Fill Out Your Ssu 225 2 Form

The Ssu 225 2 Form plays a crucial role in facilitating the direct deposit of employee paychecks, ensuring a seamless transfer of funds into designated bank accounts. This form serves as the official request for companies to initiate automatic payroll deposits to an employee’s account at the Security Service Federal Credit Union. Essential details required on this form include the employee's name, employee ID number, and their contact information, alongside the bank's routing number and account number. Additionally, it is imperative for employees to specify the desired start date for these deposits. By authorizing their employer to make these transactions, employees enhance the convenience of receiving wages while also reducing the risk of lost or delayed checks. The Ssu 225 2 Form includes important provisions concerning compliance with U.S. laws governing Automated Clearing House (ACH) transactions, demonstrating the commitment to both security and regulatory adherence in payroll processing. This comprehensive form not only benefits employees by providing an efficient method for recognizing income but also aids employers in streamlining their payroll operations.

Ssu 225 2 Example

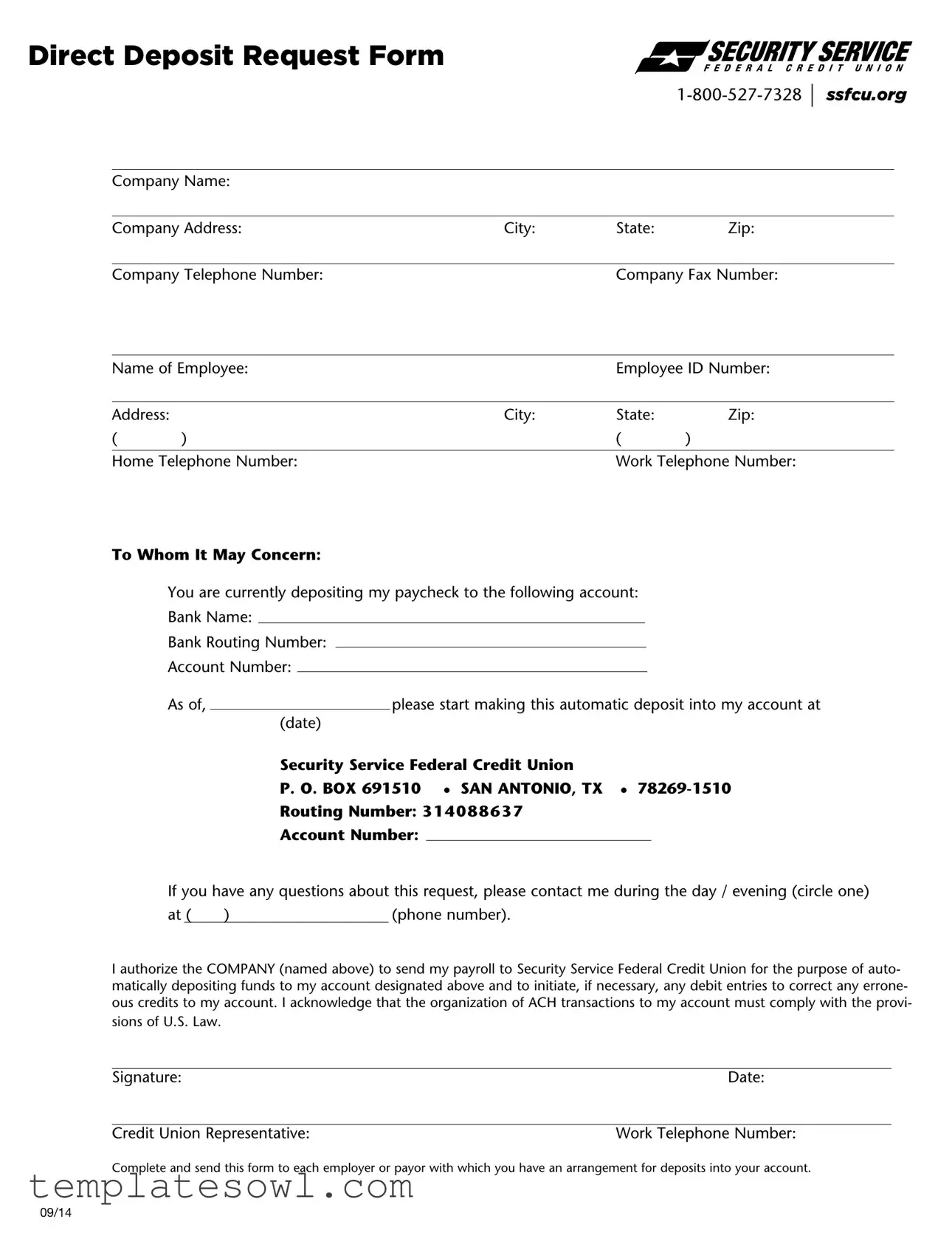

Direct Deposit Request Form

Company Name:

Company Address: |

City: |

State: |

Zip: |

|

|

|

|

Company Telephone Number: |

|

Company Fax Number: |

|

Name of Employee: |

|

Employee ID Number: |

||

|

|

|

|

|

Address: |

|

City: |

State: |

Zip: |

( |

) |

|

( |

) |

|

|

|

||

Home Telephone Number: |

|

Work Telephone Number: |

||

To Whom It May Concern:

You are currently depositing my paycheck to the following account:

Bank Name:

Bank Routing Number:

Account Number:

As of, |

|

please start making this automatic deposit into my account at |

||

|

||||

|

(date) |

|||

|

Security Service Federal Credit Union |

|||

|

P. O. BOX 691510 l SAN ANTONIO, TX l |

|||

|

Routing Number: 3 1 4 0 8 8 6 3 7 |

|||

|

Account Number: |

|

|

|

|

|

|||

If you have any questions about this request, please contact me during the day / evening (circle one)

at ( |

) |

(phone number). |

|

|

|

|

|

I authorize the COMPANY (named above) to send my payroll to Security Service Federal Credit Union for the purpose of auto- matically depositing funds to my account designated above and to initiate, if necessary, any debit entries to correct any errone- ous credits to my account. I acknowledge that the organization of ACH transactions to my account must comply with the provi- sions of U.S. Law.

Signature: |

Date: |

|

|

Credit Union Representative: |

Work Telephone Number: |

Complete and send this form to each employer or payor with which you have an arrangement for deposits into your account.

09/14

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The SSU 225 2 form serves as a Direct Deposit Request Form for employees wishing to have their paychecks automatically deposited into their bank accounts. |

| Governing Law | This form complies with U.S. laws governing Automated Clearing House (ACH) transactions, including the Electronic Funds Transfer Act. |

| Authorization | By signing the form, employees authorize their employer to deposit their wages directly into the specified bank account. |

| Required Information | Employees must provide personal details such as name, address, employee ID number, and bank account information. |

| Contact Information | Employees are encouraged to provide contact numbers to clarify any questions regarding the direct deposit arrangement. |

| Submission Instructions | The completed form should be submitted to each employer or payor to establish the direct deposit arrangement. |

Guidelines on Utilizing Ssu 225 2

After you gather your information, filling out the SSU 225 2 form is a straightforward process. The form is essential for setting up direct deposit, ensuring your paycheck is deposited directly into your bank account. Follow these steps carefully to complete the form accurately.

- Begin by locating the top section of the form, where you will input your employer's information. Fill in the Company Name, Company Address, City, State, Zip, Company Telephone Number, and Company Fax Number.

- Next, move to the section for employee details. Enter your Name and Employee ID Number.

- Continue by providing your Address, City, State, and Zip code.

- Fill in your contact information including your Home Telephone Number and Work Telephone Number.

- In the next part, specify the bank details. Write the Bank Name, Bank Routing Number, and Account Number where your paycheck will be deposited.

- Indicate the date from which you want the automatic deposit to begin.

- Provide a contact number where you can be reached during the day or evening by circling the appropriate option.

- Read the authorization section carefully. By signing your Signature and adding the Date, you give permission to your employer to deposit your paychecks directly into your bank account.

- Finally, the Credit Union Representative and their Work Telephone Number should also be included at the bottom of the form.

After completing the form, review it for accuracy. Once validated, send a copy to your employer or the respective payor. This will ensure your direct deposit request is processed efficiently, bringing peace of mind regarding your finances.

What You Should Know About This Form

What is the purpose of the SSU 225 2 form?

The SSU 225 2 form, also known as the Direct Deposit Request Form, is used to set up automatic deposits from your employer or payor into your designated bank account. By completing this form, you give your employer permission to deposit your paycheck directly into a bank account at the Security Service Federal Credit Union. This is a secure and convenient way to receive your earnings without the need to visit the bank.

What information do I need to provide on the SSU 225 2 form?

You will need to provide several key pieces of information on the SSU 225 2 form. This includes your employer's name and address, your employee ID number, and your personal contact information. Additionally, you must include details about the bank account where your paycheck will be deposited, such as the bank name, routing number, and account number. Make sure to double-check this information for accuracy to avoid any potential issues with your deposits.

When should I submit the SSU 225 2 form?

What should I do if I encounter issues with my direct deposit?

If you experience problems with your direct deposit, the first step is to contact your employer’s payroll department. They can verify that your SSU 225 2 form has been processed correctly and confirm that your banking details are accurate. If the problem persists, you should reach out to the Security Service Federal Credit Union for assistance. They can help you resolve any issues related to your account or any errors in the deposit process.

Common mistakes

Filling out the SSU 225 2 form can seem straightforward, but common mistakes can lead to complications. One common error involves incorrect personal information. People often miswrite their names or employee IDs. Even a small typo can delay processing and cause confusion. It’s essential to double-check these details for accuracy.

Another frequent mistake is providing the wrong bank details. Applicants may list an incorrect bank routing or account number. This mistake can prevent direct deposits from reaching the intended account. Therefore, ensure that these numbers match what is on your bank documents to avoid delays.

Many individuals forget to date their request. Including the date is crucial for the employer’s records and for setting an effective start date for the direct deposit. Omitting this detail may cause the request to be processed incorrectly or not at all.

Some people also fail to specify their preferred contact method. While it’s often assumed that the work phone number will be used, not circling "day" or "evening" can leave employers unsure of when to reach you. Clear communication is key to avoiding misunderstandings.

Another mistake involves not notifying your employer sufficiently in advance of a shift to direct deposit. Some workers simply assume their request will be processed immediately. It is wise to confirm how long it typically takes for changes in direct deposit to take effect, ensuring you have no gaps in pay.

Misunderstanding the need for a signature is also a common error. Some fill out the form but forget to sign it, which renders the form invalid. Always confirm that you have signed before submission.

Additionally, forgetting to send the completed form to the correct employer or payor can create major issues. People sometimes overlook the need to submit the form to each company where they receive payments. Ensure that you distribute copies of the form to all relevant parties.

Failure to keep copies of submitted forms is another oversight. Keeping a record of what you have sent and when can be beneficial for follow-up discussions or in case of discrepancies. Documentation provides a level of safety and assurance that can be very helpful.

Lastly, many people neglect to follow up after submission. Checking in with the employer or payor helps ensure that the request is processed correctly. Regular communication can enhance the likelihood of receiving timely payments without issues.

Documents used along the form

The SSU 225 2 form plays a crucial role in enabling direct deposits to your bank account. However, it is often used in conjunction with other important forms and documents that can enhance the clarity and effectiveness of the direct deposit process. Below are several additional documents that may be beneficial to consider.

- W-4 Form: This form is used by an employee to indicate their tax situation to their employer. It helps determine the amount of federal income tax that should be withheld from each paycheck.

- Direct Deposit Authorization Form: Similar to the SSU 225 2 form, this document authorizes an employer to deposit wages directly into an employee's bank account. It may be requested alongside or instead of the SSU 225 2.

- Payroll Deduction Form: This form allows employees to authorize deductions from their paychecks for various purposes, such as insurance premiums or retirement plan contributions.

- Employment Application: A completed employment application provides the employer with necessary employee information, which may also include bank details needed for direct deposits.

- Employer-Specific Deposit Agreement: Some companies may require a specific agreement outlining terms around direct deposits, including timelines and conditions for changes or cancellations.

- Void Check or Bank Letter: Often requested for verification purposes, this document confirms account details necessary to set up the direct deposit, including account and routing numbers.

- Change of Direct Deposit Information Form: If you need to update your banking information, this form is essential for notifying your employer of any changes to your direct deposit preferences.

- Tax Statement (e.g., W-2): At year-end, this document summarizes your earnings and taxes withheld. It provides insights into how your direct deposits align with reported income for tax purposes.

Using these forms and documents together with the SSU 225 2 form fosters a smooth and transparent direct deposit arrangement. Ensure that you keep copies of all paperwork for your records and reach out to your employer or financial institution if you have any questions about the process.

Similar forms

The SSU 225 2 form serves as a crucial document for establishing direct deposit of wages, but it has equivalents in various financial and administrative processes. Understanding these similar documents can help streamline financial transactions and ensure accurate processing. Here are five documents that share similarities with the SSU 225 2 form:

- Direct Deposit Authorization Form: This form is often provided by employers to allow employees to designate a bank account for payroll deposits. Like the SSU 225 2 form, it requires personal details, banking information, and a signature to authorize the bank transactions.

- ACH Authorization Form: Used for Automated Clearing House (ACH) transactions, this form allows individuals or businesses to authorize recurring electronic payments directly from their bank accounts. Both documents stipulate the necessary banking information and include language about compliance with relevant laws.

- Payroll Deduction Authorization Form: This document permits an employer to deduct certain amounts from an employee’s paycheck, such as for benefits or retirement plans. Similar to the SSU 225 2 form, it requires the employee's consent and specific financial details.

- Tax Refund Direct Deposit Form: Individuals use this form when they wish to have their income tax refund deposited directly into their bank account. Both forms necessitate the bank account information and the recipient's authorization for direct deposits.

- Loan Payment Authorization Form: When taking out a loan, borrowers often complete this form to authorize automatic payments to the lender from their bank accounts. Like the SSU 225 2 form, it includes information on the borrower’s account and an agreement to the terms of payment direction.

By recognizing these similar documents, individuals can more effectively manage their financial arrangements and ensure compliance with the necessary processes involved in direct payments and deposits.

Dos and Don'ts

Filling out the Ssu 225 2 form requires careful attention to detail. Here are some important things to remember.

- Do read the instructions carefully before starting.

- Do provide accurate information for all requested fields, such as your name and employee ID number.

- Do double-check the bank details, including the routing and account numbers.

- Do ensure the form is signed and dated before submission.

- Do keep a copy of the completed form for your records.

- Don't leave any mandatory fields blank.

- Don't use an outdated version of the form.

- Don't provide incorrect or incomplete contact information.

- Don't submit the form without verifying all the information.

Misconceptions

There are several misconceptions surrounding the Ssu 225 2 form, a document designed for initiating direct deposit requests. Understanding these misconceptions can help ensure proper handling of payroll deposits. Here are six common misunderstandings:

- The form is only for new employees. Many believe the Ssu 225 2 form is only applicable for new hires. In reality, existing employees can also use it to set up, change, or cancel direct deposit arrangements.

- Direct deposit is mandatory. Some think that once a direct deposit form is submitted, it becomes a requirement. This is incorrect as employees typically have the option to choose between direct deposit and receiving physical checks.

- Submitting the form guarantees immediate processing. There is a misconception that once the Ssu 225 2 form is completed, the process is instantaneous. Actual processing times may vary based on the employer's payroll schedule and procedures.

- Only one account can be designated for deposit. It is often assumed that employees can only set up deposits to a single bank account. However, many employers allow for multiple accounts to be designated for direct deposit, provided this is specified on the form.

- Changing bank accounts requires a new form. Some people believe they need to fill out a completely new Ssu 225 2 form each time they change their bank account. That is not necessarily true; updates can often be made on the same form, specifying the new account details.

- This form is only useful for payroll deposits. Finally, there is the idea that direct deposit via the Ssu 225 2 form is limited to payroll. In fact, the form can also be utilized for various types of recurring payments, such as bonuses or reimbursements, as long as the employer approves.

Key takeaways

Filling out the Ssu 225 2 form, also known as the Direct Deposit Request Form, is a straightforward process, but there are key aspects to keep in mind for successful completion and usage.

- Accurate Information is Crucial: Ensure that all fields, including your name, employee ID number, and account details, are filled out accurately to avoid any delays in processing your request.

- Bank Details are Mandatory: Provide precise bank information, such as the bank's name, routing number, and account number, as this is essential for initiating direct deposits.

- Specify the Start Date: Indicate the date from which you want the automatic deposit to begin. This helps your employer manage payroll schedules efficiently.

- Contact Information is Necessary: Clearly note your home and work telephone numbers. Employers may need to reach you for verification or additional information.

- Authorization Required: Signing the form grants authorization to your employer to deposit funds into your account. Be mindful of the legal implications of this consent.

- Change of Employer: If you switch jobs or change bank accounts, remember to complete a new form to ensure continuous direct deposits.

- Compliance with U.S. Law: The form acknowledges the need for ACH transactions to comply with U.S. regulations, highlighting the importance of adhering to legal standards.

- Submission to Multiple Employers: Keep in mind that this form must be submitted to each employer for whom you wish to set up direct deposit. Be proactive in ensuring that all necessary parties have the updated information.

By understanding these key takeaways, individuals can effectively navigate the process of setting up direct deposit, enhancing their banking experience and financial management.

Browse Other Templates

What Is a Ps Form 1093 - Applicants are encouraged to monitor their email for payment notifications related to their boxes.

Tn Enhanced Carry Permit Class Online - Each completed form provides a clear record of qualifications.