Fill Out Your St 101 Form

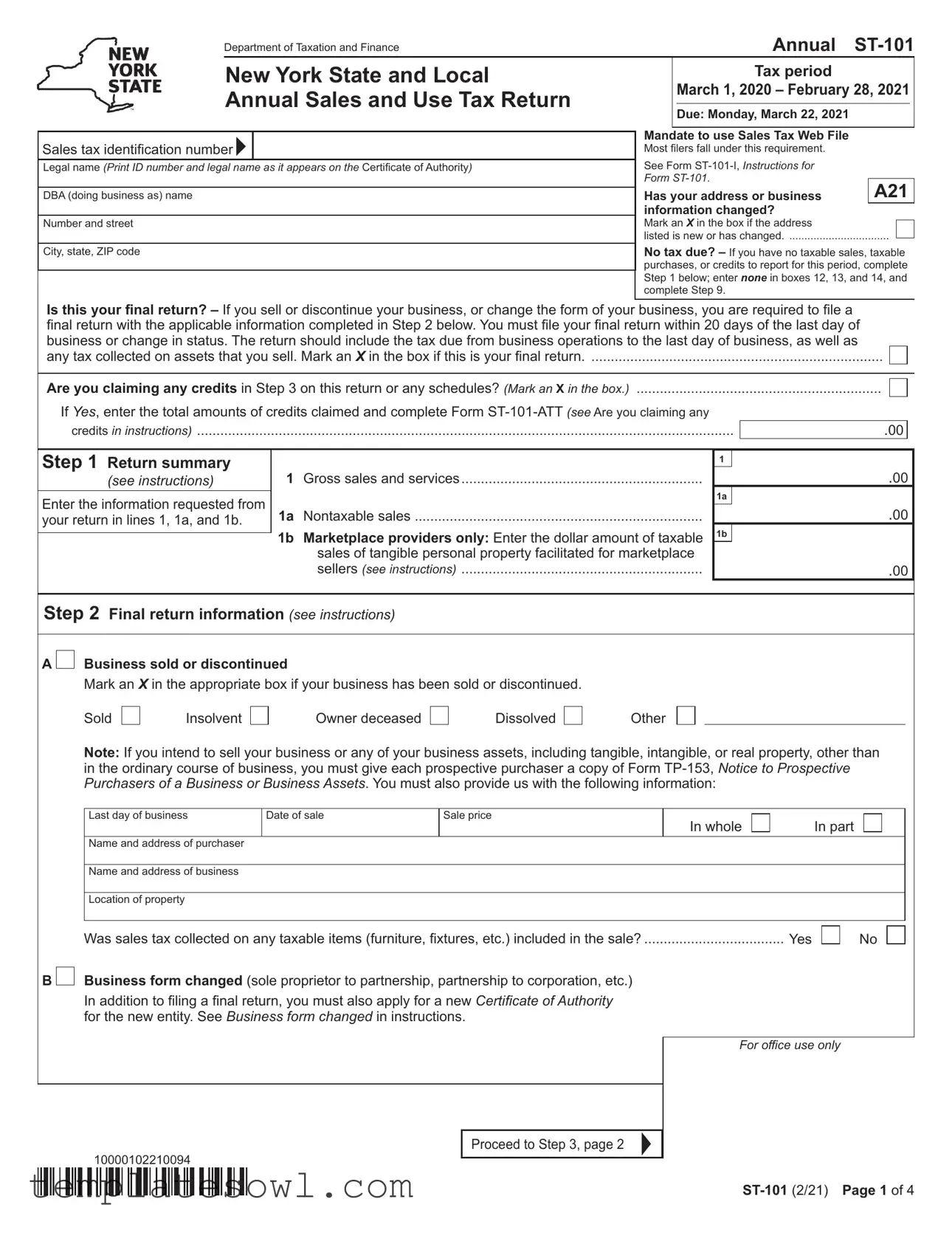

The ST-101 form is a vital document for businesses operating within New York State, specifically focusing on the annual Sales and Use Tax Return. For the tax period spanning March 1, 2020, to February 28, 2021, this form must be filed by Monday, March 22, 2021. Many business owners are required to file online through the Sales Tax Web File, ensuring a streamlined approach to tax reporting. When filling out the form, individuals must accurately list their sales tax identification number, legal name as it appears on their Certificate of Authority, and any "Doing Business As" (DBA) names. The form prompts users to disclose if their business information such as address has changed and provides options for those with no taxable sales, purchases, or credits, allowing them to indicate this status promptly. Furthermore, if a business has sold, discontinued operations, or undergone changes in its legal structure, a final return must be filed within 20 days, including specifics about the last day of business and any sales tax collected on tangible items sold. The form also allows for the claiming of credits, calculating taxes due, and determining any vendor collection credits, reinforcing its importance in ensuring compliance and accurate tax reporting within the state.

St 101 Example

Department of Taxation and FinanceAnnual

|

New York State and Local |

|

|

|

|

|

Tax period |

|

|

|

|||

|

Annual Sales and Use Tax Return |

|

|

March 1, 2020 – February 28, 2021 |

|||||||||

|

|

|

Due: Monday, March 22, 2021 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mandate to use Sales Tax Web File |

|

|

|

|||||

Sales tax identification number |

|

|

|

|

|

|

|||||||

|

|

|

Most filers fall under this requirement. |

|

|

|

|||||||

|

|

|

|

See Form |

|

|

|

||||||

Legal name (Print ID number and legal name as it appears on the Certificate of Authority) |

|

|

|

||||||||||

|

|

|

|

|

Form |

|

|

|

|||||

|

|

|

|

|

A21 |

||||||||

DBA (doing business as) name |

|

|

Has your address or business |

||||||||||

|

|

|

|

|

information changed? |

|

|

|

|||||

Number and street |

|

|

Mark an X in the box if the address |

|

|

|

|||||||

|

|

|

|

|

listed is new or has changed |

|

|

|

|||||

City, state, ZIP code |

|

|

No tax due? – If you have no taxable sales, taxable |

||||||||||

|

|

|

|

|

purchases, or credits to report for this period, complete |

||||||||

|

|

|

|

|

Step 1 below; enter none in boxes 12, 13, and 14, and |

||||||||

|

|

|

|

|

complete Step 9. |

|

|

|

|||||

Is this your final return? – If you sell or discontinue your business, or change the form of your |

business, you are required to file a |

|

|

|

|||||||||

final return with the applicable information completed in Step 2 below. You must file your final return within 20 days of the last day of |

|

|

|

||||||||||

business or change in status. The return should include the tax due from business operations to the last day of business, as well as |

|

|

|

||||||||||

any tax collected on assets that you sell. Mark an X in the box if this is your final return |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Are you claiming any credits in Step 3 on this return or any schedules? (Mark an X in the box.) |

|

|

|

|

|

|

|

|

|||||

If Yes, enter the total amounts of credits claimed and complete Form |

|

|

|

||||||||||

credits in instructions) |

|

|

|

|

|

|

|

|

.00 |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 1 Return summary |

|

|

|

|

|

1 |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

(see instructions) |

1 |

Gross sales and services |

|

|

|

|

|

.00 |

|

||||

|

|

|

|

|

|

|

|

1a |

|

|

|

|

|

Enter the information requested from |

1a |

Nontaxable sales |

|

|

.00 |

|

|||||||

|

|

|

|

|

|

||||||||

your return in lines 1, 1a, and 1b. |

|

|

|

|

|

|

|||||||

|

|

|

1b |

Marketplace providers only: Enter the dollar amount of taxable |

1b |

|

|

|

|

||||

|

|

|

|

|

|

||||||||

|

|

|

|

sales of tangible personal property facilitated for marketplace . |

|

|

|

|

|

||||

|

|

|

|

sellers (see instructions) |

|

|

|

|

|

.00 |

|

||

Step 2 Final return information (see instructions)

A

Business sold or discontinued

Business sold or discontinued

Mark an X in the appropriate box if your business has been sold or discontinued.

Sold

Insolvent

Owner deceased

Dissolved

Other

Note: If you intend to sell your business or any of your business assets, including tangible, intangible, or real property, other than in the ordinary course of business, you must give each prospective purchaser a copy of Form

Last day of business |

Date of sale |

Sale price |

In whole |

|

In part |

|

|

|

|

|

|||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Name and address of purchaser |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and address of business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location of property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Was sales tax collected on any taxable items (furniture, fixtures, etc.) included in the sale? |

Yes |

B  Business form changed (sole proprietor to partnership, partnership to corporation, etc.)

Business form changed (sole proprietor to partnership, partnership to corporation, etc.)

In addition to filing a final return, you must also apply for a new Certificate of Authority for the new entity. See Business form changed in instructions.

No

For office use only

10000102210094

Proceed to Step 3, page 2

Page 2 of 4

Sales tax identification number

A21

Annual

Step 3 Calculate sales and use taxes |

|

|

|

Column C |

|

|

|

Column D |

|

Column E |

|

Column F |

|||

|

|

|

Taxable sales |

+ |

|

Purchases subject |

× |

Tax rate |

= |

Sales and |

|||||

|

(see instructions) |

|

|

|

and services |

|

to tax |

|

use tax |

||||||

|

|

|

|

|

|

|

|

|

|

|

(C + D) × E |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Enter the total from Schedule FR, page 4, Step 6, box 18 (if |

|

|

|

|

|

|

|

|

|

2 |

|

|

|||

any) in box 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter the total paper bag fee from Schedule E, box 1 (if any) in box 2a |

|

|

|

|

|

|

|

|

|

2a |

|

|

|||

Enter the sum of any totals from Schedules A, B, H, N, T, and W (if any) |

3 |

|

.00 |

|

4 |

|

.00 |

|

|

5 |

|

|

|||

|

Column A |

Column B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxing jurisdiction |

Jurisdiction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

code |

|

|

.00 |

|

|

|

.00 |

4% |

|

|

|

|

|

New York State only |

NE |

0021 |

|

|

|

|

|

|

|

|

|

||||

Albany County |

AL |

0181 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Allegany County |

AL |

0221 |

|

|

.00 |

|

|

|

.00 |

8½% |

|

|

|

|

|

Broome County |

BR |

0321 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Cattaraugus County (outside the following) |

CA |

0481 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Olean (city) |

OL |

0441 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salamanca (city) |

SA |

0431 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Cayuga County (outside the following) |

CA |

0511 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Auburn (city) |

AU |

0561 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Chautauqua County |

CH |

0651 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Chemung County |

CH |

0711 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Chenango County (outside the following) |

CH |

0861 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Norwich (city) |

NO |

0831 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Clinton County |

CL |

0921 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Columbia County |

CO |

1021 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Cortland County |

CO |

1131 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Delaware County |

DE |

1221 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Dutchess County |

DU |

1311 |

|

|

.00 |

|

|

|

.00 |

81/8%* |

|

|

|

|

|

Erie County |

ER |

1451 |

|

|

.00 |

|

|

|

.00 |

8¾% |

|

|

|

|

|

Essex County |

ES |

1521 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Franklin County |

FR |

1621 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Fulton County (outside the following) |

FU |

1791 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gloversville (city) |

GL |

1741 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Johnstown (city) |

JO |

1751 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Genesee County |

GE |

1811 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Greene County |

GR |

1911 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Hamilton County |

HA |

2011 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Herkimer County |

HE |

2121 |

|

|

.00 |

|

|

|

.00 |

8¼% |

|

|

|

|

|

Jefferson County |

JE |

2221 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Lewis County |

LE |

2321 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Livingston County |

LI |

2411 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Madison County (outside the following) |

MA |

2511 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oneida (city) |

ON |

2541 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Monroe County |

MO |

2611 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Montgomery County |

MO |

2781 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Nassau County |

NA |

2811 |

|

|

.00 |

|

|

|

.00 |

85/8%* |

|

|

|

|

|

Niagara County |

NI |

2911 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Oneida County (outside the following) |

ON |

3010 |

|

|

.00 |

|

|

|

.00 |

8¾% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rome (city) |

RO |

3015 |

|

|

.00 |

|

|

|

.00 |

8¾% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Utica (city) |

UT |

3018 |

|

|

.00 |

|

|

|

.00 |

8¾% |

|

|

|

|

|

Onondaga County |

ON |

3121 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Ontario County |

ON |

3211 |

|

|

.00 |

|

|

|

.00 |

7½% |

|

|

|

|

|

Orange County |

OR |

3321 |

|

|

.00 |

|

|

|

.00 |

81/8%* |

|

|

|

|

|

Orleans County |

OR |

3481 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Oswego County (outside the following) |

OS |

3501 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oswego (city) |

OS |

3561 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

|

|

|

6 |

|

|

|

7 |

|

|

|

|

8 |

|

|

Column subtotals; also enter on page 3, boxes 9, 10, and 11: |

|

|

.00 |

|

|

|

.00 |

|

|

|

|

|

|||

10000202210094

Annual

A21

Sales tax identification number

|

Column A |

|

Column B |

|

Column C |

|

|

Column D |

|

|

Column E |

|

Column F |

|||||

|

Taxing jurisdiction |

|

Jurisdiction |

|

Taxable sales |

+ |

Purchases subject |

× |

Tax rate |

= |

Sales and |

|||||||

|

|

|

code |

|

and services |

to tax |

|

use tax |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(C + D) × E |

|

Otsego County |

|

OT |

3621 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

||

Putnam County |

|

PU |

3731 |

|

|

|

.00 |

|

|

|

.00 |

83/8%* |

|

|

|

|

||

Rensselaer County |

|

RE |

3881 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

||

Rockland County |

|

RO |

3921 |

|

|

|

.00 |

|

|

|

.00 |

83/8%* |

|

|

|

|

||

St. Lawrence County |

|

ST |

4091 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

||

Saratoga County (outside the following) |

|

SA |

4111 |

|

|

|

.00 |

|

|

|

.00 |

7% |

|

|

|

|

||

|

Saratoga Springs (city) |

|

SA |

4131 |

|

|

|

.00 |

|

|

|

.00 |

7% |

|

|

|

|

|

Schenectady County |

|

SC |

4241 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

||

Schoharie County |

|

SC |

4321 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

||

Schuyler County |

|

SC |

4411 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

||

Seneca County |

|

SE |

4511 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

||

Steuben County |

|

ST |

4691 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

||

Suffolk County |

|

SU |

4711 |

|

|

|

.00 |

|

|

|

.00 |

85/8%* |

|

|

|

|

||

Sullivan County |

|

SU |

4821 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

||

Tioga County |

|

TI |

4921 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

||

Tompkins County (outside the following) |

|

TO |

5081 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

||

|

Ithaca (city) |

|

IT |

5021 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Ulster County |

|

UL |

5111 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

||

Warren County (outside the following) |

|

WA |

5281 |

|

|

|

.00 |

|

|

|

.00 |

7% |

|

|

|

|

||

|

Glens Falls (city) |

|

GL |

5211 |

|

|

|

.00 |

|

|

|

.00 |

7% |

|

|

|

|

|

Washington County |

|

WA 5311 |

|

|

|

.00 |

|

|

|

.00 |

7% |

|

|

|

|

|||

Wayne County |

|

WA 5421 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|||

Westchester County (outside the following) |

|

WE |

5581 |

|

|

|

.00 |

|

|

|

.00 |

83/8%* |

|

|

|

|

||

|

Mount Vernon (city) |

|

MO |

5521 |

|

|

|

.00 |

|

|

|

.00 |

83/8%* |

|

|

|

|

|

|

New Rochelle (city) |

|

NE |

6861 |

|

|

|

.00 |

|

|

|

.00 |

83/8%* |

|

|

|

|

|

|

White Plains (city) |

|

WH |

6513 |

|

|

|

.00 |

|

|

|

.00 |

83/8%* |

|

|

|

|

|

|

Yonkers (city) |

|

YO |

6511 |

|

|

|

.00 |

|

|

|

.00 |

8⅞%* |

|

|

|

|

|

Wyoming County |

|

WY |

5621 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

||

Yates County |

|

YA |

5721 |

|

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

||

New York City/State combined tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[New York City includes counties of Bronx, Kings (Brooklyn), |

NE |

8081 |

|

|

|

.00 |

|

|

|

.00 |

87/8%* |

|

|

|

|

|||

New York (Manhattan), Queens, and Richmond (Staten Island)] |

|

|

|

|

|

|

|

|

|

|

||||||||

New York State/MCTD |

|

NE |

8061 |

|

|

|

.00 |

|

|

|

.00 |

43/8%* |

|

|

|

|

||

New York City - local tax only |

|

NE |

8091 |

|

|

|

.00 |

|

|

|

.00 |

4½% |

|

|

|

|

||

|

|

|

|

|

|

|

|

.00 |

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

.00 |

|

|

|

|

|

|

|

Column subtotals from page 2, boxes 6, |

7, and 8: |

9 |

|

|

.00 |

10 |

|

|

.00 |

|

|

11 |

|

|

|||

|

If box 14 is more than $3,000, see page 1 |

|

|

12 |

|

|

|

13 |

|

|

|

|

|

|

14 |

|

|

|

|

of instructions. |

Column totals: |

|

|

|

.00 |

|

|

|

.00 |

|

|

|

|

|

|||

|

|

|

|

|

|

Internal code |

|

|

Column G |

|

|

Column H |

|

Column J |

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||||

Step 4 Calculate special taxes (see instructions) |

|

|

|

|

|

|

Taxable receipts |

× |

Tax rate |

= |

Special taxes due |

|||||||

|

|

|

|

|

|

|

|

|

(G × H) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Passenger car rentals (outside the MCTD) |

|

|

|

|

PA |

0012 |

|

|

|

|

.00 |

12% |

|

|

|

|

||

Passenger car rentals (within the MCTD) |

|

|

|

|

PA |

0030 |

|

|

|

|

.00 |

12% |

|

|

|

|

||

Information & entertainment services furnished via telephony and telegraphy |

|

IN |

7009 |

|

|

|

|

.00 |

5% |

|

|

|

|

|||||

Vapor products |

|

|

|

|

VA |

7060 |

|

|

|

|

.00 |

20% |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Total special taxes: |

15 |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 5 Other tax credits and advance payments (see instructions) |

|

|

|

|

Internal code |

|

|

Column K |

||||||||||

|

|

|

|

|

|

|

|

|

Credit amount |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Credit for prepaid sales tax on cigarettes |

|

|

|

|

|

|

|

|

|

|

CR C8888 |

|

|

|

|

|||

Overpayment being carried forward from a prior period |

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|||

Advance payments (made with Form |

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

Total tax credits, advance payments, and overpayments: |

16 |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*43/8% = 0.04375; 73/8% = 0.07375; 81/8% = 0.08125; |

|

Proceed |

to Step 6, page 4 |

|||||||||||||

|

|

83/8% = 0.08375; 85/8% = 0.08625; 87/8% = 0.08875 |

|

|

|

|

|

|

|

|

||||||||

10000302210094

Page 4 of 4 |

|

Sales tax identification number |

|

|

|

|

|

|

A21 |

|

Annual |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 6 Calculate taxes due |

|

|

Add Sales and use tax column total (box 14) to Total special |

|

|

|

|

|

Taxes due |

|

|

|||||||||||||||

|

|

|

taxes (box 15) and subtract Total tax credits, advance |

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

payments, and overpayments (box 16). Enter result in box 17. |

|

|

|

|

|

|

|||||||||||

|

Box 14 |

|

|

+ |

Box 15 |

|

|

|

|

Box 16 |

= |

|

17 |

|

|

|

|

|

|||||||||

|

amount |

$ |

|

amount $ |

|

|

|

|

amount $ |

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 7 Calculate vendor collection credit |

|

If you are filing this return after the due date and/or not paying the full |

|

|

|

|

|

|

||||||||||||||||||

|

|

amount of tax due, STOP! You are not eligible for the vendor collection |

|

|

|

|

|

|

|||||||||||||||||||

|

or pay penalty and interest (see instructions) |

|

credit. If you are not eligible, enter 0 in box 18 and go to 7B. |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

7A |

Vendor collection credit worksheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

1 |

Enter the box 14 amount |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

2 |

Enter the amount from Schedule E, box 1 |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

3 |

Subtract line 2 from line 1 |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

4 |

Enter the box 15 amount |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

5 |

Add lines 3 and 4 |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

6Enter the amount from Schedule FR as

|

|

instructed on the schedule (if any) |

$ |

|

|

|

|

|

|

|

|

|

|

Enter this amount as a positive number. |

|

|

|

|

|

|

|

||

|

|

7 Add lines 5 and 6 |

|

$ |

|

|

|

|

|

||

|

|

............................................................................................. |

Vendor collection credit |

||||||||

|

|

|

|

|

|||||||

|

|

8 Credit amount (multiply line 7 by 5% (.05)) |

$ |

|

|

|

VE 7706 |

|

|||

|

|

Enter the line 8 amount or $200, whichever is less, in box 18. |

18 |

|

|

||||||

|

|

|

|

|

|||||||

|

OR Pay penalty and interest if you are filing late |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Penalty and interest |

||||

|

|

|

|

|

|

|

|

|

19 |

|

|

|

7B |

Penalty and interest are calculated on the amount in box 17, Taxes due. |

|

||||||||

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

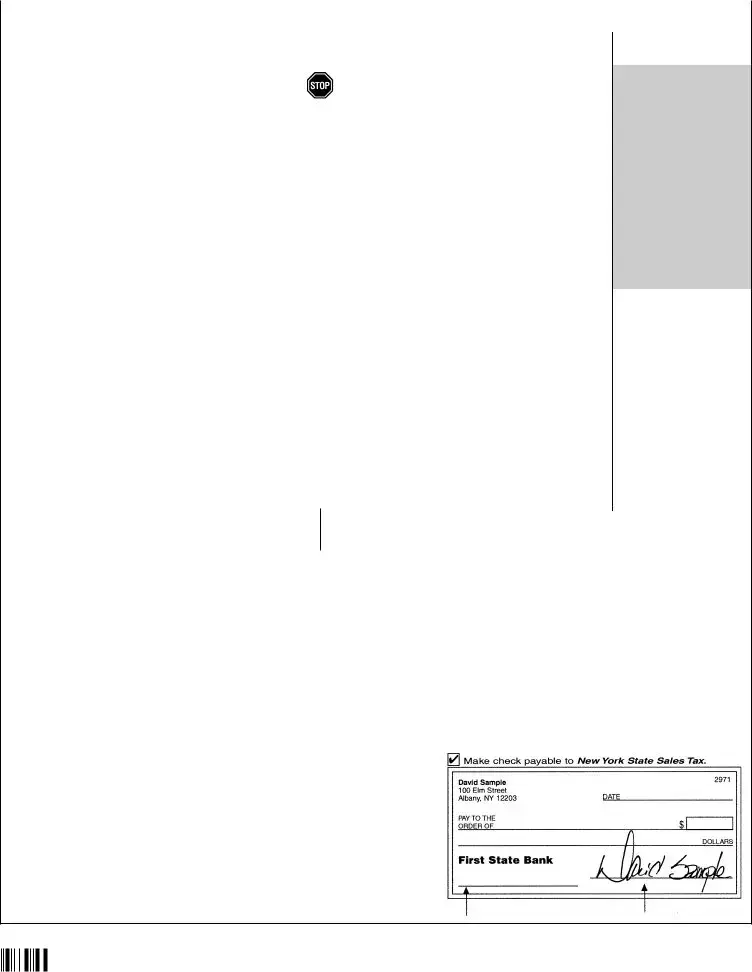

Step 8 Calculate total amount due |

Make check or money order payable to New York State Sales |

|

Total amount due |

||||||||

|

|

(see instructions) |

|

Tax. Write on your check your sales tax identification number, |

|

||||||

|

|

|

|

|

|

||||||

|

|

|

Taking vendor collection credit? Subtract box 18 from box 17. |

20 |

|

|

|||||

|

8A |

Amount due: |

|

||||||||

|

Paying penalty and interest? Add box 19 to box 17. |

|

|

|

|||||||

|

|

|

|

|

|

||||||

|

|

|

Enter your payment amount. This amount should match your |

21 |

|

|

|||||

|

8B |

Amount paid: |

|

||||||||

|

amount due in box 20. |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Step 9 Sign and mail this return (see instructions)

Be sure to keep a completed copy for your records.

Must be postmarked by Monday, March 22, 2021, to be considered filed on time. See below for complete mailing information.

Third – |

|

Do you want to allow another person to discuss this return with the Tax Dept? (see instructions) |

Yes |

|

|

|

(complete the following) No |

|

|

||||||||||||

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Designee’s name |

|

Designee’s phone number |

|

Personal identification |

|

|

|

|

||||||||||||

|

|

|

|

|

|||||||||||||||||

party |

|

|

|

( |

) |

|

|

|

|

|

number (PIN) |

|

|

|

|

||||||

designee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Designee’s email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized |

Signature of authorized person |

|

|

|

Official title |

|

|

|

|

|

|

|

|

|

|

||||||

person |

|

Email address of authorized person |

|

|

|

|

|

|

Telephone number |

|

|

|

|

Date |

|||||||

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

Paid |

|

Firm’s name (or yours if |

|

|

|

|

|

Firm’s |

EIN |

|

|

|

|

|

Preparer’s |

PTIN or SSN |

|||||

preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of individual preparing this return |

Address |

|

|

|

|

City |

|

|

|

|

|

State |

ZIP code |

|||||||

use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Email address of individual preparing this return |

Telephone number |

|

Preparer’s NYTPRIN |

|

NYTPRIN |

Date |

||||||||||||||

(see instr.) |

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

excl. code |

|

|

|

|||

Where to file your return and attachments

Web File your return at www.tax.ny.gov (see Highlights in instructions).

(If you are not required to Web File, mail your return and attachments to: NYS Sales Tax Processing, PO Box 15169, Albany NY

If using a private delivery service rather than the U.S. Postal Service, see Publication 55, Designated Private Delivery services.

|

March 10, 2021 |

New York State Sales Tax |

X,XXX.XX |

(your payment amount) |

|

|

|

Don’t forget to write your sales tax |

Don’t forget to |

ID number, |

sign your check |

10000402210094 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Need help? |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The ST-101 form is used to report annual sales and use tax for businesses in New York State. |

| Filing Period | This form covers the tax period from March 1, 2020, to February 28, 2021. |

| Due Date | All forms must be submitted by Monday, March 22, 2021, to avoid penalties. |

| Sales Tax Identification | A unique sales tax identification number must be included on the form. Most filers are required to provide this. |

| Final Return | If a business is discontinued or sold, a final return must be filed within 20 days of the business’s last operation day. |

| Credits Claim | Taxpayers can claim various credits by marking 'yes' in Step 3 and completing Form ST-101-ATT. |

| Sales Tax Calculation | Sales and use tax must be calculated in Step 6 based on taxable sales and applicable rates. |

| Payment Method | Payments can be made via check or money order, and should include the sales tax ID, form number, and fiscal year. |

| Submission Options | Form ST-101 can be filed online through the Sales Tax Web File or mailed to NYS Sales Tax Processing. |

Guidelines on Utilizing St 101

Completing the ST-101 form is essential for filing your annual sales and use tax return in New York. Follow these detailed steps to ensure accurate submission by the due date. Be mindful of any changes in your business status, as this may affect your filing process.

- Gather Required Information: Collect your sales tax identification number, legal name, DBA name (if applicable), and current business address. Make sure to have records of gross sales, nontaxable sales, and any credits claimed.

- Check for Changes: Confirm if there are any changes to your business address or information. If so, mark the box indicating a new address.

- Determine Taxable Activity: If you have no taxable sales, mark the relevant boxes and proceed to Step 9. If this is your final return, mark the box for final return and provide the necessary details.

- Input Sales Figures: In Step 1, enter your gross sales and services. If applicable, include the nontaxable and taxable sales information.

- Complete Final Return Section: If you sold or discontinued your business, provide details in Step 2, including the last day of business and names of associated parties.

- Calculate Sales and Use Taxes: In Step 3, enter taxable sales and purchases and multiply by the appropriate tax rate. Include any additional fees applicable.

- Calculate Any Special Taxes: For specialty taxes listed in Step 4, multiply taxable receipts by applicable tax rates.

- Input Tax Credits and Advance Payments: Step 5 requires you to list any tax credits or advance payments you have. This can help reduce the amount due.

- Calculate Total Amount Due: In Step 6, add your total sales tax amount and any special taxes. Subtract credits to determine the total amount due.

- Vendor Collection Credit: If filing late, complete Step 7 to determine eligibility for the vendor collection credit.

- Finalize Payment Amount: After accounting for credits in Step 8, calculate your final payment. Be sure to comply with instructions regarding payments, including any penalties for late filing.

- Sign and Mail Your Return: Finally, sign the return and make sure it is postmarked by the due date, which is March 22, 2021. If applicable, offer a designee’s information for follow-up with the Tax Department.

What You Should Know About This Form

What is the ST-101 form?

The ST-101 form is the annual Sales and Use Tax Return for New York State and local jurisdictions. It is used by businesses to report their sales tax obligations for the previous tax period, which runs from March 1 to February 28. This form must be filed annually by all businesses that collect sales tax in New York State, even if no tax is due for that year.

When is the ST-101 form due?

The ST-101 form is due annually on March 22nd following the end of the reporting period. For example, for the tax period from March 1, 2020, to February 28, 2021, the due date was March 22, 2021. Timely filing is important to avoid penalties and interest on any taxes owed.

Who is required to file the ST-101 form?

Most businesses that have a sales tax identification number and make taxable sales or purchases in New York are required to file the ST-101 form. This includes both sole proprietors and businesses registered as corporations or partnerships. If a business has made no taxable sales or purchases within the filing period, a return must still be filed stating that no tax is due.

What should I do if I no longer operate my business?

If you have sold or discontinued your business, you must file a final ST-101 return within 20 days of the last day of business. This final return should include all tax due up until the business closure. You should indicate that this is a final return by checking the appropriate box on the form.

Are there any credits I can claim on the ST-101 form?

Yes, you may be able to claim credits if applicable. Specifically, if you are eligible for any tax credits or have overpaid in previous periods, you should complete Step 3 of the form. The total amount of credits claimed must be reported accurately, and you may need to submit additional documentation, such as Form ST-101-ATT, to detail those credits.

How do I calculate the taxes due on the ST-101 form?

To determine the taxes due, add together all taxable sales and purchases reported in the relevant columns of the ST-101 form. The total gross sales and taxable services must then be multiplied by the applicable tax rate, which varies by jurisdiction. Further deductions from this total may also apply if you qualify for certain credits or have advance payments that can be subtracted from your total liability.

Where should I send my completed ST-101 form?

If you are filing electronically, you can use the New York State Sales Tax Web File tool available on their website. If you are mailing your return, send it to NYS Sales Tax Processing, PO Box 15169, Albany, NY 12212-5169. Ensure it is postmarked by the due date to avoid late filing penalties.

Common mistakes

Completing the ST-101 form for New York State sales and use tax can be daunting, and many individuals and businesses make various mistakes during this process. One common error is neglecting to update their contact information. If a person's legal name, DBA name, or address has changed, the new information must be accurately reflected on the form. Failing to do so can result in communication issues with tax authorities and possible delays in processing.

Another frequent mistake is not marking the correct boxes to indicate whether the return is final. If a business has ceased operations or undergone a significant change in form, such as from a sole proprietorship to a corporation, it is essential to mark the appropriate box on the form. Neglecting to do this could lead to significant misunderstandings with the tax authorities regarding the business status.

Additionally, individuals often forget to include all relevant sales and purchases. It can be easy to overlook certain taxable sales, especially if they occurred during a busy period. Completing Step 1 summarizes gross sales and services, and it's important to include all figures accurately to avoid discrepancies. Also, potential errors could arise when reporting nontaxable sales or marketplace provider transactions. Each element must be clearly documented to ensure compliance.

The computation of sales and use taxes poses another challenge. Many filers either miscalculate or overlook the proper tax rates for different jurisdictions. The ST-101 form features specific tax rates for areas throughout New York State, and inaccuracies in this section can have serious financial implications. Anyone completing this form should double-check their rates against official resources to ensure they are correct.

Furthermore, claiming credits can lead to confusion. If an individual is entitled to claim any tax credits, they need to mark the relevant box and provide accurate figures. Leaving this section incomplete or filled out incorrectly can result in delays or denial of the credits. Hence, reviewing the instructions carefully related to this step is critical.

Another common error is neglecting to include a signature or date. The final step of signing and dating the return is essential, as an unsigned return will not be processed. This simple oversight may lead to unnecessary complications and delays in tax filings.

Many individuals also misinterpret instructions given on the form or in accompanying documents. Each section has specific guidelines, and not adhering to these instructions can lead to mistakes. It is crucial to read each instruction thoroughly and ask questions if there is any uncertainty.

Sometimes, filers ignore the importance of keeping records. It is advisable for individuals to retain a copy of the completed ST-101 form for their records, along with any documents submitted. This practice can be invaluable if questions arise later regarding a submitted return.

Finally, the deadline for submission can be easily overlooked. Marking the due date and ensuring timely filing is essential in avoiding penalties. Missing the deadline can inhibit a business's ability to operate smoothly and can result in additional fees.

Documents used along the form

The ST-101 form is an essential document for reporting sales and use taxes in New York State. It is often accompanied by several other forms and documents that provide important additional information or fulfill required duties. Understanding these related documents can help ensure compliance with tax obligations and facilitate smooth processing.

- Form ST-101-I: This form provides the instructions for completing the ST-101. It outlines the steps that filers must follow, as well as offers guidance on how to calculate taxes and report sales accurately.

- Form ST-101-ATT: This attachment is used to report any credits claimed on the ST-101 return. Filers must complete this form to detail the total amounts of the credits they are claiming, which can reduce their tax liability.

- Form TP-153: Known as the Notice to Prospective Purchasers of a Business or Business Assets, this form is required if a business is sold or discontinued. It provides potential buyers with critical information about the seller's sales tax obligations.

- Form ST-330: This is a payment form used for making advance payments of sales tax. If a business has made any payments for future tax obligations, this form is necessary to report those amounts.

- Form NYS-45: This form is used for reporting New York State unemployment insurance contributions. If a business has employees, it is important to file this form along with the ST-101, as it relates to employee-related taxes.

- Form ST-2: This form is used by resellers to purchase property or services without paying sales tax. A registered vendor provides this document to suppliers, enabling tax exemption for qualified purchases.

In conclusion, while the ST-101 form is vital for reporting sales and use taxes, it often works in conjunction with other documents. Staying informed and organized with these related forms can help businesses navigate their tax responsibilities more effectively.

Similar forms

- Form ST-100: This form is an annual sales tax return for vendors. It serves a similar purpose to ST-101, allowing businesses to report taxable sales and calculate tax due.

- Form ST-102: Used for exempt organizations, this form enables qualifying entities to claim sales tax exemptions similar to those detailed in ST-101.

- Form ST-120: This form is a Resale Certificate, which allows the purchase of goods tax-free if those goods are intended for resale, thereby being essential for businesses to document exempt purchases.

- Form ST-136: A Certificate of Exemption, this document allows certain purchases to be made without sales tax. It parallels the claims made regarding exemptions in the ST-101.

- Form ST-346: This Specific Utility Services form is submitted for claiming sales tax exemptions on certain utility services, similar to exemptions reported in ST-101.

- Form ST-500: This document pertains to the reporting of sales and use tax for certain businesses and mimics the format of ST-101 for reporting purposes.

- Form ST-641: A return used specifically for vendors who pay sales tax on certain fuels. This form, like ST-101, involves reporting and calculation of taxes due relevant to specific sales tax considerations.

Dos and Don'ts

Here’s a guide on what to do and what to avoid when filling out the St 101 form.

- Double-check all your information for accuracy.

- Use clear, legible writing or print the form when possible.

- Pay attention to deadlines and submit on time.

- Keep copies of the completed form and all attachments for your records.

- Mark any boxes clearly; avoid smudges or unclear markings.

- Do not leave any required fields blank.

- Avoid using whiteout or correction fluid on the form.

- Do not forget to sign the form and include your payment if required.

- Don’t miss out on claiming any eligible credits or deductions.

Misconceptions

- All businesses need to file the ST-101 form. Not every business must file. Only those with taxable sales or purchases are required to submit the ST-101 form for New York State sales tax.

- If you had no sales, you don’t need to file. Even if there are no taxable sales, businesses must still file the form and indicate that the amounts are zero.

- It's okay to submit the form late without penalties. There are penalties for late submissions. Filing on time helps avoid extra fees and interest.

- Your business’s DBA name is not necessary on the form. The DBA name needs to be included as it highlights the operating name of your business and is essential for identification.

- You don’t need to worry about final returns. If your business is sold, discontinued, or there’s a change in structure, a final return must be filed within 20 days.

- Only physical businesses need to file the ST-101 form. Online businesses and marketplace sellers are also required to file if they meet the sales threshold.

- Once filed, you don’t need to keep a copy of the ST-101. It’s important to keep a copy for your records. You may need it for future reference or in case of audits.

- You need to provide estimated tax amounts. The form requires actual sales data, not estimates. Providing accurate information is vital.

- Signatures are optional on the ST-101 form. A signature is necessary. By signing, you affirm that the information provided is truthful and accurate.

- The ST-101 form is only for New York City. This form applies to all businesses in New York State. It's not limited to New York City or its surrounding areas.

Key takeaways

The ST-101 form is used for filing the Annual Sales and Use Tax Return in New York State. Each business must accurately report its taxable sales, purchases, and any credits claimed during the tax period.

Ensure that your sales tax identification number and legal name are correctly printed on the form as they appear on your Certificate of Authority. This helps avoid processing delays.

If your business address has changed, it is necessary to mark the appropriate checkbox on the form. Additionally, report any changes related to the business structure, such as selling or discontinuing operations.

The due date for filing the ST-101 form is set for March 22, 2021. This filing must be postmarked by this date to be considered timely, ensuring compliance with tax obligations.

If no tax is due for the reporting period, simply complete Step 1, entering 'none' in the relevant boxes. However, if applicable, always check and claim any credits you may have.

Any final return must be filed within 20 days of the last day of business or change in status. Ensure to enter details regarding the sale of business assets and tax collected in this instance.

Browse Other Templates

Jack Kent Cooke Scholarship - Scholarships play a crucial role in enabling educational pursuits for those in need.

Consent to Release - This document can help expedite the resolution of Medicare recovery claims.