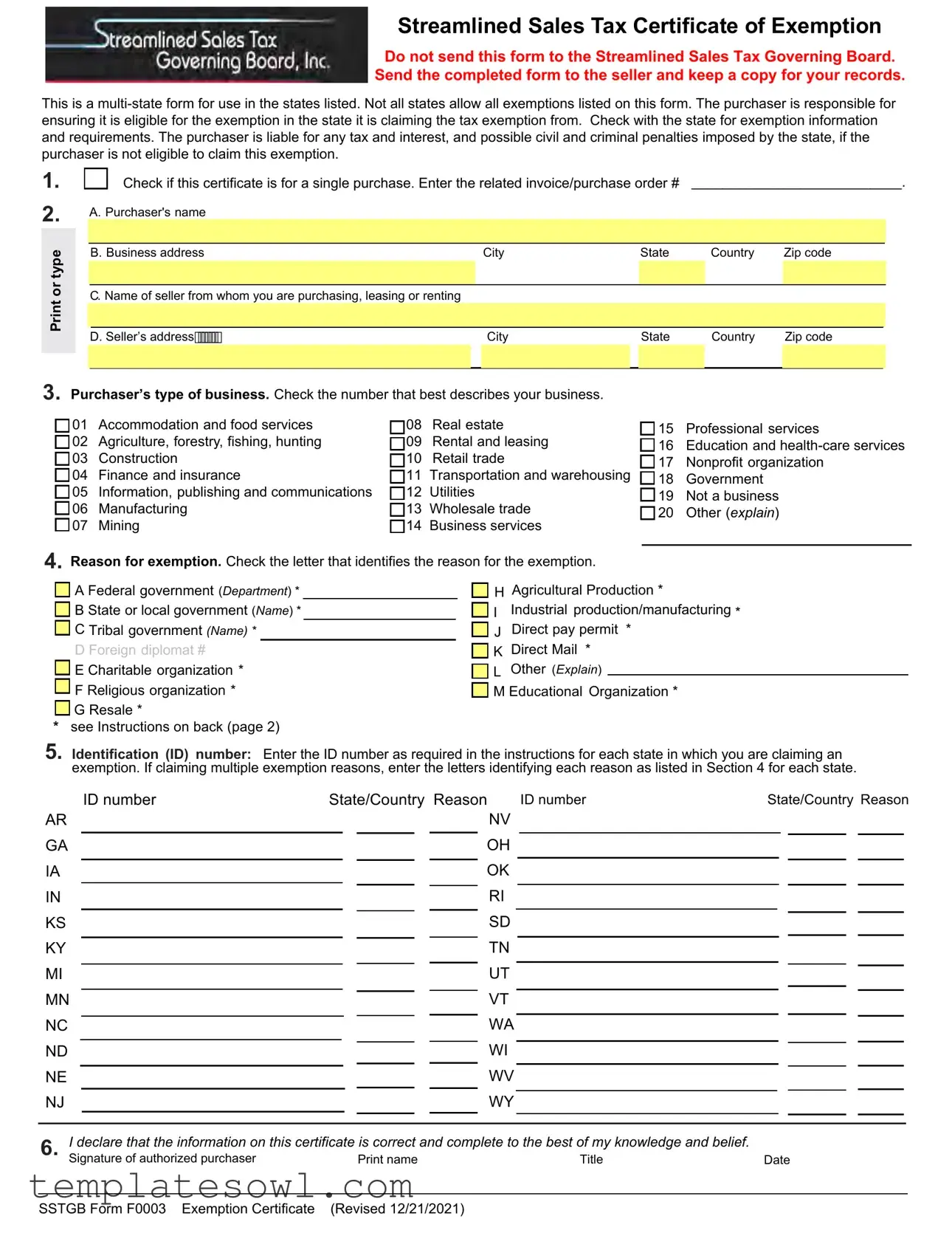

Fill Out Your Sstgb F0003 Form

The SSTGB F0003 form is a crucial document for purchasers looking to claim exemptions from sales tax in multiple states across the U.S. This form, recognized as the Streamlined Sales Tax Certificate of Exemption, allows you to communicate your eligibility for tax exemptions directly to sellers, without needing to submit it to the Streamlined Sales Tax Governing Board. Instead, it is critical that the completed form is sent to the seller, while you retain a copy for your own records. It’s crucial to remember that not all states accept every type of exemption listed, and it is the buyer’s responsibility to confirm that they meet the specific requirements for the exemptions they are claiming in each state. Should the purchaser claim an exemption they aren’t eligible for, they face the risk of accruing taxes, interest, or even severe penalties. This form requires you to provide essential information, such as the names and addresses of both the purchaser and seller, the specific type of business, and the reason for the tax exemption being sought. Additionally, you must include an ID number where required for each state involved. Understanding the details of the SSTGB F0003 is vital in navigating sales tax exemptions and ensuring compliance while avoiding potential legal complications.

Sstgb F0003 Example

Streamlined Sales Tax Certificate of Exemption

Do not send this form to the Streamlined Sales Tax Governing Board.

Send the completed form to the seller and keep a copy for your records.

This is a

1.

2.

Print or type

3.

|

Check if this certificate is for a single purchase. Enter the related invoice/purchase order # |

___________________________. |

|||||||

A. Purchaser's name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Business address |

|

City |

State |

|

Country |

Zip code |

||

|

|

|

|

|

|

|

|

|

|

|

C. Name of seller from whom you are purchasing, leasing or renting |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Seller’s address |

|

City |

State |

|

Country |

Zip code |

||

|

|

|

|

|

|

|

|

|

|

Purchaser’s type of business. Check the number that best describes your business.

01 |

Accommodation and food services |

08 |

Real estate |

15 |

Professional services |

02 |

Agriculture, forestry, fishing, hunting |

09 |

Rental and leasing |

16 |

Education and |

03 |

Construction |

10 |

Retail trade |

17 |

Nonprofit organization |

04 |

Finance and insurance |

11 |

Transportation and warehousing |

18 |

Government |

05 |

Information, publishing and communications |

12 |

Utilities |

19 |

Not a business |

06 |

Manufacturing |

13 |

Wholesale trade |

20 |

Other (explain) |

07 |

Mining |

14 |

Business services |

|

|

4. Reason for exemption. Check the letter that identifies the reason for the exemption.

A Federal government (Department) * B State or local government (Name) * C Tribal government (Name) *

D Foreign diplomat #

E Charitable organization * F Religious organization * G Resale *

*see Instructions on back (page 2)

H Agricultural Production *

IIndustrial production/manufacturing * J Direct pay permit *

K Direct Mail * L Other (Explain)

M Educational Organization *

5. Identification (ID) number: Enter the ID number as required in the instructions for each state in which you are claiming an |

|||||||||||||||||||||||

|

exemption. If claiming multiple exemption reasons, enter the letters identifying each reason as listed in Section 4 for each state. |

||||||||||||||||||||||

|

|

|

ID number |

State/Country Reason |

ID number |

State/Country Reason |

|||||||||||||||||

AR |

|

|

|

|

|

|

|

|

|

NV |

|

|

|

|

|

|

|

|

|

||||

GA |

|

|

|

|

|

|

|

|

|

OH |

|

|

|

|

|

|

|

|

|

||||

IA |

|

|

|

|

|

|

|

|

|

OK |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

IN |

|

|

|

|

|

|

|

|

|

RI |

|

|

|

|

|

|

|

|

|

|

|||

KS |

|

|

|

|

|

|

|

|

|

SD |

|

|

|

|

|

|

|

|

|

||||

KY |

|

|

|

|

|

|

|

|

|

TN |

|

|

|

|

|

|

|

|

|

||||

MI |

|

|

|

|

|

|

|

|

|

UT |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

MN |

|

|

|

|

|

|

|

VT |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NC |

|

|

|

|

|

|

|

|

|

WA |

|

|

|

|

|

|

|

|

|

|

|

||

ND |

|

|

|

|

|

|

|

|

|

WI |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

NE |

|

|

|

|

|

|

|

|

|

WV |

|

|

|

|

|

|

|

|

|

|

|

||

NJ |

|

|

|

|

|

|

|

|

|

WY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

I declare that the information on this certificate is correct and complete to the best of my knowledge and belief. |

|

|

|

|

|

|

|

|

||||||||||||||

|

Signature of authorized purchaser |

|

|

|

Print name |

Title |

Date |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSTGB Form F0003 Exemption Certificate |

(Revised 12/21/2021) |

|

|

|

|

|

|

|

|

|

|||||||||||||

Streamlined Sales and Use Tax Exemption Certificate Instructions

Sections 1‐6 are required information. A signature is not required if in electronic form.

Section 1: Check the box for a single purchase and enter the invoice number. If the box is not checked, this certificate is considered a blanket certificate and remains effective until cancelled by the purchaser if purchases are no more than 12 months apart , unless a longer period is allowed by a state.

Section 2: Enter the purchaser’s and seller’s name, street address, city, state, country and zip code.

Section 3 Type of Business: Check the number that best describes the purchaser’s business or organization. If none of the categories apply, check 20 and provide a brief description.

Section 4 Reason for Exemption: Check the letter that identifies the reason for the exemption. If the exemption you are claiming is not listed, check “L Other” and provide a clear and concise explanation of the exemption claimed. Not all states allow all exemptions listed on this form. The purchaser must check with that state for exemption information and requirements.

Section 5 Identification ID Number:

Purchaser's Instructions:

Enter the ID number as required in the instructions below for each state in which you are claiming an exemption. Identify the state or if a foreign ID, the country the ID number is from. If multiple exemption reasons are being claimed enter the letters identifying the reasons for exemption as listed in Section 4 for each state.

ID Numbers for Exemptions other than resale: You are responsible for ensuring that you are eligible for the exemption in the state you are claiming the tax exemption. Provide the ID number to claim exemption from sales tax that is required by the taxing state. Check with that state to determine your exemption requirements and status.

Foreign diplomats and consular personnel must enter their individual tax identification number shown on their sales tax exemption card issued by the United States Department of State's Office of Foreign Missions.

ID Numbers for Resale Purchases (Including Drop Shipments): If you are claiming a purchase is not subject to tax because it is for resale (Exemption Reason G.) and you are:

1.Required to be registered in the state you are claiming the tax exemption: Provide your sales tax ID number issued by that state. If claiming exemption in OH and registration is not required in the state, enter any tax ID number issued by OH. If claiming exemption in MI and registration is not required in the state, enter “Not Required”.

2.Not registered in the state you are claiming the tax exemption: Provide your sales tax ID number issued by any state.

3.Not required to register for sales tax and you do not have a sales tax identification number from any state: Enter ‐Your FEIN.

‐If you do not have a FEIN, enter a different state‐issued business ID number.

‐If you do not have any state‐issued business ID number or FEIN, enter your state driver's license number.

4.A foreign purchaser and you do not have an ID number described in 1, 2 or 3: The following states will accept the tax ID number

(e.g., VAT number) issued by your country: AR, IN, KS, KY, ND, NJ, OK, RI, SD, TN, UT, WA, WY. All other states require an ID number as listed in 1, 2 or 3.

If you do not have any of the ID numbers listed in 1 thru 4: You are not required to list an ID number for the following states: NE, OH, SD, WI. Enter "Not Required" and the reason for exemption for that state. All other states require an ID number.

Seller’s Instructions

The seller is not required to verify the purchaser’s ID number or determine the purchaser's registration requirements. (GA requires the seller verify the purchaser’s ID number.) The seller is required to maintain proper records of exempt transactions and provide those records to the state when requested in the form in which it is maintained. These certificates may be provided in paper or electronic format.

The seller is not liable for any tax, interest, or penalty if the purchaser improperly claims an exemption or provides incorrect information on the certificate, provided all the following conditions are met:

1.The fully completed exemption certificate is provided to the seller at the time of sale or within 90 days subsequent to the date of sale;

2.The seller did not fraudulently fail to collect the tax due; and

3.The seller did not solicit customers to unlawfully claim an exemption.

Note: A seller may not accept a certificate of exemption for an entity‐based exemption on a sale made at a location operated by the seller within the designated state if the state does not allow such an entity‐based exemption.

Drop Shipper Instructions: The drop shipper may accept an ID number to claim the resale exemption as provided above in the Purchaser’s Instructions. The ID number may include an ID number issued by another state. This may result in the same ID number being used for multiple states to claim the resale exemption (e.g., a retailer or marketplace seller may only be required to register for sales tax in one state).

SSTGB Form F0003 Exemption Certificate Page 2 (Revised 12/21/2021)

Form Characteristics

| Fact | Description |

|---|---|

| Purpose of the Form | The SSTGB F0003 form serves as a Streamlined Sales Tax Certificate of Exemption for qualifying purchases. It allows purchasers to claim exemptions from sales tax in participating states. |

| Submission Guidelines | Completed forms should not be sent to the Streamlined Sales Tax Governing Board. Instead, they must be provided to the seller, and a copy should be retained for personal records. |

| Eligibility and Responsibilities | The purchaser is accountable for determining eligibility for the exemption according to state-specific laws. If ineligible, the purchaser may face taxes, interest, and potential penalties. |

| State-Specific Requirements | Various states may have different rules regarding the exemptions listed on this form. It's important to check with each state for specific information and requirements related to tax exemptions. |

Guidelines on Utilizing Sstgb F0003

To complete the SSTGB F0003 form, follow these steps to ensure that you accurately fill in the necessary details. This process will help maintain compliance with sales tax regulations and facilitate proper documentation for your records.

- Print or type all entries clearly on the form.

- Indicate if the certificate is for a single purchase by checking the appropriate box.

- Enter the related invoice or purchase order number in the designated space.

- Fill in the Purchaser's name and Business address, including City, State, Country, and Zip code.

- Provide the Name of seller from whom you are purchasing, leasing, or renting, followed by the Seller’s address, including City, State, Country, and Zip code.

- Select the number that represents your type of business and reflect it in the space provided.

- Check the letter that corresponds to the reason for the exemption. If applicable, select “L” and provide a brief explanation.

- Enter your identification (ID) number as required for each state where you are claiming an exemption. If claiming multiple exemptions, list each state and respective reason.

- Sign the form to declare that all information provided is accurate. Print your name, add your title, and date the document.

After completing the form, remember to send it directly to the seller and keep a copy for your own records. Staying organized helps ensure you meet all necessary conditions for tax exemption smoothly.

What You Should Know About This Form

What is the SSTGB Form F0003?

The SSTGB Form F0003, also known as the Streamlined Sales Tax Certificate of Exemption, is a multi-state form that allows a purchaser to claim a tax exemption when buying goods or services. It simplifies the process for certain types of organizations and individuals who meet specific criteria for exemption, such as government entities, charities, or businesses for resale purposes.

Who should use the SSTGB Form F0003?

This form should be used by individuals or organizations that qualify for a sales tax exemption in the states listed on the form. For example, a charitable organization purchasing materials for its mission or a business buying inventory for resale needs this form. It's essential to check your eligibility according to state laws before using the form.

How do I fill out the SSTGB Form F0003?

To complete the form, you will need to provide various pieces of information. This includes the names and addresses of both the purchaser and seller, the reason for the exemption, and the type of business. Make sure to check the appropriate boxes and include any required identification numbers. A signature is not required if you submit the form electronically.

Where should I send the completed SSTGB Form F0003?

Do not send the form to the Streamlined Sales Tax Governing Board. Instead, send the completed form directly to the seller from whom you are purchasing. It's important to keep a copy of the form for your records as well.

What if my state doesn’t allow all the exemptions listed?

Not every state allows all of the exemptions specified on the SSTGB Form F0003. It is your responsibility as the purchaser to verify that the exemption you are claiming is acceptable in your state. Always check your state's rules and regulations regarding tax exemptions to avoid any penalties.

What are the consequences of incorrectly claiming an exemption?

If you claim an exemption incorrectly, you may become liable for any sales tax owed, along with any interest or penalties. Moreover, civil and criminal penalties could be imposed if the state finds you ineligible for the exemption. Accuracy when filling out the form is vital to avoid these potential issues.

Can this form be used for more than one purchase?

The SSTGB Form F0003 can function as a blanket certificate if you do not check the box indicating a single purchase. This means it can remain effective for subsequent purchases made within a 12-month period, unless otherwise stated by the state. If your purchases span beyond this timeframe, you will need to renew your certificate.

Common mistakes

Filling out the SSTGB F0003 form, the Streamlined Sales Tax Certificate of Exemption, can be a straightforward process. However, there are common pitfalls that many individuals encounter. Recognizing these mistakes is the first step to ensuring a smooth submission.

One frequent error occurs when purchasers fail to check the box for a single purchase. Not marking this box turns the certificate into a blanket exemption, which may not be the intended approach. If you plan to make just one purchase, be sure to indicate this clearly by checking the appropriate box and providing the related invoice or purchase order number.

Another mistake involves leaving out important details about the seller or purchaser. This form requires the names and full addresses of both parties. Missing any information—such as the zip code or state—can lead to complications, including delays or outright rejection of the exemption claim. Double-check these sections to ensure every detail is accurately filled in.

Moreover, providing incorrect or incomplete ID numbers is a common oversight. Given that each state has its own requirements for ID numbers based on the exemption reasons being claimed, it’s essential to verify the correct number beforehand. If multiple exemptions are being claimed, as is often the case, purchasers must include all relevant IDs, which are critical for supporting the claim.

Finally, misunderstanding the reason for the exemption can lead to errors in selection. Each category, from federal government to charitable organization, has distinct guidelines. If someone randomly selects a letter without fully understanding the implications, it could jeopardize their exemption. It is wise to consult the state’s exemption information and requirements before finalizing the form.

By keeping these mistakes in mind, you can navigate the SSTGB F0003 form with greater ease and confidence. Checking details, understanding the requirements, and providing the correct information will go a long way in securing your sales tax exemption.

Documents used along the form

The SSTGB F0003 form functions as a key document for individuals and businesses seeking to claim tax exemptions on purchases. This form may be accompanied by various other documents that provide essential information or support for filing. Understanding these documents can ensure that a purchaser is fully prepared and compliant with tax regulations.

- Sales Tax ID Certificate: This document provides the seller's tax identification number, which is necessary when claiming resale exemptions. Having this ID can help confirm that the purchaser is registered appropriately to avoid sales tax on eligible transactions.

- Exemption Certificate for Agriculture: Often used by agricultural entities, this certificate specifies that certain purchases are exempt from sales tax due to the nature of agricultural activities. It provides detail on the specific exemptions allowed within the state.

- Direct Pay Permit: This permit allows qualifying purchasers to directly pay taxes on their sales rather than the seller collecting them at the point of sale. It is particularly useful for larger businesses that undertake frequent transactions subject to sales tax.

- Resale Certificate: This document is used primarily by retailers to confirm that the items purchased will be resold rather than used personally. It serves as proof to sellers that the purchaser is not liable for sales tax on the items intended for resale.

Being informed about these supplementary forms can enhance the efficiency of the exemption process. Each document plays a vital role in ensuring compliance and upholding tax obligations effectively.

Similar forms

-

Certificate of Exemption (Form ST-2): This form is issued by several states to allow purchasers to buy certain items without paying sales tax. Like the SSTGB F0003, it identifies the reason for exemption and requires the purchaser to provide specific details, such as their business information and applicable ID numbers.

-

IRS Form W-9: This document is used to request a taxpayer's identification number and certification. Both forms require accurate information, including the name and address of the individual or entity involved. While the W-9 focuses on tax identification, the SSTGB F0003 emphasizes sales tax exemptions.

-

Form ST-4 (Sales Tax Resale Certificate): Like the SSTGB F0003, the Form ST-4 allows businesses to buy items intended for resale without paying sales tax. Both forms require buyers to check specific boxes to determine the type of exemption being claimed.

-

Form ST-5 (Sale to Exempt Organizations): This form is used by nonprofit organizations to claim sales tax exemptions similar to those claimed using the SSTGB F0003. Each document requests the name, address, and tax ID of the organization seeking the exemption.

-

Form M-3 (Residency Exemption Certificate): This document shows that the purchaser resides in a state that exempts them from particular taxes. It shares similarities with the SSTGB F0003 in that both forms require identification of the individual or organization and state-specific requirements.

-

Form 1065 (U.S. Return of Partnership Income): Although primarily a tax return, this form allows partnerships to report income, deductions, and credits. It is similar because both require precise information about the business but serve different purposes regarding tax obligations.

Dos and Don'ts

When filling out the SSTGB F0003 form, follow these guidelines:

- Print or type clearly in all sections to ensure readability.

- Check the appropriate box if the certificate is for a single purchase.

- Enter the correct invoice or purchase order number if applicable.

- Double-check the ID numbers you provide for accuracy.

- Keep a copy for your records after submitting it to the seller.

- Confirm eligibility for the exemption in your state before submitting.

Avoid these mistakes:

- Do not leave any required sections blank.

- Do not send this form to the Streamlined Sales Tax Governing Board.

- Do not assume exemptions are accepted in all states; verify first.

- Do not use outdated information or previous versions of the form.

- Do not ignore the state-specific instructions for ID numbers.

- Do not make false claims regarding your eligibility for exemption.

Misconceptions

The SSTGB F0003 form, also known as the Streamlined Sales Tax Certificate of Exemption, is often misunderstood. Below are common misconceptions about this form, clearly explained to help you navigate the process with confidence.

- Misconception 1: This form should be sent to the Streamlined Sales Tax Governing Board.

- Misconception 2: All states accept every exemption listed on this form.

- Misconception 3: A signature is always required on the form.

- Misconception 4: You are automatically exempt from sales tax if you submit this form.

- Misconception 5: Completing the form incorrectly has no consequences for the purchaser.

- Misconception 6: The form does not require any identification numbers.

- Misconception 7: Sellers must verify the purchaser's identification number.

- Misconception 8: The form is valid indefinitely once submitted.

This is incorrect. The completed form must be sent to the seller, while a copy should be kept for your records.

Not true. The SSTGB F0003 is a multi-state form, but each state has its own rules regarding what exemptions are accepted. It is crucial to verify eligibility in the specific state.

This is a misconception. If the form is submitted electronically, a signature is not necessary.

This is false. The purchaser is responsible for demonstrating eligibility for the claimed exemptions and could face penalties if ineligible.

In reality, errors can result in civil and criminal penalties. It's essential to ensure all information is accurate and complete.

This is misleading. Depending on the state and the type of exemption, certain identification numbers must be provided to validate the claim.

This is generally incorrect. Sellers are not obligated to verify the purchaser’s ID number, with Georgia being a notable exception where verification is required.

The form acts as a blanket certificate only if the box for a single purchase is not checked. It remains valid until canceled by the purchaser or as specified by state law.

Understanding these misconceptions can help ensure that you use the SSTGB F0003 form correctly. Proper use reduces the risk of challenges and penalties related to tax exemptions.

Key takeaways

Here are some key takeaways regarding the Sstgb F0003 form:

- The Sstgb F0003 form is a Streamlined Sales Tax Certificate of Exemption.

- Do not submit this form to the Streamlined Sales Tax Governing Board. Instead, send it to the seller and keep a copy for your records.

- This form is valid in multiple states, but not all exemptions may apply everywhere. It's crucial to verify whether the exemption is allowed in your state.

- The purchaser is responsible for ensuring eligibility for the exemption and must check with the relevant state for specific requirements.

- The purchaser may be held liable for any taxes, interest, or penalties if found ineligible for the claimed exemption.

- Sections 1 through 6 of the form require specific information, and accuracy is essential.

- Signatures are not mandatory if the form is submitted electronically, but the information must still be complete and accurate.

- The seller is not required to verify the purchaser’s ID number or compliance with registration requirements, although they must maintain proper records of exempt transactions.

Browse Other Templates

Teacher Search - Include your date of birth to aid in verifying your records.

1 Year Workmanship Warranty - Purchasers must keep a copy of the warranty for their records after closing.

Ft Sill - It includes a section dedicated to miscellaneous facility features.