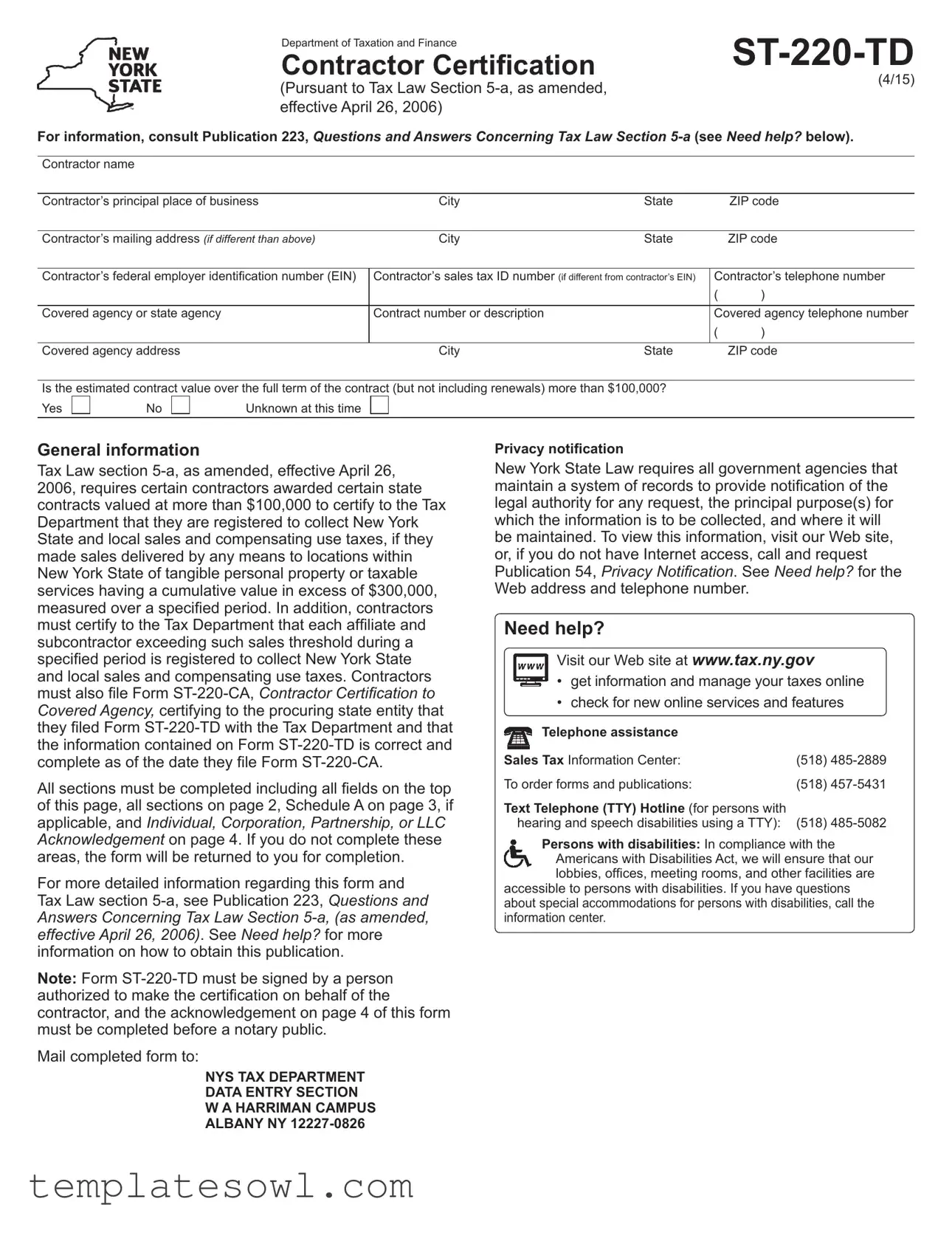

Fill Out Your St 220 Td Form

The ST-220-TD form, provided by the New York State Department of Taxation and Finance, serves a vital role in ensuring that contractors comply with tax regulations when engaging in contracts valued over $100,000. This certification form is a requirement for contractors who have made sales of tangible personal property or taxable services within New York State, particularly if those sales exceed a cumulative value of $300,000 within a defined period. Not only must contractors certify their registration to collect state and local sales taxes, but they are also responsible for verifying that any affiliates or subcontractors who meet the same sales thresholds are likewise registered. Completing this form accurately is essential, as omissions or errors can lead to delays or rejections. Specific sections require detailed listings of contractors, their affiliates, and subcontractors, particularly if they exceed the sales threshold. Moreover, each form must be notarized and submitted to the appropriate state agency by an authorized representative, ensuring correctness and compliance. For more in-depth information about the stipulations surrounding this form and the relevant tax laws, contractors should refer to the accompanying Publication 223, which provides essential guidance on Tax Law Section 5-a.

St 220 Td Example

Department of Taxation and Finance

Contractor Certification

(Pursuant to Tax Law Section

(4/15)

For information, consult Publication 223, Questions and Answers Concerning Tax Law Section

Contractor name |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

Contractor’s principal place of business |

|

City |

State |

|

ZIP code |

||||||

|

|

|

|

|

|

|

|

|

|

||

Contractor’s mailing address (if different than above) |

|

City |

State |

|

ZIP code |

||||||

|

|

|

|

|

|

|

|

||||

Contractor’s federal employer identification number (EIN) |

Contractor’s sales tax ID number (if different from contractor’s EIN) |

Contractor’s telephone number |

|||||||||

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

||

Covered agency or state agency |

|

Contract number or description |

|

Covered agency telephone number |

|||||||

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Covered agency address |

|

|

City |

State |

|

ZIP code |

|||||

|

|

|

|

|

|

|

|

|

|||

Is the estimated contract value over the full term of the contract (but not including renewals) more than $100,000? |

|

|

|||||||||

Yes |

|

|

No |

|

|

Unknown at this time |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General information

Tax Law section

All sections must be completed including all fields on the top of this page, all sections on page 2, Schedule A on page 3, if applicable, and Individual, Corporation, Partnership, or LLC Acknowledgement on page 4. If you do not complete these areas, the form will be returned to you for completion.

For more detailed information regarding this form and Tax Law section

Note: Form

Mail completed form to:

Privacy notification

New York State Law requires all government agencies that maintain a system of records to provide notification of the legal authority for any request, the principal purpose(s) for which the information is to be collected, and where it will be maintained. To view this information, visit our Web site, or, if you do not have Internet access, call and request Publication 54, Privacy Notification. See Need help? for the Web address and telephone number.

Need help?

Visit our Web site at www.tax.ny.gov

•get information and manage your taxes online

•check for new online services and features

Telephone assistance |

|

Sales Tax Information Center: |

(518) |

To order forms and publications: |

(518) |

Text Telephone (TTY) Hotline (for persons with

hearing and speech disabilities using a TTY): (518)

Persons with disabilities: In compliance with the Americans with Disabilities Act, we will ensure that our lobbies, offices, meeting rooms, and other facilities are

accessible to persons with disabilities. If you have questions about special accommodations for persons with disabilities, call the information center.

NYS TAX DEPARTMENT DATA ENTRY SECTION W A HARRIMAN CAMPUS ALBANY NY

Page 2 of 4

I, |

, hereby affirm, under penalty of perjury, that I am |

||

|

(name) |

|

(title) |

of the above‑named contractor, and that I am authorized to make this certification on behalf of such contractor.

Complete Sections 1, 2, and 3 below. Make only one entry in each section.

Section 1 – Contractor registration status

G The contractor has made sales delivered by any means to locations within New York State of tangible personal property or taxable services having a cumulative value in excess of $300,000 during the four sales tax quarters which immediately precede the sales tax quarter in which this certification is made. The contractor is registered to collect New York State and local sales and compensating use taxes with the Commissioner of Taxation and Finance pursuant to Tax Law sections 1134 and 1253, and is listed on Schedule A of this certification.

G The contractor has not made sales delivered by any means to locations within New York State of tangible personal property or taxable services having a cumulative value in excess of $300,000 during the four sales tax quarters which immediately precede the sales tax quarter in which this certification is made.

Section 2 – Affiliate registration status

G The contractor does not have any affiliates.

G To the best of the contractor’s knowledge, the contractor has one or more affiliates having made sales delivered by any means to locations within New York State of tangible personal property or taxable services having a cumulative value in excess of $300,000 during the four sales tax quarters which immediately precede the sales tax quarter in which this certification is made, and each affiliate exceeding the $300,000 cumulative sales threshold during such quarters is registered to collect New York State and local sales and compensating use taxes with the Commissioner of Taxation and Finance pursuant to Tax Law sections 1134 and 1253. The contractor has listed each affiliate exceeding the $300,000 cumulative sales threshold during such quarters on Schedule A of this certification.

G To the best of the contractor’s knowledge, the contractor has one or more affiliates, and each affiliate has not made sales delivered by any means to locations within New York State of tangible personal property or taxable services having a cumulative value in excess of $300,000 during the four sales tax quarters which immediately precede the sales tax quarter in which this certification is made.

Section 3 – Subcontractor registration status

G The contractor does not have any subcontractors.

G To the best of the contractor’s knowledge, the contractor has one or more subcontractors having made sales delivered by any means to locations within New York State of tangible personal property or taxable services having a cumulative value in excess of $300,000 during the four sales tax quarters which immediately precede the sales tax quarter in which this certification is made, and each subcontractor exceeding the $300,000 cumulative sales threshold during such quarters is registered to collect New York State and local sales and compensating use taxes with the Commissioner of Taxation and Finance pursuant to Tax Law sections 1134 and 1253. The contractor has listed each subcontractor exceeding the $300,000 cumulative sales threshold during such quarters on Schedule A of this certification.

G To the best of the contractor’s knowledge, the contractor has one or more subcontractors, and each subcontractor has not made sales delivered by any means to locations within New York State of tangible personal property or taxable services having a cumulative value in excess of $300,000 during the four sales tax quarters which immediately precede the sales tax quarter in which this certification is made.

Sworn to this |

|

day of |

|

, 20 |

(sign before a notary public) |

(title) |

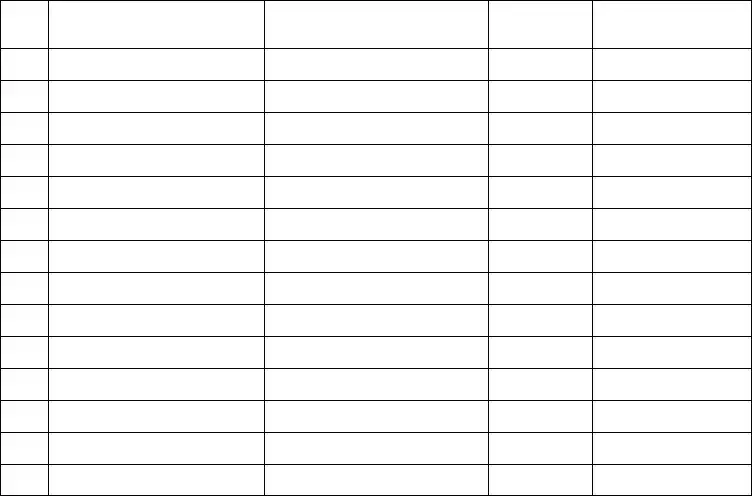

Schedule A – Listing of each entity (contractor, affiliate, or subcontractor) exceeding $300,000 cumulative sales threshold

List the contractor, or affiliate, or subcontractor in Schedule A only if such entity exceeded the $300,000 cumulative sales threshold during the specified sales tax quarters. See directions below. For more information, see Publication 223.

A

Relationship

to

contractor

B

Name

C

Address

D

Federal ID number

E |

F |

Sales tax ID number |

Registration |

|

in progress |

|

|

Column A – Enter C in column A if the contractor; A if an affiliate of the contractor; or S if a subcontractor.

Column B – Name - If the entity is a corporation or limited liability company, enter the exact legal name as registered with the NY Department of State, if applicable. If the entity is a partnership or sole proprietor, enter the name of the partnership and each partner’s given name, or the given name(s) of the owner(s), as applicable. If the entity has a different DBA (doing business as) name, enter that name as well.

Column C – Address - Enter the street address of the entity’s principal place of business. Do not enter a PO box.

Column D – ID number - Enter the federal employer identification number (EIN) assigned to the entity. If the entity is an individual, enter the social security number of that person.

Column E – Sales tax ID number - Enter only if different from federal EIN in column D.

Column F – If applicable, enter an X if the entity has submitted Form

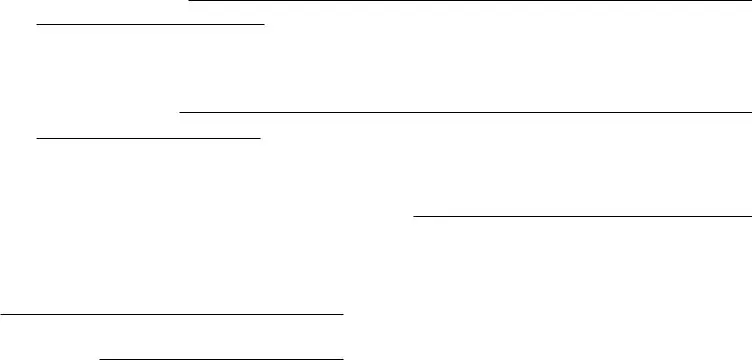

Page 4 of 4

Individual, Corporation, Partnership, or LLC Acknowledgment

STATE OF |

: |

} |

SS.: |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

COUNTY OF |

} |

|

|

|

|

|

|

|

|

|

|

||||||||

On the |

|

|

|

|

day of |

|

|

in the year 20 |

|

, before me personally appeared |

|

|

|

, |

|||||

|

|

|

|

|

|

|

|

|

|||||||||||

known to me to be the person who executed the foregoing instrument, who, being duly sworn by me did depose and say that |

|

||||||||||||||||||

he resides at |

, |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Town of |

|

|

|

|

|

|

|

, |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

County of |

|

|

|

|

, |

|

|

|

|||||||||||

State of |

|

|

|

|

; and further that: |

|

|||||||||||||

|

|

|

|

|

|||||||||||||||

(Mark an X in the appropriate box and complete the accompanying statement.)

G G

G

(If an individual): _he executed the foregoing instrument in his/her name and on his/her own behalf.

(If a corporation): _he is the |

|

of |

, the corporation described in said instrument; that, by authority of the Board |

of Directors of said corporation, _he is authorized to execute the foregoing instrument on behalf of the corporation for purposes set forth therein; and that, pursuant to that authority, _he executed the foregoing instrument in the name of and on behalf of said corporation as the act and deed of said corporation.

(If a partnership): _he is a

of, the partnership described in said instrument; that, by the terms of said

partnership, _he is authorized to execute the foregoing instrument on behalf of the partnership for purposes set forth therein; and that, pursuant to that authority, _he executed the foregoing instrument in the name of and on behalf of said partnership as the act and deed of said partnership.

G (If a limited liability company): _he is a duly authorized member of

LLC, the limited liability company described in said instrument; that _he is authorized to execute the foregoing instrument on behalf of the limited liability company for purposes set forth therein; and that, pursuant to that authority, _he executed the foregoing instrument in the name of and on behalf of said limited liability company as the act and deed of said limited liability company.

Notary Public

Registration No.

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | New York Tax Law Section 5-a governs the ST-220-TD form, as amended effective April 26, 2006. |

| Purpose | This form helps contractors certify their compliance with New York State and local sales tax collection requirements. |

| Threshold Value | It applies to contracts valued over $100,000 and requires a sales threshold of $300,000 for reporting purposes. |

| Filing Requirements | All fields in the form must be completed, including additional scheduling for affiliates and subcontractors, if applicable. |

| Certification | The form must be signed by an authorized individual on behalf of the contractor, and it must include notarization. |

| Submission | Completed forms should be mailed to the New York State Tax Department at the specified address. |

| Contact Resources | For assistance, contact the Sales Tax Information Center or visit the New York State Department website. |

Guidelines on Utilizing St 220 Td

The ST-220-TD form must be accurately completed to ensure compliance with state tax regulations. Each section requires your careful attention, and it is essential to provide all necessary information. Any missing details may result in delays or the need for corrections.

- Begin by entering the contractor's name at the top of the form.

- Fill in the principal place of business with the complete address, including city, state, and ZIP code.

- If applicable, provide the mailing address (if different), along with the city, state, and ZIP code.

- Include the contractor’s federal employer identification number (EIN).

- If the contractor has a different sales tax ID number, enter that as well.

- Fill in the contractor’s telephone number in the format (XXX) XXX-XXXX.

- Provide the covered agency or state agency name, along with the contract number or description.

- Include the covered agency telephone number and the complete address, including city, state, and ZIP code.

- Indicate if the estimated contract value exceeds $100,000 by checking "Yes," "No," or "Unknown at this time."

- In Section 1, register the contractor's sales status regarding New York State and local sales taxes.

- In Section 2, declare the registration status of any affiliates.

- In Section 3, indicate the registration status of any subcontractors.

- Make sure to fill out Schedule A with details about each contractor, affiliate, or subcontractor that exceeded the $300,000 sales threshold.

- Complete the acknowledgment section on page 4, ensuring a notary public witnesses the signatory.

- Finally, send the completed form to the specified address provided in the instructions.

What You Should Know About This Form

What is the purpose of the ST-220-TD form?

The ST-220-TD form serves as a certification to the New York State Tax Department. It is required for contractors who have been awarded state contracts valued at over $100,000. Essentially, the form confirms that these contractors are registered to collect New York State and local sales and compensating use taxes. It also requires contractors to certify that any relevant affiliates and subcontractors are registered if their sales exceed a certain threshold established by the state tax law.

Who needs to complete the ST-220-TD form?

Contractors who have secured state contracts worth more than $100,000 must fill out the ST-220-TD form. This is particularly important for those who have made sales resulting in cumulative values exceeding $300,000 during the specified sales tax quarters prior to their certification date. It is also the responsibility of contractors to ensure their affiliates and subcontractors understand these requirements and are properly registered to collect the relevant sales taxes.

What happens if the form is not completed correctly?

If the ST-220-TD form is not filled out completely, it will be returned to the contractor for necessary corrections. All sections must be carefully completed, including those that pertain to contractor registration status, affiliate status, and subcontractor status. Missing information could delay processing or result in the inability to proceed with the contract awarded by the state.

Is notarization required for the ST-220-TD form?

Yes, notarization is necessary for the ST-220-TD form. The individual signing the document must do so in the presence of a notary public. This step is essential as it affirms the authenticity of the signature and the information provided in the form. Without this notarization, the document will not be considered valid.

How can contractors seek help if they have questions regarding the ST-220-TD form?

Contractors can find assistance through several channels. The New York State Tax Department provides a variety of resources online. They can visit the official website for comprehensive guidance, including access to Publication 223, which details Tax Law Section 5-a and answers common queries. Additionally, contractors can contact the Sales Tax Information Center via telephone for personalized support, ensuring they get the answers they need in a timely manner.

Common mistakes

Filling out the ST-220-TD form can be complicated, and many people make common mistakes that can lead to delays or rejections. One frequent error is missing information. Each section of the form requires specific details, including the contractor’s principal place of business, federal employer identification number (EIN), and sales tax ID number if different from the EIN. Leaving any of these fields blank can result in the form being returned.

Another common mistake occurs when individuals do not accurately complete Schedule A. This section is crucial for listing entities that exceed the $300,000 sales threshold. Some people neglect to provide a complete name, address, or the correct identification numbers for these entities, which can lead to complications with the certification process.

Furthermore, individuals sometimes misinterpret registration status. The contractor must affirm whether they have made sales exceeding $300,000 during the specified period. Marking the wrong box can misrepresent the contractor's eligibility and lead to certification issues.

The signature section also presents pitfalls. The form requires a signature from an authorized person. Failure to sign, or having someone who is not authorized sign, renders the certification invalid. Proper acknowledgment before a notary is also essential; without it, the form cannot be accepted.

Another mistake involves the understanding of affiliate and subcontractor requirements. Contractors often overlook the need to address affiliate and subcontractor sales accurately. An inaccurate statement about their sales can have significant repercussions, as each entity must be registered to collect sales tax.

Lastly, people may not adhere to the submission guidelines. Once the form is completed, it must be mailed to the correct address provided in the instructions. Failing to do so can result in unnecessary delays in processing. Following these guidelines ensures a smoother submission process.

Documents used along the form

The ST-220-TD form is essential for contractors in New York State, especially for those involved in state contracts worth over $100,000. When submitting this document, certain other forms and records may also be required to ensure comprehensive compliance with state tax laws. Below are several forms and documents that are commonly associated with the ST-220-TD form.

- Form ST-220-CA: This form is the Contractor Certification to the Covered Agency. It certifies that the contractor has filed the ST-220-TD with the Tax Department and confirms that the information provided in that document is accurate and complete at the time of submission.

- Form DTF-17: This is the Application for a Sales Tax Certificate of Authority. This form is necessary for businesses seeking authorization to collect sales tax in New York State. If the contractor's application is pending, it should be noted in the ST-220-TD.

- Form ST-120: This form allows contractors to claim an exemption from sales tax for certain purchases made for use in their business. If applicable, it helps to clarify tax obligations related to specific purchased items.

- Publication 223: This document provides comprehensive guidance regarding Tax Law Section 5-a. It answers frequently asked questions and offers valuable information on requirements for contractors under this specific law.

- Federal Employer Identification Number (EIN): While not a form, having an EIN is crucial for contractors, as it identifies them for tax purposes at the federal level. This number is required on the ST-220-TD and other related documents.

- Sales Tax ID Number: Similar to the EIN, contractors must provide their New York State sales tax identification number on the ST-220-TD form. This number is used to track sales tax obligations.

- Notarized Acknowledgment: For the ST-220-TD form to be valid, it typically must be notarized. This acknowledgment ensures that the individual signing the form is authorized to do so and that the certification is made under penalty of perjury.

Using these forms and documents correctly helps contractors navigate their responsibilities under New York State tax law. Staying organized and thorough in this process can prevent potential issues or delays related to tax compliance and contract fulfillment.

Similar forms

The ST-220-TD form is a critical document for contractors in New York. It certifies a contractor's registration to collect sales and compensating use taxes. Other documents share similar purposes or functions. Below are ten documents similar to the ST-220-TD form, along with their similarities:

- Form ST-220-CA: This document certifies to the procuring agency that the contractor has filed the ST-220-TD and confirms its accuracy. Like the ST-220-TD, it represents a compliance measure regarding state contracts.

- Form W-9: Contractors use this form to provide their taxpayer identification number and certification of their tax status. Both documents require confirmation of tax-related information.

- Form 1099: Issued for reporting income from non-employee compensation. Similar to the ST-220-TD, it ensures that the correct tax information is reported to the IRS and verifies compliance with tax law.

- Form DTF-17: This is an application for a sales tax certificate of authority. Both forms involve sales tax registration and require accuracy in reported information.

- Form ST-120: This exemption certificate allows buyers to purchase items tax-free. It's similar in that it relates to sales tax management and requires justification for tax exemptions.

- Form ST-121: This form is a resale certificate. Like the ST-220-TD, it is used to document tax status for sales transactions but specifically focuses on items for resale.

- Form ST-133: Used for claiming an exemption from sales tax. This form, akin to the ST-220-TD, involves a certification process tied to sales tax compliance.

- Form ST-5: This form allows exempt organizations to purchase items without paying sales tax. Both documents involve essential compliance validations tied to sales tax regulations.

- Form IT-201: This is the New York State resident income tax return. While focused on income tax, like the ST-220-TD, it requires accurate reporting of tax-related information.

- Form NYS-1: This is the New York State withholding tax return. It serves a similar function in documenting tax compliance, particularly in relation to employee withholding.

Dos and Don'ts

When filling out the ST-220-TD form, it’s important to be careful and thorough. Here's a handy guide of what you should and shouldn't do:

- Do provide accurate and complete information in all sections. Every question matters and omissions can lead to delays.

- Don’t leave any fields blank. If a section doesn’t apply to you, indicate so rather than skipping it.

- Do ensure that the form is signed by a person who is authorized to certify on behalf of the contractor. This is a crucial step.

- Don’t forget to have your acknowledgment notarized. A notary public must witness the signing of the document.

- Do include all necessary attachments or schedules, like Schedule A, if applicable. Missing documentation can cause processing delays.

- Don’t use a P.O. Box for the address. Always provide the physical address of the contractor's principal place of business.

- Do check your math. Ensure that the sales figures reflect the actual amounts and are calculated correctly throughout the form.

Taking these steps will help ensure your form is processed smoothly and efficiently. Remember, it’s better to double-check than to risk an error that could delay your contract approval!

Misconceptions

Misunderstandings about the ST-220-TD form can create confusion for contractors and agencies alike. Here are five common misconceptions:

- It's only for contracts over $500,000. Many believe this form only applies to larger contracts. However, the requirement kicks in for contracts exceeding $100,000.

- Anyone can sign the form. In actuality, the ST-220-TD must be signed by someone authorized to act on behalf of the contractor. This includes the title of the signing individual.

- Filing this form is optional. This is not correct. If a contractor meets the specified sales thresholds, filing the ST-220-TD is mandatory as per Tax Law section 5-a.

- The form does not require additional documents. This is a misconception since contractors must also file Form ST-220-CA afterward, verifying they have submitted ST-220-TD correctly.

- It can be submitted without the notary's signature. Submitting the form without a notary's acknowledgment renders it incomplete. A notary public must verify the signature of the authorized person.

Key takeaways

Filling out and utilizing the ST-220-TD form can seem daunting, but understanding its key components will help streamline the process. Here are essential takeaways to keep in mind:

- Purpose of the Form: The ST-220-TD form certifies that contractors are registered to collect New York State and local sales and compensating use taxes for contracts exceeding $100,000.

- Required Information: Accurate completion of all fields, including contractor's name, address, and federal employer identification number (EIN), is mandatory.

- Threshold for Sales: The form is relevant if your business has made sales in New York exceeding $300,000 over the four sales tax quarters prior to certification.

- Affiliates and Subcontractors: Information regarding affiliates and subcontractors who meet the sales threshold must be included on Schedule A.

- Notarization Required: The completed form must be signed by an authorized person and acknowledged before a notary public.

- Deadline: It’s crucial to file the form promptly to avoid delays in your contract approval process.

- Using Publication 223: For detailed guidance, refer to Publication 223, which addresses questions about Tax Law Section 5-a.

- Common Errors: Incomplete forms will be returned. Double-check all sections before submission to ensure accuracy.

- Mailing Address: Completed forms should be sent to the designated address in Albany, NY, as indicated in the instructions.

- Seek Assistance: If you need help, resources such as the Sales Tax Information Center or the NYS Tax Department website can provide valuable support.

Being informed about these aspects will not only help you complete the ST-220-TD accurately but also enhance your overall experience when establishing contracts in the state of New York.

Browse Other Templates

Sers Retirement Ct - Highlight your relationship with the designated Attorney-In-Fact on the form.

Massachusetts Dnr - Each patient's MOLST preferences can be as unique as their individual health circumstances.

How to Setup Direct Deposit - Employees should ensure their submitted information matches their bank records to avoid issues.