issued ID: Identification such as a passport, driver's license, or other official ID is used to verify identity and residency.

- Proof of Employment or Income: This could include pay slips, contracts, or business registration documents for self-employed individuals.

- Dependent Records: Documents such as birth certificates for children or marriage certificates for dependents may be required to establish eligibility for dependents' benefits.

Gathering these documents thoroughly ensures a smoother application process for obtaining an SSS number. Always make sure to provide original or certified copies, as required, when submitting the SSS Registration E1 form.

Similar forms

Birth Certificate: Like the SSS Registration E1 form, a birth certificate serves to establish personal identity and basic information such as name, date of birth, and place of birth. This document is often required for various applications, just as the E1 form is necessary for obtaining an SS number.

Marriage Certificate: This document evidences marital status, similar to how the E1 form collects civil status information. It plays a critical role in determining eligibility for various benefits and rights within the social security system.

Government Issued ID: ID cards, such as driver’s licenses or passports, validate identity and support the information provided on the E1 form. They are often required for processes involving legal recognition and access to services.

NBI Clearance: This document is needed for identity verification and ensures that an individual has no pending criminal cases. Much like the E1 form's purpose, NBI Clearance serves as a safeguard when entering official records and systems.

Tax Identification Number (TIN) Card: A TIN card reinforces the economic identity of an individual, akin to the way the E1 form represents personal and occupational details required for social security membership.

Professional Regulation Commission (PRC) Card: This card is used to verify professional qualifications. Similar to the E1 form, it confirms an individual's credentials and can be essential for self-employed individuals or professionals seeking to register with the SSS.

Dos and Don'ts

When filling out the SSS Registration E1 form, it is important to follow certain guidelines to ensure accuracy and completeness. Below is a list of things you should and shouldn't do.

- Do read all instructions carefully before starting.

- Do print all information in capital letters using black ink.

- Do fill out the required sections completely and accurately.

- Do use "N/A" for questions that are not applicable to you.

- Do submit additional sheets if you have more dependents than spaces provided.

- Don't leave any required fields blank.

- Don't use blue ink or pencil; only black ink is acceptable.

- Don't forget to sign and date the form where indicated.

- Don't submit photocopies of documents without presenting the original or certified true copies.

Misconceptions

Misconception 1: The SSS Registration E1 form is only for employees.

Many believe that this form is exclusively for individuals who are formally employed. In fact, the SSS Registration E1 form is intended for various groups, including self-employed persons, Overseas Filipino Workers (OFWs), and even non-working spouses. Each demographic has specific sections to fill out, making the form versatile for different types of applicants.

Misconception 2: You can have multiple SSS numbers.

Some individuals think that it’s acceptable to have more than one Social Security System (SSS) number. This is incorrect. Your SSS number is unique and remains with you for life. Having multiple numbers can lead to confusion and complications in benefits application and tracking.

Misconception 3: Only certain documents are required for registration.

People often assume that the documentation needed for the SSS Registration E1 form is limited. In reality, a variety of documents can serve as proof of identity and civil status. These include birth certificates, marriage contracts, and even certain ID cards. It’s crucial to check the full list of acceptable documents to ensure compliance.

Misconception 4: The SSS Registration E1 form does not need to be filled out correctly.

Another common misconception is that minor mistakes in the form will not affect the registration process. This is not the case. It is vital to fill out the form accurately and completely. Errors or incomplete information can delay the processing of your application, or worse, result in denial of registration.

Key takeaways

When filling out the SSS Registration E1 form, it is important to ensure that all information is accurate and complete. Below are key takeaways to keep in mind:

- Print Clearly: Always fill out the form in capital letters using black ink. This helps in ensuring that your information is easily readable.

- Applicable Sections: Complete the sections that pertain to your situation. For example, Part I-A, B, and D are necessary for standard applicants, while Self-Employed, OFWs, or Non-Working Spouses need to fill out Part I-A, B, C, and D.

- Use "N/A": If certain information does not apply to you, indicate this by writing "N/A" or "Not Applicable." This helps avoid confusion for those processing your form.

- Two Copies: If downloading the form from the internet, you must fill out two copies of the completed form for submission.

- Document Verification: Always present the original or certified true copies of required documents, such as birth certificates or marriage contracts, when submitting your application.

- Lifetime SS Number: Remember that your Social Security number is assigned for life. You should not apply for multiple SS numbers.

- Age Restrictions: Individuals over sixty years old who are not surviving spouse pensioners cannot apply for a new SS number.

- Completing Certification: The certifying individual, typically the registrant, must ensure that the information provided is true. If unable to sign, fingerprints can be used in the presence of SSS personnel.

- Dependents and Beneficiaries: If applicable, list dependents or beneficiaries in Part I-B and use an additional sheet if more space is needed.

By keeping these points in mind, you can facilitate a smoother experience while completing and submitting the SSS Registration E1 form.

Browse Other Templates

Weiser Security Services - State your ability to navigate emergency stairwells as necessary.

Online Drivers Ed Indiana - Include date and time for every practice session.

Adp Flex Direct - Using this form effectively allows you to manage your healthcare expenses through your FSA.