Fill Out Your St 119 1 Exempt Form

The New York Exempt Purchase Certificate, known as Form ST 119.1, plays a crucial role for educational institutions like Indiana University, which is recognized as exempt from sales and use tax under Section 1116(a)(4) of New York law. This exemption allows the University to make purchases of tangible personal property or taxable services without incurring sales tax, provided certain conditions are met. For instance, Indiana University must be both the direct purchaser and payer of record, meaning all transactions must be invoiced and charged directly to the University. Additionally, purchases can only benefit the University, excluding any personal benefit to individual employees or officers. While the exemption does not extend to motor fuel or diesel fuel, the form allows for a streamlined process where a blanket certificate is valid for three years, covering multiple transactions without needing to issue a new certificate each time. Completing the form requires specific details, such as the seller's name and address, and must be signed by a designated responsible officer, underscoring the importance of proper documentation in these tax-exempt purchases. Understanding and utilizing Form ST 119.1 not only helps Indiana University maximize its resources but also ensures compliance with state regulations.

St 119 1 Exempt Example

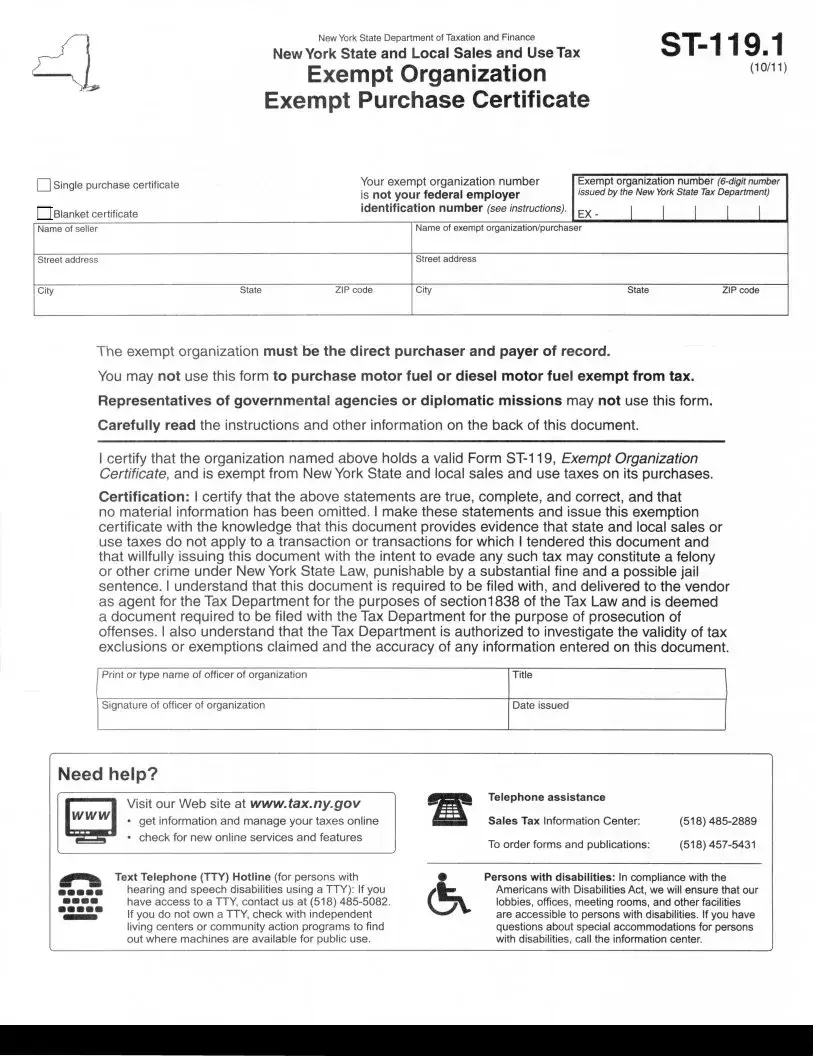

NEW YORK EXEMPT PURCHASE CERTIFICATE (FORM ST 119.1)

***For internal Indiana University use only***

NOTE: According to New York, Section 1116(a)(4), Indiana University is exempt from sales and use tax because it is organized exclusively for educational purposes. The University must issue the attached certificate to vendors when purchasing tangible personal property or taxable services to qualify for the exemption. A vendor may accept Form ST 119.1 from Indiana University at the time of sale, or within 90 days of accepting delivery of the property or the rendering of services.

•Indiana University must be the direct purchaser and payer of record. Purchases must be made in the following manner:

O Are directly invoiced and charged to Indiana University, and O Are directly paid by Indiana University via

check,

credit card

•All purchases made using Form ST 119.1 must benefit the University only. The form may not be used for the benefit of any officer, member, or employee of Indiana University.

•The exemption does not apply to purchases of motor fuel or diesel motor fuel.

•It is not necessary to give the seller a new certificate every time a purchase is made. A blanket exemption claim covers all exempt transfers between the University and the vendor for a three year period from the date of purchase.

INSTRUCTIONS: Fill out all sections highlighted in blue including:

•Seller’s Name and Address

•The exemption certificate must have the original signature of a responsible officer. Indiana University has designated Associate Vice President & Director of Procurement Services, Jill Schunk, as the signatory. Please

New York State Department of Taxation and Finance |

|

New York State and Local Sales and Use Tax |

Exempt Organization |

(10/11) |

|

|

Exempt Purchase Certificate |

|

0 Single purchase certificate

0

Blanket certificate Name of seller

Blanket certificate Name of seller

Street address

Your exempt organization number |

Exempt organization number |

|||||

is not your federal employer |

issued by the New York State Tax Department) |

|||||

|

|

|

|

|

|

|

identification number (see instructions). |

EX- |

I |

I |

I |

I |

I |

|

||||||

Name of exempt organization/purchaser

Street address

City |

State |

ZIP code |

City |

State |

ZIP code |

T he exempt organization must be the direct purchaser and payer of record.

You may not use this form to purchase motor fuel or diesel motor fuel exempt from tax.

Representatives of governmental agencies or diplomatic missions may not use this form.

Carefully read the instructions and other information on the back of this document.

I certify that the organization named above holds a valid Form

Certification: I certify that the above statements are true, complete, and correct, and that no material information has been omitted . I make these statements and issue this exemption certificate with the knowledge that this document provides evidence that state and local sales or use taxes do not apply to a transaction or transactions for which I tendered this document and that willfully issuing this document with the intent to evade any such tax may constitute a felony or other crime under New York State Law, punishable by a substantial fine and a possible jail sentence. I understand that this document is required to be filed with , and delivered to the vendor as agent for the Tax Department for the purposes of section1838 of the Tax Law and is deemed a document required to be filed with the Tax Department for the purpose of prosecution of offenses. I also understand that the Tax Department is authorized to investigate the validity of tax exclusions or exemptions claimed and the accuracy of any information entered on this document.

Print or type name of officer of organization |

Title |

Signature of officer of organization |

Date issued |

Need help?

1;1 Visit our Web site at www.tax.ny.gov

• get information and manage your taxes online

• check for new online services and features

|

Text Telephone (TTY) Hotline (for persons with |

セ@ |

|

••••• |

hearing and speech disabilities using a TTY): If you |

•••• |

have access to a TTY, contact us at (518) |

••••• |

If you do not own a TTY, check with independent |

- |

living centers or community action programs to find |

out where machines are available for public use . |

|

• |

Telephone assistance |

|

|

|

Sales Tax Information |

Center: |

(518) |

||

To order forms and |

publications: |

(518) |

•Persons with disabilities: In compliance with the セ@Americans with Disabilities Act, we will ensure that our

lobbies, offices, meeting rooms, and other facilities are accessible to persons with disabilities. If you have questions about special accommodations for persons with disabilities, call the information center.

Form Characteristics

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Governing Authority | The form is governed by New York Section 1116(a)(4), which states educational organizations are exempt from sales and use tax. |

| 2 | Eligible Purchaser | Indiana University must be the direct purchaser to qualify for the tax exemption. |

| 3 | Payment Method | Purchases must be made via check or credit card directly charged to Indiana University. |

| 4 | Exemption Scope | The exemption applies only to purchases benefiting Indiana University, not individuals associated with it. |

| 5 | Exclusion of Certain Purchases | Motor fuel and diesel motor fuel purchases are not exempt under this certificate. |

| 6 | Blanket Certificate Validity | A single blanket exemption can cover all purchases over a three-year period. |

| 7 | Signature Requirement | The form must bear the original signature of Jill Schunk, the designated signatory for Indiana University. |

| 8 | Delivery Deadline | The certificate may be submitted at the time of sale or within 90 days of delivery. |

| 9 | Legal Consequences | Willfully issuing this exemption certificate with intent to evade taxes may result in legal penalties. |

Guidelines on Utilizing St 119 1 Exempt

Completing the ST-119.1 Exempt Purchase Certificate is essential for Indiana University to qualify for the sales tax exemption. Ensuring all necessary information is filled out accurately is critical to maintain compliance with tax regulations. Follow the steps below to successfully complete the form.

- Obtain the ST-119.1 form from the New York State Department of Taxation and Finance website or your local office.

- In the designated section, enter the Seller’s Name and Address. Make sure this information is accurate to avoid any issues.

- Provide your exempt organization number. Remember, this is a 6-digit number issued by the New York State Tax Department, not your federal employer identification number.

- Fill in the Name of the Exempt Organization/Purchaser and its Street Address.

- Complete the City, State, and ZIP Code fields for both the seller and your organization.

- Sign the form. The signature of a responsible officer of Indiana University is required. Contact Associate Vice President & Director of Procurement Services, Jill Schunk, to arrange for her signature.

- Print or type the Name and Title of the signing officer in the designated spaces.

- Indicate the Date Issued next to the officer’s signature.

- Once completed, submit the form to the vendor at the time of purchase or within 90 days of delivery.

What You Should Know About This Form

What is the purpose of the ST 119.1 Exempt Purchase Certificate?

The ST 119.1 Exempt Purchase Certificate is designed for Indiana University to make tax-exempt purchases in New York. Because the University is considered an educational institution, it qualifies for exemption from sales and use tax under New York state law. This certificate allows the University to receive tangible personal property or taxable services without paying sales tax, provided that the purchases are used for the benefit of the University only.

Who can use the ST 119.1 certificate?

This certificate can only be used by Indiana University. It must be issued directly by the University to vendors when making qualified purchases. The University itself must be named as the direct purchaser and payer of record. Individual employees or officers cannot use this certificate for personal benefit; all purchases must serve the University's purposes.

What purchases are not eligible for tax exemption using this certificate?

While the ST 119.1 certificate provides significant benefits, it does not apply to all purchases. Specifically, purchases of motor fuel and diesel motor fuel are excluded from this exemption. Only tangible personal property and taxable services may be acquired without sales tax through this certificate.

How long is the ST 119.1 certificate valid for purchases?

The ST 119.1 certificate can be used as a blanket exemption claim covering all eligible purchases from a vendor for a three-year period. This means that once issued, a single certificate can apply to multiple transactions within that time frame, simplifying the process for the University and its vendors.

What information is needed to complete the ST 119.1 form?

When filling out the ST 119.1 form, certain sections highlighted in blue must be completed. This includes the seller’s name and address, as well as the exempt organization number issued to Indiana University by the New York State Tax Department. Additionally, the original signature of a designated, responsible officer, specifically Jill Schunk, should be included to validate the certificate.

What should I do if I have questions about using the ST 119.1 form?

If you have any questions regarding the ST 119.1 Exempt Purchase Certificate, you can visit the New York State Department of Taxation and Finance website for comprehensive information. For specific inquiries, you can contact their Sales Tax Information Center directly via telephone. They also provide resources for individuals with hearing or speech disabilities to ensure accessibility for all users.

Common mistakes

Filling out the St 119.1 Exempt form can be a straightforward process, but there are common mistakes that individuals often make. One critical error is failing to provide the seller's name and address. This section is essential because it identifies the vendor from whom the purchase is being made. If this information is incorrect or missing, it can lead to complications, including the denial of the sales tax exemption.

Another frequent mistake is neglecting to obtain the required signature from a responsible officer. The form must include the original signature of someone with authority, specifically the designated Associate Vice President & Director of Procurement Services. Without this signature, the form is not valid, which can result in a retroactive tax charge. Maintaining clear communication with the designated officer ensures that all necessary signatures are collected in a timely manner.

People also often misuse the form by attempting to apply it for purchases that do not qualify for exemption. For instance, motor fuel and diesel motor fuel purchases are specifically excluded from eligibility. Using the form for these prohibited items can attract legal penalties and compromise the exempt status of the organization. Understanding what qualifies for exemption is vital for compliance.

Lastly, some individuals mistakenly think they need to submit a new exemption certificate for every purchase. In reality, a blanket exemption claim can cover all exempt transactions between Indiana University and a vendor for a three-year period. This knowledge is vital to avoid unnecessary paperwork and to streamline the purchasing process. Understanding these nuances can help avoid potential pitfalls that could result in financial loss or legal issues.

Documents used along the form

The ST-119.1 Exempt Purchase Certificate is an essential document for Indiana University, allowing it to purchase goods and services without paying sales tax. Alongside this form, several other documents may also be needed to ensure compliance and smooth transactions. Below is a list of these documents with brief descriptions of each.

- Form ST-119, Exempt Organization Certificate: This certificate proves that an organization is recognized as tax-exempt in New York, allowing it to benefit from sales and use tax exemptions.

- Purchase Order (PO): A document issued by Indiana University that authorizes a purchase transaction. It provides details such as quantities, types, and agreed prices for goods or services.

- Invoice: A detailed bill provided by the vendor after goods or services have been delivered. It must be matched to a corresponding purchase order to ensure correct payment processing.

- Payment Authorization Document: This form indicates approval for payment of an invoice to the vendor. It signifies that the purchased items have been received satisfactorily.

- Vendor Registration Form: This document collects necessary information from vendors seeking to do business with Indiana University, including tax identification and compliance certifications.

- Certificate of Insurance: An insurance document required from vendors, verifying that they carry adequate liability coverage as required by Indiana University.

- Receiving Report: A record created upon receiving goods. It confirms that the items ordered have been received in full and in good condition.

- Vendor Agreement: A contract outlining the terms and conditions between Indiana University and the vendor, including pricing, delivery terms, and service expectations.

Understanding and preparing these documents is crucial for ensuring compliance with tax regulations and maintaining efficient purchasing processes. Each document plays a role in supporting Indiana University's tax-exempt status and facilitating its operations. Please ensure that you have the necessary forms ready at the time of transaction.

Similar forms

The ST 119.1 Exempt form is essential for institutions like Indiana University to purchase items without incurring sales tax. Several other documents share similarities with the ST 119.1 form. Below is a list of these similar documents, highlighting their common features:

- ST-119 Exempt Organization Certificate: This certificate also indicates that an organization is exempt from sales and local use taxes, serving as proof of exemption for purchases.

- ST-120 Resale Certificate: Similar to the ST 119.1, this form allows businesses to purchase goods without paying sales tax, provided they intend to resell those goods.

- ST-121 Exempt Use Certificate: This document allows organizations to claim exemptions on certain purchases used for exempt purposes, paralleling the ST 119.1's focus on educational use.

- ST-125 Exempt Certificate for Nonprofit Organizations: This form is issued to nonprofit entities, allowing tax-exempt purchases. Like the ST 119.1, it requires the certificate holder to be the direct buyer.

- ST-129 Exempt Certificate for Government Agencies: Government agencies may use this certificate for tax-exempt purchases. It similarly emphasizes the need for the agency to be the purchaser.

- ST-140 Agricultural Exemption Certificate: This document allows farmers to purchase supplies exempt from sales tax, reflecting similarities in the exemption criteria based on usage.

These documents maintain a common purpose of facilitating tax exemptions under specific conditions, highlighting their roles in various purchasing contexts.

Dos and Don'ts

When filling out the New York Exempt Purchase Certificate (Form ST 119.1), it's crucial to adhere to certain best practices to ensure a smooth process. Here are four important do's and don'ts to keep in mind:

- Do fill out all sections highlighted in blue. This includes essential information such as the seller’s name and address.

- Do have the form signed by a responsible officer. For Indiana University, this signature should come from Jill Schunk, the Associate Vice President & Director of Procurement Services.

- Don’t use the form for purchasing motor fuel or diesel motor fuel. These items are explicitly excluded from the exemption.

- Don’t submit a new certificate for every transaction. A blanket exemption claim can cover purchases for a three-year period with a single submission.

By following these guidelines, individuals can navigate the process more effectively and ensure compliance with New York's sales and use tax regulations.

Misconceptions

Misconceptions about the ST 119.1 Exempt Form can lead to confusion. Here are ten common misunderstandings:

- Only Indiana University can use the form. Many believe that only Indiana University can use this form. However, any exempt organization registered with New York State can use it, provided they meet the criteria.

- Form ST 119.1 is valid forever. Some think the exemption lasts indefinitely. It is important to note that the blanket exemption applies for only three years from the date of purchase.

- You need to provide a new certificate for every purchase. This is a frequent misconception. A blanket certificate covers multiple transactions within that three-year period.

- The form is valid for purchasing motor fuel. Many mistakenly believe this form can be used for any type of purchase. However, the exemption does not apply to motor fuels or diesel motor fuels.

- Anyone from Indiana University can sign the form. Only designated individuals are permitted to sign the ST 119.1 form. In the case of Indiana University, the Associate Vice President & Director of Procurement Services is the designated signer.

- It can be used for personal purchases. This is incorrect. The form may only be used for purchases that benefit Indiana University directly, never for personal gain.

- You can use the form after the purchase. Some people think they can submit the form after making a purchase. The form must be provided at the time of sale or within 90 days of receiving the items or services.

- There’s no need for original signatures. A common myth is that a digital signature is sufficient. The form requires the original signature of a responsible officer.

- All transactions will automatically qualify. Not every transaction qualifies for exemption just because the form is used. It is essential to ensure that the purchases align with the exemption criteria.

- The vendor has to accept the form. While vendors are allowed to accept the ST 119.1 form, acceptance is not mandatory. Vendors might have their policies regarding acceptance.

Clearing up these misconceptions can help organizations properly use the ST 119.1 Exempt Form and avoid potential errors in tax exemptions.

Key takeaways

When filling out and using the ST 119.1 Exempt Purchase Certificate, keep the following key points in mind:

- Correct Usage: This form is meant for purchases made by Indiana University to ensure they are exempt from sales tax. Ensure the purchases benefit the University directly.

- Filling Out the Form: Complete all sections highlighted in blue. Don't forget to include the seller's name, address, and the original signature of an authorized officer, which in this case, is Jill Schunk.

- Validity Period: A blanket exemption can cover multiple purchases for up to three years. This means you don't have to present a new form for each transaction during this time.

- Restrictions: Remember, this form cannot be used for motor fuel or diesel purchases. It is also not valid for transactions involving governmental agencies or diplomatic missions.

Browse Other Templates

National University Federal Id Number - Information on federal education loan interest rates and fees is essential for financial planning.

When Can You No Longer Claim a Child as a Dependent - Publication 501 invites all taxpayers to stay informed about their tax obligations and potential benefits available to them.

How Old Do You Have to Be to Get a Driver's License in California - Employers assess safety-sensitive positions carefully to align with federal guidelines.