Fill Out Your St 125 Form

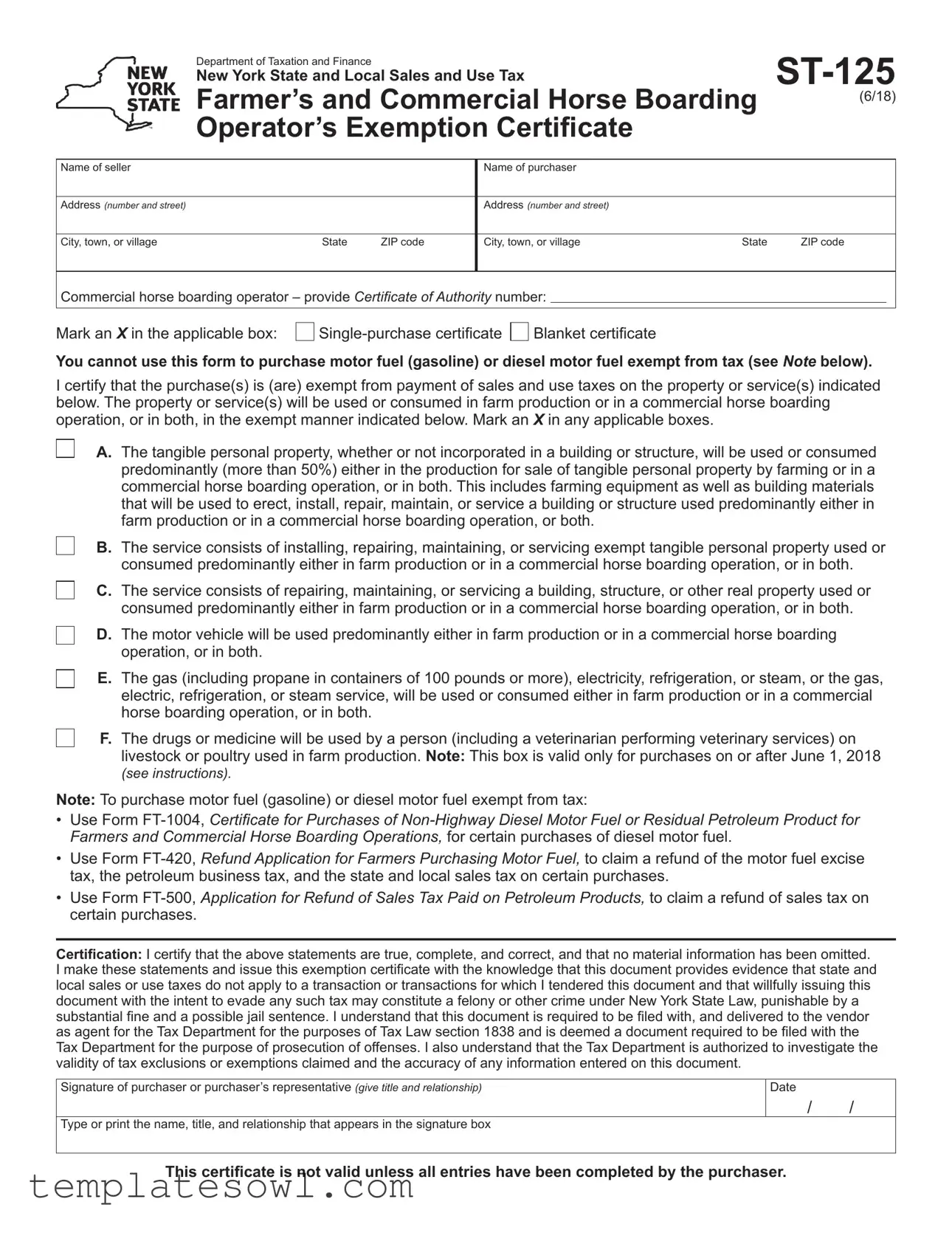

The ST-125 form is vital for farmers and commercial horse boarding operators in New York State, facilitating the exemption from sales and use tax on specific purchases essential for their operations. This form serves as a declaration of the exemption, allowing operators to acquire necessary tangible personal property and services without incurring state or local sales tax, provided those items will be predominantly used in farming or horse boarding. Key features of the ST-125 include the identification of the seller and purchaser, certification of compliance, and clear parameters defining eligible purchases. Operators must indicate whether they are submitting a single-purchase certificate or a blanket certificate, with penalties for misuse outlined clearly. The form also specifies that it cannot be used for the purchase of motor fuel or diesel motor fuel, directing users to appropriate alternative forms for those transactions. Additionally, significant changes have been made to include specific exemptions for drugs and medicines used on livestock, emphasizing the importance of compliance to avoid severe penalties. By understanding the ST-125 and fulfilling its requirements, operators can effectively manage their tax responsibilities while supporting their agricultural enterprises.

St 125 Example

|

Department of Taxation and Finance |

|

|

|

||

|

New York State and Local Sales and Use Tax |

|

||||

|

Farmer’s and Commercial Horse Boarding |

(6/18) |

||||

|

|

|

|

|

||

|

Operator’s Exemption Certiicate |

|

|

|

||

|

|

|

|

|

|

|

Name of seller |

|

Name of purchaser |

|

|

|

|

|

|

|

|

|

|

|

Address (number and street) |

|

Address (number and street) |

|

|

|

|

|

|

|

|

|

|

|

City, town, or village |

State ZIP code |

City, town, or village |

State |

ZIP code |

||

|

|

|

|

|

|

|

Commercial horse boarding operator – provide Certiicate of Authority number: |

|

|

|

|||

|

|

|

|

|

|

|

Mark an X in the applicable box:

Blanket certiicate

You cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax (see Note below).

I certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated below. The property or service(s) will be used or consumed in farm production or in a commercial horse boarding operation, or in both, in the exempt manner indicated below. Mark an X in any applicable boxes.

A. The tangible personal property, whether or not incorporated in a building or structure, will be used or consumed predominantly (more than 50%) either in the production for sale of tangible personal property by farming or in a commercial horse boarding operation, or in both. This includes farming equipment as well as building materials that will be used to erect, install, repair, maintain, or service a building or structure used predominantly either in farm production or in a commercial horse boarding operation, or both.

B. The service consists of installing, repairing, maintaining, or servicing exempt tangible personal property used or consumed predominantly either in farm production or in a commercial horse boarding operation, or in both.

C. The service consists of repairing, maintaining, or servicing a building, structure, or other real property used or consumed predominantly either in farm production or in a commercial horse boarding operation, or in both.

D. The motor vehicle will be used predominantly either in farm production or in a commercial horse boarding operation, or in both.

E. The gas (including propane in containers of 100 pounds or more), electricity, refrigeration, or steam, or the gas, electric, refrigeration, or steam service, will be used or consumed either in farm production or in a commercial horse boarding operation, or in both.

F. The drugs or medicine will be used by a person (including a veterinarian performing veterinary services) on livestock or poultry used in farm production. Note: This box is valid only for purchases on or after June 1, 2018

(SEE INSTRUCTIONS).

Note: To purchase motor fuel (gasoline) or diesel motor fuel exempt from tax:

•Use Form

•Use Form

•Use Form

Certiication: I certify that the above statements are true, complete, and correct, and that no material information has been omitted.

I make these statements and issue this exemption certiicate with the knowledge that this document provides evidence that state and local sales or use taxes do not apply to a transaction or transactions for which I tendered this document and that willfully issuing this

document with the intent to evade any such tax may constitute a felony or other crime under New York State Law, punishable by a substantial ine and a possible jail sentence. I understand that this document is required to be iled with, and delivered to the vendor as agent for the Tax Department for the purposes of Tax Law section 1838 and is deemed a document required to be iled with the

Tax Department for the purpose of prosecution of offenses. I also understand that the Tax Department is authorized to investigate the validity of tax exclusions or exemptions claimed and the accuracy of any information entered on this document.

Signature of purchaser or purchaser’s representative (give title and relationship)

Type or print the name, title, and relationship that appears in the signature box

Date

/ /

This certiicate is not valid unless all entries have been completed by the purchaser.

Page 2 of 2

Instructions

New

Box F – Effective June 1, 2018, mark an X in this box for purchases of drugs or medicine that will be used by a person (including a veterinarian performing veterinary services) on livestock or poultry used in farm production. Box F is not valid for purchases of drugs or medicine made before June 1, 2018, and the purchaser must use

Form

Deinitions

Farm production means the production of tangible personal property for sale by farming. Farming includes agriculture, horticulture, viniculture, viticulture, aquaculture, silviculture, or loriculture; stock, dairy, poultry, fruit, vegetable, fur bearing animal, graping, truck, and tree farming; ranching; operating nurseries, greenhouses, vineyard trellises, or other similar structures

used primarily for the raising of agricultural, horticultural, vinicultural, viticultural, silvicultural, or loricultural commodities; operating orchards; raising, growing, and harvesting crops, livestock, and livestock products; and

raising, growing, and harvesting woodland products,

including but not limited to timber, logs, lumber, pulpwood, posts, and irewood. Administrative activities that are predominantly related to farm production are considered

to be activities of farm production. Farm production begins

with the preparation of the soil or other growing medium and, in the case of animals, from the beginning of the

life cycle. Production ceases when the product is ready for sale in its natural state; for farm products that will be

converted into other products, farm production ceases when the normal development of the farm product has reached a stage where it will be processed or converted into a related product.

Predominantly means more than 50%, measured, for example, by hours of usage or by miles traveled.

Commercial horse boarding operation means an agricultural enterprise of at least seven acres and boarding at least

10 horses, regardless of ownership, that receives $10,000 or more in gross receipts annually from fees generated either through the boarding of horses or through the production for sale of crops, livestock, and livestock products, or through

both such boarding and such production. Under no circumstances shall this include an operation whose primary

Misuse of this certiicate

Misuse of this exemption certiicate may subject you

to serious civil and criminal sanctions in addition to the payment of any tax and interest due. These include:

•a penalty equal to 100% of the tax due;

•a $50 penalty for each fraudulent exemption certiicate issued;

•criminal felony prosecution, punishable by a substantial ine and a possible jail sentence; and

•revocation of your Certiicate of Authority, if you are required to be registered as a vendor. See

To the seller

When making purchases that qualify for exemption from

sales and use tax, the purchaser must provide you with this exemption certiicate with all entries completed to

establish the right to the exemption.

As a New York State registered vendor, you may accept an exemption certiicate in lieu of collecting tax and be protected from liability for the tax if the certiicate is valid. The certiicate will be considered valid if it is:

•accepted in good faith;

•in your possession within 90 days of the transaction; and

•properly completed (all required entries were made).

An exemption certiicate is accepted in good faith when you have no knowledge that the exemption certiicate is false or

is fraudulently given, and you exercise reasonable ordinary

due care. If you do not receive a properly completed certiicate within 90 days after the delivery of the property

or service, you will share with the purchaser the burden of proving the sale was exempt.

Failure to collect sales or use tax, as a result of accepting an improperly completed exemption certiicate or receiving the certiicate more than 90 days after the sale, will make

you personally liable for the tax plus any penalty and interest charges due.

If the blanket certiicate box is marked, you may consider this certiicate part of any order received from the purchaser during the period that the blanket certiicate remains in effect. A blanket certiicate remains in effect

until the purchaser gives you written notice of revocation,

or until the Tax Department notiies you that the purchaser

may not make exempt purchases.

You must maintain a method of associating an invoice

(or other source document) for an exempt sale with the exemption certiicate you have on ile from the purchaser. You must keep this certiicate at least three years after the

due date of your sales tax return to which it relates, or the date the return was iled, if later.

Privacy notiication

New York State Law requires all government agencies that

maintain a system of records to provide notiication of the legal

authority for any request for personal information, the principal purpose(s) for which the information is to be collected, and where it will be maintained. To view this information, visit our

website, or, if you do not have Internet access, call and request Publication 54, Privacy Notiication. See Need help? for the Web address and telephone number.

Need help?

Visit our website at www.tax.ny.gov

•get information and manage your taxes online

•check for new online services and features

Telephone assistance |

|

Sales Tax Information Center: |

|

To order forms and publications: |

|

Text Telephone (TTY) or TDD |

Dial |

equipment users |

New York Relay Service |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The ST-125 form is used by farmers and commercial horse boarding operators in New York to claim an exemption from sales and use taxes for certain purchases related to farm production and horse boarding services. |

| Effective Date | This version of the ST-125 form became effective on June 1, 2018. Any exemptions claimed for drugs or medicine must follow this date; otherwise, Form AU-11 should be used for refunds. |

| Usage Limitations | The ST-125 form cannot be used for the purchase of motor fuel, including gasoline or diesel. Separate forms are provided for such exemptions. |

| Blanket Certification | Purchasers can indicate a blanket certification, which allows them to make exempt purchases over a specified period without needing to fill out a new certifying form for each transaction. |

| Required Information | To complete the form, sellers and purchasers must provide their names, addresses, and other relevant details, ensuring no section is left blank, as this is crucial for validation. |

| Usage Definition | 'Farm production' encompasses various agricultural activities and means the production of goods intended for sale, highlighting the importance of this form for farmers. |

| Consequences of Misuse | Issuing this certificate with the intent to evade tax obligations can lead to severe penalties, including criminal prosecution and monetary fines. |

| Record Retention | Sellers must keep the ST-125 form on file for at least three years after the associated sales tax return is due or filed to demonstrate compliance with tax regulations. |

Guidelines on Utilizing St 125

Before you begin filling out the ST-125 form, gather all necessary information, including the details about the seller, purchaser, and specifics surrounding the exempt purchase. Precision is key since accuracy is essential to ensure the form is valid and accepted.

- Identify the seller and purchaser: Fill in the name of the seller and the name of the purchaser in the designated fields.

- Provide addresses: Enter the complete address (number and street) for both the seller and purchaser, including the city, state, and ZIP code.

- Commercial horse boarding operator: If applicable, include the Certificate of Authority number for the commercial horse boarding operator.

- Select the type of certificate: Mark an X in the box next to either "Single-purchase certificate" or "Blanket certificate." Choose based on your purchase needs.

- Sign the certification: Certify that the information provided is true and complete by signing where indicated. Include your title and relationship to the purchaser.

- Print the name and title: Clearly type or print the name and title of the person who signed the certification in the designated box.

- Enter the date: Fill in the date of form completion in the specified format (month/day/year).

Once you've completed the form, ensure you submit it to the seller. Keep a copy for your records, as it provides evidence of the exemption. Remember, any improper use of this form can lead to serious consequences.

What You Should Know About This Form

What is the ST-125 form used for?

The ST-125 form is a Sales and Use Tax Exemption Certificate specifically designed for purchases by farmers and commercial horse boarding operators in New York State. This certificate allows eligible individuals to claim exemptions from sales and use taxes on specific tangible personal property or services used predominantly in farm production or commercial horse boarding operations. Completing this form accurately is essential to ensure compliance with tax regulations while accessing these exemptions.

Who can use the ST-125 form?

The ST-125 form can be used by individuals engaged in farm production or commercial horse boarding operations. To qualify, a commercial horse boarding operator must have a minimum of seven acres of land and board at least ten horses, generating $10,000 or more in gross receipts annually from related activities. Those involved in producing tangible personal property through various types of agriculture, horticulture, and animal husbandry may also utilize this exemption certificate.

What types of purchases are exempt under the ST-125 form?

Exempt purchases under the ST-125 form may include farming equipment, building materials, and services related to the installation and maintenance of these items. It also covers utilities such as electricity and gas, provided they are used predominantly in farm production or commercial horse boarding operations. It's important to note that this form cannot be used for purchasing motor fuels like gasoline and diesel, which have separate exemption procedures.

What information is required to complete the ST-125 form?

To complete the ST-125 form, the seller and purchaser must provide their names, addresses, and a Certificate of Authority number if applicable. Additionally, the purchaser must identify whether they are applying for a single purchase or a blanket certificate. They also need to affirm the specific intent for the purchased property or service, marking relevant boxes that describe how the purchases will be utilized in their operations. All sections of the form must be filled out for it to be valid.

What are the consequences of misusing the ST-125 form?

Misuse of the ST-125 form can lead to serious repercussions, including civil and criminal penalties. If a purchaser fraudulently claims an exemption, they may face a penalty equal to 100% of the tax due, as well as additional fines for issuing fraudulent certificates. Criminal prosecution may also occur, potentially resulting in incarceration and revocation of their Certificate of Authority for vendor registration purposes. Accurate completion and honest representation of facts are critical to avoid these penalties.

How long is the ST-125 form valid?

The ST-125 form remains valid as long as it has been properly completed and accepted by the seller in good faith. If a blanket certificate is marked, it remains effective until either the purchaser revokes it in writing or the Tax Department provides notice regarding its invalidity. Sellers should retain the certificate for at least three years after the due date of the related sales tax return or when the return was filed, whichever is later.

Where can I get help with the ST-125 form?

If you need assistance with the ST-125 form, you can visit the New York State Department of Taxation and Finance website. They provide extensive resources, guides, and answers to frequently asked questions. If you prefer speaking to someone directly, you may contact the Sales Tax Information Center at 518-485-2889. They can help clarify any specific questions you may have regarding the form or the exemption process.

Common mistakes

Filling out the ST-125 form can be straightforward, but many people make mistakes. Here are ten common errors to watch out for.

One frequent mistake is omitting necessary information in the name and address fields. Both the seller and purchaser must provide complete and accurate details. Leaving out even a small piece of information can lead to processing delays.

Another error occurs when individuals fail to mark the correct type of certificate. The form includes options for a single purchase or a blanket certificate. By not indicating the right choice, the exemption may be invalidated.

Many users also misunderstand the criteria for predominantly use. The form specifies that the property or service must be used over 50% in farm production or horse boarding operations. Not checking this properly can result in issues during audits.

In addition, people often forget to sign the form. The signature of the purchaser or their representative is essential. An unsigned form is not valid, regardless of the completeness of the other information.

Date entry is another common pitfall. The date section at the bottom must be filled out. A missing or incorrect date can raise red flags during tax review processes.

Some individuals mistakenly believe they can use the ST-125 for purchasing motor fuel. However, this form specifically excludes motor fuel from its exemptions. This misunderstanding can lead to tax liabilities.

Failure to attach or cite the correct Certificate of Authority number for commercial horse boarding can also cause problems. This number is vital for validating the operation's exempt status and should be included accurately.

Another mistake involves selecting multiple boxes without clarifying the main usage purpose. Marking too many boxes can confuse the exemption's scope and lead to complications when the form is reviewed.

People sometimes neglect to provide their title or relationship to the purchaser when signing. This detail is critical for establishing authority and validity, and an omission could invalidate the certification.

Lastly, individuals often fail to retain a copy of the completed ST-125 form. Not having a copy for your own records makes it challenging to prove eligibility for the exemption if questions arise later.

Avoid these mistakes to ensure that your ST-125 form is completed accurately and promptly. This will help you stay compliant and make the process simpler in the future.

Documents used along the form

The ST-125 form is an important document used in New York State for farmers and commercial horse boarding operations to claim tax exemptions. Along with the ST-125, several other forms and documents facilitate various aspects of tax exemption and refunds related to sales and use taxes. Below is a list of commonly used forms that complement the ST-125.

- Form FT-1004: This certificate allows farmers and commercial horse boarding operators to purchase non-highway diesel motor fuel exempt from tax. It specifically applies to certain diesel fuel purchases necessary for agricultural operations.

- Form FT-420: This refund application is designed for farmers seeking to recover excise taxes, petroleum business taxes, and state/local sales tax on specific motor fuel purchases.

- Form FT-500: Farmers and commercial horse boarding operations use this form to claim refunds for sales tax paid on petroleum products. It helps ensure that eligible entities are reimbursed for excess taxes paid.

- Form AU-11: Individuals who paid sales taxes on drugs or medicine for livestock or poultry can use this application to request credits or refunds. This is particularly relevant for purchases made before June 1, 2018.

- Form ST-120: The exemption certificate is utilized by organizations or individuals claiming exemption from sales tax. It's essential for bulk purchases or non-profit organizations operating in relevant sectors.

- Form ST-121: This certificate is for manufacturers and wholesalers to exempt tangible personal property used in their operations from sales and use taxes.

- Form ST-126: This document serves as a blanket exemption certificate and allows for multiple purchases exempt from sales tax during a set period without the need for completing new paperwork each time.

- Form ST-5: Commonly used, this exemption certificate allows qualifying entities to purchase tangible personal property or services tax-free provided they meet specific criteria outlined in the form.

- Form IT-201: This is the New York State resident income tax return that may require farmers or commercial boarding operators to report tax information accurately, ensuring compliance with state tax regulations.

- Form IT-502: This form is used by New York State non-residents or part-year residents who earn income from farming or commercial boarding, helping them navigate their tax obligations appropriately.

Understanding these forms can simplify the tax exemption process for farmers and commercial horse boarding operators. Each document plays a crucial role in ensuring compliance with state tax laws while maximizing available benefits. Make sure to utilize the correct forms for your specific situation to maintain eligibility for any tax exemptions.

Similar forms

ST-120 Exempt Use Certificate: This document allows buyers to claim exemptions on purchases for specific uses, like for agricultural or manufacturing. It ensures the seller isn’t required to collect sales tax for qualifying transactions.

ST-121 Resale Certificate: This is a key document for resellers, enabling them to buy goods tax-free, as they plan to sell the items. It’s similar in its intent to avoid tax at the purchase point.

FT-1004 Certificate for Purchases of Non-Highway Diesel: Used specifically for diesel purchases by farmers, this certificate helps streamline tax exempt transactions for fuel used in agricultural operations.

FT-420 Refund Application for Farmers: Farmers can use this form to recover taxes paid on motor fuel purchases, ensuring they’re not taxed on fuel for exempt activities.

FT-500 Application for Refund of Sales Tax Paid: This form is for refunds on certain purchases where tax was erroneously paid. It shares the same goal of ensuring fairness in tax application.

AU-11 Application for Credit or Refund: This document lets purchasers claim refunds for sales tax paid on exempt items. It serves a similar purpose of correcting tax overpayments.

Form IT-201 Resident Income Tax Return: Although primarily for income tax, it may require evidence of tax exemptions similar to what the ST-125 does for sales tax, linking the two systems.

Form DTF-502 Exempt Organization Certificate: Nonprofits utilize this to claim exemptions on certain purchases, similar to how the ST-125 serves farmers and commercial boarding operations.

TC-328 Agricultural Production Certificate: This document helps agricultural producers claim exemptions on purchases necessary for farm production, aligning it closely with the ST-125.

Draft Acquisition Certificates: These certificates relate to tax exemptions on goods acquired for certain exempt purposes, much like the ST-125 for specific farming and horse boarding transactions.

Dos and Don'ts

When completing the ST-125 form, it is crucial to follow certain guidelines to ensure accuracy and compliance. Below is a list of recommended practices and common mistakes to avoid while filling out the form.

- Do ensure that all entries are completed accurately, including names, addresses, and the purpose of the exemption.

- Do mark the applicable exemption boxes, providing clear indication of how the items will be used.

- Do provide the Certificate of Authority number if identifying as a commercial horse boarding operator.

- Do consult the instructions regarding the validity of exemptions and specific purchases (e.g., drugs, motor fuel).

- Don't omit any required information, as incomplete forms are not valid and may lead to penalties.

- Don't misuse the exemption certificate; it could lead to severe penalties, including criminal charges.

- Don't forget to deliver the completed certificate to the vendor promptly to establish the right to exemption.

- Don't attempt to make exempt purchases using this form for items that do not qualify under the guidelines provided.

Misconceptions

There are several misconceptions surrounding the ST-125 form, which can lead to confusion. Below are some of the most common misunderstandings and clarifications regarding this important tax document.

- The ST-125 can be used for any purchase. The ST-125 form is specifically designed for certain types of purchases related to farm production or commercial horse boarding. It cannot be used to purchase motor fuel exempt from tax.

- All purchases made with the ST-125 are automatically exempt. While the form provides a basis for exemption, the stated conditions must be met. The items purchased must be utilized predominantly in exempt activities, such as farming or commercial horse boarding.

- The form does not require complete information. It's crucial to fill out all necessary entries on the ST-125 form. Incomplete forms may be deemed invalid and not provide the intended exemption.

- A blanket certificate lasts indefinitely. Although a blanket certificate may remain in effect for a period of time, it is not permanent. The purchaser must provide written notice of revocation, or the Tax Department may inform the seller that the purchaser can no longer make exempt purchases.

- The ST-125 can replace other tax exemption forms. The ST-125 is not a substitute for other exemption forms needed for different types of purchases, such as forms required for motor fuel. Each form serves a specific purpose under tax law.

- Tax authorities will not verify the validity of the ST-125 form. There is a possibility that tax authorities will investigate the information provided on the ST-125. Misuse or fraudulent use can lead to serious penalties, including fines and potential criminal charges.

Understanding these misconceptions can aid in the proper use of the ST-125 form and ensure compliance with tax regulations.

Key takeaways

When filling out and using the ST-125 form, keep these key takeaways in mind:

- Certification Requirement: You must provide accurate information on the form. A false statement can lead to serious legal consequences.

- Exemption Scope: This form does not apply to purchases of motor fuels. Be sure to use the designated forms for those types of purchases.

- Validity of the Form: The certificate is only valid if it’s completed fully and includes your signature. Missing information can invalidate your exemption.

- Retention Policy: Keep the completed form for at least three years after your sales tax return is due or filed. This helps maintain compliance with state regulations.

Browse Other Templates

Bright Money Refund Phone Number - Medallion Signature Guarantees must be obtained from participating financial institutions, not from notaries.

Modified Business Tax Return Nevada - Employers should track wage thresholds that can influence their tax calculations for the quarter.

Iris Home Health - The form may contain a parental fee if applicable to the individual's situation.