Fill Out Your St 4 Certificate Form

The New Jersey ST-4 Certificate, often referred to as the Exempt Use Certificate, plays a crucial role in the Sales and Use Tax process for eligible nonregistered purchasers. Designed to assist buyers in claiming exemption from sales tax, this form must be accurately filled out and presented to the seller. It requires essential details such as the purchaser's name, address, type of business, and New Jersey taxpayer registration number. The certificate's main purpose is to certify that the purchased tangible personal property or services will be used for exempt purposes as defined under New Jersey tax law. Buyers must clearly indicate their basis for exemption and provide relevant statutory citations to substantiate their claims. Sellers rely on this completed form to avoid liability for tax collection, provided it is submitted within a specified timeframe. Retaining these certificates for a minimum of four years is also necessary for sellers, ensuring compliance with audit requirements. Furthermore, the ST-4 outlines common scenarios where exemptions apply, including equipment for manufacturing, research, or transportation services. By understanding the intricacies of the ST-4 Certificate, purchasers can benefit from significant tax savings while ensuring they follow New Jersey's regulations accurately.

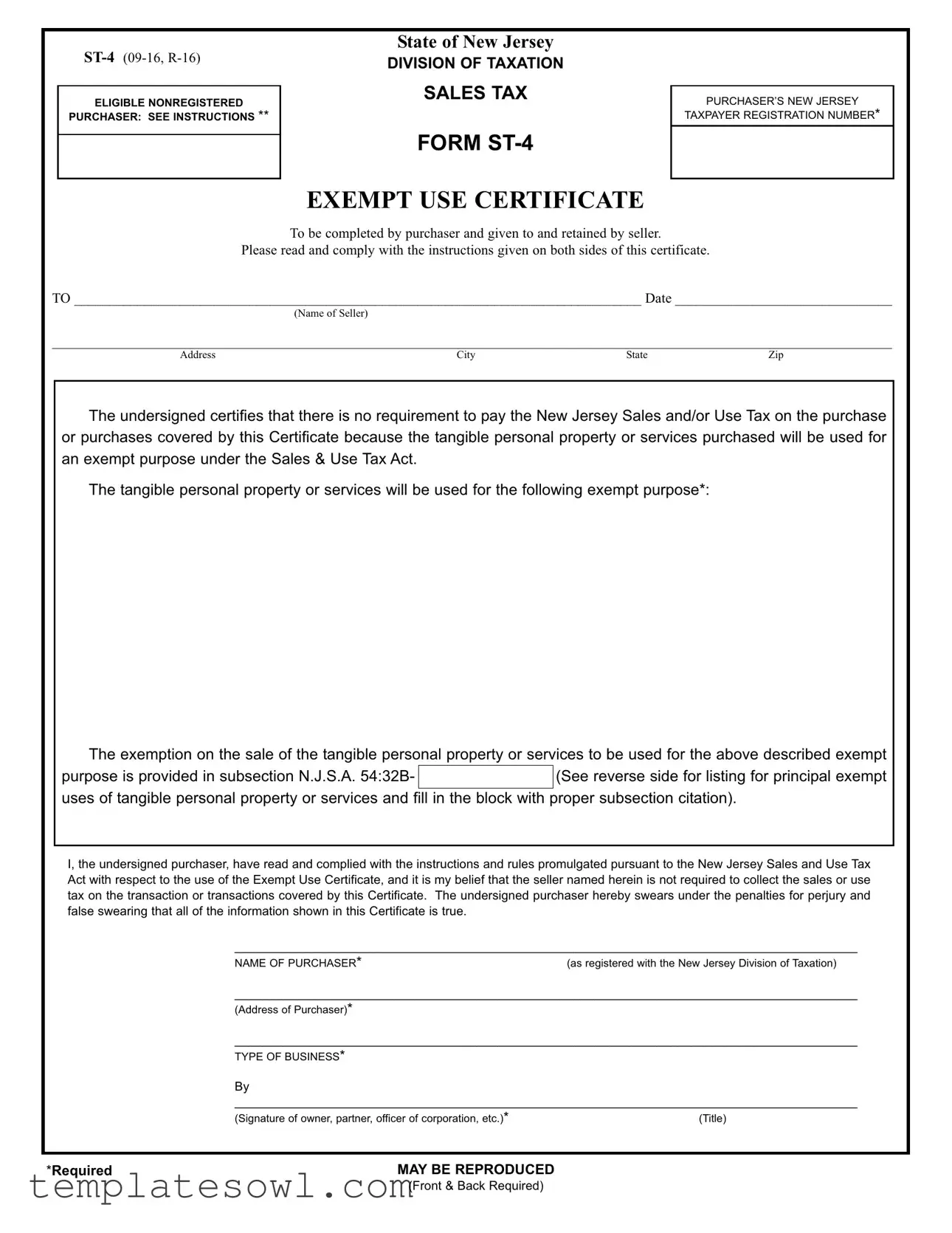

St 4 Certificate Example

ELIGIBLE NONREGISTERED

PURCHASER: SEE INSTRUCTIONS **

State of New Jersey

DIVISION OF TAXATION

SALES TAX

FORM

EXEMPT USE CERTIFICATE

PURCHASER’S NEW JERSEY

TAXPAYER REGISTRATION NUMBER*

To be completed by purchaser and given to and retained by seller.

Please read and comply with the instructions given on both sides of this certificate.

TO _________________________________________________________________________________ Date _______________________________

(Name of Seller)

________________________________________________________________________________________________________________________

Address |

City |

State |

Zip |

The undersigned certifies that there is no requirement to pay the New Jersey Sales and/or Use Tax on the purchase or purchases covered by this Certificate because the tangible personal property or services purchased will be used for an exempt purpose under the Sales & Use Tax Act.

The tangible personal property or services will be used for the following exempt purpose*:

The exemption on the sale of the tangible personal property or services to be used for the above described exempt

purpose is provided in subsection N.J.S.A. 54:32B-

(See reverse side for listing for principal exempt uses of tangible personal property or services and fill in the block with proper subsection citation).

(See reverse side for listing for principal exempt uses of tangible personal property or services and fill in the block with proper subsection citation).

I, the undersigned purchaser, have read and complied with the instructions and rules promulgated pursuant to the New Jersey Sales and Use Tax Act with respect to the use of the Exempt Use Certificate, and it is my belief that the seller named herein is not required to collect the sales or use tax on the transaction or transactions covered by this Certificate. The undersigned purchaser hereby swears under the penalties for perjury and false swearing that all of the information shown in this Certificate is true.

__________________________________________________________________________________________

|

NAME OF PURCHASER* |

(as registered with the New Jersey Division of Taxation) |

|

__________________________________________________________________________________________ |

|

|

(Address of Purchaser)* |

|

|

__________________________________________________________________________________________ |

|

|

TYPE OF BUSINESS* |

|

|

By |

|

|

__________________________________________________________________________________________ |

|

|

(Signature of owner, partner, officer of corporation, etc.)* |

(Title) |

|

|

|

*Required |

MAY BE REPRODUCED |

|

(Front & Back Required)

INSTRUCTIONS FOR USE OF EXEMPT USE CERTIFICATES - |

1.Registered sellers who accept fully completed exemption certificates within 90 days subsequent to the date of sale are relieved of liability for the collection and payment of sales tax on the transactions covered by the exemption certificate. The following information must be obtained from a purchaser in order for the exemption certificate to be fully completed:

•Purchaser’s name and address;

•Type of business;

•Reasons(s) for exemption;

•Purchaser’s New Jersey tax identification number or, for a purchaser that is not registered in New Jersey, the Federal employer identification number or

•If a paper exemption certificate is used (including fax), the signature of the purchaser.

The seller’s name and address are not required and are not considered when determining if an exemption certificate is fully completed. A seller that enters data elements from paper into an electronic format is not required to retain the paper exemption certificate.

The seller may, therefore, accept this certificate as a basis for exempting sales to the signatory purchaser and is relieved of liability even if it is determined that the purchaser improperly claimed the exemption. If it is determined that the purchaser improperly claimed an exemption, the purchaser will be held liable for the nonpayment of the tax.

2.Retention of Certificates - Certificates must be retained by the seller for a period of not less than four years from the date of the last sale covered by the certificate. Certificates must be in the physical possession of the seller and available for inspection.

3.Acceptance of an exemption certificate in an audit situation – On and after October 1, 2011, if the seller either has not obtained an exemption certificate or the seller has obtained an incomplete exemption certificate, the seller has at least 120 days after the Division’s request for substantiation of the claimed exemption to either:

1.Obtain a fully completed exemption certificate from the purchaser, taken in good faith, which, in an audit situation, means that the seller obtain a certificate claiming an exemption that:

(a)was statutorily available on the date of the transaction, and

(b)could be applicable to the item being purchased, and

(c)is reasonable for the purchaser’s type of business; OR

2.Obtain other information establishing that the transaction was not subject to the tax.

If the seller obtains this information, the seller is relieved of any liability for the tax on the transaction unless it is discovered through the audit process that the seller had knowledge or had reason to know at the time such information was provided that the information relating to the exemption claimed was materially false or the seller otherwise knowingly participated in activity intended to purposefully evade the tax that is properly due on the transaction. The burden is on the Division to establish that the seller had knowledge or had reason to know at the time the information was provided that the information was materially false.

4.Common exempt uses of property or services for which the

NOTE: The descriptions are general and do not necessarily cover every exempt use or service or every condition for exemption. Further information is available from the Division of Taxation.

•Sales of machinery and equipment for use directly and primarily in the production of property by manufacturing, processing, assembling or refining. N.J.S.A.

•Sales of equipment to a telecommunication service provider subject to the jurisdiction of the BPU or the FCC for use directly and primarily in providing interactive telecommunications services for sale. N.J.S.A.

•Sales of tangible personal property for use directly and exclusively in experimental research and development in the laboratory sense. N.J.S.A. 54:32B- 8.14.

•Sales of wrapping materials or

•Sales of busses to regulated bus companies for public passenger transportation or to carriers for use in school children transportation services. N.J.S.A.

•Sales of equipment for use directly and primarily in the production department of a newspaper plant or for use in the production of property for sale by a commercial printer. N.J.S.A.

•Sales of advertising material to be published in a newspaper. N.J.S.A.

•Sales of aircraft or repair services to an “air carrier,” and repairs to certain business aircraft, including machinery or equipment installed on such. N.J.S.A.

•Sales of equipment used exclusively to sort and prepare solid waste for recycling or in recycling (does not include motor vehicles). N.J.S.A. 54:32B- 8.36.

•Sales of printed advertising materials for

•Sales of commercial trucks, truck tractors and

INSTRUCTIONS FOR USE OF EXEMPT USE CERTIFICATES - |

•Sales of machinery and equipment used directly and primarily in producing broadcast programming or cable/satellite television programming. N.J.S.A.

•Sales of tangible property for use directly and primarily in the production of film or video for sale, including motor vehicles, parts, supplies and services to such property.. N.J.S.A.

•Sales of commercial ships and charges for components, repair and alteration services for commercial ships. N.J.S.A.

•Sales of materials, such as chemicals and catalysts, used to induce or cause a refining or chemical process. N.J.S.A.

•Sales of electronically delivered computer software that is used directly and exclusively in the conduct of the purchaser’s business, trade, or occupation. N.J.S.A.

**5. Eligible Nonregistered Purchaser - If the purchaser is not required to be registered for sales and use tax purposes in New Jersey, in the box at the top, left corner of the form marked “Eligible Nonregistered Purchaser” the purchaser is required to place one of the following in order of preference: 1) the Federal Identification Number of the business; 2) out of state registration number.

Private reproduction of both sides of the Exempt Use Certificates may be made without the prior permission of the Division of Taxation.

FOR MORE INFORMATION: Read publication

http://www.state.nj.us/treasury/taxation/pdf/pubs/sales/su6.pdf

DO NOT MAIL THIS FORM TO THE DIVISION OF TAXATION

This form is to be completed by purchaser and given to and retained by seller.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The ST-4 form is an Exempt Use Certificate allowing eligible purchasers to claim exemption from New Jersey sales tax on specific purchases. |

| Requirements | Purchasers must provide their New Jersey Taxpayer Registration Number and other pertinent information to complete the form. |

| Retention Period | Sellers must retain completed ST-4 certificates for at least four years from the last transaction date for audit purposes. |

| Governing Law | The ST-4 form is governed by the New Jersey Sales and Use Tax Act (N.J.S.A. 54:32B). |

| Signature Requirement | The purchaser's signature is mandatory on the form to certify the accuracy of the provided information. |

| Nonregistered Purchasers | Eligible nonregistered purchasers must provide a Federal Identification Number or an out-of-state registration number in lieu of a New Jersey Tax ID. |

Guidelines on Utilizing St 4 Certificate

Completing the ST-4 Certificate form requires careful attention to detail to ensure that all necessary information is accurately filled out. Once the form is properly completed and signed, it should be given to the seller. The seller will then retain it for their records. This process helps establish the conditions under which an exemption from sales tax is valid.

- At the top left corner of the form, identify the section titled “Eligible Nonregistered Purchaser.” Here, provide your New Jersey Taxpayer Registration number or, if you do not have one, your federal identification number or out-of-state registration number.

- In the section for the seller's information, fill in the Name of the seller along with their Address, including City, State, and Zip Code.

- Write the date when the form is completed in the designated space provided.

- State the exempt purpose for which the tangible personal property or services will be used in the appropriate section. Be specific to ensure clarity.

- Reference the applicable subsection from the New Jersey Sales and Use Tax Act in the provided box. This will require checking the reverse side of the form for the principal exempt uses list.

- In the section labeled “Name of Purchaser,” write your name as registered with the New Jersey Division of Taxation. Fill in your address in the specified area.

- Indicate your Type of Business in the appropriate section to clarify your business operations.

- Finally, sign the form. Ensure your title is provided next to your signature, as required.

What You Should Know About This Form

What is the ST-4 Certificate form used for?

The ST-4 Certificate form is used in New Jersey to claim an exemption from sales and use tax for certain purchases. Buyers use this form when they intend to use the purchased items for exempt purposes defined by New Jersey law. For example, if you are buying materials to create a product or equipment for manufacturing, this form might apply to you.

Who can use the ST-4 Certificate?

The ST-4 Certificate can be used by purchasers who qualify as eligible nonregistered purchasers. This includes businesses not required to register for sales tax in New Jersey. For these buyers, it’s important to provide either a Federal Identification Number or an out-of-state registration number on the form.

What information do I need to complete the ST-4 Certificate?

You will need to fill out various pieces of information on the ST-4 Certificate. You’ll need to provide your name, address, the type of business, and the reason for claiming the exemption. It’s also essential to include your New Jersey tax identification number or, for non-residents, your Federal employer identification number. Lastly, the form requires a signature from the purchaser to validate the claim.

How long does a seller need to keep the ST-4 Certificate?

Sellers are required to keep the ST-4 Certificate for at least four years from the date of the last transaction covered by it. The certificates should be physically retained and easily available for inspection, should the state request it.

What happens if a seller does not collect sales tax on a transaction that should have been taxable?

If a seller accepts the ST-4 Certificate in good faith but it later turns out that the purchaser wrongly claimed an exemption, the purchaser, not the seller, will be held responsible for the unpaid sales tax. Sellers can protect themselves by ensuring that the ST-4 Certificate is fully completed and accurately represented at the time of sale.

Are there specific types of purchases that qualify for the ST-4 exemption?

Yes, several categories qualify for exemption under the ST-4 Certificate. These include the purchase of machinery used in manufacturing, equipment for telecommunication services, and materials used in research and development, among others. For a complete understanding, it’s beneficial to refer to New Jersey's tax regulations or consult the Division of Taxation for further guidelines.

Common mistakes

Filling out the ST-4 Certificate form requires attention to detail. One common mistake is failing to provide the purchaser's New Jersey Taxpayer Registration Number. This information is crucial for processing the exemption. Without it, the seller may not accept the certificate, potentially leading to unexpected tax liabilities.

Another frequent error occurs when individuals neglect to specify the exempt purpose for which the purchased items will be used. Clear identification of the exempt purpose is required. If it is not provided, the seller has no basis for accepting the certificate, which can complicate the transaction.

Many people also overlook including their signature. An unsigned certificate could be deemed incomplete. This vital step can create delays or problems with tax exemption claims. The signature confirms compliance with the underlying tax laws.

Furthermore, failing to select the correct type of business can lead to misunderstandings. Sellers rely on this information to determine if the exemption applies. If the type of business does not align with the purchase purpose, the exemption may be denied.

Some purchasers mistakenly leave the address of the purchaser blank or incomplete. Providing a full and accurate address is essential for record-keeping. Sellers need this information for verification and to ensure they correctly handle the exemption.

Lastly, individuals often ignore reading the instructions carefully. Each detail matters. Not following the specific guidelines can lead to improper submissions and potential audits later on. This oversight could prove costly in terms of time and resources.

Documents used along the form

The ST-4 Exempt Use Certificate is critical for ensuring that certain purchases in New Jersey are made without sales tax due to their exempt status. However, several other documents often accompany this form, each serving a specific purpose to facilitate the tax exemption process. Below is a list of these related documents, highlighting their functions.

- Form ST-3: This is the general sales tax exemption certificate that allows registered purchasers to claim exemption from sales tax on exempt purchases. It provides a broader application than the ST-4.

- Form ST-4A: This form serves a similar purpose as the ST-4 but is specifically designed for use by exempt organizations. It certifies the exempt status of an organization under New Jersey law.

- Form ST-4B: Intended for non-profit organizations, this document specifies the nature of the exempt purpose. It ensures that purchases made by non-profits are recognized as exempt from sales tax.

- Form ST-4C: This form is for use by governmental entities claiming exemption from sales tax. It includes details on the governmental purpose of the purchase.

- Form ST-8: A resale certificate allowing sellers to claim tax exemption on purchases made for resale. This document provides a way for businesses to avoid being taxed on items they do not end up consuming.

- Form ST-11: This is the direct pay permit used by certain businesses to purchase tangible property and services without payment of sales tax. It is often used in conjunction with the ST-4 when specific exemptions apply.

- Form ST-4R: This form applies specifically to retail purchasers claiming an exemption for certain tangible personal property. It details the conditions under which the exemption applies.

- Proof of Nonprofit Status: This document provides evidence that an organization qualifies for tax-exempt status, typically a 501(c)(3) determination letter issued by the IRS. It is often required alongside exemption certificates.

Understanding these accompanying documents enhances compliance and ensures accurate processing of tax exemptions. They collectively help clarify the intentions behind tax-exempt purchases, so both buyers and sellers can operate within the bounds of the law while benefiting from any applicable exemptions.

Similar forms

The ST-4 Certificate form serves to exempt certain purchases from New Jersey sales tax. Several other documents share similarities in purpose or function with this certificate. Below are five such documents:

- ST-3 Sales Tax Exempt Certificate: This document is used by a seller to verify that the customer is purchasing goods for resale. Like the ST-4, it requires specific buyer information and serves as proof to relieve the seller from collecting sales tax.

- ST-5 Resale Certificate: Issued by a buyer, this certificate indicates that the purchased goods are intended for resale. It functions similarly to the ST-4 in that it helps sellers avoid sales tax liability when the buyer properly asserts their intention to resell the items.

- ST-8 Certificate of Exempt Use: This document serves to exempt certain uses of property from sales tax. Like the ST-4, it includes details about the specific exempt use of property, and the signatory must be aware of the applicable tax laws.

- ST-4A Exempt Use Certificate for Medical Equipment: Similar to the ST-4, this form is specifically for the purchase of medical equipment that is exempt from sales tax. Both documents outline the exempt purpose and require details about the buyer’s business type.

- Form ST-6 Exempt Organization Certificate: Used by non-profit entities, this certificate allows tax-exempt organizations to purchase goods without paying sales tax. The requirements for completion and the types of exemptions granted bear resemblance to the stipulations in the ST-4.

Dos and Don'ts

Things to Do When Filling Out the ST-4 Certificate Form:

- Carefully read all instructions provided on both sides of the certificate.

- Ensure you include your New Jersey taxpayer registration number or appropriate identification number.

- Provide clear and precise reasons for the exemption you are claiming.

- Sign the certificate to confirm that the information you provided is accurate.

- Keep a copy of the completed certificate for your records.

Things Not to Do When Filling Out the ST-4 Certificate Form:

- Do not leave any required fields blank; incomplete forms can lead to issues.

- Avoid providing false or misleading information on the form.

- Do not mail the completed form to the Division of Taxation.

- Refrain from using obsolete versions of the form; always use the most current version.

- Never assume the seller knows your exemption details without clear communication on the form.

Misconceptions

- Only businesses can use the ST-4 Certificate. Many people believe that only registered businesses can utilize this certificate. However, individuals making exempt purchases can also use it, provided they meet specific criteria.

- Completion of the form is optional. Some think completing the ST-4 Certificate is optional. In reality, if you want to claim an exemption for sales tax, you must complete this form accurately and provide it to the seller.

- The seller must keep the original certificate. While it is common to assume that sellers must hold onto the paper copy of the form, sellers are allowed to keep a digital record. This offers flexibility and can simplify record-keeping.

- The ST-4 Certificate can be used indefinitely. Many believe that once the ST-4 form is filled out, it remains valid forever. However, sellers must retain it for no less than four years from the date of the last sale covered by the certificate.

- Exemptions under the ST-4 Certificate are universal. Some may think that all purchases qualify for sales tax exemptions. In fact, only certain types of tangible personal property or services are eligible. It's essential to understand the specific exemptions listed in the New Jersey Sales and Use Tax Act.

- Providing a completed ST-4 Certificate absolves the seller of all responsibility. While a fully completed certificate can protect a seller from sales tax liability, if future audits reveal the purchaser improperly claimed an exemption, the purchaser may still be held liable for unpaid taxes.

- All sellers are required to accept the certificate. Some people assume that every seller must accept the ST-4 Certificate. In reality, sellers can choose whether or not to accept the form based on their policies regarding tax exemptions.

Key takeaways

When filling out and using the ST-4 Certificate form, keep these key points in mind:

- Purpose: The ST-4 form serves as an Exempt Use Certificate, helping certain buyers avoid paying sales and use tax on qualifying purchases.

- Completion: The form must be filled out entirely by the purchaser. It must detail their New Jersey Taxpayer Registration Number and the business type.

- Validity: Registered sellers who accept a properly completed ST-4 Certificate are protected from liability for tax collection related to the transaction.

- Signature Required: The purchaser must sign the form. This indicates they believe the exemption is valid.

- Seller's Retention: Sellers must keep the completed form for at least four years for potential inspection by tax authorities.

- Incomplete Forms: If a seller has an incomplete certificate in an audit, they may have 120 days to rectify the situation.

- Common Exempt Uses: The ST-4 applies to various exempt purposes, such as production equipment, laboratory research, and certain transportation services.

- Eligible Nonregistered Purchasers: If a purchaser is not required to register in New Jersey, they must provide either a Federal Identification Number or an out-of-state registration number on the form.

- Don't Mail: The completed form should not be sent to the Division of Taxation. It should be given directly to the seller.

Understanding these takeaways will help ensure that the ST-4 Certificate is utilized correctly and efficiently.

Browse Other Templates

California Recs - Request beds for various specialized care needs based on community demands.

Texas Women's Health Benefits Application,Women's Health Program Enrollment Form,Texas Health Coverage Application,Texas Women's Health Assistance Form,Health Benefits Application for Women,Women’s Health Services Registration Form,Texas Family Plann - Indicate if you'd like assistance with voter registration on this form.

Icici Bank Letter Head - Encourage clear handwriting or typing for readability in the form.