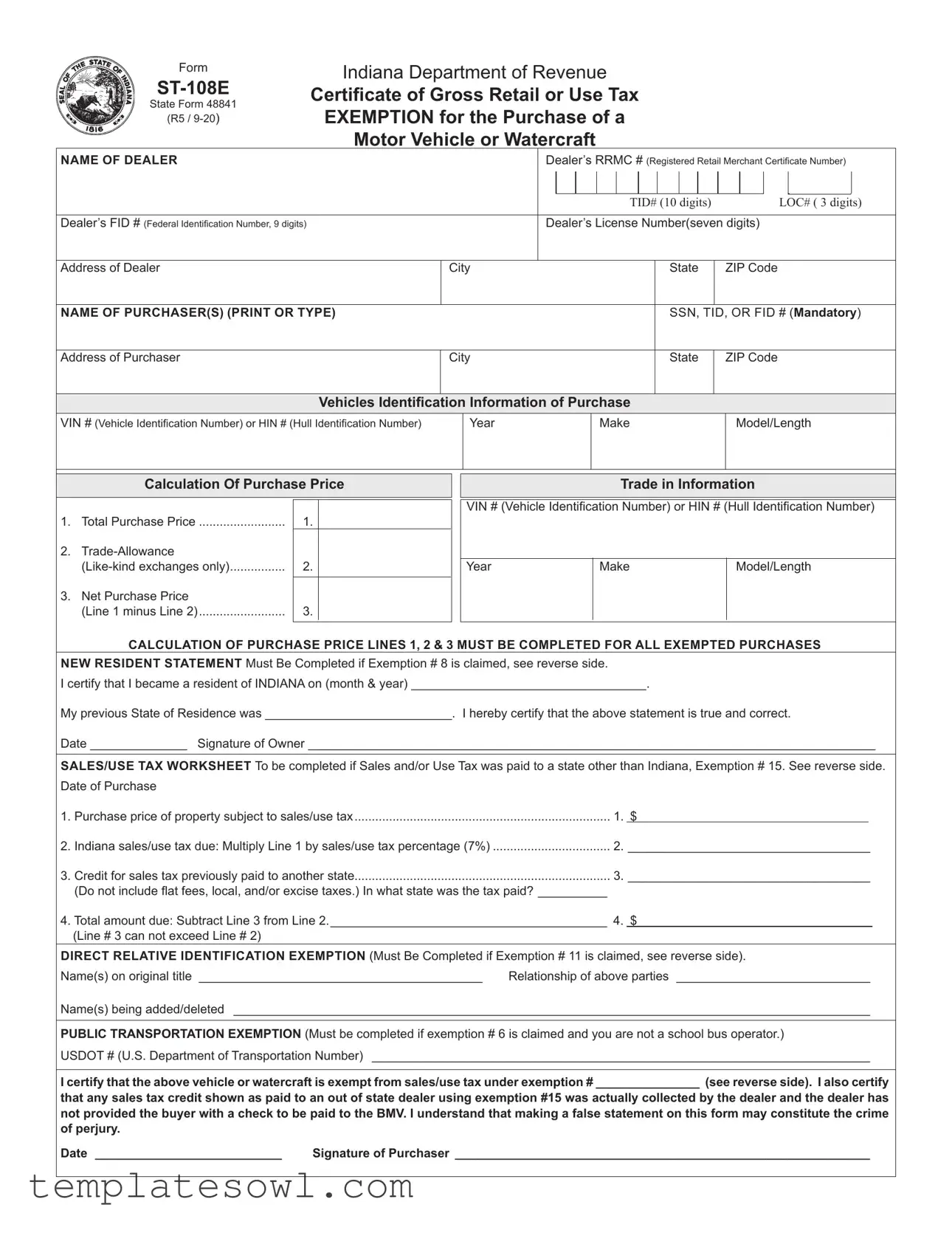

Fill Out Your St 108E State Form

The Indiana Department of Revenue’s ST-108E form plays a crucial role in the buying process for motor vehicles and watercraft in the state. Specifically designed for exemption claims, it helps purchasers avoid unnecessary sales and use taxes under certain conditions. Key elements of the form include fields for basic information about both the dealer and the purchaser, including names, addresses, and identification numbers. Additionally, it requires detailed vehicle information, such as the Vehicle Identification Number (VIN) or Hull Identification Number (HIN), as well as the year, make, and model. Buyers must also complete a calculation of the purchase price that details the total price, trade-allowance, and net purchase price to confirm eligibility for exemption. The form outlines various exemptions available, including those for governmental units, nonprofit organizations, and even for new residents of Indiana. Exemption claims can be complicated; thus, a clear understanding of the form’s requirements is essential for anyone looking to benefit from these tax breaks. Finally, certain statements must be certified, ensuring that all information provided is accurate to avoid potential penalties.

St 108E State Example

|

Form |

|

Indiana Department of Revenue |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

|

Certificate of Gross Retail or Use Tax |

|

|

|

|

|

|||||||||||||||||

|

State Form 48841 |

|

|

|

|

|

|||||||||||||||||

|

(R5 / |

|

EXEMPTION for the Purchase of a |

|

|

|

|

|

|||||||||||||||

|

|

|

Motor Vehicle or Watercraft |

|

|

|

|

|

|||||||||||||||

NAME OF DEALER |

|

|

|

|

|

Dealer’s RRMC # (Registered Retail Merchant Certificate Number) |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TID# (10 digits) |

|

|

LOC# ( 3 digits) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Dealer’s FID # (Federal Identification Number, 9 digits) |

|

|

|

Dealer’s License Number(seven digits) |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Dealer |

|

|

City |

|

|

|

|

|

|

|

State |

|

|

ZIP Code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF PURCHASER(S) (PRINT OR TYPE) |

|

|

|

|

|

|

|

|

|

|

SSN, TID, OR FID # (Mandatory) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Purchaser |

|

|

City |

|

|

|

|

|

|

|

State |

|

|

ZIP Code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicles Identification Information of Purchase |

|

|

|

|

|

|||||||||||||||

VIN # (Vehicle Identification Number) or HIN # (Hull Identification Number) |

|

|

Year |

|

|

|

|

Make |

Model/Length |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculation Of Purchase Price |

|

|

|

|

|

|

|

|

Trade in Information |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total Purchase Price |

|

|

|

|

VIN # (Vehicle Identification Number) or HIN # (Hull Identification Number) |

|||||||||||||||||

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

Year |

|

|

|

|

Make |

Model/Length |

||||||||||||

3. |

Net Purchase Price |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(Line 1 minus Line 2) |

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CALCULATION OF PURCHASE PRICE LINES 1, 2 & 3 MUST BE COMPLETED FOR ALL EXEMPTED PURCHASES

NEW RESIDENT STATEMENT Must Be Completed if Exemption # 8 is claimed, see reverse side.

I certify that I became a resident of INDIANA on (month & year) __________________________________.

My previous State of Residence was ___________________________. I hereby certify that the above statement is true and correct.

Date ______________ Signature of Owner __________________________________________________________________________________

SALES/USE TAX WORKSHEET To be completed if Sales and/or Use Tax was paid to a state other than Indiana, Exemption # 15. See reverse side. Date of Purchase

1. |

Purchase price of property subject to sales/use tax |

1. |

$ |

|

|

2. |

Indiana sales/use tax due: Multiply Line 1 by sales/use tax percentage (7%) |

2. |

___________________________________ |

|

|

3. |

Credit for sales tax previously paid to another state |

3. |

___________________________________ |

|

|

|

(Do not include flat fees, local, and/or excise taxes.) In what state was the tax paid? __________ |

|

|

|

|

4. Total amount due: Subtract Line 3 from Line 2.________________________________________ 4. |

$ |

|

|

||

|

(Line # 3 can not exceed Line # 2) |

|

|

|

|

DIRECT RELATIVE IDENTIFICATION EXEMPTION (Must Be Completed if Exemption # 11 is claimed, see reverse side). |

|||||

Name(s) on original title _________________________________________ |

Relationship of above parties ____________________________ |

||||

Name(s) being added/deleted ____________________________________________________________________________________________

PUBLIC TRANSPORTATION EXEMPTION (Must be completed if exemption # 6 is claimed and you are not a school bus operator.)

USDOT # (U.S. Department of Transportation Number) ________________________________________________________________________

I certify that the above vehicle or watercraft is exempt from sales/use tax under exemption # _______________ (see reverse side). I also certify

that any sales tax credit shown as paid to an out of state dealer using exemption #15 was actually collected by the dealer and the dealer has not provided the buyer with a check to be paid to the BMV. I understand that making a false statement on this form may constitute the crime of perjury.

Date ___________________________ |

Signature of Purchaser ____________________________________________________________ |

GENERAL INFORMATION

INDIANA CODE

If NONE of the exemptions apply to the purchase, Form

A purchaser’s ID#

1.Vehicles or watercraft purchased by Indiana or Federal governmental units or their instrumentalities.

2.Vehicles or watercraft purchased by nonprofit organizations operated exclusively for religious, charitable, or educational pur-

poses and using the vehicle for the purpose for which such organization is exempt. The applicant MUST indicate its 13 digit

Indiana TID and LOC number on the front of the form. The nonprofit name must be on the title to claim this exemption.

3.Issue title for the sole purpose of adding lien holder information. This exemption is not available to add, delete, or change the name on a title.

4.Trucks, not to be licensed for highway use, and to be directly used in direct production of manufacturing, mining, refining or harvesting of agricultural commodities.

5.Sales of motor vehicles or watercraft to Registered Retail Merchants acquiring the vehicles or watercraft to rent, or lease to others and whose ordinary course of business is to rent or lease vehicles or watercraft to others.

6.Vehicles or watercraft to be predominately used for hire in public transportation. (Hauling for hire.) Your USDOT number must be shown on the reverse side of this form. Predominate use is greater than 50%.

7.Vehicles or watercraft transferred from one individual to another with no consideration involved or received as outright gift or inheritance. Assumption of loan payments by the purchaser constitutes consideration and is therefore NOT exempt unless the transferred party was listed on the original security agreement. A copy of the original security agreement must be submitted with the title paperwork.

8.Vehicles previously purchased, titled and licensed in another State or Country by a bona fide resident of that State or Country, who subsequently has become an Indiana resident, are exempt from Indiana sales/use tax upon titling and registration of the vehicle in Indiana. Watercraft previously purchased, titled, or licensed in another state, by a bona fide resident of that state, who subsequently has become an Indiana resident, are exempt from sales/use tax upon titling or registration of the watercraft in Indiana. The New Resident Statement on the front of the form MUST be completed.

9.Vehicles or watercraft purchased to be immediately placed into inventory for resale. NonIndiana dealers must enter both their FID number and their state’s Dealer License Number on this form in lieu of the Indiana TID number if they are not registered with the Indiana Department of Revenue. Note: Motor vehicle dealers are only exempt from sales tax on new motor vehicles purchased for which they possess a manufacturer’s franchise to sell that particular vehicle. If a dealer does not possess a manufacturer’s franchise to sell the new vehicle purchased the dealer must pay sales tax and the resale exemption is invalid.

(I.C.

10.Vehicles or watercraft, not to be licensed for use, which are eligible for a repossession title issued by the State of Indiana as a result of a bona fide credit transaction or salvage title resulting from an insurance settlement.

11.Transactions consisting of adding or deleting a spouse, child, grandparent, parent, or sibling of the owner of a motor vehicle only per

12.Vehicles or watercraft won as a prize in a raffle or drawing which were previously titled by a qualified nonprofit organization. A valid Federal Miscellaneous Income Statement, Form

13.Redemption of repossessed vehicles or watercraft by the original owner.

14.Indiana Department of Revenue use only. This exemption may not be used unless authorized by the Department by calling (317)

15.Sales tax paid to a

This agency is requesting the disclosure of your Social Security number in accordance with IC

Disclosure is mandatory; this record cannot be processed without it.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The ST-108E is used to certify exemption from the Indiana gross retail or use tax for motor vehicle or watercraft purchases. |

| Governing Law | This form operates under Indiana Code 6-2.5-9-6, which requires certification for tax exemption upon titling. |

| Mandatory Information | Purchasers must provide their Social Security number, Taxpayer Identification Number, or Federal Identification Number to claim an exemption. |

| Purchase Price Calculation | Calculations for total purchase price, trade-allowance, and net purchase price must be completed for all exempted purchases. |

| New Resident Exemption | A statement is required if the purchaser claims exemption #8 as a new resident of Indiana. |

| Sales/Use Tax Worksheet | This section must be filled out if taxes were previously paid in another state, following exemption #15 rules. |

| Direct Relative Exemption | If claiming exemption #11, the identification of direct relatives on the original title must be recorded. |

| Public Transportation Exemption | Exemption #6 requires certification for vehicles primarily used for public transportation, with appropriate documentation. |

| Exemption Types | The form outlines various exemptions, including those for governmental units, nonprofits, and immediate resale vehicles. |

| Forms Submission Requirement | If no exemptions apply, both dealer and purchaser must complete Form ST-108 for tax collection to indicate compliance. |

Guidelines on Utilizing St 108E State

Filling out the State Form ST-108E is an essential step for those looking to claim an exemption on the purchase of a motor vehicle or watercraft. Taking your time and ensuring that every section is accurately completed will help you smoothly navigate the process. Here are the steps to follow:

- Start with Dealer Information: Fill in the name of the dealer, their Registered Retail Merchant Certificate Number (RRMC#), Transaction Identification Number (TID#), Location Number (LOC#), Federal Identification Number (FID#), and Dealer’s License Number. Enter the dealer's address, city, state, and ZIP code.

- Include Purchaser Details: Provide the name(s) of the purchaser(s) clearly, along with their Social Security Number (SSN), TID, or FID number. Then, fill out the purchaser's address, city, state, and ZIP code.

- Assign Vehicle Identification: Input the Vehicle Identification Number (VIN) or Hull Identification Number (HIN). List the year, make, and model/length of the vehicle or watercraft you are purchasing.

- Calculate Purchase Price: Record the total purchase price of the vehicle or watercraft in Line 1. If you have a trade-in, enter the VIN or HIN and the details of the trade-in. Calculate the trade-allowance and record it on Line 2. Subtract Line 2 from Line 1 to arrive at the net purchase price, which should be noted on Line 3.

- Complete the New Resident Statement: If you are claiming Exemption #8, note the month and year when you became a resident of Indiana and provide your previous state of residence. Sign and date this section to certify its accuracy.

- Sales/Use Tax Worksheet: If applicable, fill out this section by entering the date of purchase, the purchase price, and then calculate the Indiana sales/use tax due. Include any credit for sales tax paid to another state, and determine the total amount due.

- Direct Relative Identification Exemption: If you are claiming Exemption #11, provide the names of the parties on the original title and their relationship to you. Note the names being added or deleted.

- Public Transportation Exemption: If claiming Exemption #6, include the U.S. Department of Transportation Number (USDOT#) and certify the vehicle's exemption status.

- Sign and Date: Ensure that all required signatures are provided, as falsifying information could lead to serious consequences. Sign the form, and include the date.

Once you have filled out the form, check your entries for accuracy and completeness. This careful attention will help facilitate processing. You can then submit the completed form to the relevant authorities to claim your exemption.

What You Should Know About This Form

What is the purpose of the ST-108E form?

The ST-108E form serves as a Certificate of Gross Retail or Use Tax Exemption for the purchase of a motor vehicle or watercraft in Indiana. It allows qualifying purchasers to claim exemption from sales or use tax. Certain criteria must be met, including the completion of specific sections, to ensure the exemption is valid.

Who needs to fill out this form?

This form must be completed by the purchaser if they are claiming an exemption when purchasing a motor vehicle or watercraft. The dealer will also need to fill out some sections. It is essential for both parties to provide accurate information, as failing to do so may result in tax liabilities.

What information is required on the ST-108E form?

Key information needed includes details about the dealer, such as their RRMC number and address, as well as the purchaser's name, address, and identification number (like SSN, TID, or FID). Additionally, details about the purchase itself, like the vehicle's VIN or Hull Identification Number, total purchase price, and trade-in information, must be provided. Completing each section accurately is crucial for the exemption to be accepted.

What types of exemptions are available under the ST-108E?

The form outlines several exemption categories. These can range from sales to governmental units and nonprofit organizations, to individuals claiming exemptions as new residents of Indiana. Other exemptions might apply based on direct relatives or public transportation uses. Each exemption category has specific requirements that must be adhered to, so it’s important to review which applies to your situation.

What happens if I do not present the ST-108E form?

If you do not present the ST-108E form, sales and use tax may be assessed on your vehicle or watercraft purchase. Indiana law mandates that proof of tax exemption be provided. Without it, the Bureau of Motor Vehicles (BMV) may require you to pay the tax when registering your vehicle or watercraft, potentially leading to unexpected costs.

Is there a penalty for providing false information on the ST-108E?

Yes, providing false information on the ST-108E form can be serious. Such actions may be classified as perjury, which is a crime. It's important to ensure all information provided is accurate and truthful, as any discrepancies can lead to legal repercussions and complications regarding the legitimacy of your tax exemption claim.

Common mistakes

Filling out the St 108E form can be a straightforward process, but many individuals make critical mistakes that may lead to complications. One common error occurs when people fail to include mandatory identification numbers, such as a Social Security Number (SSN) or Federal Identification Number (FID). Incomplete forms can delay the processing of claims and lead to additional scrutiny by the Indiana Department of Revenue.

Secondly, inaccuracies in the Vehicle Identification Number (VIN) or Hull Identification Number (HIN) can result in significant issues. It is essential to double-check these numbers to ensure they match official documents. Any discrepancy may raise red flags during processing and could ultimately lead to rejection of the form.

Another frequent mistake is neglecting to fill out the calculation of the purchase price accurately. Lines 1, 2, and 3 must be completed for all exempted purchases. Failing to provide this information can invalidate the exemption claim. Additionally, some individuals forget to provide trade-in information, which must be clearly stated if applicable.

People often overlook the requisite New Resident Statement when claiming exemption number 8. A signed and dated statement confirming the date of residency in Indiana must be included. Without it, eligibility for the exemption cannot be confirmed.

Not completing the Direct Relative Identification Exemption, when applicable, also leads to errors. Individuals may mistakenly assume that their relationship to another party is known and fail to disclose this information fully. Proper identification of both original and new title holders is essential to ensure smooth processing.

In addition, there is a tendency to skip over the section dedicated to out-of-state tax credits. If sales tax was paid in another state, proper documentation needs to be provided. Simply stating that taxes were paid elsewhere is not sufficient; the related details must be elaborated in the designated section.

Moreover, individuals sometimes make the error of misinterpreting exemption categories. The exemptions allowed are specific and have strict criteria. Misclassifying the type of exemption being claimed can lead to immediate rejection of the application.

Another common blunder involves improper completion of the Public Transportation Exemption. Many people forget to include the required U.S. Department of Transportation (USDOT) number. This information is critical for verifying eligibility and must be included to avoid delays.

Finally, providing insufficient evidence of sales tax paid when making claims can create issues. Any supporting documents required, such as a Federal Miscellaneous Income Statement for prize vehicles, must accompany the form. Failure to provide adequate backup can trigger further scrutiny and rejection.

In summary, careful attention to detail is crucial when completing the St 108E form. By avoiding these common mistakes, individuals can ensure their exemption claims are processed swiftly and accurately.

Documents used along the form

When purchasing a motor vehicle or watercraft in Indiana, several forms and documents accompany the ST-108E State form to ensure compliance with tax regulations and to streamline the process. Each document has its own specific purpose and assists in confirming eligibility for tax exemptions or detailing pertinent information regarding the purchase.

- ST-108 Form: This is the standard form used when exemptions do not apply. It indicates that sales/use tax was collected by the dealer, enabling them to submit the tax directly to the Indiana Department of Revenue.

- New Resident Statement: This form is necessary for new residents claiming an exemption. It affirms the date of residency change and previous state of residence, verifying eligibility for tax exemption upon vehicle registration.

- Sales/Use Tax Worksheet: Required for individuals who paid sales/use tax to another state, this worksheet calculates the Indiana tax credit based on prior payments, ensuring that taxpayers don’t pay double taxes.

- Direct Relative Identification Exemption: This document is essential if a buyer is adding or deleting a relative's name from a vehicle title. It details the relationship and names involved to confirm eligibility for specific exemptions.

- Public Transportation Exemption: Used when claiming exemption under public transportation rules, it requires the submission of the USDOT number and confirmation of the intended use for hire.

- Proof of Delivery: This document affirms that the vehicle or watercraft has been delivered to the buyer, establishing the transaction’s legitimacy and helping to substantiate claims for tax exemptions.

- Affidavit for Prize Vehicles: For vehicles won through raffles, this affidavit must be completed by the nonprofit organization. It provides necessary documentation to claim the associated tax exemption.

Understanding these various forms and their functions will help streamline the process of claiming tax exemptions when titling and registering a vehicle or watercraft in Indiana. Proper documentation ensures compliance and aids in avoiding unnecessary burdens during the transaction.

Similar forms

- Form ST-108: This form is used by dealers to indicate that sales/use tax was collected when no exemptions apply. Just like the ST-108E, it demands important details about the purchase, including the purchaser's identification and vehicle information, ensuring transparency in tax obligations.

- Form ST-139: This is an exemption certificate for purchases made by non-profit organizations. Similar to the ST-108E, it enables organizations to claim sales tax exemptions but focuses specifically on those with a charitable or educational purpose and requires the same rigorous identification proofs.

- Form ST-105: This form allows for tax exemptions on specific purchases for resale. Like the ST-108E, it needs identification details and emphasizes the same principle: that no sales tax will be charged on qualifying purchases, thereby promoting fair tax practices among registered retailers.

- Form ST-108S: This is a sales tax exemption form used for sales made to governmental entities. Echoing the ST-108E, it likewise validates the tax-exempt status with stringent identification requirements, ensuring that only eligible entities benefit from the tax exemptions.

- Form ST-200: Similar to the ST-108E, this form is used to claim sales tax exemption for purchases made by Indiana residents moving from another state. Both forms require a declaration of the previous state of residence and verification of residency status, solidifying their connection.

- Form ST-151: This form facilitates the exemption for the purchase of certain vehicles under the Lienholder and Transfer Authority regulations. Like the ST-108E, it contains sections for specific vehicle details and identification that ensure compliance with tax laws regarding vehicle ownership transfers.

Dos and Don'ts

Things You Should Do:

- Print or type all required information clearly to ensure accuracy.

- Provide a valid ID number (SSN, TID, or FID) as this is mandatory for claiming any exemptions.

- Complete all sections related to the calculation of the purchase price, including lines #1, #2, and #3.

- Check all entries for correctness before submission to prevent delays in processing.

Things You Shouldn't Do:

- Do not leave any mandatory fields blank; incomplete forms will be rejected.

- Avoid providing false information or omitting required details, as this could lead to legal repercussions.

- Do not forget to sign and date the form, as these steps are crucial for validation.

- Do not submit the form without reviewing the exemption criteria to ensure that you qualify.

Misconceptions

Understanding the Indiana Department of Revenue's ST 108E form can help many individuals navigate the tax exemption process related to motor vehicle or watercraft purchases. However, several common misconceptions can lead to confusion about this form's usage and requirements. Below is a list of eight misconceptions, along with clarifications to help clarify the truth.

- All vehicle purchases qualify for tax exemption under the ST 108E form. Many people believe that any vehicle purchased can qualify for exemption. In reality, only specific categories, like purchases by government units or vehicles used mainly for public transportation, are eligible.

- Only Indiana residents can use the ST 108E form. Some assume that only residents of Indiana can claim exemptions. However, individuals who have recently moved to Indiana and purchased a vehicle in another state may also qualify for exemptions, provided certain conditions are met.

- The form can be submitted without an ID number. It is a common belief that the ST 108E can be filed without providing a Social Security Number, Taxpayer ID, or Federal ID number. However, without this mandatory identification, the form is invalid.

- Trade-ins do not need to be documented. Many purchasers think they do not have to detail trade-in values on the ST 108E form. But accurately completing the calculations for the net purchase price, including trade-in values, is essential for claiming the exemption.

- It's unnecessary to provide purchase price information for exempted purchases. Some might think that simply claiming an exemption is enough without providing the corresponding purchase price documentation. However, the form requires complete calculations to validate the exemption claim.

- The ST 108E form can be used for any type of vehicle or watercraft. Many believe any vehicle or watercraft qualifies for exemptions. The truth is that specific classifications, like those used primarily for manufacturing or designated as gifts, must meet strict criteria to be exempt.

- Once a vehicle is exempt, no further documentation is necessary. It's a misconception that exemption claims remain valid without subsequent verification. The Indiana Department of Revenue may require additional documentation later on to substantiate previous exemption claims.

- The form only applies when purchasing from Indiana dealers. Some assume that the ST 108E can only be utilized for purchases made from Indiana dealers. However, it also applies to purchases made from out-of-state dealers, provided that the necessary information is submitted as required.

Being informed about these misconceptions can empower individuals during the vehicle purchasing process, ensuring they complete the ST 108E form accurately and take full advantage of their exemption opportunities.

Key takeaways

1. Purpose of Form ST-108E: The ST-108E form certifies exemption from sales or use tax for purchasing a motor vehicle or watercraft in Indiana.

2. Accurate Information Required: Complete the form with precise details about the dealer and purchaser, including names, identification numbers, addresses, and vehicle identification numbers (VIN or HIN).

3. Purchase Price Calculation: Ensure that lines for total purchase price, trade-allowance, and net purchase price are filled out. All three calculations are mandatory for valid exemption claims.

4. ID Requirement: A purchaser's ID number (either SSN, TID, or FID) is essential to claim any exemption. This information must be included to validate the exemption.

5. Exemptions Specifics: There are several exemptions available, including those for government purchases, nonprofit organizations, and certain types of vehicle transfers. Review the exemption options to determine eligibility.

6. New Resident Statement: If claiming exemption as a new resident of Indiana, complete the New Resident Statement section with the date of residency change and previous state of residence.

7. Penalties and Erroneous Claims: Be aware that providing false information can lead to criminal charges, including perjury. It's crucial to ensure all statements made on the form are accurate.

Browse Other Templates

Hair Salon Business Plan Template - Laura Doe brings over ten years of styling experience to the team.

Signa Pharmacy - If there are other individuals to update, list their names in the provided space.