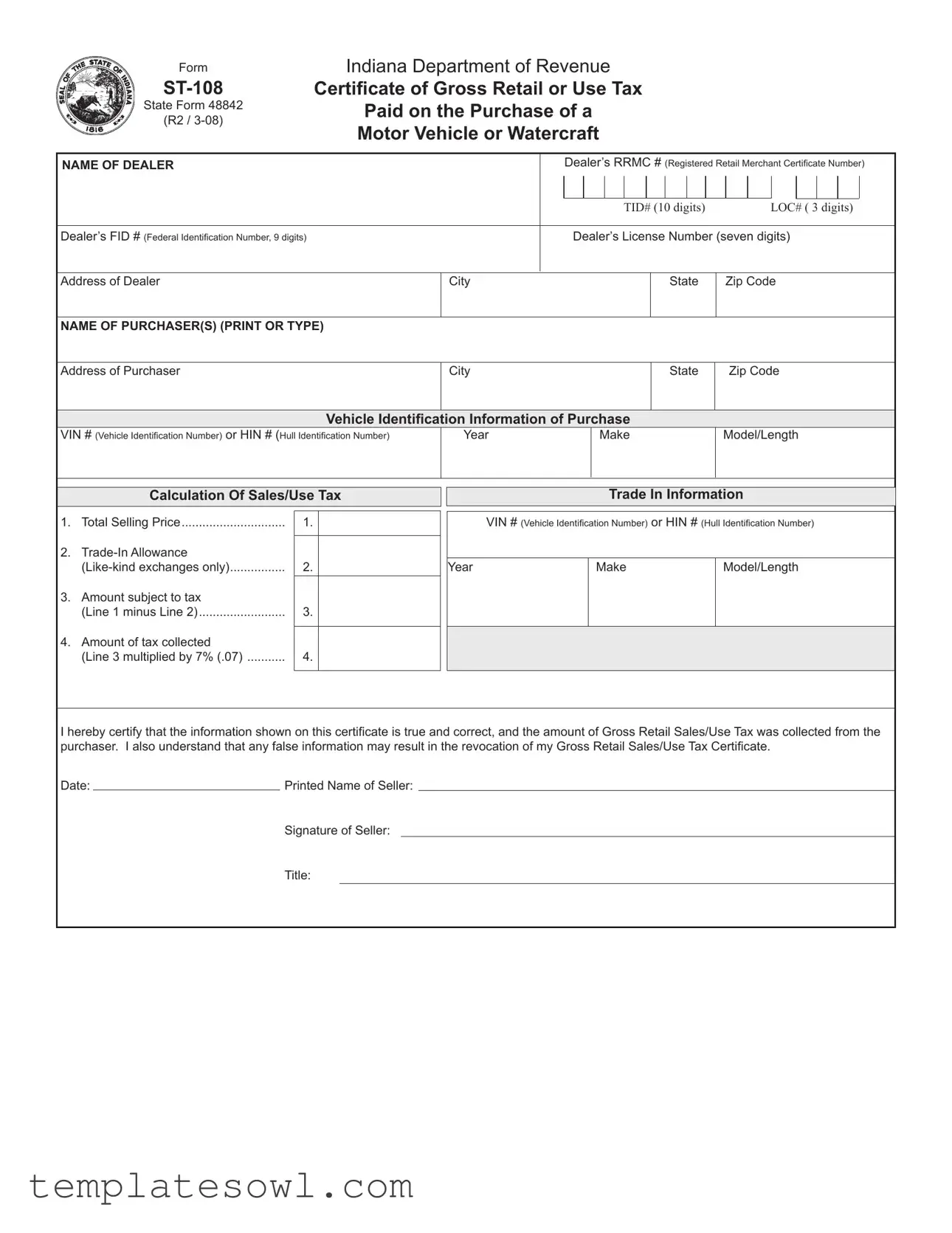

Fill Out Your St 108 Form

The ST-108 form, issued by the Indiana Department of Revenue, plays a crucial role in the taxation process for motor vehicle or watercraft purchases. This certificate is essential for buyers, as it provides evidence that the gross retail sales or use tax has been paid on their purchase. It serves as a channel to ensure that the dealer collects the appropriate tax amount, calculated at a rate of 7% on the amount subject to tax after deducting any trade-in allowances. To complete the form, sellers must supply detailed information, including their identification numbers, tax identification details, and the vehicle or watercraft data, such as the Vehicle Identification Number (VIN) or Hull Identification Number (HIN). Additionally, the form requires a straightforward breakdown of the total selling price, trade-ins, and tax calculations, ensuring clarity for both the seller and purchaser. Certification by the dealer is paramount, as it affirms that the information provided is accurate, while improper completion may lead to rejection of the form at the license branch. Understanding each aspect of the ST-108 form is vital for both automotive and watercraft dealers to comply with Indiana's tax regulations, avoid unnecessary delays during the titling process, and fulfill their obligations to the Department of Revenue.

St 108 Example

Form

State Form 48842

(R2 /

Indiana Department of Revenue

Certificate of Gross Retail or Use Tax

Paid on the Purchase of a

Motor Vehicle or Watercraft

NAME OF DEALER |

|

|

Dealer’s RRMC # (Registered Retail Merchant Certificate Number) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TID# (10 digits) |

|

|

LOC# ( 3 digits) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Dealer’s FID # (Federal Identification Number, 9 digits) |

|

|

Dealer’s License Number (seven digits) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Dealer |

City |

|

|

|

|

|

|

|

State |

|

Zip Code |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Purchaser(s) (pRINT OR tYPE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Purchaser |

City |

|

|

|

|

|

|

|

State |

|

Zip Code |

||||||||

Vehicle Identification Information of Purchase

VIN # (Vehicle Identification Number) or HIN # (Hull Identification Number) |

Year |

Make |

Model/Length |

|

|

|

|

Calculation Of Sales/Use Tax

1. |

Total Selling Price |

1. |

|

2. |

|

|

|

|

2. |

|

|

3. |

Amount subject to tax |

|

|

|

(Line 1 minus Line 2) |

3. |

|

4. |

Amount of tax collected |

|

|

|

|

||

|

(Line 3 multiplied by 7% (.07) |

4. |

|

|

|

|

|

Trade In Information

VIN # (Vehicle Identification Number) or HIN # (Hull Identification Number)

Year |

Make |

Model/Length |

|

|

|

|

|

|

I hereby certify that the information shown on this certificate is true and correct, and the amount of Gross Retail Sales/Use Tax was collected from the purchaser. I also understand that any false information may result in the revocation of my Gross Retail Sales/Use Tax Certificate.

Date: |

|

Printed Name of Seller: |

|

|

|

Signature of Seller: |

|

|

|

Title: |

|

Instructions for completing Form

or Use Tax on the Purchase of a Motor Vehicle or Watercraft.

INDIANA CODE

The

If an exemption from the tax is claimed, the purchaser and the dealer must complete Form

Seller Information

NAME OF DEALER: Indicate the name of the dealer as it appears on the Registered Retail Merchant Certificate (RRMC).

FID # (Federal Identification Number): Indicate the Federal Identification Number of the dealer, if applicable.

Dealer’s License #: Indicate the Dealer’s License Number(seven digits) as it appears on the Dealer’s License Certificate.

RRMC # (same as TID # - 10 Digits + LOC # - 3 Digits): Indicate the Indiana Taxpayer Identification Number and Location Number as it appears on the Registered Retail Merchant Certificate. This number must be in the following format:

Address of Dealer: Indicate the address of the dealer as it appears on the Registered Retail Merchant Certifi- cate.

Vehicle Identification Information

VIN or HIN ID #: Enter the Vehicle ID # (VIN) or the Hull ID # (HIN).

YEAR: Indicate the year the motor vehicle or watercraft was manufactured.

MODEL # OR WATERCRAFT LENGTH: If a motor vehicle is being sold indicate the model name for the vehicle. If a watercraft is being sold indicate the length of the craft.

Calculation of Sales/Use Tax

TOTAL SELLING PRICE: When determining the total selling price include all delivery, make ready, repair, or other costs incurred prior to transfer to the buyer. Federal excise tax is NOT included.

You must also indicate the make, model, year, and ID # of the

AMOUNT SUBJECT TO TAX: Line 1 minus Line 2 results in the amount on which the sales/use tax will be calcu- lated.

AMOUNT OF TAX COLLECTED: Line 3 multiplied by 7% or .07 equals the amount to be collected by the seller.

Signature Section: The Seller must sign the

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The ST-108 form certifies that the gross retail or use tax has been paid on the purchase of a motor vehicle or watercraft. |

| Governing Law | Indiana Code 6-2.5-9-6 mandates the presentation of this certificate when titling a vehicle or watercraft. |

| Tax Calculation | The form requires calculation of the sales/use tax, which is computed by applying a 7% rate to the amount subject to tax. |

| Seller's Responsibility | The seller must sign and certify the accuracy of the information on the ST-108 to ensure acceptance by the license branch. |

Guidelines on Utilizing St 108

When preparing to fill out the ST-108 form, it’s important to ensure that all necessary information is accurately captured. This form is crucial for certifying the payment of gross retail or use tax on the purchase of a motor vehicle or watercraft. Completing the form accurately will prevent any delays or complications during the titling process with the Bureau of Motor Vehicles.

- Provide Seller Information: Enter the Name of Dealer exactly as it appears on the Registered Retail Merchant Certificate.

- Fill in the Dealer’s RRMC #, which includes the 10-digit TID# and 3-digit LOC# formatted as “0001234567-001.” Ensure this number is correct, as it is crucial.

- Input the Dealer’s FID # if applicable, followed by the Dealer’s License Number, which should be seven digits.

- List the Address of Dealer, along with the City, State, and Zip Code.

- Complete Purchaser Information: Enter the Name of Purchaser(s) in printed letters, followed by the Address, City, State, and Zip Code.

- Vehicle Identification: Input the VIN # (Vehicle Identification Number) or HIN # (Hull Identification Number).

- Indicate the Year, Make, and Model/Length of the vehicle or watercraft being purchased.

- Calculate Sales/Use Tax: Enter the Total Selling Price, including delivery and other related costs, excluding federal excise tax.

- Provide the Trade-In Allowance if applicable, making sure it’s for like-kind exchanges only.

- Calculate the Amount Subject to Tax by subtracting the trade-in allowance from the total selling price.

- Compute the Amount of Tax Collected by multiplying the amount subject to tax by 7% (0.07).

- Trade-In Information: If a trade-in was involved, fill in the details of that vehicle or watercraft, including its VIN #, Year, Make, and Model/Length.

- Sign the Form: The Seller must print their name, sign, and enter their title in the designated spaces at the bottom of the form to certify the accuracy of the information and confirm tax collection.

After completing each section carefully, ensure that all signatures are included and that the form is free from errors. This documentation will be essential for the successful processing of the vehicle or watercraft title.

What You Should Know About This Form

What is Form ST-108 and when is it required?

Form ST-108 is a certificate of gross retail or use tax paid on the purchase of a motor vehicle or watercraft. It is required under Indiana Code 6-2.5-9-6 when a person is titling a vehicle or watercraft. The form certifies that the necessary sales and use tax has been collected by the dealer. Without this certificate, you must pay the tax directly to a Bureau of Motor Vehicles license branch at the time of titling.

Who is responsible for completing Form ST-108?

The dealer is responsible for completing Form ST-108. This includes providing accurate information about the vehicle, the purchaser, and the calculation of sales tax. If tax exemptions are applicable, both the dealer and the purchaser must complete Form ST-108E instead and submit it at the time of licensing.

What information must be provided on Form ST-108?

Form ST-108 requires several details: the dealer's registered business name, tax identification numbers, address, and the seller's name and signature. You must also provide the purchaser's information along with the vehicle identification number (VIN) or hull identification number (HIN), year, make, and model. Additionally, it requires entering the total selling price and the trade-in allowance if applicable, followed by the calculated tax amount.

What happens if Form ST-108 is not filled out correctly?

If Form ST-108 is not completed correctly, it may be rejected by the license branch. This means the purchaser would need to return to the dealer to obtain a valid certificate. Key mistakes include missing the dealer’s RRMC number, failing to sign the form, or providing incorrect information that does not meet the required format.

Common mistakes

Filling out Form ST-108 is an essential step in the process of purchasing a motor vehicle or watercraft in Indiana. However, many people make common mistakes that can lead to delays or even rejections of the form. Understanding these pitfalls can help ensure a smoother transaction.

One frequent error is related to the Dealer’s RRMC Number. This number must follow a specific format: 10 digits followed by a hyphen and then 3 digits. If the dealer's RRMC number is not entered correctly, the form will be rejected. Additionally, failure to include the Dealer’s License Number can also invalidate the form, as this seven-digit identifier is critical for processing.

Another mistake often seen is in the calculations of the sales/use tax. It is crucial that the total selling price includes all relevant costs, such as delivery or repair fees. Neglecting to account for these costs can result in incorrect tax calculations. Furthermore, individuals sometimes omit the Trade-In Allowance. The trade-in deduction is only applicable for like-kind items, and mistakenly applying it for dissimilar trades can lead to significant issues.

Some purchasers fail to provide complete vehicle identification information. The VIN or HIN must be accurately recorded, along with the year and model or length of the vehicle or watercraft being purchased. Incomplete or incorrect information can complicate the titling process.

Signature errors are also a common pitfall. The seller's signature is necessary for the validity of Form ST-108. Without it, the license branch will reject the form. This oversight can create frustration for both parties involved in the transaction.

The omission of the Seller’s Federal Identification Number can further complicate matters. If applicable, this number must be included to ensure the legitimacy of the transaction. A missing Federal ID may cause the dealer to forfeit their ability to provide appropriate tax documentation.

It’s important to fully understand when exemptions apply. If an exemption from tax is claimed, both the purchaser and seller must complete Form ST-108E and submit it alongside the ST-108. Each party should be aware of the exemptions available to them to avoid unnecessary complications.

Lastly, paying close attention to the Date is essential. Any failure to record the date when the seller certifies the information can render the document invalid. Each of these mistakes can delay the process, making it crucial for individuals to carefully review the form before submission.

By being aware of these common errors, individuals can avoid unnecessary delays and ensure a more efficient transaction process when completing Form ST-108.

Documents used along the form

The ST-108 form is a crucial document used to certify that gross retail or use tax has been paid on the purchase of a motor vehicle or watercraft in Indiana. However, there are additional forms and documents that often accompany the ST-108, each serving its own important purpose. Understanding these documents can facilitate a smoother transaction and ensure compliance with state regulations.

- Form ST-108E: This form serves as an affidavit of exemption for purchasers. It is completed by the buyer to attest that they qualify for a tax exemption on their vehicle or watercraft purchase. Both the dealer and buyer must submit this form at the time of licensing.

- Sales and Use Tax Report: Dealers must submit a sales and use tax report to the Indiana Department of Revenue. This document details the total sales and use tax collected from transactions, including those involving the ST-108 form.

- Dealer’s License Certificate: This certificate verifies that the dealer is licensed to sell vehicles or watercraft in Indiana. It includes important information such as the dealer’s license number and should be readily available during the transaction.

- Registered Retail Merchant Certificate (RRMC): The RRMC is essential for dealers to operate legally. It provides the Indiana Taxpayer Identification Number necessary for the ST-108 form and demonstrates that the dealer is compliant with tax regulations.

- Title Application: To legally transfer ownership of a vehicle or watercraft, a title application must be completed. This form requires the VIN or HIN and the details of the new owner.

- Bill of Sale: A bill of sale is often used to finalize the sale, documenting the transaction and providing proof of purchase. This document should include details of the sale including the selling price and vehicle or watercraft details.

- Proof of Insurance: Indiana law requires evidence of insurance coverage when titling a vehicle or watercraft. A declaration page from the insurance provider is typically required at the time of licensing.

Being aware of these accompanying forms and documents can streamline your experience when purchasing a motor vehicle or watercraft in Indiana. Ensure that you have all necessary paperwork in order to avoid complications during the licensing process. Take prompt action to gather the required documents and facilitate compliance with state regulations.

Similar forms

The ST-108 form plays a critical role in the process of vehicle and watercraft titling in Indiana by certifying that the appropriate sales or use tax has been paid. There are several other documents that share similarities with the ST-108 in terms of their purpose, structure, and the information they gather. Below is a list of ten such documents, each accompanied by a brief explanation of how they relate to the ST-108 form.

- Form ST-108E: This form is an affidavit of exemption that allows buyers to claim certain exemptions from sales tax. Like the ST-108, it requires information about both the purchaser and seller, verifying tax obligations related to the transaction.

- Form 8300: This document is used to report cash payments over $10,000. It is similar in that it must be completed by the seller and requires detailed identification information, just like the ST-108 ensures tax compliance.

- Form 1040 Schedule C: Business owners use this form to report income or loss from a business. It gathers financial data and requires identification details, echoing the ST-108’s focus on tax reporting during vehicle sales.

- Sales Tax Exemption Certificate: This document allows buyers to make tax-exempt purchases. It captures detailed information regarding the buyer, akin to how the ST-108 collects purchaser details before the tax is validated.

- IRS Form W-9: Collecting a taxpayer's identification information, this form is similar to the ST-108 in that it serves a regulatory purpose by ensuring that the identifying data is accurate for tax reporting.

- Form RESC1: Used in residential sales to validate exempt sales situations. Its process and importance parallel the ST-108 form, where both are critical for confirming tax compliance in specific transactions.

- Form 1099-MISC: This form reports various types of income other than wages. Like the ST-108, it is essential for ensuring proper tax treatment of reported income and demands detailed identifying information.

- Form 941: Though primarily for reporting employment taxes, it captures detailed employee information. The ST-108 similarly collects detailed information about parties involved to ensure proper tax assessment.

- Form 1098: This form is utilized for reporting mortgage interest payments. It has a similar information-gathering purpose as the ST-108, helping track financial transactions for tax purposes.

- Form 706: This is the estate tax return, which records the value of an estate to ensure tax compliance. Both the Form 706 and ST-108 require precise financial and identification information.

These documents, while serving different specific purposes, demonstrate a commonality with the ST-108 in their function of ensuring tax compliance and collecting necessary information related to financial transactions.

Dos and Don'ts

When completing the ST-108 form, it is crucial to approach the process with care and attention to detail. Below is a list of things you should and shouldn't do to ensure a smooth experience.

- Do verify that all information is accurate and complete before submission.

- Do include the dealer’s RRMC number in the correct format.

- Do ensure the Vehicle Identification Number (VIN) or Hull Identification Number (HIN) is clearly entered.

- Do collect all required signatures at the time of completing the form.

- Do calculate the tax based on the total selling price, ensuring all calculations are precise.

- Don't leave any sections of the form blank; it may lead to rejection.

- Don't forget to include your Federal Identification Number, if applicable.

- Don't mistakenly include federal excise tax in the total selling price.

- Don't use the ST-108 form for non-qualifying sales or exemptions.

- Don't overlook the importance of correct trade-in details; inaccurate information can impact tax calculations.

Making sure these guidelines are followed can help avoid delays and ensure the successful processing of your ST-108 form.

Misconceptions

Misconceptions regarding the ST-108 form are common, and clarity is essential for ensuring compliance with Indiana tax regulations. Below are nine prevalent misconceptions, along with explanations to shed light on the reality of the situation.

- The ST-108 form is only required for new vehicles. In reality, the ST-108 form is necessary for both new and used vehicles, as well as watercraft. Any transaction that involves the transfer of ownership is subject to this requirement.

- Only the buyer needs to fill out the form. This is a misunderstanding. Both the dealer and the buyer must provide information on the form. The dealer certifies that the sales/use tax has been collected, while the buyer’s details are also necessary for accurate record-keeping.

- Trading in a vehicle means there is no tax liability. This is misleading. While the trade-in allowance can reduce the taxable amount, it does not eliminate tax liability altogether. The tax is calculated based on the selling price minus the trade-in value, but the trade-in must be like-kind to qualify for this exemption.

- Federal excise tax is included in the total selling price. This is incorrect. According to the guidelines for the ST-108, federal excise tax should not be included in the total selling price. The total only reflects costs incurred up to the transfer, excluding any federal taxes.

- The ST-108 form can be submitted without a dealer’s signature. This is mistaken. The seller's signature is crucial for the validity of the ST-108 form. Without it, the form will be rejected by the Bureau of Motor Vehicles, leading to delays in the titling process.

- All sales are taxable under this form. Not necessarily. While the ST-108 is often used to document taxable sales, certain exemptions apply. If an exemption is claimed, both the dealer and the buyer must complete Form ST-108E instead.

- Using the ST-108 guarantees automatic tax exemption. Misunderstandings arise here as well. The ST-108 serves to document tax collection, but does not guarantee an exemption from tax. Such exemptions must be properly claimed and documented using the appropriate forms.

- Completing the form is optional for dealers. This misconception could lead to significant issues. Completion of the ST-108 is mandatory for dealers when selling vehicles or watercraft. Failing to provide this form can result in penalties for the dealer.

- Any information can be provided on the form. This is not true. Accuracy is imperative; the information on the ST-108 must match the dealer’s Registered Retail Merchant Certificate. Any discrepancies can lead to rejection of the form and complications in the licensing process.

Understanding these misconceptions can help both buyers and dealers navigate the complexities surrounding vehicle and watercraft purchases in Indiana more effectively. It fosters compliance with legal obligations and promotes smoother transactions.

Key takeaways

Here are some important points to remember when filling out and using Form ST-108 for the purchase of a motor vehicle or watercraft:

- Correct Information is Essential: Always ensure that all dealer details, including the Registered Retail Merchant Certificate Number and dealer's license number, are accurate. If this information is incorrect or not formatted properly, the form may be rejected.

- Tax Calculation: Carefully calculate the sales or use tax. This is done by taking the total selling price, subtracting any trade-in allowance, and then applying the 7% tax rate to the remaining amount.

- Signature Requirement: The seller must sign the ST-108 to confirm that the sales/use tax has been collected. Without a signature, the form will be rejected, causing unnecessary delays.

- Exemptions: If a purchaser claims an exemption from the tax, both the buyer and the dealer need to fill out Form ST-108E. This form should be submitted at the time of licensing to substantiate the exemption claim.

Browse Other Templates

Form Ar-11 - There are checkboxes for easy data entry on various categories.

How Do I Get a Direct Deposit Form - Ensure the amounts entered for dollars and cents are reflected correctly to avoid discrepancies.